Treatment-Resistant Hypertension Market Summary

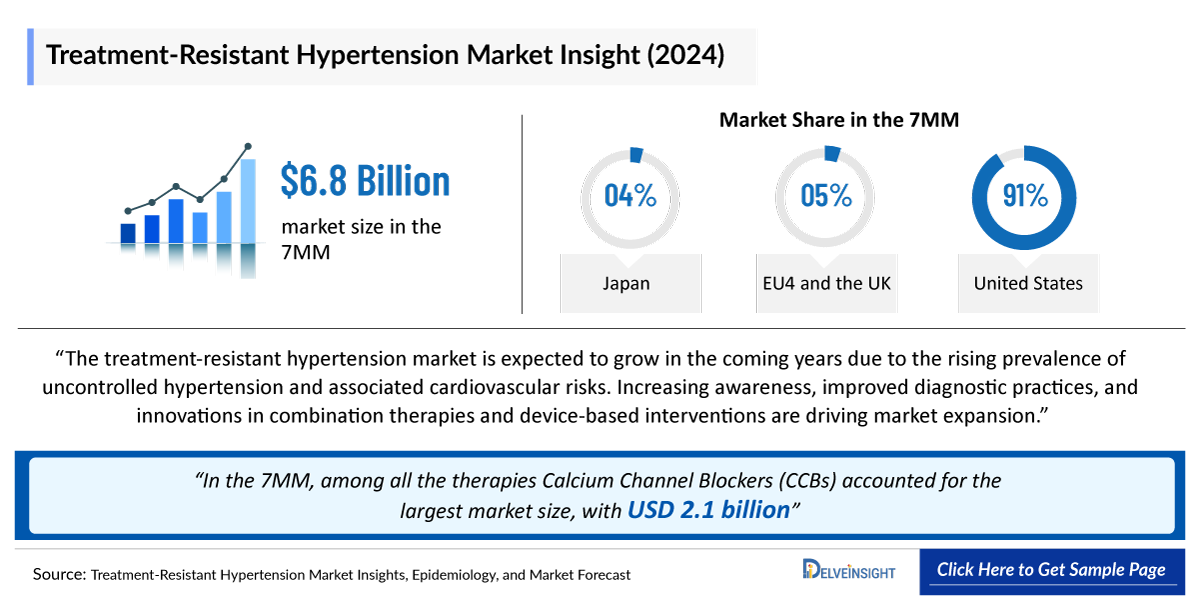

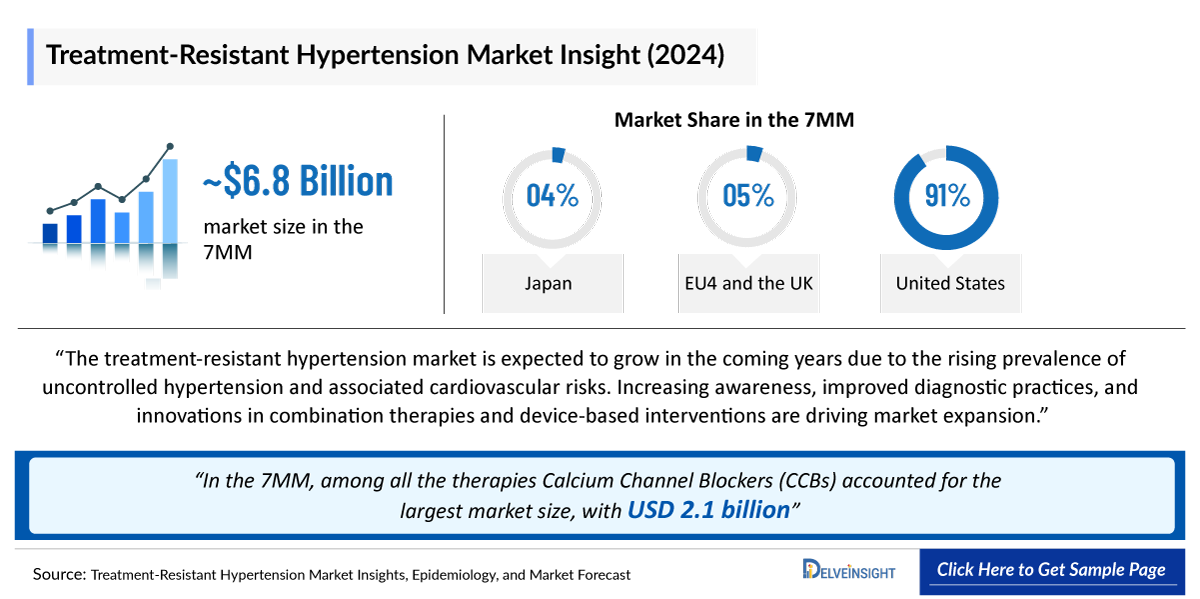

- The Treatment-Resistant Hypertension market size in the 7MM was valued at approximately USD 6,958 million in 2025. Over the forecast period from 2025 to 2034.

- The Treatment-Resistant Hypertension market is projected to grow at a CAGR of 6.30% by 2034 in leading countries (US, EU4, UK and Japan).

- In 2024, the Treatment Resistant Hypertension market size was highest in the US among the 7MM, accounting for approximately ~USD 6,210 million, which is further expected to increase by 2034.

- In the 7MM, among all the therapies Calcium Channel Blockers (CCBs) accounted for the largest market size in 2024, with approximately ~USD 2,110 million.

Treatment-Resistant Hypertension Market and Epidemiology Analysis

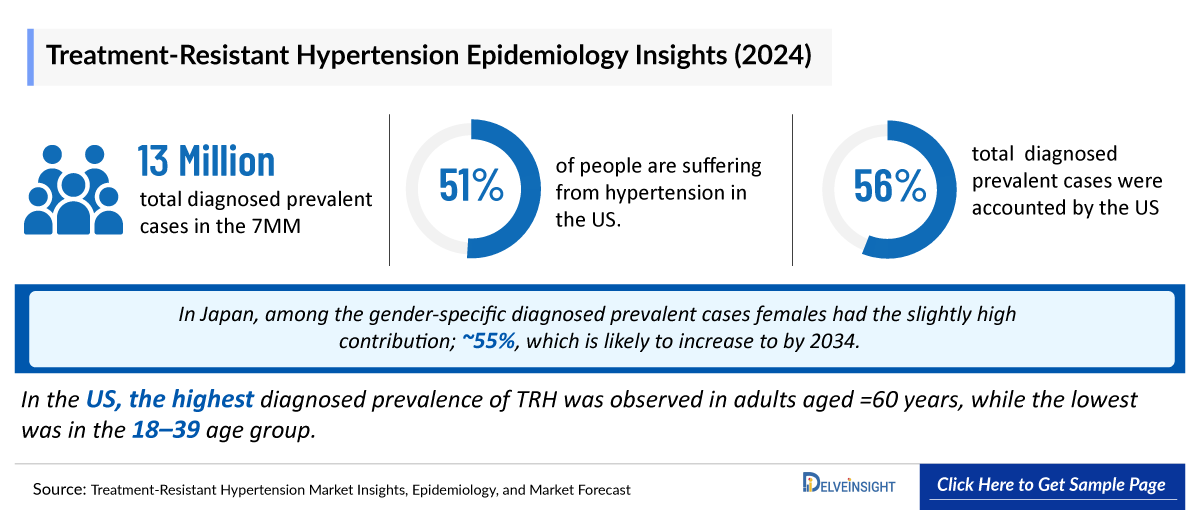

- As per estimates, overall 51% of people are suffering from hypertension in the US.

- The leading Treatment Resistant Hypertension companies such as AstraZeneca, Mineralys Therapeutics, E-Star BioTech, Ionis Pharmaceuticals, Kardiga, Regeneron Pharmaceuticals, Alnylam Pharmaceuticals, Roche, Idorsia Pharmaceutical, and others are dveloping therapies for Treatment Resistant Hypertension treatment.

- The evaluation of resistant hypertension begins with accurate blood pressure measurements, as improper techniques can result in falsely high readings. Automated Office Blood Pressure (AOBP) measurement with a specialized oscillometric device allows repeated blood pressure measurements.

- There were nearly 13,193,000 diagnosed prevalent cases of Treatment Resistant Hypertension in the 7MM in 2024. Among these, the US accounted for the highest number of diagnosed prevalent cases of Treatment Resistant Hypertension.

- Resistant hypertension is initially managed with an ACE inhibitor or ARB, a CCB, and a long-acting thiazide diuretic; if uncontrolled, spironolactone is recommended as a fourth-line agent, with ß-blockers or a-blockers added if further escalation is needed.

- TRYVIO/JERAYGO, developed by Idorsia Pharmaceuticals, the first new class of antihypertensive medication in over 40 years, represents a breakthrough by targeting the endothelin pathway through inhibition of Endothelin-1 (ET-1) binding to ETA and ETB receptors. Approved by the Food and Drug Administration (FDA) and European Medicines Agency (EMA) in 2024 for use in combination with other antihypertensive agents, the MHRA recently approved it in January 2025 for the treatment of hypertension in adults whose blood pressure remains uncontrolled despite the use of at least three other medications. TRYVIO was commercially launched in the US in October 2024.

- The full release of TRYVIO from its Risk Evaluation and Mitigation Strategy (REMS) requirement by the US FDA in March 2025 marks a significant regulatory milestone, potentially reflecting improved safety data and enabling broader clinical adoption.

- Several Treatment Resistant Hypertension drugs with different mechanisms of action that are in development are aldosterone synthase inhibitor (baxdrostat, lorundrostat), Guanylyl Cyclase A (GC-A) receptor activator (MANP), Natriuretic Peptide Receptor 1 (NPR1) agonist (REGN5381), angiotensinogen expression inhibitors (zilebesiran), and targeting angiotensinogen (tonlamarsen). The success of these candidates could diversify the treatment landscape and intensify competition.

- The Treatment Resistant Hypertension drug development pipeline faces major challenges, with several candidates withdrawn or stalled. Firibastat (Quantum Genomics) failed its Phase III trial and was discontinued due to efficacy and financial issues. VELTASSA (patiromer) saw no progress post-Phase II and was removed from development. Ocedurenone (Novo Nordisk) was terminated in Phase III after not meeting its primary endpoint, reflecting the high attrition rate in Treatment Resistant Hypertension drug development.

Treatment-Resistant Hypertension Market size and Forecast:

- 2025 Treatment-Resistant Hypertension Market Size: USD 6,958 million in 2025

- 2034 Projected Treatment-Resistant Hypertension Market Size: USD 12,081 million in 2034

- Treatment-Resistant Hypertension Growth Rate (2025-2034): 6.30% CAGR

- Largest Treatment-Resistant Hypertension Market: United States

Key Factors Driving Treatment Resistant Hypertension Market

Rising Prevalence of Treatment-Resistant Hypertension

Hypertension affects an estimated 51% of the US population, with nearly 13.2 million diagnosed prevalent cases of TRH reported across the 7MM in 2024. The US accounts for the largest share of these cases. Accurate evaluation of resistant hypertension begins with precise blood pressure measurements, as improper techniques can result in falsely elevated readings.

Emerging Competitors in the TRH Market

The TRH market is witnessing the emergence of several innovative therapies from leading companies such as AstraZeneca, Mineralys Therapeutics, E-Star BioTech, Ionis Pharmaceuticals, Kardiga, Regeneron Pharmaceuticals, Alnylam Pharmaceuticals, Roche, and Idorsia Pharmaceuticals. A major breakthrough in this market is TRYVIO/JERAYGO (Idorsia Pharmaceuticals), the first new class of antihypertensive therapy in over 40 years, which targets the endothelin pathway by inhibiting Endothelin-1 (ET-1) binding to ETA and ETB receptors.

Impact of TRYVIO/JERAYGO on TRH Treatment Paradigms

TRYVIO was approved by the FDA and EMA in 2024 for use in combination with other antihypertensive agents, and the MHRA granted approval in January 2025 for adults whose blood pressure remains uncontrolled despite at least three other medications. Commercially launched in the US in October 2024, TRYVIO achieved a significant regulatory milestone with the full release from the FDA’s Risk Evaluation and Mitigation Strategy (REMS) in March 2025, reflecting improved safety data and enabling broader clinical adoption.

Increased TRH Clinical Trial Activity

Ongoing clinical trials across these emerging therapies highlight the robust development activity in the TRH space, positioning the market for sustained growth and innovation over the next decade. Several innovative TRH therapies are in development with diverse mechanisms of action, including aldosterone synthase inhibitors (Baxdrostat by AstraZeneca and Lorundrostat by Mineralys Therapeutics), Guanylyl Cyclase A receptor activator (MANP by E-STAR BioTech), Natriuretic Peptide Receptor 1 agonist (REGN5381 by Regeneron Pharmaceuticals), angiotensinogen expression inhibitors (Zilebesiran by Alnylam Pharmaceuticals and Roche), and angiotensinogen-targeted therapies (Tonlamarsen by Ionis Pharmaceuticals and Kardiga). The success of these candidates is expected to diversify the treatment landscape, provide new therapeutic options for patients, and intensify market competition.

DelveInsight’s “Treatment Resistant Hypertension Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of historical and forecasted epidemiology as well as market trends in the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan. Treatment Resistant Hypertension therapeutics market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM market size from 2020 to 2034. The report also covers current treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

Treatment Resistant Hypertension Market |

|

|

Treatment Resistant Hypertension Market Size | |

|

Treatment Resistant Hypertension Companies |

Novartis, F. Hoffmann-La Roche, Ionis Pharmaceuticals, AstraZeneca (Alexion Pharmaceuticals), Vertex Pharmaceuticals, Otsuka Pharmaceutical, Biogen, Arrowhead Pharmaceuticals, NovelMed, Q32 Bio, Walden Biosciences, Takeda Pharmaceutical, Vera Therapeutics, and others |

|

Treatment Resistant Hypertension Epidemiology Segmentation |

|

Treatment Resistant Hypertension Disease Understanding

Treatment Resistant Hypertension Overview

Resistant hypertension is defined as either uncontrolled blood pressure remaining at =130 mmHg Systolic Blood Pressure (SBP) and = 80 mm Hg Diastolic Blood Pressure (DBP) despite the concurrent prescription of three or four antihypertensive drugs of different classes or controlled blood pressure with the prescription of more than or equal to four antihypertensive drugs, with both definitions including a thiazide diuretic and all medications at maximally tolerated doses. Uncontrolled cases of elevated blood pressure in patients prescribed more than or equal to adequately dosed antihypertensive drugs, inclusive of a diuretic, will include both RHT and refractory hypertension. It is observed that people in whom blood pressure is controlled on more than three antihypertensive drugs may also benefit from a review in a specialist setting. This will ensure that pseudo-resistant and secondary hypertension are excluded and optimal drugs and doses are prescribed, thus avoiding potential over-treatment. Blood pressure is determined by complex interactions that occur among the Renin–Angiotensin–Aldosterone System (RAAS), the Sympathetic Nervous System (SNS), the endothelin system, natriuretic peptides, the arterial vasculature, and the immune system. Hypertension may result from dysfunction in any or all of these systems, with contributions from genetics, environmental factors (e.g., high sodium intake, low potassium intake, sleep apnea, excessive alcohol intake, physical inactivity, and stress), and aging. Hypertension often has no symptoms, making regular blood pressure checks essential. When extremely high (180/120 mm Hg or more), it can cause headaches, chest pain, dizziness, vision changes, shortness of breath, nausea, anxiety, nosebleeds, and irregular heartbeat. If untreated, it can lead to serious conditions like heart disease, stroke, and kidney damage.

Treatment Resistant Hypertension Diagnosis

Evaluating resistant hypertension starts with ensuring accurate blood pressure measurements, as errors like using the wrong cuff size or incorrect arm positioning can lead to falsely elevated readings. It's also crucial to rule out the white coat effect using ambulatory or home blood pressure monitoring that follows established guidelines. AOBP measurement, which uses a specialized oscillometric device to take repeated readings every 1–2 minutes while the patient sits alone in a quiet room, helps minimize this effect. A meta-analysis found AOBP results comparable to home monitoring, supporting its use for reducing the white coat effect. As per Hypertension Canada Guidelines, AOBP is the preferred method for office blood pressure measurement. Ultimately, true resistant hypertension can only be diagnosed if patients are confirmed to be taking their prescribed medications correctly.

Further details related to country-based variations are provided in the report…

Treatment Resistant Hypertension Treatment

Once the diagnosis is established, resistant hypertension management remains challenging. Effective treatments should combine lifestyle changes and removal of interfering substances, optimization of ongoing treatment, and a sequential introduction of antihypertensive drugs on top of triple therapy. Further options, such as renal artery denervation, may be considered in selected cases. Given the association with various comorbidities and the need for multiple and complex drug regimes, patients with resistant hypertension should be referred to a hypertension specialist or even to a specialized hypertension center if necessary. A dedicated follow-up program is mandatory.

Nonpharmacological management of Treatment Resistant Hypertension focuses on foundational lifestyle modifications, including smoking cessation, stress reduction, limiting alcohol intake, regular physical activity such as aerobic exercise, and dietary adjustments like adopting the DASH diet, which is low in sodium and rich in potassium. In recent years, several innovative pharmacological treatments have emerged to address Treatment Resistant Hypertension more effectively. These include endothelin receptor antagonists, which reduce vasoconstriction and sodium retention; aldosterone synthase inhibitors, which block aldosterone production; and novel nonsteroidal mineralocorticoid receptor antagonists (nsMRAs) that provide targeted inhibition with fewer side effects. Additionally, small interfering RNA (siRNA) therapies targeting hepatic angiotensinogen production have shown promise in suppressing the RAAS. Other novel agents include atrial natriuretic peptides, which enhance natriuresis and vasodilation, and aminopeptidase A inhibitors, which interfere with central blood pressure regulation by reducing the formation of angiotensin III. Together, these strategies offer a multifaceted approach to managing Treatment Resistant Hypertension beyond conventional therapies.

Further details related to treatment will be provided in the report…

Treatment Resistant Hypertension Epidemiology

The Treatment Resistant Hypertension epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of treatment resistant hypertension, gender-specific diagnosed prevalent cases of treatment resistant hypertension, age-specific diagnosed prevalent cases of treatment resistant hypertension in the 7MM covering the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Treatment-Resistant Hypertension Epidemiological Analyses and Forecast:

- In 2024, the total diagnosed prevalent cases of Treatment Resistant Hypertension in the United States were approximately 7,365,300 cases, projected to increase during the forecast period (2025–2034).

- In Japan, among the gender-specific diagnosed prevalent cases females had the slightly high contribution; ~55% in 2024, which is likely to increase to by 2034.

- In the US in 2024, the highest diagnosed prevalence of Treatment Resistant Hypertension was observed in adults aged =60 years, with ~2,732,600 cases, while the lowest was in the 18–39 age group.

Treatment Resistant Hypertension Epidemiology Segmentation:

- Total diagnosed prevalent cases of treatment resistant hypertension

- Gender-specific diagnosed prevalent cases of treatment resistant hypertension

- Age-specific diagnosed prevalent cases of treatment resistant hypertension

Treatment-Resistant Hypertension Market Recent Developments and Breakthroughs

- In May 2025, Q1 presentation, the company stated plans to announce the topline results from the KARDIA-3 study and to initiate a Phase III cardiovascular outcomes trial of zilebesiran in the second half of 2025.

- In the Q1 2025 presentation, Regeneron Pharmaceuticals announced the initiation of a Phase II clinical trial evaluating REGN5381 for the treatment of uncontrolled hypertension.

- In March 2025, Idorsia Pharmaceuticals announced that the US FDA had fully released TRYVIO from its REMS requirement. Idorsia is also released from the PMR to conduct a worldwide descriptive study that collects prospective and retrospective data in women exposed to TRYVIO during pregnancy and/or lactation as these data are no longer needed

- In February 2025, Idorsia Pharmaceuticals announced that the exclusivity agreement signed in November 2024 with an undisclosed party for the global rights to aprocitentan had concluded without the party signing the deal as foreseen in the nonbinding term sheet.

Treatment Resistant Hypertension Drug Analysis

The drug chapter segment of the disease report encloses a detailed analysis of Treatment Resistant Hypertension-marketed drugs and mid and late-stage pipeline drugs. It also helps understand the Treatment Resistant Hypertension clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases. The Treatment Resistant Hypertension drugs market is witnessing steady growth, driven by rising prevalence, increased awareness, and ongoing advancements in novel therapies targeting resistant forms of high blood pressure.

Treatment Resistant Hypertension Marketed Drug

TRYVIO/JERAYGO (aprocitentan): Idorsia Pharmaceutical

TRYVIO is a once-daily, orally active, dual endothelin receptor antagonist which inhibits the binding of ET-1 to ETA and ETB receptors. Aprocitentan has a low potential for drug-drug interaction and a mechanism of action that is ideally suited for lowering blood pressure in adult patients whose hypertension is not adequately controlled by other drugs and has been commercially available since October 2024 in the US. In 2024, Idorsia received EC approval for JERAYGO to treat treatment-resistant hypertension in adults, and FDA approval for TRYVIO to manage hypertension in patients not adequately controlled by other drugs. The FDA had updated the FDA label of TRYVIO after the removal of REMS.

Emerging Treatment Resistant Hypertension Drugs

Baxdrostat (CIN-107): AstraZeneca

Baxdrostat is a highly selective, oral small-molecule inhibitor of aldosterone synthase, the enzyme responsible for the synthesis of aldosterone in the adrenal gland, in development for patient populations with significant unmet medical needs, including Treatment Resistant Hypertension, primary aldosteronism, and CKD. Baxdrostat selectively targets aldosterone synthase, which is encoded by the CYP11B2 gene, while having a much lower affinity for the blocking activity of 11ß-hydroxylase, the enzyme responsible for cortisol synthesis, which is encoded by the CYP11B1 gene. The company is anticipating the first Phase III data for the BaxHTN study (baxdrostat for uncontrolled or resistant hypertension) in the second half of 2025.

Lorundrostat (MLS-101): Mineralys Therapeutics

Lorundrostat, an investigational drug, is a novel, oral, highly selective, once-daily aldosterone synthase inhibitor. Lorundrostat targets aldosterone-driven hypertension by inhibiting the enzyme that catalyzes the final steps of aldosterone synthesis. Our goal is to decrease levels of aldosterone by selectively inhibiting aldosterone synthesis without affecting cortisol synthesis. Lorundrostat has 374-fold selectivity for inhibiting aldosterone synthesis over cortisol synthesis. Mineralys Therapeutics mentioned the plans to provide additional data from the pivotal Phase III Launch-HTN at an upcoming medical conference and in a peer-reviewed publication.

Treatment Resistant Hypertension Drug Class Insights

Aldosterone Synthase Inhibitor

Aldosterone synthase inhibitors target the enzyme responsible for aldosterone production, which helps regulate blood pressure. In Treatment Resistant Hypertension, where aldosterone often contributes to persistent high blood pressure despite multiple medications, these inhibitors can effectively lower blood pressure by reducing aldosterone levels. Two most potential drugs baxdrostat (AstraZeneca) and lorundrostat (Mineralys Therapeutics) act by this mechanism of action.

Endothelin receptor antagonists

ERAs block the action of endothelin-1 (ET-1), a potent vasoconstrictor, by inhibiting its binding to ETA and ETB receptors. This reduces vascular tone, lowers blood pressure, and helps improve endothelial function, making ERAs effective in managing treatment-resistant hypertension. The only market approved drug with this novel mechanism of action is TRYVIO (Idorsia Pharmaceutical).

Treatment Resistant Hypertension Market Outlook

Resistant hypertension causes vascular damage, raising the risk of cardiovascular events. Older (=65 years), obese patients with comorbidities like diabetes, Chronic Kidney Disease, or left ventricular hypertrophy face greater difficulty in blood pressure control. Resistant hypertension is linked to higher rates of diabetes (48% vs. 30%), CKD (45% vs. 24%), ischemic heart disease (41% vs. 22%), and stroke (16% vs. 9%) compared to those with controlled blood pressure.

Management of resistant hypertension relies on lifestyle measures (maintaining a healthy weight through regular physical activity and a healthy diet, salt restriction, limiting alcohol intake, and smoking cessation), pharmacotherapy, and interventional approaches, where required. Pharmacotherapy includes a combination of a renin–angiotensin system blocker, a long-acting calcium channel blocker, and a diuretic at maximally tolerated doses, ideally as a single pill combination. Spironolactone is currently recommended as the preferred fourth-line therapy, with alpha-blockers, beta-blockers, centrally acting sympatholytic agents, or vasodilators as alternatives. If BP control cannot be achieved with the above strategies, interventional approaches such as renal denervation and novel therapeutic agents (once available) should be considered. Lifestyle changes play a key role in managing resistant hypertension. A recent meta-analysis showed lifestyle interventions as the most effective non-drug approach, lowering office SBP by -7.26 mmHg. The DASH diet—rich in whole grains, fruits, vegetables, and low-fat dairy, while low in saturated fats and sugars—has proven effective, as has the Mediterranean diet. Finerenone, a selective nonsteroidal mineralocorticoid receptor antagonist (nsMRA), blocks aldosterone effects even without its presence, offering a promising alternative for resistant hypertension. While spironolactone is the first-line treatment, its anti-androgenic side effects make it less suitable for males, and there are limited options for those intolerant or hyperkalemic.

TRYVIO (aprocitentan) represents a breakthrough in antihypertensive treatment as the first new class in over 30 years, targeting the endothelin pathway. Approved by the FDA in the spring of 2024, TRYVIO is a once-daily tablet, easy for patients to use and physicians to prescribe. The FDA’s decision to remove the REMS requirement reflects growing confidence in its safety profile. While it can now be prescribed to high-risk cardiovascular patients, the risk of fluid retention in 18% of high-dose patients may pose a challenge to established treatments. Idorsia has not yet disclosed the suitor for global rights, but the positive Phase III trial results suggest strong potential for TRYVIO in the market.

Aldosterone synthase inhibitors, like baxdrostat and lorundrostat, are promising options for resistant hypertension. Baxdrostat, currently in Phase III (results expected in the second half of 2025), shows significant reductions in systolic blood pressure (SBP) and a favorable safety profile, outperforming TRYVIO in Phase II. AstraZeneca sees it as a potential blockbuster. Lorundrostat, developed by Mineralys Therapeutics, is gaining attention as a high-potential entrant in the antihypertensive market with promising Phase II and III trial results (Advance-HTN and Launch-HTN), showing better BP reduction than TRYVIO, positioning it as a potential best-in-class treatment.

In addition to these drugs, several promising candidates with novel mechanisms of action, including GC-A activating (MANP), targeting angiotensinogen (tonlamarsen), NPR1 agonist (REGN5381), and Angiotensinogen expression inhibitors (zilebesiran). The RHTN treatment landscape is expected to undergo significant changes during the forecast period of 2025–2034, driven by the launch of new therapies and a strong pipeline of drugs in development.

The clinical development landscape is quite constrained currently. Consequently, in light of this scarcity, our forecast considers the potential impact of key players like AstraZeneca (baxdrostat), Mineralys Therapeutics (lorundrostat), E-STAR BioTech (MANP), Ionis Pharmaceuticals, and Kardigan (tonlamarsen), and others.

The approval of these therapies is anticipated to reshape the market dynamics during the forecast period (2025–2034).

- The Treatment-Resistant Hypertension market size in the 7MM was valued at ~USD 6,958 million in 2025 and is anticiptaed to grow with a CAGR of 6.30% during the forecast period from 2025 to 2034.

- In 2024, the US captured the highest market share, i.e., nearly USD 6,210 million out of all the 7MM.

- Among the EU4 and the UK, Germany held the highest market share in 2024, while the UK accounted for the lowest.

- In Japan, the Treatment Resistant Hypertension market size accounted for nearly USD 259 million in 2024, and is expected to increase at a significant CAGR during the forecast period (2025–2034).

- In 2024, among all the current therapies for Treatment Resistant Hypertension, the highest revenue was generated by CCBs in the US.

To be continued in the report….

Treatment Resistant Hypertension Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034. The landscape of Treatment Resistant Hypertension treatment has experienced a profound transformation with the uptake of novel drugs.

Further detailed analysis of emerging therapies drug uptake in the report…

Treatment Resistant Hypertension Pipeline Development Activities

The Treatment Resistant Hypertension pipeline report provides insights into Treatment Resistant Hypertension clinical trials Phase III, Phase II, and Phase I/II. It also analyzes key players involved in developing targeted therapeutics.

Treatment Resistant Hypertension Pipeline Development Activities

The Treatment Resistant Hypertension clinical trials analysis report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Treatment Resistant Hypertension emerging therapies.

