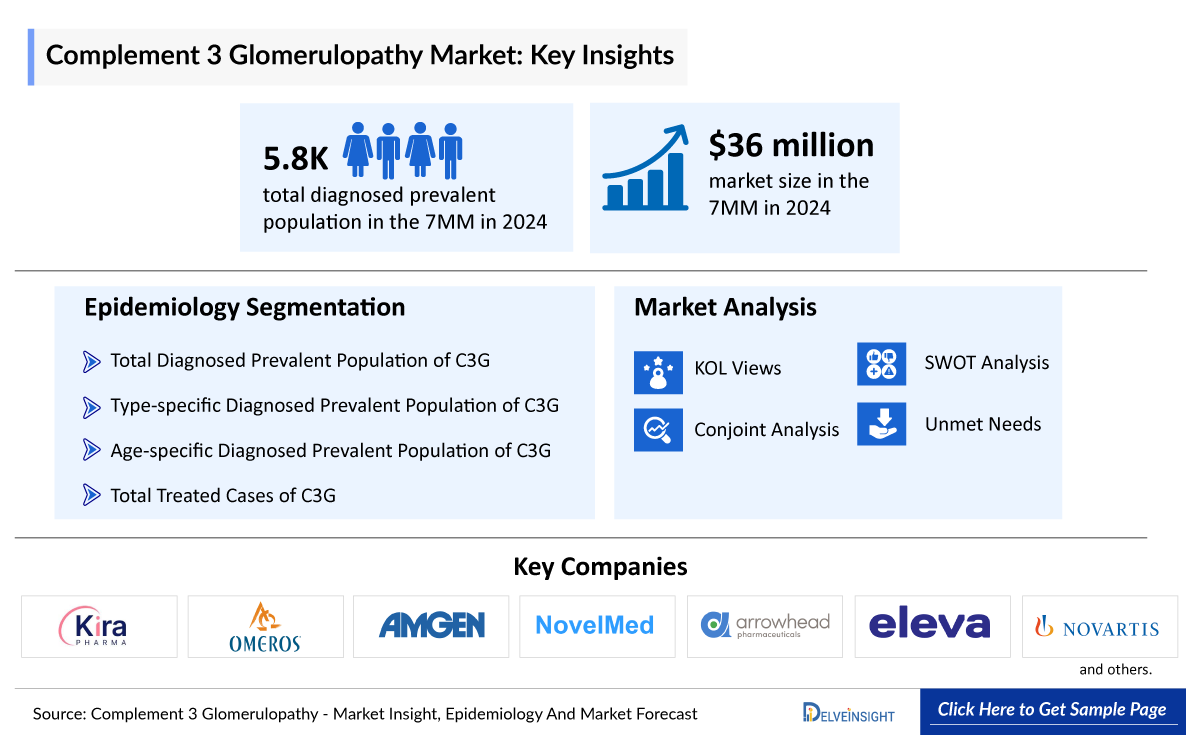

Complement 3 Glomerulopathy Market Summary

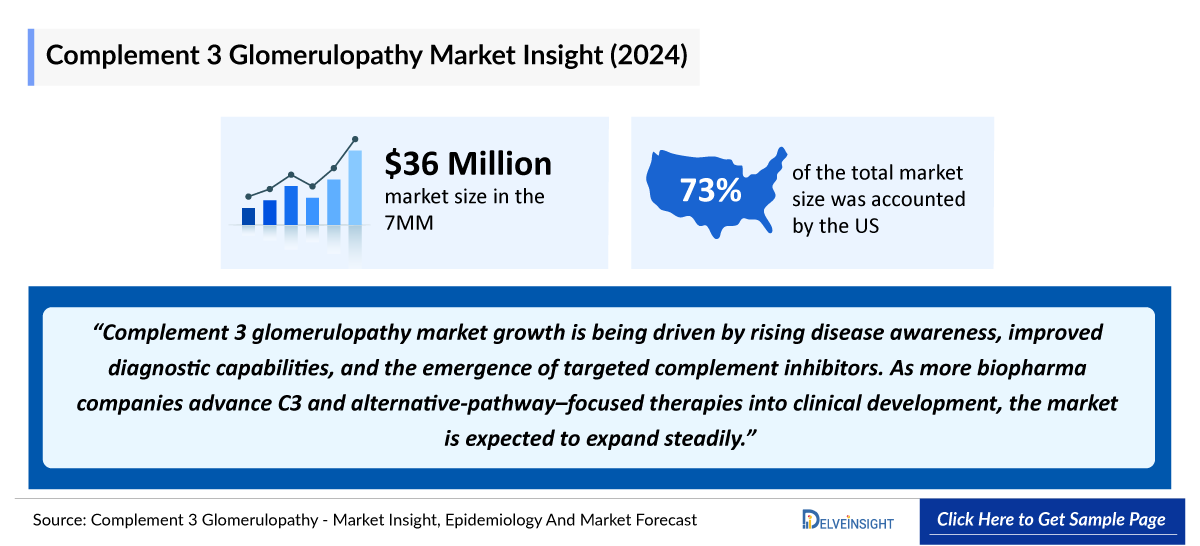

- The Complement 3 Glomerulopathy Market is projected to grow at a significant CAGR by 2034 in leading countries like the US, EU4, UK, and Japan.

- The leading Complement 3 Glomerulopathy Companies such as Novartis, Apellis Pharmaceuticals, Sobi, Kira Pharmaceuticals, Omeros Corporation, NovelMed Therapeutics, Arrowhead Pharmaceuticals, and others.

Complement 3 Glomerulopathy Market and Epidemiology Analysis

- C3G presents with various glomerulonephritis patterns, including membranoproliferative, mesangial proliferative, diffuse endocapillary proliferative, and crescentic types.

- Two forms of C3G have been found through several secondary sources, namely Dense Deposit Disease (DDD) and C3 Glomerulonephritis (C3GN), which vary as per the patterns of damage and inflammation in the glomeruli. In addition, it is important to note that the features of DDD tend to appear earlier than those of C3GN, usually in adolescence.

- C3G is associated with a challenging long-term outlook, driven by its progressive course and high risk of recurrence. Approximately 30–50% of patients develop End-stage Kidney Disease (ESKD) within 10 years of diagnosis.

- The Complement 3 Glomerulopathy Diagnosed Prevalent Population in the 7MM is expected to grow between 2024 and 2034, driven by advancements in complement biology and enhanced diagnostic capabilities. Greater use of genetic testing, complement assays, and renal biopsy interpretation supported by multidisciplinary collaboration is enabling earlier and more accurate diagnosis.

- The management of C3G is predominantly reliant on off-label use of various prescription drugs, reflecting the unmet need for approved, targeted therapies. Current treatment options include immunosuppressants, corticosteroids, Renin Angiotensin Aldosterone System (RAAS) inhibitors, and other supportive agents such as calcineurin inhibitors and antibodies.

- Additional off-label treatments include monoclonal antibodies such as eculizumab and rituximab. These antibodies specifically target the terminal complement pathway by inactivating C5, which can improve renal function and reduce proteinuria.

- FABHALTA became the first therapy approved for the treatment of C3G, followed by EMPAVELI/ASPAVELI from Apellis Pharmaceuticals and Sobi. However, a significant challenge remains in the form of a black box warning for life-threatening infections caused by encapsulated organisms (e.g., Neisseria meningitidis, Streptococcus pneumoniae, and Haemophilus influenzae type b) and necessitating vaccination at least 2 weeks before treatment initiation.

- EMPAVELI/ASPAVELI presents a promising therapeutic option for C3G by targeting C3 directly and proximally within the complement cascade. It has demonstrated notable clinical efficacy, nearly doubling the outcomes observed with FABHALTA, thereby distinguishing itself in terms of therapeutic effectiveness.

- Emerging therapies targeting novel mechanisms such as dual complement inhibitors (C5 and Factor H (KP104), MASP-3 inhibitors (Zaltenibart), RNA interference (RNAi) therapeutics targeting complement C3 (ARO-C3), and others are showing promise as potential treatment options.

