CD-20 Market Summary

- The CD20 Market is driven by rising B-cell malignancies, strong monoclonal antibody adoption, expanding biosimilars, and ongoing R&D fueling targeted therapy growth.

- The leading CD-20 Companies, such as Regeneron Pharmaceuticals, CHO Pharma, Vaccinex, Biocon, and others

CD20 Market Insights

- CD20 Inhibitors are monoclonal antibodies that specifically target the CD20 protein present on the surface of B cells, leading to their depletion through mechanisms such as antibody-dependent cellular cytotoxicity (ADCC), complement-dependent cytotoxicity (CDC), and direct apoptosis. This targeted action spares other immune cells, offering a more selective and effective therapeutic approach.

- CD20 inhibitors are primarily approved and used for the treatment of B-cell malignancies and autoimmune diseases such as non-Hodgkin lymphoma (NHL), multiple sclerosis (MS), rheumatoid arthritis (RA), and others.

- Upon approval in 1997, rituximab became the first anti-CD20 monoclonal antibody approved by the FDA for the treatment of NHL. Today, it is approved for mature B-cell acute leukemia (B-AL), chronic lymphocytic leukemia (CLL), rheumatoid arthritis (RA) in combination with methotrexate in adult patients with an inadequate response to one or more TNF antagonist therapies, granulomatosis with polyangiitis (GPA) and microscopic polyangiitis(MPA) in adults and pediatric patients aged 2 years and older (in combination with glucocorticoids), and moderate to severe pemphigus vulgaris (PV) in adult patients.

