Neurovascular Devices Market Summary

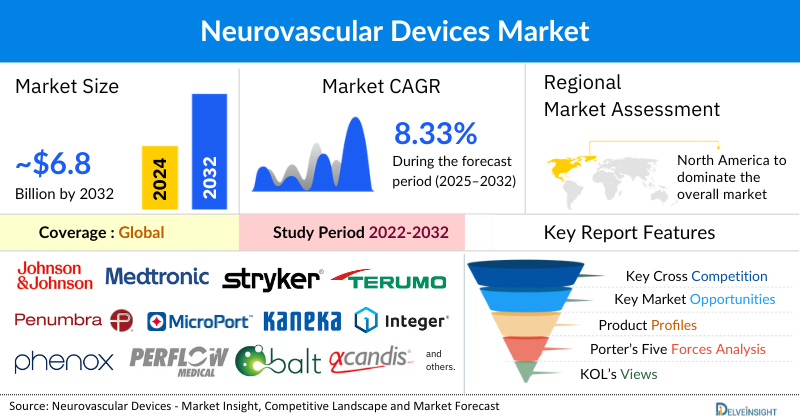

- The Global Neurovascular Devices market is expected to increase from USD 3,616.46 million in 2024 to USD 6,814.26 million by 2032, reflecting strong and sustained growth.

- The Global Neurovascular Devices market is growing at a CAGR of 8.33% during the forecast period from 2025 to 2032.

Neurovascular Devices Market Trends and Insights

- The Neurovascular Devices Market is being primarily driven by the rising prevalence of Neurovascular disorders, increasing technological advancements in devices, increasing shift towards minimally invasive surgeries, increasing stroke awareness & screening programs, and an increase in product development activities among the key market players.

- The leading Neurovascular Devices Companies such as Johnson & Johnson Services Inc., Medtronic, Stryker, Terumo Corporation, Penumbra, Inc., Microport Scientific Corporation, Kaneka Corporation, Integer Holdings Corporation, phenox GmbH, Perflow Medical Ltd., Balt, Rapid Medical, ASAHI INTECC CO., LTD., Acandis GmbH, Cerus Endovascular Inc., and others.

- North America is expected to dominate the overall Neurovascular devices market due to the high prevalence of stroke and other Neurovascular disorders, a well-established healthcare infrastructure, strong adoption of advanced and minimally invasive technologies, and supportive reimbursement policies. Additionally, the presence of leading medical device companies, continuous R&D investments, and growing awareness programs for stroke prevention and treatment further strengthen the region’s market leadership.

- In the product type segment of the Neurovascular devices market, within the Cerebral Balloon Angioplasty and Stenting Systems category, the Carotid Artery Stents segment is projected to dominate in 2024.

Request for unlocking the report of the @ Neurovascular Devices Market

Neurovascular Devices Market Size and Forecasts

- 2024 Market Size: USD 3,616.46 million

- 2032 Projected Market Size: USD 6,814.26 million

- Growth Rate (2025-2032): 8.33% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Factors Contributing to the Growth of the Neurovascular Devices Market

Increasing prevalence of neurological disorders leading to a surge in Neurovascular devices:

The increasing prevalence of neurological disorders such as stroke, brain aneurysms, and arteriovenous malformations is a key factor boosting the overall market for Neurovascular devices. Rising cases of these conditions, driven by aging populations, sedentary lifestyles, and associated risk factors like hypertension and diabetes, are creating higher demand for advanced diagnostic and treatment solutions. This is accelerating the adoption of Neurovascular devices for minimally invasive procedures, thereby fueling market growth.

Increasing technological advancements in devices are escalating the market of Neurovascular devices:

Increasing technological advancements in Neurovascular devices, such as next-generation stent retrievers, flow diverters, embolic coils, and AI-enabled imaging systems, are significantly escalating the market. These innovations enhance precision, safety, and success rates of minimally invasive procedures, reducing recovery time and complications. As a result, hospitals and clinicians are increasingly adopting these advanced solutions, driving strong Neurovascular Devices market growth.

