Nonalcoholic Steatohepatitis Market Summary

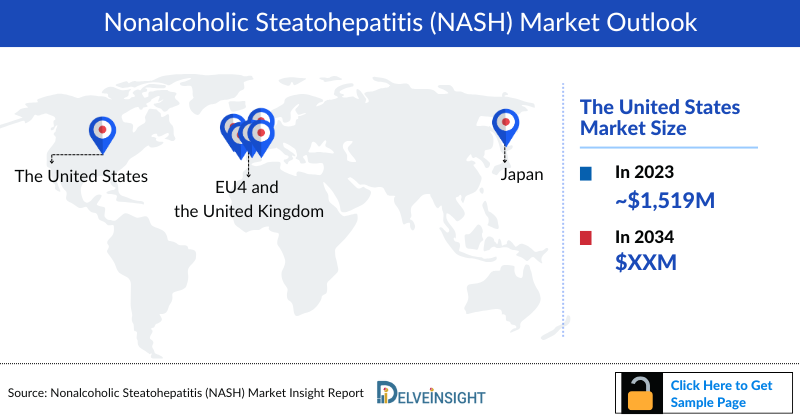

- The NASH Market Size in the 7MM was approximately ~USD 2,114 million in 2023 and is projected to increase during the forecast period (2024–2034). in the leading countries (US, EU4, UK and Japan).

NASH Market and Epidemiology Analysis

- In 2023, the NASH Market Size was highest in the US among the 7MM, accounting for approximately USD 1,519 million which is further expected to increase by 2034.

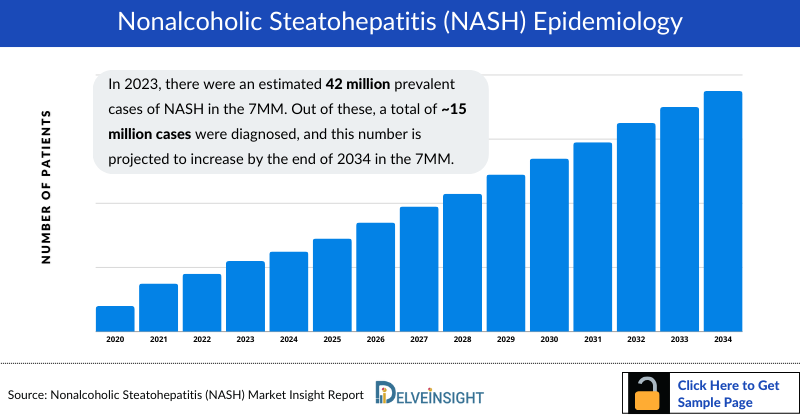

- In 2023, there were an estimated 42 million NASH Prevalence Cases in the 7MM. Out of these, a total of ~15 million cases were diagnosed, and this number is projected to increase by the end of 2034 in the 7MM.

- The Nonalcoholic Steatohepatitis Severity-specific Prevalence Cases are divided into the following groups: F0 Stage, F1 Stage, F2 stage, F3 stage, and F4 stage. In the United States, a higher number of cases were observed in the F1 stage compared to others, comprising around 38% of the total diagnosed cases in 2023.

- In 2023, of the Nonalcoholic Steatohepatitis Gender-specific Diagnosed Prevalent Cases in EU4 and the UK nearly 2,018 thousand cases occurred in males and 1,656 thousand cases among females. It is projected that by 2034, the number of cases will increase more significantly in males compared to females.

- In November 2024, Novo Nordisk announced positive results for semaglutide in treating Nonalcoholic Steatohepatitis. In the Phase 3 Essence trial, a once-weekly 2.4 mg dose of semaglutide improved liver fibrosis and resolved steatohepatitis without worsening liver fibrosis in NASH patients with stage 2 or stage 3 fibrosis, meeting the primary endpoints.

- In October 2024, Sagimet Biosciences (SGMT) announced that it has successfully completed end-of-Phase 2 interactions with the FDA, paving the way for denifanstat to advance into Phase 3 trials for metabolic dysfunction-associated steatohepatitis.

