IDH Inhibitors Market Summary

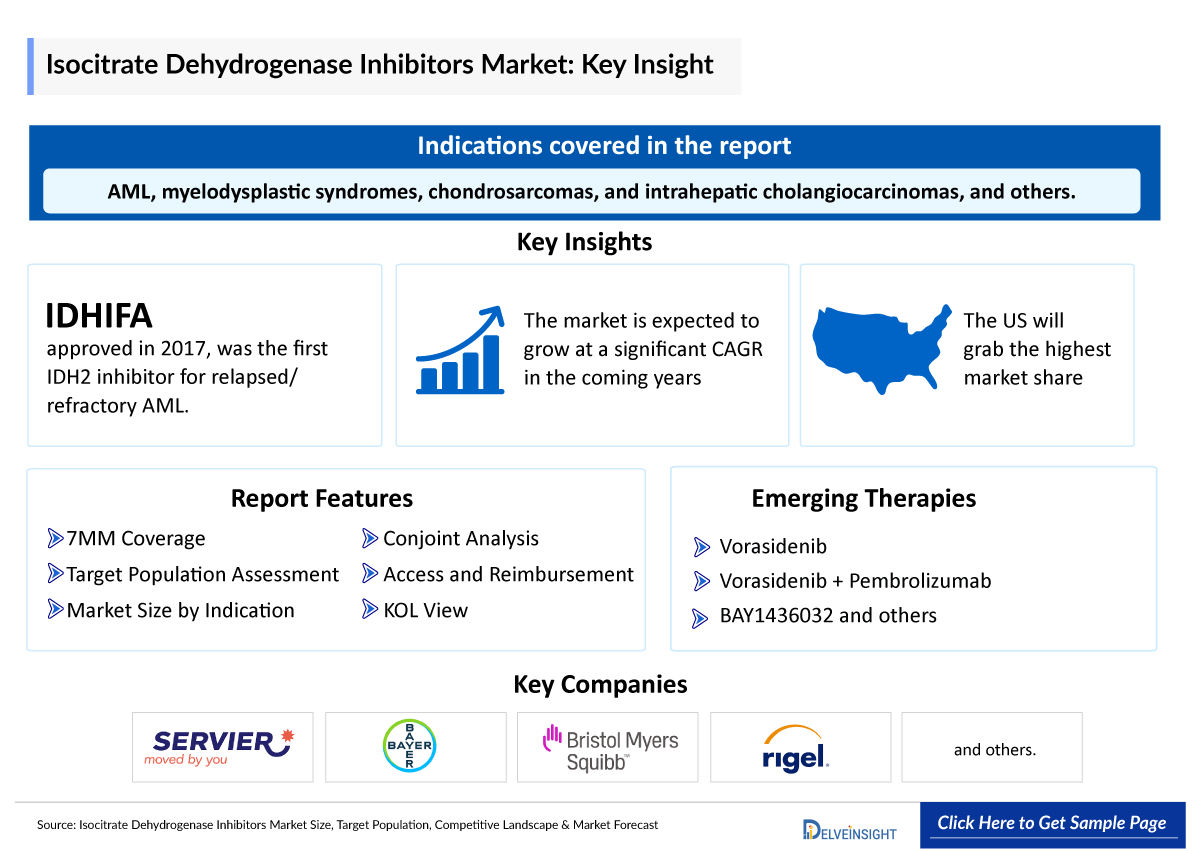

- The Isocitrate Dehydrogenase Inhibitor market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

Isocitrate Dehydrogenase Inhibitor Market and Epidemiology Analysis

- Upon Approval in 2017, IDHIFA (enasidenib) became the First-in-class, oral, targeted inhibitor of mutant isocitrate dehydrogenase 2 (IDH2) for the treatment of patients with relapsed or refractory acute myeloid leukemia (AML) with an IDH2 mutation.

- IDHIFA (enasidenib) is a targeted therapy that fills an unmet need for patients with relapsed or refractory AML who have an IDH2 mutation. The use of IDHIFA was associated with complete remission in some patients and a reduction in the need for both red cell and platelet transfusions.

- IDH inhibitors, including TIBSOVO (ivosidenib), IDHIFA (enasidenib mesylate), and REZLIDA (enasidenib mesylate) have received approval from regulatory bodies such as the Food and Drug Administration (FDA) and European Medicine Agency (EMA). Currently, IDH inhibitors are used for the treatment of various types of cancer, including acute myeloid leukemia, myelodysplastic syndromes, metastatic cholangiocarcinoma, and others.

- Moreover, several IDH inhibitors are currently under evaluation in clinical trials. For instance, Servier’s vorasidenib is in the development phase and is expected to gain approval within the forecast period.

- IDH inhibitors work by targeting the mutated IDH enzymes, reducing the production of 2-HG, and potentially slowing down or inhibiting tumor growth.

- There are promising opportunities for research in the field of IDH inhibitors. IDH is a promising therapeutic target for inhibitors that work by targeting the mutated IDH enzymes, reducing the production of 2-HG, and potentially slowing down or inhibiting tumor growth.

- In February 2024, the FDA and EMA accepted vorasidenib’s regulatory submission for the treatment of IDH-mutant diffuse glioma. The FDA has assigned a Prescription Drug User Fee Act (PDUFA) action date of August 20, 2024, and the European Commission approval is anticipated.

- Vorasidenib was granted Fast Track Designation (FTD) by the FDA in February 2023 and Breakthrough Therapy Designation by the FDA in August 2023.

- Servier, Bayer, and several other companies are currently engaged in the development and production of selective IDH inhibitors, which have the potential to significantly impact and enhance the Isocitrate Dehydrogenase inhibitor market.

DelveInsight’s “Isocitrate Dehydrogenase Inhibitors (IDHi) Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the Isocitrate Dehydrogenase inhibitors, historical and forecasted epidemiology, competitive landscape as well as the Isocitrate Dehydrogenase inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The IDH inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted Isocitrate Dehydrogenase inhibitors market size across 7Mm from 2020 to 2034. The report also covers current IDH inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

IDH Inhibitors Understanding and Treatment Algorithm

IDH Inhibitors Overview

An IDH inhibitor is a type of medication or compound that targets and inhibits the activity of the isocitrate dehydrogenase (IDH) enzyme. These enzymes play a crucial role in cellular metabolism by catalyzing the conversion of isocitrate to alpha-ketoglutarate in the citric acid cycle. Inhibiting IDH enzymes can have therapeutic implications, particularly in the treatment of certain types of cancer.

Isocitrate dehydrogenase is one of the key enzymes in the citric acid cycle. IDHs belong to a large ancient family of enzymes that play central roles in energy metabolism, amino acid biosynthesis, and vitamin production.

Isocitrate Dehydrogenase protein family consists of three self-regulating enzymes (IDH1, IDH2, and IDH3). IDH1 and IDH2 are both nicotinamide adenine dinucleotide phosphate (NADP)-dependent enzymes that catalyze the oxidative decarboxylation of isocitrate to alpha-ketoglutarate (α-KG) while producing NADPH either in peroxisomes and the cytosol (IDH1) or in mitochondria (IDH2). IDH3 catalyzes the same reaction in the mitochondria but in an NAD-dependent fashion. Mutations in IDH1 and IDH2 have been demonstrated in a variety of malignancies. IDH inhibitors have engendered hope in IDH1/2 mutant myeloid malignancies.

Mutations in IDH genes have been found in various cancers, including gliomas, acute myeloid leukemia (AML), chondrosarcomas, and intrahepatic cholangiocarcinomas. These mutations result in the production of an oncometabolite called 2-hydroxyglutarate, which can contribute to tumorigenesis and cancer progression.

Isocitrate Dehydrogenase inhibitors examples include TIBSOVO (ivosidenib) and IDHIFA (enasidenib), which have been approved by regulatory agencies like the US FDA for the treatment of AML with specific IDH mutations. Ongoing research continues to explore the potential of IDH inhibitors in treating other cancers and improving patient outcomes.

Isocitrate Dehydrogenase Expression

Multiple studies have demonstrated that IDH gene expression, particularly mutations in IDH1 and IDH2, plays a significant role in the pathogenesis of several cancers, including gliomas, AML, and chondrosarcoma. Understanding the molecular mechanisms underlying IDH mutations is essential for developing targeted therapies and improving patient outcomes in these malignancies

Isocitrate Dehydrogenase Inhibitors Treatment

The IDH inhibitors treatment primarily targets certain types of cancer, particularly those with mutations in isocitrate dehydrogenase (IDH) genes such as gliomas, acute myeloid leukemia (AML), chondrosarcomas, and intrahepatic cholangiocarcinomas. Before initiating treatment with IDH inhibitors, patients undergo genetic testing to identify mutations in IDH genes, particularly IDH1 and IDH2. Once the mutation is identified and the patient is deemed suitable for IDH inhibitor therapy. Isocitrate Dehydrogenase inhibitor suitable for treatment is given. For example, ivosidenib is indicated for AML patients with IDH1 mutations, while enasidenib is used for AML patients with IDH2 mutations.

Isocitrate Dehydrogenase inhibitors work by targeting the mutated IDH enzymes, reducing the production of 2-HG, and potentially slowing down or inhibiting tumor growth. These inhibitors have shown promising results in preclinical studies and clinical trials, leading to their development as targeted therapies for certain types of cancer.

Further details related to country-based variations are provided in the report

IDH Inhibitors Drug Chapters

The drug chapter segment of the IDH inhibitors reports encloses a detailed analysis of IDH inhibitors, marketed drugs and late-stage (Phase III and Phase I/II) pipeline drugs. It also helps understand the IDH inhibitors' clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Isocitrate Dehydrogenase Marketed Drugs

TIBSOVO (ivosidenib): Servier

TIBSOVO (ivosidenib) is an isocitrate dehydrogenase-1 (IDH1) inhibitor indicated in the treatment of patients with IDH1-mutated acute myeloid leukemia (AML), IDH1-mutated cholangiocarcinoma, and IDH1-mutated myelodysplastic syndromes with a susceptible IDH1 mutation as detected by an FDA-approved test.

It is the first FDA-approved therapy for patients with R/R AML and an IDH1 mutation. It is an incredibly exciting milestone for the approximately 6-10% of AML patients with an IDH1 mutation who have been waiting for new treatment options that work radically differently than conventional chemotherapy.

IDHIFA (enasidenib mesylate): Bristol Myers Squibb

IDHIFA is an isocitrate dehydrogenase-2 inhibitor that works by blocking several enzymes that promote cell growth. If the IDH2 mutation is detected in blood or bone marrow samples using the RealTime IDH2 Assay, the patient may be eligible for treatment with IDHIFA. The drug is approved for use with a companion diagnostic, the RealTime IDH2 Assay, which is used to detect specific mutations in the IDH2 gene in patients with AML. The FDA granted the approval of IDHIFA to Celgene Corporation and approval of the RealTime IDH2 Assay to Abbott Laboratories.

The IDHIFA prescribing information and patient Medication Guide have a boxed warning for risk of differentiation syndrome (DS). A boxed warning is the most serious warning from the US FDA. It alerts doctors and patients about drug effects that may be dangerous. DS is a serious condition that happens when cancer cells release certain proteins into your blood. This condition can be life-threatening if not treated, and you may need treatment in a hospital if you develop DS during your IDHIFA treatment.

|

Product |

Company |

Indication |

|

TIBSOVO (ivosidenib) |

Servier |

|

|

IDHIFA (enasidenib mesylate) |

Bristol Myers Squibb |

IDHIFA is indicated for the treatment of adult patients with relapsed or refractory acute myeloid leukemia (AML) with an isocitrate dehydrogenase-2 (IDH2) mutation. |

|

REZLIDHA (olutasidenib) |

Rigel Pharms |

REZLIDHIA is indicated for the treatment of adult patients with relapsed or refractory acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation |

Isocitrate Dehydrogenase Emerging Drugs

|

List of Emerging Drugs | |||||

|

Vorasidenib |

Servier |

Grade 2 Glioma, Residual Glioma, Recurrent Glioma |

IDH Inhibitor |

III |

NCT04164901 |

|

Vorasidenib + Pembrolizumab |

Servier |

Astrocytoma |

IDH Inhibitor |

I |

NCT05484622 |

|

BAY1436032 |

Bayer |

Solid tumors |

IDH inhibitor |

I |

NCT02746081 |

Note: The emerging drug list is indicative, the full list will be given in the final report.

Isocitrate Dehydrogenase Inhibitors Market Outlook

The market for Isocitrate Dehydrogenase inhibitors is expected to grow significantly in the coming years. This is due to the rising occurrence of IDH-mutated cancers, such as acute myeloid leukemia (AML) and cholangiocarcinoma, along with the growing awareness of IDH inhibitors.

The clinical adoption of Isocitrate Dehydrogenase inhibitors, such as ivosidenib and enasidenib, has been steadily increasing, particularly in the treatment of acute myeloid leukemia (AML) with IDH mutations. As more healthcare providers become familiar with these drugs and their indications, their use is expected to expand.

In February 2024, the FDA and EMA accepted vorasidenib regulatory submissions for the treatment of IDH-mutant diffuse glioma. Vodasidemib has innovative targeted therapy which is a selective, highly brain-penetrant dual inhibitor of mutant isocitrate dehydrogenase 1 and 2 (IDH1/2) enzymes for the treatment of IDH-mutant diffuse glioma. If approved, vorasidenib would become a first-in-class targeted therapy for patients with IDH-mutant gliomas and would mark Servier’s sixth approval across IDH-mutant cancers.

Recently, Servier acquired Agios for USD 2 billion plus royalties, this transaction includes the transfer to Servier of Agios Pharmaceuticals’ oncology portfolio, development pipeline, and research programs

IDH inhibitors are only effective in patients with specific genetic mutations in the IDH gene, which limits the eligible patient population for these drugs. This means that the market potential for IDH inhibitors is relatively small compared to other cancer therapies

Several key Isocitrate Dehydrogenase inhibitor companies, including Servier, Bayer, and others, are involved in developing drugs for IDH inhibitors for various indications such as Grade 2 Glioma, Residual Glioma, Recurrent Glioma, Astrocytoma Solid tumor, and others.

Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of IDH inhibitors and define their role in the therapy of cancer.

Isocitrate Dehydrogenase inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging IDH inhibitors expected to be launched in the market during 2020–2034.

Isocitrate Dehydrogenase Inhibitors Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I Isocitrate Dehydrogenase inhibitor clinical trial stage. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for IDHi market growth over the forecasted period.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for IDH inhibitors emerging therapies.

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example, in July 2020, Servier completed its acquisition of Agios Pharmaceuticals' commercial, clinical, and research-stage oncology portfolio for up to USD 2 billion plus royalties. Under the terms of the transaction agreement, Agios received an upfront payment of USD 1.8 billion from Servier and is eligible to receive an additional USD 200 million in a potential regulatory milestone, plus royalties.