Rise in demand for minimally invasive Neurovascular surgical procedures:

The rise in demand for minimally invasive Neurovascular surgical procedures is boosting the overall market of Neurovascular devices, as these approaches reduce hospital stays, lower complication risks, and ensure faster patient recovery compared to traditional surgeries. Growing patient preference and physician adoption of such advanced techniques are driving the use of specialized devices like stent retrievers, embolic coils, and flow diverters, thereby fueling market growth.

Neurovascular Devices Market Report Segmentation

This Neurovascular devices market report offers a comprehensive overview of the Global Neurovascular devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product Type (Cerebral Embolization and Aneurysm Coiling Devices [Embolic Coils, Flow Diversion Devices, and Liquid Embolic Agents], Cerebral Balloon Angioplasty and Stenting Systems [Carotid Artery Stents and Embolic Protection Systems], Neurothrombectomy Devices [Clot Retrievers, Suction Devices, and Vascular Snare], and Support Devices [Micro Catheters and Micro Guidewires]), Application (Stroke, Cerebral Aneurysm, Carotid Artery Stenosis, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing Neurovascular devices market.

Neurovascular devices comprise coils, stents, clot-retrieval devices, and other similar devices used for the treatment of Neurovascular disorders such as brain aneurysms or Neurovascular thrombectomy.

The demand for Neurovascular devices is gaining importance owing to the rising prevalence of the target patient population, increasing demand for minimally invasive neurosurgical procedures, ongoing development of technologically advanced products, and rising R&D investments, among others, which are contributing to the overall growth of the Neurovascular devices market during the forecast period from 2025 to 2032.

What are the latest Neurovascular Devices Market Dynamics and Trends?

The Neurovascular Devices Market is gaining pace at present, owing to the increasing prevalence of Neurovascular diseases and their associated comorbidities such as ischemic strokes, hemorrhagic strokes, aging populations, hypertension, and arrhythmias.

According to recent analysis by DelveInsight, the 7MM (United States, Japan, Germany, France, Italy, Spain, and the United Kingdom) accounted for over 1.5 million cases of acute ischemic stroke. Globally, it is estimated that more than 3.5 million new cases of intracerebral hemorrhagic stroke occur each year, representing over 28.5% of all stroke incidents. In addition, approximately 1.3 million new subarachnoid hemorrhagic strokes are reported annually. Notably, a significant proportion of these cases, over 23.1% of intracerebral hemorrhagic strokes and 28% of subarachnoid hemorrhagic strokes, affect individuals aged 15-49, highlighting the impact on a younger population and the critical need for timely interventions.

These statistics directly translate to increased adoption of Neurovascular devices such as stent retrievers, embolic coils, flow diverters, and carotid stents, which are essential for minimally invasive management of ischemic and hemorrhagic strokes. As stroke awareness among clinicians and patients rises, the push for early diagnosis and intervention grows stronger, further driving demand for advanced, precise, and safe devices. Moreover, technological advancements in imaging, device design, and materials enhance procedural success and reduce complications, making these interventions more attractive to hospitals and healthcare providers. This combination of high patient burden, clinical need for effective treatment, and continuous innovation in device technology is creating a strong growth trajectory for the Neurovascular devices market.

The players are focusing their efforts on developing advanced Neurovascular devices. For instance, in June 2024, Penumbra announced the CE Mark and European launch of BMX™81 and BMX™96. These offerings, designed for the Neurovascular management of both ischemic and hemorrhagic strokes, represent Penumbra’s most advanced neuro access technologies to date, reflecting the emphasis on innovation and clinical efficacy in the Neurovascular devices market.

However, the increasing number of product recalls and the stringent regulatory process for product approval may hinder the future Neurovascular devices market.

