Hypophosphatasia Market

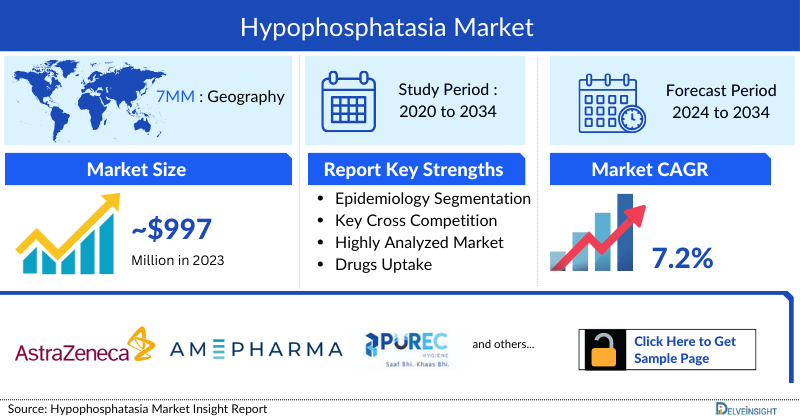

- According to DelveInsight’s analysis, the Hypophosphatasia Market in the 7MM was valued at approximately USD 997 million in 2023. Over the forecast period from 2024 to 2034, this market is projected to grow at a CAGR of 7.2%.

- The hypophosphatasia market is set for steady growth, with a robust compound annual growth rate (CAGR) anticipated from 2024 to 2034. This expansion in the 7MM is driven by the introduction of innovative therapies such as asfotase alfa, advancements in diagnostic techniques, and the increasing use of genetic screening.

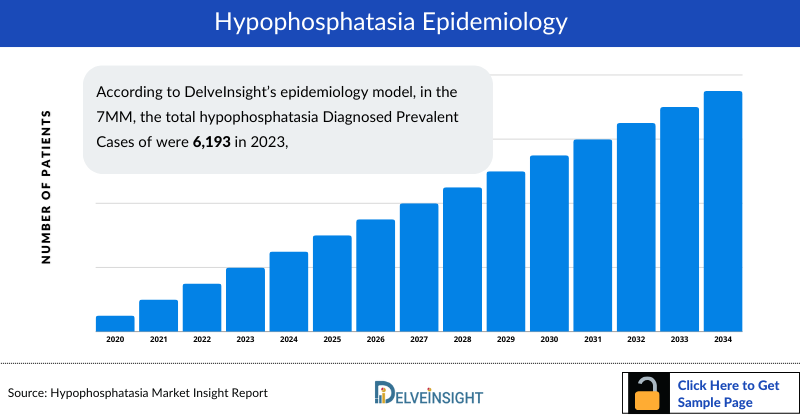

- According to DelveInsight’s estimates, in 2023, there were approximately 6,200 Hypophosphatasia Diagnosed Prevalent cases of in the 7MM. Of these, the United States accounted for 90% of the cases, while Japan and Germany represented 2.3% and 2.0% of the cases, respectively.

- Despite the availability of STRENSIQ (asfotase alfa), which primarily targets severe cases, there remains a significant gap in effective treatment options for patients with milder or adult-onset hypophosphatasia. These patients often experience suboptimal outcomes due to the lack of tailored therapies.

- Asfotase alfa, the leading therapy for hypophosphatasia, can cost upwards of USD 1 million annually per patient, presenting a major barrier to access and adherence, particularly in markets with less comprehensive healthcare coverage or stringent reimbursement policies.

- Hypophosphatasia Companies like Alexion Pharmaceuticals (now part of AstraZeneca) have been pioneers in the hypophosphatasia market with the launch of asfotase alfa. Other companies are entering the space, leveraging orphan drug designations and seeking to expand market share through clinical trials and partnerships focused on new treatment modalities.

- Several promising Hypophosphatasia drugs are currently in development specifically targeting hypophosphatasia, including ALXN1850 (efzimfotase alfa), Ilofotase alfa, and REC-01, among others.

Request for unlocking the CAGR of the "Hypophosphatia Drugs Market"

Key Factors Driving Hypophosphatasia Market

Hypophosphatasia Patient Pool and Rising Prevalence

According to DelveInsight’s estimates, there were approximately 6.2K diagnosed prevalent cases of Hypophosphatasia in the 7MM in 2023. The United States accounted for 90% of cases, while Japan and Germany represented 2.3% and 2.0% of cases, respectively. Increasing awareness, improved genetic screening, and advancements in diagnostic techniques are expected to drive early diagnosis and expand the identified patient pool over the forecast period.

Hypophosphatasia Market Dynamics

The Hypophosphatasia Market in the 7MM was valued at approximately USD 997 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2034. Market growth is supported by the availability of asfotase alfa for severe cases, increasing adoption of genetic testing, and the development of therapies targeting milder or adult-onset forms of the disease. Expansion in healthcare access and reimbursement in key markets also contributes to anticipated growth.

Hypophosphatasia Treatment Landscape

STRENSIQ (asfotase alfa) remains the leading therapy for Hypophosphatasia, particularly in severe pediatric-onset patients. While it offers disease-modifying benefits, high annual treatment costs—upwards of USD 1 million per patient—pose access challenges in some regions. Companies such as Alexion Pharmaceuticals (AstraZeneca) have pioneered this space, and emerging players are leveraging orphan drug designations to develop new treatment modalities tailored to diverse patient needs.

Hypophosphatasia Clinical Trials and Emerging Therapies

Several promising therapies are under development, including ALXN1850 (efzimfotase alfa), Ilofotase alfa, and REC-01. These candidates are being evaluated across various stages of clinical trials to expand therapeutic options, improve outcomes for adult-onset and mild patients, and address limitations of existing treatments. The competitive landscape remains focused on innovation and improving accessibility for the growing Hypophosphatasia patient pool.

DelveInsight’s “Hypophosphatasia Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of hypophosphatasia , historical and forecasted epidemiology, as well as the hypophosphatasia market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Hypophosphatasia Treatment Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM hypophosphatasia market size from 2020 to 2034. The report also covers hypophosphatasia Treatment Market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Hypophosphatasia Treatment Market

Hypophosphatasia is a rare genetic metabolic disorder marked by inadequate mineralization of bones and teeth. This impaired mineralization causes bones to be soft, leading to increased susceptibility to fractures and deformities, as well as tooth loss. The condition can be inherited either in an autosomal recessive or dominant pattern, depending on the specific form. A heterogeneous inherited disorder of bone metabolism, it has a very varied clinical expression. It is characterized by defective bone and dental mineralization, leading to skeletal abnormalities with complications resulting in significant morbidity and mortality. The phenotypes range from the complete absence of bone mineralization and fetal death, mainly due to respiratory problems associated with thoracic deformities and pulmonary hypoplasia, to spontaneous fractures, premature tooth loss, seizures, or even nephrocalcinosis.

Hypophosphatasia is classified into several forms based on the severity of symptoms and age of onset. The most severe type is perinatal lethal, often resulting in death shortly after birth, followed by perinatal benign, which is non-lethal. Infantile hypophosphatasia presents within the first 6 months and can be severe, while childhood onset occurs later with variable severity. Adult hypophosphatasia involves musculoskeletal pain, and odontohypophosphatasia is the mildest form, primarily affecting dental health.

Hypophosphatasia Diagnosis

Hypophosphatasia is diagnosis by identifying its symptoms and complications and understanding the patient history. Hypophosphatasia signs are revealed by a thorough clinical examination, supported by routine x-rays and various laboratory tests, including biochemical studies, alkaline phosphatase (ALP) assay, and blood and urine tests, among others. Serum alkaline phosphatase activity is markedly reduced while 5'pyridoxal phosphate in the blood and urinary phosphoethanolamine increase. Ultrasound is done for prenatal and perinatal forms; clinical examinations and radiographs help establish infantile, childhood, and adult diagnoses.

Further details related to country-based variations are provided in the report…

Hypophosphatasia Treatment

Until recently, the Hypophosphatasia Treatment was mostly symptomatic and supportive, depending upon clinical manifestation. However, almost a demi decade ago, the first line of therapy for hypophosphatasia, STRENSIQ (asfotase alfa), developed by AstraZeneca (Alexion AstraZeneca Rare Disease), was approved by the US FDA (2015). An enzyme replacement therapy (ERT) using bone-targeting recombinant alkaline phosphatase replaces the deficient TNSALP activity in patients. It reduces the accumulation of extracellular TNSALP substrate, thereby improving mineralization, motor capabilities, and respiratory function while reducing mortality.