Request for Unlocking the Sample Page of the "Complement 3 Glomerulopathy Market"

Key Factors Driving the Growth of the Complement 3 Glomerulopathy Market

-

Growing C3G Patient Population

In 2024, the diagnosed prevalent population of C3 glomerulopathy in the 7MM was approximately 5,800. This number is expected to rise through 2034, driven by advances in complement biology, improved diagnostics, and wider use of genetic testing, complement assays, and multidisciplinary biopsy evaluation.

-

Advancements in Targeted Therapies

The development of targeted therapies, such as complement inhibitors, has improved treatment options for C3G. These therapies aim to regulate the complement system, addressing the underlying cause of the disease. Notable drugs in this category include Pegcetacoplan (EMPAVELI/ ASPAVELI) and Iptacopan (FABHALTA/ FABIHARTA), which have shown promise in clinical trials.

-

Expected Launch of C3G Drugs

Key players such as Kira Pharmaceuticals (KP104), Omeros Corporation (Zaltenibart [OMS906]), NovelMed Therapeutics (Ruxoprubart [NM8074]), Arrowhead Pharmaceuticals (ARO-C3), and others are currently developing drugs for C3G. These therapies are expected to create an upward shift in the C3G treatment market after their launch in the coming years, in the 7MM.

-

Emergence of Novel Mechanisms in C3G

Emerging therapies targeting novel mechanisms such as dual complement inhibitors (C5 and Factor H (KP104), MASP-3 inhibitors (Zaltenibart), RNA interference (RNAi) therapeutics targeting complement C3 (ARO-C3), and others are showing promise as potential treatment options.

DelveInsight’s “Complement 3 Glomerulopathy Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Complement 3 Glomerulopathy, historical and forecasted epidemiology, as well as Complement 3 Glomerulopathy market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Complement 3 Glomerulopathy Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Complement 3 Glomerulopathy market size from 2020 to 2034. The report also covers current Complement 3 Glomerulopathy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the Complement 3 Glomerulopathy Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

C3G Epidemiology |

Segmented by:

|

|

C3G Companies |

|

|

C3G Therapies |

|

|

C3G Market |

Segmented by:

|

|

Analysis |

|

Complement 3 Glomerulopathy Disease Understanding and Treatment Algorithm

Complement 3 Glomerulopathy Overview

The term complement 3 glomerulopathy was adopted by expert consensus in 2013 to define a group of rare kidney diseases driven by dysregulation of the complement cascade. The major features of Complement 3 Glomerulopathy include high levels of protein in the urine (proteinuria), blood in the urine (hematuria), reduced amounts of urine, low levels of protein in the blood, and swelling in several areas of the body.

Complement 3 Glomerulopathy is a type of glomerular disease, characterized by predominant C3 complement component (C3) deposits in the glomeruli in the absence of a significant amount of immunoglobulin and without deposition of C1q and C4. The accumulation of C3 without a significant amount of classical or lectin complement components in the glomeruli suggests dysregulation of the alternative complement pathway as the underlying pathogenetic mechanism. This finding, in the absence or near absence of immunoglobulin deposits in a patient with the classic clinical features of glomerulonephritis, is the single diagnostic criterion. The rarity of Complement 3 Glomerulopathy makes it challenging to derive precise incidence and prevalence of the indication; however, several small cohort studies have generated estimates of limited reliability.

Complement 3 Glomerulopathy Diagnosis

In most cases, Complement 3 Glomerulopathy Diagnosis requires a renal biopsy and careful review of light microscopy, immunofluorescence, and electron microscopy. Broadly, Complement 3 Glomerulopathy is defined as the predominant staining of C3 on immunofluorescence (IF) when compared to immunoglobulin (intensity >2 orders of magnitude). Complement 3 Glomerulopathy is classified by electron microscopy findings into DDD or C3GN, depending on the presence or absence of dense osmiophilic intramembranous deposits. However, the various diagnostic tests used for establishing a Complement 3 Glomerulopathy diagnosis are as follows: Urine test, Blood test, Glomerular filtration rate (GFR), and Kidney biopsy.

