CAR-T Market

- The CAR-T cell therapy market is expected to grow significantly during the forecast period of 2024–2034 driven by its effectiveness and the potential for broader applications. Collaboration between pharmaceutical companies and research institutions, coupled with ongoing innovations, is likely to contribute to the market's growth. However, challenges such as manufacturing complexities and pricing considerations may need to be addressed.

- Chimeric Antigen Receptor-T Cell (CAR-T) therapy is a transformative cancer treatment that harnesses a patient’s immune system to target and eliminate cancer cells, offering a one-time, long-term solution that avoids the toxicity of salvage chemotherapy and autologous transplant. This innovative immunotherapy has significantly improved outcomes for high-risk patients—especially those who are primary refractory or experience early recurrence—by redefining the standard of care.

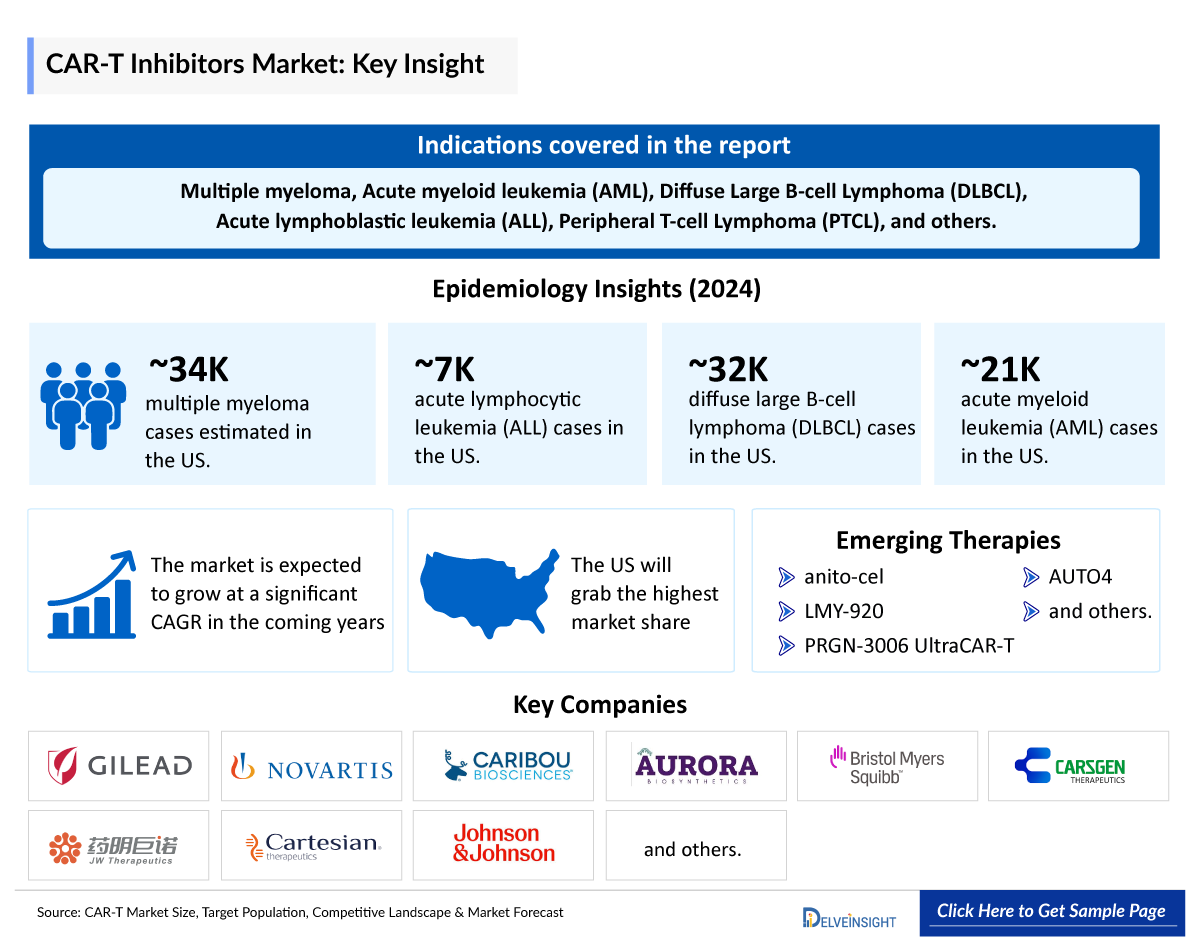

- CAR-T cell therapies have been involved in treating many oncological indications like multiple myeloma, Acute myeloid leukemia (AML), Diffuse Large B-cell Lymphoma (DLBCL), Acute lymphoblastic leukemia (ALL), Peripheral T-cell Lymphoma (PTCL), and others.

- The approved CAR-T cell therapies CARVYKTI (Johnson & Johnson Innovative Medicine), TECARTUS and YESCARTA (Kite Pharma [a Gilead company]), BREYANZI (Juno Therapeutics/ Bristol-Myers Squibb), ABECMA (Bristol-Myers Squibb), and KYMRIAH (Novartis).

- BREYANZI has gained broad approval across multiple indications including Large B-cell Lymphoma (LBCL) (including DLBCL, High-grade B-cell Lymphoma [HGBCL], and Primary Mediastinal Large B-cell Lymphoma [PMBCL]), follicular lymphoma, Chronic Lymphocytic Leukemia/Small Lymphocytic Lymphoma (CLL/SLL), and Mantle Cell Lymphoma, reinforcing its position as a versatile and widely applicable CAR-T therapy.