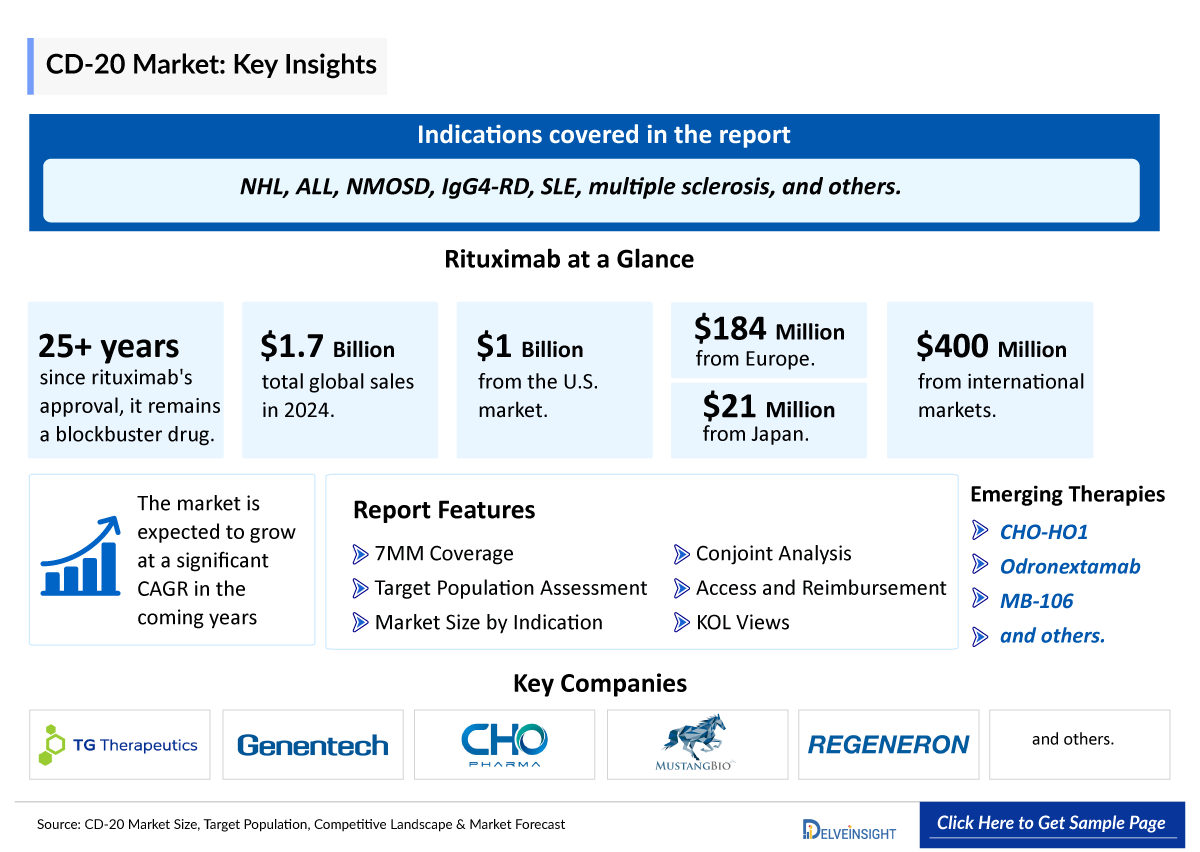

- More than 25 years post-approval, rituximab remains a blockbuster drug, generating total global sales of USD 1,694 million in 2024, including USD 1,034 million from the U.S., USD 184 million from Europe, USD 21 million from Japan, and USD 455 million from international markets.

- Several CD20-targeting mAbs are now available for the treatment of both indolent and aggressive forms of B-cell non-Hodgkin lymphoma (NHL) in the front line, at relapse, and as maintenance therapy.

- Currently, several monoclonal antibodies target CD20 receptors available to treat multiple sclerosis (MS), including ocrelizumab, ofatumumab, and ublituximab. These agents have shown robust efficacy in reducing clinical manifestations and MRI lesion activity, forming a cornerstone of highly effective disease-modifying treatments.

- Beyond traditional mAbs, advancements include antibody-drug conjugates (ADCs), bispecific antibodies (BsAbs), and chimeric antigen receptor-modified (CAR) T cells. ADCs combine the precision of antibodies with the cytotoxic potential of drugs, enhancing therapeutic efficacy. BsAbs, especially CD20xCD3 constructs, redirect cytotoxic T cells to eliminate cancer cells with improved precision and potency. CAR-T cells represent a highly personalized and promising strategy for treating hematologic malignancies.

- Moreover, several CD20 inhibitors are currently being evaluated in CD-20 Clinical Trials. One example is odronextamab (REGN1979), a hinge-stabilized, IgG4-based CD20xCD3 bispecific antibody designed with reduced effector function. It is under investigation for follicular lymphoma, B-cell non-Hodgkin lymphoma (B-NHL), and other B-cell malignancies, with anticipated FDA approval during the forecast period.

- In February 2025, Regeneron Pharmaceuticals announced that the FDA had accepted the Biologics License Application (BLA) for odronextamab for review for relapsed/refractory Follicular Lymphoma, with a decision expected by July 2025.

- In March 2025, the FDA accepted the supplemental Biologics License Application (sBLA) for GAZYVA (obinutuzumab) for lupus nephritis. This decision is based on positive Phase III REGENCY trial results, which showed that GAZYVA plus standard therapy significantly improved complete renal response (CRR) compared to standard therapy alone. FDA approval is expected by October 2025.

Request for Unlocking the Sample Page of the "CD-20 Inhibitors Market"

Factors Impacting the CD20 Inhibitor Market Growth

-

Rising Prevalence of B-cell Malignancies and Autoimmune Diseases

The increasing incidence of B-cell malignancies such as non-Hodgkin lymphoma (NHL), chronic lymphocytic leukemia (CLL), and autoimmune disorders like rheumatoid arthritis and multiple sclerosis is a key driver. The growing disease burden is fueling the demand for targeted CD20 therapies.

-

Advancements in Monoclonal Antibody Development

Innovations in monoclonal antibody (mAb) technology, including humanized and fully human antibodies targeting CD20, have enhanced efficacy, reduced immunogenicity, and expanded therapeutic options, driving market growth.

-

Growing Acceptance of Biosimilars

The entry of cost-effective CD20 biosimilars is expanding patient accessibility while offering healthcare systems affordable alternatives to branded therapies, boosting overall market adoption.