Neurovascular Devices Market Segment Analysis

Neurovascular Devices Market by Product Type (Cerebral Embolization and Aneurysm Coiling Devices [Embolic Coils, Flow Diversion Devices, and Liquid Embolic Agents], Cerebral Balloon Angioplasty and Stenting Systems [Carotid Artery Stents and Embolic Protection Systems], Neurothrombectomy Devices [Clot Retrievers, Suction Devices, and Vascular Snare], and Support Devices [Micro Catheters and Micro Guidewires]), Application (Stroke, Cerebral Aneurysm, Carotid Artery Stenosis, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

Neurovascular Devices Market By Product Type

By Product Type: Carotid Artery Stents Category Dominates the Neurovascular Devices Market

In the product type segment of the Neurovascular devices market, within the Cerebral Balloon Angioplasty and Stenting Systems category, the Carotid Artery Stents segment is projected to dominate in 2024, capturing approximately 65% of the market share. Carotid artery stents are key drivers in the growth of the Neurovascular devices market by offering less invasive, highly effective treatments for carotid artery disease, a leading cause of ischemic stroke. Compared to traditional surgery, stenting provides shorter recovery times, reduced procedural risk, and wider applicability for high-risk patients. Additionally, the technological innovations such as dual-layer micromesh, MicroNet mesh coatings, and integrated embolic protection enhance both safety and long-term outcomes, further bolstering clinician confidence and adoption.

On the regulatory front, several impactful approvals have signaled robust advancements that further boost the market of the segment. For instance, in April 2025, Terumo Neuro’s Dual-Layer Micromesh Carotid Stent System received FDA Premarket Approval (PMA), the first of its kind in the U.S. This device targets carotid stenosis, including both de novo and post-endarterectomy restenotic lesions with vessel diameters from 3.5 mm to 9 mm, offering a significant new option for patients at higher risk following endarterectomy.

Collectively, these factors position carotid artery stents as a key growth driver within the Neurovascular devices market, expanding their role in stroke prevention and reshaping treatment strategies worldwide.

Neurovascular Devices Market By Application

By Application: Stroke Category Dominates the Neurovascular Devices Market

In the Neurovascular devices market, strokes are projected to account for the largest share, representing 55% in 2024, driven by the high prevalence of ischemic strokes caused by blocked blood vessels in the brain. According to DelveInsight, the U.S. recorded nearly 754,000 diagnosed cases of acute ischemic stroke in 2023, the highest among the 7MM, a number that is projected to rise steadily by 2034. Thus, the timely and precise intervention is essential to restore blood flow and reduce brain damage, making advanced Neurovascular devices critical in patient care.

Additionally, the minimally invasive thrombectomy procedures, performed using stent retrievers, aspiration catheters, and embolic protection systems, have become the standard of care for eligible patients. Continuous innovations in device design, imaging technologies, and AI-assisted procedural guidance have improved treatment efficacy, safety, and overall success rates, encouraging wider clinical adoption. A notable example is Johnson & Johnson’s April 2024 launch of the CEREGLIDE™ 71 Aspiration Catheter. Equipped with TruCourse™ technology, it offers enhanced flexibility and trackability, allowing clinicians to effectively access challenging anatomical regions and remove clots efficiently during acute ischemic stroke interventions.

Thus, the factors mentioned above are expected to boost the category, thereby boosting the overall market of Neurovascular devices across the globe.

Neurovascular Devices Market By End-User

By End-User: Hospitals Dominate the Neurovascular Devices Market

Hospitals are boosting the overall Neurovascular devices market by increasingly adopting advanced, minimally invasive treatment solutions to improve patient outcomes and reduce procedural risks. Investments in state-of-the-art imaging systems, catheterization labs, and specialized stroke care units are driving higher demand for devices such as stent retrievers, embolic coils, and flow diverters. Additionally, hospitals’ focus on early diagnosis, rapid intervention, and comprehensive Neurovascular care is encouraging clinicians to use these devices more frequently, thereby accelerating Neurovascular Devices market growth.

Neurovascular Devices Market Regional Analysis

North America Neurovascular Devices Market Trends

North America is projected to hold the largest share of the Global Neurovascular devices market in 2024, accounting for around 30%, driven by advanced healthcare infrastructure, high stroke prevalence, strong adoption of innovative neurointerventional technologies, and supportive reimbursement policies. Additionally, the presence of leading medical device companies, continuous R&D investments, and growing awareness programs for stroke prevention and treatment further strengthen the region’s market leadership.

According to DelveInsight analysis (2023), approximately 376,000 males and 378,000 females in the United States were affected by acute ischemic stroke in 2023. This significant patient population is driving strong demand for advanced Neurovascular devices, including thrombectomy systems, embolic protection devices, clot retrieval catheters, and stent retrievers, as hospitals and healthcare providers seek to improve patient outcomes and reduce mortality rates.

Furthermore, the growing adoption of advanced and minimally invasive technologies is further accelerating the Neurovascular devices market. Procedures such as thrombectomy and endovascular coiling have become standard practice due to their ability to deliver favorable outcomes, lower complication rates, and shorter recovery times. In addition, increasing product development activities by key market players are expected to further boost Neurovascular devices market growth. For example, in October 2024, Contego Medical received FDA premarket approval (PMA) for the Neuroguard IEP® System, featuring the company’s clinically proven Integrated Embolic Protection™ (IEP) technology, highlighting the ongoing innovation and expansion in the neuroprotection devices segment.

Therefore, the factors mentioned above are expected to drive the growth of the Neurovascular Devices market in North America.

Europe Neurovascular Devices Market Trends

Europe is playing a significant role in driving the growth of Neurovascular devices fueled The region has a high prevalence of Neurovascular disorders, including acute ischemic stroke, aneurysms, and arteriovenous malformations, which creates a substantial demand for advanced treatment options. European healthcare systems are increasingly focusing on early diagnosis and minimally invasive interventions, which has accelerated the adoption of Neurovascular devices such as thrombectomy systems, embolic protection devices, stent retrievers, and clot retrieval catheters. Moreover, the presence of key market players and continuous product innovation in the region, such as the development of next-generation thrombectomy and embolic protection devices, further strengthens market expansion. For instance, in June 2025, InspireMD announced that its CGuard® Prime Embolic Prevention System (EPS) received CE Mark approval under the European Medical Device Regulation (MDR) for use in stroke prevention.

Asia-Pacific Neurovascular Devices Market Trends

Asia-Pacific is emerging as a major growth driver for the Neurovascular devices market due to its rapidly rising patient pool for Neurovascular disorders, including acute ischemic stroke and aneurysms, driven by aging populations. DelveInsight estimates indicate that in Japan, males were affected more with acute ischemic stroke, accounting for nearly 100,000 cases compared to females (around 90,000 cases) in 2022. Additionally, the growing awareness about early diagnosis and the benefits of minimally invasive procedures is fueling the adoption of advanced Neurovascular devices, including thrombectomy systems, stent retrievers, and embolic protection devices across the region.

Who are the major players in the Neurovascular devices market?

The following are the leading companies in the Neurovascular devices market. These companies collectively hold the largest Neurovascular devices market share and dictate industry trends.

Neurovascular devices Companies

- Johnson & Johnson Services Inc.

- Medtronic

- Stryker

- Terumo Corporation

- Penumbra, Inc.

- Microport Scientific Corporation

- Kaneka Corporation

- Integer Holdings Corporation

- phenox GmbH

- Perflow Medical Ltd.

- Balt

- Rapid Medical

- ASAHI INTECC CO., LTD.

- Acandis GmbH

- Cerus Endovascular Inc.

- Others

How is the competitive landscape shaping the Neurovascular devices market?

