BRAF Targeted Therapies Market

- The BRAF Targeted Therapies Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

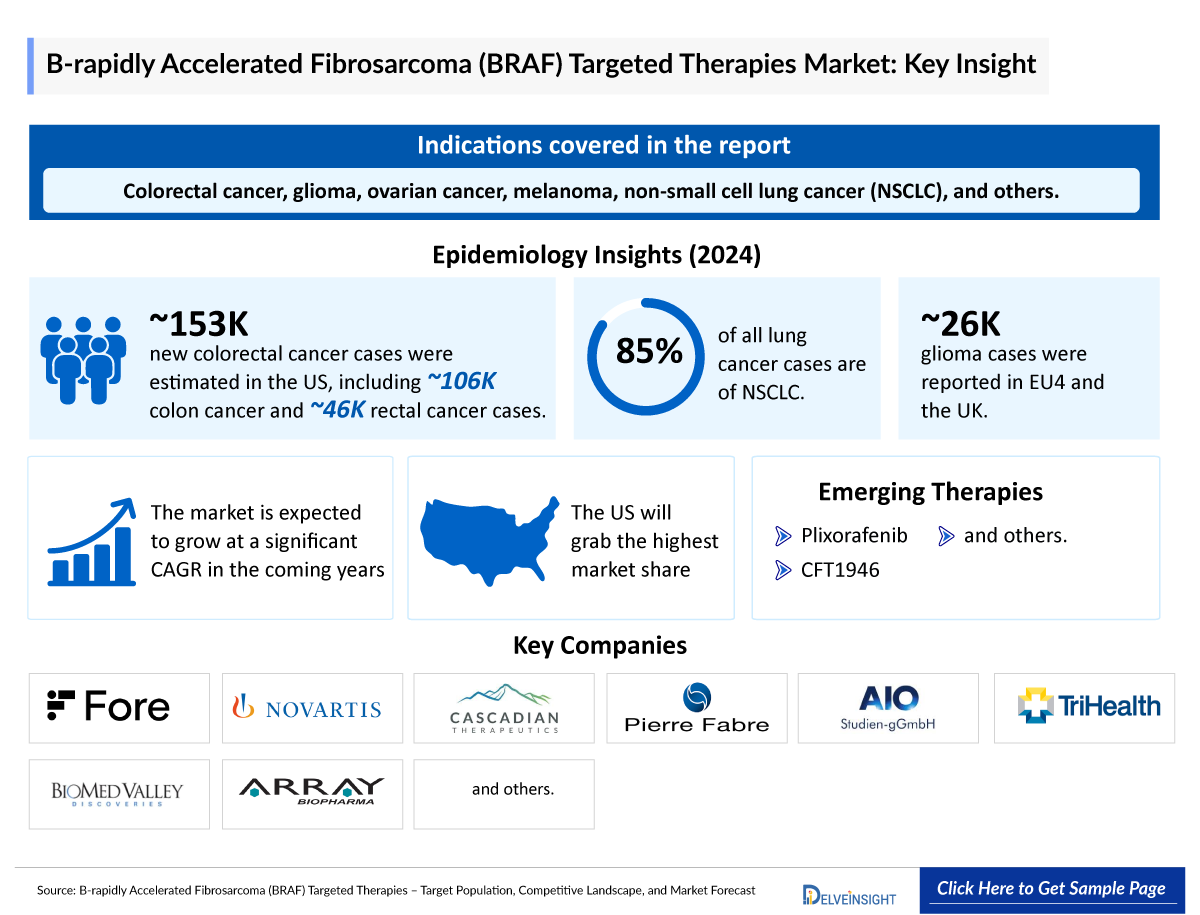

- The BRAF gene, located on chromosome 7, encodes a protein that regulates cell growth. Mutations, like the common BRAFV600E, cause continuous cell division, contributing to cancers such as colorectal cancer, glioma, ovarian cancer, melanoma, non-small cell lung cancer (NSCLC), and others.

- Approximately 20% of patients with colorectal cancer are present with metastatic disease at the time of initial diagnosis, with 5-year survival rates <20% for metastatic colorectal cancer across Europe. Mutations in the BRAF gene occur in 8%-12% of metastatic colorectal cancer cases, >95% of which are BRAFV600E.”

- Activating BRAF mutations are present in approximately 50% of all melanomas. Approximately 90% of these mutations occur at amino acid 600, the majority of which are BRAFV600E mutations. Other mutations have been recorded at codon 600, including BRAF V600K, V600D, and V600M.

