Joint Reconstruction Devices Market

- The Joint Reconstruction Devices Market is experiencing significant growth, driven by the rising prevalence of musculoskeletal disorders, osteoarthritis, and rheumatoid arthritis. Increasing geriatric populations, advancements in orthopedic technology, and rising awareness about minimally invasive procedures are also key contributors to market expansion.

- The leading Joint Reconstruction Devices Companies such as Medtronic, Zimmer Biomet, Stryker, NuVasive®, Inc., Smith & Nephew PLC, CONMED Corporation, DJO, LLC, MicroPort Scientific Corporation, Globus Medical, Arthrex, Inc., Corin Group, Integra LifeSciences, Johnson & Johnson Services, Inc., OMNIlife science™, Inc, Exactech, Inc., B. Braun Melsungen AG, Medacta International, and others.

Request for Unlocking the Sample Page of the “Joint Reconstruction Devices Market”

Joint Reconstruction Devices Market by Joint Type (Knee Reconstruction, Hip Reconstruction, Shoulder Reconstruction, and Others), Technique (Joint Replacement, Arthroplasty, Osteotomy, Resurfacing Surgery, and Others), End-User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the increasing number of trauma cases and the rising number of sports-related injuries worldwide

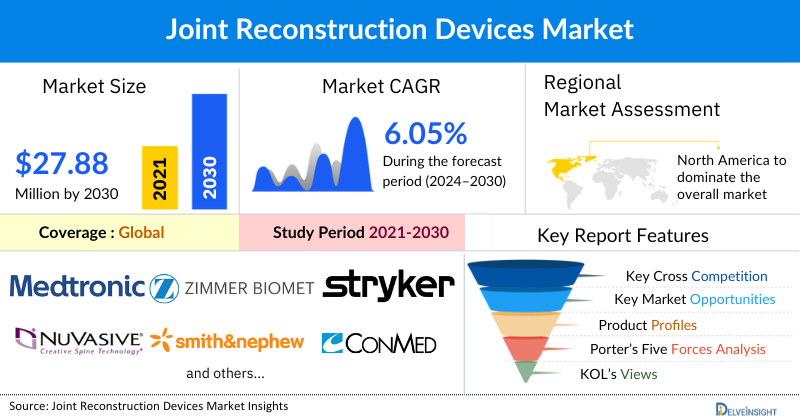

The Joint Reconstruction Devices Market was valued at USD 19.63 million in 2023, growing at a CAGR of 6.05% during the forecast period from 2024 to 2030, to reach USD 27.88 million by 2030. The joint reconstruction devices market is experiencing significant growth due to the increasing number of trauma cases, which are often the result of road traffic accidents, rising injuries due to sports-related activities, and increased product developmental activities that are acting as major factors in escalating the demand for joint reconstruction devices during the forecast period from 2024 to 2030.

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

Geographies Covered |

|

|

Joint Reconstruction Devices Market |

|

|

Joint Reconstruction Devices Market Size |

~USD 19.63 Million in 2023 |

|

Joint Reconstruction Devices Companies |

|

Joint Reconstruction Devices Market Dynamics

As per data from the World Health Organization factsheet (2023) on road traffic injuries, road traffic injuries are the leading cause of fatality in children and young adults in the age group of 5-29 years. The same factsheet further stated that nearly 20-50 million people suffer from non-fatal injuries in road accidents resulting in a disability as a result of their injury each year worldwide. These incidents majorly result in bone fractures and dislocations that can drastically affect the quality of life of patients.

Recent updated data from the National Safety Council (2024) stated that in 2023, emergency departments treated 3.7 million people for injuries related to sports and recreational equipment. The activities most often led to these injuries were exercise, cycling, and basketball. Furthermore, it stated that injuries from exercise and exercise equipment went up by 8% in 2023, with 482,886 injuries compared to 445,642 in 2022. The highest injury rate was among 15 to 24-year-olds.

