Breast Cancer Market

- According to DelveInsight, Breast Cancer market size is expected to grow at a decent CAGR by 2032

- The total ER+/HER2- Breast Cancer market size in adjuvant/neoadjuvant setting in 2022 was around USD 870 million, and is projected to increase during the forecast period (2023–2032).

- In 2023, it is estimated that there will be 297,790 new cases of female breast cancer in the United States.

- Estrogen receptor alpha (ERa), encoded by the ESR1 gene, is a member of the nuclear hormone receptor superfamily that is expressed in ~70% of newly diagnosed breast cancers.

- Up to 55% of breast cancer patients fall into that HER2-low definition. These patients currently aren’t eligible to receive a HER2-targeted agent.

- Invasive ductal carcinoma makes up about 70–80% of all breast cancers

- Approval of VERZENIO, the CDK4/6 inhibitor in the adjuvant setting, is expected to reap benefits of first mover advantage in this setting

- Upcoming pipeline of ER+, HER2- Breast cancer comprises many next-generation SERD drug candidates. They will face a strong competition from the existing CDK4/6 inhibitors that have a strong hold over majority of the market share. This could lead to their slow growth.

- ORSERDU is the first endocrine innovation in 20 years specifically targeting ESR1 mutations in ER+, HER2-, advanced, or metastatic breast cancer patients with disease progression following at least one line of endocrine therapy.

- ESR1 mutations rarely exist in primary tumors (~ 1%) but are relatively common (10–50%) inmetastatic, endocrine therapy-resistant cancers and are associated with a shorter progression-free survival.

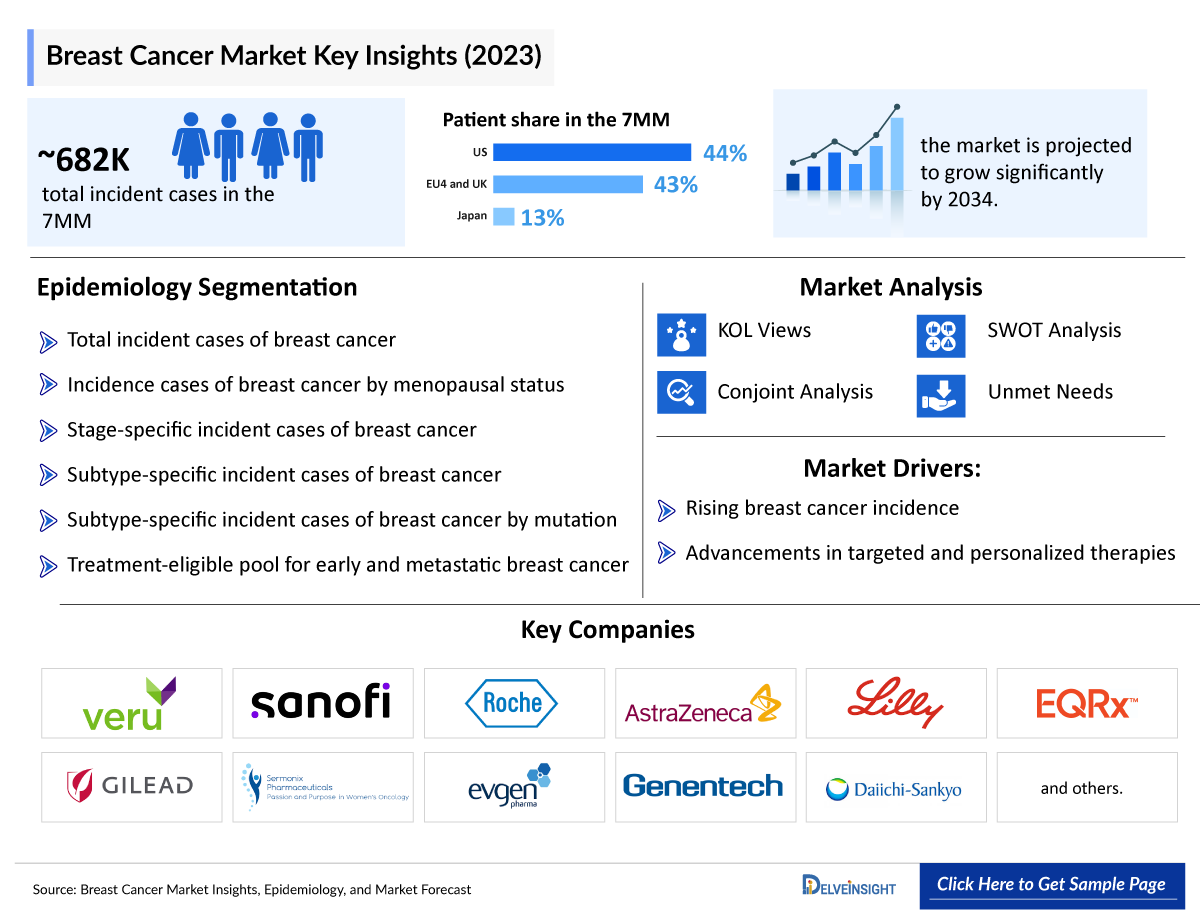

DelveInsight’s “Breast Cancer Market Insights, Epidemiology and Market Forecast – 2032” report delivers an in-depth understanding of Breast Cancer, historical and forecasted epidemiology as well as Breast Cancer market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Breast Cancer market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Breast Cancer market size from 2019 to 2032. The Breast Cancer treatment market report also covers current Breast Cancer treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2019 to 2032 |

|

Forecast Period |

2023-2032 |

|

Geographies Covered |

|

|

Breast Cancer Market |

|

|

Breast Cancer Market Size | |

|

Breast Cancer Companies |

|

Breast Cancer Treatment Market

Breast Cancer Overview

Breast cancer is a disease in which abnormal breast cells grow out of control and form tumours. If left unchecked, the tumours can spread throughout the body and become fatal. Breast cancer cells begin inside the milk ducts and/or the milk-producing lobules of the breast. The earliest form (in situ) is not life-threatening. Cancer cells can spread into nearby breast tissue (invasion). This creates tumours that cause lumps or thickening. Invasive cancers can spread to nearby lymph nodes or other organs (metastasize). Metastasis can be fatal.

Types of Breast Cancer

There are many types of breast cancer, and many different ways to describe them. A breast cancer's type is determined by the specific cells in the breast that become cancer.

Ductal or lobular carcinoma

Most breast cancers are carcinomas, which are tumors that start in the epithelial cells that line organs and tissues throughout the body. When carcinomas form in the breast, they are usually a more specific type called adenocarcinoma, which starts in cells in the ducts (the milk ducts) or the lobules (glands in the breast that make milk).

In situ vs. invasive breast cancers

The type of breast cancer can also refer to whether the cancer has spread or not. In situ breast cancer (ductal carcinoma in situ or DCIS) is a pre-cancer that starts in a milk duct and has not grown into the rest of the breast tissue. The term invasive (or infiltrating) breast cancer is used to describe any type of breast cancer that has spread (invaded) into the surrounding breast tissue.

Triple-negative Breast Cancer (TNBC)

TNBC accounts for about 10-15% of all breast cancers. The term triple-negative breast cancer refers to the fact that the cancer cells don’t have estrogen or progesterone receptors (ER or PR) and also don’t make any or too much of the protein called HER2. (The cells test "negative" on all 3 tests.) These cancers tend to be more common in women younger than age 40, who are Black, or who have a BRCA1 mutation.

Further details related to types are provided in the report…

Breast Cancer Diagnosis

Breast cancer can be diagnosed through multiple tests, including a mammogram, ultrasound, MRI and biopsy. Mammograms: A mammogram is an x-ray of the breast. While screening mammograms are routinely performed to detect breast cancer in women who have no apparent symptoms, diagnostic mammograms are used after suspicious results on a screening mammogram or after some signs of breast cancer alert the physician to check the tissue.

Breast Ultrasound: Breast ultrasound uses sound waves and their echoes to make computer pictures of the inside of the breast. It can show certain breast changes, like fluid-filled cysts, that can be harder to see on mammograms. Ultrasound is not typically used as a routine screening test for breast cancer. But it can be useful for looking at some breast changes, such as lumps (especially those that can be felt but not seen on a mammogram). Ultrasound can be especially helpful in women with dense breast tissue, which can make it hard to see abnormal areas on mammograms. It also can be used to get a better look at a suspicious area that was seen on a mammogram.

Breast MRI: Breast MRI (magnetic resonance imaging) uses radio waves and strong magnets to make detailed pictures of the inside of the breast. Breast MRI might be used in different situations.

To screen for breast cancer: For certain women at high risk for breast cancer, a screening breast MRI is recommended along with a yearly mammogram. MRI is not recommended as a screening test by itself, because it can miss some cancers that a mammogram would find.

To look at the breasts if someone has symptoms that might be from breast cancer: Breast MRI might sometimes be done if breast cancer is suspected (based on symptoms or exam findings, such as suspicious nipple discharge). Other imaging tests such as mammograms and breast ultrasound are usually done first, but MRI might be done if the results of these tests aren’t clear.

To help determine the extent of breast cancer: If breast cancer has already been diagnosed, breast MRI is sometimes done to help determine the exact size and location of the cancer, to look for other tumors in the breast, and to check for tumors in the other breast. Breast MRI isn’t always helpful in this setting, so not every woman who has been diagnosed with breast cancer needs this test.

Further details related to diagnosis are provided in the report…

Breast Cancer Treatment

Treatment for breast cancer depends on the subtype of cancer and how much it has spread outside of the breast to lymph nodes (stages II or III) or to other parts of the body (stage IV). The combine treatments to minimize the chances of the cancer coming back (recurrence) include:

- surgery to remove the breast tumour

- radiation therapy to reduce recurrence risk in the breast and surrounding tissues

- medications to kill cancer cells and prevent spread, including hormonal therapies, chemotherapy or targeted biological therapies.

- Treatments for breast cancer are more effective and are better tolerated when started early and taken to completion.

- Surgery may remove just the cancerous tissue (called a lumpectomy) or the whole breast (mastectomy). Surgery may also remove lymph nodes to assess the cancer’s ability to spread.

- Radiation therapy treats residual microscopic cancers left behind in the breast tissue and/or lymph nodes and minimizes the chances of cancer recurring on the chest wall.

Medical treatments for breast cancers, which may be given before (“neoadjuvant”) or after (“adjuvant”) surgery, is based on the biological subtyping of the cancers. Cancer that express the estrogen receptor (ER) and/or progesterone receptor (PR) are likely to respond to endocrine (hormone) therapies such as tamoxifen or aromatase inhibitors. These medicines are taken orally for 5–10 years and reduce the chance of recurrence of these “hormone-positive” cancers by nearly half. Endocrine therapies can cause symptoms of menopause but are generally well tolerated.

Radiotherapy plays a very important role in treating breast cancer. With early-stage breast cancers, radiation can prevent a woman having to undergo a mastectomy. With later stage cancers, radiotherapy can reduce cancer recurrence risk even when a mastectomy has been performed. For advanced stage of breast cancer, in some circumstances, radiation therapy may reduce the likelihood of dying of the disease.

Further details related to treatment are provided in the report…

Breast Cancer Epidemiology

The Breast Cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of breast cancer, incident cases of breast cancer by menopausal status, stage-specific incident cases of breast cancer, subtype-specific incident cases of breast cancer,subtype-specific incident cases of breast cancer by mutation, and treatment eligible pool for early and metastatic breast cancer in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2019 to 2032.

- Breast cancer is the most common cancer in women in the United States, except for skin cancers. It is about 30% (or 1 in 3) of all new female cancers each year. Approximately 0.5–1% of breast cancers occur in men.

- The breast cancer subtype HR+/HER2- is the most common subtype with an age-adjusted rate of 87.2 new cases per 100,000 women in the United States.

- Based on the menopausal status of women suffering from breast cancer, in the US, the higher number of cases were observed for the postmenopausal Breast cancer, accounting for 80–20% of the cases, while premenopausal women contributed a significantly lesser proportion of the patients.

- Among the various subtypes of the disease (localized and regional), ER+/HER2- occupies the maximum patient pool, with approximately 140,000 cases of this category, followed by the number of those with near about 24,000 cases of Triple-negative and around 20,000 cases of ER+/HER2+ in 2022. On the other hand, HR-/HER2+ accommodated the least number of cases.

Recent Developments in Breast Cancer Clinical Trials

- In September 2025, Shanghai Henlius Biotech and Organon announced that the U.S. FDA approved BILDYOS® (denosumab-nxxp) injection 60 mg/mL and BILPREVDA® (denosumab-nxxp) injection 120 mg/1.7 mL, biosimilars to PROLIA and XGEVA, respectively, for all indications of the reference products. BILDYOS is a RANK ligand (RANKL) inhibitor indicated for osteoporosis treatment in high-risk postmenopausal women and men, glucocorticoid-induced osteoporosis, and bone mass increase in prostate and breast cancer patients receiving specific therapies. Patients with advanced kidney disease face higher risks of severe hypocalcemia, requiring expert supervision before and during treatment.

- In August 2025, Atavistik Bio dosed the first patient in a Phase 1 trial of ATV-1601, a selective inhibitor targeting the AKT1 E17K mutation in solid tumors such as breast, endometrial, and prostate cancers. The drug uses a reversible allosteric mechanism and has shown better efficacy and tolerability than broader AKT inhibitors in preclinical studies.

- In August 2025, Atavistik Bio dosed the first patient in a Phase 1 trial of ATV-1601, a selective inhibitor targeting the AKT1 E17K mutation in solid tumors such as breast, endometrial, and prostate cancers. The drug uses a reversible allosteric mechanism and has shown better efficacy and tolerability than broader AKT inhibitors in preclinical studies.

- In August 2025, Anixa Biosciences, Inc., in collaboration with Cleveland Clinic, began transferring the Investigational New Drug (IND) application that supported the Phase 1 clinical trial of its breast cancer vaccine to Anixa. Having completed enrollment and observed promising immune response data in Phase 1, Anixa plans to move forward with a Phase 2 clinical trial and will take full sponsorship of the IND. To manage this transition and FDA interactions, Anixa has engaged Advyzom, a regulatory consulting firm, as its U.S. regulatory agent.

- In July 2025, an AI-based breast cancer risk technology developed by Washington University and licensed to Prognosia Inc. received FDA Breakthrough Device designation. The software analyzes mammograms to predict a woman’s personalized five-year risk of breast cancer, using both 2D and 3D imaging. This risk score helps clinicians align care with U.S. national risk reduction guidelines. The designation expedites FDA review to accelerate patient access to this promising diagnostic tool.

- In July 2025, SimBioSys® received FDA 510(k) clearance for TumorSight™ Viz 1.3, enhancing its AI platform for breast cancer. The software converts standard breast MRI into 3D visualizations, improving precision in surgical decision-making with better performance and easier integration into clinical workflows.

- In June 2025, Jaguar Health’s family company Napo Pharmaceuticals recapped its May 28 FDA Type C Meeting with the Division of Gastroenterology, discussing statistically significant responder analysis results in adult breast cancer patients from its Phase 3 OnTarget trial.

- In June 2025, results from the Phase III OASIS-4 study showed that elinzanetant significantly reduced moderate to severe vasomotor symptoms (VMS) in women undergoing endocrine therapy for hormone receptor-positive (HR+) breast cancer. Statistically significant improvements were also seen in sleep disturbances, menopause-related quality of life, and VMS severity. The findings were presented at ASCO 2025 and published in the New England Journal of Medicine. OASIS-4 is the first global Phase III trial to evaluate elinzanetant for VMS linked to endocrine therapy in HR+ breast cancer.

- In May 2025, Clairity, Inc. received FDA De Novo authorization for CLAIRITY BREAST, an AI-driven platform that predicts five-year breast cancer risk from routine screening mammograms. The company plans to launch the tool across major health systems throughout 2025.

- In April 2025, AstraZeneca and Daiichi Sankyo’s Enhertu (trastuzumab deruxtecan) was approved in the EU as monotherapy for adults with unresectable or metastatic HR-positive, HER2-low/ultralow breast cancer, after at least one endocrine therapy and when further endocrine therapy is unsuitable.

- In March 2025, the FDA granted orphan drug designation to Nerlynx® (neratinib) for breast cancer patients with brain metastases. Neratinib is a tyrosine kinase inhibitor approved for extended adjuvant treatment of HER2-positive breast cancer after trastuzumab therapy.

- In March 2025, IceCure Medical Ltd. announced it is in ongoing discussions with the FDA regarding its De Novo marketing authorization request for ProSense® in early-stage low-risk breast cancer with endocrine therapy. IceCure develops minimally-invasive cryoablation technology that destroys tumors by freezing, offering an alternative to surgical removal.

- In February 2025, the FDA granted Lumitron Technologies, Inc. "Breakthrough Device" designation for its HyperVIEW™ X-Ray system, which uses the K-Edge subtraction technique to enable contrast-enhanced imaging for breast cancer diagnosis. This technology utilizes Lumitron’s proprietary distributed charge laser-Compton technology, offering 100 times higher resolution and significantly safer imaging compared to standard X-rays.

- In January 2025, the FDA approved AstraZeneca (AZN.L) and Daiichi Sankyo's (4568.T) precision drug, Datroway, for treating advanced breast cancer in patients who have received prior treatment.

- In Dec 2024, ScreenPoint Medical showcased new FDA clearance for advanced capabilities of its leading Breast AI, Transpara, at the 110th Annual Radiological Society of North America (RSNA) meeting (December 1-4, 2024, South Hall #5316). Transpara, the most clinically validated Breast AI on the market, assists radiologists in detecting cancers earlier and reducing recall rates.

- On October 16, 2024, the FDA approved inavolisib (Itovebi), in combination with palbociclib and fulvestrant, for adults with endocrine-resistant, PIK3CA-mutated, hormone receptor-positive, HER2-negative locally advanced or metastatic breast cancer.

- On October 14, 2024, Roche announced FDA approval of its drug inavolisib, under the brand name Itovebi, for treating breast cancer. Inavolisib targets the PI3K pathway, which plays a critical role in cancer cell growth, offering new hope for patients with PIK3CA-mutated breast cancer that has become resistant to other treatments.

- In October 2024, Foundation Medicine received FDA approval for its FoundationOne Liquid CDx to serve as a companion diagnostic for the cancer therapy ITOVEBI (inavolisib), which Roche, Foundation's parent company, developed.

- In October 2024, Novartis announced that the European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP) has issued a positive opinion, recommending marketing authorization for KISQALI (ribociclib) as an adjuvant treatment for adults with early breast cancer (HR+/HER2-), who are at high risk of disease recurrence, including patients with node-negative disease.

Breast Cancer Drug Chapters

The drug chapter segment of the Breast Cancer drugs market report encloses a detailed analysis of marketed and the late-stage (Phase III) pipeline drug. The marketed drugs segment encloses Breast Cancer drugs such as Pfizer (IBRANCE), AstraZeneca (LYNPARZA), and others. Furthermore, the current key Breast Cancer companies for the upcoming emerging drugs and their respective drug candidates include AstraZeneca (camizestrant), Sermonix Pharmaceuticals (lasofoxifene), and others. The drug chapter also helps understand the Breast Cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Breast Cancer Drugs

IBRANCE (palbociclib): Pfizer

Pfizer’s IBRANCE (palbociclib) is a kinase inhibitor approved in the US by the FDA, in Europe by the EMA, and in Japan by PMDA for the treatment of adult patients with HR+ HER2- advanced or metastatic breast cancer in combination with an aromatase inhibitor (AI) as initial endocrine-based therapy in postmenopausal women or men or fulvestrant in patients with disease progression following endocrine therapy. IBRANCE is currently approved in more than 90 countries.

It is used in combination with an aromatase inhibitor as initial endocrine-based therapy in postmenopausal women or men; or fulvestrant in patients with disease progression following endocrine therapy to treat HR+, HER2– advanced, or metastatic breast cancer.

In April 2019, IBRANCE was approved by the US FDA for the treatment of men with HR+, HER2- metastatic breast cancer. The new indication applies to the use of palbociclib (IBRANCE, Pfizer) — a cyclin-dependent kinase 4/6 inhibitor — in combination with specific endocrine therapies. An expanded indication for IBRANCE to include male patients is based upon data from postmarketing reports and electronic health records that showed that the safety profile for men treated with IBRANCE is consistent with the safety profile in women treated with IBRANCE.

LYNPARZA (olaparib): AstraZeneca

LYNPARZA is a poly (ADP-ribose) polymerase (PARP) inhibitor, including PARP1, PARP2, and PARP3. It is used in patients with deleterious or suspected deleterious gBRCAm, HR+ HER2- metastatic breast cancer who have been treated with chemotherapy in the neoadjuvant, adjuvant, or metastatic setting. Patients with HR+ breast cancer can also be treated with prior endocrine therapy or be considered inappropriate for endocrine therapy. This drug is also used as a first-line maintenance treatment of BRCA-mutated advanced ovarian cancer. LYNPARZA is now indicated for the adjuvant treatment of adult patients with deleterious or suspected deleterious gBRCAm HER2- high-risk early breast cancer who have been treated with neoadjuvant or adjuvant chemotherapy.

In March 2022, AstraZeneca and MSD’s LYNPARZA (olaparib) was approved in the US for the adjuvant treatment of patients with germline BRCA-mutated (gBRCAm) HER2- high-risk early breast cancer who have already been treated with chemotherapy either before or after surgery. It is the first and only approved medicine targeting BRCA mutations in early breast cancer.

Note: Detailed marketed therapies assessment will be provided in the final report.

Emerging Breast Cancer Drugs

Camizestrant (AZD9833): AstraZeneca

Camizestrant (AZD9833) is an oral SERD that has shown antitumor efficacy in a range of preclinical models of breast cancer. This compound was a highly potent SERD that showed a pharmacological profile comparable to fulvestrant’s ability to degrade ERa in both MCF-7 and CAMA-1 cell lines. Stringent control of lipophilicity ensured it had favorable physicochemical and preclinical pharmacokinetic properties for oral administration. This is combined with the demonstration of potent in vivo activity in mouse xenograft models.

In June 2020, AstraZeneca initiated a Phase III Breast Cancer clinical trial, SERENA-6, to evaluate the safety and efficacy of AZD9833 in combination with a CDK4/6 inhibitor (palbociclib or abemaciclib) for the treatment of patients with HR+ HER2- metastatic breast cancer with a detectable ESR1 mutation. Moreover, the company has also anticipated for first estimated filing acceptance by 2024. The indication for SERENA-6 has been granted Fast Track Designation by the US FDA.

Lasofoxifene: Sermonix Pharmaceuticals

Lasofoxifene is being investigated as a potent, bioavailable selective estrogen receptor modulator (SERM – also known as an estrogen agonist/antagonist) with a differentiated safety profile that could prove useful in treating postmenopausal women and premenopausal women on ovarian suppression with locally advanced or metastatic ER+ breast cancer. In May 2019, the US FDA granted lasofoxifene Fast Track Designation (FTD) to treat women who have ER+ metastatic breast cancer with an ESR1 mutation.

Lasofoxifene has demonstrated preclinical antitumor activity in ESR1-mutant models and is currently being investigated in different clinical trials. The Phase II ELAINE trial (NCT03781063) explores lasofoxifene vs. fulvestrant in female patients with advanced luminal BC with ESR1 mutations. Moreover, the Phase II ELAINE-2 trial (NCT04432454) currently evaluates the combination of lasofoxifene plus abemaciclib in the same setting. (Sermonix Pharmaceuticals, 2021). Both the ELAINE 1 and ELAINE 2 trials have completed their enrollment. In December 2022, both trial-updated results were presented at the 2022 San Antonio Breast Cancer Symposium (SABCS).

Breast Cancer Drug Classs Insights

The emergence of several novel CDK4/6 inhibitors in ER+/HER2- Breast Cancer space has demonstrated a widespread potential for this patient population in combination and as monotherapy. Moreover, the upcoming SERDS could also muscle its way into this treatment space for this patient pool. The other class of therapies includes AKT inhibitors, mTOR inhibitors, SERMS, PI3K inhibitors, PARP inhibitors, and TROP-2 targeting antibody-drug conjugate.

Breast Cancer Market Outlook

The stage (extent) of breast cancer is an essential factor in making treatment decisions. Most women with breast cancer in Stages I, II, or III are treated with surgery, often followed by radiation therapy. Most women with breast cancer in Stages I–III will get some drug therapy as part of their treatment. This may include chemotherapy, hormone therapy (tamoxifen, an aromatase inhibitor, or one followed by the other), HER2 targeted drugs, such as trastuzumab (Herceptin) and pertuzumab (Perjeta), and some combination of these. The Breast Cancer drugs that might work best depend on the tumor’s hormone receptor status, HER2 status, and other factors.

Among Stage I breast cancers, for women who have an HR+ (ER+ or PR+) breast cancer, most doctors recommend hormone therapy (tamoxifen or an aromatase inhibitor, or one followed by the other) as an adjuvant (additional) treatment, no matter how small the tumor is. Women with tumors larger than 0.5 cm across may be more likely to benefit from it. Hormone therapy is typically given for at least 5 years. If the tumor is larger than 1 cm across, adjuvant chemotherapy is sometimes recommended. A woman’s age at the time of diagnosis may help in deciding if chemotherapy should be offered or not. Some doctors may suggest chemotherapy for smaller tumors as well, especially if they have any unfavorable features (cancer that is growing fast; HR-, HER2+; or having a high score on a gene panel). For HER2+ cancers, 6 months to a year of adjuvant trastuzumab (Herceptin) is usually recommended as well.

Furthermore, systemic therapy is recommended for women with Stage II breast cancer. Some systemic therapies are given before surgery (neoadjuvant therapy), and others are given after surgery (adjuvant therapy). Neoadjuvant treatments are often a good option for women with large tumors because they can shrink the tumor before surgery, possibly enough to make breast-conserving surgery an option. But this does not improve survival more than getting these treatments after surgery. In some cases, systemic therapy may be started before surgery and then continued after surgery.

Most often, Stage III cancers are treated with neoadjuvant chemotherapy (before surgery). For HER2+ tumors, the targeted drug trastuzumab (Herceptin) is given as well, sometimes along with pertuzumab. This may shrink the tumor enough to allow a woman to have breast-conserving surgery (BCS). If the tumor does not shrink enough, a mastectomy is done. Nearby lymph nodes will also need to be checked. A sentinel lymph node biopsy (SLNB) is often not an option for Stage III cancers, so an axillary lymph node dissection (ALND) is usually done.

Among the approved Breast Cancer therapies, CDK4/6 inhibitors (palbociclib, ribociclib, and abemaciclib) have attracted the most attention. CDK4/6 regulate cell cycle progression by their reversible interaction with cyclin D1. Approximately 29 and 14% of patients with HR+/HER2- BC were found to have amplification of cyclin D1 and CDK4, respectively. Importantly, even when hormonal resistance develops, the tumors still depend on CDK4/6-cyclin D1 for proliferation. Therefore, more pronounced G1-S cell cycle arrest was observed in HR+/HER2- BC after treatment with a combination of hormonal therapy and CDK4/6 inhibitor. CDK4/6 inhibitors work by blocking the phosphorylation of retinoblastoma protein, thereby downregulating E2F-response genes to mediate G1-S arrest. They also dephosphorylate the transcription factor Forkhead box protein M1 to inhibit cell proliferation.

- The total ER+/HER2- breast cancer market size in the 7MM was approximately USD 7,400 million in 2022, and is projected to increase during the forecast period (2023–2032).

- The current ER+/HER2- Breast Cancer treatment market in adjuvant and neo adjuvant setting includes aromatase inhibitors, tamoxifen, chemotherapy, CDK4/6 inhibitor-Verzenio and others. The tota ER+/HER2- Breast Cancer US treatment market was valued at approximately USD 6,300 million in 2019.

- Pfizer’s IBRANCE is expected to dominate the first (1L) and second line (2L) market even after the entry of Next generation SERDs during the forecast years.

- In 2022, the ER+/HER2- breast cancer market size in first-line setting in the United States was around USD 3,800 million, and is projected to increase during the forecast period (2023–2032).

Breast Cancer Drugs Uptake

This section focuses on the uptake rate of potential Breast Cancer drugs expected to be launched in the Breast Cancer treatment market during 2019–2032, which depends on the competitive landscape, safety, efficacy data along with order of entry. It is important to understand that the key Breast Cancer companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch and rapid uptake.

The current first-line ER+/HER2- Breast Cancer market is mainly led by CDK4/6 inhibitors. Palbociclib is the leading molecule in the first-line of therapy, as it has also got the first-mover advantage in the first-line and second-line setting, along with the highest Breast Cancer revenue in terms of sales. Based on more penetration power of CDK4/6 inhibitors in this setting, the dominancy level is expected to be much more than SERDS and AKT inhibitors in future. Pfizer’s Ibrance is expected to dominate the first (1L) and second-line (second-line) Breast Cancer market even after the entry of Next-generation SERDs during the forecast years.

Further detailed analysis of emerging therapies drug uptake in the report…

Breast Cancer Pipeline Development Activities

The Breast Cancer treatment report provides insights into therapeutic candidates in Phase III, Phase II stage, Phase I stage. It also analyzes key Breast Cancer companies involved in developing targeted therapeutics.

Breast Cancer Clinical Trials Activities

The Breast Cancer drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging Breast Cancer therapy.

KOL Views on Breast Cancer

To keep up with current Breast Cancer market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Breast Cancer evolving treatment landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including breast surgeons, radiation oncologists, surgical oncologists and others.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Some of the leaders from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, MD Anderson Cancer Center. Their opinion helps to understand and validate current and emerging therapies treatment patterns or, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Breast Cancer market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Breast Cancer therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging Breast Cancer therapies are decided.

Breast Cancer Market Access and Reimbursement

Breast cancer is a disease in which cells in the breast grow out of control. There are different kinds of breast cancer. Nearly 70% of breast cancers are estrogen receptor (ER)-positive, of which many are effectively cured. Despite the availability of effective hormonal and targeted therapies, about half of these patients get a relapse or progress to incurable metastatic disease.

HTA agencies are evaluating the drugs based on the segments they are targeting. The Breast Cancer treatment market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Breast Cancer Market Report

- The Breast Cancer treatment market report covers a segment of key events, an executive summary, descriptive overview of Breast cancer, explaining its causes, signs and symptoms, pathogenesis, and currently used Breast Cancer therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging Breast Cancer therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Breast cancer market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the Breast Cancer drugs market report, covering the 7MM drug outreach.

- The Breast Cancer market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Breast cancer market.

Breast cancer Market Report Insights

- Breast Cancer Patient Population

- Therapeutic Approaches

- Breast cancer Pipeline Analysis

- Breast cancer Market Size

- Breast Cancer Market Trends

- Existing and Future Breast Cancer Market Opportunity

Breast cancer Market Report Key Strengths

- Ten Years Forecast

- The 7MM Coverage

- Breast cancer Epidemiology Segmentation

- Key Cross Competition

- Breast Cancer Drugs Uptake

- Key Breast Cancer Market Forecast Assumptions

Breast Cancer Market Report Assessment

- Current Breast Cancer Treatment Practices

- Breast Cancer Unmet Needs

- Breast Cancer Pipeline Product Profiles

- Breast Cancer Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

FAQs

- What was the Breast cancer market size, the market size by therapies, market share (%) distribution in 2022, and what would it look like by 2032? What are the contributing factors for this growth?

- How will CDK4/6inhibitors as a target class affect the treatment paradigm of Breast Cancer?

- What are the pricing variations among different geographies for approved therapies?

- What can be the future treatment paradigm of Breast Cancer?

- What are the disease risk, burdens, and unmet needs of Breast Cancer? What will be the growth opportunities across the 7MM concerning the patient population with Breast Cancer?

- What is the historical and forecasted Breast Cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What are the current options for the treatment of Breast Cancer? What are the current guidelines for treating Breast Cancer in the US, Europe, and Japan?

- How many emerging Breast Cancer therapies are in the mid-stage and late stage of development for treating Breast Cancer?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitation of existing therapies?

- What is the cost burden of current therapies on the patient?

- What are the country-specific accessibility issues of expensive, current therapies? Focusing on the reimbursement policies.

Reasons to Buy

- The Breast Cancer treatment market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Breast Cancer market.

- Understand the existing Breast Cancer market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Breast Cancer companies in the Breast Cancer market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging Breast Cancer therapies under the Analyst view section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet need of the existing market so that the upcoming Breast Cancer companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- Precautions for Breast Cancer: Empower Yourself Through Knowledge and Action

- Breast Cancer Insights: Identifying Symptoms and Protecting Your Health

- Roche’s HER2-Positive Breast Cancer Treatment Franchise

- 7 Most Common Myths About Breast Cancer Demystified

- Novel Insights Into New Therapies for HR+/HER2- Breast Cancer

- Key Facts to Know About Triple-Negative Breast Cancer in Breast Cancer Awareness Month

- How HR+/ HER2-Breast Cancer Emerging Drugs Will Transform The Market?

- HR+/HER2- Breast Cancer: Unveiling the Worldwide Advances and Strategies

- The Evolving Landscape of ER+ Breast Cancer Treatments

- Metastatic HER2-Positive Breast Cancer Landscape: What You Need to Know

- Latest DelveInsight Blogs

---Market-.png&w=256&q=75)