GPRC5D-directed Therapies Market Summary

- The GPRC5D-directed Therapies market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

GPRC5D-directed Therapies Market and Epidemiology Analysis

- The GPRC5D-directed Therapies Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- G protein-coupled receptor, class C group 5 member D (GPRC5D), located on human chromosome 12p13, is an orphan G-protein coupled receptor, GPRC5D protein is predominantly expressed in cells with a plasma cell phenotype and has little to no expression in normal B cells, T cells, natural killer cells, monocytes, granulocytes, and bone marrow progenitors.

- GPRC5D is highly expressed in multiple myeloma cells and is abundant in the bone marrow of patients with multiple myeloma and smoldering multiple myeloma.

- Currently, TALVEY (talquetamab-tgvs), approved in August 2023, is the first and the only approved GPRC5D-directed therapy in the market.

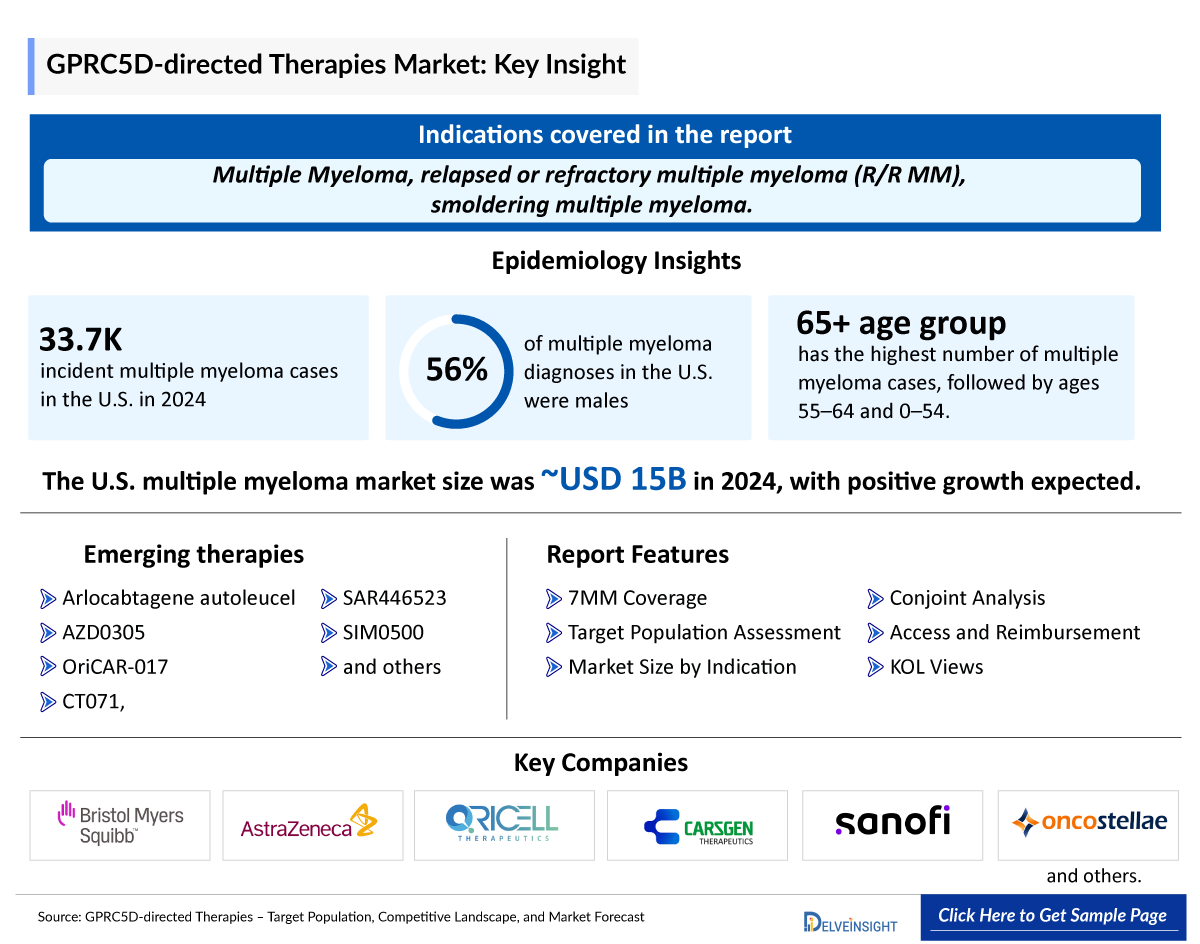

- Some of the major emerging key players in the GPRC5D market include CARsgen Therapeutics (CT071), Oricell (OriCAR-017), Bristol-Myers Squibb (Arlocabtagene autoleucel), AstraZeneca (AZD0305), and others.

- As per DelveInsight's estimates, the total market size in the US for multiple myeloma was ~USD 15,000 million in 2024, which is expected to show positive growth.

- In June 2025, CARsgen Therapeutics presented a Phase I study of CT071 for the treatment of newly diagnosed multiple myeloma at the European Hematology Association (EHA) website.

- Oricell Therapeutics presented the two-year long-term follow-up results of OriCAR-017, an open-label Phase I study evaluating GPRC5D-targeted CAR-T therapy in patients with relapsed/refractory multiple myeloma, in an oral presentation at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting. The updated data demonstrate that OriCAR-017 elicits deep and durable responses in patients.

- In the crowded market of multiple myeloma and now with several approved and emerging CAR-Ts, GPRC5D CAR-T therapies represent an innovative approach to the multiple myeloma treatment.

- According to DelveInsight's analysis, the growth of the GPRC5D market is expected to be mainly driven by the expected launch of various emerging therapies, including CT071, OriCAR-017, BMS-986393, AZD0305, SIM0500, and others.

DelveInsight’s “GPRC5D-directed Therapies Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the GPRC5D, historical and competitive landscape as well as the GPRC5D therapies therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The GPRC5D-directed therapies market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted GPRC5D-directed therapies market size from 2020 to 2034 across 7MM. The report also covers currently approved GPRC5D-directed therapies and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

GPRC5D-directed Therapies Market |

|

|

GPRC5D-directed Therapies Market Size | |

|

GPRC5D-directed Therapies Companies |

Bristol-Myers Squibb, AstraZeneca, Oricell, CARsgen Therapeutics, Sanofi, Oncostellae, and others |

|

GPRC5D-directed Therapies Patient Pool Segmentation |

|

GPRC5D-directed Therapies Treatment Market

GPRC5D-directed Therapies Overview

GPRC5D, located on human chromosome 12p13, is an orphan G-protein coupled receptor, meaning that its ligand is unknown. GPRC5D is a validated target for multiple myeloma therapies. In early Phase trials, GPRC5D-targeting T-cell–redirecting agents have shown promising efficacy and manageable safety profiles, which need to be confirmed in Phase III trials.

GPRC5D is highly expressed in multiple myeloma cells and is abundant in the bone marrow of patients with multiple myeloma and smoldering multiple myeloma. Additionally, GPRC5D mRNA expression is also higher in multiple myeloma cells as compared to other hematologic cancers. The selective expression in multiple myeloma cells suggests that GPRC5D is an ideal target for immune effector cell-mediated therapy to treat multiple myeloma. GPRC5D-targeting T-cell–redirecting therapies, as monotherapy or in combination with other anti-myeloma agents, will expand the number of treatment options available for patients with multiple myeloma. These therapies may provide options for patients who may need treatment with a novel mechanism of action that preserves BCMA-targeting therapy for later lines of therapy, have experienced suboptimal response or antigen loss with other agents, or for patients who exhibit clonal heterogeneity. However, the optimal treatment sequence for patients with multiple myeloma will need to be elucidated.

While GPRC5D and BCMA have a similar expression on CD138+ cells, the expression patterns are independent of each other, offering distinct clinical targets. GPRC5D expression is also unaffected by BCMA loss, which has been associated with disease relapse following treatment with BCMA-targeting therapies and may support combining GPRC5D-targeting and BCMA-targeting T-cell redirecting agents to address the heterogeneity of multiple myeloma.

Further details related to country-based variations are provided in the report…

GPRC5D-directed Therapies Patient Pool

The GPRC5D epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications (multiple myeloma) for GPRC5D-directed therapies, total eligible patient pool in selected indications for GPRC5D-directed therapies, and total treated cases in selected indications for GPRC5D-directed therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In the US, there were around 33,700 incident cases of multiple myeloma in 2024, which was the highest among seven major markets.