- Although KYMRIAH was the first CAR-T therapy approved globally, YESCARTA became the first to receive FDA approval for DLBCL in October 2017. Gilead has since expanded YESCARTA’s indications, gaining approvals for second-line transplant-eligible DLBCL in 2022 and initiating the ZUMA-23 trial for first-line use. KYMRIAH, approved by the FDA in May 2018 for R/R LBCL, stumbled in the second-line BELINDA trial, failing to meet its primary endpoint.

- CAR-T therapies have transformed multiple myeloma treatment, with CARVYKTI, the first and only BCMA-targeted CAR-T approved for patients with ≥1 prior therapy, leading the market after record-breaking sales as soon as it entered the market, an achievement unmatched by any previous CAR-T therapy. However, competition is growing, with ABECMA remaining a strong contender.

- There are currently many emerging CAR-Ts being investigated for various indications. Some of the potential therapies include anitocabtagene autoleucel (Arcellx and Kite Pharma), zamtocabtagene autoleucel (Miltenyi Biomedicine), LMY-920 (Luminary Therapeutics), PRGN-3006 (Precigen), cemacabtagene ansegedleucel (Allogene Therapeutics), P-BCMA-ALLO1 (Poseida Therapeutics and Roche), AUTO4 (Autolus), and others.

- With no approved first-line CAR-T cell therapy, cemacabtagene ansegedleucel is an off-the-shelf, allogeneic CD19 CAR-T cell in Phase II ALPHA3 trial, assessing its role in first-line consolidation for LBCL patients with MRD post-standard treatment. Its market entry could offer a breakthrough option.

- In December 2024, Kite Pharma announced results from four analyses that continue to demonstrate the durability of response of TECARTUS (brexucabtagene autoleucel) in patients with R/R MCL and R/R B-cell precursor ALL during the 66th American Society of Hematology (ASH) Annual Meeting and Exposition.

DelveInsight’s “Chimeric Antigen Receptor (CAR)-T Cell Therapy Market Size, Target Population, Competitive Landscape & Market Forecast - 2034” report delivers an in-depth understanding of the CAR-T cell therapy, historical and competitive landscape as well as the CAR-T cell therapy market trends in the US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan.