DelveInsight’s “CD20 inhibitors Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CD20 inhibitors, historical and Competitive Landscape as well as the CD20 inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The CD20 Inhibitors Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CD20 inhibitors market size from 2020 to 2034. The report also covers current CD20 inhibitor treatment practices and algorithms, as well as unmet medical needs, to identify the best opportunities and assess the market’s potential.

Scope of the CD20 Inhibitor Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

CD-20 Market |

|

|

CD-20 Market Size | |

|

CD-20 Companies |

|

CD20 Inhibitors Market: Understanding and Treatment Algorithm

CD20 inhibitors are a class of therapeutic agents designed to target the CD20 protein, a non-glycosylated phosphoprotein predominantly expressed on the surface of B cells from the pre-B to mature stages. This 297-amino acid, four-transmembrane protein plays a crucial role in B cell proliferation and differentiation. CD20 is highly expressed in various B-cell malignancies, making it an attractive target for therapeutic intervention. The expression of CD20 is regulated by a complex network of epigenetic factors and transcription factors, including EZH2, HDAC1/2, NFκB, and FOXO1, among others. These factors influence the signaling propensity of the B cell receptor (BCR), thereby affecting CD20 expression and function.

Therapeutically, CD20 inhibitors, particularly monoclonal antibodies, have revolutionized the treatment of B-cell malignancies such as non-Hodgkin lymphoma (NHL) and chronic lymphocytic leukemia (CLL). These antibodies can induce tumor cell death through several mechanisms: antibody-dependent cell-mediated cytotoxicity (ADCC), complement-dependent cytotoxicity (CDC), and direct induction of apoptosis. The first-generation anti-CD20 monoclonal antibody, rituximab, is a chimeric IgG1 antibody that has been widely used in clinical practice. Subsequent generations, such as ofatumumab (fully human IgG1) and obinutuzumab (humanized IgG1 with enhanced Fc glycosylation), have been developed to improve efficacy and reduce immunogenicity. These newer agents demonstrate enhanced ADCC and CDC activities, thereby offering more potent therapeutic options for patients with CD20-positive B-cell malignancies.

CD20 Inhibitors Overview

The global CD20 inhibitors market is experiencing robust growth driven by the increasing prevalence of B-cell malignancies such as non-Hodgkin lymphoma and leukemia, alongside advances in immunotherapy and personalized medicine. Key growth drivers include rising cancer incidence globally, increasing demand for targeted therapies with improved efficacy and safety profiles, and expanding clinical approvals (e.g., CAR T therapies and novel monoclonal antibodies). CAR T-cell therapies, which target CD20, currently hold over 40% of the CD antigen cancer therapy market share and are a major growth segment due to their success in hematologic malignancies. The market is highly competitive with key CD20 Companies such as Genentech, Novartis, Amgen, Roche, Novartis AG, Pfizer, Biogen, Genentech, Immunomedics, AbbVie, and others investing heavily in R&D to develop next-generation CD20 inhibitors with enhanced potency and safety.

CD20 Inhibitors Epidemiology

The CD20 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total CD20 inhibitors Cases of selected indications, total CD20 inhibitors eligible patient pool of selected indication, total CD20 inhibitors treated cases in selected indications in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

CD20 Inhibitors Epidemiology Segmentation

- CD20 inhibitors Case of selected indications

- Total CD20 inhibitor-eligible patient pool for the selected indication

- Total CD20 inhibitor-treated cases in selected indications

CD20 Inhibitor Drugs Analysis

The drug chapter segment of the CD20 inhibitors Drugs Market Reports encloses a detailed analysis of approved CD20 inhibitors, late-stage (Phase III and Phase II) CD20 inhibitors pipeline drugs analysis. It also helps understand the CD20 inhibitor’s clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest CD-20 news and press releases.

CD-20 Marketed Drugs

-

BRIUMVI (ublituximab-XIIY): TG Therapeutics

BRIUMVI is a novel monoclonal antibody that targets a unique epitope on CD20-expressing B-cells. Targeting CD20 using monoclonal antibodies has proven to be an important therapeutic approach for the management of autoimmune disorders, such as RMS. BRIUMVI is uniquely designed to lack certain sugar molecules normally expressed on the antibody. Removal of these sugar molecules, allows for efficient B-cell depletion at low doses. BRIUMVI is indicated for the treatment of adults with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease. It is the first and only anti-CD20 monoclonal antibody approved in the United States and European Union for adult RRMS patients that can be administered in a one-hour infusion, twice a year, following the starting dose.