Complement 3 Glomerulopathy Treatment

Optimal treatment for Complement 3 Glomerulopathy has not been established yet, since no treatment has proven effective and beneficial for Complement 3 Glomerulopathy. All patients diagnosed with Complement 3 Glomerulopathy should be treated with renoprotective measures, including lifestyle advice, an angiotensin-converting enzyme inhibitor or angiotensin-receptor blocker to control hypertension and proteinuria, and lipid-lowering treatment. Such medication alone has not been shown to protect against progression to end-stage renal disease but may improve the protective effect of immunosuppressive medication. Due to the absence of approved treatment/therapies for Complement 3 Glomerulopathy, as well as therapies that can attack the cause of Complement 3 Glomerulopathy, the treatment regimen focuses on slowing the process of kidney damage from Complement 3 Glomerulopathy. This treatment regimen may include corticosteroids (often called “steroids”), immunosuppressive drugs, ACE Inhibitors and ARBs, diet changes, and complement inhibitors. FABHALTA became the first FDA-approved therapy for C3G, targeting the alternative complement pathway by inhibiting Factor B. It was followed by EMPAVELI/ASPAVELI, a C3 inhibitor offering broader upstream blockade, expanding treatment options for complement-mediated kidney diseases.

Complement 3 Glomerulopathy Epidemiology

The disease epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent population of Complement 3 Glomerulopathy, type-specific diagnosed prevalent population of Complement 3 Glomerulopathy, age-specific diagnosed prevalent population of Complement 3 Glomerulopathy, and total treated cases of Complement 3 Glomerulopathy in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom and Japan from 2020 to 2034.

Key findings from the Complement 3 Glomerulopathy Epidemiological Analysis and Forecast

- In 2024, the diagnosed prevalent population of C3 glomerulopathy in the 7MM was approximately 5,800. This number is expected to rise through 2034, driven by advances in complement biology, improved diagnostics, and wider use of genetic testing, complement assays, and multidisciplinary biopsy evaluation.

- The diagnosed prevalent population of Complement 3 Glomerulopathy, in the United States, was found to be 3,400 in 2024.

- In 2024, Complement 3 Glomerulopathy predominantly affected adults in the United States, with 89% of the cases, while the pediatric population accounted for the remaining 11%. By 2034, these numbers are expected to rise to 3,800 cases in adults and 480 cases in children.

- In Japan, adults are more prevalent in Complement 3 Glomerulopathy compared to pediatrics.

Complement 3 Glomerulopathy Epidemiology Segmentation

- Total Complement 3 Glomerulopathy Diagnosed Prevalent Population

- Complement 3 Glomerulopathy Type-specific Diagnosed Prevalent Population

- Complement 3 Glomerulopathy Age-specific Diagnosed Prevalent Population

- Total Complement 3 Glomerulopathy Treated Cases

Complement 3 Glomerulopathy Drug Analysis

The drug chapter segment of the Complement 3 Glomerulopathy Therapeutics Market Report encloses a detailed analysis of the marketed and the late-stage (Phase III and Phase II) pipeline drugs. Furthermore, the current approved Complement 3 Glomerulopathy Drugs include Novartis Pharmaceuticals (Iptacopan), Apellis Pharmaceuticals and Sobi (pegcetacoplan), while the emerging drugs include Kira Pharmaceuticals (KP104), Omeros Corporation (Zaltenibart [OMS906]), NovelMed Therapeutics (Ruxoprubart [NM8074]), Arrowhead Pharmaceuticals (ARO-C3), and others. The drug chapter also helps understand the Complement 3 Glomerulopathy clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Complement 3 Glomerulopathy Marketed Drugs

-

Iptacopan (FABHALTA/FABIHARTA): Novartis

Iptacopan is an oral Factor B inhibitor of the alternative complement pathway. In C3G, overactivation of the alternative complement pathway leads to C3 cleavage within the glomeruli, resulting in C3 deposition and inflammation, which are thought to contribute to the pathogenesis of C3G. By binding to Factor B, iptacopan inhibits the alternative pathway.

-

- In March 2025, Novartis announced that oral iptacopan had received US FDA approval for the treatment of adults with C3G, to reduce proteinuria based on the Phase III APPEAR-C3G trial.

- In April 2025, Novartis announced that the CHMP of the EMA had adopted a positive opinion and recommended granting a marketing authorization for iptacopan for the treatment of adults with C3G.

- In May 2025, Novartis Pharma announced that it had received approval for an additional indication of efficacy for C3 nephropathy for FABIHARTA Capsules 200mg (generic name: iptacopan hydrochloride hydrate; hereinafter "FABIHARTA").