The CAR-T cell therapy market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CAR-T cell therapy market size from 2020 to 2034. The report also covers current CAR-T cell therapy practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

CAR-T Cell Therapies’ Epidemiology |

Segmented by:

|

|

CAR-T Cell Therapies Companies |

|

|

CAR-T Cell Therapies Therapies |

|

|

CAR-T Cell Therapies’ Market |

Segmented by:

|

|

Analysis |

|

Chimeric Antigen Receptor (CAR)-T Cell Therapy Market: Understanding

Chimeric Antigen Receptor (CAR)-T Cell Therapy Overview

CAR-T cell therapy is a groundbreaking form of immunotherapy designed to treat certain types of blood cancers, including leukemias and lymphomas. The process begins with the collection of a patient's T cells through a procedure called apheresis. These T cells are then genetically modified in a laboratory to express a Chimeric Antigen Receptor (CAR) that enables them to better recognize and attack cancer cells. After this modification, the CAR-T cells are multiplied and infused back into the patient's bloodstream, where they seek out and destroy cancerous cells. This therapy has shown promising results, with some patients achieving complete remission even after other treatments have failed. However, CAR-T therapy is not without risks; potential side effects include Cytokine Release Syndrome (CRS) and neurological complications, necessitating close monitoring by specialized medical teams during and after treatment.

Chimeric Antigen Receptor (CAR)-T Cell Therapy Epidemiology

The CAR-T cell therapy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total incident cases of selected indications for CAR-T cell therapy, total eligible patient pool for CAR-T cell therapy in selected indications, and total treated cases in selected indications for CAR-T cell therapy in the 7MM covering the US, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan from 2020 to 2034.

|

Table 1: Epidemiology of Oncology Indications | |

|

Indication |

Estimated Cases in the US (2024) |

|

Multiple myeloma |

33,700 |

|

ALL |

6,900 |

|

DLBCL |

32,300 |

|

AML |

21,200 |

|

MCL |

3,500 |

Chimeric Antigen Receptor (CAR)-T Cell Therapy Drug Chapters

The drug chapter segment of the CAR-T cell therapy reports encloses a detailed analysis of CAR-T cell therapy marketed drugs and pipeline drugs. It also helps understand the CAR-T cell therapy clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed CAR-T cell therapy Drugs

CARVYKTI (ciltacabtagene autoleucel): Johnson & Johnson Innovative Medicine

CARVYKTI (ciltacabtagene autoleucel) by Johnson & Johnson Innovative Medicine is a BCMA-directed genetically modified autologous T-cell immunotherapy indicated for the treatment of adult patients with RRMM. It involves reprogramming a patient’s T cells with a transgene encoding a CAR that identifies and eliminates cells that express BCMA.

In February 2022, the FDA approved CARVYKTI (ciltacabtagene autoleucel) to treat adults with multiple myeloma that has relapsed or is refractory to other treatments. In May 2022, the European Medicines Agency (EMA) granted conditional marketing authorization for CARVYKTI (ciltacabtagene autoleucel) for the treatment of adult patients with Relapsed and Refractory Multiple Myeloma (RRMM) who have received at least three prior therapies: An Immunomodulatory Agent (IMiD), a proteasome inhibitor, and an anti-CD38 antibody. In September 2022, Japan’s Ministry of Health, Labour and Welfare (MHLW) approved CARVYKTI (ciltacabtagene autoleucel) for patients with both cases - no history of CAR-positive T cell infusion therapy targeting BCMA and Patients who have received three or more lines of therapies, including an immunomodulatory agent, a proteasome inhibitor and an anti-CD38 monoclonal antibody, and in whom multiple myeloma has not responded to or has relapsed following the most recent therapy. In April 2024, the US FDA approved the drug for patients with RRMM who have received at least one prior line of therapy.

YESCARTA (axicabtagene ciloleucel): Kite Pharma (Gilead Sciences)

YESCARTA is a CD19-directed genetically modified autologous T-cell immunotherapy indicated for the treatment of adult patients with large B-cell lymphoma that is refractory to first-line chemoimmunotherapy or that relapses within 12 months of first-line chemoimmunotherapy and adult patients with R/R LBCL after two or more lines of systemic therapy, including DLBCL NOS, PMBCL, HGBCL, and DLBCL arising from follicular lymphoma