-

OCREVUS (ocrelizumab): Genentech

OCREVUS is a CD20-directed cytolytic antibody indicated for the treatment of relapsing forms of multiple sclerosis (MS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease, in adults with primary progressive MS, in adults. The precise mechanisms through which OCREVUS exerts its therapeutic clinical effects in relapsing multiple sclerosis and relapsing-remitting multiple sclerosis are not fully elucidated but are presumed to involve immunomodulation through selective binding to CD20-expressing B cells. Following cell surface binding to B lymphocytes, OCREVUS results in antibody-dependent cellular cytolysis and complement-mediated lysis.

OCREVUS received FDA approval on March 28, 2017, for the treatment of relapsing and primary progressive multiple sclerosis. This approval made it the first drug approved for primary progressive MS. OCREVUS ZUNOVO, a subcutaneous injection formulation of ocrelizumab, was approved in September 2024.

Comparison of Key Marketed Drugs | |||

|

Product |

Company |

RoA |

Indication |

|

OCREVUS (ocrelizumab) |

Genetech |

IV |

Multiple Sclerosis (MS) |

|

KESIMPTA (ofatumumab) |

Novartis |

SC |

Relapsing forms of multiple sclerosis (MS) |

|

BRIUMVI (ublituximab-XIIY) |

TG Therapeutics |

IV |

Relapsing forms of multiple sclerosis (MS) |

|

RITUXAN (rituximab) |

Genentech |

IV |

B-cell acute leukemia (B-AL), CLL, RA in combination with methotrexate in adult patients with moderately-to-severely active RA who have inadequate response to one or more TNF antagonist therapies, granulomatosis with polyangiitis (GPA) (Wegener’s granulomatosis), microscopic polyangiitis (MPA) in adult and pediatric patients aged 2 years and older in combination with glucocorticoids, and moderate to severe pemphigus vulgaris (PV) in adult patients . |

CD-20 Emerging Drugs

-

CHO-HO1: CHO Pharma

CHO-H01 is the world’s first glycoengineered bio better antibody featuring a homogeneous, fully α2,6-sialylated biantennary glycan structure. According to the NIH, biobetters are newly developed drugs based on existing peptide or protein therapeutics, enhanced to improve characteristics such as target epitope affinity and selectivity, as well as resistance to degradation.

CHO-H01 is designed to target CD20, a protein found on the surface of B cells. It works mainly through several immune mechanisms: triggering cell killing by immune cells (ADCC), promoting immune cell engulfing of cancer cells (ADCP), activating the complement system to kill cells (CDC), and inducing cancer cell death (apoptosis). Compared to its original non-glycoengineered version, CHO-H01 binds more strongly to the FcγRIIIa receptor, shows 30–50 times higher ADCC activity, and is more effective at reducing tumor growth in preclinical studies. It also remains effective against B lymphoma cells that no longer respond to Rituximab.

CHO-H01 is currently in Phase I/IIa, recruiting subjects with refractory non-Hodgkin lymphoma (NHL).

-

MB-106 : MustangBio

Mustang Bio, in partnership with Fred Hutch, is advancing MB-106, a CD20-targeted CAR T therapy, initially aimed at treating hematologic malignancies and now pivoting toward autoimmune diseases. As of March 2025, 73 patients have been treated in ongoing Phase 1 CD-20 clinical trials, demonstrating a favorable safety profile and high response rates, including a 90% overall response rate in Waldenström macroglobulinemia. Despite these promising results, Mustang closed its own MB-106 trials in mid-2024 due to funding limitations. The clinical development of MB-106 will now focus solely on autoimmune indications, with a Phase I investigator-sponsored trial at Fred Hutch planned for initiation in late 2025. This strategic shift underscores a resource-driven realignment while maintaining development momentum in a promising therapeutic domain.

