Cutaneous T-Cell Lymphoma Market

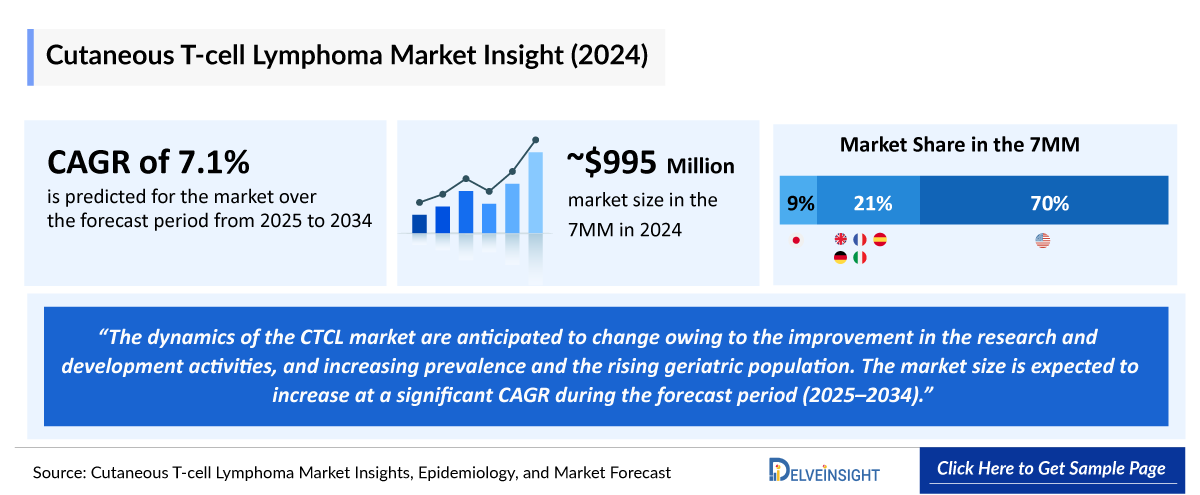

- The Cutaneous T-Cell Lymphoma market size in the 7MM was valued at approximately USD 1,042 million in 2025 and is projected to reach USD 1,622 million by 2034 over the forecast period from 2024 to 2034.

- The Cutaneous T-Cell Lymphoma market is projected to grow at a CAGR of 5.00% by 2034 in leading countries (US, EU4, UK and Japan).

- In the 7MM, the United States accounted for the highest Cutaneous T-cell Lymphoma market share, i.e., approximately 70% in 2024.

Cutaneous T-Cell Lymphoma Market and Epidemiology Analysis

- CTCLs are a heterogeneous subset of extranodal non-Hodgkin lymphomas (NHL) of mature, skin-homing T-cells that are mainly localized to the skin. The most common types of CTCL are mycosis fungoides and primary cutaneous CD30+ anaplastic large cell lymphoma (pcALCL), jointly representing an estimated 80–85% of all CTCL.

- Although indolent in most, one-third of patients with early-stage mycosis fungoides can progress to advanced-stage disease (=IIB), with a low overall survival rate.

- Currently, there are no molecular/biological markers available to predict which patients with early-stage CTCL will progress or which patients with advanced disease will enjoy a longer-than-expected life.

- Oral retinoids are commonly chosen as first-line systemic therapy for patients unresponsive to skin-directed treatments.

- Skin-directed therapies are the mainstay for treatment of early-stage disease, but they also have an important role in disease palliation in patients with advanced disease.

- Approved Cutaneous T-cell Lymphoma therapies with different MoA include CCR4 inhibitors (POTELIGEO), CD30-targeted ADC (ADCETRIS), HDAC inhibitors (ZOLINZA), and retinoids (TARGRETIN), offering multi-modal options.

- Currently, POTELIGEO and ADCETRIS dominating the Cutaneous T-cell Lymphoma market.

- LYMPHIR’s US launch offers CTCL patients a new, effective treatment option, enhancing available therapy choices.

- KINSELBY (4SC), a promising oral HDAC inhibitor, received a negative opinion from the Committee for Medicinal Products for Human Use (CHMP) on its Marketing Authorization Application (MAA), ultimately leading to the termination of its development and commercialization.