It is recommended as the mainstay treatment for individuals with perinatal, infantile, and juvenile-onset Hypophosphatasia. Pharmacological therapies like NSAIDs, glucocorticoids, potassium binders, vitamin D and B6 supplementation, and others; nonpharmacological therapies like mechanical ventilation and surgical intervention are also recommended.

Hypophosphatasia Epidemiology

As the market is derived using a patient-based model, the hypophosphatasia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of hypophosphatasia and severity-specific diagnosed prevalent cases of hypophosphatasia in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight’s epidemiology model, in the 7MM, the total hypophosphatasia Diagnosed Prevalent Cases of were 6,193 in 2023, which are expected to increase at a CAGR of 0.8% by 2034.

- In the US, there were 5,572 total diagnosed prevalent cases of hypophosphatasia in 2023; which are expected to increase at a CAGR of 0.9% to 5,600 by 2034.

- In EU4 and the UK, the total diagnosed prevalent cases of hypophosphatasia were 481 in 2023. Of these, nearly 122 cases were found in Germany, followed by 119 cases in France and 117 in the UK. These cases are expected to change during the study period.

- In 2023, there were 780 mild cases, 4,736 moderate cases, and 56 severe cases of hypophosphatasia reported in the US, based on severity-specific diagnosed Hypophosphatasia prevalence. These numbers are projected to increase to 784 mild cases, 4,760 moderate cases, and 56 severe cases by 2034.

- Japan had the second-highest number of diagnosed prevalent cases of hypophosphatasia among the 7MM, with 141 cases in 2023.

Hypophosphatasia Marketed Drugs

- STRENSIQ (asfotase alfa): AstraZeneca

STRENSIQ (asfotase alfa), developed by Alexion Pharma (now part of AstraZeneca), is a TNSALP indicated for the treatment of patients with perinatal, infantile- and juvenile-onset hypophosphatasia. STRENSIQ is a soluble glycoprotein composed of two identical polypeptide chains, which consists of the catalytic domain of human TNSALP, the human immunoglobulin G1 Fc domain, and a deca-aspartate peptide used as a bone-targeting domain. Two disulfide bonds covalently link the two polypeptide chains. By replacing the deficient ALP, STRENSIQ reduces the elevated enzyme substrate levels and improves bone mineralization. In October 2015, the US FDA approved STRENSIQ for treating patients with perinatal-, infantile- and juvenile-onset hypophosphatasia. Earlier the drug had received approval from EMA and PMDA in August 2015 and July 2015, respectively.

In September 2014, asfotase alfa received an Orphan Drug Designation (ODD) in Japan for the treatment of Hypophosphatasia Patients. In May 2013, the US FDA granted asfotase alfa Breakthrough Therapy Designation (BTD) for treating perinatal, infantile, and juvenile-onset hypophosphatasia. In May 2009, the US FDA granted FTD to asfotase alfa for the treatment of hypophosphatasia. In September 2008, the US FDA granted ODD to asfotase alfa in the US. In December 2008, STRENSIQ (asfotase alfa) was granted ODD in Europe.

|

MoA |

RoA |

Company |

Logo |

|

Alkaline phosphatase stimulants; Esterase replacements |

Subcutaneous |

AstraZeneca |

Hypophosphatasia Emerging Drugs

- ALXN1850 (efzimfotase alfa): AstraZeneca (Alexion Pharmaceuticals)

ALXN1850 (efzimfotase alfa) is an enzyme replacement therapy that substitutes for deficient alkaline phosphatase (ALP) activity. It targets ALP substrates to enhance bone mineralization and alleviate systemic disease manifestations. This next-generation therapy for hypophosphatasia offers higher activity, greater bioavailability, and a longer half-life compared to STRENSIQ (asfotase alfa). ALXN1850 is formulated for subcutaneous administration.

A Phase III trial has been initiated to evaluate efzimfotase alfa in adolescent and adult hypophosphatasia patients who have not previously been treated with STRENSIQ, with results anticipated beyond 2025. In November 2020, Alexion submitted an IND for ALXN1850 to the FDA and received approval to proceed with a Phase I study in hypophosphatasia patients.