In October 2017, the FDA granted regular approval to YESCARTA to treat adult patients with R/R LBCL after two or more lines of systemic therapy, including DLBCL not otherwise specified, PMBCL, HGBCL, and DLBCL arising from follicular lymphoma. In August 2018, the European Commission (EC) granted marketing authorization to YESCARTA as a treatment for adult patients with R/R DLBCL and PMBCL after two or more lines of systemic therapy. In January 2021, Daiichi Sankyo announced the Japan Ministry of Health, Labour and Welfare (MHLW) had approved YESCARTA (axicabtagene ciloleucel for the treatment of adult patients with certain R/R LBCL. Moreover, In January 2017, Daiichi Sankyo received exclusive development, manufacturing, and commercialization rights for YESCARTA in Japan from Kite Pharma, a Gilead Company. In January 2024, Kite announced that the US FDA had approved a manufacturing process change resulting in a shorter manufacturing time for YESCARTA. With this approval, Kite’s median Turnaround Time (TAT) in the US is anticipated to be reduced from 16 days to 14 days.

|

Table 1: Comparison of Key Marketed Drugs | |||

|

Drug Name |

Company |

Initial Approval in the US |

Indication |

|

CARVYKTI (ciltacabtagene autoleucel) |

Johnson & Johnson Innovative Medicine |

2022 |

RRMM |

|

TECARTUS (brexucabtagene autoleucel) |

Kite Pharma (a Gilead company) |

2020 |

Mantle Cell Lymphoma (MCL) |

|

BREYANZI (lisocabtagene maraleucel) |

Juno Therapeutics |

2021 |

R/R LBCL |

|

ABECMA (idecabtagene vicleucel) |

Bristol-Myers Squibb |

2021 |

RRMM |

|

YESCARTA (axicabtagene ciloleucel) |

Kite Pharma (a Gilead company) |

2017 |

LBCL |

|

KYMRIAH (tisagenlecleucel) |

Novartis |

2017 |

ALL |

Note: Detailed current therapies assessment will be provided in the full report of CAR-T cell therapy.

Emerging CAR-T cell therapy Drugs

Anitocabtagene autoleucel (anito-cel): Arcellx and Kite Pharma (A Gilead Company)

Anitocabtagene autoleucel is a cell therapy product candidate involving patient-derived, or autologous, T-cells that have been genetically modified to recognize and kill specific cells expressing BCMA, a target antigen for multiple myeloma. This candidate utilizes D-Domain in place of the traditional scFv binding domain of conventional cell therapies. Anitocabtagene autoleucel has been granted Fast Track Designation (FTD), Orphan Drug Designation (ODD), and Regenerative Medicine Advanced Therapy Designation (RMAT) by the US FDA for the treatment of RRMM. In November 2023, Kite and Arcellx announced that the companies have expanded their existing collaboration, which was originally announced in December 2022. The companies have also expanded the scope of the collaboration for Arcellx’s CART-ddBCMA to include lymphomas. In May 2024, Kite and Arcellx announced several key operational updates on their partnered anitocabtagene autoleucel (anito-cel) multiple myeloma program. The companies shared the design of a global, Phase III randomized controlled clinical trial, iMMagine-3, which Kite expects to start in the second half of 2025 for the treatment of RRMM.

Cemacabtagene ansegedleucel: Allogene Therapeutics

Cemacabtagene ansegedleucel (previously known as ALLO-501A) is a next-generation anti-CD19 AlloCAR-T investigational product for the treatment of LBCL. Allogene has oncology rights to cema-cel in the US, EU, and UK, with options for rights in China and Japan. The pivotal Phase II ALPHA3 trial was initiated in June 2024, and site activation is ahead of schedule, with 10 community cancer and academic centers opened in less than 2 months. Patient screening for minimal residual disease (MRD) and enrollment is proceeding as planned. This groundbreaking study is evaluating the use of cemacabtagene ansegedleucel as part of the first-line treatment regimen for patients with LBCL who are likely to relapse after standard 1L treatment. ALPHA3 is the first pivotal trial to offer CAR T as part of 1L treatment consolidation. Because of the potential of the earlier line ALPHA3 trial, the company has deprioritized the third line LBCL ALPHA2 and EXPAND trials. Cemacabtagene ansegedleucel’s potential BLA submission is expected in 2027.

|

Table 2: Comparison of key emerging drugs | ||||

|

Drug name |

Company |

MoA |

Phase |

Indication |

|

Anitocabtagene autoleucel (anito-cel) |

Arcellx and Kite Pharma |

D-domain BCMA-directed chimeric antigen receptor (CAR) T-cell therapy |

III |

RRMM |

|

Zamtocabtagene autoleucel |

Miltenyi Biomedicine |

Targeting the combination of CD19 and CD20 |

II |

DLBCL |

|

Cemacabtagene ansegedleucel |

Allogene Therapeutics |

Targets CD19 |

II |

R/R LBCL |

|

LMY-920 |

Luminary Therapeutics |

B-cell Activating Factor (BAFF) expressing CAR-T cells |

I |

RRMM |

|

PRGN-3006 UltraCAR-T |

Precigen |

Targeted CD33 elimination |

I |

CD33-Positive RR AML |

|

LMY-920 |

Luminary Therapeutics |

BAFF expressing CAR-T cells |

I |

NHL |

|

P-BCMA-ALLO1 |

Poseida Therapeutics/Roche |

BCMA-targeted CAR-T cells |

I |

RRMM |

|

AUTO4 |

Autolus |

TRBC1-targeting CAR-T cell therapy |

I |

PTCL |

Note: Detailed emerging therapies assessment will be provided in the final report.

Chimeric Antigen Receptor (CAR)-T Cell Therapy Market Outlook

The CAR T cell therapy market is expected to grow significantly in the coming years. This is due to the increasing number of patients being diagnosed with cancer, the growing awareness of CAR T cell therapies, and the increasing number of CAR T cell therapies that are under clinical trials and filed for approval by various companies. First CAR-T was approved in 2017, i.e., KYMRIAH for ALL, later in the same year YESCARTA got approval for LBCL.

The CAR T cell therapy market is characterized by a landscape of intense competition and rapid innovation, driven by the pressing need for effective treatments across a spectrum of cancers. One significant advantage of CAR-T cell therapies is their unique one-and-done approach, requiring only a single administration, as opposed to the continuous treatment needed with bispecific antibodies like TECVAYLI and TALVEY, as well as other treatments available for the treatment of multiple myeloma. Other than this, the approval of ABECMA (idecabtagene vicleucel) manufactured by Bristol-Myers Squibb, and CARVYKTI (ciltacabtagene autoleucel), which is manufactured by Johnson & Johnson Innovative Medicine highlights the potential of CAR-T cell therapy as a game-changing treatment for multiple myeloma.

CAR-T cell therapy approvals have opened up new opportunities for companies focusing on developing treatments for the different stages in the pipeline. Some of the prominent emerging players in this field include Arcellx and Kite Pharma ([a Gilead company] anitocabtagene autoleucel [anito-cel], Poseida Therapeutics/Roche (P-BCMA-ALLO1), Luminary Therapeutics (LMY-920), Precigen (PRGN-3006 UltraCAR-T), and others.

CAR-T Cell Therapy Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CAR-T cell therapy expected to be launched in the market during 2025–2034.

CAR-T therapy represents a groundbreaking approach to cancer treatment, particularly for oncological indications. This innovative therapy involves modifying a patient’s T cells to better recognize and attack cancer cells. There are currently many CAR-T cell therapies approved, especially for multiple myeloma. One of the major approvals dates back to October 2017, when YESCARTA (axicabtagene ciloleucel) was approved for LBCL. The drug generated USD 7 million in sales in 2017, and USD 264 million in sales in 2018. Later in March 2021, the drug received approval for R/R follicular lymphoma and in April 2022, it became the first CAR-T therapy for the initial treatment of R/R LBCL. In 2024, YESCARTA had approximately USD 1,570 million, and strong demand for the drug outside the US was partially offset by the US dynamics for YESCARTA. This marks a steady and significant increase in sales, reflecting growing adoption and broader clinical use over the years.

CAR-T Cell Therapy Pipeline Development Activities

The CAR-T Cell Therapy market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I and analyzes key CAR-T Cell Therapy companies involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for CAR-T cell therapy market growth over the forecast period.

CAR-T Cell Therapy Clinical Trial Activities

The CAR-T Cell Therapy market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CAR-T cell therapy.

KOL Views on CAR-T Cell Therapy

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CAR-T cell therapy's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as MPH Fred Hutchinson Cancer Center, University of Pennsylvania, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or CAR-T cell therapy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“CAR-T therapy is a highly innovative and cutting-edge cancer treatment that is showing a great deal of promise for cancer patients. This therapy involves extracting T cells from a patient's blood, modifying them in a lab to better recognize and fight cancer cells, and then injecting them back into the patient's body. CAR-T therapy is still in its early stages of development, but early results look very promising.” MD, Researcher, University of Cambridge, UK |

|

“Establishing a reliable biomarker for early detection of CAR-T cell expansion would improve the ability to monitor real-time CAR activity in patients. Using serum cytokines or product phenotype levies the knowledge of the product attributes or non–cell-based measurements post–CAR-T cell infusion to predict CAR expansion before it occurs in the patient.” PhD, Drexel University, Philadelphia, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging CAR-T Cell Therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of CAR-T Cell Therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

CAR-T Cell Therapy Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health Technology Assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on CAR-T Cell Therapy Clinical Trials

- In April 2025, Kite Pharma presented the findings from a retrospective study of brexucabtagene autoleucel for patients over 70 years of age with R/R MCL who do not benefit from intensive treatment, at the 51st Annual EBMT Meeting.

- In February 2025, Bristol Myers Squibb announced that the Phase II TRANSCEND FL trial evaluating BREYANZI (lisocabtagene maraleucel) in adult patients with R/R indolent B-cell NHL met its primary endpoint in the MZL cohort.

- In December 2024, the updated results from the Phase II ZUMA-5 trial, showing that treatment with YESCARTA led to durable responses and long-term survival in patients with R/R follicular lymphoma and MZL, were presented at ASH 2024.

- In December 2024, Arcellx announced new positive data from its Phase II pivotal iMMagine-1 study of anitocabtagene autoleucel, in patients with RRMM, at ASH 2024.

- In November 2024, Arcellx announced the upcoming poster presentation of preliminary clinical data in an oral presentation from its iMMagine-1 study Phase I of anitocabtagene autoleucel (anito-cel) in patients with RRMM at the 66th American Society of Hematology (ASH) Annual Meeting 2024.

The abstract list is not exhaustive, will be provided in the final report

Scope of the CAR-T Cell Therapy Market Report

- The CAR-T Cell Therapy market report covers a segment of key events, an executive summary, and a descriptive overview of CAR-T therapy, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the CAR-T therapy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CAR-T therapy market.

CAR-T Cell Therapy Market Report Insights

- CAR-T Therapy Targeted Patient Pool

- Therapeutic Approaches

- CAR-T Therapy Pipeline Analysis

- CAR-T Therapy Market Size

- CAR-T Cell Therapy Market Trends

- Existing and future CAR-T Cell Therapy Market Opportunity

CAR-T Cell Therapy Market Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- CAR-T Cell Therapy Drugs Uptake

- Key CAR-T Cell Therapy Market Forecast Assumptions

CAR-T Cell Therapy Market Report Assessment

- Current CAR-T Cell Therapy Treatment Practices

- CAR-T Cell Therapy Unmet Needs

- CAR-T Cell Therapy Pipeline Product Profiles

- CAR-T Cell Therapy Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions

- What was the CAR-T therapy market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in CAR-T Cell Therapy Market in 2034?

- Which is the most lucrative CAR-T Cell Therapy market?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for CAR-T therapy evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CAR-T therapy? What will be the growth opportunities across the 7MM for the patient population of CAR-T therapy?

- What are the key factors hampering the growth of the CAR-T therapy market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CAR-T therapy?

- What is the cost burden of approved CAR-T Cell Therapy on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The CAR-T Cell Therapy market report will help develop business strategies by understanding the latest trends and changing dynamics driving the CAR-T therapy market.

- Understand the existing CAR-T Cell Therapy market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan.

- Identifying strong upcoming CAR-T Cell Therapy companies in the CAR-T Cell Therapy market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CAR-T Cell Therapy market so that the upcoming CAR-T Cell Therapy companies can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)