- Cutaneous T-cell Lymphoma companies developing therapies for treating CTCL, includes HyBryte (Soligenix), PTX-100 (Prescient Therapeutics), Lacutamab (Innate Pharma), Golcadomide (Bristol-Myers Squibb), BI-1808 (BioInvent International AB), DR-01 (Dren Bio), and others.

- The CTCL market is witnessing significant growth, driven by the emergence of numerous drugs in the pipeline, signaling a strong push toward advancing treatment options.

Cutaneous T-Cell Lymphoma Market size and Forecast

- 2025 Cutaneous T-Cell Lymphoma Market Size: USD 1,042 million

- 2034 Projected Cutaneous T-Cell Lymphoma Market Size: USD 1,622 million

- Cutaneous T-Cell Lymphoma Growth Rate (2025-2034): 5.00% CAGR

- Largest Cutaneous T-Cell Lymphoma Market: United States

Request for Sample Report @ Cutaneous T-cell Lymphoma Market Report

DelveInsight’s "Cutaneous T-cell Lymphoma (CTCL) Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of CTCL, historical and forecasted epidemiology as well as the CTCL therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The CTCL market report provides current treatment practices, emerging drugs, CTCL share of individual therapies, and current and forecasted CTCL market size from 2020 to 2034, segmented by seven major markets. The Cutaneous T-cell Lymphoma market report also covers current CTCL treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Cutaneous T-cell Lymphoma market.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan |

|

Cutaneous T-cell Lymphoma Epidemiology |

Segmented by:

|

|

Cutaneous T-cell Lymphoma Companies |

|

|

Cutaneous T-cell Lymphoma Therapies |

|

|

CTCL Market |

Segmented by:

|

|

Analysis |

|

Key Factors Driving the Cutaneous T-Cell Lymphoma Market

- Rising CTCL Incidence

The increasing incidence of CTCL, particularly among older adults, is a primary driver of CTCL market expansion. In the US, in 2024, there were ~3K incident cases of CTCL, which will further reach 3.6K by 2034.

- Rising Opportunities in GGT1-Targeted Therapies

Emerging evidence of PTX-100’s superior efficacy and safety over LYMPHIR highlights a growing opportunity for drug developers to focus on therapies targeting GGT1 inhibition.

- Emerging CTCL Competitive Landscape

Some of the CTCL drugs in clinical trials include HyBryte (Soligenix and Sterling Pharma Solutions), PTX-100 (Prescient Therapeutics), Lacutamab (Innate Pharma), Golcadomide (Bristol Myers Squibb), BI-1808 (BioInvent), and others.

Cutaneous T-cell Lymphoma Disease Understanding

Cutaneous T-cell Lymphoma (CTCL) Overview

CTCL is a type of Non-Hodgkin's Lymphoma that originates in the skin, specifically from T lymphocytes, which are a subtype of white blood cells involved in immune responses to viruses and cancers. Unlike lymphomas that begin in other parts of the lymphatic system, such as the lymph nodes or organs, CTCL originates in the skin, the largest lymphoid organ in the human body. While B-cell lymphomas are more common overall, T-cell lymphomas, including CTCL, are more prevalent in the skin. CTCL is a complex and evolving condition, with numerous subtypes characterized by different growth patterns and biology. The classification and treatment of CTCL depend on the specific subtype and the underlying T-cell characteristics. Proper diagnosis and identification of the subtype are crucial for determining the most effective treatment approach, as each subtype may respond differently to therapies.

Further details are provided in the report…

Cutaneous T-cell Lymphoma (CTCL) Diagnosis

The Cutaneous T-cell Lymphoma diagnosis is based upon a thorough clinical evaluation, detection of certain symptoms and physical findings, a detailed patient history, and various specialized tests. Such testing is necessary to confirm the specific type (and subtype) of CTCL, assess the nature and extent of the disease, and determine the most appropriate treatments. Biopsies of skin lesions are commonly performed to confirm the diagnosis, as early-stage CTCL can resemble other skin conditions like psoriasis. Multiple biopsies may be required due to the difficulty in distinguishing CTCL in its early stages. T-cell Receptor Gene Rearrangement Analysis (TCRGR) is also used to identify characteristic gene changes in T-cells. Blood tests assess white blood cell counts, liver enzymes, and lactate dehydrogenase (LDH) levels, with high LDH suggesting more aggressive disease. Imaging procedures such as X-rays and CT scans help determine the extent of disease spread, while a bone marrow biopsy may be conducted to check for involvement of the bone marrow. Additional tests may be needed to assess organ function, especially in cases where treatment may impact the heart or lungs.