Ilofotase alfa: AM Pharma

Ilofotase alfa is a proprietary recombinant alkaline phosphatase constructed from two human isoforms of alkaline phosphatase that is well tolerated, stable, and highly active in multiple clinical trials in acute kidney injury and hypophosphatasia.

The recombinant enzyme displays exquisite activity towards dephosphorylating and detoxifying damage-associated molecular patterns (DAMPs) and pathogen-associated molecular patterns (PAMPs) such as lipopolysaccharide (LPS), ATP, ADP, and other extracellular substrates that drive acute inflammation and microvascular ischemia found in acute kidney injury. In hypophosphatasia, ilofotase alfa addresses elevated levels of pyridoxal-5'-phosphate (PLP), inorganic pyrophosphates (PPi), two disease-related biomarkers that are related to, for example, bone mineralization and pain sensation.

Ilofotase alfa was recently evaluated in a Phase Ib study in hypophosphatasia, and is being evaluated in a Phase II trial in CSA-RD. However, there is no recent update on hypophosphatasia. In June 2015, the US FDA and the EMA granted AM-Pharma orphan drug designation (ODD) for ilofotase alfa in hypophosphatasia.

- REC-01: PuREC

PuREC specializes in regenerative cell therapy using mesenchymal stem cells (MSCs). MSCs are multipotent cells that differentiate into various mesenchymal lineage cells, including bone. MSCs have low immunogenicity and are a promising candidate for human cell therapy. Advancements in human bone marrow cell isolation have led to the extraction of an extremely pure and rapidly expanding MSC population. This clonal isolation is achieved by selecting cell surface markers related to enriched clonogenic cells.

REC exhibits improved self-renewal and multilineage differentiation, which is highly relevant to cell therapy. In parallel, an initial clinical study infusing MSCs in patients with severe hypophosphatasia has shown improvement in bone mineralization and bone function.

The company is looking for global business partners and licensors. Currently, Phase I/II clinical study in Japan is being led by Shimane University with a Japanese government grant (AMED (Japan Agency for Medical Research and Development)) and key hospitals using PuREC’s REC.

|

MoA |

RoA |

Company |

Logo |

|

Next Generation TNSALP ERT |

SC |

AstraZeneca (Alexion Pharmaceuticals) |

|

|

Endotoxin inhibitors; Enzyme replacements; Purinergic P1 receptor agonists; Purinergic receptor agonists |

IV |

AM Pharma |

|

|

Mesenchymal stem cell therapy |

XX |

PuREC |

XX |

Hypophosphatasia Drugs Market Insights

STRENSIQ is an ERT using bone-targeting recombinant alkaline phosphatase, addressing the main cause for manifestation. It is a human, recombinant TNSALP replacement therapy that replaces deficient TNSALP activity in patients with and reduces the accumulation of extracellular TNSALP substrate. It improves skeletal mineralization, motor capabilities, and respiratory function while reducing mortality compared to historically untreated patients with more severe perinatal, infantile, and childhood forms of hypophosphatasia.

Teriparatide, a recombinant human parathyroid hormone that improves pain, and mobility, and repairs fractures in hypophosphatasia patients, is given off-label to several adults with complicated metatarsal stress fractures or femoral pseudofractures. Its mechanism of action is based on the direct stimulation of bone formation. Isolated cases treated with teriparatide at low doses have been described as inducing a paradoxical reaction with decreased pain, better radiological consolidation of pseudofractures or stress fractures, and an improvement in biochemical and densitometric parameters.

The monoclonal anti-sclerostin antibody has demonstrated the ability to increase bone formation, reduce bone resorption in hypophosphatasia patients, and increase bone mineral density. Sclerostin is a protein in osteocytes embedded in the bone; it helps downregulate osteoblasts. Antibodies that act against sclerostin have increased bone mass in osteoporosis.

Hypophosphatasia Market Outlook

Until recently, the treatment was mostly symptomatic and supportive, depending upon clinical manifestation. NSAIDs or glucocorticoids were majorly recommended to treat bone and joint pain due to the deposition of calcium pyrophosphate or hydroxyapatite crystals. They are still recommended to improve bone, joint, or persistent pain secondary to fractures. Vitamin B6 and vitamin D are recommended for seizure control and supplementation. Potassium and phosphate binders and ACE inhibitors are also recommended.

