Pulse Oximeters Market Summary

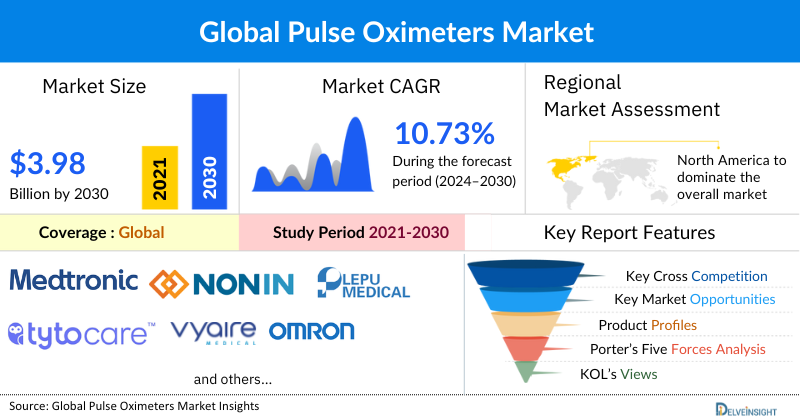

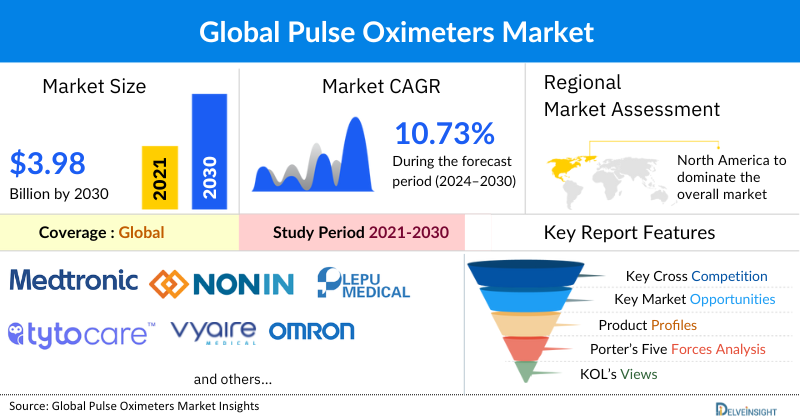

- The pulse oximeters market was valued at USD 2.16 billion in 2023 and expected to reach USD 3.98 billion by 2030.

- The global pulse oximeters market is growing at a CAGR of 10.73% during the forecast period from 2024 to 2030.

Pulse Oximeters Market Trends & Insights

- North America is expected to dominate the pulse oximeters market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This is driven by the increasing prevalence of chronic respiratory diseases and the need for improved management tools.

- Some of the key market players operating in the pulse oximeters market include Medtronic, Nonin, Lepu Medical Technology, TytoCare Ltd., Meditech Equipment Co ., Ltd., VYAIRE, OMRON Healthcare, Inc., Promed, Smiths Medical, NISSEI HOLDINGS INC., CONTEC MEDICAL SYSTEMS CO., LTD., Shenzhen Aeon Technology Co., Ltd., Masimo, SPENGLER HOLTEX Group, Opto Circuits India Ltd., and others.

- In the product type segment of the pulse oximeters market, the fingertip pulse oximeters category is expected to have a significant revenue share in the year 2023.

Pulse Oximeters Market Size and Forecasts

- 2023 Market Size: USD 2.16 Billion

- 2030 Projected Market Size: USD 3.98 Billion

- Growth Rate (2025-2032): 10.73% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Factors Contributing to the Growth of the Pulse Oximeters Market

Rising Burden of Respiratory Diseases

- Increasing prevalence of COPD, asthma, pneumonia, and sleep apnea is driving demand for continuous oxygen saturation monitoring.

- Post-COVID respiratory complications have sustained long-term monitoring needs.

Expansion of Home Healthcare & Remote Patient Monitoring (RPM)

- Growing preference for home-based care for chronic diseases.

- Integration of pulse oximeters with telehealth and smartphone apps boosts consumer adoption.

Increasing Surgical Procedures & Hospital Admissions

- Pulse oximeters remain a standard of care during anesthesia, post-operative care, and critical monitoring.

- Higher global surgical volume directly increases device utilization.

Technological Advancements

- Improvements in motion tolerance, low-perfusion accuracy, multi-wavelength sensors, and AI-driven signal processing.

- Emergence of wearable, ring-based, and wrist-worn continuous monitoring devices.

Growing Adoption in Ambulatory & Emergency Care

-

Wider deployment of portable oximeters in ambulances, emergency rooms, and primary care clinics, especially in emerging markets.