Further details related to country-based variations are provided in the report…

CTCL Treatment

The treatment plan for CTCL, including Mycosis Fungoides and Sezary syndrome, is tailored to the individual, considering factors such as the patient's overall health, age, and the stage of the disease. The primary goals of treatment are to alleviate symptoms, induce remission, and slow disease progression. For patients with early-stage Mycosis Fungoides or Sezary syndrome, skin-directed therapies (topical treatments) may be effective. However, more advanced cases often require a combination of skin-directed therapies and systemic treatments that affect the entire body. The selection of treatment should be personalized, with a careful evaluation of the potential risks and benefits, and should involve the patient in the decision-making process to ensure the most appropriate approach for their condition. Mycosis fungoides/Sézary syndrome is radiosensitive. Thus, radiation therapy, with curative intent, may be considered in patients with localized, unilesional mycosis fungoides. For those with more widespread disease, palliative local radiation or low-dose Total Skin Electron Beam Therapy (TSEBT) is effective.

Further details related to treatment and management are provided in the report…

Cutaneous T-cell Lymphoma (CTCL) Epidemiology

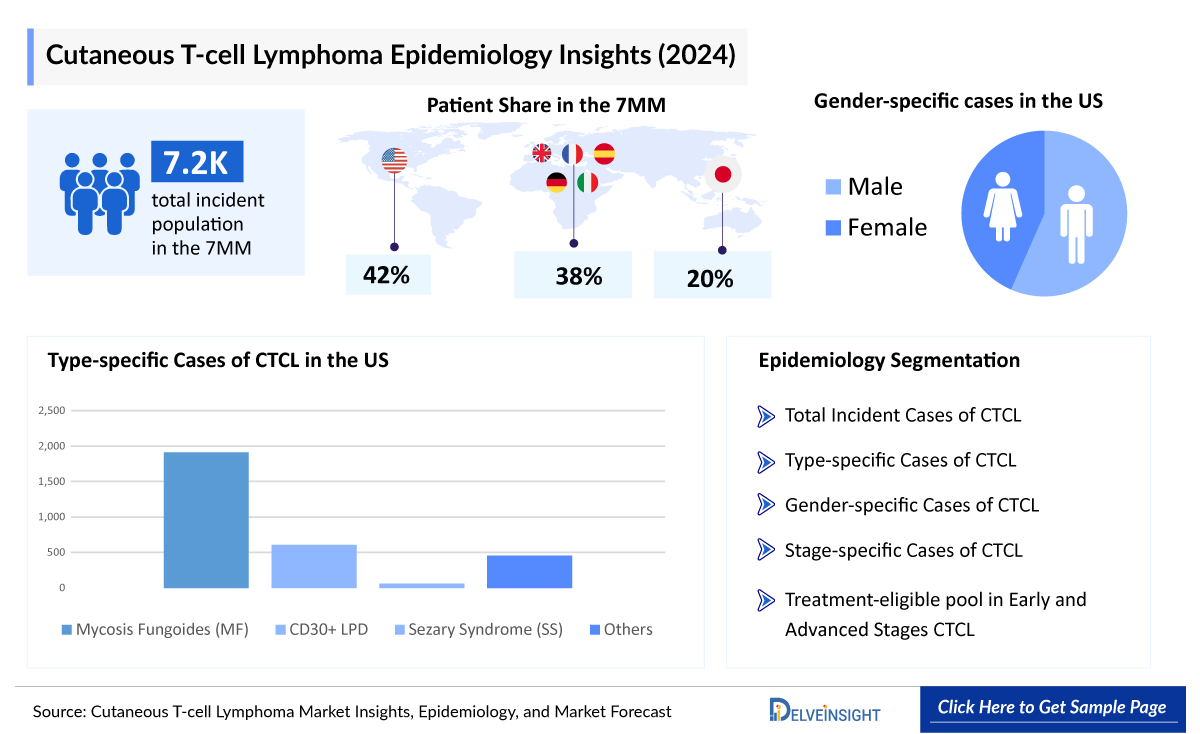

The Cutaneous T-cell Lymphoma epidemiology chapter in the CTCL Market report provides historical as well as forecasted epidemiology segmented total incident population, type-specific cases, gender-specific cases, stage-specific cases, treatment-eligible incident population in early and advanced stages of CTCL in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Cutaneous T-Cell Lymphoma Epidemiological Analyses and Forecast

- Among the 7MM, the US accounted for the highest number of cases of CTCL in 2024, with nearly 3,050 cases. These cases are anticipated to increase by 2034.

- In the 7MM, approximately 7,250 total incident cases of CTCL were reported in 2024, with most cases found in the male population.

- In the United States, among type-specific cases of CTCL in 2024, most of the cases were found to be mycosis fungoides.

- Among the EU4 and the UK, Germany accounted for the highest number of ~760 cases among the total incident cases of CTCL in 2024.

Cutaneous T-cell Lymphoma Epidemiology Segmentation

- Total Incident Cases of CTCL

- Type-specific Cases of CTCL

- Gender-specific Cases of CTCL

- Stage-specific Cases of CTCL

- Treatment-eligible pool in Early and Advanced Stages CTCL

Cutaneous T-Cell Lymphoma Market Recent Developments and Breakthroughs

- In August 2025, the FDA approved LYMPHIR (denileukin diftitox-cxdl) for the treatment of adult patients with relapsed or refractory Stage I-III CTCL after at least one prior systemic therapy. The company anticipates the commercial launch of LYMPHIR by mid-2025.

- According to Innate Pharma’s latest annual presentations, published in May 2025, the company anticipates initiating a Phase III trial of lacutamab, with an accelerated approval submission planned for 2027.

- According to a news release issued in April 2024, Soligenix anticipates announcing top-line results of HyBryte from its confirmatory 18-week study (FLASH2) conducted in the United States and Europe in the second half of 2026.

- In May 2025, Innate Pharma anticipates Phase III data readout of lacutamab in 2027 and beyond.

- According to a news release from March 2025, long-term follow-up data from the TELLOMAK Phase II trial of lacutamab in Sézary syndrome and mycosis fungoides was presented at the 2025 ASCO Annual Meeting held on June 2 in Chicago, Illinois (Abstracts 2522 and 2523).

- In January 2025, Kyowa Kirin International, a wholly owned subsidiary of Kyowa Kirin, and Swixx BioPharma announced that the NHIF and the Bulgarian Ministry of Health have approved the reimbursement of POTELIGEO for adult patients with mycosis fungoides and Sézary syndrome. In Croatia, reimbursement for second- and third-line treatment became effective on 15th November 2024, while in Bulgaria, second-line reimbursement was approved effective 2nd January 2025.

Cutaneous T-cell Lymphoma Drug Analysis

The section dedicated to drugs in the CTCL drugs market report provides an in-depth evaluation of late-stage pipeline drugs (Phase II) related to CTCL. The drug chapters section provides valuable information on various aspects related to CTCL clinical trials, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting CTCL.

Marketed CTCL Drugs

ADCETRIS (brentuximab vedotin): Pfizer (Seagen) and Takeda

ADCETRIS is a CD30-directed Antibody-drug Conjugate (ADC) indicated for the treatment of adult patients with primary cutaneous Anaplastic Large Cell Lymphoma (pcALCL) or CD30-expressing mycosis fungoides who have previously received systemic therapy.

- In December 2023, Pfizer completed its acquisition of Seagen, the developer of ADCETRIS.

- In November 2023, ADCETRIS was approved in Japan for the treatment of relapsed or refractory CD30-positive CTCL.

