Atypical Hemolytic Uremic Syndrome Market Summary

- Atypical Hemolytic Uremic Syndrome market size was USD 1,300 million in 2023 which is expected to rise during the study period (2020–2034).

- The United States accounted for the highest Atypical Hemolytic Uremic Syndrome market size among the 7MM in 2023, expected to increase by 2034 with a CAGR of approximately 4% during the forecast period (2024–2034).

Atypical Hemolytic Uremic Syndrome Market Insight and Trends

- Atypical hemolytic uremic syndrome (aHUS) is a disease that causes abnormal blood clots to form in small blood vessels in the kidneys. These clots can cause serious medical problems if they restrict or block blood flow, including hemolytic anemia, thrombocytopenia, and kidney failure.

- The most common symptoms of aHUS are confusion, stroke, seizure, heart attack, high blood pressure, formation of blood clots in the kidney, heart, or other organs, nausea and vomiting, abdominal pain, and kidney damage

- There are two types of HUS: Typical HUS (caused by E. coli or other food/water-borne pathogens) and atypical HUS (usually a genetic mutation but sometimes triggered by other illnesses or unknown causes).

- Most cases of aHUS are genetic, although some may be acquired due to autoantibodies or for unknown reasons (idiopathic). aHUS may become chronic, and affected individuals may experience repeated episodes of the disorder. Individuals with aHUS are much more likely to develop chronic serious complications such as severe high blood pressure (hypertension) and kidney (renal) failure.

- aHUS is related to gene mutations coupled with a triggering event. Just having a gene mutation alone usually will not cause the disease. It needs a gene mutation and a triggering event for a flare-up. Some examples of aHUS triggers are pregnancy, infections (from viruses and/or bacteria), cancers, and certain medicines.

- The clinical manifestations of aHUS change easily and involve different frequencies of all organ systems. These presentations include renal, hematologic, respiratory tract, ocular, skin, CNS, cardiovascular, and GI tract.

- The diagnostic test of aHUS includes a complete blood count (CBC) test, which is used to measure the red blood cell and platelet count. Kidney health can be measured by a test called estimated glomerular filtration rate (eGFR) which is calculated using the creatinine level, age, sex, and race.

- In 2023, total diagnosed cases of aHUS in the 7MM were nearly 4,800 cases.

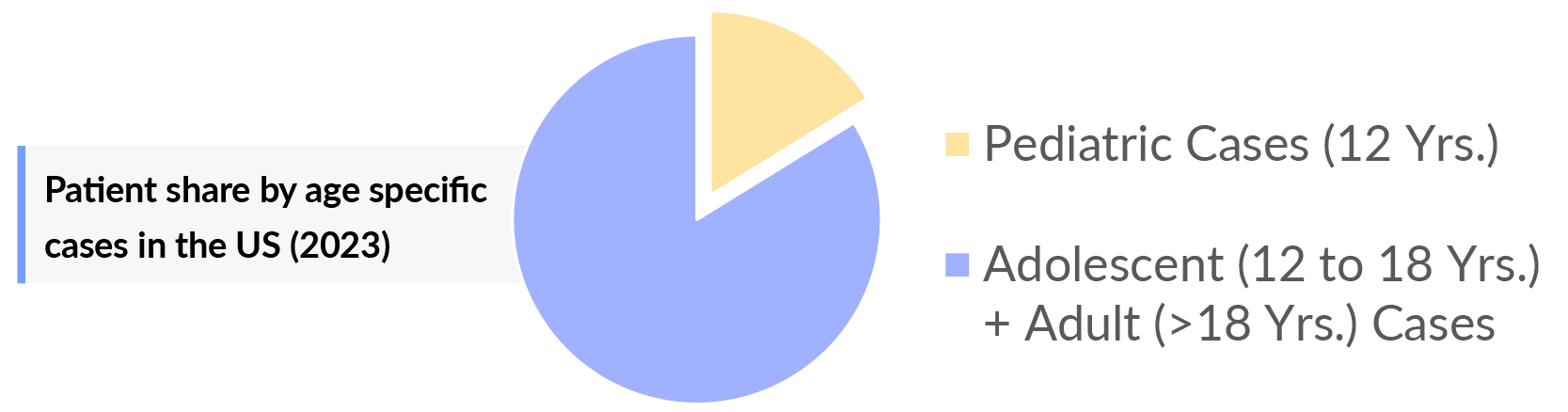

- aHUS is more common in adolescents and adults population than in pediatric. There were approximately 4,000 and 700 cases of adolescent adults and pediatric patients, respectively, in 2023.

- Currently, only two drugs have been approved for the treatment of aHUS, eculizumab, and ravulizumab. Both drugs were developed by Alexicon Pharmaceuticals, and this company was acquired by AstraZeneca in July 2021.

- Iptacopan (LNP023), developed by Novartis Pharmaceuticals is the only oral drug in late-stage (Phase III) clinical development. Iptacopan has the potential to become a preferred treatment option due to its convenient route of administration, i.e. oral and is expected to generate more than USD 500 million in 2034.

- Premium pricing of the Atypical Hemolytic Uremic Syndrome drugs has resulted in the low commercial uptake of the drug, safety concerns with the treatment of aHUS, lack of definitive diagnostic criteria, and upcoming generic competition are expected to hit the aHUS disease market.

Atypical Hemolytic Uremic Syndrome Market size and forecast

- 2023 Atypical Hemolytic Uremic Syndrome Market Size: USD 1300 million

- 2034 Projected Atypical Hemolytic Uremic Syndrome Market Size: Request For Free Sample Report

- Atypical Hemolytic Uremic Syndrome Growth Rate (2025-2034): 4% CAGR

- Largest Atypical Hemolytic Uremic Syndrome Market: United States

Factors affecting Atypical Hemolytic Uremic Syndrome Market Growth

Rising disease awareness and early diagnosis

Increased awareness among healthcare professionals and improved diagnostic tests (genetic screening, complement activity assays) are facilitating early detection of aHUS.

High unmet medical need due to disease severity

aHUS is a rare, life-threatening disease with limited treatment options, creating strong demand for effective therapies.

Expanding therapeutic options

The development and approval of complement inhibitors (e.g., eculizumab, ravulizumab) and emerging pipeline drugs are driving market growth.

Growing understanding of genetic and complement-mediated mechanisms

Advances in research on complement dysregulation and genetic predisposition are enabling targeted therapies, improving patient outcomes.Increasing prevalence of chronic kidney disease and transplant complications aHUS can lead to end-stage renal disease and transplant failure, emphasizing the need for effective management strategies.

Favorable regulatory support for rare diseases

Orphan drug designations, fast-track approvals, and other incentives are encouraging investment and R&D in aHUS therapies.

Improved patient survival and quality of life with treatment

Effective therapies reduce disease complications, dialysis dependence, and hospitalizations, creating higher treatment adoption.

Rising healthcare expenditure in rare diseases

Increased funding and reimbursement for high-cost biologics are supporting market expansion.

Global collaboration and clinical trial activity

Multinational trials and partnerships between biotech and pharma companies are accelerating drug development and availability.

Technological advancements in diagnostics and monitoring

Non-invasive biomarkers, next-generation sequencing, and complement pathway monitoring tools are aiding precise treatment and follow-up.

Scope of the Atypical Hemolytic Uremic Syndrome Market | |

|

Study Period |

2020 to 2034 |

|

Geographies Covered |

|

|

Atypical Hemolytic Uremic Syndrome Market |

|

|

Atypical Hemolytic Uremic Syndrome Market Size |

USD 1,300 million in 2023 |

|

Atypical Hemolytic Uremic Syndrome Companies |

Alexion Pharmaceuticals, Omeros Corporation, Novartis Pharmaceuticals, Hoffmann-La Roche, Chugai Pharmaceutical and others. |

Atypical Hemolytic Uremic Syndrome Market Report Summary

- The Atypical Hemolytic Uremic Syndrome market report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall Atypical Hemolytic Uremic Syndrome market shift has been provided in the report.