- Multiple myeloma is more common in males as compared to females. In the United States, around 56% of males are diagnosed with multiple myeloma in 2024.

- When it comes to age-specific cases of multiple myeloma, the age group of 65 and above years has the highest number of cases, followed by 55–64 and 0–54 years.

- In Japan, there were nearly 5,400 first-line transplant ineligible cases and nearly 1,300 first-line transplant eligible cases in 2024.

NOTE: The list of indications is not exhaustive and is subject to change as per report updation…

GPRC5D-directed Therapies Drug Chapters

The drug chapter segment of the GPRC5D reports encloses a detailed analysis of GPRC5D targeting pipeline drugs in different phases of development. It also helps understand the GPRC5D clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed GPRC5D-directed Therapies

TALVEY (talquetamab-tgvs): Johnson & Johnson Innovative Medicine (Janssen Biotech)

TALVEY is a first-in-class bispecific T-cell engaging antibody that binds to the CD3 receptor on the surface of T cells and G protein-coupled receptor class C group 5 member D (GPRC5D) expressed on the surface of multiple myeloma cells, non-malignant plasma cells and healthy tissue such as epithelial cells in keratinized tissues of the skin and tongue. TALVEY is approved as a weekly or biweekly subcutaneous (SC) injection after an initial step-up Phase, offering physicians the flexibility to determine the optimal treatment regimen for patients.

Emerging GPRC5D-directed Therapies

OriCAR-017: Oricell

OriCAR-017, a Chimeric Antigen Receptor (CAR) T cell therapy targeting GPRC5D, is a groundbreaking innovation in the treatment of relapsed/refractory multiple myeloma. Leveraging Oricell Therapeutics' cutting-edge proprietary technology platforms, OriCAR-017 exhibits differentiated binding avidity, persistence, anti-tumor efficacy, and safety profile. OriCAR-017 received IND approval from the FDA in Jan 2024 after its approval by NMPA in 2023.

Arlocabtagene autoleucel (BMS-986393): Bristol Myers Squibb (Juno Therapeutics)

BMS-986393 is a GPRC5D-directed autologous CAR T cell therapy. The company is currently conducting a Phase II (QUINTESSENTIAL) trial in relapsed/refractory multiple myeloma with projected data readout in 2026. At the ASH 2023 conference updated data from the Phase I study of BMS-986393, showed deepening responses, a tolerable safety profile, and activity across both B-cell maturation antigen (BCMA)-naïve and -exposed patients.

|

Product |

Company |

RoA |

Molecule Type |

Phase |

|

Arlocabtagene autoleucel (BMS-986393) |

Bristol Myers Squibb (Juno Therapeutics) |

IV infusion |

Autologous CAR T cell therapy |

II |

|

AZD0305 |

AstraZeneca |

IV |

Antibody-drug Conjugates (ADCs) |

I/II |

|

OriCAR-017 |

Oricell |

IV infusion |

Autologous CAR T cell therapy |

I |

|

CT071 |

CARsgen Therapeutics |

IV infusion |

Autologous CAR T cell therapy |

I/II |

|

SAR446523 |

Sanofi |

Sc |

Monoclonal antibody |

I |

|

SIM0500 |

Jiangsu Simcere Pharmaceutical and AbbVie |

Sc |

Trispecific antibody |

I |

GPRC5D-directed Therapies Market Outlook

GPRC5D has emerged as a promising therapeutic target for treating multiple myeloma. Preclinical studies have demonstrated the efficacy of GPRC5D CAR-T cells using a human-derived GPRC5D-targeted scFv clone 109 (GPRC5D[109]) in various multiple myeloma cell lines, including primary cells from bone marrow aspirates. Ongoing trials are exploring the safety and effectiveness of combining these T-cell–redirecting agents with other anti-myeloma treatments for patients with relapsed or refractory multiple myeloma. These combinations include talquetamab with teclistamab, daratumumab, pomalidomide, anti-PD-1 antibodies, carfilzomib, and lenalidomide. This suggests that GPRC5D-targeting bispecific antibodies could be versatile partners in combination therapies. However, managing GPRC5D-associated adverse events requires further investigation into dose modification strategies, such as reduced frequency or fixed-duration dosing, and other mitigation measures. These approaches aim to balance the potential toxicity related to on-target effects with the promising efficacy seen in these therapies. In addition to CAR-T therapies, ongoing research includes CAR–natural killer cell therapies, bispecific–natural killer cell engagers, and antibody-drug conjugates, which collectively offer potential advancements in treating multiple myeloma.

Additionally, clinical trials, including those investigating GPRC5D-targeting T-cell–redirecting agents in combination with other anti-myeloma therapies and with different treatment modalities, may help to elucidate the future optimal treatment regimen and sequence for patients with multiple myeloma and improve survival outcomes.

Key players in the GPRC5D market include CARsgen Therapeutics, Oricell, Bristol-Myers Squibb, AstraZeneca, Sanofi, and others.

GPRC5D-directed Therapies Drug Uptake

This section focuses on the uptake rate of potential approved and emerging GPRC5D expected to be launched in the market during 2025–2034.

GPRC5D-directed Therapies Pipeline Development Activities

The GPRC5D-directed Therapies pipeline report provides insights into GPRC5D-directed Therapies clinical trials in different Phases. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunities for GPRC5D-directed Therapies market growth over the forecasted period.

GPRC5D-directed Therapies Pipeline development activities

The GPRC5D-directed Therapies clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for GPRC5D emerging therapies.

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on GPRC5D's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Multiple Myeloma Research Foundation, Dana-Farber Cancer Institute, University of Texas MD Anderson Cancer Center, etc. were contacted.

Their opinion helps understand and validate current and emerging therapy treatment patterns or GPRC5D market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Results from the MonumenTAL-1 study continue to show deeper response levels and a longer duration of response in patients treated with either of the approved dose options of talquetamab, while the median overall survival has yet to be reached at two years.” |

|

“Arlo-cel, a potential first-in-class, GPRCD-targeted, autologous CAR T-cell therapy administered to patients with heavily pretreated relapsed/refractory multiple myeloma, showed manageable safety and promising efficacy.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on GPRC5D-directed Therapies

- As per the first quarter presentation of Bristol-Myers Squibb, the company anticipates the New Molecular Entity (NME) registrational data of Arlo-cel for the RRMM QUINTESSENTIAL study in 2026.

- In January 2025, AbbVie and Simcere Zaiming announced an option to license agreement to develop SIM0500, an investigational new drug candidate. SIM0500 is currently in Phase I clinical trials in patients with relapsed or refractory multiple myeloma (MM), in both China and the US.

Scope of the GPRC5D-directed Therapies Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of multiple myeloma, explaining its causes, diagnosis, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the GPRC5D-directed therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM GPRC5D-directed therapies market.

GPRC5D-directed Therapies Market Report Insights

- GPRC5D-directed therapies Patient Pool

- GPRC5D-directed Therapies Therapeutic Approaches

- GPRC5D-directed therapies Pipeline Analysis

- GPRC5D-directed therapies Market Size and Trends

- Existing and future Market Opportunity

GPRC5D-directed Therapies Market Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- GPRC5D-directed Therapies Drugs Uptake

- Key GPRC5D-directed Therapies Market Forecast Assumptions

GPRC5D-directed Therapies Market Report Assessment

- Current GPRC5D-directed Therapies Treatment Practices

- GPRC5D-directed Therapies Unmet Needs

- GPRC5D-directed Therapies Pipeline Product Profiles

- GPRC5D-directed Therapies Market Attractiveness

- Qualitative Analysis (SWOT)

- GPRC5D-directed Therapies Market Drivers

- GPRC5D-directed Therapies Market Barriers

Key Questions Answered In The GPRC5D-directed Therapies Market Report

- What was the GPRC5D-directed therapies total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for GPRC5D-directed therapies?

- Which drug type segment accounts for the maximum GPRC5D-directed therapy sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for GPRC5D-directed therapies evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment for tumors harboring GPRC5D-directed therapies? What will be the growth opportunities across the 7MM for the patient population of GPRC5D-directed therapies?

- What are the key factors hampering the growth of the GPRC5D-directed therapies market?

- What key designations have been granted to the therapies for GPRC5D-directed therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy the GPRC5D-directed Therapies Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the GPRC5D-directed therapies market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.