Antibody Drug Conjugate Market Summary

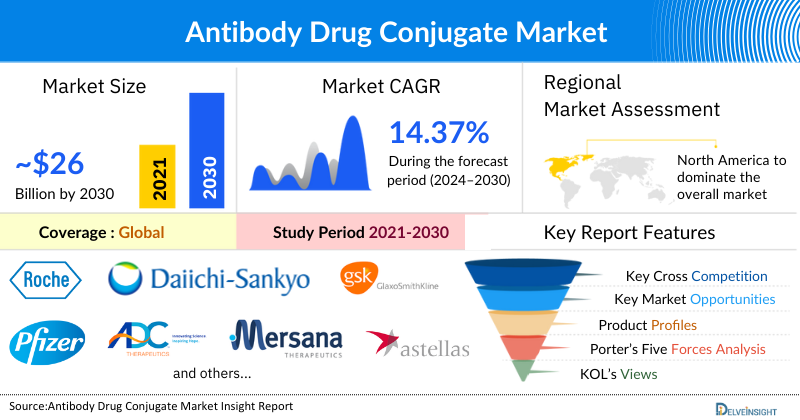

- The Antibody Drug Conjugate Market has witnessed significant growth in recent years. According to DelveInsight, the Antibody Drug Conjugate Market Size is expected to expand substantially over the next decade, fueled by an increasing number of Antibody Drug Conjugate FDA approvals, a growing pipeline of candidates, and advancements in linker technology.

- The leading Antibody Drug Conjugate Companies such as F. Hoffmann-La Roche Ltd, DAIICHI SANKYO COMPANY, LIMITED, Pfizer Inc., Gilead Sciences, Inc., ADC Therapeutics SA., GSK plc, Mersana Therapeutics, Astellas Pharma Inc., AstraZeneca, ImmunoGen Inc., and others.

Request for Unlocking the Sample Page of the “Antibody Drug Conjugate Market”

Key Factors Driving the Antibody Drug Conjugate Market Growth

-

Rising Prevalence of Cancer

The growing global incidence of various cancer types, including breast, lung, ovarian, and hematologic malignancies, is a primary driver of the Antibody Drug Conjugate (ADC) market. ADCs, known for their targeted drug delivery and reduced systemic toxicity, are increasingly being adopted as advanced treatment options to meet the rising oncology burden.

-

Advancements in Targeted Therapy Technologies

Continuous technological innovations in linker chemistry, payload optimization, and antibody engineering are enhancing the precision, efficacy, and safety of ADCs. These advancements are expanding the therapeutic window of ADCs and encouraging broader clinical adoption across diverse cancer subtypes.

-

Expanding Clinical Pipeline and Regulatory Approvals

A robust clinical development pipeline, with several ADCs in late-stage trials, is significantly driving market growth. Moreover, favorable regulatory outcomes and accelerated FDA and EMA approvals for promising ADC candidates are increasing product availability and market penetration.

-

Strategic Collaborations and Licensing Agreements

Pharmaceutical and biotechnology companies are increasingly engaging in strategic partnerships, mergers, and licensing deals to strengthen their ADC portfolios. Collaborations between global players facilitate the exchange of technology and expertise, accelerating drug development and commercialization.

Antibody Drug Conjugate Market By Cancer Type (Breast Cancer, Lung Cancer, Bladder Cancer, Brain Tumor, And Others), Target Type (CD19, HER2, CD22, And Others), End-User (Hospitals And Specialty Cancer Centers, Biotechnology And Pharmaceutical Companies, And Others), And Geography (North America, Europe, Asia-Pacific, And Rest Of The World) is expected to grow at a steady CAGR forecast till 2030 owing to the growing prevalence of cancer and increasing R&D activities and clinical trials for development of antibody drug conjugate

The Global Antibody Drug Conjugate Market was valued at USD 10.13 billion in 2023, growing at a CAGR of 14.37% during the forecast period from 2024 to 2030 to reach USD 25.79 billion by 2030. The demand for antibody-drug conjugates is primarily being boosted by the growing prevalence of cancer globally, increasing research & development activities, and clinical trials for the development of antibody-drug conjugates, during the forecast period from 2024-2030.

