NM-8074 Sales Forecast

Key Factors Driving NM-8074 Growth

Market Share Gains and New Patient Starts

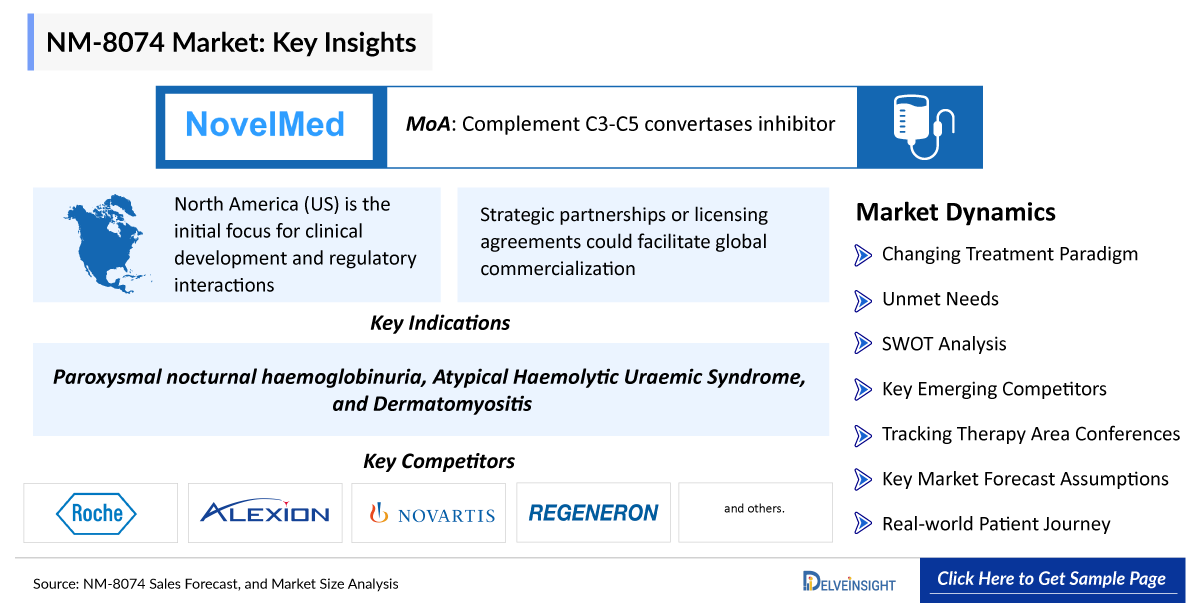

- NM-8074 (ruxoprubart) is positioned to capture share in the complement-mediated disease market, which includes rare hematologic and inflammatory conditions with high unmet need.

- The drug’s first-in-class anti-Bb antibody mechanism—selectively blocking the alternative complement pathway (AP) while preserving the classical pathway—is expected to differentiate it from existing complement inhibitors.

- As clinical development progresses across multiple complement-driven indications (e.g., PNH, aHUS), new patient starts are anticipated to grow steadily, particularly among patients naïve to complement inhibitor therapy.

- NovelMed’s strategy of targeting rare and orphan diseases helps concentrate early adoption among specialists in hematology and nephrology, supporting early momentum.

Expansion Across Key Indications

- Paroxysmal Nocturnal Hemoglobinuria (PNH): Ruxoprubart is actively being evaluated in Phase II clinical trials in PNH patients who are treatment-naïve to complement inhibitors, with interim data showing promising safety and efficacy signals.

- Atypical Hemolytic Uremic Syndrome (aHUS): Clinical development has expanded into aHUS, clearing FDA Phase II trial initiation based on targeted AP blockade.

- Complement C3 Glomerulopathy (C3G): NM-8074 is planned for a Phase Ib study in C3G, supporting broader renal disease targeting.

- Dermatomyositis and Other Autoimmune Disorders: Regulatory clearance to initiate Phase II trials in dermatomyositis highlights expansion into chronic inflammatory conditions.