- In January 2018, Takeda Pharmaceutical announced that the European Commission extended the current conditional marketing authorization of ADCETRIS and approved ADCETRIS for the treatment of adult patients with CD30-positive CTCL after at least one prior systemic therapy. The decision follows a positive opinion from the Committee for Medicinal Products for Human Use (CHMP) on November 9, 2017.

LYMPHIR/REMITORO/E7777/ONTAK (denileukin diftitox): Citius Pharmaceuticals

LYMPHIR is an IL-2 receptor directed cytotoxin indicated for the treatment of adult patients with relapsed or refractory stage I-III CTCL after at least one prior systemic therapy.

- In February 2025, Citius Pharmaceuticals and its oncology-focused subsidiary, Citius Oncology, announced that LYMPHIR has been assigned a unique, permanent HCPCS J-code (J9161) by the CMS. The establishment of a permanent J-code marks a critical milestone in supporting patient access to LYMPHIR, providing coding clarity for physicians and facilities who administer LYMPHIR, and facilitating reimbursement.

- In August 2024, Citius Pharmaceuticals announced that the US FDA had approved LYMPHIR for the treatment of relapsed or refractory CTCL after at least one prior systemic therapy.

- In August 2024, Citius Pharmaceuticals announced the completion of the previously disclosed merger between its oncology subsidiary and TenX Keane Acquisition Corp. The newly combined entity will operate under the name Citius Oncology.

Comparison of Cutaneous T-cell Lymphoma Marketed Drugs | ||||||

|

Product |

Company |

MoA |

RoA |

Patient Segment |

Molecule Type |

Approval Year |

|

POTELIGEO (mogamulizumab) |

Kyowa Hakko Kirin |

CCR4 receptor antagonists |

IV infusion |

Adult patients with relapsed or refractory mycosis fungoides or Sézary syndrome after at least one prior systemic therapy |

Monoclonal antibody |

US: 2018 EU: 2018 JP: 2014 |

|

ADCETRIS (brentuximab vedotin) |

Pfizer (Seagen) and Takeda |

CD30-directed antibody and microtubule inhibitor |

IV infusion |

Adult patients with primary cutaneous Anaplastic Large Cell Lymphoma (pcALCL) or CD30-expressing mycosis fungoides who have received at least one prior systemic therapy |

ADC |

US: 2017 EU: 2018 JP: 2023 |

|

VALCHLOR/LEDAGA (mechlorethamine) |

Helsinn Therapeutics |

Alkylating agent which inhibits rapidly proliferating cells |

Topical |

Stage IA and IB mycosis fungoides-type CTCL in patients who have received prior skin-directed therapy |

Small molecule |

US: 2013 EU: 2017 |

|

LYMPHIR (denileukin diftitox) |

Citius Pharmaceuticals |

Protein synthesis inhibitors (Its unique mechanism of action targets both malignant T-cells and immunosuppressive regulatory T-cells) |

IV infusion |

Adult patients with relapsed or refractory Stage I–III CTCL after at least one prior systemic therapy |

Recombinant engineered fusion protein |

US: 2024 JP: 2021 |

|

TARGRETIN (bexarotene) |

Valeant Pharmaceuticals/Bausch Health |

Activates retinoid X receptor subtypes |

Oral and Topical gel |

CTCL patient’s refractory to at least one prior systemic therapy |

Small molecule |

US: 1999 EU: 2001 JP: 2016 |

|

ISTODAX (romidepsin) |

Bristol-Myers Squibb |

HDAC inhibitor |

IV infusion |

CTCL in adult patients who have received at least one prior systemic therapy |

Small molecule |

US: 2009 |

Emerging Cutaneous T-cell Lymphoma Therapies

HyBryte (Synthetic Hypericin/SGX301): Soligenix and Sterling Pharma Solutions

HyBryte is an ointment containing hypericin, one of the most photosensitive compounds known. HyBryte is applied to CTCL lesions in a thin layer, and after covering the lesion for 18–24 h, the lesion is exposed to a concentrated visible light source. Hypericin is activated by visible light and drives the death of the malignant T cells in the CTCL lesion.

