Open-Angle Glaucoma Market Summary

- The Open-Angle Glaucoma Market is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

- The leading Open-Angle Glaucoma Companies such as Ocuvex Therapeutics, Thea Pharma, Omikron Italia, PolyActiva Pty and others.

Open-Angle Glaucoma Market and Epidemiology Analysis

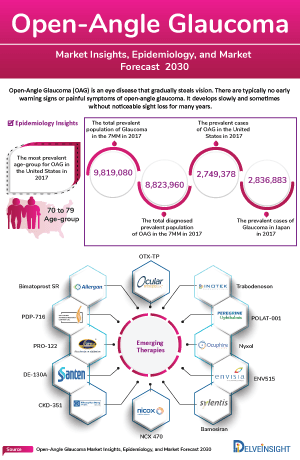

- Open-angle glaucoma is a chronic, progressive eye disease characterized by the gradual blockage of the eye's drainage canals, leading to increased intraocular pressure and damage to the optic nerve.

- Primary open-angle glaucoma (POAG) is the most common type, characterized by increased resistance to drainage in the trabecular meshwork. However, the drainage angle between the cornea and iris remains open.

- As per the American Academy of Ophthalmology (AAO), selective laser trabeculoplasty can safely and effectively be used as primary intervention for the Open-Angle Glaucoma Treatment or as replacement for medications.

- In June 2025, Qlaris Bio presented new data on its lead investigational compound, QLS-111, at the 2025 World Glaucoma Congress (WGC), including results from the Phase II 'Osprey' (QC-111-201) studies in patients with primary open-angle glaucoma (POAG) and ocular hypertension.

- In October 2024, the National Institute for Health and Care Excellence (NICE) has issued guidance recommending Santen’s ROCLANDA for use in patients with POAG or ocular hypertension.

- The OAG treatment pipeline is well-established, with many approved drugs, but current focus is shifting toward implants. Emerging therapies are largely implant-based, offering longer-lasting pressure control and better adherence than traditional eye drops.

- The emerging Open-Angle Glaucoma Pipeline consists of products such as Citicoline (Omikron Italia), AMDX-2011P (Amydis), PA5108 (PolyActiva Pty), PER-001 (Perfuse Therapeutics), AGN-193408 SR (Abbvie), among others.

Request for Unlocking the CAGR of the Open-Angle Glaucoma Market

DelveInsight’s "Open-angle Glaucoma Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of OAG, historical and forecasted epidemiology as well as the OAG market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Open-Angle Glaucoma Treatment Market Report provides current treatment practices, emerging drugs, OAG share of individual therapies, and current and forecasted OAG market size from 2020 to 2034, segmented by seven major markets. The report also covers current Open-Angle Glaucoma treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Open-angle Glaucoma Epidemiology |

Segmented by

|

|

Open-angle Glaucoma Companies |

|

|

Open-angle Glaucoma Therapies |

|

|

Open-angle Glaucoma Market |

Segmented by

|

|

Analysis |

|

Key Factors Driving the Growth of the Open-Angle Glaucoma Market

Aging population & rising open-angle glaucoma disease prevalence

Prevalence of open-angle glaucoma increases sharply with age, and global demographic shifts (larger elderly populations) are a primary long-term demand driver for diagnostics, chronic therapies, and surgical interventions. In the US, at least 2.7 million individuals aged 40 and older have been diagnosed with glaucoma. This number represents a significant public health concern.

Greater disease detection & screening efforts

Improved screening programs, wider use of OCT and tele-ophthalmology, and growing awareness mean more early diagnoses, which increases lifetime treatment uptake (drops, combination therapy, procedures). This enlarges the addressable treated population even where the underlying incidence is stable.

New open-angle glaucoma drug classes

In OAG, FP receptor agonists like ZIOPTAN and EP2 agonists such as OMLONTI remain key intraocular pressure-lowering therapies. Beta-blockers, alpha agonists, and carbonic anhydrase inhibitors support conventional management. Meanwhile, emerging candidates such as citicoline, investigated for its glutathione-stimulating properties, are gaining attention for targeting pressure-independent neuroprotective pathways; broadening the therapeutic scope beyond traditional IOP reduction.

Minimally invasive glaucoma surgeries (MIGS) & surgical device uptake

Minimally invasive glaucoma surgery (MIGS) devices like iStent, Hydrus Microstent, and Xen Gel Stent are increasingly used for patients needing surgical intervention, offering a safer profile compared to traditional filtering surgeries, the use of emerging technologies are increasing healthcare expendiature which furhter is fueling market.

Expected launch of open-angle glaucoma drugs

The anticipated launch of open-angle glaucoma drugs such as Citicoline (Omikron Italia), AMDX-2011P (Amydis), PA5108 (PolyActiva Pty), PER-001 (Perfuse Therapeutics), AGN-193408 SR (AbbVie), and others will change the dynamics of the open-angle glaucoma market in the next 10 years.

Open-angle Glaucoma Disease Understanding and Treatment Algorithm

Open-angle Glaucoma Overview

Glaucoma is a collection of diseases where increased intraocular pressure adversely impacts the optic nerve and, subsequently, the visual field. However, not all cases of glaucoma are associated with increased intraocular pressure. A subset includes similar optic nerve and visual field damage, known as normal pressure glaucoma. The collection of glaucomatous diseases is subdivided into open-angle and closed-angle glaucoma, both of which can have primary or secondary causes and can be of an iatrogenic or non-iatrogenic origin. OAG is a chronic, progressive, and irreversible multifactorial optic neuropathy characterized by an open angle of the anterior chamber, typical optic nerve head changes, retinal nerve fiber layer thinning, and progressive loss of peripheral vision. Central visual field loss and blindness can occur in the advanced stages of glaucoma. Intraocular pressure is an important risk factor and the target for therapy when treating patients. The disease is usually bilateral, but asymmetry depends on the etiology. Although increased intraocular pressure is a significant risk factor in developing glaucoma, intraocular pressure levels greater than 21 mm Hg do not necessarily because glaucoma and optic nerve damage in all patients. Studies have shown asymptomatic individuals with ocular hypertension who maintain normal visual fields and healthy optic nerves.

Open-angle Glaucoma Diagnosis

OAG is diagnosed through a combination of clinical evaluations, primarily focused on three key features: optic nerve changes, visual field defects, and elevated intraocular pressure. Optic nerve assessment, using slit-lamp biomicroscopy with a 78D or 90D lens, reveals characteristic changes like thinning of the neuroretinal rim, increased cup-to-disc ratio, and optic disc hemorrhages. Visual field testing, particularly using static automated perimetry (e.g., Humphrey Field Analyzer), identifies typical glaucomatous defects such as arcuate scotomas and nasal steps, often appearing after significant retinal ganglion cell loss. Intraocular pressure, although not definitive for diagnosis, remains a critical modifiable risk factor and is measured using Goldmann applanation tonometry, with accuracy influenced by factors like corneal thickness and diurnal variations. Gonioscopy is essential to confirm an open angle and rule out angle-closure glaucoma. Optical coherence tomography (OCT) is widely used to detect retinal nerve fiber layer (RNFL) and macular thinning. Corneal photokeratoscopy has shown potential as a biomarker, correlating structural corneal changes with glaucoma progression, though further validation is needed. Together, these tools support early diagnosis, monitoring, and management of OAG.

Further details related to diagnosis will be provided in the report…

Open-angle Glaucoma Treatment

The primary goal in treating OAG is to prevent optic nerve damage and visual field loss by maintaining intraocular pressure below a target level. Treatment initiation depends on the severity of optic nerve or retinal nerve fiber layer damage, with therapy tailored to the individual’s risk factors, disease progression, and tolerance. First-line treatment typically involves topical medications such as prostaglandin analogs, beta-blockers, alpha agonists, carbonic anhydrase inhibitors, and parasympathomimetics, while systemic agents like acetazolamide or mannitol are reserved for acute or refractory cases. Laser options, including selective laser trabeculoplasty and micropulse diode laser, offer alternatives for patients non-compliant or intolerant to drops. Surgical interventions—like trabeculectomy, drainage implants, and minimally invasive glaucoma surgeries (MIGS) are considered when medical or laser treatments fail or when lower target intraocular pressure is required. Advances in laser techniques and MIGS aim to improve safety and long-term outcomes. Treatment plans are continuously adjusted based on intraocular pressure trends, visual field changes, and optic nerve appearance.

Open-angle Glaucoma Epidemiology

The OAG epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total Open-Angle Glaucoma Prevalent Cases, Open-Angle Glaucoma Gender-specific Cases, Open-Angle Glaucoma Age-Specific Cases, and Open-Angle Glaucoma Type-specific Cases in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Open-Angle Glaucoma Epidemiological Analyses and Forecast

- In the US, approximately 80% of all glaucoma cases are classified as OAG. This makes OAG the most prevalent form of glaucoma in the US.

- In the US, at least 2.7 million individuals aged 40 and older have been diagnosed with glaucoma. This number represents a significant public health concern.

- In Europe, 7.8 million people were affected by primary OAG and the total prevalence is 2.51%.

- The most common type of glaucoma in the UK is primary OAG, affecting 2% of individuals older than 40 years and 10% of individuals older than 75 years.

- Male-to-female prevalence ratios ranged from 0.39 to 2.61 indicating that men are found to be more susceptible to primary OAG than women.

Open-Angle Glaucoma Epidemiology Segmentation

- Total Open-Angle Glaucoma Prevalent Cases

- Open-Angle Glaucoma Gender-Specific Cases

- Open-Angle Glaucoma Age-Specific Cases

- Open-Angle Glaucoma Type-Specific Cases

Open-angle Glaucoma Drug Analysis

The drug chapter segment of the Open-Angle Glaucoma Market Report encloses a detailed analysis of Open-Angle Glaucoma-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the Open-Angle Glaucoma Clinical Trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Open-Angle Glaucoma Marketed Drugs

-

OMLONTI (omidenepag isopropyl ophthalmic solution): Ocuvex Therapeutics

OMLONTI is a relatively selective prostaglandin EP2 receptor agonist, which increases aqueous humor drainage through the conventional (or trabecular) and uveoscleral outflow pathways, and the only product with this pharmacological action. OMLONTI was launched in Japan as EYBELIS ophthalmic solution 0.002% in November 2018, and was filed for marketing approval in Asian countries in stages. The product was released in five countries and regions beginning in February 2021.

In September 2022, the US Food and Drug Administration (FDA) approved OMLONTI 0.002% eye drops for the reduction of elevated intraocular pressure in patients with primary open-angle glaucoma or ocular hypertension.

-

ZIOPTAN (tafluprost ophthalmic solution): Thea Pharma

ZIOPTAN, a prostaglandin analog, is a selective FP prostanoid receptor agonist that is believed to reduce intraocular pressure by increasing uveoscleral outflow. It is indicated for reducing elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension. Prasco Laboratories announced the launch of the Authorized Generic of ZIOPTAN. This is Prasco’s first Authorized Generic launch in partnership with Théa Pharma.

In February 2012, the US FDA approved ZIOPTAN, a preservative-free prostaglandin analog, to reduce elevated intraocular pressure in patients with open-angle glaucoma, as well as in patients with ocular hypertension.

|

Key Cross of Marketed Therapies in Open-angle Glaucoma | ||||

|

Drug |

Company |

MoA |

Patient Segment |

Initial US Approval |

|

OMLONTI |

Ocuvex Therapeutics |

Prostaglandin EP2 receptor agonist |

Primary open-angle glaucoma or ocular hypertension. |

2022 |

|

ZIOPTAN |

Thea Pharma |

FP prostanoid receptor agonist |

Open-angle glaucoma or ocular hypertension |

2012 |

Open-Angle Glaucoma Emerging Drugs

-

Citicoline: Omikron Italia

The mechanism of action of citicoline is multifarious and includes preservation of cardiolipin and sphingomyelin, restoration of phosphatidylcholine, stimulation of glutathione synthesis, lowering of glutamate concentration, rescuing mitochondrial function, and others. It is currently in the Phase II of development for the Open Angle Glaucoma Patients.

-

PA5108: PolyActiva Pty

The PA5108 Ocular Implant employs the proprietary Prezia Sustained Drug Delivery Technology to release a constant daily dose of latanoprost free acid and is designed to include attributes not achievable by conventional blend technologies including: zero order drug release and rapid, complete, non-toxic biodegradation soon after the end of treatment. It is currently in the Phase II of development for the treatment of patients with primary open-angle glaucoma.

In December 2024, PolyActiva has announced promising results from its Phase II clinical trial of PA5108. The trial met key efficacy and safety end points, showing significant reductions in intraocular pressure over 26 weeks. According to the company, the clinical trial data represent a significant step forward in the company’s vision to provide long-term, reliable drug delivery for patients with primary open-angle glaucoma.

|

Comparison of Emerging Drugs Under Development | ||||

|

Drug Name |

Company |

Highest Phase |

Indication |

MoA |

|

Citicoline |

Omikron Italia |

II |

Open angle glaucoma |

Glutathione stimulator |

|

PA5108 |

PolyActiva Pty |

II |

Primary Open-Angle Glaucoma |

Prostaglandin F2 alpha agonists |

Open-Angle Glaucoma Drug Class Analysis

In OAG, FP receptor agonists like ZIOPTAN and EP2 agonists such as OMLONTI remain key intraocular pressure-lowering therapies. Beta-blockers, alpha agonists, and carbonic anhydrase inhibitors support conventional management. Emerging options include citicoline, studied for its glutathione stimulator, targeting intraocular pressure-independent pathways.

-

Prostaglandin EP2 receptor agonist

Prostaglandin EP2 receptor agonists, such as OMLONTI, are a newer class of intraocular pressure-lowering agents used in the management of open-angle glaucoma and ocular hypertension. By selectively activating the EP2 receptor, they promote relaxation of the ciliary muscle and remodeling of the extracellular matrix, enhancing uveoscleral outflow of aqueous humor. Unlike FP receptor agonists, EP2 agonists achieve intraocular pressure reduction without significantly affecting iris pigmentation or eyelash growth, offering a safer alternative for long-term use. This mechanism supports their role as an emerging option in patients who are intolerant or unresponsive to conventional therapies.

Open-angle Glaucoma Market Outlook

The Open-Angle Glaucoma Therapeutic Market Landscape has evolved significantly, yet remains centered on intraocular pressure reduction as the primary strategy to slow disease progression. Marketed therapies include FP receptor agonists such as ZIOPTAN and XALATAN, which enhance uveoscleral outflow, and beta-blockers like timolol, which reduce aqueous humor production. Alpha agonists (e.g., brimonidine) and carbonic anhydrase inhibitors (e.g., dorzolamide) provide additional intraocular pressure-lowering options. Newer agents, such as OMLONTI, an EP2 receptor agonist, and RIPASUDIL, a Rho kinase inhibitor, offer novel mechanisms to enhance trabecular outflow with potential neuroprotective benefits. To address adherence issues and provide sustained drug delivery, implantable therapies such as the DURYSTA (bimatoprost intracameral implant) have been introduced. These offer extended intraocular pressure control with a single administration, reducing the burden of daily eye drops. Additionally, minimally invasive glaucoma surgery (MIGS) devices like iStent, Hydrus Microstent, and Xen Gel Stent are increasingly used for patients needing surgical intervention, offering a safer profile compared to traditional filtering surgeries.

Emerging adjunctive options such as Citicoline, a neuroprotective compound, are under investigation for their ability to support retinal ganglion cell health and visual function. As treatment evolves, emphasis is shifting toward individualized, long-term management strategies that combine pressure-lowering, neuroprotection, and improved patient compliance to preserve vision and quality of life in OAG.

Open-Angle Glaucoma Companies

Ocuvex Therapeutics, Thea Pharma, Omikron Italia, PolyActiva Pty, and others.

Open-angle Glaucoma Drugs Uptake

This section focuses on the uptake rate of potential Open-Angle Glaucoma drugs expected to be launched in the market during 2025–2034. The Open-Angle Glaucoma Treatment Market Landscape has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs reflects the unwavering dedication of physicians, ophthalmologists, and the broader healthcare community in their tireless pursuit of advancing patient care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Open-angle Glaucoma Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, and Phase II stage. It also analyzes key players involved in developing targeted therapeutics.

Latest KOL- Views on Open-Angle Glaucoma

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. These experts include respected professionals such as MDs, PhDs, professors, department vice chairs, and directors in the field of ophthalmology. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or OAG market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as the Washington University School of Medicine, University Medical Center Hamburg-Eppendorf, and University Graduate School of Medicine etc. were contacted. Their opinion helps understand and validate OAG epidemiology and market trends.

|

KOL Views |

|

“Growing attention is being given to ocular surface health in patients receiving chronic topical therapy. As preservative-related toxicity becomes a concern, preservative-free formulations and alternative delivery platforms are gaining preference to enhance tolerability and long-term compliance.” -MD, University Hospital of Udine, Italy |

|

“The integration of long-acting implants and minimally invasive surgical options is gaining traction as a means to enhance treatment durability and adherence. These advancements are seen as crucial in reducing daily medication burden and achieving sustained pressure control, particularly in cases with moderate to severe disease progression.” -OD, Southern College of Optometry, US |

Open-Angle Glaucoma Report Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects pos d by the drug in the trials.

Open-Angle Glaucoma Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Open-Angle Glaucoma Market Report

- The report covers a descriptive overview of OAG, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into OAG epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for OAG is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the OAG market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM OAG market.

Open-angle Glaucoma Market Report Insights

- Patient-based Open-Angle Glaucoma Market Forecasting

- Therapeutic Approaches

- Open-angle Glaucoma Pipeline Analysis

- Open-angle Glaucoma Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

Open-angle Glaucoma Market Report Key Strengths

- 10-Year Open-Angle Glaucoma Market Forecast

- 7MM Coverage

- Open-angle Glaucoma Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Open-Angle Glaucoma Drugs Market

- Open-Angle Glaucoma Drugs Uptake

Open-angle Glaucoma Market Report Assessment

- Current Open-Angle Glaucoma Treatment Practices

- Open-Angle Glaucoma Unmet Needs

- Open-Angle Glaucoma Pipeline Drugs Profiles

- Open-Angle Glaucoma Drugs Market Attractiveness

- Analyst Views

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Open-Angle Glaucoma Market Report

Open-Angle Glaucoma Market Insights

- What was the OAG market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the OAG total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the market across the 7MM and which country will have the largest OAG market size during the study period (2020–2034)?

- At what CAGR, the OAG market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the OAG market growth till 2034?

- What are the disease risks, burdens, and unmet needs of OAG?

- What is the historical OAG patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of OAG?

- Amon the 7MM which country would have the most prevalent cases of OAG?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

- How many companies are developing therapies for the treatment of OAG?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of OAG?

- What are the key collaborations (industry–industry, industry-academia), Mergers and acquisitions, and licensing activities related to OAG therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for OAG and their status?

- What are the key designations that have been granted for the emerging therapies for OAG?

- What are the 7MM historical and forecasted market of OAG?

Reasons to Buy the Open-Angle Glaucoma Market Report

- The report will help in developing business strategies by understanding trends shaping and driving the OAG market.

- To understand the future market competition in the OAG market and insightful review of the SWOT analysis of OAG.

- Organize sales and marketing efforts by identifying the best opportunities for OAG in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- To understand the future market competition in the OAG.

Stay updated with us for Recent Articles-

.png)