Infusion Pumps Market

- The leading Infusion Pumps companies working in the Infusion Pumps Market include Abbott, Boston Scientific Corporation, CryoLife, Inc., Edward Lifesciences Corporation, Medtronic, Sorin Group (LivaNova PLC), and others.

- According to recent data provided by GLOBOCAN, in 2022 estimated new number of cancer cases was 20 million, and the projection is estimated to increase to 32.6 million by 2045.

Infusion Pumps Market By Type (Volumetric Pumps, Syringe Pumps, Enteral Pumps, Insulin Pumps, Elastomeric Pumps, Implantable Pumps, and Patient-Controlled Analgesia Pumps), Infusion Pumps Market By Application (Diabetes, Oncology, Pain Management, Gastroenterology, and Others), Infusion Pumps Market By End-User (Hospitals & Clinics, Ambulatory Care Settings, Home Care Settings, and Others), and Infusion Pumps Market By Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising incidence of chronic illnesses such as cancer, diabetes, and other conditions, coupled with the prevalence of Hospital-Acquired Infections (HAIs), increasing number of surgical procedures, increased demand for remote patient monitoring, and increased infusion pumps products approval and launches across the globe.

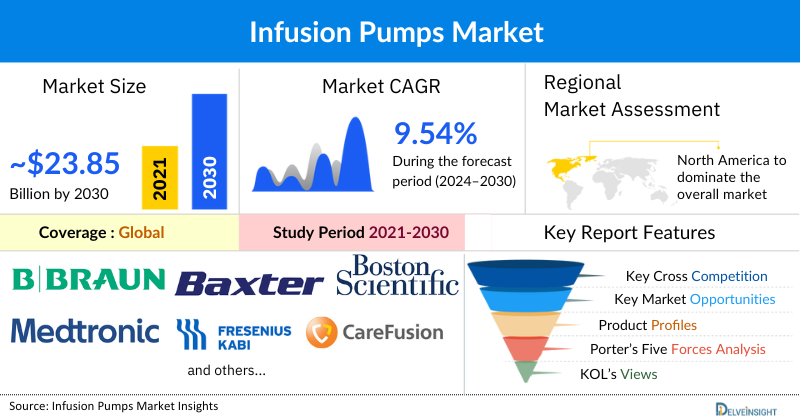

The global infusion pumps market was valued at USD 13.80 billion in 2024, growing at a CAGR of 9.54% during the forecast period from 2025 to 2032, to reach USD 23.85 billion by 2032. This rise in chronic conditions often requires prolonged and precise medication management, which infusion pumps can provide. These devices ensure accurate and consistent delivery of medications, vital for managing complex treatment regimens associated with chronic diseases. Additionally, infusion pumps, particularly those designed with advanced safety features and sterile pathways, play a crucial role in minimizing the risk of infections in hospitals. The demand for infusion pumps that enhance patient safety by reducing the incidence of HAIs is a strong driver in the market. Infusion pumps are essential in surgical settings for administering anesthesia, pain management, and post-operative care. The need for precise and controlled delivery of medications during and after surgery drives the demand for sophisticated infusion pump systems. Furthermore, infusion pumps that support remote monitoring enable healthcare providers to manage patients’ conditions effectively from a distance. This capability is especially crucial for chronic disease management and long-term therapies. The increased demand for remote patient monitoring solutions, therefore, significantly boosts the market for infusion pumps. Additionally, the continuous influx of new infusion pumps products and technologies ensures that the market remains dynamic and innovative, during the forecast period from 2025 to 2032.

Infusion Pumps Market Dynamics:

According to recent data provided by GLOBOCAN, in 2022 estimated new number of cancer cases was 20 million, and the projection is estimated to increase to 32.6 million by 2045.

Additionally, according to the recent update provided by the International Diabetes Federation, in 2021, approximately 537 million adults aged 20-79 were living with diabetes. This number was projected to rise to 643 million by 2030 and 783 million by 2045.

Thus, the increasing prevalence of these chronic diseases, therefore, amplifies the demand for infusion pumps as these pumps help in the precise delivery of chemotherapeutic agents in cancer patients and in case of diabetes requiring insulin therapy infusion pumps offer a consistent and controlled delivery of insulin, helping to maintain optimal blood glucose levels thereby boosting the overall market of infusion pumps.