-

- In March 2024, MB-106 was granted the Regenerative Medicine Advanced Therapy (RMAT) designation by the FDA for the treatment of relapsed or refractory CD20-positive WM and FL.

- In June 2022, MB-106 received an Orphan Drug Designation for the Treatment of Waldenstrom macroglobulinemia (WM).

-

Odronextamab: Regeneron

Odronextamab is a CD20xCD3 bispecific antibody designed to bridge CD20 on cancer cells with CD3-expressing T cells to facilitate local T-cell activation and cancer-cell killing. Odronextamab is being investigated in a broad clinical development program exploring its use as a monotherapy as well as in combination regimens in several types of B-NHLs in earlier lines of therapy. In FL, odronextamab is being evaluated as a monotherapy against rituximab plus standard-of-care chemotherapies in a Phase III confirmatory trial (OLYMPIA -1) and in combination with chemotherapy against rituximab plus standard-of-care chemotherapies in a separate Phase III trial (OLYMPIA -2).

Odronextamab is also being tested in Phase II for the B-cell non-Hodgkin lymphoma (B-NHL) and Phase I for certain B-cell malignancies.

- In March 2024, the FDA issued two complete response letters (CRLs) for the (BLA) of odronextamab in relapsed/refractory follicular lymphoma (FL) and diffuse large B-cell lymphoma (DLBCL) after two or more lines of systemic therapy. These CRLs were based solely on the enrollment status of confirmatory trials, with no concerns regarding efficacy, safety, trial design, labeling, or manufacturing. Subsequently, in February 2025, the FDA accepted the resubmission of the BLA for odronextamab in relapsed/refractory FL, following the achievement of the FDA-mandated enrollment target for the Phase 3 OLYMPIA-1 trial. The target action date for the FDA decision is July 30, 2025.

Comparison of Key Emerging Drugs | ||||

|

Product |

Company |

RoA |

Phase |

Indication |

|

CHO-HO1 |

CHO Pharma |

IV |

I/II |

Non-Hodgkin Lymphoma (NHL) |

|

Odronextamab |

Regeneron |

IV |

III, II, I |

Follicular lymphoma, B-cell non-Hodgkin lymphoma (B-NHL), Certain B-cell malignancies. |

|

MB-106 |

MustangBio |

IV |

I |

Autoimmune diseases |

CD20 Inhibitor Market Outlook

he CD20 Inhibitors Market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with NHL, ALL, NMOSD, IgG4-RD, SLE, multiple sclerosis, and many more indications; the growing awareness of CD20 inhibitors; and the increasing number of emerging drugs that are under CD-20 Clinical Trials and filed for approval by various companies.

The leading CD-20 Companies such as Regeneron Pharmaceuticals, CHO Pharma, Vaccinex, Inc., Biocon, and others are involved in developing drugs for CD20 inhibitors for various indications such as Follicular lymphoma, B-cell non-Hodgkin lymphoma (B-NHL), Certain B-cell malignancies, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of CD20 inhibitors and define their role in the therapy of cancers and autoimmune disorders.

CD20 inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CD20 expected to be launched in the CD20 market during 2020–2034.

CD20 Inhibitor Pipeline Development Activities

The CD-20 Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key CD-20 Companies involved in developing targeted therapeutics. The presence of numerous drugs at different stages is expected to generate immense opportunities for the CD20 inhibitors market growth over the forecasted period.

CD20 Clinical Trial Activities

The CD-20 Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CD20 inhibitor therapies.

KOL Views on CD20

To keep up with current and future CD20 market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CD20 inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others. Their opinion helps understand and validate current and emerging therapy treatment patterns or CD20 inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the CD-20 unmet needs.