Antibody Drug Conjugate Market Dynamics

According to the International Agency for Research on Cancer (IARC) report 2022, there were almost 20 million new cases of cancer and close to 10 million deaths from cancer in 2022. Demographics-based predictions indicated that the annual number of new cases of cancer will reach 35 million by 2050, that is, a 77% increase from the number in 2022. The increasing number of people affected with cancer is expected to drive the demand for antibody-drug conjugates in the forecasted period, thus resulting in the positive growth of the antibody-drug conjugate market.

Further, the growing research & development activities and clinical trials will create a significant opportunity to drive the market for antibody-drug conjugates. For instance, in March 2023, Ambrx Biopharma Inc. announced that it had been informed by its partner, NovoCodex Biopharmaceuticals, Inc., that an interim analysis for ACE-Breast-02, a randomized Phase 3 breast cancer clinical trial investigating Ambrx’s ARX788, an anti-HER2 antibody-drug conjugate, has met its pre-specified interim primary efficacy endpoint with statistical significance, demonstrating a greater progression-free survival (PFS) benefit compared to the active control.

On the other hand, in February 2022, Piramal Pharma, an Indian CDMO, invested 55 million pounds sterling ($74.4 million) to expand its antibody-drug conjugate and active pharmaceutical ingredient (API) manufacturing facilities in the U.K. This investment will boost the R&D of novel ADC drug capabilities in the UK. Thus, due to the interplay of all the above-mentioned factors, the demand for Antibody Drug Conjugates will increase, thus resulting in the overall growth of the Antibody Drug Conjugates market. However, the various side effects associated with antibody-drug conjugates, and the high manufacturing cost of antibody-drug conjugates, may act as factors that are expected to limit the growth of the antibody drug conjugates market.

Antibody Drug Conjugate Market Segment Analysis

Antibody Drug Conjugate Market by Cancer Type (Breast Cancer, Lung Cancer, Bladder Cancer, Brain Tumor, and Others), Target Type (CD19, HER2, CD22, and Others), End-User (Hospitals and Specialty Cancer Centers, Biotechnology and Pharmaceutical Companies, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the cancer type segment of the antibody drug conjugate market, the breast cancer category is estimated to amass a significant revenue share in the antibody drug conjugate market in 2023. This can be attributed to the large patient population associated with breast cancer and the rising product development activities and availability of drugs related to breast cancer.

As per the 2024 Antibody Drug Conjugate Market Forecast report by the World Health Organization (WHO), breast cancer emerged as the most prevalent cancer among women in 157 out of 185 countries in 2022. During the same period, there were 2.3 million reported cases of breast cancer globally, resulting in 670,000 deaths. Breast cancer can affect women worldwide following puberty, with rates escalating in later stages of life. This widespread incidence of cancer fuels the demand for antibody-drug conjugates.

Moreover, recent approvals for breast cancer treatments are anticipated to spur growth in the Antibody Drug Conjugate Market Size segment. For instance, in August 2022, the FDA greenlit fam-trastuzumab deruxtecan-nxki (marketed as Enhertu) for adult patients with unresectable or metastatic HER2-low breast cancer, particularly those who have undergone prior chemotherapy or experienced disease recurrence within six months of completing adjuvant chemotherapy.

Thus, given the ongoing product launches and the escalating cases of breast cancer, the Antibody Drug Conjugate Market Size is poised to propel the overall growth of the antibody drug conjugate market during the forecast period.

North America Is Expected To Dominate The Overall Antibody Drug Conjugate Market

North America is expected to account for the highest proportion of the antibody drug conjugate market in 2023, out of all regions. This is due to the significant burden of cancer, with a high incidence rate across various types of malignancies in the region. Additionally, North America is home to a robust biopharmaceutical industry comprising numerous companies engaged in the research, development, and commercialization of antibody-drug conjugate therapies. These companies benefit from access to advanced infrastructure, research funding, and a skilled workforce. These are some of the key factors driving the growth of the Antibody Drug Conjugate market in North America.

According to the American Cancer Society's Cancer Facts and Figures 2024 report, approximately 2 million new cancer cases are expected to be diagnosed in 2024 in the United States alone. Among these, prostate cancer is estimated at 299,010 cases, followed by lung cancer at 234,580 cases, and female breast cancer at 310,720 cases, demonstrating a rapid increase in the incidence of cancer cases in the country.

In addition, the various regulatory approvals for Antibody Drug Conjugate Market by the FDA are also expected to propel the market demand for antibody drug conjugate market. For example, in April 2024, AstraZeneca and Daiichi Sankyo's Enhertu (trastuzumab deruxtecan) was approved in the US for the treatment of adult patients with unresectable or metastatic HER2-positive (IHC 3+) solid tumors who have received prior systemic treatment and have no satisfactory alternative treatment options. This indication is approved under accelerated approval based on objective response rate (ORR) and duration of response (DoR). Thus, the rising incidence of cancer in North America along with the various product launch activities taking place will eventually drive the overall market for antibody drug conjugate in North America during the forecast period.

Antibody Drug Conjugate Companies

The leading Antibody Drug Conjugate Companies such as F. Hoffmann-La Roche Ltd, DAIICHI SANKYO COMPANY, LIMITED, Pfizer Inc., Gilead Sciences, Inc., ADC Therapeutics SA., GSK plc, Mersana Therapeutics., Astellas Pharma Inc., AstraZeneca, ImmunoGen Inc. and others.

Recent Developmental Activities In The Antibody Drug Conjugate Market

- In November 2025, Cidara Therapeutics Inc. initiated a clinical study to evaluate the safety and immune response of repeated annual doses of the investigational drug CD388 in healthy adults who had previously received one dose without serious adverse effects. The study aims to assess whether multiple administrations of CD388 lead to the development of antibodies that could impact the drug’s efficacy or safety, as well as to further understand its overall tolerability profile. Participants will receive two doses of CD388 over a two-year period and will be monitored for 18 months to evaluate immune responses and safety outcomes.

- In November 2025, MediLink Therapeutics (Suzhou) Co., Ltd. announced the initiation of a Phase I first-in-human study of YL201 across China and the United States. This trial will be conducted in two parts: a dose-escalation phase (Part 1) to determine the optimal dose and a dose-expansion phase (Part 2) to further evaluate safety, tolerability, and preliminary efficacy in patients.

- In November 2025, Takeda launched a Phase III clinical trial with the primary objective of comparing modified progression-free survival (mPFS) between two treatment regimens for frontline therapy in advanced classical Hodgkin lymphoma (HL). The study will assess brentuximab vedotin (ADCETRIS®) plus AVD—a combination of doxorubicin (Adriamycin), vinblastine, and dacarbazine (A+AVD)—against the standard ABVD regimen (doxorubicin, bleomycin, vinblastine, and dacarbazine) to determine comparative efficacy and safety outcomes.

Key Takeaways From The Antibody Drug Conjugate Market Report Study

- ADC Market size analysis and adc market forecast for 6 years (2024-2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the global Antibody Drug Conjugate market.

- Various opportunities are available for the other competitors in the Antibody Drug Conjugate Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current Antibody Drug Conjugate market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Antibody Drug Conjugate market growth in the coming future?

Target Audience Who Can Be Benefited From This Antibody Drug Conjugate Market Report Study

- Antibody Drug Conjugate Market product providers

- Research organizations and consulting Antibody Drug Conjugate Companies

- Antibody Drug Conjugate market forecast-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in Antibody Drug Conjugate

- Various end-users who want to know more about the Antibody Drug Conjugate Market and the latest technological developments in the Antibody Drug Conjugate Market.

Stay Updated with us for New Articles:-

- Antibody-drug Conjugates in Oncology: An Overview of the Current and Future Treatment Landscape

- Antibody-Drug Conjugate: The Smart Biological Bomb

- Seagen/Astellas plans to expand their Antibody Drug Conjugate (ADC), Padcev in additional bladder cancer settings?

- Insights into the Evolving Landscape of Antibody-Drug Conjugate (ADC) & the Key Companies in the Segment

- Cancer-killing virus flees immune destruction and attacks metastatic lung tumors; Urovant's vibegron fails trial; Genmab discards antibody-drug conjugate; Polyphor picks up $3.3M for inhaled antibiotic

- Antibody-Drug Conjugate Market Insight

- Antibody-Drug Conjugate and Big Pharmaceutical Companies

- Next Generation Antibody-Drug Conjugate Therapeutics and Market Analysis

- Latest DelveInsight Blogs