The transaction includes the transfer of Agios Pharmaceuticals’ oncology portfolio, development pipeline, and research programs, notably: TIBSOVO (ivosidenib), IDHIFA (enasidenib) a medicine co-promoted with Bristol Myers Squibb in the US to Servier

Vorasidenib, an investigational, brain-penetrant, dual inhibitor of mutant IDH1 and IDH2 is currently being studied in the registration-enabling Phase III INDIGO study in patients with IDH-mutant low-grade glioma.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on IDH inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or IDH inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The Isocitrate Dehydrogenase inhibition reimbursement has been universal in the United States and even in Europe. In the UK, the National Institute for Health and Care Excellence (NICE) recommends ivosidenib as an option for treating locally advanced or metastatic cholangiocarcinoma with an IDH1 R132 mutation in adults after one or more systemic treatments. The committee made these recommendations because the usual treatment for locally advanced or metastatic cholangiocarcinoma with an IDH1 R132 mutation after systemic treatment is modified folinic acid plus fluorouracil and oxaliplatin (mFOLFOX), and the best supportive care to manage symptoms.

Isocitrate Dehydrogenase inhibitor Clinical trial evidence shows that ivosidenib increases how long people live and how long they have before their cancer gets worse compared with placebo. Ivosidenib has not been directly compared with mFOLFOX in a clinical trial. An indirect comparison suggests that ivosidenib increases how long people live compared with mFOLFOX.

There is a considerable unmet need for treatments for locally advanced or metastatic cholangiocarcinoma. When considering the condition's severity, and its effect on quality and length of life, the most likely cost-effectiveness estimates are within the range that NICE considers an acceptable use of NHS resources. So, ivosidenib is recommended.

It was also observed that the most plausible ICER was within the range that NICE considers to be a cost-effective use of NHS resources. This included a severity weight of 1.7 applied to the QALYs. The committee concluded that ivosidenib is recommended for treating locally advanced or metastatic cholangiocarcinoma with an IDH1 R132 mutation in adults after 1 or more systemic treatments.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on Isocitrate Dehydrogenase Inhibitors

- Many Pharma companies presented the data of their IDH inhibitors during the ASCO 2023 conference including Servier and others. Servier’s study concluded that Vorasidenib demonstrates over 50% risk reduction in disease progression or death compared to placebo, with median progression-free survival at 27.7 vs 11.1 months. It delays next intervention by over 70%, with 83% probability of not requiring further treatment at 24 months vs 27% in the placebo group.

- FDA and EMA accept vorasidenib's regulatory submission for IDH-mutant diffuse glioma treatment. and FDA's PDUFA action date set is for August 20, 2024, European Commission approval expected in second half of 2024

- Vorasidenib was granted Fast Track Designation (FTD) by the FDA in February 2023 and Breakthrough Therapy Designation by the FDA in August 2023.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of IDH inhibitors, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the IDH inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM IDH inhibitors market.

Isocitrate Dehydrogenase Inhibitors Report Insights

- Isocitrate Dehydrogenase Inhibitor Targeted Patient Pool

- Therapeutic Approaches

- Isocitrate Dehydrogenase Inhibitors Pipeline Analysis

- Isocitrate Dehydrogenase Inhibitors Market Size and Trends

- Existing and Future Isocitrate Dehydrogenase Inhibitor Market Opportunity

Isocitrate Dehydrogenase Inhibitors Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

IDH Inhibitors Report Assessment

- Current Treatment Practices

- Isocitrate Dehydrogenase Inhibitor Unmet Needs

- Isocitrate Dehydrogenase Inhibitor Pipeline Product Profiles

- Isocitrate Dehydrogenase Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the total Isocitrate Dehydrogenase inhibitor market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative IDH inhibitors market?

- Which drug type segment accounts for the maximum IDH inhibitor sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for IDH inhibitors evolved since the first one was approved?

- Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with IDH inhibitors? What will be the growth opportunities across the 7MM for the patient population of IDH inhibitors?

- What are the key factors hampering the growth of the IDH inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for IDH inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the IDH inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-inhibitors.png&w=256&q=75)