FGFR inhibitors Market Summary

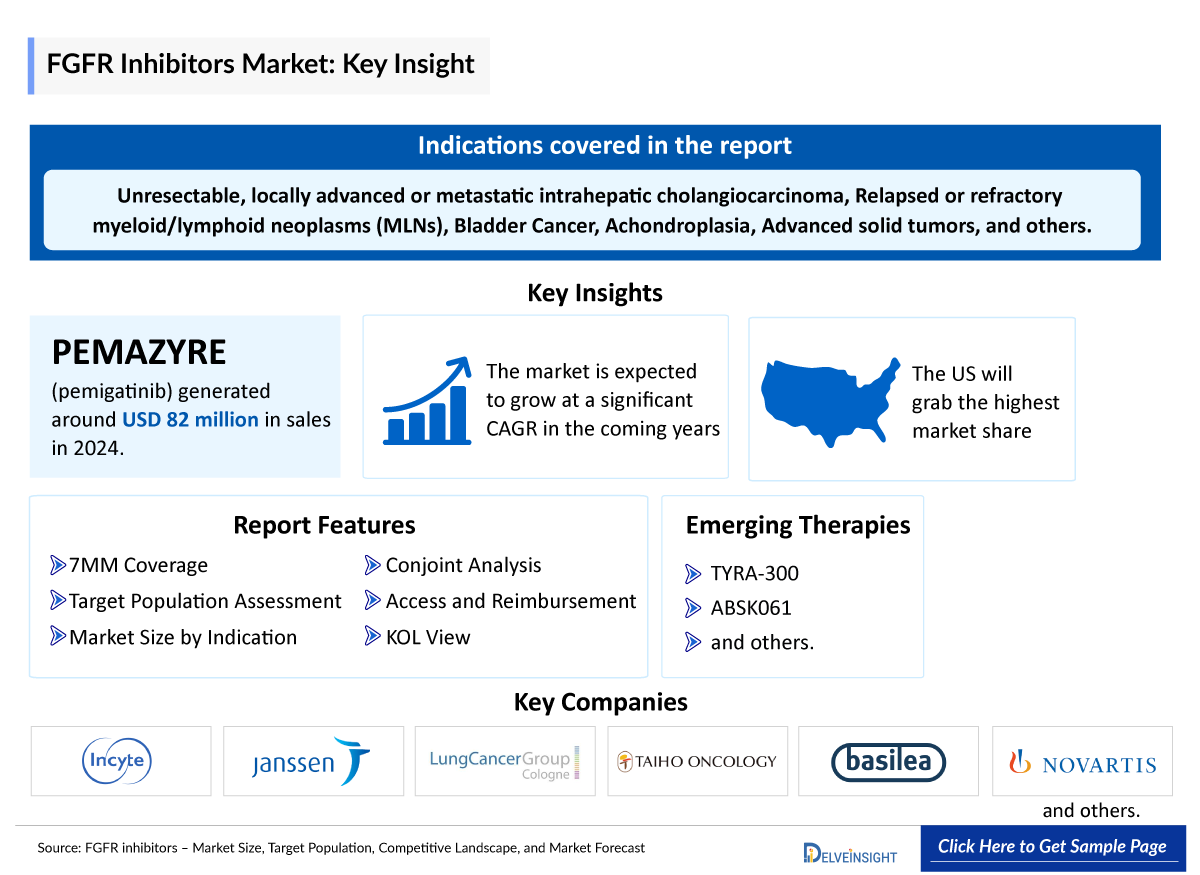

- The FGFR Inhibitors market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

FGFR inhibitors Market and Epidemiology Analysis

- FGFR inhibitors are a class of targeted therapies designed to block the activity of fibroblast growth factor receptors (FGFRs), which are involved in cell growth, survival, migration, and angiogenesis. Aberrations in FGFR genes, such as mutations, amplifications, or fusions.

- The main FDA-approved indications for FGFR inhibitors include: Locally advanced or metastatic urothelial carcinoma with FGFR2/FGFR3 alterations, previously treated unresectable or metastatic cholangiocarcinoma with FGFR2 fusions/rearrangements, and relapsed/refractory myeloid/lymphoid neoplasms with FGFR1 rearrangement.

- Leading FGFR inhibitor companies include Johnson & Johnson, AstraZeneca, Tyra Biosciences, Abbisko Therapeutics, and Taiho Oncology, among others.

- The FGFR inhibitor approved therapies include LYTGOBI (futibatinib), PEMAZYRE (pemigatinib), and BALVERSA (erdafitinib).

- Incyte’s FGFR inhibitor PEMAZYRE (pemigatinib) generated approximately USD 82 million in sales in the full year of 2024.

- In May 2024, the FDA announced the final withdrawal of TRUSELTIQ (infigratinib) for previously treated, unresectable locally advanced or metastatic cholangiocarcinoma with FGFR2 fusions or rearrangements. QED Therapeutics voluntarily requested the withdrawal, citing challenges in enrolling patients for the required confirmatory trial in first-line cholangiocarcinoma and deeming continued distribution for the approved second-line indication commercially unviable. Infigratinib had received accelerated approval in May 2021, based on its activity in this patient population, with the requirement to verify clinical benefit through postmarketing studies.

- In May 2024, Johnson & Johnson presented updated results from a Phase I open-label, multicenter, multi-cohort study evaluating TAR-210, an intravesical targeted releasing system designed for sustained local delivery of BALVERSA (erdafitinib) into the bladder, in patients with non-muscle-invasive bladder cancer (NMIBC) with select FGFR alterations. The data were featured in an Oral Presentation Session (Abstract #PD48-02) at the 2024 American Urological Association (AUA) Annual Meeting.

- Tyra Biosciences' proprietary SNÅP platform enables rapid, precise drug design using iterative molecular SNÅP shots to optimize potency, selectivity, and tolerability. This approach has led to the development of TYRA-300, TYRA-200, and TYRA-430—clinical-stage FGFR inhibitors designed to overcome the toxicity and resistance seen with first-generation therapies.

- In January 2025, Tyra Biosciences received FDA clearance to initiate the Phase II SURF302 trial of TYRA-300 in FGFR3-altered low-grade, intermediate-risk NMIBC. The primary endpoint is complete response at three months, with secondary endpoints including recurrence, response duration, RFS, PFS, and safety. First dosing is expected in Q2 2025, with future plans for combination studies in bladder cancer.

DelveInsight’s “FGFR inhibitors – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the FGFR inhibitors, historical and emerging competitive landscape as well as the FGFR inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The FGFR inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted FGFR inhibitors market size from 2020 to 2034 across 7MM. The report also covers current FGFR inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

FGFR Inhibitors Disease Understanding and Treatment Algorithm

FGFR Inhibitors Overview

FGFR inhibitors are a class of targeted cancer therapies designed to block FGFR signaling, which is often dysregulated in various malignancies due to genetic alterations like mutations, fusions, or amplifications. These drugs include both selective and pan-FGFR inhibitors, such as erdafitinib, pemigatinib, futibatinib, and infigratinib, which have demonstrated efficacy in cancers like urothelial carcinoma and cholangiocarcinoma, especially where FGFR2 or FGFR3 alterations are present. FGFR inhibitors work mainly as small-molecule tyrosine kinase inhibitors, preventing phosphorylation and downstream signaling that drive tumor growth. Some are reversible, while others, like futibatinib, are irreversible covalent inhibitors, and a few target the extracellular domain or act as ligand traps. Clinical studies report objective response rates around 25–45% and disease control rates up to 60% in FGFR-altered tumors, with manageable side effects such as hyperphosphatemia and fatigue.

Further details related to country-based variations are provided in the report

FGFR Inhibitors Market Overview

FGFR inhibitor market has emerged as a significant segment within oncology, driven by the growing understanding of FGFR genetic alterations across various cancers, including cholangiocarcinoma, urothelial carcinoma, and others. Multiple FGFR inhibitors have received regulatory approvals in recent years, including BALVERSA (erdafitinib), PEMAZYRE (pemigatinib), and LYTGOBI (futibatinib), offering targeted treatment options for patients with FGFR-driven tumors. These approvals underscore the therapeutic potential of FGFR inhibition, particularly in cancers with limited treatment options. Despite advancements, the market continues to face challenges such as resistance mechanisms, safety concerns, and the need for effective companion diagnostics. Additionally, competition among existing therapies and ongoing clinical development of next-generation FGFR inhibitors and novel delivery methods—such as Johnson & Johnson’s intravesical TAR-210—highlight the dynamic and evolving nature of the FGFR inhibitor landscape. The market is highly competitive with key players, including Tyra Biosciences, Johnson & Johnson, Incyte Corporation, and others investing heavily in R&D to develop next-generation FGFR inhibitors with enhanced potency and safety.

Further details related to country-based variations are provided in the report…

FGFR Inhibitors Patient Pool

This chapter focuses on the FGFR inhibitor potential patient pool, covering nearly 10 key indications where FGFR-targeted therapies may be applicable. It provides both historical and projected data on the total number of cases, the eligible population for treatment, and estimated treated patients across the 7 major markets (the United States, EU4 – Germany, France, Italy, and Spain – the United Kingdom, and Japan) from 2020 to 2034.

NOTE: Above figure is indicative and are subject to change as per report updation

FGFR Inhibitor Drug Chapters

The drug chapter segment of the FGFR inhibitors reports encloses a detailed analysis of approved FGFR inhibitors late-stage (Phase III and Phase II) FGFR inhibitors. It also helps understand the FGFR inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

FGFR Inhibitor Marketed Drugs

LYTGOBI (futibatinib): Taiho Oncology

LYTGOBI (futibatinib), developed by Taiho Oncology, is an oral, irreversible fibroblast growth factor receptor (FGFR) inhibitor approved for treating adult patients with previously treated, unresectable, locally advanced or metastatic intrahepatic cholangiocarcinoma (iCCA) harboring FGFR2 gene fusions or rearrangements.

In September 2022, the US FDA granted accelerated approval for futibatinib, based on the results of the FOENIX-CCA2 trial, which demonstrated an objective response rate of 42% and a median duration of response of 9.7 months. Unlike other FGFR inhibitors, LYTGOBI covalently binds to FGFR2, providing sustained inhibition of the receptor and its downstream signaling pathways. In July 2023, the European Commission granted conditional marketing authorization for futibatinib in the European Union for similar indications. Additionally, in August 2023, Taiho Pharmaceutical announced the launch of futibatinib in Japan for patients with biliary tract cancer harboring FGFR2 gene fusions that have progressed after chemotherapy.

PEMAZYRE (pemigatinib): Incyte Corporation

PEMAZYRE (pemigatinib), developed by Incyte Corporation, is an oral FGFR inhibitor approved for adults with previously treated, unresectable locally advanced or metastatic cholangiocarcinoma with FGFR2 fusions or rearrangements.

It received FDA accelerated approval in April 2020 based on the FIGHT-202 study, which showed a 36% response rate. In 2022, PEMAZYRE also gained FDA approval for treating relapsed or refractory myeloid/lymphoid neoplasms with FGFR1 rearrangement, supported by FIGHT-203 trial results. The drug is further approved in Japan for this rare blood cancer and continues to be evaluated in ongoing studies across other FGFR-driven cancers.

|

Comparison of Key Marketed Drugs | |||

|

Product |

Company |

RoA |

Indication |

|

LYTGOBI |

Taiho Oncology |

Oral |

|

|

PEMAZYRE |

Incyte Corporation |

Oral |

|

Note: Detailed current therapies assessment will be provided in the full report of FGFR inhibitors

FGFR Inhibitor Emerging Drugs

TYRA-300: Tyra Biosciences

TYRA-300, is an investigational inhibitor of FGFR3 that is designed to be potent and selective in an effort to address two critical limitations of currently approved and investigational FGFR inhibitors: activity in the presence of treatment-emergent resistance mutations such as the V555 gatekeeper mutation, and selectivity for FGFR3 over FGFR1 and other FGFR isoforms to avoid off-target side effects.

The drug is currently being evaluated in Phase I/II clinical trials for mUC (SURF301) and has received FDA clearance to proceed with a Phase II trial (SURF302) in intermediate-risk NMIBC. Interim data from SURF301 showed promising efficacy, with partial response rates of up to 54.5% and a 100% disease control rate at certain dose levels, alongside a favorable safety profile and infrequent serious adverse events. TYRA-300 has also received FDA Rare Pediatric Disease Designation for achondroplasia, reflecting its potential in both oncology and rare skeletal disorders. The development program includes plans for pediatric trials in achondroplasia and ongoing studies in bladder cancer across multiple countries. With its unique selectivity for FGFR3, TYRA-300 aims to offer a more tolerable and effective treatment option for patients with FGFR3-altered diseases, positioning Tyra Biosciences as a contender in the precision oncology and rare disease space.

ABSK061: Abbisko Therapeutics

ABSK061 is an oral, highly selective FGFR2/3 inhibitor designed to reduce off-target FGFR1-related toxicities and offer a broader therapeutic window than pan-FGFR inhibitors. It holds potential for both oncology and non-oncology indications, including achondroplasia (ACH), a genetic disorder commonly caused by FGFR3 mutations. ABSK061 is the first FGFR2/3 inhibitor to enter clinical trials globally and is positioned as a next-generation therapy due to its improved selectivity. In oncology, Abbisko is conducting Phase I trials in China and the U.S. In February 2024, preliminary data presented at the ESMO TAT conference showed an overall response rate (ORR) of 37.5% in patients with FGFR-altered solid tumors treated with ABSK061 at 75 mg BID and 150 mg QD doses.

|

Comparison of Key Emerging Drugs | |||||

|

Product |

Company |

RoA |

Phase |

Designation |

Indication |

|

TYRA-300 |

Tyra Biosciences |

Oral |

II |

Orphan drug designation and rare pediatric disease designation |

|

|

ABSK061 |

Abbisko Therapeutics |

Oral |

II |

N/A |

|

Note: Detailed emerging therapies assessment will be provided in the final report.

FGFR Inhibitor Market Outlook

The FGFR inhibitor market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with urothelial carcinoma, cholangiocarcinoma, myeloid/lymphoid neoplasms, and many more indications; the growing awareness of FGFR inhibitors; and the increasing number of FGFR inhibitors emerging therapies that are under clinical trials and filed for approval by various companies.

Several key FGFR inhibitor companies, including Johnson & Johnson, AstraZeneca, Tyra Biosciences, Abbisko Therapeutics, and Taiho Oncology, and others, are actively advancing FGFR inhibitors across a range of indications. This emerging class of targeted therapies holds strong potential, with ongoing clinical studies expected to clarify their role in cancer and autoimmune disease treatment. However, recent strategic withdrawals, such as QED Therapeutics’ discontinuation of infigratinib and Bayer’s halt on rogaratinib and the regorafenib-nivolumab combination, reflect a more selective and competitive landscape. These decisions underscore the industry’s shift toward clinically differentiated, commercially viable assets, paving the way for next-generation FGFR inhibitors to gain momentum.

FGFR inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging FGFR inhibitor drugs expected to be launched in the market during 2020–2034.

FGFR Inhibitor Pipeline Development Activities

The report provides insights into different FGFR inhibitors therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key FGFR inhibitors players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for the FGFR inhibitors market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for FGFR inhibitor therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on FGFR inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or FGFR inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“FGFR inhibitors are shaping the future of precision medicine in urothelial carcinoma. Recent advancements, including erdafitinib’s FDA approval and promising combination regimens, highlight their growing role in targeted therapy for biomarker-selected patients. Expanding their use to earlier stages of disease remains a key challenge.” |

|

“Future research efforts in this area should focus on getting patients who have received a standard-of-care FGFR inhibitor, such as infigratinib or pemigatinib (Pemazyre), enrolled on clinical trials that are examining second-generation FGFR inhibitors. The number of patients that can be enrolled in these trials is small because cholangiocarcinoma is a rare malignancy. As such, collaboration will be necessary to get patients enrolled to these trials and to improve upon the standard of care in this population.” |

FGFR Inhibitors Market Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

In August 2023, Taiho Pharmaceutical announced that its FGFR inhibitor, LYTGOBI Tablets 4 mg (generic name: futibatinib), has been added to the National Health Insurance (NHI) reimbursement price list in Japan with a reimbursement price of ¥10,252.50 per tablet. The NHI price listing means that LYTGOBI is covered by Japan’s universal health insurance, allowing patients to receive the medication with reimbursement support, reducing the out-of-pocket cost burden.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on FGFR Inhibitor

- In October 2024, Tyra Biosciences reported interim data from its ongoing study of TYRA-300 in patients with FGFR3-positive metastatic urothelial carcinoma (mUC). Among those who received doses of 90 mg or higher once daily, 6 out of 11 patients (54.5%) achieved a confirmed partial response. As of the August 2024 data cutoff, preliminary findings indicated that TYRA-300 was generally well-tolerated, with low incidence of toxicities typically associated with FGFR2 and FGFR1 inhibition. Dose optimization efforts are currently ongoing as part of the study.

- In February 2024, preliminary results from the first-in-human study of ABSK061 in patients with advanced solid tumors were presented during an oral presentation at the 2024 European Society for Medical Oncology Targeted Anticancer Therapies Congress. The ABSK061 75mg BID and 150mg QD cohorts demonstrated promising anti-tumor activity, achieving an ORR of 37.5% in 8 patients with solid tumors harboring FGFR activating alterations.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a FGFR inhibitor descriptive overview, explaining its mechanism, and current and emerging therapies.

- Comprehensive insight into the FGFR Inhibitor competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and FGFR Inhibitor emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the FGFR inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM FGFR inhibitor market.

FGFR inhibitor Report Insights

- FGFR inhibitors Targeted Patient Pool

- Therapeutic Approaches

- FGFR inhibitor Pipeline Analysis

- FGFR inhibitor Market Size and Trends

- Existing and future FGFR Inhibitor Market Opportunity

FGFR inhibitor Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

FGFR inhibitor Report Assessment

- Current Treatment Practices

- FGFR Inhibitor Market Unmet Needs

- Pipeline Product Profiles

- FGFR Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the total FGFR inhibitor market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this FGFR Inhibitor market growth?

- Which FGFR Inhibitor drug is going to be the largest contributor in 2034?

- Which is the most lucrative FGFR inhibitor market?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for FGFR inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and FGFR inhibitors treatment unmet needs? What will be the growth opportunities across the 7MM for the FGFR inhibitors patient population?

- What are the key factors hampering the FGFR inhibitor market growth?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the FGFR inhibitor therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the FGFR inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming FGFR inhibitors players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.