- In March 2024, Madrigal Pharmaceuticals’ groundbreaking product, REZDIFFRA (resmetirom), a once-daily, oral THR-ß agonist, received accelerated endorsement from the US FDA based on results from the Phase III MAESTRO-NASH trial. This approval marks a significant stride in the medical landscape, as REZDIFFRA becomes the inaugural and sole FDA-sanctioned therapy for adults afflicted with non-cirrhotic NASH, accompanied by moderate to advanced liver scarring (fibrosis) corresponding to stages F2–F3 fibrosis.

- The emerging drug Pegozafermin is expected to launch in the US NASH market by 2026, the drug has the potential to reduce the disease burden of Nonalcoholic Steatohepatitis in the forecasted years.

Request for Unlocking the Sample Page of the "Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market"

Key Factors Driving NASH Market

Nonalcoholic Steatohepatitis Rising Prevalence

In 2023, the 7MM recorded approximately 42 million NASH cases, with around 15 million diagnosed. The US accounted for the largest share of the market at USD 1,519 million. Increasing obesity, diabetes, and metabolic syndrome prevalence are driving a rise in diagnosed cases, with projections indicating continued growth through 2034.

Nonalcoholic Steatohepatitis Market Dynamics

NASH severity-specific prevalence shows the F1 stage as the most common in the US, representing 38% of diagnosed cases. Gender-specific analysis in EU4 and the UK highlights a higher male prevalence, with 2,018 thousand male cases versus 1,656 thousand female cases. Growing awareness, improved diagnostic tools, and rising lifestyle-related risk factors are key drivers of market expansion.

Nonalcoholic Steatohepatitis Treatment Landscape

Current treatment approaches include lifestyle modifications, metabolic modulators, and emerging pharmacotherapies targeting fibrosis and steatohepatitis resolution. Semaglutide demonstrated efficacy in the Phase 3 ESSENCE trial, improving liver fibrosis and resolving steatohepatitis without worsening fibrosis. REZDIFFRA (resmetirom) received accelerated FDA approval as the first therapy for adults with non-cirrhotic NASH and F2–F3 fibrosis, marking a milestone in NASH management. Denifanstat has progressed to Phase 3 following successful FDA end-of-Phase 2 interactions.

Nonalcoholic Steatohepatitis Clinical Trials and Emerging Therapies

Pegozafermin (BIO89-100) by 89bio targets FGF21 to improve glucose and lipid metabolism, with Phase III ENLIGHTEN-Cirrhosis trial initiated in May 2024. Efruxifermin (EFX) by Akero Therapeutics is a differentiated Fc-FGF21 fusion protein in the Phase III SYNCHRONY Outcomes study for F4 NASH patients. Belapectin by Galectin Therapeutics targets galectin-3 to address fibrosis and is being evaluated in the adaptive Phase IIb/III NAVIGATE trial, with interim results expected in Q4 2024. These emerging therapies indicate a robust pipeline poised to address unmet clinical needs in NASH.

DelveInsight's "Nonalcoholic Steatohepatitis Diagnostics Market Insights, Epidemiology, and Market Forecast-2034" report delivers an in-depth understanding of the Nonalcoholic Steatohepatitis, historical and forecasted epidemiology as well as the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The Nonalcoholic Steatohepatitis Diagnostics Market Report provides current treatment practices, emerging drugs, NASH Market Share of the individual therapies, current and forecasted Nonalcoholic Steatohepatitis Treatment Market Size from 2020 to 2034 segmented by seven major markets. The Report also covers current Nonalcoholic Steatohepatitis Treatment Market practice/algorithm, market drivers, market barriers and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Nonalcoholic Steatohepatitis Diagnostics Market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2023-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Nonalcoholic Steatohepatitis Diagnostics Market |

|

|

Nonalcoholic Steatohepatitis Market Size | |

|

Nonalcoholic Steatohepatitis Companies |

Inventiva Pharma, Zydus Therapeutics, Novo Nordisk A/S, Eli Lilly and Company, Madrigal Pharmaceuticals, Inc, Terns, Inc., Intercept Pharmaceuticals, Enyo Pharma, 89bio, Inc., Akero Therapeutics, Inc, and others. |

|

Nonalcoholic Steatohepatitis Epidemiology Segmentation |

|

Nonalcoholic Steatohepatitis Treatment Market

Nonalcoholic Steatohepatitis is the progressive form of liver injury that carries a risk of progressive fibrosis, cirrhosis, and end-stage liver disease. It is a common chronic liver disease and defined as liver inflammation and damage caused by buildup of fat in the liver. Much like adults, children who have certain unhealthyconditions may also develop NAFLD and NASH. It is still not known of why some children with NAFLD have simple fattyliver while others have NASH.

Many people have a buildup of fat in the liver, and for most people there are usually no symptoms and no problems,whereas, in some people, the fat causes inflammation and damages the cells in liver and because of this damage, theliver is unable to work as it should. NASH is similar to the kind of liver disease that is caused by long-term, heavydrinking and if someone has NASH, their liver has a high percentage of fat with swollen sustained damage, causingfibrosis, or scarring. If the scarring is remarkably significant, it may lead to cirrhosis, a condition that causes permanentliver damage.

According to the American Liver Foundation, the exact cause of NAFLD is not known. The likely cause to develop NAFLD – either simple fatty liver or NASH – is in case of overweight or obesity, type 2 diabetes or pre-diabetes,abnormal levels of fats reported in blood, and others.

Nonalcoholic Steatohepatitis Diagnosis

This segment of the report covers the detailed diagnostic methods or tests for Nonalcoholic Steatohepatitis.

Nonalcoholic Steatohepatitis Treatment

It covers the details of conventional and current medical therapies available in the NASH Market for the treatment of the condition. It also provides Nonalcoholic Steatohepatitis treatment algorithms and guidelines in the United States, Europe, and Japan.

Nonalcoholic Steatohepatitis Epidemiology

The Nonalcoholic Steatohepatitis epidemiology section provides insights about the historical and current Nonalcoholic Steatohepatitis patient pool and forecasted trends for individual seven major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the NASH Market report also provides the diagnosed patient pool and their trends along with assumptions undertaken.

Key Findings from the Nonalcoholic Steatohepatitis Epidemiology Analysis and Forecast

The disease epidemiology covered in the report provides historical as well as forecasted Nonalcoholic Steatohepatitis epidemiology scenario in the 7MM covering the United States, EU5 countries (Germany, Spain, Italy, France, and the United Kingdom), and Japan from 2020 to 2034.

- Based on DelveInsight's estimates, the United States had the highest number of Nonalcoholic Steatohepatitis Diagnosed Prevalence Cases in 2023, with a total of ~9.4 million cases. Following the US, EU4 and the UK had ~3.6 million cases, while Japan had ~2.5 million cases.

- The categorization based on gender, showed that Nonalcoholic Steatohepatitis diagnosed prevalent cases in males were higher than in females in the 7MM. The male-diagnosed prevalent cases accounted for 56% of the total cases in the 7MM.

- Japan accounted for approximately 16% of the total NASH Diagnosed Prevalent Cases in the 7MM in 2023. These cases are expected to increase in the study period (2020–2034).

Nonalcoholic Steatohepatitis Epidemiology Segmentation

- Total Nonalcoholic Steatohepatitis Prevalence Cases

Total Nonalcoholic Steatohepatitis Diagnosed Prevalence Cases

Nonalcoholic Steatohepatitis Gender-specific Diagnosed Prevalence Cases

Nonalcoholic Steatohepatitis Severity-specific Diagnosed Prevalence Cases

Nonalcoholic Steatohepatitis Drugs Market Chapters

The drug chapter segment of the Nonalcoholic Steatohepatitis drugs market report encloses a detailed analysis of Nonalcoholic Steatohepatitis off-label drugs and late-stage (Phase-III and Phase-II) Nonalcoholic Steatohepatitis pipeline drugs analysis. It also helps to understand the Nonalcoholic Steatohepatitis clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Nonalcoholic Steatohepatitis Marketed Drugs

