Bipolar Depression Market

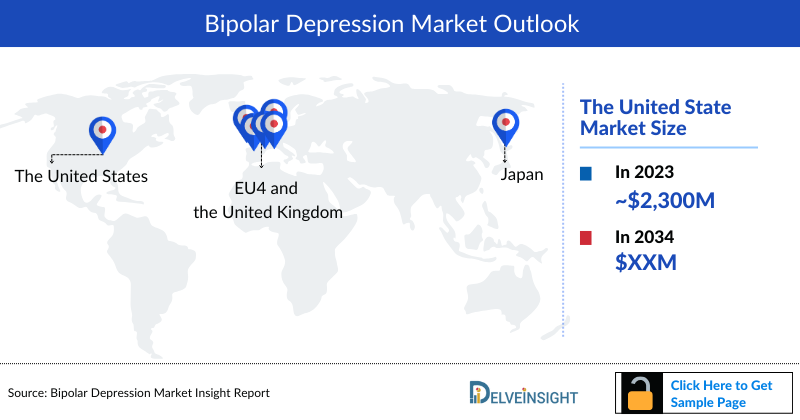

- The United States accounts for the largest Bipolar depression market share (around 85%) , in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Among the marketed Bipolar depression therapies, CAPLYTA (lumateperone) is expected to garner the highest Bipolar depression market size by 2034 in the 7MM.

- Bipolar Depression (BD), which is sometimes also referred to as manic depressive illness or manic depression is a brain disorder that causes changes in a person's mood, energy, and ability to function.

- Bipolar depression is a chronic illness that causes severe mood swings that can differ in duration and intensity. There are 30% higher as many depressive episodes as manic moments in those who have bipolar depression. And those episodes are frequently 50% longer in duration.

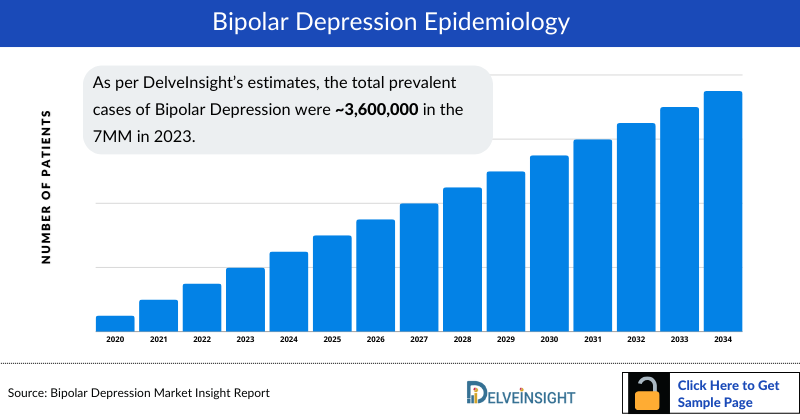

- As per DelveInsight’s estimates, the total prevalent cases of Bipolar Depression were ~3,600,000 in the 7MM in 2023. Moreover, severe cases accounted for majority (~75%) of the cases in 2023.

- DelveInsight’s consultant estimates that Bipolar II Disorder constituted the maximum number of cases (nearly 60%), based on type-specific diagnosed prevalent cases of bipolar depression in the 7MM in 2023.

- There are several Bipolar Depression medications that have received United States Food and Drug Administration (FDA) approval for acute bipolar depression. The olanzapine‐fluoxetine combination (OFC) was first approved in 2003. Quetiapine was approved in 2006. In 2013, LATUDA (lurasidone) was approved as a monotherapy and adjunct to ongoing lithium or valproate for bipolar I depression, cariprazine, was approved in 2019 and CAPLYTA (lumateperone) received US FDA approval in 2021.

- In April 2024, NRx Pharmaceuticals announced promising findings in Phase IIb/III clinical trial of NRX-101 vs. lurasidone for treatment of suicidal bipolar depression, which demonstrated a promising, though not yet statistically significant 33% reduction in suicidality together with a 70% reduction (P=.076) reduction in symptoms of akathisia.

Request for unlocking the Sample Page of the Bipolar Depression Drugs and Treatment Market

DelveInsight's “Bipolar Depression Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of bipolar depression, historical and forecasted epidemiology as well as the bipolar depression market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Bipolar Depression Treatment Market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM bipolar depression market size from 2020 to 2034. The report also covers current bipolar depression treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2019 to 2032 |

|

Forecast Period |

2023-2032 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Bipolar Depression Market |

|

|

Bipolar Depression Market Size | |

|

Bipolar Depression Epidemiology Segmentation |

|

Bipolar Depression Treatment Market

Bipolar Depression Overview, Country-Specific Treatment Guidelines and Diagnosis

Bipolar Depression is a disorder that causes unusual shifts in mood, energy, activity levels, concentration, and the ability to carry out day-to-day tasks. Bipolar Depression can be of different types including Bipolar I, Bipolar II, Cyclothymia, mixed features, and rapid cycling. Under the umbrella term Bipolar Depression comes bipolar depression which is a major clinical challenge. As the predominant psychopathology even in treated Bipolar Depression, depression is associated not only with excess morbidity, but also mortality from co-occurring general medical disorders and high suicide risk.

Currently, no established diagnostic test is available for Bipolar Depression. The diagnosis of Bipolar Depression usually requires a physical examination, psychiatric assessment, mood charting, and the use of criteria for Bipolar Depression. The bipolar depression report provides an overview of bipolar depression pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Bipolar Depression Treatment

Major drug classes that are recommended for the treatment of bipolar depression are antipsychotics, mood stabilizers, anti-seizure medications, and atypical neuroleptics. Other than pharmacological therapy, stimulants, electroconvulsive therapy, and transcranial magnetic stimulation are a few options available for patients suffering from bipolar depression.

Monotherapy with quetiapine or LATUDA (lurasidone) and combination pharmacotherapy with lithium and lamotrigine, and either quetiapine or lurasidone plus a mood stabilizer (lithium or valproate), are majorly used in acute bipolar depressive episodes. The combination of olanzapine and fluoxetine is approved for treating Bipolar-I depression. Also, for the refractory patient or first line for treating bipolar depression with psychotic features, electroconvulsive therapy is considered. Cariprazine is a new second‐generation antipsychotic (SGA) that received FDA approval for bipolar mania with and without mixed features in 2015. In June 2019, cariprazine received FDA approval for acute bipolar depression in doses of 1.5 or 3 mg daily.

Further details related to country-based variations in treatment are provided in the report...

Bipolar Depression Epidemiology

The bipolar depression epidemiology chapter in the bipolar depression market report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The bipolar depression epidemiology is segmented with detailed insights into Total Diagnosed Prevalent Cases of Bipolar Depression, Type-specific Diagnosed Prevalent Cases of Bipolar Depression, Severity-specific Diagnosed Prevalent Cases of Bipolar Depression and Total Treated Cases of Bipolar Depression.

- As per DelveInsight's estimates, diagnosed prevalent cases of bipolar depression in the United States was around 70% of the total cases in the 7MM in 2023.

- In the United States, severe cases constituted the maximum number of cases based on severity with approximately 75% cases in 2023.

- Among the 7MM, the highest number of treated cases of bipolar depression was observed in the United States, which accounted for more than 60% of the total treated cases in 2023.

- Germany accounted for the highest diagnosed prevalent cases of bipolar depression in 2023 among the EU4 and the UK.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Bipolar Depression Prevalence

Recent Developments In Bipolar Depression Clinical Trial

- In March 2025, PharmaTher Holdings Ltd. announced the resubmission of its response to the complete response amendment for its FDA new drug application for Ketamine, addressing the minor deficiencies outlined in the FDA’s complete response letter (CRL) dated October 22, 2024.

-

In January 2025, Johnson & Johnson and Intra-Cellular Therapies announced a definitive agreement under which Johnson & Johnson will acquire all outstanding shares of Intra-Cellular Therapies, a biopharmaceutical company specializing in the development and commercialization of CNS disorder treatments, for $132.00 per share in cash, totaling approximately $14.6 billion in equity value.

- In December 2024, NRx Pharmaceuticals announced the submission of the first section of its New Drug Application (NDA) for NRX-100 (ketamine) to the FDA. NRX-100, which was granted Fast Track Designation in 2017, is being developed for use in combination with NRX-101 (D-cycloserine/lurasidone) to treat suicidal bipolar depression.

