HER2+ Directed Therapies Market Summary

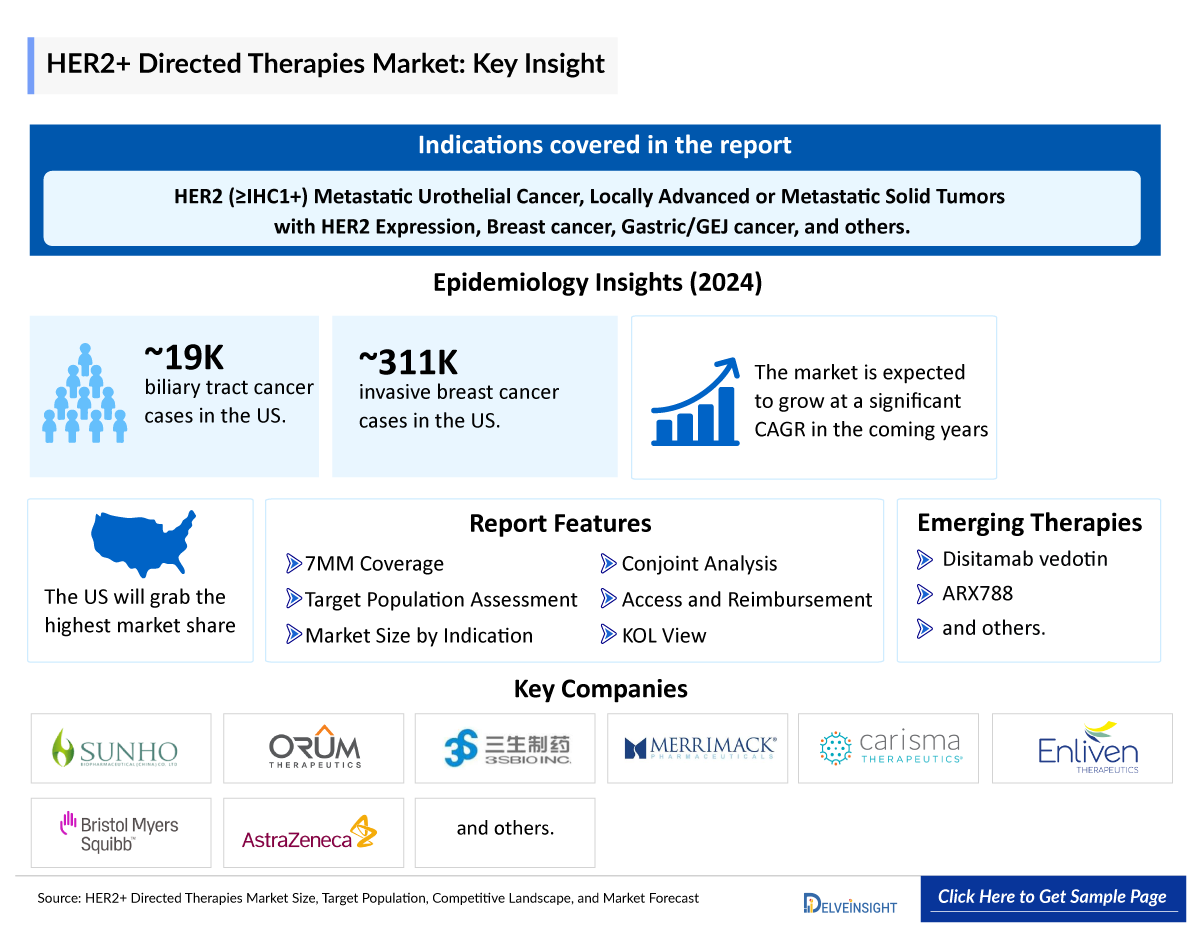

- The HER2+ Directed Therapies market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

HER2+ Directed Therapies Market and Epidemiology Analysis

- HER2-positive (HER2+) cancers have abnormally high levels of the HER2 protein, which fuels rapid and aggressive tumor growth. This marker plays a critical role in driving oncogenesis, making it a prime target for precision therapies.

- Anti-HER2 therapies, also known as HER2-targeted treatments, have transformed the HER2+ cancers management, especially HER2+ breast cancer, and are now expanding into HER2-low subtypes, offering new hope for patients previously deemed ineligible for targeted care.

- These therapies work by blocking HER2 signaling, thereby halting tumor growth and potentially shrinking the cancer.

- According to findings, breast cancer is the most common cancer in women in the US, and HER2-positive breast cancer accounts for ~20 percent of all breast cancer diagnoses.

- The evolution of HER2-directed therapies has been remarkable, moving from foundational monoclonal antibodies like HERCEPTIN (trastuzumab) to advanced antibody-drug conjugates (ADCs) such as KADCYLA (ado-trastuzumab emtansine) and ENHERTU (fam-trastuzumab deruxtecan-nxki), as well as rational combination regimens that address resistance mechanisms and improve outcomes

- FDA-approved HER2+ therapies now include Herceptin (and its biosimilars), PERJETA, MARGENZA, ZIEHERA, TUKYSA, ENHERTU, and others, each offering unique benefits across different stages and subtypes of HER2+ disease.

- While breast cancer remains the cornerstone indication, HER2-directed therapies are rapidly expanding into other solid tumors. Trastuzumab plus chemo is now standard in HER2+ gastric cancer, and promising activity has been seen in lung, colorectal, biliary, and urothelial cancers.

- In a landmark decision, the FDA granted tumor-agnostic approval to ENHERTU in April 2024 for HER2-positive solid tumors that have progressed after prior treatment, paving the way for a biomarker-driven, pan-cancer strategy.

- Additionally, in November 2024, the FDA granted accelerated approval to ZIIHERA (zanidatamab) for previously treated, unresectable or metastatic HER2+ biliary tract cancer.

- Industry leaders like AstraZeneca, Daiichi Sankyo, Pfizer, RemeGen, and Ambrx are aggressively expanding into HER2-expressing cancers beyond the breast, pushing the boundaries of what HER2-targeted medicine can do.

- ENHERTU has rapidly emerged as a major success in oncology. After pioneering the treatment of breast cancer. In 2024, ENHERTU generated combined global sales of USD 3.75 billion for AstraZeneca and Daiichi Sankyo, up from USD 2.57 billion in 2023.

- The loss of exclusivity for key HER2-targeted therapies: HERCEPTIN (trastuzumab, already off-patent), PERJETA (pertuzumab), and KADCYLA (trastuzumab emtansine/T-DM1), combined with the increasing penetration of biosimilars, poses a significant headwind to market growth over the forecast period. These shifts are expected to intensify pricing pressure and erode market share for originator products. In parallel, next-generation ADCs such as disitamab vedotin and others are progressing through late-stage development and securing approvals, adding competitive complexity and potentially redefining the treatment landscape for HER2-positive breast cancer.

- With innovation accelerating, HER2+ therapies are set to play a transformative role across oncology, offering new hope through more precise, personalized, and effective treatment options.

- In April 2024, the FDA granted accelerated approval to ENHERTU for adult patients with unresectable or metastatic HER2-positive solid tumors who have received prior systemic treatment and have no satisfactory alternative treatment options.

- In November 2024, the FDA granted accelerated approval to ZIIHERA for previously treated, unresectable or metastatic HER2-positive biliary tract cancer.

DelveInsight’s “HER2+ Directed Therapies – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the HER2+ Directed Therapies, historical and Competitive Landscape as well as the HER2+ directed therapies market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The HER2+ directed therapies market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM HER2+ Directed Therapies market size from 2020 to 2034. The report also covers current HER2+ directed therapies, treatment practices/algorithms, and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

HER2+ Directed Therapies Understanding and Treatment Algorithm

HER2+ Directed Therapies Overview

HER2 stands for human epidermal growth factor receptor 2. HER2+ means that tumor cells make high levels of a protein called HER2/neu, which has been shown to be associated with certain aggressive types of breast cancer. HER2-positive breast cancers have a lot of the protein called HER2 on the surface of their cells. The HER2 protein is an important driver of cell growth and survival. HER2-targeted therapies are used to treat HER2+ breast cancers. They have no role in the HER2-negative cancers treatment.

Further details related to country-based variations are provided in the report

HER2+ Directed Therapies Market Overview

The HER2-positive (HER2+) directed therapies market is undergoing dynamic expansion, driven by advances in targeted drug development and a growing recognition of HER2 expression across multiple tumor types. HER2+ breast cancer remains the cornerstone of the market, with established therapies like trastuzumab, pertuzumab, and trastuzumab deruxtecan (ENHERTU) significantly improving outcomes and setting benchmarks for efficacy.

Recent years have seen the emergence of next-generation HER2-targeted therapies, including antibody-drug conjugates (ADCs), bispecific antibodies, and tyrosine kinase inhibitors (TKIs), aiming to address resistance and improve outcomes in heavily pretreated or HER2-low populations. The FDA's recent tumor-agnostic approval of Enhertu and approvals in HER2-low breast cancer and biliary tract cancer (zanidatamab) reflect the broadening application of HER2-targeted strategies beyond traditional breast and gastric cancers.

Further details related to country-based variations are provided in the report…

HER2+ Directed Therapies Patient Pool

The HER2+ Directed Therapies epidemiology chapter in the report provides historical as well as forecasted patient pool segmented as total cases of selected indications for HER2+, total eligible patient pool of selected indication for HER2+, total treated cases in selected indications for HER2+ in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- Breast cancer is the most common cancer diagnosed among women in the US. Each year, about 32% of all newly diagnosed cancers in women are breast cancer.

- According to ACS, in 2024, there were 310,720 new cases of invasive breast cancer.

- In 2024, the US accounted for ~19,000 biliary tract cancer cases.

HER2+ Directed Therapies Drug Chapters

The drug chapter segment of the HER2+ directed therapies report encloses a detailed analysis of approved HER2+ directed therapies late-stage (Phase III and Phase II) HER2+. It also helps understand the HER2+ directed therapies clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

HER2+ Directed Marketed Drugs

ENHERTU (fam-trastuzumab deruxtecan-nxki): Daiichi Sankyo/ AstraZeneca

ENHERTU is a HER2-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC technology, ENHERTU is the lead ADC in the oncology portfolio of Daiichi Sankyo and the most advanced programme in AstraZeneca’s ADC scientific platform. ENHERTU consists of a HER2 monoclonal antibody attached to a number of topoisomerase I inhibitor payloads (an exatecan derivative, DXd) via tetrapeptide-based cleavable linkers.

In April 2024, ENHERTU approved in the US as first tumour-agnostic HER2-directed therapy for previously treated patients with metastatic HER2-positive solid tumours. In December 2019, ENHERTU FDA granted accelerated approval (first approval) to ENHERTU for the treatment of adults with unresectable (unable to be removed with surgery) or metastatic HER2-positive breast cancer who have received two or more prior anti-HER2-based regimens in the metastatic setting.

ZIIHERA (zanidatamab-hrii): Jazz Pharmaceuticals

ZIIHERA (zanidatamab-hrii) is a bispecific HER2-directed antibody that binds to two extracellular sites on HER2. Binding of zanidatamab-hrii with HER2 results in internalization, leading to a reduction of the receptor on the tumor cell surface. Zanidatamab-hrii induces complement-dependent cytotoxicity (CDC), antibody-dependent cellular cytotoxicity (ADCC), and antibody-dependent cellular phagocytosis (ADCP). These mechanisms result in tumor growth inhibition and cell death in vitro and in vivo. In the United States, ZIIHERA is indicated for the treatment of adults with previously treated, unresectable or metastatic HER2-positive (IHC 3+) biliary tract cancer (BTC), as detected by an FDA-approved test. The US FDA granted accelerated approval for this indication based on overall response rate and duration of response.

|

Table 1: Comparison of Key Marketed Drugs | |||

|

Product |

Company |

RoA |

Indication |

|

ENHERTU |

Daiichi Sankyo/ AstraZeneca |

IV |

|

|

ZIIHERA |

Jazz Pharmaceuticals |

IV |

|

Note: Detailed current therapies assessment will be provided in the full report of HER2+ Directed Therapies

HER2+ Directed Emerging Drugs

Disitamab vedotin: Pfizer/RemeGen

Disitamab vedotin is a novel HER2-targeted antibody-drug conjugate (ADC), designed to treat tumors with both high and low HER2 expression. It combines a humanized anti-HER2 monoclonal antibody with the cytotoxic agent monomethyl auristatin E (MMAE) via a cleavable linker, enabling targeted delivery of the payload to HER2-expressing cancer cells. Once internalized, MMAE disrupts microtubules, leading to cell cycle arrest and apoptosis. Pfizer and RemeGen have a collaboration agreement to co-develop disitamab vedotin.

ARX788: Ambrx

ARX788, an anti-HER2 ADC currently being studied broadly in breast cancer, gastric/GEJ cancer and other solid tumor clinical trials. The FDA has granted Fast Track Designation for ARX788 in HER2+ metastatic breast cancer and Orphan Drug Designation for ARX788 in gastric cancer.

ARX788 is a homogeneous and highly stable ADC, which targets the HER2 receptor and contains two AS269 cytotoxic payloads site-specifically conjugated to a trastuzumab-based antibody. ARX788 was designed to maximize potential anti-tumor activity by optimizing the number and position of the payloads and the chemical bonds that conjugate the payloads to the antibody.

|

Table 2: Comparison of Key Emerging Drugs | |||||

|

Product |

Company |

RoA |

Phase |

Designation |

Indication |

|

Disitamab vedotin |

Pfizer/RemeGen |

IV |

III |

BTD, FTD |

|

|

ARX788 |

Ambrx |

IV |

II |

FTD;ODD |

|

Note: Detailed emerging therapies assessment will be provided in the final report.

HER2+ Directed Therapies Market Outlook

HER2 is an established therapeutic target in a large subset of women with breast cancer; a variety of agents including trastuzumab, pertuzumab, lapatinib, neratinib, and trastuzumab emtansine (T-DM1) have been approved for the HER2-positive breast cancer treatment. HER2 is also overexpressed in subsets of patients with other solid tumours. Notably, the addition of trastuzumab to first-line chemotherapy has improved the overall survival of patients with HER2-positive gastric cancer and has become the standard-of-care treatment for this group of patients.

The global HER2-directed therapy market is witnessing strong growth, fueled by rising HER2-positive cancer incidence and continued innovation in targeted treatments. Foundational agents like trastuzumab and pertuzumab have transformed outcomes in HER2-positive breast cancer, significantly improving survival. However, resistance remains a clinical challenge, driving the development of next-generation therapies—such as antibody-drug conjugates (ADCs) and bispecific antibodies—that aim to enhance efficacy, address resistance, and extend benefits to pretreated or HER2-low populations. Emerging players, including Pfizer/RemeGen, Ambrx, and AstraZeneca, are broadening the HER2 landscape beyond breast cancer, with promising candidates in urothelial cancer, gastric cancer, and other solid tumors. As these novel agents progress through clinical development, their evolving data will clarify optimal sequencing, combination strategies, and potential to redefine standard of care across multiple tumor types.

HER2+ Directed Therapies Uptake

This section focuses on the uptake rate of potential approved and emerging HER2+ directed therapies expected to be launched in the market during 2020–2034.

HER2+ Directed Therapies Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for HER2+ Directed Therapies market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HER2+ Directed Therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on HER2+ directed therapies evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or HER2+ directed therapies market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“HER2-positive breast cancer is the subtype of breast cancer that’s benefited the most from the development of targeted therapies, [which has] led to the FDA approval of 8 drugs to treat [patients with] HER2-positive disease, all targeting HER2 in various ways.” |

|

“Zanidatamab is an interesting bispecific antibody that binds to 2 different molecules on 2 different epitopes of HER2. Technically, it’s a biparatopic antibody but by binding to 2 separate epitopes on HER2, it can cause differences in internalization and perhaps immune response.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on HER2+ Directed Therapies

-

In April 2024, the FDA granted accelerated approval to ENHERTU for adult patients with unresectable or metastatic HER2-positive solid tumors who have received prior systemic treatment and have no satisfactory alternative treatment options.

-

In November 2024, the FDA granted accelerated approval to ZIIHERA for previously treated, unresectable or metastatic HER2-positive biliary tract cancer.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the HER2+ directed therapies, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the HER2+ directed therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM HER2+ directed therapies market.

HER2+ Directed Therapies Report Insights

- HER2+ Directed Therapies Targeted Patient Pool

- Therapeutic Approaches

- HER2+ Directed Therapies Pipeline Analysis

- HER2+ Directed Therapies Market Size and Trends

- Existing and future HER2+ Directed Therapies Market Opportunity

HER2+ Directed Therapies Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

HER2+ Directed Therapies Report Assessment

- Current Treatment Practices

- HER2+ Directed Therapies Unmet Needs

- HER2+ Directed Therapies Pipeline Product Profiles

- HER2+ Directed Therapies Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the total HER2+ Directed Therapies market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative HER2+ Directed Therapies market?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for HER2+ Directed Therapies evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with HER2+ Directed Therapies? What will be the growth opportunities across the 7MM for the patient population of HER2+ Directed Therapies?

- What are the key factors hampering the HER2+ Directed Therapies market growth?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the HER2+ Directed Therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the HER2+ Directed Therapies market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.