-

Pegcetacoplan (EMPAVELI/ ASPAVELI): Apellis Pharmaceuticals and Sobi

Pegcetacoplan is a targeted C3 therapy designed to regulate excessive activation of the complement cascade, part of the body’s immune system, which can lead to the onset and progression of many serious diseases. It is approved for the treatment of C3G and primary IC-MPGN in the United States. The therapy is also under investigation for other rare diseases like focal segmental glomerulosclerosis (FSGS).

-

- In July 2025, Apellis Pharmaceuticals announced that the US FDA had approved pegcetacoplan as the first treatment for C3G or primary IC-MPGN in patients 12 years of age and older, to reduce proteinuria based on the Phase III VALIANT study.

- In June 2025, Apellis Pharmaceuticals presented new data from the open-label period of the Phase III VALIANT study, investigating pegcetacoplan for C3G and primary IC-MPGN. The data were presented as part of a late-breaking session at the ERA Congress.

Marketed Drug Key Competitors | ||||||||

|

Drug |

Developer |

MoA |

RoA |

Molecule Type |

Patient segment |

US Approval |

EU Approval |

JP Approval |

|

Iptacopan (FABHALTA/ FABIHARTA) |

Novartis |

CFB inhibitor |

Oral |

Small molecule |

Adults with C3G, to reduce proteinuria |

March 2025 |

April 2025 |

May 2025 |

|

Pegcetacoplan (EMPAVELI/ ASPAVELI) |

Apellis Pharmaceuticals and Sobi |

Complement C3 inhibitor |

SC |

Cyclic peptide conjugated to a linear polyethylene glycol molecule |

Adult and pediatric patients aged 12 years and older with C3G or primary IC-MPGN, to reduce proteinuria |

July 2025 |

- |

- |

Complement 3 Glomerulopathy Emerging Drugs

-

KP104: Kira Pharmaceuticals

KP104 is a potent, first-in-class bifunctional biologic designed to simultaneously and selectively block the alternative and terminal pathways, providing a powerful and synergistic method of targeting validated drivers of complement disease. KP104 is entering Phase II proof-of-concept trials across multiple indications with significant unmet need, including IgAN, C3G, SLE-TMA, and PNH. Phase II trials will be conducted globally, including in the US, China, Australia, and South Korea.

-

Zaltenibart (OMS906): Omeros Corporation

Zaltenibart is an investigational human monoclonal antibody targeting Mannan-binding lectin-associated Serine Protease-3 (MASP-3), the key and most proximal activator of the complement system’s alternative pathway. Following completion of the Phase II study, and assuming strong evidence of efficacy, Omeros Corporation plans to initiate a Phase III trial in C3G. According to Omeros’ June 2025 corporate presentation, the company anticipates upcoming Phase II data readouts for zaltenibart in C3G.

- In October 2024, Omeros Corporation announced that zaltenibart received Rare Pediatric Disease Designation (RPDD) from the US Food and Drug Administration (FDA) for the treatment of C3G.

-

NM-8074: NovelMed

NM-8074 (ruxoprubart) is a humanized monoclonal antibody from NovelMed Therapeutics that inhibits complement factor Bb, selectively blocking the alternative complement pathway while preserving classical and lectin pathways. In Phase II trials, it has demonstrated improved hemoglobin levels, reduced LDH, and transfusion independence in PNH patients. NM-8074 is also being evaluated for aHUS and dermatomyositis and remains investigational with orphan drug designation.

Comparison of Emerging Drugs Under Development | ||||||

|

Product |

Company |

Mechanism of Action |

Phase |

Indication |

ROA |

Molecular Type |

|

KP104 |

Kira Pharmaceuticals |

Dual-targeting complement inhibitor (C5 and Factor H) |

II |

C3G |

IV and SC |

Bifunctional fusion protein |

|

Zaltenibart (OMS906) |

Omeros Corporation |

MASP-3 inhibitor |

II |

C3G |

IV |

Monoclonal antibody |

|

TAVNEOS (avacopan)* |

Amgen |

Complement 5a Receptor 1 (C5aR1) antagonist |

II |

C3G |

Oral |

Small molecule |

|

Ruxoprubart (NM8074)** |

NovelMed Therapeutics |

An anti-Bb humanized antibody that binds and neutralizes the activity of both C3 and C5 convertases |