The competitive landscape of the Neurovascular devices market is moderately consolidated, with a handful of Global leaders holding substantial market share while regional players and emerging startups are steadily gaining traction. Major Neurovascular devices companies such as Medtronic, Stryker Corporation, Johnson & Johnson, Penumbra Inc., and Terumo Corporation dominate the market with comprehensive portfolios of Neurovascular stents, coils, thrombectomy devices, and embolization systems, supported by advanced technologies and extensive Global distribution networks. These companies are strengthening their positions through continuous innovation in minimally invasive procedures, integration of imaging and navigation technologies, and strategic acquisitions, exemplified by Stryker’s acquisition of Inari Medical to expand its Neurovascular offerings. At the same time, emerging players, particularly in Asia-Pacific regions like China, Japan, and India, are intensifying competition by providing cost-effective devices and localized solutions, aiming to address the growing prevalence of strokes and other cerebrovascular disorders. The increasing focus on portable, efficient, and user-friendly Neurovascular interventions, coupled with rising adoption in hospitals and specialized clinics, is opening avenues for new entrants. Overall, while the market remains concentrated among established leaders, the rise of regional innovators and strategic collaborations is gradually reshaping the competitive environment, making it more dynamic and innovation-driven.

Recent Developmental Activities in the Neurovascular Devices Market

- In May 2025, Terumo Interventional Systems announced the commercial launch of its FDA-approved ROADSAVER™ Carotid Stent System. Designed for use with the Nanoparasol® Embolic Protection System, the ROADSAVER Stent System is intended to treat carotid artery stenosis in patients at elevated risk of complications from carotid endarterectomy.

- In March 2025, Boston Scientific launched an updated FilterWire EZ embolic protection system in select European markets. The system features a wire with a 110-micron-pore filter at its tip, designed to capture embolic material while maintaining blood flow and reliably conforming to the artery walls.

- In September 2024, Minima Stent System received FDA clearance for its stent system, which is indicated for use in the treatment of intracranial aneurysms, offering a minimally invasive option for patients.

Scope of the Neurovascular devices Market Report | |

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Neurovascular Devices Market CAGR |

8.33% |

|

Neurovascular Devices Companies |

Johnson & Johnson Services Inc., Medtronic, Stryker, Terumo Corporation, Penumbra, Inc., Microport Scientific Corporation, Kaneka Corporation, Integer Holdings Corporation, phenox GmbH, Perflow Medical Ltd., Balt, Rapid Medical, ASAHI INTECC CO., LTD., Acandis GmbH, Cerus Endovascular Inc., and others. |

|

Neurovascular Devices Market Segments |

by Product Type, by Application, by End-user, and by Geography |

|

Neurovascular Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Neurovascular Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Neurovascular Devices Market Segmentation

-

Neurovascular Devices Product Type Exposure

-

- Cerebral Embolization and Aneurysm Coiling Devices

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty and Stenting Systems

- Carotid Artery Stents

- Embolic Protection Systems

- Neurothrombectomy Devices

- Clot Retreivers

- Suction Devices

- Vascular Snare

- Support Devices

- Micro Catheters

- Micro Guidewires

- Cerebral Embolization and Aneurysm Coiling Devices

-

Neurovascular Devices Application Exposure

- Stroke

- Cerebral Aneurysm

- Carotid Artery Stenosis

- Other Diseases

-

Neurovascular Devices End-Users Exposure

- Hospitals

- Ambulatory Surgical Centers

- Others

-

Neurovascular Devices Geography Exposure

- North America Structural Heart Devices Market

- United States Structural Heart Devices Market

- Canada Structural Heart Devices Market

- Mexico Structural Heart Devices Market

- Europe Structural Heart Devices Market

- United Kingdom Structural Heart Devices Market

- Germany Structural Heart Devices Market

- France Structural Heart Devices Market

- Italy Structural Heart Devices Market

- Spain Structural Heart Devices Market

- Rest of Europe

- Asia-Pacific Structural Heart Devices Market

- China Structural Heart Devices Market

- Japan Structural Heart Devices Market

- India Structural Heart Devices Market

- Australia Structural Heart Devices Market

- South Korea Structural Heart Devices Market

- Rest of Asia-Pacific

- Rest of the World

- South America Structural Heart Devices Market

- Middle East Structural Heart Devices Market

- Africa Structural Heart Devices Market

- North America Structural Heart Devices Market

Neurovascular Devices Market Recent Industry Trends and Milestones | |

|

Category |

Key Developments |

|

Neurovascular Devices Product Launches |

BMX™81 and BMX™96 by Penumbra, CEREGLIDE™ 71 Aspiration Catheter by Johnson & Johnson, Neuroguard IEP® System by Contego Medical |

|

Neurovascular Devices Regulatory Approvals |

Penumbra - BMX™81 and BMX™96 (CE), Contego Medical - Neuroguard IEP® System (FDA) |

|

Partnerships in the Neurovascular Devices Market |

Philips with Sim&Cure, Brainomix with Medtronic Neurovascular |

|

Acquisitions in the Neurovascular Devices Market |

Stryker acquired Inari Medical, and Stryker Corporation acquired Boston Scientific's Neurovascular business. |

|

Company Strategy |

Medtronic: Planned to double the number of Neurovascular patients treated annually within three years. Philips: Strengthened its strategic partnership with Sim&Cure to expand innovation in Neurovascular therapy. |

|

Emerging Technology |

Artificial Intelligence (AI) and Machine Learning (ML), Advanced Imaging Technologies, Robotics and Navigation Systems, Remote Monitoring and Telemedicine |

Impact Analysis

AI-Powered Innovations and Applications in Neurovascular devices

Artificial intelligence (AI) is rapidly transforming the Neurovascular devices market by enhancing the accuracy, efficiency, and safety of cerebrovascular diagnosis and interventions. AI-powered tools are increasingly integrated into imaging platforms, enabling real-time analysis of complex Neurovascular structures through high-resolution MRI, CT, and angiography. These technologies assist clinicians in identifying vascular anomalies, planning interventions, and predicting procedural outcomes with higher precision. Machine learning algorithms also support stroke detection by rapidly analyzing imaging data to distinguish between ischemic and hemorrhagic strokes, which accelerates decision-making in critical care settings. Beyond diagnostics, AI is being applied in robotic-assisted Neurovascular interventions, guiding catheters, stents, and thrombectomy devices with improved precision and reduced procedural risks. Additionally, AI-driven platforms facilitate personalized treatment planning by integrating patient-specific anatomical and physiological data, optimizing device selection, and predicting clinical outcomes. The incorporation of cloud-based monitoring, predictive analytics, and decision-support systems further enhances post-procedural care and follow-up, improving overall patient outcomes. Overall, AI-powered innovations are redefining Neurovascular care, enabling minimally invasive procedures, enhancing procedural safety, and paving the way for more personalized and efficient treatment strategies.

U.S. Tariff Impact Analysis on Neurovascular Devices Market

The U.S. medical device industry, including Neurovascular devices, is significantly impacted by recent tariff policies. The average applied U.S. tariff rate rose from 2.5% to an estimated 27% in early 2025, the highest level in over a century. Companies like Johnson & Johnson anticipate approximately $400 million in tariff-related expenses, primarily affecting their medical technology division. Additionally, over half of all medical devices depend on semiconductors, which are subject to tariffs, further escalating costs. In response, manufacturers are exploring cost reductions and may temporarily defer price hikes for specific customers with strong cases. These tariff-induced challenges are prompting companies to consider shifting production to lower-tariff countries and seeking tariff exemptions to mitigate disruptions to patient care.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends in Neurovascular devices | ||||

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

Neuralink |

$650 million |

Brain-computer interface |

Series E |

Brain-computer interface for controlling digital and physical devices via thought |

|

MedTech Innovator 2025 Cohort |

Over $800,000 in non-dilutive funding |

Neurovascular devices |

Various (Seed to Series C) |

Diverse medical technologies, including Neurovascular innovations |

Key takeaways from the Neurovascular devices market report study

- Market size analysis for the current Neurovascular devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the Neurovascular devices market.

- Various opportunities available for the other competitors in the Neurovascular devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Neurovascular devices market scenario?

- · Which are the regions and countries where companies should have concentrated on opportunities for the Neurovascular devices market growth in the future?