- These indication expansions suggest multi-disease potential beyond hematology, significantly broadening the drug’s market reach.

Geographic Expansion

- North America (US) is the initial focus for clinical development and regulatory interactions, with FDA support for multiple Phase II studies.

- As development advances, NovelMed is expected to pursue regulatory engagement in Europe, Asia-Pacific, and other major markets, particularly where rare complement-mediated diseases have recognized unmet needs.

- Strategic partnerships or licensing agreements could facilitate global commercialization, especially in regions with strong orphan drug incentives.

New Indication Approvals

- NM-8074 has received USAN generic naming as “ruxoprubart”, a key regulatory and commercial milestone in the drug’s lifecycle.

- Multiple FDA IND approvals have been granted to initiate Phase II clinical trials for diverse indications including PNH, C3G, aHUS, IgA nephropathy, ANCA-associated vasculitis, and dermatomyositis.

- These investigational approvals significantly expand the drug’s potential treatment landscape, improving platform flexibility and future label breadth.

Strong Volume Momentum Across Complement-Mediated Diseases

- Many complement-mediated conditions (e.g., PNH, aHUS, C3G) involve chronic disease processes and limited treatment alternatives, creating substantial patient pools and ongoing demand.

- Early Phase II data in PNH show meaningful clinical activity, including prevention of hemolysis and increases in hemoglobin, supporting volume potential once approved.

- The ability to address both intravascular and extravascular hemolysis with a selective AP inhibitor may translate into sustained use across multiple rare disease populations.

Competitive Differentiation and Market Trends

- Ruxoprubart’s targeted alternative complement pathway inhibition differentiates it from broader complement blockers (e.g., C3 or C5 inhibitors like eculizumab or C5/C3 agents), preserving immune functions such as opsonization.

- This precision mechanism is expected to reduce safety concerns (e.g., infection risk) associated with broad complement blockade, potentially improving tolerability and long-term adherence.

- Broader market trends such as rare disease specialization, personalized immune modulation, and biologics innovation support strong positioning for ruxoprubart.

- Growing reliance on real-world evidence (RWE) and biomarker-guided therapy is likely to strengthen payer confidence and refine patient selection post-approval.

NM-8074 Recent Developments

- In May 2025, NovelMed announced positive 12-week interim results from the ongoing multi-dose Phase II trial of Ruxoprubart, a novel complement-targeting immunotherapy, in adult patients with Paroxysmal Nocturnal Hemoglobinuria (PNH).

- In February 2025, NovelMed Therapeutics announced that the US Food and Drug Administration (FDA) granted clearance for Ruxoprubart (NM8074), an investigational drug, to begin an efficacy Phase II trial to treat Dermatomyositis (DM), a rare autoimmune disorder.

“NM-8074 Sales Forecast, and Market Size Analysis – 2034” report provides comprehensive insights of NM-8074 for potential indications like Paroxysmal nocturnal haemoglobinuria, Atypical Haemolytic Uraemic Syndrome, and Dermatomyositis in the 7MM. A detailed picture of NM-8074’s existing usage in approved and anticipated entry and performance in potential indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the NM-8074 for approved and potential indications.

The NM-8074 market report provides insights about NM-8074’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current NM-8074 performance, future market assessments inclusive of the NM-8074 market forecast analysis for approved and potential indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of NM-8074 sales forecasts, along with factors driving its market.

NM-8074 Drug Market Summary

NM-8074 also known as ruxoprubart, is a humanized monoclonal antibody developed by NovelMed Therapeutics that specifically targets and inhibits complement factor Bb (anti-Bb), a key serine protease in the alternative complement pathway (AP). It selectively blocks AP activation by preventing the amplification loop while preserving classical and lectin pathway functions, thereby reducing C3b deposition, membrane attack complex (MAC) formation, hemolysis, and inflammation in complement-mediated diseases such as paroxysmal nocturnal hemoglobinuria (PNH). Administered intravenously (e.g., 20 mg/kg every two weeks or loading doses followed by maintenance), it has shown promising Phase II results including hemoglobin stabilization, reduced lactate dehydrogenase (LDH), transfusion independence, and improved quality of life in treatment-naïve and anti-C5-experienced PNH patients, with FDA orphan drug designation and IND approval but remaining investigational as of late 2025. The report provides NM-8074’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

NM-8074 is in the Phase II stage of clinical development for the treatment of patients with Paroxysmal Nocturnal Hemoglobinuria (NCT05646524) and AHUS - Atypical Hemolytic Uremic Syndrome (NCT05684159), and Dermatomyositis (NCT06887738).