I/II |

C3G |

IV |

Monoclonal antibody |

|

ARO-C3 |

Arrowhead Pharmaceuticals |

RNA interference (RNAi) therapeutic targeting complement C3 |

I/IIa |

C3G |

SC |

RNAi therapeutic |

|

CPV-104*** |

Eleva |

Recombinant proteins |

I |

C3G |

IV and SC |

Modified recombinant human Complement Factor H (CFH) |

|

*The trial will start in November 2025. **There have been no recent updates on the program; the last recorded PCD activity was in March 2021 with completed trial status. ***As per recent activity, the therapy has entered Phase I/II clinical studies to treat C3G. | ||||||

Complement 3 Glomerulopathy Drug Class Insights

Renin-angiotensin-aldosterone system inhibitors, ARBs, and ACE inhibitors are both used to treat hypertension in Complement 3 Glomerulopathy. Combination use of RAAS inhibitors showed higher efficiency compared with monotherapy and was associated with a higher incidence of adverse events.

Immunosuppressants: Corticosteroids, calcineurin inhibitors, corticosteroids in combination with mycophenolate mofetil (MMF), and others are used for the treatment of Complement 3 Glomerulopathy. Among all nonspecific immunosuppressive therapies, MMF-based treatment is promising compared with others concerning clinical remission and renal survival. Complement inhibitors are the primary class in the emerging pipeline for Complement 3 Glomerulopathy therapy. Complement inhibitors Pegcetacoplan and Iptacopan perform well in Complement 3 Glomerulopathy in terms of safety and effectiveness.

Complement 3 Glomerulopathy Market Outlook

The management of C3G is predominantly reliant on off-label use of various prescription drugs, reflecting the unmet need for approved, targeted therapies. Current treatment options include immunosuppressants, corticosteroids, Renin angiotensin aldosterone System (RAAS) inhibitors, and other supportive agents such as calcineurin inhibitors and antibodies. Additional off-label treatments include calcineurin inhibitors, other immunosuppressive agents, and monoclonal antibodies such as eculizumab and rituximab. These antibodies specifically target the terminal complement pathway by inactivating C5, which can improve renal function and reduce proteinuria. Patients with evidence of terminal pathway activation, indicated by high levels of C5b-9 in circulation and kidney biopsies, may particularly benefit from these therapies, a profile commonly observed in C3G.

The Complement 3 Glomerulopathy Treatment Market Landscape saw a breakthrough in March 2025 with the FDA approval of Iptacopan, the first targeted therapy for this condition. In July 2025, the FDA approved pegcetacoplan for the treatment of C3G and primary IC-MPGN in patients aged 12 years and older. This marks a significant expansion in targeted therapies for complement-mediated kidney diseases.

- The Complement 3 Glomerulopathy Market Size in the 7MM was approximately USD 36 million in 2024.

- The United States accounts for the largest Complement 3 Glomerulopathy Market Size, in comparison to EU4 and the UK, and Japan, i.e., ~73% of the 7MM.

- The emerging Complement 3 Glomerulopathy pipeline holds a few significant products in development by prominent key Complement 3 Glomerulopathy Companies such as Kira Pharmaceuticals (KP104), Omeros Corporation (Zaltenibart [OMS906]), NovelMed Therapeutics (Ruxoprubart [NM8074]), Arrowhead Pharmaceuticals (ARO-C3), and others. These therapies are expected to create an upward shift in the C3G treatment market after their launch in the coming years, in the 7MM.

Complement 3 Glomerulopathy Drugs Uptake

This section focuses on the uptake rate of potential Complement 3 Glomerulopathy drugs expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake. Following the approvals of Iptacopan and Pegcetacoplan, the treatment landscape for C3G is rapidly evolving, with several complement-targeted therapies in clinical development. These investigational agents aim to address unmet needs such as long-term kidney preservation, broader patient eligibility (e.g., pediatrics, transplant), and alternative mechanisms of action.