Joint reconstruction devices play a crucial role in treating injuries resulting from road traffic accidents and sports-related incidents. These devices are used to repair or replace damaged joints, restoring functionality and mobility. In cases of severe fractures or dislocations, joint reconstruction surgery is often required to realign and stabilize the joint, helping patients regain their quality of life and prevent long-term disability.

Increased product developmental activities such as approvals by regulatory bodies and launches are also slated to witness market growth of knee reconstruction/replacement devices. For instance, in June 2024, Meril, a Gujarat-based medical devices company, introduced its indigenously developed surgical robotic technology, MISSO. This innovative system was designed to assist doctors during knee replacement surgeries in real time and was expected to reduce the cost of these procedures by up to 66 percent.

Therefore, the factors stated above collectively will drive the overall joint reconstruction devices market during the forecast period from 2024 to 2030. However, nerve and blood vessel injury, bleeding, and stiffness associated with implants, and nerve damage can cause numbness, weakness, and pain among others may restrain the growth of the joint reconstruction devices.

Joint Reconstruction Devices Market Segment Analysis

Joint Reconstruction Devices Market by Joint Type (Knee Reconstruction, Hip Reconstruction, Shoulder Reconstruction, and Others), Technique (Joint Replacement, Arthroplasty, Osteotomy, Resurfacing Surgery, and Others), End-User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the technique segment of joint reconstruction devices, the joint replacement category is expected to have a significant revenue share in the year 2023. The rapid growth of this category can be attributed to the features and advantages associated with this technique. This procedure involves replacing damaged or diseased joints with prosthetic components, typically made from durable materials like metal, ceramic, or high-grade plastics. The primary feature of joint replacement is its ability to restore mobility and alleviate pain, significantly improving the quality of life for patients suffering from severe arthritis, fractures, or joint degeneration.

The major advantage of joint replacement is the long-term relief it provides; patients often experience significant pain reduction and increased functionality, enabling them to return to daily activities with minimal discomfort. Moreover, advancements in surgical techniques and materials have led to improved outcomes, with many joint replacements lasting for decades. This technique also has a high success rate in reducing the need for further surgeries, making it a preferred option for those with chronic joint issues.

Rising product launches and various clearances from regulatory bodies are also likely to push forward the market revenue shares of this category. For example, in May 2024, OrthAlign, Inc., a leading innovator in surgical technology, announced the launch of its flagship product, Lantern, in Japan for total knee arthroplasty. The launch was supported by its longstanding commercial partner, who had represented OrthAlign in the market since 2013 and had supported over 68,000 OrthAlign cases. Therefore, owing to all the above-mentioned factors, the demand for the joint replacement category upsurges, thereby the category is expected to witness considerable growth eventually contributing to the overall growth of the joint reconstruction devices market during the forecast period from 2024 to 2030.

North America is expected to dominate the overall joint reconstruction devices market:

Among all the regions, North America is expected to dominate the joint reconstruction devices market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This is due to the high incidence of hip fractures, avascular necrosis, and various shoulder injuries, increasing instances of knee replacement surgeries due to bone disorders, and the strong presence of major market players, supportive healthcare infrastructure in the region drives the market for joint reconstruction devices during the forecast period from 2024 to 2030.

According to data from the American Academy of Orthopaedic Surgeons (2024), annually, over 300,000 individuals in the U.S. experience a hip fracture, with the majority occurring in those aged 65 and older due to falls at home or in the community. In addition to this, the National Institute of Health (2023) stated that in the United States, avascular necrosis of the femoral head is estimated to affect between 20,000 and 30,000 new patients each year.

As per data from the American Academy of Physical Medicine and Rehabilitation (2022), in the US, the incidence of shoulder dislocations is approximately 23.9 per 100,000 person-years, with 85-98% of these being anterior dislocations. The frequency of proximal humerus fractures rises with age, increasing by about 15% per year, and these fractures often become more complex in older individuals. Among those over 65 years old, the incidence of humeral fractures is 101 per 100,000 person-years. Clavicle fractures represent about 2.6% to 10% of all fractures across various sports, with a global incidence ranging from 17.4 to 91 per 100,000 person-years. Acromioclavicular joint separations account for 9-12% of shoulder girdle injuries, with Type I and II separations being the most common. These injuries are predominantly seen in contact sports and occur most frequently in young males aged 20 to 30 years.

According to data from the American Academy of Orthopaedic Surgeons (2024), it stated that over 700,000 total knee replacement surgeries are performed each year on average in the US. In addition to this, recent updates provided by the Arthritis Society Canada (2022), stated that 1 million Canadians were affected by gout, which is the most common form of inflammatory arthritis. Gout predominantly impacts males more than females, with approximately 4% of men and 1% of women affected. Among the various joints that can be affected, the knee joint is the most commonly involved.

Joint reconstruction devices play a crucial role in treating conditions such as hip fractures, avascular necrosis, and various shoulder and knee injuries. For hip fractures and avascular necrosis of the femoral head, devices like hip prostheses or total hip replacements are commonly used to restore joint function and alleviate pain. In shoulder injuries, including dislocations and proximal humerus fractures, shoulder prostheses or fixation devices are utilized to stabilize the joint and promote healing. For knee conditions, such as those requiring total knee replacement, joint reconstruction devices are vital in restoring mobility and reducing pain. These devices are essential for improving patient outcomes across these orthopedic conditions.

The prompt and well-established healthcare services and infrastructure supported by product developmental activities by regulatory bodies further contribute to the growth of the regional joint reconstruction devices market growth. The presence of key Joint Reconstruction Devices Companies such as Johnson & Johnson Services, Inc., Stryker Corporation, and Zimmer Biomet, among others with their strong distribution networks ensure widespread availability and accessibility of these devices across the region increasing their revenue shares in the market, and supportive reimbursement programs providing immense growth opportunities for the same.

Therefore, the interplay of all the aforementioned factors above would provide a conducive growth environment for the North America region in the joint reconstruction devices market.

Joint Reconstruction Devices Companies

The leading Joint Reconstruction Devices Companies such as Medtronic, Zimmer Biomet, Stryker, NuVasive®, Inc., Smith & Nephew PLC, CONMED Corporation, DJO, LLC, MicroPort Scientific Corporation, Globus Medical, Arthrex, Inc., Corin Group, Integra LifeSciences, Johnson & Johnson Services, Inc., OMNIlife science™, Inc, Exactech, Inc., B. Braun Melsungen AG, Medacta International, and others.

Recent Developmental Activities in the Joint Reconstruction Devices Market

- In August 2021, the US FDA approved the Persona IQ and awarded a de novo classification grant and authorization to Zimmer Biomet and Canary Medical to market the tibial extension for Persona IQ for total knee replacement surgery.

- In May 2021, Orthofix Medical announced the US and European full market launch of the OSCAR PRO Ultrasonic Arthroplasty Revision System.

- In May 2021 Conformis, Inc. received the 510(k) clearance by the US FDA for its Identity Imprint Knee Replacement System.

- In January 2021, DePuy Synthes received 510(k) FDA approval for its VELYS™ robotic-assisted solution designed for use with the ATTUNE® total knee system.

Key Takeaways from the Joint Reconstruction Devices Market Report Study

- Market size analysis for current joint reconstruction devices market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/services developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the joint reconstruction devices market

- Various opportunities available for the other competitors in the joint reconstruction devices market space

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current joint reconstruction devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for joint reconstruction devices market growth in the coming future?

Target audience who can be benefited from this Joint Reconstruction Devices Market Report Study

- Joint reconstruction device product providers

- Research organizations and consulting companies

- Joint reconstruction devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in joint reconstruction devices

- Various end-users who want to know more about the joint reconstruction devices market and the latest developments in the joint reconstruction devices market

Stay Updated with us for Recent Articles