Scope of the NM-8074 Market Report

The report provides insights into:

- A comprehensive product overview including the NM-8074 MoA, description, dosage and administration, research and development activities in potential indications like Paroxysmal nocturnal haemoglobinuria, Atypical Haemolytic Uraemic Syndrome, and Dermatomyositis.

- Elaborated details on NM-8074 regulatory milestones and other development activities have been provided in NM-8074 market report.

- The report also highlights NM-8074‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved and potential indications across the United States, Europe, and Japan.

- The NM-8074 market report also covers the patents information, generic entry and impact on cost cut.

- The NM-8074 market report contains current and forecasted NM-8074 sales for approved and potential indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The NM-8074 market report also features the SWOT analysis with analyst views for NM-8074 in approved and potential indications.

NM-8074 Market Methodology

The NM-8074 market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

NM-8074 Analytical Perspective by DelveInsight

In-depth NM-8074 Market Assessment

This NM-8074 sales market forecast report provides a detailed market assessment of NM-8074 for potential indications like Paroxysmal nocturnal haemoglobinuria, Atypical Haemolytic Uraemic Syndrome, and Dermatomyositis in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted NM-8074 sales data uptil 2034.

NM-8074 Clinical Assessment

The NM-8074 market report provides the clinical trials information of NM-8074 for approved and potential indications covering trial interventions, trial conditions, trial status, start and completion dates.

NM-8074 Competitive Landscape

The NM-8074 Market report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

NM-8074 Market Potential & Revenue Forecast

- Projected market size for the NM-8074 and its key indications

- Estimated NM-8074 sales potential (NM-8074 peak sales forecasts)

- NM-8074 Pricing strategies and reimbursement landscape

NM-8074 Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- NM-8074 Market positioning compared to existing treatments

- NM-8074 Strengths & weaknesses relative to competitors

NM-8074 Regulatory & Commercial Milestones

- NM-8074 Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

NM-8074 Clinical Differentiation

- NM-8074 Efficacy & safety advantages over existing drugs

- NM-8074 Unique selling points

NM-8074 Market Report Highlights

- In the coming years, the NM-8074 market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The NM-8074 companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence NM-8074’s dominance.

- Other emerging products for Paroxysmal nocturnal haemoglobinuria, Atypical Haemolytic Uraemic Syndrome, and Dermatomyositis are expected to give tough market competition to NM-8074 and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of NM-8074 in approved and potential indications.

- Analyse NM-8074 cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted NM-8074 sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of NM-8074 in approved and potential indications.

Key Questions Answered in NM-8074 Market Report

- What is the class of therapy, route of administration and mechanism of action of NM-8074? How strong is NM-8074’s clinical and commercial performance?

- What is NM-8074’s clinical trial status in each individual indications such as Paroxysmal nocturnal haemoglobinuria, Atypical Haemolytic Uraemic Syndrome, and Dermatomyositis and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the NM-8074 Manufacturers?

- What are the key designations that have been granted to NM-8074 for approved and potential indications? How are they going to impact NM-8074’s penetration in various geographies?

- What is the current and forecasted NM-8074 market scenario for approved and potential indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of NM-8074 in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to NM-8074 for approved and potential indications?

- Which are the late-stage emerging therapies under development for the treatment of approved and potential indications?

- How cost-effective is NM-8074? What is the duration of therapy and what are the geographical variations in cost per patient?