- In April 2025, FORE Biotherapeutics data of Phase I/II and Phase II of plixorafenib at the American Association for Cancer Research (AACR) Annual Meeting 2025.

- In March 2025, Servier and Black Diamond Therapeutics announced a strategic worldwide licensing agreement for BDTX-4933.

- In February 2025, Pfizer announced positive topline results from the Phase III BREAKWATER study of the BRAFTOVI (encorafenib) combination regimen in colorectal cancer patients.

- As per the 43rd Annual JP Morgan Healthcare Conference presentation of January 2025, the company anticipates to present data from Phase I cohorts evaluating CFT1946 as a monotherapy in melanoma, in combination with trametinib in melanoma, and in combination with cetuximab in colorectal cancer to define and enable next Phase of development, in the second half of 2025.

- Key players in the market include pharmaceutical giants like Genentech, Pfizer, Ono Pharmaceutical, Pierre Fabre, and Novartis who have developed well-known drugs such as ZELBORAF (vemurafenib), BRAFTOVI (encorafenib), and TAFINLAR (dabrafenib).

- Several key players are actively developing novel BRAF-targeting therapies, including Fore Biotherapeutics (plixorafenib), C4 Therapeutics (CFT1946), Black Diamond Therapeutics (BDTX-4933), and Deciphera Pharmaceuticals (DCC-3084), among others.

- In December 2024, Pfizer announced that the US Food and Drug Administration (FDA) approved BRAFTOVI (encorafenib) in combination with cetuximab and fluorouracil, leucovorin, and oxaliplatin for the treatment of patients with metastatic colorectal cancer with a BRAFV600E mutation, as detected by an FDA-approved test.

- BRAF Targeted Therapies Companies are currently investigating the possibility of BRAF degraders since BRAF/MEK inhibitor combinations are being utilized to treat a variety of cancer types. Although proof-of-concept for such therapies has been accomplished, it is still unclear if BRAF degraders would be more effective than pan-RAF inhibitors or BRAF/MEK inhibitor combinations.

- Systemic therapies that target class II or class III BRAF alterations are not yet approved. Hence, there is a need for therapies that display activity beyond BRAFV600E.

- Overall, this is an exciting class that holds great potential for the development of treatment for oncology and other indications. The maturation of current studies over the next few years will lead to a better understanding of BRAF and define their role in the therapy of autoimmune indications.

DelveInsight’s “B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the BRAF-targeted therapies, historical and competitive landscape as well as its BRAF Targeted Therapies therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The BRAF-targeted therapies’ market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM BRAF-targeted therapies market size from 2020 to 2034. The report also covers current BRAF treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

BRAF Targeted Therapies Market |

|

|

BRAF Targeted Therapies s Market Size | |

|

BRAF Targeted Therapies Companies |

Fore Biotherapeutics, Novartis Pharmaceuticals, Cascadian Therapeutics Inc., Pierre Fabre Medicament, AIO-Studien-gGmbH, TriHealth Inc., BioMed Valley Discoveries Inc, Array BioPharma, and others |

|

BRAF Targeted Therapies Epidemiology Segmentation |

|

BRAF Targeted Therapies Treatment Market

B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies Overview

The BRAF gene is located on the long arm of chromosome 7 (7q34) and codes for the serine/threonine-protein kinase B-Raf. B-Raf is a member of the Raf kinase family and is a downstream target of RAS, playing a pivotal role in the MAPK/ERK signaling pathway. A BRAF mutation is a spontaneous change in the BRAF gene that makes it work incorrectly. A mutation causes the gene to turn on the protein and keep it on, which means certain cells get ongoing signals to keep dividing and no instructions on when to stop. This can lead to the development of a tumor. Scientists have identified many different types of BRAF mutations. One of the most common types is the BRAFV600E mutation. Some mutations in BRAF cause cancer in combination with additional mutations or other factors. BRAF mutations can also cause cancers to grow more quickly than they would otherwise, either alone or in combination with additional mutations.

Further details related to country-based variations are provided in the report...

B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies Market Overview

In recent years, there has been a growing interest in the exploration of BRAF-targeted therapies for a variety of indications, encompassing colorectal cancer, glioma, ovarian cancer, melanoma, NSCLC, and other indications.

Further details related to country-based variations are provided in the report...

B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies Epidemiology

The epidemiology chapter of BRAF in the report provides historical as well as forecasted epidemiology segmented as total incident cases of selected indications with BRAF mutation, total eligible patient pool for BRAF-targeting therapies in selected indications, and total treatable cases in selected indications for BRAF-targeting therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, nearly 152,810 new cases of colorectal cancer were estimated. Of these, 106,590 cases were of colon cancer, and 46,220 cases were of rectal cancer.

- Out of the total lung cancer cases, approximately 85% of lung cancers are NSCLC.

- As per DelveInsight, there were nearly 25,800 cases of glioma in EU4 and the UK in 2024.

- Target Pool Assessment of B‐rapidly Accelerated Fibrosarcoma (BRAF)

The list is indicative and not exhaustive...

BRAF Targeted Therapies Drug Chapters

The drug chapter segment of the BRAF report encloses a detailed analysis of approved and emerging BRAF-targeted therapies. It also helps understand the clinical trial details of BRAF-targeted therapies, expressive pharmacological action, agreements and collaborations, approval, and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

BRAFTOVI (encorafenib): Pfizer/Ono Pharmaceutical/Pierre Fabre

BRAFTOVI (encorafenib) is a kinase inhibitor that targets BRAFV600E, as well as wild-type BRAF and CRAF, in in vitro cell-free assays. It is approved for multiple indications, including melanoma (in combination with MEKTOVI [binimetinib]), which received FDA approval in 2018; colorectal cancer with BRAFV600E mutation (in combination with cetuximab), approved in 2020; and NSCLC with BRAFV600E mutation (in combination with MEKTOVI), which gained FDA approval in 2023. In June 2020, Pierre Fabre announced that the European Commission (EC) had approved BRAFTOVI in combination with cetuximab for the treatment of adult patients with BRAFV600E-mutant metastatic colorectal cancer who have received prior systemic therapy. BRAFTOVI (encorafenib) patents are estimated to expire on August 2033.

TAFINLAR (dabrafenib): Novartis

TAFINLAR (dabrafenib) is a BRAF inhibitor that targets certain mutated BRAF kinases, including BRAFV600E and BRAFV600K mutations. It is approved for multiple indications, often in combination with MEKINIST. TAFINLAR was first approved as a monotherapy for melanoma in 2013, followed by its 2014 approval in combination with MEKINIST. In 2017, the combination received approval for treating NSCLC with BRAFV600E mutations. In 2018, it was approved for BRAF-positive anaplastic thyroid cancer. The combination was further expanded in 2022 for BRAFV600E-mutant solid tumors, and in 2023, it gained approval for treating pediatric patients with BRAFV600E-mutant low-grade glioma. Its patents are estimated to expire by 2026, 2029, 2030, and 2032.

Emerging B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies

Plixorafenib: Fore Biotherapeutics

Plixorafenib (formerly known as FORE8394 or PLX-8394) is an experimental, next-generation small-molecule drug that selectively inhibits mutated BRAF. Its ability to block ERK signaling makes it a promising candidate for treating tumors driven by class I or II BRAF mutations and fusions. In March 2023, the US FDA granted Orphan Drug designation (ODD) to plixorafenib in treating primary brain and central nervous system cancers, as well as Fast Track Designation (FTD), in September 2022, for cancers with BRAF Class 1 (V600) and Class 2 (including fusions) mutations in patients who have exhausted other treatment options. The drug is currently in Phase II clinical trial.

CFT1946: C4 Therapeutics

CFT1946 is an investigational, orally bioavailable small molecule degrader of BRAFV600 mutations in solid tumors currently being evaluated in a Phase I/II global clinical trial in patients refractory to BRAF inhibitors. CFT1946 is designed to be potent and selective against the BRAFV600 mutant form. It is worth noting that CFT1946 is the only degrader of BRAFV600 mutant solid tumors in clinical trials. As per the fourth quarter and full-year financial results of 2024, C4 Therapeutics anticipates completing Phase I dose escalation in BRAFV600 mutant solid tumors in the first half of 2025.

Note: Detailed emerging therapies assessment will be provided in the final report...

Drug Class Insights

Patients with BRAF mutations in melanoma and NSCLC are treated with BRAF and MEK inhibitors, often combined for better results. Immunotherapies like pembrolizumab and nivolumab are also used, alone or with targeted therapies.

BRAF inhibitors like vemurafenib and encorafenib show partial responses in BRAFV600E-mutant metastatic colorectal cancer, but resistance often arises through EGFR and PI3K/AKT activation. Combining BRAF inhibitors with anti-EGFR agents, PI3K inhibitors, or chemotherapy, as seen in the BEACON trial with encorafenib and cetuximab, has improved outcomes, though toxicity remains a challenge.