According to recent data, 75% of patients achieved ‘Treatment Success’ after 18 weeks of treatment, reinforcing HyBryte as a potentially safe and fast-acting therapy for CTCL. HyBryte is currently in Phase III of Cutaneous T-cell Lymphoma clinical trials. Upon successful completion of the Phase III FLASH2 study, regulatory approval will be sought to support potential commercialization worldwide. Additionally, discussions with the FDA are ongoing regarding potential modifications to the development pathway to address the agency’s preference for a longer-duration comparative study rather than a placebo-controlled trial.

According to Soligenix’s corporate presentation published in May 2025, the company anticipates providing an update on Phase III enrollment status for HyBryte in the second half of 2025, along with a status update on the Investigator-initiated Study (IIS) by the end of 2025.

Soligenix presented findings from recent supportive trials evaluating HyBryte for the treatment of Cutaneous T-cell Lymphoma at the United States Cutaneous Lymphoma Consortium (USCLC) Workshop on March 6, 2025, and at the American Academy of Dermatology (AAD) Annual Meeting held from March 7 to March 11, 2025.

PTX-100: Prescient Therapeutics

PTX-100 is a first-in-class compound with the ability to block an important cancer growth enzyme, thereby disrupting the oncogenic Ras pathway. PTX-100 is currently in a Phase IIa clinical study in refractory/relapsed CTCL with the potential for a Phase IIb registration study.

- In May 2025, Prescient Therapeutics initiated its Phase IIa clinical trial evaluating PTX-100 for the treatment of relapsed or refractory Cutaneous T-cell Lymphoma, with the first patient successfully dosed. Earlier in December 2024, the company received US FDA clearance to proceed with Phase II clinical trials.

- In March 2025, Prescient Therapeutics opened the first clinical site for its Phase IIa study of PTX-100 in patients with relapsed or refractory Cutaneous T-cell Lymphoma.

Comparison of Cutaneous T-cell Lymphoma Emerging Drugs Under Development | ||||||

|

Drug Name |

Company |

Highest Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

HyBryte (Synthetic Hypericin/SGX301) |

Soligenix and Sterling Pharma Solutions |

III |

CTCL (Stage IA, Stage IB, or Stage IIA) |

Topical |

Photosensitizer |

Small molecule |

|

PTX-100 |

Prescient Therapeutics |

II |

Relapsed/Refractory CTCL |

IV infusion |

Geranylgeranyl Transferase-1 (GGT-1) inhibitor |

Small molecule |

|

Lacutamab (IPH4102) |

Innate Pharma |

II |

Relapsed and/or refractory stage IVA, IVB Sézary syndrome who have received at least two prior systemic therapies and relapsed and/or refractory stage IB, IIA, IIB, III, and IV mycosis fungoides |

IV infusion |

Anti-KIR3DL2 |

Monoclonal antibody |

|

BMS-986369 (Golcadomide) |

Bristol-Myers Squibb |

I/II |

Participants with relapsed or refractory T-cell lymphomas (Mycosis fungoides with advanced stage [stage IIB–IVB]) in Japan |

Oral |

Small molecule | |

|

ONO-4685 |

ONO Pharmaceutical |

I |

Patients with relapsed or refractory T-cell lymphoma and chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) including CTCL |

IV infusion |

PD-1×CD3 bispecific antibody |

Bispecific antibody |

CTCL Drug Class Analysis

Histone Deacetylases Inhibitors

Histone deacetylases catalyze the removal of acetyl groups from both histone and non-histone proteins. As histone acetylation is associated with an open chromatin configuration associated with active gene transcription, histone deacetylases catalyze contribute to histone deacetylation and the epigenetic repression of gene transcription. As histone deacetylases catalyze regulate a wide variety of processes involved in carcinogenesis, multiple mechanisms may explain the clinical activity of histone deacetylases catalyze inhibitor, including altered gene expression of cell-cycle and apoptotic regulatory proteins, acetylation of non-histone proteins regulating cell growth and survival, angiogenesis, aggresome formation, and DNA repair. In addition, histone deacetylases catalyze has profound effects on the tumor microenvironment in CTCL.