Increasing Awareness of Preventive Health Monitoring

-

Rising consumer demand for self-monitoring devices used for fitness, wellness, and early detection of respiratory distress.

Rising Neonatal & Pediatric Monitoring Needs

-

Growing focus on neonatal intensive care units (NICUs) encourages adoption of pediatric-friendly and high-sensitivity oximeters.

Regulatory Support & Standardization

-

Favorable guidelines promoting the use of pulse oximetry in perioperative care, sleep studies, and chronic disease management.

Market Expansion in Developing Regions

-

Strengthening healthcare infrastructure and affordable device availability are boosting uptake in Asia-Pacific, Latin America, and Africa.

Integration with Digital Health Ecosystems

-

Cloud connectivity, Bluetooth, and EHR integration support seamless data tracking, making pulse oximeters essential for digital health platforms.

Pulse Oximeters market forecast by Product Type (Fingertip Pulse Oximeters, Handheld Pulse Oximeters, Bench-Top Pulse Oximeters, and Wearable Pulse Oximeters), Age Group (Adult and Pediatrics), End-User (Hospitals, Ambulatory Surgical Centers, Homecare Settings, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to growing burden of respiratory disorders and the growing technological innovations across the globe

The pulse oximeters market was valued at USD 2.16 billion in 2023, growing at a CAGR of 10.73% during the forecast period from 2024 to 2030 to reach USD 3.98 billion by 2030. The pulse oximeters market is expanding rapidly due to the rising prevalence of respiratory conditions such as asthma & chronic obstructive pulmonary disease (COPD), coupled with advancements in technology, and rising government initiatives concerning the usage of pulse oximeters are expected to escalate the overall growth of the pulse oximeters market during the forecast period from 2024 to 2030.

Pulse Oximeters Market Dynamics

According to data provided by the World Health Organization (WHO) (2024), in 2019 there were 262 million people affected by asthma. As per the same source in 2023, 392 million people were living with COPD with three-quarters of them living in low and middle-income countries. Pulse oximeters are crucial in managing asthma and COPD by offering real-time measurements of blood oxygen levels and pulse rate. For asthma patients, these devices help track how well treatments are working and identify early signs of worsening symptoms by detecting drops in oxygen saturation. In COPD, pulse oximeters monitor disease progression and the effectiveness of oxygen therapy. Their ease of use and non-invasive nature make them particularly valuable in areas with limited healthcare resources, enabling patients and healthcare providers to make timely and informed decisions about treatment.

Increased product developmental activities by regulatory bodies and market key players across the globe are slated to witness market growth for pulse oximeters. For example, in March 2021, Masimo secured CE mark approval for a rugged handheld device called Rad-G, a 2-in-1 device for pulse oximetry and temperature measurement.

In addition, emerging government guidelines and recommendations on the use of pulse oximeter boosted the overall market of pulse oximeter. For instance, in November 2023, the Food and Drug Administration published the discussion paper, “Approach for improving the performance evaluation of pulse oximeter taking into consideration skin pigmentation, race, and ethnicity” stating the approach to improve the methods used to evaluate the performance of pulse oximeter taking into consideration patient skin pigmentation, race, and ethnicity. Additionally, as per the same source Food and Drug Administration conducted a virtual meeting in February 2024, to discuss the guidelines for pulse oximeters. Thus, such guidelines and recommendations for the use and improvement of pulse oximeters will boost the future market during the forecast period.

Therefore, the factors stated above collectively will drive the overall pulse oximeter market growth.

However, regulatory concerns associated with over-the-counter pulse oximeter devices and accuracy concerns of pulse oximeter readings due to poor circulation, skin pigmentation, thickness, & temperature, and others may prove to be challenging factors for the pulse oximeter market growth.

Pulse Oximeters Market Segment Analysis

Pulse Oximeters By Product Type

- Fingertip Pulse Oximeters

- Handheld Pulse Oximeters

- Bench-Top Pulse Oximeters

- Wearable Pulse Oximeters

Pulse Oximeters By Age Group

- Adult

- Pediatrics

Pulse Oximeters By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Homecare Settings

- Others

Pulse Oximeters By Geography

-

North America Pulse Oximeters Market

-

United States Pulse Oximeters Market

-

Canada Pulse Oximeters Market

-

Mexico Pulse Oximeters Market

-

Europe Pulse Oximeters Market

-

United Kingdom Pulse Oximeters Market

-

Germany Pulse Oximeters Market

-

France Pulse Oximeters Market

-

Italy Pulse Oximeters Market

-

Spain Pulse Oximeters Market

-

Rest of Europe

-

Asia-Pacific Pulse Oximeters Market

-

China Pulse Oximeters Market

-

Japan Pulse Oximeters Market

-

India Pulse Oximeters Market

-

Australia Pulse Oximeters Market

-

South Korea Pulse Oximeters Market

-

Rest of Asia-Pacific

-

Rest of the World

-

South America Pulse Oximeters Market

-

Middle East Pulse Oximeters Market

-

Africa Pulse Oximeters Market

In the product type segment of the pulse oximeters market, the fingertip pulse oximeters category is expected to have a significant revenue share in the year 2023. This is because of the widespread uses and various advantages of fingertip pulse oximeters that enhance their utility and effectiveness.

Fingertip pulse oximeters are compact devices that provide quick, non-invasive measurements of blood oxygen saturation and pulse rate, using light sensors to assess how well oxygen is being transported throughout the body. One of the primary advantages is their ease of use; patients can perform measurements at home with minimal training, making them accessible for routine monitoring.

The portability of fingertip pulse oximeters allows users to carry them easily and measure their oxygen levels wherever they are, which is particularly beneficial for individuals with chronic respiratory conditions. Additionally, many modern fingertip pulse oximeters come with digital displays that provide clear, real-time readings, and some models offer data storage and trend-tracking features that can help manage long-term health.

Furthermore, technological advancements and product innovations taking place in the development of fingertip pulse oximeters are likely to propel the pulse oximeters market growth. For instance, in January 2022, TytoCare Ltd introduced an advanced fingertip pulse oximeter equipped with artificial intelligence (AI) capabilities, designed to enhance the management of chronic respiratory conditions such as COPD and asthma.

Therefore the widespread uses and various advantages of fingertip pulse oximeters enhance performance and usability, solidifying the significant impact on the growth of the overall pulse oximeters market during the forecast period from 2024 to 2030.

Pulse Oximeters Regional Analysis

North America is expected to dominate the overall Pulse Oximeters Market

Among all the regions, North America is expected to dominate the pulse oximeters market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This is driven by the increasing prevalence of chronic respiratory diseases and the need for improved management tools. Advancements in pulse oximeter technology, regulatory support, and the introduction of innovative devices by key pulse oximeters market players are acting as key factors contributing to the growth of the pulse oximeter market in the North America region during the forecast period from 2024 to 2030.

According to data from the Centers for Disease Control and Prevention (CDC) (2023), in 2021, approximately 11.5% of U.S. adults aged 18 years or older were current cigarette smokers, equating to an estimated 28.3 million individuals. As per the same source, over 16 million Americans are affected by smoking-related diseases. Smoking is a major risk factor associated with the development of COPD disorder among the population.

According to the American Lung Association data updated in April 2024, it stated that more than 34 million people are currently living in the US with chronic lung diseases like asthma and COPD. In addition to this, the same source stated that in 2023, approximately 11.7 million people in the US were living with chronic respiratory disorders, which over time makes it harder for patients to breathe. Furthermore, as per data provided by the CDC (2023), in 2021, around 14.2 million people in the US had COPD.

Pulse oximeters play a crucial role in managing chronic respiratory conditions like COPD and asthma, which are significantly influenced by smoking and other factors. For individuals with chronic lung diseases, maintaining adequate oxygen levels is essential for managing symptoms and preventing complications. Pulse oximeters monitor oxygen saturation trends over time, guiding treatment adjustments and assessing the effectiveness of interventions. In patients with COPD, regular monitoring with a pulse oximeter helps detect drops in oxygen levels early, allowing for timely medical responses to prevent exacerbations and improve overall quality of life.

Rising product developmental activities by regulatory bodies and key players in the region will further boost the market for pulse oximeters. For example, in February 2024, Masimo announced FDA clearance of MightySat® Medical, making it the first and only FDA-cleared medical fingertip pulse oximeter available Over-The-Counter (OTC) directly to consumers without a prescription.

Therefore, the interplay of all the aforementioned factors would provide a conducive growth environment for the North American pulse oximeters market.

Pulse Oximeters Market Key Players

Some of the key market players operating in the pulse oximeters market include Medtronic, Nonin, Lepu Medical Technology, TytoCare Ltd., Meditech Equipment Co ., Ltd., VYAIRE, OMRON Healthcare, Inc., Promed, Smiths Medical, NISSEI HOLDINGS INC., CONTEC MEDICAL SYSTEMS CO., LTD., Shenzhen Aeon Technology Co., Ltd., Masimo, SPENGLER HOLTEX Group, Opto Circuits India Ltd., and others.

Pulse Oximeters Market – Recent Industry Trends and Milestones (2022–2025) | |

|---|---|

| Category | Key Developments (2022–2025) |

| Product Launches | Multiple companies introduced next-generation fingertip, handheld, and wearable pulse oximeters featuring improved motion tolerance, enhanced accuracy in low-perfusion patients, and continuous remote monitoring capabilities. Device makers launched smartphone-integrated SpO₂ systems and multi-parameter oximeters with Bluetooth/IoT connectivity for homecare and telehealth applications. |

| Regulatory Approvals | Several FDA and CE approvals were granted for advanced pulse oximetry systems, including pediatric-specific sensors, hospital-grade continuous monitoring platforms, and AI-based signal processing upgrades. Approvals also expanded for devices focused on neonatal monitoring and low-resource clinical settings. |

| Partnerships | Manufacturers collaborated with telehealth providers, hospital networks, and digital-health platforms to integrate pulse oximetry data into remote patient monitoring (RPM) ecosystems. Partnerships also strengthened supply-chain resilience and expanded distribution channels during post-pandemic demand normalization. |

| Acquisitions | Companies pursued acquisitions to strengthen capabilities in wearable biosensors, signal-processing technologies, and cloud-based patient monitoring. M&A activity targeted firms specializing in non-invasive diagnostics, sensor miniaturization, and home-health technology portfolios. |

| Company Strategy | Global leaders increased R&D investments in sensor accuracy, skin-tone bias reduction, improved calibration algorithms, and integration with multi-parameter monitoring. Companies focused on expanding presence in homecare, chronic respiratory disease management, and emerging markets through affordable and ruggedized devices. |

| Emerging Technology | Innovations include AI-powered SpO₂ estimation, multi-wavelength oximetry for higher accuracy across skin tones, advanced photoplethysmography (PPG) analytics, wearable ring/wrist oximeters, and cloud-connected continuous monitoring platforms. Bio-integrated sensors, flexible materials, and edge-AI capabilities are shaping next-generation devices. |

Recent Developmental Activities in the Pulse Oximeters Market

- In May 2025, Zynex Inc. (NASDAQ: ZYXI) CEO Thomas Sandgaard discussed the company’s recent FDA submission for a new non-invasive pulse oximeter, highlighting its improved accuracy for individuals with darker skin tones and conditions like carbon monoxide poisoning.

- In May 2025, Zynex, Inc. (NASDAQ: ZYXI) announced the submission of a 510(k) application to the FDA for NiCO™, its noninvasive CO-oximeter device used in patient monitoring.

- In January 2025, the FDA proposed new testing guidelines to address racial biases in pulse oximeters, requiring clinical studies to include at least 25% of patients with darker skin tones. However, over-the-counter oximeters are not covered by these new guidelines.

- On December 3, 2024, Movano Health announced that it received FDA 510(k) clearance for the pulse oximeter feature in its Eviemed smart ring. This clearance supports Movano’s plans to market the wearable device to clinical trial organizations and healthcare companies helping patients manage chronic diseases.

- On December 2, 2024, Movano Health announced that it received FDA 510(k) clearance for the pulse oximeter in its EvieMED Ring.

- In March 2021, Nonin Medical, Inc. launched two new disposable products – a single-use wristband and a sensor for use with Nonin’s WristOx2 3150, a wrist-worn pulse oximeter (SpO2). Nonin’s new disposables offer immediate and cost-effective solutions to reduce healthcare provider and patient exposure to infectious agents.

- In June 2021, DetelPro launched the Oxy10 pulse oximeter. This compact device with an LED display that can easily be attached to the fingertip, providing readings for oxygen saturation and pulse rate.

Scope of the Pulse Oximeters Market | |

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024 to 2030 |

|

Pulse Oximeters CAGR | |

|

Pulse Oximeters Market Size | Request for Sample Page |

|

Key Pulse Oximeters Companies |

Medtronic, Nonin Medical Inc., Lepu Medical Technology, TytoCare Ltd., VYAIRE., OMRON Corporation, Meditech Equipment Co ., Ltd, among others. |

Key Takeaways from the Pulse Oximeters Market Report Study

- Market size analysis for current pulse oximeters market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the pulse oximeter market

- Various opportunities available for the other competitors in the pulse oximeters market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current pulse oximeters market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for pulse oximeters market growth in the coming future?

Target Audience who can be benefited from Pulse Oximeters Market Report Study

- Pulse oximeters product providers

- Research organizations and consulting companies

- Pulse oximeters-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in pulse oximeters

- Various end-users want to know more about the pulse oximeters market and the latest technological developments in the pulse oximeters market.