Latest KOL-Views on Treatment Resistant Hypertension

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, PhD, Research Project Manager, Director, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Treatment Resistant Hypertension market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. University of Virginia School of Medicine, l'institut du Thorax, University of Brescia, Harvard Medical School, King's College London, etc., were contacted. Their opinion helps understand and validate Treatment Resistant Hypertension epidemiology and market trends.

Treatment Resistant Hypertension Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Treatment Resistant Hypertension Market Access and Reimbursement

The cost of newly approved medications is usually high, and because of it, patients escape from proper treatment or opt for off-label and cheap medications. It affects market access to newly launched medications, and reimbursement is crucial. The decision to reimburse often comes down to the drug’s price relative to the benefit it produces in treated patients. Market access and reimbursement options can differ depending on regulatory status, target population size, the setting of care, unmet needs, the magnitude of incremental benefit claims, and costs.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The United States

TRYVIO Patient Support

- Ask the doctor about a 30-day free trial offer for the first TRYVIO prescription, regardless of insurancea.

- Commercially eligible patients may receive TRYVIO for as little as USD 10 per month through Walgreens Specialty Pharmacyb.

a This offer is good for a 30-day (maximum 30 tablets; one-time use) free trial of TRYVIO at no cost to you.

b For commercially eligible patients only. This offer is not valid under Medicare, Medicaid, or any other federal or state program. The patient must be 18 years of age or older and a resident of the US.

Further detailed analysis of emerging therapies drug uptake in the report…

Scope of the Treatment Resistant Hypertension Market Report

- The report covers a descriptive overview of Treatment Resistant Hypertension, explaining its causes, signs and symptoms, pathogenesis, and currently available and promising emerging therapies.

- Comprehensive insight has been provided into Treatment Resistant Hypertension epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Treatment Resistant Hypertension is provided, along with the assessment of new therapies that will have an impact on the current treatment landscape.

- A detailed review of the Treatment Resistant Hypertension market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM Treatment Resistant Hypertension market.

Treatment Resistant Hypertension Market Report Insights

- Treatment Resistant Hypertension Patient population

- Treatment Resistant Hypertension Therapeutic approaches

- Treatment Resistant Hypertension pipeline analysis

- Treatment Resistant Hypertension market size and trends

- Treatment Resistant Hypertension Market opportunities

- Impact of upcoming Treatment Resistant Hypertension therapies

Treatment Resistant Hypertension Market Report Key Strengths

- Ten years forecast

- 7MM coverage

- Treatment Resistant Hypertension epidemiology segmentation

- Key cross competition

- Highly analyzed market

- Treatment Resistant Hypertension Drugs uptake

Treatment Resistant Hypertension Market Report Assessment

- Current Treatment Resistant Hypertension treatment practices

- Treatment Resistant Hypertension Unmet needs

- Treatment Resistant Hypertension Pipeline product profiles

- Treatment Resistant Hypertension Market attractiveness

- Qualitative analysis (SWOT and conjoint analysis)

- Treatment Resistant Hypertension Market Drivers

- Treatment Resistant Hypertension Market Barriers

FAQs

- What was Treatment Resistant Hypertension market share (%) distribution in 2024, and what would it look like in 2034?

- What would be the Treatment Resistant Hypertension total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- Which country will have the largest Treatment Resistant Hypertension market size during the study period (2020–2034)?

- What are the disease risks, burdens, and unmet needs of Treatment Resistant Hypertension?

- What is the historical Treatment Resistant Hypertension patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Treatment Resistant Hypertension?

- How many emerging therapies are in the mid- and late-stage of development for the treatment of Treatment Resistant Hypertension?

- What are the key collaborations (Industry–Industry, Industry–Academia), mergers and acquisitions, and licensing activities related to Treatment Resistant Hypertension therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Treatment Resistant Hypertension and their status?

Reasons to Buy Treatment Resistant Hypertension Market Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving Treatment Resistant Hypertension.

- To understand the future market competition in the Treatment Resistant Hypertension market and an Insightful review of the SWOT analysis of Treatment Resistant Hypertension.

- Organize sales and marketing efforts by identifying the best opportunities for Treatment Resistant Hypertension in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Treatment Resistant Hypertension market.

- To understand the future market competition in the Treatment Resistant Hypertension market.