Additional supportive therapies include ventilatory support, physiotherapy, occupational therapy, chronic pain management, and fracture care. Some cases, like nonhealing fractures or craniosynostosis, require surgical intervention. However, with the approval, the treatment paradigm for hypophosphatasia has changed making ERT the mainstay treatment for at least all severe forms of the disease.

Almost a demi decade ago, the first line of therapy for hypophosphatasia, STRENSIQ (asfotase alfa), developed by Alexion (AstraZeneca), was approved by the US FDA (2015). It is recommended as the mainstay treatment for individuals with perinatal, infantile, and juvenile-onset hypophosphatasia. The drug is also approved in Europe for treating patients with pediatric-onset hypophosphatasia and in Japan for treating patients with hypophosphatasia. In adult forms of hypophosphatasia, the signs or symptoms are less severe and may not require enzyme replacement. Additional treatments that have shown improvement in hypophosphatasia patients include teriparatide and monoclonal anti-sclerostin antibodies.

- The Hypophosphatasia treatment is multifaceted, focusing on identifying and addressing the underlying cause while managing symptoms to improve patient comfort.

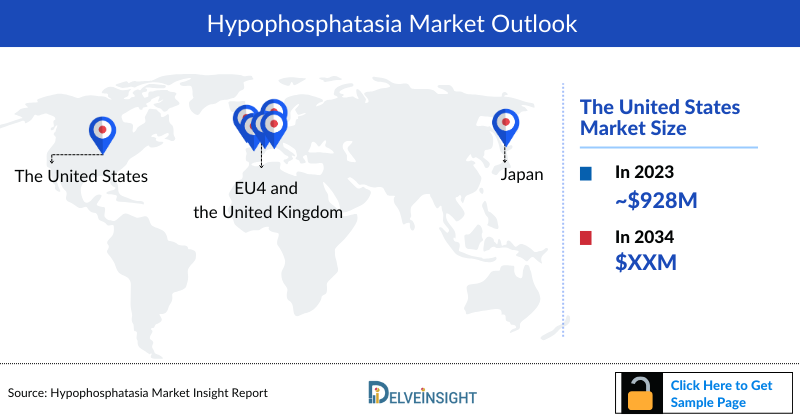

- The Hypophosphatasia Treatment Market Size in the 7MM was approximately USD 997.4 million in 2023 and is projected to increase during the forecast period (2024–2034).

- The Hypophosphatasia Treatment Market Size in the US was approximately USD 928.9 million in 2023, accounting for approximately 93% of the total market revenue for the 7MM.

- The Hypophosphatasia Treatment Market Size in EU4 and the UK was calculated to be approximately USD 50.3 million in 2023. Among the EU4 and the UK, Germany accounted for the highest Hypophosphatasia Drugs Market with approximately USD 12.8 million, followed by France with approximately USD 12.5 million in the respective year, and the UK with USD 12.3 million.

- The total Hypophosphatasia Market Size in Japan was approximately USD 18.2 million in 2023.

- Among the currently used therapies, the majority of the Hypophosphatasia Market Share was of STRENSIQ (asfotase alfa), with a revenue of approximately USD 992.6 million in 2023 among the 7MM.

Hypophosphatasia Drugs Uptake

This section focuses on the uptake rate of potential Hypophosphatasia drugs expected to be launched in the market during 2020–2034.

Hypophosphatasia Pipeline Development Activities

The Hypophosphatasia drugs market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Hypophosphatasia Companiesinvolved in developing targeted therapeutics.

Pipeline development activities

The Hypophosphatasia drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Hypophosphatasia emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on hypophosphatasia evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like Metabolic Research Unit, Shriners Hospital, US, Harvard Medical School, US, University of Munich Hospital, Germany, University of Granada, Spain, University of Liverpool, UK, and Fujita Health University of Medicine, Japan were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or hypophosphatasia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

The Hypophosphatasia Prevalence is approximately 1 in every 100,000 live births. Though the exact numbers are unknown, it is believed nearly 1 in every 200 may be carriers of the hypophosphatasia gene in the US. About 50% of individuals with persistently low alkaline phosphatase (ALP) levels have mutations in the TNSALP gene, with enzyme activity decreasing with each mutation. Haploinsufficiency alone can lower blood ALP levels, and approximately 50% of patients with these mutations show a buildup of phosphorylated substrates. This indicates a significant genetic component in hypophosphatasia.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Hypophosphatasia Drugs Market Access and Reimbursement

Nevertheless, several organizations in the 7MM are working to provide support to patients and spread awareness, including STRENSIQ (asfotase alfa) coverage and reimbursement support services, among others.