Bipolar Depression Drug Chapters

The drug chapter segment of the bipolar depression therapeutics market report encloses a detailed analysis of bipolar depression marketed drugs and late-stage (Phase III and Phase II) Bipolar Depression pipeline drugs. It also deep dives into the pivotal bipolar depression clinical trials details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Bipolar Depression Drugs

- VRAYLAR (Cariprazine): Allergan (AbbVie)/Gedeon Richter

VRAYLAR is an oral capsule containing cariprazine as an active ingredient. It is approved in the US for schizophrenia, Bipolar Depression, and bipolar disorder. VRAYLAR was discovered and co-developed by Gedeon Richter Plc and is licensed by Allergan in the US. In May 2019, the US FDA approved a supplemental New Drug Application (sNDA) for VRAYLAR (cariprazine) for expanded use to treat depressive episodes associated with bipolar I disorder (bipolar depression) in adults. The FDA approval for the expanded indication of VRAYLAR was based on three pivotal trials, including RGH-MD-53, RGH-MD-54, and RGH-MD-56, in which cariprazine demonstrated greater improvement than placebo for the change from baseline to weeks on the Montgomery – Asberg Depression Rating Scale (MADRS) total score.

- LYBALVI (olanzapine, samidorphan L-malate): Alkermes

LYBALVI is composed of olanzapine, an established antipsychotic agent, co-formulated with samidorphan, a new chemical entity, in a single bilayer tablet. In Jun 2021, the US. FDA approved Lybalvi (olanzapine and samidorphan) for the treatment of adults with bipolar I disorder, as a maintenance monotherapy or for the acute treatment of manic or mixed episodes, as monotherapy or an adjunct to lithium or valproate. The FDA approval of Lybalvi was supported by the results of the ENLIGHTEN program's pivotal ENLIGHTEN-1 efficacy study and ENLIGHTEN-2 weight study.

|

Drugs |

Company |

MOA |

ROA |

Approval |

|

VRAYLAR (Cariprazine) |

Allergan (AbbVie)/Gedeon Richter |

Partial agonist activity at central dopamine D2 and serotonin 5-HT1A receptors and antagonist activity at serotonin 5-HT2A receptors |

Oral |

US: 2019 |

|

LYBALVI (olanzapine, samidorphan L-malate) |

Alkermes |

Dopamine and serotonin type 2 (5HT2) receptor Antagonist |

Oral |

US: 2021 |

Note: Detailed marketed therapies assessment will be provided in the final report...

Emerging Bipolar Depression Drugs

- NRX-100 and NRX-101: NeuroRx

NeuroRx has developed a sequential therapy consisting of intravenous NRX-100 (ketamine HCL) for rapid stabilization of symptoms of depression and suicidal ideation followed by oral NRX-101 (fixed-dose combination of D-cycloserine and lurasidone) for maintenance of stabilization of symptoms of depression and suicidal ideation. In September 2017, the US FDA granted fast track designation to NRX-100 (ketamine HCl) followed by NRX-101 (D-cycloserine + lurasidone) for bipolar depression with suicidal ideation.

Currently, the company is planning to file an NDA by first half of 2024 and expects to get PDUFA date by 2024 for NRX-100 (IV Ketamine). Recently, in April 2024, the company has posted promising results for NRX-101 that showed 33% advantage in sustained remission in suicidality (not statistically significant at this sample size) and 75% advantage in relief from Akathisia relative to lurasidone.

- COMP 360 (Psilocybin): COMPASS Pathways

Psilocybin therapy is an approach being investigated for the treatment of mental health challenges. It combines the pharmacological effects of psilocybin, a psychoactive substance, with psychological support. Psilocybin is an active ingredient in some species of mushrooms, often referred to as ‘magic mushrooms.’ COMPASS Pathways have developed a synthesized formulation of psilocybin, COMP360, and is investigating the effectiveness of psilocybin therapy, initially in treatment-resistant depression/bipolar depression. It is currently being investigated under Phase II clinical trial. However, it is not currently in the developmental pipeline of the Compass Pathway for bipolar depression and the company suggests that research on bipolar depression could reveal potential findings for them to investigate more deeply and incorporate into their development process.