Further detailed analysis of emerging therapies, drug uptake in the report…

Complement 3 Glomerulopathy Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase III and II. It also analyzes key Complement 3 Glomerulopathy Companies involved in developing targeted therapeutics. The Complement 3 Glomerulopathy Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Complement 3 Glomerulopathy emerging therapies.

Latest KOL Views on Complement 3 Glomerulopathy

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, nephrologists, Consultant Nephrologists, and Honorary Associate Professor at University Hospitals of Leicester NHS Trust, and Others.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapy treatment patterns or Complement 3 Glomerulopathy market trends.

|

Region |

KOL Views |

|

United States |

Complement inhibition is showing promising results in the treatment of C3G as well as other complement-mediated disorders. This strategy has the potential to provide patients with targeted therapy and possibly avoid the toxicity from nonspecific immunosuppressive agents such as corticosteroids.” - MD, Columbia University, US |

|

United Kingdom |

“Lack of compliance and loss of follow-up were frequent pitfalls. Optimal kidney protection with renin-angiotensin-aldosterone inhibitors (and now gliflozins) or immunosuppressive regimen (e.g., mycophenolate mofetil and glucocorticoids) was not reached in all patients, blurring its evaluation in the long term.” - MD, Center University Hospital of Toulouse, France |

Complement 3 Glomerulopathy Qualitative Analysis

We perform qualitative and Complement 3 Glomerulopathy Drugs Market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Complement 3 Glomerulopathy Market Access and Reimbursement

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc. Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders.

FABHALTA Co-pay Plus

If eligible, Co-pay Plus may help patients pay for their FABHALTA, including refills. Co-pay Plus is not health insurance, but it can help cover out-of-pocket expenses related to their prescription.

- Pay as little as USD 0 with Co-pay Plus

- Eligible patients with private insurance may pay as little as USD 0

- Annual benefit limit of USD 20,000 per calendar year

Scope of the Complement 3 Glomerulopathy Market Report

- The Complement 3 Glomerulopathy Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current Complement 3 Glomerulopathy Treatment Market Landscape.

- A detailed review of the Complement 3 Glomerulopathy Treatment Market, historical and forecasted Complement 3 Glomerulopathy Market Size, Complement 3 Glomerulopathy Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Complement 3 Glomerulopathy Therapeutics Market Report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Complement 3 Glomerulopathy Drugs Market.

Complement 3 Glomerulopathy Market Report Insights

- Patient-based Complement 3 Glomerulopathy Market Forecasting

- Therapeutic Approaches

- Complement 3 Glomerulopathy Pipeline Drugs Analysis

- Complement 3 Glomerulopathy Market Size and Trends

- Existing and future Complement 3 Glomerulopathy Drugs Market Opportunity

Complement 3 Glomerulopathy Market Report Key Strengths

- 10 Years Complement 3 Glomerulopathy Market Forecast

- The 7MM Coverage

- Complement 3 Glomerulopathy Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Complement 3 Glomerulopathy Drugs Uptake

- Key Complement 3 Glomerulopathy Market Forecast Assumptions

Complement 3 Glomerulopathy Market Report Assessment

- Current Complement 3 Glomerulopathy Treatment Practices

- Complement 3 Glomerulopathy Unmet Needs

- Complement 3 Glomerulopathy Pipeline Drugs Profiles

- Complement 3 Glomerulopathy Drugs Market Attractiveness

- Complement 3 Glomerulopathy Analyst Views

- Complement 3 Glomerulopathy Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Complement 3 Glomerulopathy Market Report

Complement 3 Glomerulopathy Market Insights

- What is the historical and forecasted Complement 3 Glomerulopathy patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What was the Complement 3 Glomerulopathy total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the advantages of complement inhibitors over immunosuppressants?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- Which complement inhibitor generated the highest revenue by 2034?

Reasons to Buy the Complement 3 Glomerulopathy Market Report

- The Complement 3 Glomerulopathy Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Complement 3 Glomerulopathy Drugs Market.

- Insights on patient burden/disease Complement 3 Glomerulopathy Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Complement 3 Glomerulopathy Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the Complement 3 Glomerulopathy Drugs Market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights into the unmet needs of the existing Complement 3 Glomerulopathy Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles