Dermatomyositis Market Summary

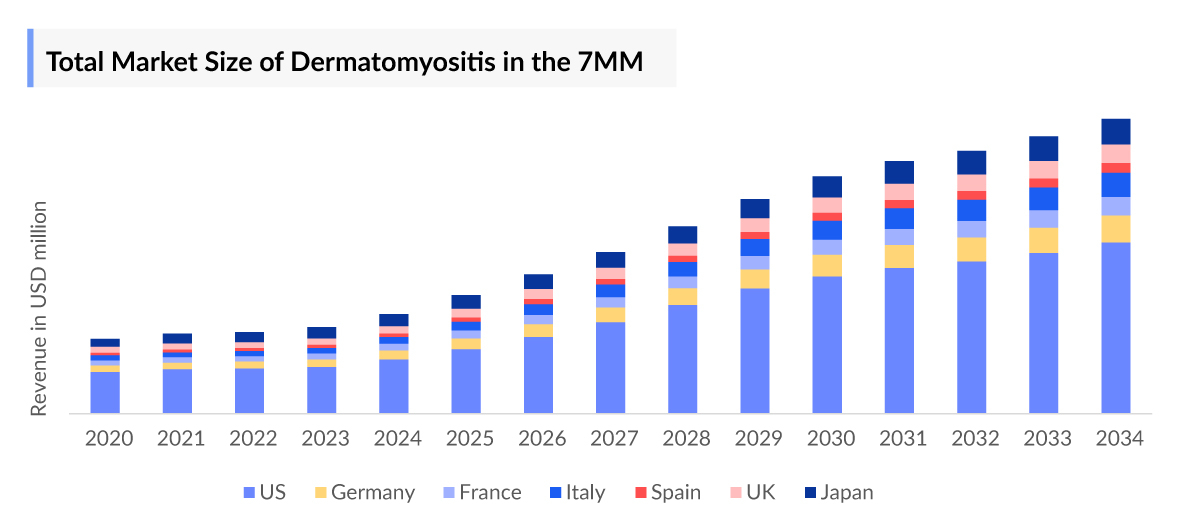

- The total Dermatomyositis market size is anticipated to experience growth during the forecast period due to expected entry of emerging Dermatomyositis therapies that includes Brepocitinib, SAPHNELO, Dazukibart, Efgartigimod, and HIZENTRA.

- In 2023, the Dermatomyositis market size was highest in the US among the 7MM accounting for approximately USD 117.6 million that is further expected to increase at a CAGR of 17.7%.

- Key Dermatomyositis companies such as Argenx, Pfizer, Janssen, and others are working to develop therapies which will drive the Dermatomyositis market.

- The current Dermatomyositis treatment options mainly rely upon the use of corticosteroids, Immunosuppressants, Immunoglobulins, Biologics and others. Immunoglobulins accounted for highest market share of ~119 million in 2023, for treatment of Dermatomyositis in the 7MM.

- The Dermatomyositis market size in the 7MM will increase at a CAGR of 16.8% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging Dermatomyositis therapies

Dermatomyositis Market Insights and Trends

- Dermatomyositis is a rare inflammatory condition characterized by muscle weakness and distinctive skin rashes. It primarily affects adults and children, leading to significant physical disability if left untreated.

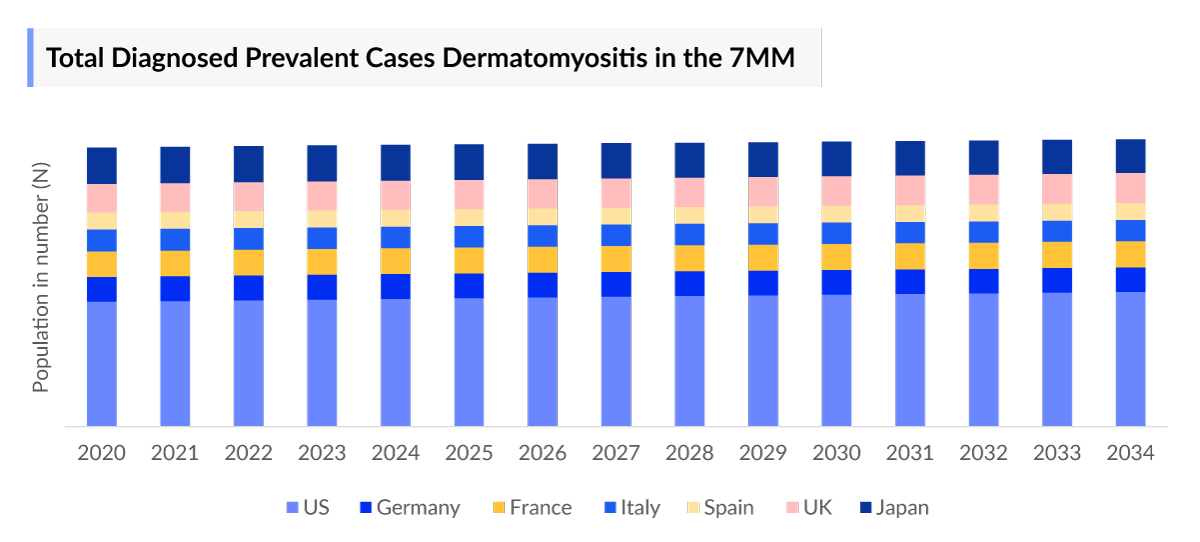

- According to DelveInsight’s estimates, in 2023, there were nearly 72 thousand total diagnosed prevalent cases of dermatomyositis in the 7MM, of which nearly 9% were juvenile and 91% were adult.

- In mid-2021, Octapharma’s OCTAGRAM 10% received significant regulatory approvals for the treatment of adult dermatomyositis: in July from the US FDA, in June from European authorities.

- In July 2024, Priovant Therapeutics completed enrollment for the Phase III VALOR study, evaluating brepocitinib in dermatomyositis. The trial enrolled 241 subjects across 90 sites worldwide, making it the largest interventional dermatomyositis trial to date. VALOR is a double-blind, placebo-controlled study with subjects randomized into three groups. The primary endpoint is the Total Improvement Score (TIS) at 52 weeks, with data expected in the second half of 2025, followed by a potential NDA submission.

- The dermatomyositis market is expanding due to increasing dermatomyositis prevalence, rising awareness and better diagnostic capabilities, which increase demand for treatments. Advancements in research, increased funding for rare diseases, and the development of novel Dermatomyositis therapies are also key drivers.

DelveInsight’s “Dermatomyositis– Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Dermatomyositis, historical and forecasted epidemiology as well as the Dermatomyositis market trends in the United States, EU4, and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Dermatomyositis market report provides current treatment practices, emerging Dermatomyositis drugs, market share of individual Dermatomyositis therapies, and current and forecasted 7MM Dermatomyositis market size from 2020 to 2034. The Report also covers current Dermatomyositis treatment options, Dermatomyositis market drivers, Dermatomyositis market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Dermatomyositis market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Key Factors Driving the Dermatomyositis Market

Rising Dermatomyositis Prevalence

Recent studies indicate an increasing prevalence of dermatomyositis in the US. This trend is attributed to a combination of factors including improved diagnostic techniques, heightened awareness among healthcare providers, and a potential rise in underlying autoimmune conditions. According to DelveInsight’s estimates, in 2024, there were nearly 70K total diagnosed prevalent cases of dermatomyositis in the 7MM.

Off-label Adoption and Real-world Evidence (RWE)

Early positive RWE (case series, single-arm studies) for agents such as JAK inhibitors and select biologics has accelerated off-label use in refractory patients, helping build clinical momentum ahead of formal label expansions.

Advancements in Diagnostic Technologies

Advancements in diagnostic technologies, such as biomarkers and genetic testing, may improve early detection and diagnosis, potentially expanding the market.

Launch of Emerging Dermatomyositis Drugs

Few new agents are being developed and tested as potential treatments for dermatomyositis; the emerging drugs include Brepocitinib by Priovant Therapeutics/Pfizer, Dazukibart PF-06823859 (anti-beta interferon) by Pfizer, Efgartigimod by Argenx, SAPHNELO (anifrolumab) by AstraZeneca, and others.

Dermatomyositis Understanding and Treatment Algorithm

Idiopathic inflammatory myopathies (IIM) are a heterogeneous group of connective tissue disorders characterized by progressive muscle weakness. IIM is the umbrella term that includes dermatomyositis, polymyositis (PM), overlap myositis (OM), sporadic inclusion body myositis (IBM), and necrotizing autoimmune myopathy (NAM), also known as immune-mediated necrotizing myopathy (IMNM).

Dermatomyositis is a rare autoimmune disorder characterized by muscle inflammation (myositis) and skin inflammation (dermatitis). Proximal muscle weakness is a hallmark feature, affecting muscles close to the trunk, such as those in the thighs and upper arms, including heliotrope rash (purplish discoloration around the eyes), Gottron’s papules (reddish bumps on knuckles), and photosensitive rash on sun-exposed areas.

The onset of the disease is usually insidious or acute, with a waxing and a waning course. Other findings present in dermatomyositis include Raynaud’s phenomenon, gastrointestinal ulcers, and cardiac symptoms. Systemic symptoms such as fever, malaise, and weight loss are also present,

Dermatomyositis is a complex and heterogeneous condition that occurs in both adults and even in children, juvenile dermatomyositis (JDM). They share the hallmark features of pathognomic skin rash and muscle inflammation but are heterogeneous disorders with various additional features and complications.

Dermatomyositis Diagnosis

The Dermatomyositis diagnosis involves a combination of clinical evaluation, detection of characteristic physical findings, certain laboratory tests, and imaging studies. Key diagnostic criteria include muscle weakness, characteristic skin rash, elevated muscle enzymes, myositis-associated enzyme levels, electromyography, and muscle biopsy. Muscle biopsy is the most accurate test to confirm the diagnosis and to exclude other causes of muscle weakness or skin rash. However, choosing the right muscle for a biopsy is crucial to prevent a missing diagnosis. Further, the differential diagnosis includes body myositis, myasthenia gravis, muscular dystrophies, motor neuron disease, neuropathy, and inherited metabolic myopathy.

Further details related to diagnosis are provided in the report…

Dermatomyositis Treatment

Dermatomyositis treatment management typically involves a multidisciplinary approach. Treatment aims to suppress inflammation and relieve associated symptoms. The first-line treatment is systemic glucocorticoids with or without immunosuppressant (methotrexate, cyclosporine, mycophenolate, azathioprine, and others), biologic (rituximab, abatacept, and others). Initially, prednisolone is given at high doses for the first few months until the muscle enzyme levels decline and muscle strength improves. Once alternate diagnoses are ruled out, steroid-sparing immunosuppressant can be added. If biologics fails, IVIG or a combination of immunosuppressants are used as a second-line therapy.

Moreover, exercise and physical therapy are used to maintain muscle functioning and mobility. Dermatomyositis treatment may also include managing any internal organ involvement, such as Interstitial Lung Disease (ILD) or cardiac issues.

The current Dermatomyositis treatment market has several drawbacks, like, most current therapies are off-label or generics, and there is only one approved Dermatomyositis therapy, Octapharma’s OCTAGAM 10%, for treating dermatomyositis.

Further details related to treatment are provided in the report…

Dermatomyositis Epidemiology

As the Dermatomyositis market is derived using a patient-based model, the Dermatomyositis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Diagnosed Dermatomyositis prevalence, Type-specific Diagnosed Dermatomyositis prevalence, Age-specific Diagnosed Dermatomyositis prevalence, Gender-specific Diagnosed Prevalent Cases of Dermatomyositis, Severity-specific Diagnosed Prevalent Cases of Dermatomyositis, and Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis, in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

Key Findings from Dermatomyositis Epidemiological Analyses and Forecast

- The total diagnosed Dermatomyositis prevalence in the United States were around 38.5 thousand cases in 2023.

- The United States contributed to the largest diagnosed prevalent population of Dermatomyositis, acquiring ~54% of the 7MM in 2023. Whereas, EU4 and the UK, and Japan accounted for around 29% and 17% of the total population share, respectively, in 2023.

- Among the EU4 countries, Germany accounted for the largest number of diagnosed prevalent Dermatomyositis (5,272 Cases) cases followed by the UK (4,594 Cases), whereas Spain accounted for the lowest number of cases (3,053 Cases) in 2023.

- In 2023, it was estimated that there were around 15 thousand diagnosed cases in the age group of 40–59, followed by 13 thousand in 60–79 age group, 5,400 cases in 18–39 age group, 4,200 cases in 0–17 age group, and 1200 cases in 80 years and older in the US.

- According to DelveInsight estimates, in 2023 there were approximately 6,937 diagnosed prevalent cases of Mild type and about 5,476 cases of Moderate to severe type in Japan.

- In 2023, Dermatomyositis affected ~12 thousand males and ~26 thousand females in the United States.

- In 2023, DelveInsight analysis of the chronicity-specific data in the US revealed that 70% of people affected with Dermatomyositis have Chronic type, while 30% have the Acute Type.

- In Japan in 2023, comorbidity-specific cases accounted for the following percentages of diagnosed prevalent cases: ILD at 20%, CVD at 18%, cancer malignancy at 4%, and other conditions (including osteoporosis, dysphagia, Raynaud’s syndrome, calcinosis, etc.) at 58%.

Dermatomyositis Drugs Analysis

The drug chapter segment of the Dermatomyositis market report encloses a detailed analysis of Dermatomyositis off-label drugs and late-stage (Phase-III and Phase-II) dermatomyositis drugs. It also helps to understand the Dermatomyositis clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Recent Developments in the Dermatomyositis Market:

- In January 2025, RESTEM announced that the FDA granted Fast Track designation for its Restem-L program, using umbilical cord outer lining stem cells (ULSCs) to treat Polymyositis and Dermatomyositis (PM/DM), now classified as Idiopathic Inflammatory Myopathy (IIM). This follows the recent Orphan Drug Designation for Restem-L in IIM.

Dermatomyositis Marketed Drugs

OCTAGAM 10% (immunoglobulin): Octapharma

OCTAGAM 10% (immune globulin intravenous [human]) is the first and only intravenous immunoglobulin (IVIg) product indicated for the treatment of primary humoral immunodeficiency, chronic Immune Thrombocytopenic Purpura (ITP) and dermatomyositis. IVIG replacement therapy is the apparent treatment of choice for humoral primary immunodeficiency, such as dermatomyositis, as these patients cannot mount an effective immune response toward pathogens.

Additionally, IVIg acts as a corticosteroid-sparing agent and represents a unique dermatomyositis treatment options for patients. They are safe and effective treatment options, especially in patients showing no response or incomplete response to corticosteroids or who experience severe side effects. It is made from healthy human blood with a high level of certain defensive substances (antibodies), which help fight infections, and is also used to increase the blood count (platelets) in persons with a certain blood disorder, ITP.

In May 2017, The US FDA granted Octapharma’s OCTAGAM 10% orphan drug designation (ODD) for treating dermatomyositis. The Office of Orphan Products Development (OOPD) awarded 7 years of marketing exclusivity treatment of adult dermatomyositis.

In August 2021, Octapharma US received 7 years of marketing exclusivity from the US FDA Office of Orphan Products Development (OOPD) for OCTAGAM 10% [Immune Globulin Intravenous (Human)], making it the first and only intravenous immunoglobulin (IVIg) indicated for the treatment of adult dermatomyositis.

Further detail in the report…

Dermatomyositis Emerging Drugs

Brepocitinib: Priovant Therapeutics/Pfizer

Brepocitinib, being developed by Priovant Therapeutics, is an oral, once-daily dual inhibitor of TYK2 and JAK1. It targets the cytokine signaling pathways implicated in autoimmune diseases, including Type I and Type II interferon, IL-6, IL-12, and IL-23. This dual inhibition is intended to provide a broad suppression of these pathways, which are involved in the pathogenesis of dermatomyositis. Brepocitinib has shown promising results in several Phase II studies, demonstrating its efficacy and safety. Currently, it is being evaluated in a registrational Phase III trial specifically for dermatomyositis, aiming to address the significant unmet need for effective and convenient treatments for this condition.

In June 2022, Roivant Sciences and Pfizer launched Priovant Therapeutics, dedicated to developing and commercializing novel therapies for autoimmune diseases with the most significant morbidity and mortality.

Brepocitinib is currently under development for multiple indications, including Hidradenitis Suppurativa, Crohn’s Disease, Vitiligo, Psoriatic Arthritis, Alopecia Areata, and Lupus for product enhancement. It is also being developed as a new molecular entity for Ulcerative Colitis and as a topical treatment for Atopic Dermatitis and Psoriasis. This diverse pipeline showcases the potential versatility of brepocitinib (PF-06700841), a TYK2/JAK1 inhibitor, in treating various autoimmune and inflammatory conditions.

Brepocitinib is optimistic for its acceptance and use as a Tyk2 inhibitor for the treatment of dermatomyositis. However, results from Phase III trials are imperative to establish its efficacy in dermatomyositis patients. The approval in similar inflammatory autoimmune diseases gives the drug an upper hand with a good market presence.

The drug is under investigation for dermatomyositis in a Phase III dermatomyositis clinical trials, with top-line results expected by the second half of 2025.

Further detail in the report…

Efgartigimod: Argenx

Efgartigimod is an SC product combination of efgartigimod alfa and recombinant human hyaluronidase PH20 (rHuPH20). Efgartigimod targets the neonatal Fc receptor (FcRn) as a first-in-class investigational antibody fragment. Efgartigimod binds to the neonatal Fc receptor and inhibits its interaction with IgG, thereby reducing IgG recycling and increasing the degradation of IgG and pathological auto-antibodies without altering other immunoglobulins and albumin levels.

It is undergoing a Phase III and II/III dermatomyositis clinical trials in participants with active IIM subtypes, including dermatomyositis. Further, the interim analysis of the first 30 patients of each subset is expected by 2024.

NM-8074: NovelMed

NM-8074 (ruxoprubart) is a humanized monoclonal antibody from NovelMed Therapeutics that inhibits complement factor Bb, selectively blocking the alternative complement pathway while preserving classical and lectin pathways. In Phase II trials, it has demonstrated improved hemoglobin levels, reduced LDH, and transfusion independence in PNH patients. NM-8074 is also being evaluated for aHUS and dermatomyositis and remains investigational with orphan drug designation.

Dermatomyositis Market Outlook

There is no cure for dermatomyositis; however, medication can reduce inflammation and vasculitis, invariably minimize symptomatology, and improve the patient’s quality of life. The recent approval of OCTAGAM and the presence of several management guidelines, including the British Society for Rheumatology guideline, the Japanese Society of Rheumatology guideline, and others, have revolutionized the treatment landscape of dermatomyositis. Several other off-label medications, including corticosteroids, immunosuppressants, antimalarial drugs, antibiotics, and topical ointments, are used individually or in combination to eliminate symptoms.

Dermatomyositis skin disease is managed with general measures, physiotherapy, and medical therapy. General measures include sun protection through avoidance, sun-protective clothing, and SPF 30+ sunscreen. Topical treatments include corticosteroids and calcineurin inhibitors, while systemic management often involves hydroxychloroquine and methotrexate. Systemic glucocorticoids are effective for muscle symptoms but not for skin disease.

Nonpharmacological management of dermatomyositis includes diet, physiotherapy, and adjunctive treatments like plasmapheresis, extracorporeal photochemotherapy, and total body irradiation for therapy-resistant cases. Surgery is rarely used but may be necessary for severe esophageal dysfunction (gastrostomy) or for removing calcinosis nodules. For dry eye, preventive measures include environmental adjustments, patient education, dietary changes (e.g., fatty acid supplements), ocular lubricants, and lid hygiene.

Immunosuppressants and immunomodulators are used as adjuvants with glucocorticoids for boosting efficacy and decreasing the dose of corticosteroids. Therapy with immunosuppressants such as azathioprine, methotrexate, mycophenolate mofetil, cyclophosphamide, tacrolimus, or cyclosporine may be beneficial for some affected individuals who have an insufficient response to steroid therapy alone, dose-limiting adverse effects, or frequent relapses.