- The Atypical Hemolytic Uremic Syndrome market report also encompasses a comprehensive analysis of the aHUS market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The aHUS market report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM aHUS market.

Atypical Hemolytic Uremic Syndrome Market

- Various key Atypical Hemolytic Uremic Syndrome companies are leading the treatment landscape, such as Alexion Pharmaceuticals, Novartis, and Roche. The details of the country-wise and therapy-wise market size have been provided below.

- According to DelveInsights’s patient-based forecasting model, the total Atypical Hemolytic Uremic Syndrome market size in the 7MM was around USD 1,300 million in 2023, which is expected to witness significant growth during the forecast due to launch of new therapies.

- In the total Atypical Hemolytic Uremic Syndrome market size in the 7MM, the United States accounted for the highest Atypical Hemolytic Uremic Syndrome market share, i.e. ~70% in 2023, followed by Germany and France.

- Among the emerging Atypical Hemolytic Uremic Syndrome therapies, Novartis (iptacopan) and Roche (crovalimab) appear to be the drugs that can potentially transform the aHUS market.

- By 2034, among the emerging Atypical Hemolytic Uremic Syndrome therapies, the highest revenue is expected to be generated by iptacopan, i.e., nearly USD 100 million in the EU4 and the UK.

Atypical Hemolytic Uremic Syndrome Drugs Analysis

The section dedicated to drugs in the aHUS market report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to aHUS.

The drug chapters section provides valuable information on various aspects related to clinical trials of aHUS, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting aHUS.

Marketed Atypical Hemolytic Uremic Syndrome Therapies

ULTOMIRIS (ravulizumab): Alexion Pharmaceuticals

Ravulizumab-cwvz, a complement inhibitor, is a humanized monoclonal antibody (mAb) produced in Chinese hamster ovary (CHO) cells. ULTOMIRIS is indicated for the treatment of adult and pediatric patients 1 month of age and older with aHUS to inhibit complement-mediated thrombotic microangiopathy (TMA). In September 2020, Alexion Pharmaceuticals announced that Japan’s MHLW had approved ULTOMIRIS (ravulizumab) for adults and children living with aHUS.

SOLIRIS (eculizumab): Alexion Pharmaceuticals

Eculizumab, a complement inhibitor, is a recombinant humanized monoclonal IgG2/4κ antibody produced by murine myeloma cell culture and purified by standard bioprocess technology. Eculizumab contains human constant regions from human IgG2 sequences, human IgG4 sequences, and murine complementarity-determining regions grafted onto the human framework light and heavy-chain variable regions. SOLIRIS is indicated for the treatment of patients with aHUS to inhibit complement-mediated thrombotic microangiopathy.

Both of the approved drugs, ULTOMIRIS and SOLIRIS, come with black box warning as they increase the risk of serious and life-threatening infections caused by Neisseria meningitides. Owing to the higher risk of serious meningococcal infections, ULTOMIRIS and SOLIRIS are available only through a restricted program under a Risk Evaluation and Mitigation Strategy (REMS).

Emerging Atypical Hemolytic Uremic Syndrome Therapies

Crovalimab (RG6107; SKY59): Hoffmann-La Roche/Chugai Pharmaceutical

Crovalimab (RG6107) is a humanized complement inhibitor C5 monoclonal antibody discovered by Chugai using recycling antibody technology. Blocking the cleavage of C5 to C5a and C5b is expected to inhibit complement activation, which is the cause of several diseases. As the complement system is a key innate immune defense mechanism, it is planned to study the potential of this antibody in a broader range of complement-mediated diseases.

Currently, the drug is in Phase III clinical developmental stage for treating aHUS. It is being investigated in two Phase III clinical trials starting in October and November 2021. Both these trials are a Phase III, multicenter, single-arm study evaluating the efficacy, safety, pharmacokinetics, and pharmacodynamics of Crovalimab in adult and adolescent patients with aHUS and are expected to be completed by March 2024 and December 2025, respectively.