According, to the latest data provided by the World Health Organization (WHO) (2022), globally, healthcare-associated infections (HAIs) affect hundreds of millions annually, with 7 out of every 100 patients in high-income countries and 15 in low- and middle-income countries acquiring at least one HAI in acute care hospitals. In the EU/EEA, 8.9 million HAIs occur each year in acute and long-term care facilities. These staggering figures drive the demand for advanced infusion pumps, which are essential in reducing infection risks through their precise, controlled, and sterile drug delivery systems. The growing focus on patient safety and infection control in healthcare settings necessitates the adoption of sophisticated infusion pump technologies, which can significantly minimize the incidence of HAIs and subsequently boost the market for infusion pumps.

Additionally, the increase in infusion pumps product approval across the world is further propelling the market. For instance, in August 2023, ICU Medical received FDA clearance for a Plum Duo infusion pump with LifeShield infusion safety software. Thus, the infusion pumps approved by regulatory bodies are designed to meet high safety and performance standards, which can lead to better patient outcomes. As healthcare providers observe improved treatment results, the demand for these devices increases. Therefore, infusion pumps significantly boost the market by enhancing credibility, fostering innovation, expanding global reach, attracting investment, providing a competitive edge, facilitating broader adoption, and ultimately improving patient outcomes. These factors collectively contribute to a robust and growing market for infusion pumps.

However, the stringent regulatory hurdle for infusion pumps in gaining infusion pumps product approval and risk of infection due to improper handling, poor aseptic techniques, or environmental exposure can cause bloodstream infection, localized infection and the infusion site, sepsis, and other infections may hinder the Infusion Pumps market during the forecasted period.

Infusion Pumps Market Segment Analysis:

Infusion Pumps Market By Type (Volumetric Pumps, Syringe Pumps, Enteral Pumps, Insulin Pumps, Elastomeric Pumps, Implantable Pumps, and Patient-Controlled Analgesia Pumps), Infusion Pumps Market By Application (Diabetes, Oncology, Pain Management, Gastroenterology, and Others), Infusion Pumps Market By End-User (Hospitals & Clinics, Ambulatory Care Settings, Home Care Settings, and Others), and Infusion Pumps Market By Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the type segment of the infusion pump market, insulin pumps are projected to hold a considerable market share in 2023. This is because insulin pumps play a significant role in boosting the overall market of infusion pumps due to several key factors that distinguish them from traditional infusion devices. Insulin pumps provide precise control over insulin delivery, allowing for customizable basal rates and bolus doses tailored to individual patient needs. This precision helps in achieving tighter glycemic control and reducing the risk of hypoglycemia and hyperglycemia, which are critical concerns in diabetes management. Furthermore, modern insulin pumps are equipped with advanced features such as continuous glucose monitoring (CGM) integration, predictive algorithms for insulin dosing adjustments, and connectivity with mobile apps or cloud-based platforms further boosting the market of insulin pumps. However, the increase in cases of Type-1 diabetes across the globe is further propelling the market of insulin pumps. According to the recent data provided by the International Diabetes Federation, in 2022, around 8.75 million people with diabetes were living with the condition, with 1.52 million under age 20. Thus, the increasing cases of Type-1 diabetes often require insulin pumps to deliver insulin therefore escalating the market of insulin pumps across the globe.

Additionally, the rising product approval further accelerates the market of insulin pumps thereby boosting the overall market of infusion pumps. For instance, in April 2023, Insulet announced FDA clearance of Omnipod GO™, the first-of-its-kind basal-only insulin pod which is a type of insulin pump. It is a standalone, wearable insulin delivery system that provides a fixed rate of continuous rapid-acting insulin for 72 hours.

Additionally, in August 2023, Roche announced the clearance of 510(k) for the Accu-Chek Solo® micropump system for continuous subcutaneous insulin infusion therapy (CSII) for people living with diabetes.

Therefore, owing to the above-mentioned factors, the insulin pumps category is expected to generate considerable revenue thereby pushing the overall growth of the global infusion pumps market during the forecast period.

North America is expected to dominate the overall Infusion Pumps Market:

North America Infucion Pumps Market is expected to account for the highest proportion of the infusion pumps market in 2023, out of all regions. This can be ascribed to the increasing prevalence of cancer, diabetes, and other diseases across the region. Additionally, the presence of a large number of key infusion pumps companies involved in reimbursement, mergers, acquisitions, and other activities is likely to exhibit an increased market growth. Additionally, the high volume of surgical procedures, including both elective and emergency surgeries, requires efficient infusion pump access for fluid management before and after operation. Furthermore, the growing emphasis on infection control, and the increase in hospital admissions driven by the need to reduce HAIs, further fuels the adoption of advanced infusion pumps with features that minimize contamination risks.

According to recent data from the GLOBOCAN, in 2022, North America saw an estimated 2.67 million new cases of cancer, with forecasts indicating a rise to 3.83 million by 2045. As per the same source, in Canada, the number of new cancer cases was around 292,000 in 2022, projected to reach 449,000 by 2045. Meanwhile, in Mexico, there were approximately 207,000 new cases of cancer in 2022, expected to increase to 360,000 by 2045. Thus, cancer treatment often involves chemotherapy, which necessitates precise and continuous infusion of potent medications to target and destroy cancer cells. Infusion pumps play a crucial role in delivering chemotherapy drugs at controlled rates, ensuring optimal therapeutic efficacy while minimizing systemic side effects thereby boosting the overall market across the region.

According to the recent data provided by the U.S. Department of Health and Human Services (2021), about 1 in 31 inpatients have an infection related to hospital care in the United States. Thus, healthcare-associated infections, further fuel the adoption of advanced infusion pumps as these devices play a pivotal role in reducing infection risks by ensuring sterile and precise delivery of medications, thereby minimizing opportunities for contamination during treatment. As healthcare facilities intensify efforts to improve patient safety and infection control measures, the demand for infusion pumps equipped with enhanced safety features and rigorous adherence to sterile protocols is expected to surge.

Additionally, according to the American Hospital Association (2024), in 2022 Annual Survey reports state that U.S. hospitals had a total of 33,679,935 hospital admissions. This substantial number of hospitalizations indicates a significant need for effective infusion pump access systems thereby boosting the market as with each hospital admission, there is a potential need for involving the use of infusion therapy for various medical treatments, including medication delivery, chemotherapy, and pain management, the sheer volume of hospital stays amplifies the necessity and utilization of infusion pumps.

Additionally, the rise in activities by the large key market players to maintain their position in the market potentially increases the market for infusion pumps in the region. For instance, in April 2024, Baxter announced the U.S. FDA clearance of its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software.

Additionally, in July 2023, BD received FDA 510(k) clearance for the updated BD Alaris™ Infusion System. This clearance covers updated hardware features for Point-of-Care Units (PCU), large volume pumps, syringe pumps, patient-controlled analgesia (PCA) pumps, respiratory monitoring, and auto-identification modules.

Therefore, the above-mentioned factors are expected to bolster the growth of the North America infusion pumps market during the forecast period.

Infusion Pumps Companies:

Some of the key infusion pumps manufacturers operating in the Infusion Pumps market include B. Braun Melsungen AG, Baxter International Inc., Boston Scientific Corporation, Medtronic plc., Fresenius Kabi, CareFusion Corporation, Smiths Medical, Koninklijke Philips NV, Micrel Medical Devices SA, Terumo Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., F. Hoffmann-La Roche Ltd., Johnson & Johnson, CME Medical UK Ltd., BD, and others.

Recent Developmental Activities in Infusion Pumps:

- In April 2025, ICU Medical Inc. (NASDAQ: ICUI) announced FDA 510(k) clearance for the Plum Solo™ precision IV pump, a single-channel addition to the Plum Duo™ system.

- In November 2022, Medtronic launches the world's first and only infusion set for insulin pumps that double wear time up to 7 days in the U.S.

- In March 2022, Shanghai MicroPort Lifesciences Co., Ltd. (MicroPort® Lifesciences) received marketing approval from China’s National Medical Products Administration (NMPA) for its independently developed new AutoEx® Chemotherapy Infusion Pump (AutoEx®).

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Infusion Pumps CAGR |

9.54% |

|

Infusion Pumps Market Size |

USD 23.85 billion by 2032 |

|

Key Infusion Pumps Companies | Baxter International, B. Braun Melsungen AG, Medtronic, Micrel Medical Devices SA, Boston Scientific Corporation, CareFusion Corporation, Fresenius Kabi, Smiths Medical, and others. |

Key Takes Away from the Infusion Pumps Market Report Study

- Market size analysis for current infusion pumps size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key Infusion Pumps companies dominating the infusion pumps market.

- Various opportunities available for the other competitors in the infusion pumps market space.

- What are the top-performing segments in 2024? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current infusion pumps market scenario?

- Which are the regions and countries where infusion pumps manufacturers should have concentrated on opportunities for infusion pump market growth in the coming future?

Target Audience who can be benefited from this Infusion Pumps Market Report Study

- Infusion pump product providers

- Research organizations and consulting infusion pumps manufacturers

- Infusion pumps -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up infusion pumps manufacturers, venture capitalists, and private equity firms

- Distributors and traders dealing in infusion pumps

- Various end-users who want to know more about the infusion pumps market and the latest technological developments in the infusion pumps market.

Frequently Asked Questions for Infusion Pumps Market:

1. What are infusion pumps?

An infusion pump is a medical device used to deliver fluids into a patient’s body in a controlled manner. There are many different types of infusion pumps, which are used for a variety of purposes and in a variety of environments. Some infusion pumps are designed mainly for stationary use at a patient’s bedside. Others, called ambulatory infusion pumps, are designed to be portable or wearable.

2. What is the market for infusion pumps?

The global infusion pumps market was valued at USD 13.80 billion in 2024, growing at a CAGR of 9.54% during the forecast period from 2025 to 2032, to reach USD 23.85 billion by 2032.

3. What are the drivers for the infusion pump market?

This rise in chronic conditions often requires prolonged and precise medication management, which infusion pumps can provide. These devices ensure accurate and consistent delivery of medications, vital for managing complex treatment regimens associated with chronic diseases. Additionally, infusion pumps, particularly those designed with advanced safety features and sterile pathways, play a crucial role in minimizing the risk of infections in hospitals. The demand for infusion pumps that enhance patient safety by reducing the incidence of HAIs is a strong driver in the market. Infusion pumps are essential in surgical settings for administering anesthesia, pain management, and post-operative care. The need for precise and controlled delivery of medications during and after surgery drives the demand for sophisticated infusion pump systems. Furthermore, infusion pumps that support remote monitoring enable healthcare providers to manage patients’ conditions effectively from a distance. This capability is especially crucial for chronic disease management and long-term therapies. The increased demand for remote patient monitoring solutions, therefore, significantly boosts the market for infusion pumps. Additionally, the continuous influx of new products and technologies ensures that the market remains dynamic and innovative, during the forecast period from 2025 to 2032.

4. Who are the key Infusion Pumps companies operating in the Infusion Pumps market?

Some of the key Infusion Pumps companies operating in the Infusion Pumps market include B. Braun Melsungen AG, Baxter International Inc., Boston Scientific Corporation, Medtronic plc., Fresenius Kabi, CareFusion Corporation, Smiths Medical, Koninklijke Philips NV, Micrel Medical Devices SA, Terumo Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., F. Hoffmann-La Roche Ltd., Johnson & Johnson, CME Medical UK Ltd., BD, and others.

5. Which region has the highest share in the infusion pumps market?

North America is expected to account for the highest proportion of the infusion pumps market in 2024, out of all regions. This can be ascribed to the increasing prevalence of cancer, diabetes, and other diseases across the region. Additionally, the presence of a large number of key market players involved in reimbursement, mergers, acquisitions, and other activities is likely to exhibit an increased market growth. Additionally, the high volume of surgical procedures, including both elective and emergency surgeries, requires efficient infusion pump access for fluid management before and after operation. Furthermore, the growing emphasis on infection control, and the increase in hospital admission driven by the need to reduce HAIs, further fuels the adoption of advanced infusion pumps with features that minimize contamination risks.

Get detailed insights @ DelveInsight Blogs.