When corticosteroids alone are not sufficient or when long-term use poses risks, additional immunosuppressants such as methotrexate, azathioprine, or mycophenolate mofetil are prescribed. These drugs help further suppress the immune response to decrease inflammation and muscle damage.

Methotrexate, an antimetabolite, is considered a first-line option for adjuvant therapy in patients not responding satisfactorily to oral corticosteroids. In adults, it starts at the lower dose (7.5–10 mg/week), and the dose is slowly increased to 25 mg/week. With the gradual increase in the dose of methotrexate, the dose of corticosteroids is reduced. Gastrointestinal, hepatic, and hematological (neutropenia, thrombocytopenia) adverse events are reported with methotrexate. Folic acid is used to minimize adverse effects associated with methotrexate.

For moderate to severe dermatomyositis, treatment typically involves a combination of corticosteroids and a steroid-sparing immunosuppressant like methotrexate, azathioprine, or mycophenolate mofetil. This strategy helps reduce steroid use and manage side effects while effectively controlling the disease. In mild cases, corticosteroid monotherapy may be adequate, but for more severe cases, combining therapies is generally preferred to avoid inadequate control and minimize side effects.

Patients who do not respond satisfactorily to therapy with steroids, azathioprine, or methotrexate are considered resistant. Dermatomyositis treatment options for resistant cases include rituximab, mycophenolate mofetil, calcineurin inhibitors, IVIG, and cyclophosphamide.

Few new agents are being developed and tested as potential treatments for Dermatomyositis; the emerging drugs include Brepocitinib by Priovant Therapeutics/Pfizer, Dazukibart PF-06823859 (anti-beta interferon) by Pfizer, Efgartigimod by Argenx, SAPHNELO (anifrolumab) by AstraZeneca, and others.

- Key companies such as Argenx, Pfizer, Janssen, and others are working to develop therapies which will drive the Dermatomyositis market.

- The Dermatomyositis market size in the 7MM was approximately USD 187 million in 2023.

- The Dermatomyositis market size in the 7MM will increase at a CAGR of 16.8% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging Dermatomyositis therapies.

- The United States accounted for the highest Dermatomyositis market size approximately 62% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Among the European countries, Germany had the highest Dermatomyositis market size with nearly USD 11.29 million in 2023, while Spain had the lowest market size of Dermatomyositis with ~USD 6.54 million in 2023.

- The Dermatomyositis market size in Japan was estimated to be ~USD 25.28 million in 2023, which accounts for 14% of the total 7MM market.

- With the expected launch of upcoming Dermatomyositis therapies, such as Brepocitinib the total Dermatomyositis market size of Dermatomyositis is expected to show change in the upcoming years.

Dermatomyositis Drugs Uptake

This section focuses on the uptake rate of potential Dermatomyositis drugs expected to launch in the market during 2020–2034. For example, Brepocitinib in the US is expected to be launched by 2026 with a peak share of 15%. Brepocitinib is anticipated to take 7 years to peak with a slow-medium uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Dermatomyositis Clinical Trials Analysis

The Dermatomyositis market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Dermatomyositis companies involved in developing targeted therapeutics.

Dermatomyositis Pipeline Development Activities

The Dermatomyositis market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Dermatomyositis emerging therapies.

Latest KOL Views on Dermatomyositis

To keep up with current Dermatomyositis market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Dermatomyositis evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake` along with challenges related to accessibility, including KOL from University of Chicago Medicine, US; Joe DiMaggio Children’s Hospital, FL, US; Department of Dermatology, Perelman Center for Advanced Medicine, the US; University Medical Center Hamburg-Eppendorf, Hamburg, Germany; Strasbourg University Hospital, Strasbourg, France; Sandwell and West Birmingham Hospitals NHS Trust, UK; Osaka University Graduate School of Medicine, Suita, Japan; Kanagawa Children’s Medical Center, JapanKyushu University, Fukuoka, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Dermatomyositis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Dermatomyositis therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Dermatomyositis Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The Dermatomyositis market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Dermatomyositis Market Report

- The Dermatomyositisreport covers a segment of key events, an executive summary, and a descriptive overview of Dermatomyositis, explaining its causes, signs and symptoms, and currently available Dermatomyositis therapies.