-

REZDIFFRA (resmetirom): Madrigal Pharmaceuticals

REZDIFFRA is indicated in conjunction with diet and exercise for the treatment of adults with noncirrhotic NASH with moderate to advanced liver fibrosis (consistent with stages F2 to F3 fibrosis). The emergence of the inaugural medication for NASH is a true game-changer for healthcare providers, the research community, and, most importantly, patients living with this serious liver condition. Based on the robust efficacy and safety data generated in two large Phase III MAESTRO studies, it is believed that REZDIFFRA will become the foundational therapy for patients with NASH with moderate to advanced liver fibrosis. As well as since now that the FDA has approved REZDIFFRA for NASH, NASH Companies will have a better understanding of the thresholds they must meet to get future approvals.

Physicians hope the REZDIFFRA’s approval “energizes” the field and leads to more treatment advances. Madrigal Pharmaceuticals has already garnered widespread support among physicians. A significant portion of gastroenterologists plan to incorporate the brand into their practice within six months of its launch. They estimate that over a third of their patients with NASH/NASH could benefit from the drug, suggesting rapid adoption and utilization. Physicians are hopeful that insurance providers will cover the cost of REZDIFFRA and are poised to offer it to eligible NASH patients once it becomes available.

Emerging NASH Drugs

-

Pegozafermin: 89bio, Inc

Pegozafermin or BIO89-100 is a compound that specifically targets and activates a receptor known as fibroblast growth factor 21 (FGF21). FGF21 is a hormone involved in regulating glucose and lipid metabolism, and it has been shown to have potential therapeutic effects in NASH.

NASH Preclinical studies and early-stage clinical trials of BIO89-100 have shown promising results in improving metabolic parameters and reducing liver fat accumulation in patients with NASH.

- In May 2024, 89bio initiated Phase III ENLIGHTEN-Cirrhosis Trial of Pegozafermin in NASH patients with compensated cirrhosis.

- In October 2024, 89bio, Inc. reported that new analyses from the Phase IIb ENLIVEN trial, which investigates the efficacy of pegozafermin in patients with NASH and fibrosis, will be presented in four poster sessions at the 75th Annual American Association for the Study of Liver Diseases (AASLD) The Liver Meeting 2024 in November 2024 in San Diego, California.

-

Efruxifermin (EFX): Akero Therapeutics, Inc.

Efruxifermin (EFX), is Akero’s lead product candidate for NASH. It is a differentiated Fc-FGF21 fusion protein engineered to mimic the balanced biological activity profile of native FGF21, an endogenous hormone that alleviates cellular stress and regulates metabolism throughout the body. EFX is designed to offer convenient once-weekly SC dosing. The consistency and magnitude of observed effects position EFX to be a potentially best-in-class medicine, if approved, for treating NASH.

In June 2024, the company initiated the SYNCHRONY Outcomes study, a Phase III trial evaluating the efficacy and safety of efruxifermin (EFX) in patients with compensated cirrhosis, F4 due to NASH.

-

Belapectin: Galectin Therapeutics

Belapectin a complex carbohydrate drug, targets galectin-3, a critical protein in fatty liver disease and fibrosis pathogenesis. Galectin-3 plays a major role in organ scarring diseases, including the liver, lung, kidney, heart, and vascular systems fibrotic disorders. The drug binds to galectin-3 proteins and disrupts its function.

In April 2024, the company reported the positive outcome of its fifth independent data and safety monitoring board (DSMB) meeting for NAVIGATE, its seamless, adaptive, Phase IIb/III study of belapectin in patients with cirrhotic portal hypertension caused by NASH. The topline results from the interim analysis of the Phase IIb (Stage 1) portion of NAVIGATE is expected in the fourth quarter of 2024.

NASH Market Outlook

Until mid-March, the Nonalcoholic Steatohepatitis Therapeutics Market Landscape lacked FDA, EMA, or PMDA-approved medications, relying primarily on lifestyle adjustments like diet and exercise. Supplemental interventions encompassed off-label usage of vitamin E and antidiabetic agents (e.g., pioglitazone, liraglutide) and liver transplantation in case of severe stages. Given NASH’s multifaceted pathogenesis, effective treatment demands comprehensive targeting of various cellular and molecular pathways.

The Nonalcoholic Steatohepatitis Incidence is significantly associated with T2DM and obesity, especially in patients with a higher body mass index (BMI). In contrast, the Nonalcoholic Steatohepatitis Incidence is decreased in patients with T2DM, who received treatments such as (sodium-glucose cotransporter-2) SGLT2 Inhibitors, GLP-1 receptor antagonists, and insulin. Vitamin E, known for its antioxidant effects, is considered a first-line pharmacological treatment in managing NASH, especially when diet and other lifestyle changes are insufficient. Antifibrotic reagents can prevent the progression of liver fibrosis and MASLD to fibrotic NASH. The effects of pioglitazone (anti-diabetes agents) on NASH histology with T2D have been extensively established, but several concerns exist, such as body weight gain, fluid retention, cancer incidence, and bone fracture. In addition, there are some other targets for MASLD and NASH treatments, such as G protein-coupled receptors (GPCRs), estrogen-related receptor alpha (ERRa), bone morphogenetic proteins (BMPs), and KLFs. Bariatric surgery (BS) or weight loss surgery is the most effective way to treat obesity and diabetes by reducing food absorption and modulating gut hormone secretion and metabolic dysfunction.

American Association for the Study of Liver Diseases (AASLD) MASLD practice guidance statement recommends off-label use of vitamin E in noncirrhotic, non-diabetic patients with biopsy-proven NASH and pioglitazone for the management of diabetic patients with biopsy-proven NASH.

In conclusion, the advent of REZDIFFRA marks a significant breakthrough in NASH treatment, offering hope and promise to millions affected by this complex liver condition. As the pioneering FDA-approved therapy for NASH, REZDIFFRA leads innovation, transforming treatment. While other emerging therapies such as lanifibranor, VK2809, Semaglutide, and others show promise in addressing NASH, REZDIFFRA’s unique efficacy and safety profile position it as the cornerstone of NASH management. As we navigate this dynamic era of medical advancement, REZDIFFRA stands as a guiding light, illuminating the path toward a future where effective treatment and improved outcomes are within reach for all those affected by NASH.

Key Findings from the Nonalcoholic Steatohepatitis Market Analysis

This section includes a glimpse of the NASH Market in 7MM.

- The Nonalcoholic Steatohepatitis Market Size in the 7MM was approximately ~USD 2,114 million in 2023 and is projected to increase during the forecast period (2024–2034).

- Among European countries, Germany accounted for the maximum Nonalcoholic Steatohepatitis Market Size of USD 89 million in 2023 while Spain occupied the bottom of the ladder in the same year with USD 50 million.

- The Nonalcoholic Steatohepatitis Market Size in Japan was nearly USD 260 million in 2023, which is further expected to increase by 2034.

Nonalcoholic Steatohepatitis Drugs Uptake

This section focuses on the uptake rate of potential NASH drugs expected to launch in the NASH market during 2020–2034. For example, Lanifibranor/ IVA337 in the US is expected to be launched by 2027 with a peak share of 2.9%. HPG1860 is anticipated to take 7 years to peak with slow-medium uptake. Nonalcoholic Steatohepatitis Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of NASH Market Share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Nonalcoholic Steatohepatitis Pipeline Development Activities

The Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market Report provides insights into Nonalcoholic Steatohepatitis clinical trials within Phase II, and Phase III stage. It also analyses Nonalcoholic Steatohepatitis Companies involved in developing targeted therapeutics.

NASH Pipeline Development Activities

The Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market report covers the detailed information of collaborations, acquisition, and merger, licensing, patent details, and other information for Nonalcoholic Steatohepatitis emerging therapies.

Reimbursement Scenario

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In a report, we take reimbursement into consideration to identify economically attractive indications and NASH Market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

Latest KOL Views on the Nonalcoholic Steatohepatitis Potential Patient Population

To keep up with current Nonalcoholic Steatohepatitis Treatment Market trends, we take KOLs and SMEs ' opinion working in the Nonalcoholic Steatohepatitis domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies treatment patterns or NASH Market trends. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the Nonalcoholic Steatohepatitis Treatment Market and the unmet needs.

Competitive Intelligence Analysis

We perform Competitive and NASH Market Intelligence analysis of the NASH Market by using various Competitive Intelligence tools that include - SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market Report

- The Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market report covers the descriptive overview, explaining its causes, signs and symptoms, pathophysiology, diagnosis and currently available therapies

- Comprehensive insight has been provided into the Nonalcoholic Steatohepatitis epidemiology and treatment in the 7MM

- Additionally, an all-inclusive account of both the current and Nonalcoholic Steatohepatitis Emerging Therapies is provided, along with the assessment of new therapies, which will have an impact on the current Nonalcoholic Steatohepatitis Treatment Market Landscape

- A detailed review of the Nonalcoholic Steatohepatitis Treatment Market; historical and forecasted is included in the report, covering drug outreach in the 7MM

- The Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market Report provides an edge while developing business strategies, by understanding trends shaping and driving the global NASH Market

Nonalcoholic Steatohepatitis Treatment Market Report Highlights

- In the coming years, the NASH Market is set to change due to the rising awareness of the disease, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The NASH Companies and academics are working to assess challenges and seek opportunities that could influence Nonalcoholic Steatohepatitis R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Major NASH Companies are involved in developing therapies for Nonalcoholic Steatohepatitis. The launch of emerging therapies will significantly impact the Nonalcoholic Steatohepatitis market

- A better understanding of disease pathogenesis will also contribute to the development of novel therapeutics for Nonalcoholic Steatohepatitis

- Our in-depth analysis of the Nonalcoholic Steatohepatitis pipeline assets across different stages of development (Phase III and Phase II), different emerging trends and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Nonalcoholic Steatohepatitis Treatment Market Report Insights

- Patient-based Nonalcoholic Steatohepatitis Market Forecasting

- Nonalcoholic Steatohepatitis Therapeutics Market Approaches

- Nonalcoholic Steatohepatitis Pipeline Drugs Analysis

- Nonalcoholic Steatohepatitis Market Size and Trends

- Nonalcoholic Steatohepatitis Treatment Market Opportunities

- Impact of upcoming Nonalcoholic Steatohepatitis Therapies

Nonalcoholic Steatohepatitis Treatment Market Report Key Strengths

- 11 Years Nonalcoholic Steatohepatitis Market Forecast

- 7MM Coverage

- Nonalcoholic Steatohepatitis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Nonalcoholic Steatohepatitis Treatment Market

- Nonalcoholic Steatohepatitis Drugs Uptake

Nonalcoholic Steatohepatitis Treatment Market Report Assessment

- Current Nonalcoholic Steatohepatitis Treatment Practices

- Nonalcoholic Steatohepatitis Unmet Needs

- Nonalcoholic Steatohepatitis Pipeline Drugs Analysis Profiles

- Nonalcoholic Steatohepatitis Drugs Market Attractiveness

- Nonalcoholic Steatohepatitis Market Drivers

- Nonalcoholic Steatohepatitis Market Barriers

Key Questions Answered In the Nonalcoholic Steatohepatitis Drugs Market Report

Nonalcoholic Steatohepatitis Drugs Market Insights:

- What was the Nonalcoholic Steatohepatitis drugs market share (%) distribution in 2020 and how it would look like in 2034?

- What would be the Nonalcoholic Steatohepatitis total market size as well as market size by therapies across the 7MM during the forecast period (2020 to 2034)?

- What are the key findings pertaining to the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market across 7MM and which country will have the largest Nonalcoholic Steatohepatitis market size during the forecast period (2020 to 2034)?

- At what CAGR, the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market is expected to grow by 7MM during the forecast period (2020 to 2034)?

- What would be the Nonalcoholic Steatohepatitis market outlook across the 7MM during the forecast period (2020 to 2034)?

- What would be the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market growth till 2034, and what will be the resultant market Size in the year 2034?

- How would the unmet needs affect the Nonalcoholic Steatohepatitis Therapeutics Diagnostics Market Dynamics and subsequent analysis of the associated trends?

Nonalcoholic Steatohepatitis Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of the Nonalcoholic Steatohepatitis?

- What are the key factors driving the epidemiology trend for seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What is the historical Nonalcoholic Steatohepatitis patient pool in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What would be the forecasted patient pool of Nonalcoholic Steatohepatitis in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- Where will be the growth opportunities in the 7MM with respect to the patient population pertaining to Nonalcoholic Steatohepatitis?

- Out of all 7MM countries, which country would have the highest Nonalcoholic Steatohepatitis prevalence population during the forecast period (2020 to 2034)?

- At what CAGR the Nonalcoholic Steatohepatitis patient population is expected to grow in 7MM during the forecast period (2020 to 2034)?

Current NASH Treatment Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the Nonalcoholic Steatohepatitis treatment in addition to the approved therapies?

- What are the current treatment guidelines for the treatment of Nonalcoholic Steatohepatitis in the USA, Europe, and Japan?

- What are the Nonalcoholic Steatohepatitis marketed drugs and their respective MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many Nonalcoholic Steatohepatitis companies are developing therapies for the treatment of NASH?

- How many therapies are in-development by each company for Nonalcoholic Steatohepatitis treatment?

- How many are emerging therapies in mid-stage, and late stage of development for Nonalcoholic Steatohepatitis treatment?

- What are the key collaborations (Industry - Industry, Industry - Academia), Mergers and acquisitions, licensing activities related to the Nonalcoholic Steatohepatitis therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies being developed to overcome the limitation of existing therapies?

- What are the ongoing Nonalcoholic Steatohepatitis clinical trials and their status?

- What are the current challenges faced in Nonalcoholic Steatohepatitis drug development?

- What are the key designations that have been granted for the emerging therapies for Nonalcoholic Steatohepatitis?

- What are the global historical and forecasted Nonalcoholic Steatohepatitis Diagnostics Market?

Reasons to Buy the Nonalcoholic Steatohepatitis Drugs Market Report

- The Nonalcoholic Steatohepatitis Diagnostics Market Report will help in developing business strategies by understanding trends shaping and driving the Nonalcoholic Steatohepatitis drugs market

- To understand the future market competition in the Nonalcoholic Steatohepatitis Diagnostics Market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for Nonalcoholic Steatohepatitis in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom) and Japan

- Identification of strong upcoming players in the Nonalcoholic Steatohepatitis Diagnostics Market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for Nonalcoholic Steatohepatitis Diagnostics Market

- To understand the future market competition in the Nonalcoholic Steatohepatitis Diagnostics Market.

Stay Updated with us for New Articles:-

- Nonalcoholic Steatohepatitis: Highly Epidemic

- Meeting the Unmet: Nonalcoholic Steatohepatitis

- Madrigal’s Rezdiffra Breakthrough Transforms NASH Treatment, Leading the Way for Next-Gen Therapies

- Game-Changers in Non-Alcoholic Steatohepatitis (NASH) Treatment: Insights into Novel Drug Classes

- NASH Emerging Therapies

- Off-label therapies dominate NASH Market Share

- Empowering Change: REZDIFFRA’s Trailblazing Journey in NASH Treatment

- Nonalcoholic Steatohepatitis Newsletter

- Latest DelveInsight Blogs

-market-report.png&w=256&q=75)