- STRENSIQ (asfotase alfa)

NORD’s Hypophosphatasia Patient Assistance Program

NORD’s Hypophosphatasia Patient Assistance Programs offer eligible individuals diagnosed with hypophosphatasia financial support when faced with limited resources to pay for out-of-pocket healthcare costs, including Health insurance premiums, deductibles, copayments, and coinsurance costs for the care and treatment of hypophosphatasia, including medical appointments and consults, physician prescribed FDA approved medications, physician-prescribed laboratory and diagnostic tests.

Reimbursement

STRENSIQ Alexion OneSource Copay Program

This program helps cover some out-of-pocket costs for eligible patients. The eligibility criteria includes:

- The patient should be signed up for patient services through OneSource

- The patient should have commercial insurance (not part of a federal- or state-funded healthcare program)

- The patient should be prescribed STRENSIQ for an FDA-approved indication

- The patient should reside in the United States or its territories.

Further details will be provided in the report.

The Hypophosphatasia Drugs Market Report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Hypophosphatasia Therapeutics Market Report Scope

- The Hypophosphatasia therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the Hypophosphatasia epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Hypophosphatasia Treatment Market Landscape.

- A detailed review of the Hypophosphatasia Therapeutics Market, historical and forecasted Hypophosphatasia treatment market size, Hypophosphatasia market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Hypophosphatasia Drugs Market.

Hypophosphatasia Therapeutics Market Report insights

- Patient-based Hypophosphatasia Market Forecasting

- Hypophosphatasia Therapeutic Approaches

- Hypophosphatasia Pipeline Drugs Analysis

- Hypophosphatasia Treatment Market Size

- Hypophosphatasia Drugs Market Trends

- Existing and Future Hypophosphatasia Therapeutics Market Opportunity

Hypophosphatasia Therapeutics Market Report key strengths

- 11 years Hypophosphatasia Market Forecast

- The 7MM Coverage

- Hypophosphatasia Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Hypophosphatasia Drugs Uptake

- Key Hypophosphatasia Market Forecast Assumptions

Hypophosphatasia Treatment Market Report assessment

- Current Hypophosphatasia Treatment Market Practices

- Hypophosphatasia Unmet Needs

- Hypophosphatasia Pipeline Drugs Profiles

- Hypophosphatasia Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

Hypophosphatasia Therapeutics Market Insights

- What was the total Hypophosphatasia Market Size, the Hypophosphatasia Treatment Market Size by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will STRENSIQ (asfotase alfa) affect the treatment paradigm of hypophosphatasia?

- How will STRENSIQ (asfotase alfa) compete with the upcoming therapies?

- Which Hypophosphatasia drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed Hypophosphatasia therapies?

- How would future opportunities affect the Hypophosphatasia market dynamics and subsequent analysis of the associated trends?

Hypophosphatasia Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of hypophosphatasia? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to hypophosphatasia?

- What is the historical and forecasted hypophosphatasia patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent hypophosphatasia population during the forecast period (2024–2034)?

- What factors are contributing to the growth of hypophosphatasia cases?

Current Hypophosphatasia Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the Hypophosphatasia Treatment? What are the current clinical and treatment guidelines for treating hypophosphatasia?

- How many companies are developing therapies for the treatment of hypophosphatasia?

- How many emerging therapies are in the mid-stage and late stage of development for treating hypophosphatasia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted Hypophosphatasia Treatment Market?

Reasons to Buy

- The Hypophosphatasia Treatment Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the hypophosphatasia therapeutics market.

- Insights on patient burden/disease Hypophosphatasia Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Hypophosphatasia Therapeutics Market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the Hypophosphatasia Therapeutics Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for hypophosphatasia, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Hypophosphatasia Therapeutics Market so that the upcoming players can strengthen their development and launch strategy.

Access Exclusive Data Now! Click here to Read More about the Related Articles