Hemodialysis Catheter Market

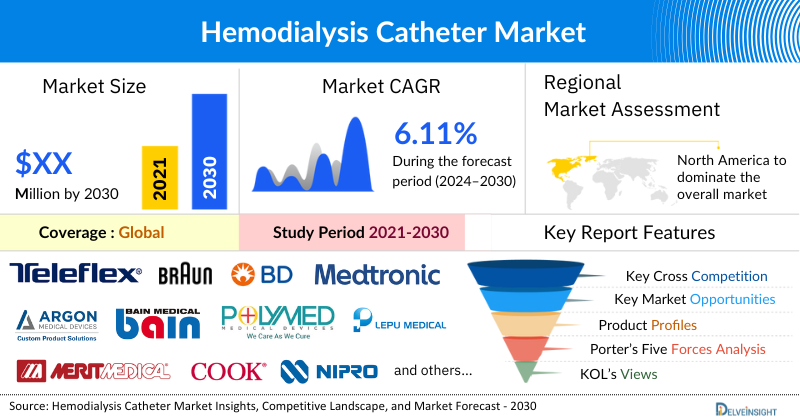

Hemodialysis Catheters Market by Product (Tunneled Catheters and Non-Tunneled Catheters), Material (Silicone and Polyurethane), Lumen (Single Lumen, Double Lumen, and Triple Lumen), End-users (Hospitals, Dialysis Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the increasing prevalence of chronic kidney disorders and growing prevalence of diabetes around the globe.

The hemodialysis catheters market size is estimated to grow at a CAGR of 6.11% during the forecast period from 2024 to 2030. The hemodialysis catheters market is driven by several key factors, including the growing prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD), which require dialysis as a life-sustaining treatment. An aging global population and increasing rates of diabetes and hypertension—major risk factors for kidney failure—also contribute to the rising demand for hemodialysis. Additionally, advancements in catheter technology, such as the development of antimicrobial-coated and biocompatible materials, are improving patient outcomes and boosting market growth. The expansion of healthcare infrastructure, particularly in developing regions, and government initiatives to enhance dialysis access further fuel the market.

Hemodialysis Catheters Market Dynamics:

The hemodialysis catheters market is expected to witness significant growth, driven primarily by the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) worldwide. According to the National Kidney Foundation (2021), around 37 million people in the United States, or approximately 1 in 7 adults, are living with kidney disease, with a staggering 90% of them unaware of their condition. The asymptomatic nature of early-stage kidney disease often leads to late diagnoses, which accelerates the progression to ESRD, where dialysis or a kidney transplant becomes essential for survival. Similarly, data from Public Health England highlights that by 2036, the prevalence of CKD stages 3-5 among individuals aged 16 and older in the UK is projected to rise to 4.2 million. As CKD progresses to ESRD, the need for hemodialysis increases substantially, further boosting the demand for hemodialysis catheters.

A major driver for the hemodialysis catheters market is the global rise in diabetes, which is a leading cause of CKD. The International Diabetes Federation (2021) reported that approximately 537 million people are living with diabetes worldwide, a figure projected to increase to 643 million by 2030. Additionally, nearly half of adults with diabetes (44%) remain undiagnosed, meaning the burden of diabetes-related complications, such as diabetic nephropathy, is likely to rise. Diabetic nephropathy results from prolonged high blood sugar levels, which damage the kidneys, eventually leading to ESRD. Diabetic patients who develop ESRD often require lifelong hemodialysis, typically three times a week, further driving the demand for hemodialysis catheters. This increase in diabetes-related kidney disease is a significant factor contributing to the growth of the market.

However, despite the growing demand, several challenges persist in the hemodialysis catheter market. One major constraint is the risk of complications associated with catheter use, such as infections, thrombosis, and catheter malfunction, which necessitate frequent replacements and higher healthcare costs. The stringent regulatory approval processes for hemodialysis catheters also pose a barrier to market growth, as companies must meet strict safety and efficacy standards before bringing new products to market. These hurdles, though challenging, also underscore the need for ongoing innovation in catheter design and materials to reduce complications and improve patient outcomes.

In conclusion, while the increasing prevalence of CKD, ESRD, and diabetes is fueling demand for hemodialysis catheters, the market is also shaped by the need to overcome associated complications and regulatory barriers. This growing need for effective and safe dialysis solutions presents a lucrative opportunity for innovation and expansion in the hemodialysis catheter market over the coming years.

Hemodialysis Catheters Market Segmnt Analysis:

Hemodialysis Catheters Market by Product (Tunneled Catheters and Non-Tunneled Catheters), Material (Silicone and Polyurethane), Lumen (Single Lumen, Double Lumen, and Triple Lumen), End-users (Hospitals, Dialysis Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product segment of the hemodialysis catheters market, the tunneled catheters category is projected to capture a significant revenue share in 2023 and beyond. This growth is largely driven by the various advantages these catheters offer, making them highly suitable for patients who require long-term hemodialysis. Unlike non-tunneled catheters, which are intended for short-term use, tunneled catheters are specifically designed for extended use, sometimes lasting months or even years. Their placement under the skin provides added stability, reducing movement and minimizing the discomfort and irritation typically associated with external catheters. This feature enhances patient comfort and lowers the need for frequent replacements, making tunneled catheters a more convenient option for long-term care.

Another benefit of tunneled catheters is their ease of use during hemodialysis sessions, simplifying access for healthcare providers and making the process smoother for patients. This contributes to an improved overall treatment experience, as less time is spent managing catheter-related complications. Additionally, many tunneled catheters feature multiple lumens, enabling the simultaneous administration of hemodialysis alongside other therapies, such as medication delivery or parenteral nutrition, which enhances their utility in complex patient cases.

Given these practical benefits—such as enhanced patient comfort, reduced need for replacements, improved treatment efficiency, and versatility in care—the tunneled catheter segment is expected to see significant growth. This surge will be a key driver of the overall hemodialysis catheters market during the forecast period, as demand continues to rise for long-term, reliable catheter solutions in managing chronic kidney disease and end-stage renal disease.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

CAGR |

6.11% (Request Sample To Know More) |

|

Hemodialysis Catheter Market |

~USD XX million by 2030 |

|

Key Hemodialysis Catheters Companies |

Teleflex Incorporated, B. Braun SE, AMECATH, BD, Medtronic, Merit Medical Systems, Cook Medical, Nipro Canada Corporation, Argon Medical Devices., Bain Medical Equipment (Guangzhou)Co., Ltd, Polymedicure, Lepu Medical Technology (Beijing)Co., Ltd., AngioDynamics, Vygon, Henan Tuoren Medical Device Co., Ltd., Intra special catheters GmbH, Harsoria Healthcare Pvt Ltd., Prymax Healthcare LLP, Cardiomac India Private Limited, Newtech Medical Devices, and others. |

North America Expected To Dominate The Overall Hemodialysis Catheters Market:

North America is projected to dominate the hemodialysis catheter market in 2023, driven by several key factors, including the growing prevalence of chronic kidney disease (CKD) and diabetes, as well as the region's advanced healthcare infrastructure and strong focus on research and development. According to data from the Centers for Disease Control and Prevention (CDC), approximately 37 million people in the United States were living with CKD in 2021, representing about 15% of the adult population. This high prevalence underscores the urgent need for effective treatment and management options, including hemodialysis catheters, which are essential for many patients with end-stage renal disease (ESRD). The rising number of CKD cases is expected to significantly boost the demand for hemodialysis catheters across the United States.

In addition to CKD, diabetes is a major contributing factor to kidney disease, with the CDC reporting that 29.7 million Americans, or 8.9% of the population, had diabetes in 2021. High blood sugar levels can cause damage to kidney blood vessels, leading to diabetic nephropathy, a key cause of ESRD. As more diabetes patients progress to kidney failure, the need for hemodialysis treatments—and by extension, hemodialysis catheters—will continue to rise, further driving market growth in North America.

Moreover, the region benefits from a well-established healthcare infrastructure and a robust regulatory environment that fosters innovation and product development. Key product launches and FDA approvals have also contributed to the market's positive growth outlook. For example, in April 2021, BD (Becton, Dickinson and Company) received FDA 510(k) clearance for its Pristine™ Long-Term Hemodialysis Catheter, featuring a unique side-hole free symmetric Y-Tip™ distal lumen design, aimed at improving dialysis efficiency and patient outcomes.

Overall, the rising prevalence of CKD and diabetes, coupled with advancements in catheter technology and the presence of a sophisticated healthcare system, are expected to drive the hemodialysis catheters market in North America during the forecast period. These factors highlight the region's leading role in addressing the growing demand for effective dialysis solutions.

Key Hemodialysis Catheters Companies In The Market Landscape:

Some of the key hemodialysis catheters companies in the market include - Teleflex Incorporated, B. Braun SE, AMECATH, BD, Medtronic, Merit Medical Systems, Cook Medical, Nipro Canada Corporation, Argon Medical Devices., Bain Medical Equipment (Guangzhou)Co., Ltd, Polymedicure, Lepu Medical Technology (Beijing)Co., Ltd., AngioDynamics, Vygon, Henan Tuoren Medical Device Co., Ltd., Intra special catheters GmbH, Harsoria Healthcare Pvt Ltd., Prymax Healthcare LLP, Cardiomac India Private Limited, Newtech Medical Devices, and others.

Recent Development Avtivities In The Hemodialysis Catheters Market:

- In June 2023, Merit Medical Systems, Inc. a leading global manufacturer and marketer of healthcare technology, announced that it has completed the acquisition of a portfolio of dialysis catheter products. Merit also announced the recent acquisition of the Surfacer® Inside-Out® Access Catheter System from Bluegrass Vascular Technologies, Inc.

- In April 2021, BD (Becton, Dickinson and Company) announced that it received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the Pristine™ Long-Term Hemodialysis Catheter, a new hemodialysis catheter with a unique side-hole free symmetric Y-Tip™ distal lumen design.

Key Takeaways From The Hemodialysis Catheters Market Report Study

- Market size analysis for current hemodialysis catheters market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the hemodialysis catheter market.

- Various opportunities available for the other competitors in the hemodialysis catheters market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current hemodialysis catheter market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for hemodialysis catheter market growth in the coming future?

Target Audience Who Can Be Benefited From This Hemodialysis Catheters Market Dynamics Report Study

- Hemodialysis catheter product providers

- Research organizations and consulting companies

- Hemodialysis Catheters - related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in hemodialysis catheters

- Various end-users who want to know more about the hemodialysis catheters market and the latest technological developments in the hemodialysis catheters market.