Note: Detailed emerging therapies assessment will be provided in the final report...

Bipolar Depression Market Outlook

Key Bipolar Depression Companies, such as NeuroRx, COMPASS Pathways, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of bipolar depression.

- Among the 7MM, the United States accounted for the highest Bipolar Depression Market Size, i.e. around USD 2,300 Million of the market in 2023, followed by Germany and Italy.

- By 2034, NRX-100 and NRX-101 are anticipated to achieve prominent Bipolar Depression market share in the 7 major markets.

- Among EU4 and the UK, Germany accounted for the highest Bipolar Depression market share (~30%) in 2023.

- By 2034, CAPLYTA (lumateperone) is projected to achieve the largest Bipolar Depression market share among currently available therapies in the 7MM.

Bipolar Depression Drugs Uptake

This section focuses on the uptake rate of potential Bipolar Depression drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key Bipolar Depression Companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Bipolar Depression Clinical Trial Activities

The Bipolar Depression therapeutics market report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Bipolar Depression Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Bipolar Depression drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for bipolar depression emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Bipolar Depression Treatment Drugs

KOL Views in Bipolar Depression

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as Nathan S. Kline Institute for Psychiatric Research, University of Siena, Morgan Stanley Research, Showa University, etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of bipolar depression. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

Region |

KOL Views |

|

United States |

“Lumateperone has a few drawbacks in Bipolar Depression. It is costly, has never been tested in mania, and unlike other antipsychotics, it has low affinity for the dopamine D2 receptor. However, it has low rates of akathisia, weight gain, metabolic disturbances, and prolactinemia in the short-term bipolar depression studies.” |

|

Italy |

“A feature unique to cariprazine among atypical antipsychotics is its potential as a long-acting oral treatment. Cariprazine is extensively metabolized by the cytochrome P450 3A4 enzyme (CYP3A4). Although cariprazine itself has a half-life of only 2–4 days, its major metabolite, didesmethyl cariprazine (DDCAR) has a half-life of 1–3 weeks, the longest of any atypical antipsychotic.” |

Qualitative Analysis

We perform Qualitative and Bipolar Depression therapeutics market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Bipolar Depression Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

The Bipolar Depression therapeutics market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Bipolar Depression Treatment Market Report Scope

- The Bipolar Depression drugs and treatment market report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current Bipolar Depression drugs and treatment market landscape.

- A detailed review of the bipolar depression drugs and treatment market, historical and forecasted Bipolar Depression market size, Bipolar Depression market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Bipolar Depression drugs market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM bipolar depression therapeutics market.

Bipolar Depression Therapeutics Market Report Insights

- Patient-based Bipolar Depression Market Forecasting

- Bipolar Depression Therapeutic Approaches

- Bipolar Depression Pipeline Analysis

- Bipolar Depression Market Size

- Bipolar Depression Market Trends

- Existing and Future Bipolar Depression Treatment Market Opportunity

Bipolar Depression Market Report Key Strengths

- 11-year Forecast

- 7MM Coverage

- Bipolar Depression Epidemiology Segmentation

- Inclusion of Country Specific Treatment Guidelines

- KOL’s Feedback On Approved and Emerging Bipolar Depression Therapies

- Key Cross Competition

- Conjoint Analysis

- Bipolar Depression Drugs Uptake

- Key Bipolar Depression Market Forecast Assumptions

Bipolar Depression Market Report Assessment

- Current Bipolar Depression Treatment Market Practices

- Bipolar Depression Unmet Needs

- Bipolar Depression Pipeline Product Profiles

- Bipolar Depression Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM bipolar depression treatment market?

- What was the bipolar depression treatment market size, the Bipolar Depression market size by therapies, Bipolar Depression market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the Bipolar Depression market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the Bipolar Depression treatment?

- How many Bipolar Depression companies are developing therapies for the Bipolar Depression treatment?

- What are the recent novel therapies, targets, Bipolar Depression mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy

- The Bipolar Depression treatment market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the bipolar depression therapeutics market.

- Insights on patient burden/Bipolar Depression prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current Bipolar Depression patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Bipolar Depression companies in the treatment market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Bipolar Depression companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles:-

.png&w=256&q=75)