In addition to histone deacetylases catalyze inhibitors, several other emerging drug classes and novel therapies are being investigated for CTCL, which include Bcl2 inhibitors, anti-KIR3DL2, and others. Other innovative approaches are also being explored to enhance treatment options for CTCL.

Cutaneous T-cell Lymphoma (CTCL) Market Outlook

The Cutaneous T-cell Lymphoma market outlook is shaped by the complexity of its management across different stages of the disease. While early-stage CTCL is treated primarily with topical therapies, advanced stages require systemic treatments, including interferon-alpha injections, stem cell, and chemotherapy regimens. Despite the higher survival rate for early-stage patients, limited data on the prevalence of early-stage cases or their progression to later stages complicates market projections. As a result, the market size for both early and late-stage CTCL is based on disease incidence. Key FDA-approved therapies, such as VALCHLOR (mechlorethamine), LYMPHIR (denileukin diftitox), ADCETRIS (brentuximab vedotin), and others, are integral to treatment, influencing the growth of the CTCL therapeutics market.

In summary, several therapies have already been approved for the management of CTCL, making a significant impact on the treatment landscape. While ongoing research continues to explore new options, these approved therapies are providing valuable solutions for patients. The forecast period (2025–2034) is expected to bring further advancements, with emerging therapies potentially enhancing existing treatment approaches. As healthcare spending continues to rise globally, the CTCL treatment space is anticipated to see a positive shift, with more accessible and effective therapies becoming available to patients in need.

A few CTCL Companies are leading the treatment landscape of Cutaneous T-cell Lymphoma, such as Pfizer, Bristol-Myers Squibb, Helsinn Therapeutics, and others. The details of the country-wise and therapy-wise market size have been provided below.

- The Cutaneous T-Cell Lymphoma market in the 7MM was valued at approximately USD 1,042 million in 2025 and is projected to reach USD 1,622 million by 2034 at a CAGR of 5.00% over the forecast period from 2024 to 2034.

- In the 7MM, the United States accounted for the highest Cutaneous T-cell Lymphoma market share, i.e., approximately 70% in 2024.

- The United States generated a Cutaneous T-cell Lymphoma revenue of approximately USD 700 million in 2024.

- Among the EU4 and the UK, Germany accounted for the highest Cutaneous T-cell Lymphoma market size in 2024 with approximately USD 70 million.

- Japan accounted for the second-largest Cutaneous T-cell Lymphoma market size among the 7MM in 2024, with an estimated value of approximately USD 90 million.

Further details are provided in the report…

Cutaneous T-cell Lymphoma (CTCL) Drugs Uptake

This section focuses on the uptake rate of potential CTCL drugs expected to be launched in the Cutaneous T-cell Lymphoma market during 2025–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key Cutaneous T-cell Lymphoma companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Cutaneous T-cell Lymphoma (CTCL) Pipeline Drugs Market

The Cutaneous T-cell Lymphoma market report provides insights into therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Cutaneous T-cell Lymphoma companies involved in developing targeted therapeutics. Cutaneous T-cell Lymphoma companies like Soligenix, Innate Pharma, and Astex Pharmaceuticals are actively engaging in late-stage and mid-stage research and development efforts for CTCL. The pipeline of CTCL possesses potential drugs, and there is a positive outlook for the Cutaneous T-cell Lymphoma therapeutics market, with expectations of growth during the forecast period (2025–2034).

Cutaneous T-cell Lymphoma Clinical Trials Activities

The Cutaneous T-cell Lymphoma treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CTCL's emerging therapy.

KOL Views on Cutaneous T-cell Lymphoma

To stay abreast of the latest trends in the Cutaneous T-cell Lymphoma market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Cutaneous T-cell Lymphoma, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

What KOLs are saying on Cutaneous T-Cell Lymphoma Patient Trends?