- Comprehensive insight has been provided into the Dermatomyositis epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Dermatomyositis treatment market.

- A detailed review of the Dermatomyositis market, historical and forecasted Dermatomyositis market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Dermatomyositis market.

Dermatomyositis Market Report Insights

- Dermatomyositis Patient Population

- Therapeutic Approaches

- Dermatomyositis Pipeline Analysis

- Dermatomyositis Market Size

- Dermatomyositis Market Trends

- Existing and Future Dermatomyositis Market Opportunities

Dermatomyositis Market Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Dermatomyositis Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Dermatomyositis Drugs Uptake and Key Market Forecast Assumptions

Dermatomyositis Market Report Assessment

- Current Dermatomyositis Treatment Practices

- Unmet Needs

- Pipeline Dermatomyositis Drugs Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions answered in the Dermatomyositis Market

Dermatomyositis Market Insights

- What was the Dermatomyositis market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Dermatomyositis total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Dermatomyositis market size during the forecast period (2024–2034)?

- At what CAGR, the Dermatomyositis market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Dermatomyositis market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Dermatomyositis market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Dermatomyositis Epidemiology Insights

- What are the disease risk, burden, and unmet needs of Dermatomyositis?

- What is the historical Dermatomyositis patient population in the United States, EU4 (Germany, France, Italy, Spain) and the UK, and Japan?

- What would be the forecasted patient population of Dermatomyositis at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Dermatomyositis?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Dermatomyositis during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Dermatomyositis along with the approved therapy?

- What are the current treatment guidelines for the treatment of Dermatomyositis in the US, Europe, And Japan?

- What are the Dermatomyositis-marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many companies are developing therapies for the treatment of Dermatomyositis?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Dermatomyositis?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to the Dermatomyositis therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the dermatomyositis clinical trials going on for Dermatomyositis and their status?

- What are the key designations that have been granted for the emerging therapies for Dermatomyositis?

- What are the 7MM historical and forecasted market of Dermatomyositis?

Reasons to Buy Dermatomyositis Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Dermatomyositis Market.

- Insights on patient burden/dermatomyositis prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Frequently Asked Questions

1. What is the forecast period covered in the report?

The Dermatomyositis Epidemiology and Market Insight report for the 7MM covers the forecast period from 2024 to 2034, providing a projection of market dynamics and trends during this timeframe.

2. Who are the key players in the Dermatomyositis market?

The Dermatomyositis market is quite robust. The major layers are Priovant Therapeutics, Pfizer, Argenx, and others which are currently developing drugs for the treatment of Dermatomyositis.

3. How is the market size estimated in the forecast report?

The market size is estimated through data analysis, statistical modeling, and expert opinions. It may consider factors such as prevalent cases, treatment costs, revenue generated, and market trends.

4. What is the key driver of the Dermatomyositis market?

The increase in diagnosed prevalent cases of Dermatomyositis and the launch of emerging therapies are attributed to be the key drivers for increasing the Dermatomyositis market.

5. What is the expected impact of emerging therapies or advancements in Dermatomyositis treatment on the market?

Introducing new therapies, advancements in diagnostic techniques, and innovations in treatment approaches can significantly impact the Dermatomyositis treatment market. Market forecast reports may provide analysis and predictions regarding the potential impact of these developments.

6. Does the report provide insights into the competitive landscape of the market?

The market forecast report may include information on the competitive landscape, profiling key market players, their product offerings, partnerships, and strategies, and helping stakeholders understand the competitive dynamics of the Dermatomyositis market.

Browse through our blog section to get detailed insights:

- Analyzing Strategies in Polymyositis and Dermatomyositis Treatment

- Unraveling the Complexities of Dermatomyositis Treatment: A Comprehensive Review and Future Perspectives

Related Report:

.jpg)