FABHALTA (iptacopan): Novartis Pharmaceuticals

Iptacopan, also known as LNP023, is a first-in-class, orally-administered, small-molecule, potent, and highly selective factor B (FB) inhibitor, a key serine protease of the alternative pathway of the complement cascade. Currently, iptacopan is in the Phase III development stage. The ongoing Phase III clinical trial is a multicenter, single-arm, open-label trial to evaluate the efficacy and safety of oral, twice-daily LNP023 in adult aHUS patients who are naive to complement inhibitor therapy and is expected to be completed by December 2024.

NM-8074: NovelMed

NM-8074 (ruxoprubart) is a humanized monoclonal antibody from NovelMed Therapeutics that inhibits complement factor Bb, selectively blocking the alternative complement pathway while preserving classical and lectin pathways. In Phase II trials, it has demonstrated improved hemoglobin levels, reduced LDH, and transfusion independence in PNH patients. NM-8074 is also being evaluated for aHUS and dermatomyositis and remains investigational with orphan drug designation.

Analysis of Emerging Atypical Hemolytic Uremic Syndrome Therapies | |||||

|

Drug Name |

Company |

MoA |

RoA |

Molecule Type |

Phase |

|

Crovalimab (RG6107; SKY59) |

Hoffmann-La Roche/ Chugai Pharmaceutical |

Complement C5 inhibitor |

Intravenous |

Monoclonal antibody |

III |

|

Iptacopan (LNP023) |

Novartis Pharmaceuticals |

Complement factor B inhibitor |

Oral |

Small molecule |

III |

|

NM8074 |

NovelMed Therapeutics |

Complement C3-C5 convertases inhibitor |

Intravenous |

Monoclonal antibody |

II |

Note: Detailed assessment will be provided in the final report of aHUS...

Atypical Hemolytic Uremic Syndrome (aHUS) Market Outlook

The introduction of complement C5 inhibition into the treatment landscape has significantly improved patient prognosis and QoL. Currently available complement C5 inhibitors across the 7MM are SOLIRIS (eculizumab) and ULTOMIRIS (ravulizumab), both Alexion Pharmaceuticals products. Alexion Pharmaceuticals was acquired by AstraZeneca in 2021.

The treatment transition of patients being treated with eculizumab to ravulizumab has been established as a viable treatment strategy, as this would lead to a reduction in the dosing frequency, which would then lead to a significant reduction of economic burden (treatment-related costs of repeated infusions) and improve the overall QoL of patients.

Although eculizumab and ravulizumab are safe and effective, their high costs often limit their usage in the treatment landscape. Hence, efficacious pharmacologic options for managing the most prevalent and most disabling stages of aHUS are extremely limited; therefore, new treatments are desperately needed.

In a nutshell, a few potential therapies are being investigated to manage aHUS. Even though it is too soon to comment on the above-mentioned promising candidate to enter the market during the forecast period (2024–2034), it is safe to assume that the future of this market is bright. Eventually, these drugs shall create a significant difference in the landscape of aHUS in the coming years. The treatment space is expected to experience a significant positive shift in the coming years owing to the improvement in healthcare spending worldwide.

Further details are provided in the report...

Atypical Hemolytic Uremic Syndrome (aHUS) Disease Understanding

Atypical Hemolytic Uremic Syndrome Overview

aHUS is an extremely rare disease characterized by low levels of circulating red blood cells due to their destruction (hemolytic anemia), low platelet count (thrombocytopenia) due to their consumption, and the inability of the kidneys to process waste products from the blood and excrete them into the urine (acute kidney failure), a condition known as uremia.

Hemolytic anemia occurs when RBC undergoes hemolysis faster than normal. In aHUS, RBCs can break apart as they squeeze past clots within small blood vessels. If cells are destroyed faster than the body can replace them, it leads to anemia. As a result of clot formation in small blood vessels, patients experience kidney damage and acute kidney failure, leading to end-stage renal disease (ESRD) in about half of all cases.

Further details are provided in the report...

Atypical Hemolytic Uremic Syndrome (aHUS) Diagnosis

Diagnosing aHUS is complicated by the fact that it is more challenging to establish without a family history of the disorder. The diagnostic criteria associated with aHUS are hemolytic anemia (anemia in the presence of broken red blood cells), low platelet count (thrombocytopenia), and kidney dysfunction.

Further details related to country-based variations are provided in the report...

Atypical Hemolytic Uremic Syndrome (aHUS) Treatment

Treatment of Atypical Hemolytic Uremic Syndrome is supportive, with attention to management of acute kidney injury and systemic complications. The use of packed cells is necessary in patients with severe anemia. Platelet transfusions are rarely required, except in counts are <10 000/cu mm or thrombocytopenia associated with active bleeding or in patients undergoing invasive procedures.

Fluid and electrolyte management is important to maintain intravascular volume status and combat the consequences of aHUS, acute kidney injury, and multisystem organ failure. Electrolyte disturbances should be promptly corrected and nephrotoxic medications avoided. Hypertension should be managed with appropriate agents. Renal replacement therapy is required in patients with uremia, fluid overload, or electrolyte abnormalities. Plasma exchange and eculizumab or rivalizumab, a complement inhibitor, offer specific forms of therapy.

Further details related to treatment and management are provided in the report...

Atypical Hemolytic Uremic Syndrome (aHUS) Epidemiology

The aHUS epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases, diagnosed cases, age-specific cases, and treated cases of aHUS in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight’s epidemiology model, the total diagnosed cases of aHUS in the 7MM was ~4,800 in 2023 which is further expected to increase over the forecast period.

- Among the 7MM, the United States accounted for the highest number of prevalent cases of aHUS in 2023, nearly 3,500 cases. These cases are anticipated to increase by 2034.

- In 7MM, Adolescents and adults population accounted for the ~80% of diagnosed cases in 2023.

- Among EU4 and the UK, Germany accounted for the highest number of prevalent cases in 2023, while Spain accounted for the least.

-03.png)

Further details related to epidemiology will be provided in the report...

Latest KOL Views on Atypical Hemolytic Uremic Syndrome

To stay abreast of the latest trends in the Atypical Hemolytic Uremic Syndrome market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of aHUS, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the University of Munich, the University of Tokyo, the European Dialysis and Transplant Association, the American Society of Nephrology, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the aHUS market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Atypical Hemolytic Uremic Syndrome Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Atypical Hemolytic Uremic Syndrome therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for aHUS, one of the most important primary endpoints was achieving hemolysis control, LDH normalization, etc. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Atypical Hemolytic Uremic Syndrome Market Access and Reimbursement

Because newly authorized Atypical Hemolytic Uremic Syndrome drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The Atypical Hemolytic Uremic Syndrome market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Atypical Hemolytic Uremic Syndrome (aHUS) Market Report Insights

- Atypical Hemolytic Uremic Syndrome Patient Population

- Atypical Hemolytic Uremic Syndrome Therapeutic Approaches

- aHUS Market Size

- Atypical Hemolytic Uremic Syndrome Market Trends

- Existing Atypical Hemolytic Uremic Syndrome Market Opportunity

Atypical Hemolytic Uremic Syndrome (aHUS) Market Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- aHUS Epidemiology Segmentation

- Key Cross Competition

Atypical Hemolytic Uremic Syndrome (aHUS) Market Report Assessment

- Current Atypical Hemolytic Uremic Syndrome Treatment Practices

- Reimbursements

- Atypical Hemolytic Uremic Syndrome Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions Answered in the Atypical Hemolytic Uremic Syndrome (aHUS) Market Report

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in aHUS management recommendations?

- Would research and development advances pave the way for future tests and therapies for aHUS?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of aHUS?

- What kind of uptake will the new therapies witness in coming years in aHUS patients?

-market-report.png&w=256&q=75)

-01.png)

-01.png)