Metabolic Dysfunction-Associated Steatohepatitis Market

- According to DelveInsight’s analysis, the MASH Market in the 7MM was valued at ~USD 1.8 billion in 2023. Over the forecast period from 2025 to 2034, this MASH Market is projected to grow at a CAGR of 24%.

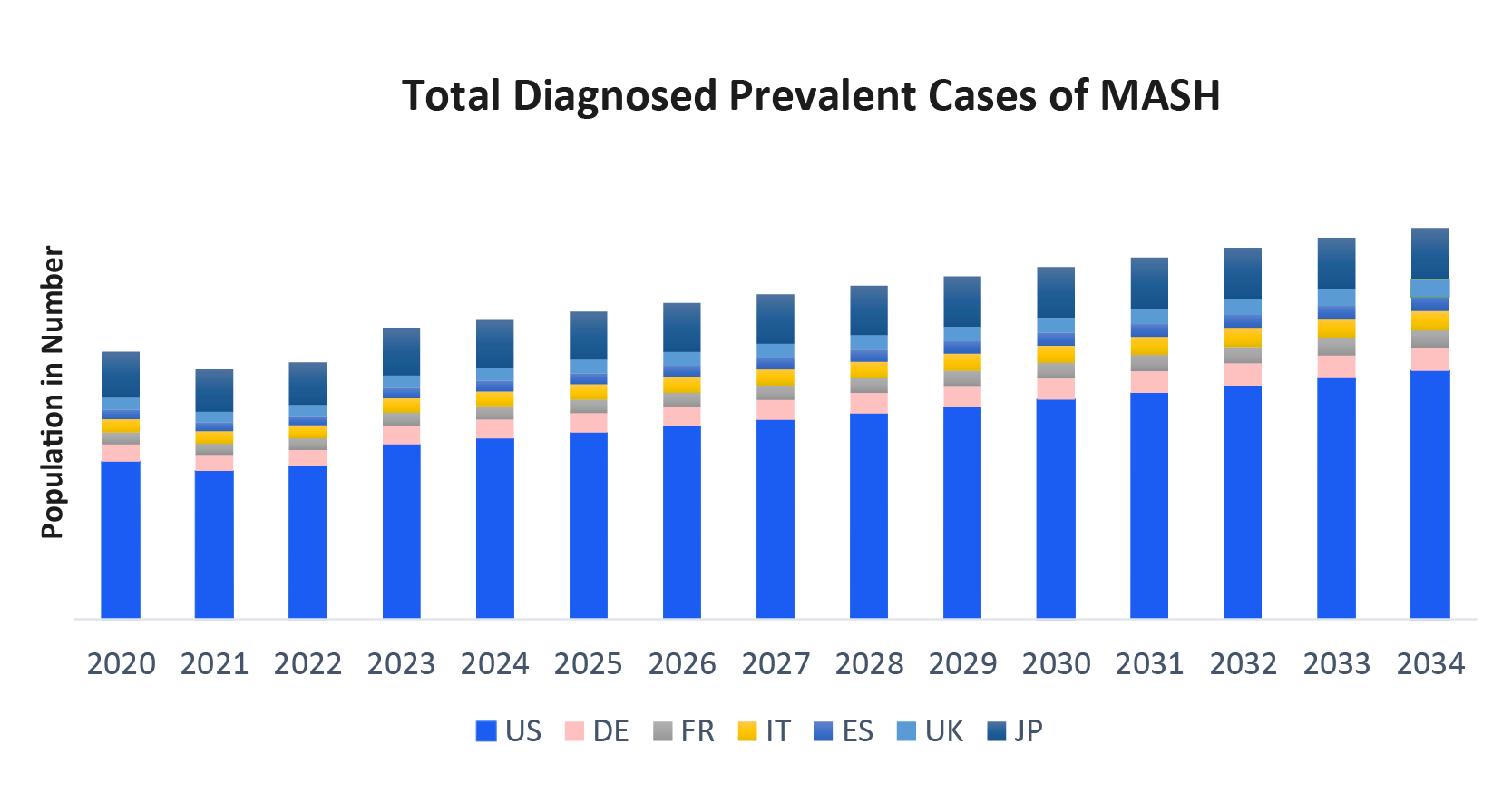

- According to DelveInsight’s estimates, in 2023, there were ~8 million MASH Diagnosed Prevalent Cases in the 7MM. Of these, the United States accounted for 55% of the cases, while EU4 and the UK accounted for nearly 36% and Japan represented 9% of the cases, respectively.

- The MASH Market is expected to experience steady growth with a strong compound annual growth rate projected from 2025 to 2034 across the 7MM. This expansion will be driven by the introduction of innovative therapies, including efruxifermin (EFX), VK2809, efimosfermin alfa (BOS-580), icosabutate, denifanstat, and pegozafermin, among others. Additionally, the rising MASH Prevalence, fueled by increasing obesity, sedentary lifestyles, poor diets, an aging population, and improved awareness and diagnosis, will further support MASH Market Growth.

- The management of MASH/NASH primarily focuses on lifestyle changes to reduce liver fat and slow disease progression. Currently, REZDIFFRA (Resmetirom) is the only US FDA-approved therapy available for MASH Treatment, specifically targeting noncirrhotic NASH with moderate to advanced fibrosis.

- However, a therapeutic gap remains as most treatments address underlying causes rather than reversing fibrosis, leaving many patients without effective therapies. The limited availability of antifibrotic options highlights the need for safe, broad-spectrum antifibrotic agents.

- Efruxifermin, an innovative therapy in development, is currently in Phase III MASH Clinical Trials and is anticipated to launch by 2027 for the MASH Treatment.

- In January 2025, Akero Therapeutics completed enrolment for the double-blind portion of the Phase III SYNCHRONY Real-World study evaluating EFX in patients with MASH or MASLD (F1–F4). Results from the study are expected in the first half of 2026.

To know in detail about MASH Market dynamics, click here @ MASH Treatment Market

DelveInsight’s “MASH Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of MASH, historical and forecasted epidemiology, as well as the MASH market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The MASH Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM MASH market size from 2020 to 2034. The report also covers MASH treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

MASH Treatment Market: Understanding and Algorithm

MASH, previously known as NASH, is a severe and progressive form of Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD), formerly known as non-alcoholic fatty liver disease (NAFLD). It is characterized by liver inflammation and damage along with excess fat accumulation. While MASLD results from fat buildup in the liver, MASH occurs when this buildup triggers inflammation and tissue damage, potentially leading to liver scarring and cirrhosis—a life-threatening condition.

Despite its seriousness, MASH often presents without noticeable symptoms. When symptoms do appear, they may include fatigue and mild pain in the upper right abdomen. As the disease advances to cirrhosis, patients may experience easy bleeding and bruising, jaundice, fluid retention, loss of appetite, nausea, leg swelling, confusion, drowsiness, slurred speech, and spider-like blood vessels on the skin. MASH is most commonly associated with obesity, diabetes, high cholesterol, high triglycerides, poor diet, metabolic syndrome, polycystic ovary syndrome, sleep apnea, and hypothyroidism. Typically, MASH remain asymptomatic in the early stages, but as liver damage progresses, symptoms may become more apparent.

MASH Diagnosis

The MASH Diagnosis is confirmed through a combination of clinical evaluation and specialized tests. Liver biopsy remains the gold standard for diagnosing MASH, providing critical information on liver inflammation, steatosis, and fibrosis staging. Non-invasive tools, such as MR-EFF and FibroScan, are gaining traction for assessing fat content and liver stiffness, offering alternatives to biopsy with reduced risk. Blood tests, including liver enzyme levels, help identify potential liver dysfunction, while imaging techniques like MRI and ultrasound are used to detect hepatic steatosis. In cases where biopsy is not feasible, these methods assist in estimating the severity of liver damage.

Further details related to country-based variations are provided in the report…

MASH Treatment

The MASH Treatment revolves around lifestyle modifications aimed at reducing liver fat and preventing disease progression. Weight loss of 5–10% has been shown to improve both biochemical markers and liver histology, with a combination of calorie reduction, exercise, and a balanced diet as key components. In particular, eliminating high fructose corn syrup and increasing omega-3 fatty acids in the diet have demonstrated benefits. The inclusion of one to two cups of caffeinated drip coffee daily may also reduce liver fibrosis.

Antioxidants like vitamin E can offer modest benefits in non-diabetic patients, though caution is advised with high doses due to the potential risk of increased all-cause mortality. For those with diabetes, the recommended dose of vitamin E should not exceed 400 units per day. Thiazolidinediones may improve insulin sensitivity but have side effects such as weight gain and cardiovascular risks, limiting their use. For patients with advanced liver disease and decompensated cirrhosis, liver transplantation remains the last resort, though there is a risk of NAFLD recurrence post-transplant.

MASH Epidemiology

As the market is derived using a patient-based model, the MASH epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total MASH Prevalence Cases of MASLD/NAFLD, total prevalent cases of MASH/NASH, total diagnosed prevalent cases of MASH/NASH, and severity-specific diagnosed prevalent cases of MASH/NASH in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight's estimates, there were ~215 million prevalent cases of MASLD (formerly known as NAFLD) in the 7MM in 2023, including ~30 million prevalent cases of MASH. Of the total MASH cases, ~8 million were diagnosed in the 7MM.

- Among the 7MM, the US had the highest number of MASH Diagnosed Prevalent Cases, with ~4 million cases in 2023, a figure projected to increase by 2034.

- In 2023, EU4 and the UK accounted for ~3 million MASH diagnosed prevalent cases with Germany having the highest at ~780 thousand cases, followed by Italy with ~615 thousand cases. In contrast, Spain had the least, with ~340 thousand cases.

- In 2023, the UK had ~480 thousand MASH Diagnosed Prevalent Cases.

- In 2023, Japan recorded ~670 thousand MASH diagnosed prevalent cases, a number expected to rise by 2034.

- In 2023, the US had the following severity-specific diagnosed prevalent cases of MASH: ~880 thousand cases at the F0 stage, ~1,610 thousand at the F1 stage, ~880 thousand at the F2 stage, ~510 thousand at the F3 stage, and ~340 thousand at the F4 stage.

Recent Developments and MASH Clinical Trials

- In Sept 2025, Echosens announced FDA CDER acceptance of its Letter of Intent to qualify Liver Stiffness Measurement by FibroScan® as a surrogate endpoint in clinical trials for metabolic dysfunction-associated steatohepatitis (MASH).

- In August 2025, Madrigal Pharmaceuticals announced that the European Commission granted conditional marketing authorization for Rezdiffra (resmetirom) to treat adults with noncirrhotic MASH with moderate to advanced liver fibrosis. Rezdiffra is now the first and only approved MASH therapy in the EU.

- In May 2025, Novo Nordisk announced that it will present new data from its portfolio in metabolic and cardiovascular health at the 32nd European Congress on Obesity (ECO) from May 11–14, 2025. The data will include real-world evidence studies on semaglutide, additional analysis of the SELECT cardiovascular outcomes trial, and part 1 of the phase 3 ESSENCE trial for metabolic dysfunction-associated steatohepatitis (MASH).

- In May 2025, Roche announced the launch of its Elecsys® PRO-C3 test, a new diagnostic solution designed to assess the severity of liver fibrosis in patients with metabolic dysfunction-associated steatotic liver disease (MASLD). Developed in collaboration with Nordic Bioscience, the test provides clinicians with a simple and efficient way to identify patients with liver fibrosis of varying severity, facilitating timely intervention and management of the disease.

- On November 1, 2024, Novo Nordisk announced positive results for semaglutide in treating metabolic dysfunction-associated steatohepatitis (MASH). In the Phase 3 Essence trial, a once-weekly 2.4 mg dose of semaglutide improved liver fibrosis and resolved steatohepatitis without worsening liver fibrosis in MASH patients with stage 2 or stage 3 fibrosis, meeting the primary endpoints.

- On October 29, 2024, Sagimet Biosciences (SGMT) announced that it has successfully completed end-of-Phase 2 interactions with the FDA, paving the way for denifanstat to advance into Phase 3 trials for metabolic dysfunction-associated steatohepatitis.

MASH Drugs Market Chapters

The drug chapter segment of the MASH drugs market report encloses a detailed analysis of MASH-marketed drugs and mid to late-stage (Phase III and Phase II) MASH Pipeline Drugs analysis. It also helps understand the MASH Clinical Trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

MASH Marketed Drugs

- REZDIFFRA (resmetirom): Madrigal Pharmaceuticals

REZDIFFRA (resmetirom), a Thyroid Hormone Receptor-beta (THR-ß) agonist, is approved for treating adults with noncirrhotic MASH and moderate to advanced liver fibrosis (F2-F3), in conjunction with diet and exercise. It received accelerated approval due to improvements in MASH and fibrosis.

In March 2024, the US FDA approved REZDIFFRA for adults with noncirrhotic MASH with moderate to advanced liver fibrosis (F2 to F3).

Madrigal Pharmaceuticals plans a country-by-country launch in Europe, starting in Germany in the second half of 2025, pending EMA approval, making it the first therapy for MASH liver fibrosis in the region. REZDIFFRA’s recommended dosage varies based on body weight, with adjustments for CYP2C8 inhibitors. It works as a partial agonist of THR-ß, primarily reducing intrahepatic triglycerides.

In February 2025, Madrigal announced new two-year data from the compensated MASH cirrhosis arm of the MAESTRO-NAFLD-1 trial, showing the potential benefit of REZDIFFRA in patients with compensated MASH cirrhosis.

MASH Emerging Drugs

- Efruxifermin (EFX): Akero Therapeutics

Efruxifermin (EFX), Akero Therapeutics’ leading candidate for MASH, is an engineered Fc-FGF21 fusion protein mimicking the biological activity of native FGF21. EFX has shown promise in reducing liver fat, inflammation, and fibrosis, while enhancing insulin sensitivity and lipid metabolism. It offers once-weekly dosing and a favorable tolerability profile in clinical trials.

Currently, EFX is being evaluated in three Phase III studies, with encouraging results from Phase II trials showing its potential to reverse fibrosis and improve liver function. The Phase III SYNCHRONY study is expected to provide results in 2026.

EFX has received multiple regulatory designations, including BTD from the US FDA for NASH/MASH in 2022, FTD in 2021, and PRIME designation from the EMA in 2020. Akero acquired exclusive global rights to EFX from Amgen in 2018.

In January 2025, Akero Therapeutics announced preliminary topline Week 96 results from the Phase IIb SYMMETRY study evaluating EFX in patients with compensated cirrhosis.

- VK2809 (TRß Agonist): Viking Therapeutics

VK2809 is an orally available, liver-targeted agonist of the Thyroid Hormone Beta Receptor (TRß), designed to specifically modulate lipid metabolism. By selectively activating TRß in liver tissue, VK2809 aims to improve cholesterol and lipoprotein levels through the upregulation of genes involved in lipid clearance.

The compound has shown significant therapeutic potential in lipid disorders, meeting both primary and secondary endpoints in the Phase IIb VOYAGE study for patients with NASH/MASH and fibrosis, as well as in a Phase IIa study for patients with elevated LDL-C and MASLD.

In November 2024, Viking Therapeutics presented results from the Phase IIb VOYAGE study of VK2809 in biopsy-confirmed NASH/MASH at the 75th Liver Meeting, hosted by the AASLD, including Week 52 secondary endpoint results.

- Efimosfermin alfa (formerly BOS-580): Boston Pharmaceuticals

Efimosfermin alfa (BOS-580), developed by Boston Pharmaceuticals, is a long-acting variant of FGF21 designed to regulate metabolic pathways, reducing liver fat, inflammation, and fibrosis in MASH patients. Manufactured in mammalian cells for human-like glycosylation, it is administered as a once-monthly subcutaneous injection. BOS-580 is currently undergoing Phase II trials for MASH treatment. In September 2020, Boston Pharmaceuticals licensed the genetically engineered FGF21 variant from Novartis, positioning it as a potential best-in-class treatment for MASH.

In November 2024, Boston Pharmaceuticals presented positive Phase II data on efimosfermin alfa (BOS-580) in F2/F3 MASH during a late-breaking oral presentation at AASLD The Liver Meeting.

MASH Drugs Market Insights

Efruxifermin (EFX) is an investigational Fc-FGF21 fusion protein developed by Akero Therapeutics for the treatment of MASH. Designed to mimic the biological activity of FGF21, EFX aims to address key drivers of MASH by reducing liver fat and inflammation, reversing fibrosis, and improving insulin sensitivity and lipid metabolism. In a 96-week Phase IIb study, 39% of patients with compensated cirrhosis due to MASH experienced a reversal of cirrhosis without worsening of the disease, compared to 15% in the placebo group. These promising results have led to the initiation of the Phase III SYNCHRONY clinical program, which includes trials evaluating EFX in patients with pre-cirrhotic MASH (F2-F3 fibrosis) and those with compensated cirrhosis (F4) due to MASH.

Pegozafermin is an investigational glycoPEGylated analog of Fibroblast Growth Factor 21 (FGF21) developed by 89bio for the treatment of MASH and fibrosis. Engineered to mimic and extend the activity of native FGF21, pegozafermin aims to address metabolic abnormalities underlying liver diseases. In a Phase IIb trial, pegozafermin demonstrated significant improvements in liver fibrosis among MASH patients, supporting its progression to Phase III studies. Notably, the ENLIGHTEN-Cirrhosis Phase III trial has been initiated to evaluate its efficacy in MASH patients with compensated cirrhosis (F4), marking the first FGF21 analog to reach this advanced stage in such a population.

MASH Market Outlook

The MASH treatment landscape is rapidly evolving, particularly with the USFDA’s accelerated approval of Madrigal’s REZDIFFRA, now considered a key therapy for patients with moderate to advanced liver fibrosis. This selective thyroid hormone receptor-beta agonist has shifted the approach from invasive liver biopsies to non-invasive diagnostic methods, improving patient access to treatment. The landscape is further shaped by a diverse pipeline of therapies targeting various mechanisms, such as FXR agonists, PPAR modulators, and GLP-1 receptor agonists, with clinical trials exploring combination therapies to address the complex nature of the disease. As researchers focus on personalized medicine and better patient stratification, the priority remains refining treatment strategies while navigating challenges in trial recruitment and regulatory requirements. The combination of emerging therapies and existing lifestyle interventions continues to influence clinical practice in managing MASH/NASH.

Emerging pipeline treatments for MASH include efruxifermin (EFX), VK2809, efimosfermin alfa (BOS-580), icosabutate, denifanstat and pegozafermin, among others.

- The MASH Market Size in 2023 in the 7MM was ~USD 1.8 billion. It is expected to grow at a significant CAGR, reaching a notable value by the end of 2034.

- In 2023, the US represented ~USD 1.3 billion of the 7MM market. According to DelveInsight's analysis, MASH Market Growth is anticipated with the introduction of emerging therapies, leading to an expansion in MASH Market Size throughout the study period (2020–2034). This anticipated growth is driven by advancements in treatment options, greater healthcare access, and a rising MASH Prevalence of the condition, which together foster higher demand for innovative and effective therapies.

- According to DelveInsight’s analysts, the total EU4 and the UK MASH Market Size was found to be ~USD 410 million in 2023, which is further expected to increase in the forecast period (2025–2034).

- The MASH Market Size in Japan was ~USD 80 million in 2023 accounting for 4% of the total market of the 7MM, and it is anticipated to change by 2034.

- Estimates suggest that efruxifermin is expected to generate ~USD 2.3 billion in the 7MM by 2034.

Metabolic Dysfunction-Associated Steatohepatitis Drugs Uptake

This section focuses on the uptake rate of potential MASH drugs expected to be launched in the market during 2020–2034.

Metabolic Dysfunction-Associated Steatohepatitis Pipeline Development Activities

The MASH pipeline segment report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key MASH Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The MASH pipeline segment report covers information on collaborations, acquisitions and mergers, licensing, and patent details for MASH emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on MASH evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of California, US, Arizona Liver Health, US, Houston Research Institute, US , University of Bonn, Germany, Hospital Saint-Antoine - Ap-Hp Sorbonne University, France, Fondazione Policlinico Universitario Agostino Gemelli, Italy, Instituto de Investigaciones Biomédicas August Pi i Sunyer (IDIBAPS), Spain, Royal Infirmary of Edinburgh, UK , and Aichi Medical University, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or MASH market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, MASH affects approximately 5% of the US adult population, driven by the growing burden of obesity, diabetes, and metabolic syndrome. Despite up to 75% of individuals with MASLD having underlying MASH, many remain undiagnosed due to gaps in screening and inconsistent diagnostic pathways. The lack of standardized criteria and reliance on varied data sources contribute to discrepancies in MASH Prevalence estimates, underscoring the urgent need for real-world epidemiological studies. Improved risk stratification and broader adoption of noninvasive diagnostic tools are essential to identifying high-risk patients earlier and mitigating long-term disease burden.

As per the KOLs from France, MASLD is a growing public health challenge in France, particularly among men and those with metabolic risk factors. The link between diabetes and advanced fibrosis highlights the urgency of national screening programs. Strengthening preventive strategies through metabolic health initiatives and physician education is key to reducing long-term disease burden

As per the KOLs from Japan, the increasing prevalence of MASLD and MASH in Japan reflects global trends, yet lean-MASH remains a distinct concern. The interplay between metabolic health and fibrosis progression remains incompletely understood, emphasizing the need for longitudinal studies and improved noninvasive diagnostics to refine risk stratification and treatment pathways

MASH Therapeutics Market: Qualitative Analysis

We perform Qualitative and MASH Therapeutics Market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving MASH treatment market landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

MASH Therapeutics Market Access and Reimbursement

REZDIFFRA

Madrigal offers a Co-pay Savings Card for eligible, commercially insured patients, allowing them to save on REZDIFFRA, with costs as low as USD 10. In 2025, the Inflation Reduction Act (IRA) introduces new affordability options for those on Medicare Part D, aiming to reduce prescription drug costs. These changes focus on making prescription costs more manageable for seniors living in the US.

Starting January 2025, a key change to the Medicare Part D program includes a USD 2,000 annual cap on out-of-pocket prescription drug costs, down from USD 3,250 in 2024. Additionally, the “donut hole” coverage gap will be eliminated. Once the USD 2,000 limit is reached, Medicare will cover any remaining prescription costs for the year.

For individuals who find the USD 2,000 cap financially challenging, the Medicare Prescription Payment Plan (MPPP) can help. The MPPP allows eligible participants to spread their prescription costs across monthly payments. They will receive a monthly statement from their Part D plan showing their costs, which will be evenly distributed over the year. Individuals can join the MPPP at any time, including during open enrollment, by contacting the number on their Part D plan ID card, visiting the plan website, or mailing in a form.

Furthermore, the Extra Help program, also known as the Low-Income Subsidy (LIS), will expand its full benefits to assist people with limited income in obtaining Part D prescription drug coverage. In 2024, participants may qualify for this subsidy if they earn up to USD 22,590 annually (for a single person) or USD 30,660 (for a couple) and meet other requirements. Additionally, their assets must be below USD 17,220 (for a single person) or USD 34,360 (for a couple) to be eligible. The income limits are updated annually based on the Federal Poverty Level.

The MASH Therapeutics Market Report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

MASH Therapeutics Market Report Scope

- The MASH therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current MASH Treatment Market Landscape.

- A detailed review of the MASH Therapeutics Market, historical and forecasted MASH Treatment Market Size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The MASH Therapeutics Market Report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM MASH drugs market.

MASH Therapeutics Market Report Insights

- Patient-based MASH Market Forecasting

- Therapeutic Approaches

- MASH Pipeline Drugs Analysis

- MASH Market Size and Trends

- Existing and Future MASH Drugs Market Opportunity

MASH Therapeutics Market Report Key Strengths

- 10 years MASH Market Forecast

- The 7MM Coverage

- MASH Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- MASH Drugs Uptake and Key MASH Market Forecast Assumptions

MASH Therapeutics Market Report Assessment

- Current MASH Treatment Market Practices

- MASH Unmet Needs

- MASH Pipeline Drugs Profiles

- MASH Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

MASH Treatment Market Insights

- What was the MASH Treatment Market Size, the MASH Market Size by therapies, and MASH Drugs Market Share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will REZDIFFRA affect the treatment paradigm of MASH?

- How will efruxifermin (EFX) compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

MASH Epidemiology Insights

- What are the disease risks, burdens, and MASH Unmet Needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to MASH?

- What is the historical and forecasted MASH patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent MASH population during the forecast period (2025–2034)?

- What factors are contributing to the growth of MASH cases?

Current MASH Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of MASH? What are the current clinical and treatment guidelines for treating MASH?

- How many companies are developing therapies for the MASH Treatment?

- How many emerging therapies are in the mid-stage and late stage of development for treating MASH?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted MASH Drugs Market?

Reasons to Buy

- The MASH Drugs Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the MASH market.

- Insights on patient burden/disease MASH Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing MASH drugs market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the MASH drugs market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for MASH, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing MASH drugs market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs