Advancements in Complement 3 Glomerulopathy (C3G) Treatment: Exploring Upcoming Anti-Complements

Feb 19, 2024

Complement 3 glomerulopathy (C3G) is a form of glomerular disease where there’s a notable presence of C3 complement component deposits in the glomeruli. These deposits occur without significant amounts of immunoglobulin and without the deposition of C1q and C4. The buildup of C3, without much classical or lectin complement component, indicates a dysregulation of the alternative complement pathway as the primary mechanism. This particular observation, alongside the typical clinical features of glomerulonephritis but with minimal or no immunoglobulin deposits, serves as the key diagnostic criterion.

DelveInsight’s analysis reveals that the overall diagnosed prevalent population of C3G in the 7MM was reported as ~5.7K in 2023. As per the analysis, the United States contributed to the largest diagnosed prevalent patient share, acquiring ~49% of the 7MM in 2023. Whereas, EU4 and the UK, and Japan accounted for ~40% and ~11% prevalent-patient share, respectively, in 2023.

Due to its rarity, determining the exact incidence and prevalence of complement 3 glomerulopathy is challenging, though some small cohort studies have provided estimates of limited reliability.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Nxera Pharma Confirms Positive Phase 3 Findings for Daridorexant in South Korea; AstraZeneca Stre...

- Ascendis Pharma’s SKYTROFA Approved by FDA for Adult Growth Hormone Deficiency; Apellis Wins FDA ...

- ASPAVELI Fuels Sobi’s Growth Strategy in Europe for C3G and IC-MPGN

- Key Pharma Players Transforming the Complement 3 Glomerulopathy Market Landscape

Challenges with Current Complement 3 Glomerulopathy Treatment

The best course of treatment for C3G remains uncertain as no treatment has been definitively proven effective. Current recommendations are derived mainly from case series and observational studies, often relying on expert opinions. Consequently, there’s no standardized treatment approach, with care typically centralized in specialized centers. Patients diagnosed with C3G are advised to undergo renoprotective measures, including lifestyle adjustments, and to use medications like angiotensin-converting enzyme inhibitors or angiotensin-receptor blockers to manage hypertension and proteinuria, along with lipid-lowering drugs. While these medications alone haven’t been proven to prevent progression to end-stage renal disease, they may enhance the protective effects of immunosuppressive medications.

As there are no approved treatments available for complement 3 glomerulopathy, and no therapies targeting its root cause, the treatment approach primarily aims to delay kidney damage progression caused by the condition. This treatment plan might involve the use of corticosteroids, immunosuppressive medications, ACE inhibitors, ARBs, dietary adjustments, and complement inhibitors.

While comprehensive data on plasma therapy’s effectiveness are not available, some instances report positive results when a disease-causing mutated protein has been identified. Plasma therapy has shown promise in treating patients with AKI associated with C3G but has not yielded success in those with C3 nephritic factors, likely due to the ongoing production of these autoantibodies even after their removal.

Although immunosuppressive therapy holds promise in dampening the cellular immune reaction linked to C3G by reducing auto-antibody production and curbing the effects of C3a and C5a anaphylatoxins, its efficacy remains inconsistent. A carefully structured prospective study, incorporating thorough genetic testing and complement data analysis, is necessary to ascertain whether specific subsets of C3G patients genuinely derive advantages from this treatment strategy.

There is a strong need for an approved and effective C3G treatment that will give a sign of relief to all the patients suffering from the disease. Many companies across the globe are working in the C3G treatment market to improve the treatment landscape in the coming years.

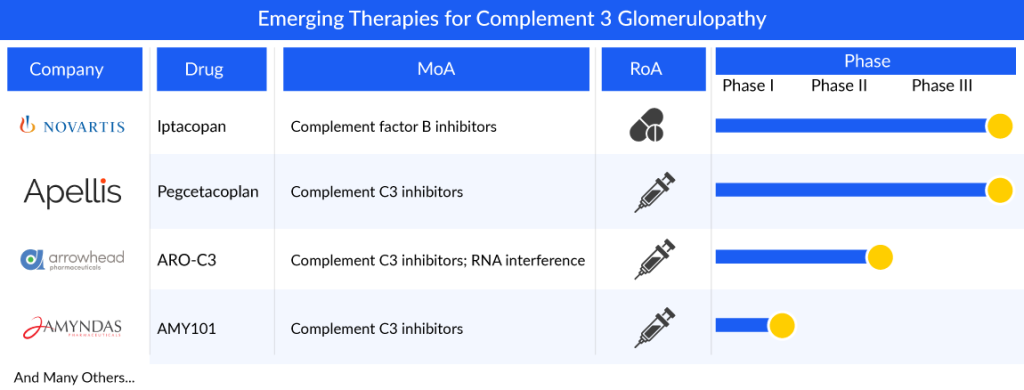

Promising Therapies for C3G Treatment on the Horizon

The current emerging market of complement 3 glomerulopathy treatment possesses an intermediate pipeline. There are no complement 3 glomerulopathy emerging therapies in their phase III developmental stage; however, a few potential emerging players are investigating their product candidates in the late- and mid-phase of the developmental stage, namely, Apellis Pharmaceuticals (pegcetacoplan), and Novartis Pharmaceuticals (iptacopan). Other actively developing early-stage players are Amyndas Pharma (AMY-101) and Arrowhead Pharmaceuticals (ARO-C3).

Novartis Pharmaceuticals is currently working on LNP023 (iptacopan), an oral small-molecule inhibitor targeting complement factor B (FB) with potential immunomodulatory effects. When administered, LNP023 binds to FB, hindering the formation of the alternative pathway (AP) C3-convertase (C3bBb). In December 2020, the FDA granted iptacopan Rare Pediatric Disease (RPD) Designation for its application in C3 glomerulopathy (C3G). Similarly, in October 2020, the EMA designated iptacopan as a PRIority MEdicine (PRIME) for C3G treatment. Furthermore, both the FDA and EMA have recognized iptacopan as an orphan drug for C3G treatment.

In June 2021, Novartis disclosed positive interim Phase II results indicating that iptacopan improved the estimated glomerular filtration rate (eGFR) slope and stabilized kidney function in C3G patients. Subsequently, the drug progressed to Phase III (APPEAR-C3G) clinical trials for C3G, with data expected in 2023, and Phase II trials with data anticipated in 2025, supporting global regulatory submissions. Additionally, Novartis plans to file for drug approval in 2024 to meet patient needs. In November 2021, the company reported that a Phase II study of iptacopan met primary endpoints, demonstrating significant reductions in proteinuria for patients with C3G.

Apellis’ Pegcetacoplan (also known as Empaveli or APL-2) is a potential medication currently being investigated. It specifically targets C3, aiming to control excessive activation of the complement system, a process linked to the development and progression of various severe illnesses. In October 2020, Sobi and Apellis joined forces to globally develop and market systemic pegcetacoplan, particularly for rare diseases lacking effective therapies. Pegcetacoplan received Orphan Drug Designation from the FDA and EMA in December 2018 for treating C3G. Presently, it’s undergoing Phase III trials (VALIANT) to assess its effectiveness and safety in C3G patients, with the first patient dosed in June 2022. Empaveli, the commercial name for pegcetacoplan, has gained approval in the United States for treating paroxysmal nocturnal hemoglobinuria in adults.

Amyndas Pharmaceuticals is working on AMY-101, a new therapeutic that targets complement C3, based on the Cp40 analog, a third-generation compstatin. Compstatins like Cp40 act by centrally inhibiting the complement system at the C3 level, thereby disrupting all subsequent pathways in the complement activation process. This unique mechanism suggests that AMY-101 might be more effective in treating a variety of complement-related diseases compared to partial inhibitors like anti-C5 drugs or other C3 inhibitors.

Experiments conducted outside the body have shown that AMY-101 can correct the complement dysregulation seen in conditions like C3 glomerulopathy, indicating its potential as a beneficial treatment approach. Recognizing its potential, both the FDA and the EMA have granted orphan drug designation to AMY-101 for C3G treatment. Following the completion of a Phase I trial, the company is now planning a Phase II trial for C3G, highlighting the promising nature of this novel therapeutic option for addressing the specific needs of C3G patients in a cost-effective and targeted manner.

The anticipated launch of these emerging therapies for C3G are poised to transform the market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the C3G market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

Clinical Outlook and Future Perspectives in C3G Treatment

Clinical outlook and future perspectives in C3G treatment are promising, with ongoing research and advancements offering hope for improved management of this complex disease. Recent insights into the pathogenesis of C3G have spurred the development of targeted therapies directed at specific components of the complement cascade. One promising avenue involves the inhibition of complement factor D, a key regulator of the alternative pathway implicated in C3G pathophysiology. Clinical trials investigating factor D inhibitors have shown encouraging results, with preliminary data suggesting improvements in renal function and reduction in proteinuria. These findings offer renewed optimism for the development of more effective and targeted treatments tailored to the underlying mechanisms of C3G.

Furthermore, emerging strategies focus on modulating complement dysregulation through gene therapy and complement regulation technologies. Gene editing techniques offer the potential to correct genetic mutations underlying complement abnormalities, offering a personalized approach to treatment. Additionally, advancements in complement-targeted therapies, such as monoclonal antibodies and small molecule inhibitors, hold promise for more precise modulation of the complement system, minimizing off-target effects and enhancing therapeutic efficacy.

As per DelveInsight analysis, the complement 3 glomerulopathy market size in the 7MM was approximately USD 35 million in 2023. The United States accounts for the largest complement 3 glomerulopathy market size, in comparison to EU4 and the UK, and Japan, i.e., ~73% of the 7MM.

In addition to pharmacological interventions, ongoing research emphasizes the importance of multidisciplinary approaches incorporating precision medicine, biomarker discovery, and patient stratification to optimize treatment outcomes in C3G. By integrating genomic, proteomic, and clinical data, researchers aim to identify predictive biomarkers and therapeutic targets, facilitating early diagnosis, risk stratification, and individualized treatment selection. Furthermore, collaborative efforts between academia, industry, and patient advocacy groups are essential for accelerating drug development and translating scientific discoveries into clinically meaningful advancements.

Downloads

Article in PDF

Recent Articles

- Key Pharma Players Transforming the Complement 3 Glomerulopathy Market Landscape

- Nxera Pharma Confirms Positive Phase 3 Findings for Daridorexant in South Korea; AstraZeneca Stre...

- Ascendis Pharma’s SKYTROFA Approved by FDA for Adult Growth Hormone Deficiency; Apellis Wins FDA ...

- ASPAVELI Fuels Sobi’s Growth Strategy in Europe for C3G and IC-MPGN