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the CTCL market, which will assist our clients in analyzing the overall epidemiology and Cutaneous T-cell Lymphoma market scenario.

|

KOL Views |

|

“If approved, we believe denileukin diftitox, with its observed efficacy and safety data, and which is already approved for [patients with] CTCL and peripheral T-cell lymphoma in Japan, would arm oncologists in the United States with an important additional treatment option for this devastating orphan disease.” |

|

“Patients with Sézary syndrome treated with more than 2 prior systemic therapies including mogamulizumab-kpkc (Poteligeo), represent a high unmet medical need population with poor quality of life. It is promising to see lacutamab achieving remarkable efficacy along with favorable safety in this heavily pre-treated population.” |

Cutaneous T-Cell Lymphoma Report Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Cutaneous T-cell Lymphoma therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.\

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for CTCL, one of the most important primary endpoints was achieving Percentage of Participants Achieving an Objective Response That Lasts at Least 4 Months (ORR4), Progression-Free Survival (PFS), Plaque Lesion Response Rates With Extended Treatment (Cycle 1 and 2 SGX301 vs Cycle 1 Placebo), and others. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Cutaneous T-cell Lymphoma Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the Cutaneous T-cell Lymphoma market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

POTELIGEO

Kyowa Kirin Cares is a program with dedicated specialists and case managers who can connect patients and caregivers to the support they need.

Commercial insurance

If the patient has commercial insurance, one might be eligible to receive copay assistance. Patients must be US residents with an active primary commercial plan. Patients with federal or state government insurance, such as Medicare, Medicaid, and Tricare are not eligible for copay assistance. Commercially insured patients do not need to participate in Kyowa Kirin Cares to be eligible for copay assistance.

ADCETRIS

The Seagen Secure patient assistance program is designed to help patients begin their ADCETRIS treatment. If eligible and enrolled, the dedicated Oncology Access Advocate will provide comprehensive, personalized support, including:

- Confirming the insurance coverage

- Evaluating out-of-pocket costs and available copay options

- Helping access alternative support options if the patient cannot afford ADCETRIS

The Cutaneous T-cell Lymphoma market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Cutaneous T-cell Lymphoma Market Report

- The Cutaneous T-cell Lymphoma market report covers a segment of key events, an executive summary, and a descriptive overview of CTCL, explaining its causes, signs, symptoms, pathogenesis, and currently used Cutaneous T-cell Lymphoma therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the marketed and emerging Cutaneous T-cell Lymphoma therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the CTCL market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CTCL Market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive CTCLs.

Cutaneous T-cell Lymphoma (CTCL) Market Report Insights

- Cutaneous T-cell Lymphoma Patient Population

- Cutaneous T-cell Lymphoma Therapeutic Approaches

- CTCL Pipeline Analysis

- CTCL Market Size

- Cutaneous T-cell Lymphoma Market Trends

- Existing and Future Cutaneous T-cell Lymphoma Market Opportunity

Cutaneous T-cell Lymphoma (CTCL) Market Report Key Strengths

- Ten Years Forecast

- The 7MM Coverage

- CTCL Epidemiology Segmentation

- Key Cross Competition

- Cutaneous T-cell Lymphoma Drugs Uptake

- Key Cutaneous T-cell Lymphoma Market Forecast Assumptions

Cutaneous T-cell Lymphoma (CTCL) Market Report Assessment

- Current Cutaneous T-cell Lymphoma Treatment Practices

- Cutaneous T-cell Lymphoma Unmet Needs

- Cutaneous T-cell Lymphoma Pipeline Product Profiles

- Cutaneous T-cell Lymphoma Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

FAQs

- What was the CTCL market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for CTCL?

- What are the disease risks, burdens, and unmet needs of CTCL? What will be the growth opportunities across the 7MM concerning the patient population with CTCL?

- What are the current options for the treatment of CTCL? What are the current guidelines for treating CTCL in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in CTCL management recommendations?

- Would research and development advances pave the way for future tests and therapies for CTCL?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of CTCL?

- What kind of uptake will the new therapies witness in the coming years in CTCL patients?

Reasons to Buy Cutaneous T-Cell Lymphoma Market Forecast Report

- The Cutaneous T-cell Lymphoma market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving CTCL.

- Insights on patient burden/Cutaneous T-cell Lymphoma prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Cutaneous T-cell Lymphoma market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming Cutaneous T-cell Lymphoma companies in the CTCL market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential Cutaneous T-cell Lymphoma therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Cutaneous T-cell Lymphoma market so that the upcoming players can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)