KOL Views |

|

“Rituximab, as the prototypical CD20 inhibitor, revolutionized treatment for B-cell lymphomas. And with newer agents like obinutuzumab and ublituximab, we're now seeing more refined options with enhanced efficacy and different toxicity profiles. There's been great interest in combining CD20 inhibitors with other modalities, like BTK inhibitors or CAR-T therapy, but we need more data on long-term outcomes and resistance mechanisms. The role of CD20 inhibition in maintenance therapy continues to evolve, especially in indolent lymphomas.” |

|

“CD20 inhibitors have completely changed how we manage relapsing MS. The B-cell targeting approach, particularly with ocrelizumab and ofatumumab, has not only shown impressive efficacy in reducing relapse rates but also in slowing disability progression. What's even more remarkable is the durability of response in many patients. The convenience of subcutaneous dosing with ofatumumab is also a game changer for patient adherence. That said, long-term safety and infection risk—especially with hypogammaglobulinemia—remain something we’re watching closely.” |

CD20 Qualitative Analysis Report

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

CD-20 Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential anti-cancer vaccines affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The CD-20 Therapeutics Market Report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on CD20 Inhibitor Clinical Trials

- In March 2025, the U.S. Food and Drug Administration (FDA) accepted the supplemental Biologics License Application (sBLA) for GAZYVA (obinutuzumab) for the treatment of lupus nephritis. This acceptance is based on positive results from the Phase III REGENCY study, which demonstrated that GAZYVA, in combination with standard therapy, significantly improved complete renal response (CRR) compared to standard therapy alone. The FDA is expected to decide on approval by October 2025.

- In February 2025, the FDA accepted the resubmission of the Biologics License Application (BLA) for odronextamab (ORDSPONO) as a treatment for relapsed/refractory follicular lymphoma (R/R FL) after two or more lines of systemic therapy. This decision followed the achievement of an FDA-mandated enrollment target for the Phase 3 OLYMPIA-1 trial, which had been the sole issue identified in the previous complete response letter. The resubmission is supported by data from the Phase 1 ELM-1 and Phase 2 ELM-2 trials, demonstrating an overall response rate of 80% and a complete response rate of 74%.

- On June 26, 2024, the Food and Drug Administration granted accelerated approval to epcoritamab-bysp, a bispecific CD20-directed CD3 T-cell engager, for adult patients with relapsed or refractory follicular lymphoma after two or more lines of systemic therapy.

- In October 2023, the FDA granted Fast Track designation to IMPT-514, a bispecific CD19/CD20-targeting chimeric antigen receptor (CAR) T-cell therapy for the treatment of active refractory lupus nephritis and systemic lupus erythematosus.

CD-20 Therapeutics Market Report Scope

- The CD-20 Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the CD20 Inhibitor Treatment Market, historical and forecasted CD-20 Market Size, CD-20 Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CD-20 Drugs Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CD-20 inhibitor Drugs Market.

CD20 Inhibitor Therapeutics Market Report Insights

- CD20 inhibitors Targeted Patient Pool

- Therapeutic Approaches

- CD20 Inhibitor Pipeline Drugs Analysis

- CD20 inhibitor Market Size

- CD20 Market Trends

- Existing and Future CD-20 Drugs Market Opportunity

CD20 Inhibitor Therapeutics Market Report Key Strengths

- 10years- CD-20 Market Forecast

- The 7MM Coverage

- Key Cross Competition

- CD-20 Drug Uptake

- Key CD-20 Market Forecast Assumptions

CD20 Inhibitor Therapeutics Market Report Assessment

- Current CD-20 Treatment Practices

- CD-20 Unmet Needs

- CD-20 Pipeline Drugs Profiles

- CD-20 Drugs Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the CD20 Inhibitor Market Report

CD20 Inhibitor Market Insights

- What was the CD20 inhibitor Treatment Market Size, the CD-20 market size by therapies, CD-20 Drugs Market Share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which CD20 drug is going to be the largest contributor in 2034?

- Which is the most lucrative CD20 inhibitor Market?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for CD20 inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CD20 inhibitors? What will be the growth opportunities across the 7MM for the patient population of CD20 inhibitors?

- What are the key factors hampering the growth of the CD20 inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CD20 inhibitors?

- What is the cost burden of approved CD20 therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved CD20 therapies?

Reasons to Buy the CD20 Inhibitor Market Report

- The CD-20 Inhibitors Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the CD-20 inhibitor Drugs Market.

- Understand the existing CD-20 Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming CD20 companies in the CD-20 Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CD-20 Drugs Market so that the upcoming CD-20 Companies can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ Latest DelveInsight Blogs