Note: Detailed insights will be provided in the final report...

BRAF Targeted Therapies Market Outlook

The global BRAF market is expected to witness substantial growth in the coming years, driven by the increasing incidence of oncology indications, robust clinical pipeline activity, and expanding regulatory approvals.

Several key players, including Fore Biotherapeutics, C4 Therapeutics, Deciphera Pharmaceuticals, and others, are involved in developing drugs for BRAF such as NSCLC, melanoma, and others, respectively. Overall, this is an exciting new class with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of BRAF and define its role in oncology.

BRAF Targeted Therapies Uptake

BRAFTOVI (encorafenib), in combination with Pfizer’s MEKTOVI (binimetinib), offers superior efficacy, better tolerability, and a more favorable side effect profile compared to Novartis’s TAFINLAR (dabrafenib) and MEKINIST (trametinib) combination. Approved for the treatment of metastatic or unresectable melanoma, the dual use of BRAF and MEK inhibitors helps delay MAPK-driven resistance and improves both response rates and duration.

This section focuses on the uptake rate of potential approved and emerging BRAF-targeted therapies expected to be launched in the market during 2025–2034.

BRAF Targeted Therapies Pipeline Development Activities

The BRAF Targeted Therapies pipeline report provides insights into different BRAF Targeted Therapies clinical trials within different Phases of the pipeline. It also analyzes key players involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for BRAF-targeted therapies market growth over the forecast period.

BRAF Targeted Therapies Pipeline Development Activities

The BRAF Targeted Therapies clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for BRAF-targeted therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on BRAF's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Oxford University and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or BRAF’s market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

KOL Views

“The management of metastatic colon cancer with BRAF mutations includes utilizing aggressive treatment options like doublet and triplet chemotherapy regimens, as these patients have poor survival rates. Patients with BRAF mutations had a limited response to chemotherapy. Treatment strategies have evolved significantly in recent years; however, a clear standard of care has not been established. Ongoing research efforts have led to the emergence of BRAF inhibitors such as vemurafenib and encorafenib.”

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health Technology Assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on B‐rapidly Accelerated Fibrosarcoma (BRAF) Targeted Therapies

- In April 2025, FORE Biotherapeutics data of Phase I/II and Phase II of plixorafenib at the American Association for Cancer Research (AACR) Annual Meeting 2025.

- In March 2025, Servier and Black Diamond Therapeutics announced a strategic worldwide licensing agreement for BDTX-4933.

- In February 2025, Pfizer announced positive topline results from the Phase III BREAKWATER study of the BRAFTOVI (encorafenib) combination regimen in colorectal cancer patients.

- As per the 43rd Annual JP Morgan Healthcare Conference presentation of January 2025, the company anticipates to present data from Phase I cohorts evaluating CFT1946 as a monotherapy in melanoma, in combination with trametinib in melanoma, and in combination with cetuximab in colorectal cancer to define and enable next Phase of development, in the second half of 2025.

The abstract list is not exhaustive, will be provided in the final report...

Scope of the BRAF Targeted Therapies Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the BRAF- Targeted Therapies, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the BRAF Targeted Therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM BRAF Targeted Therapies market.

BRAF Targeted Therapies Market Report Insights

- BRAF Targeted Therapies Patient Pool

- BRAF Targeted Therapies Therapeutic Approaches

- BRAF Pipeline Analysis

- BRAF Market Size and Trends

- Existing and future BRAF Targeted Therapies Market Opportunities

BRAF Targeted Therapies Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- BRAF Targeted Therapies Drugs Uptake

- Key BRAF Targeted Therapies Market Forecast Assumptions

BRAF Targeted Therapies Report Assessment

- Current BRAF Targeted Therapies Treatment Practices

- BRAF Targeted Therapies Unmet Needs

- BRAF Targeted Therapies Pipeline Product Profiles

- BRAF Targeted Therapies Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

- BRAF Targeted Therapies Market Drivers

- BRAF Targeted Therapies Market Barriers

Key Questions Answered In The BRAF Targeted Therapies Market Report:

- What was the total market size of BRAF Targeted Therapies, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for BRAF-targeted therapies?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for BRAF-targeted therapies evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with BRAF-targeted therapies? What will be the growth opportunities across the 7MM for the patient population of BRAF Targeted Therapies?

- What are the key factors hampering the growth of the market for BRAF-targeted therapies?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for BRAF-targeted therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy BRAF Targeted Therapies Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the BRAF Targeted Therapies market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.