Palmoplantar Pustulosis Market

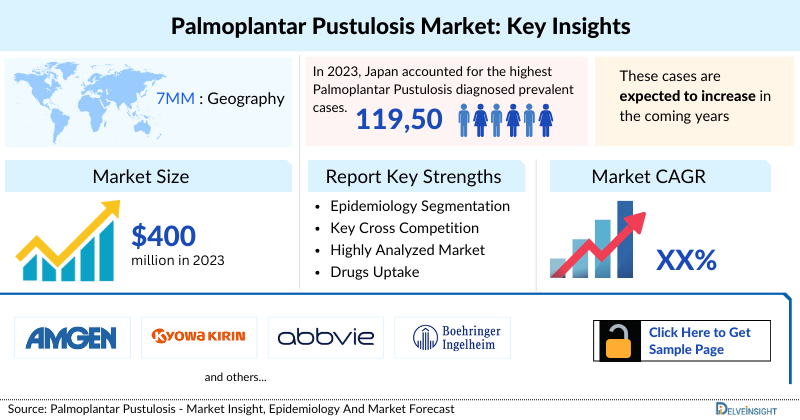

- The Palmoplantar Pustulosis Market Size in fthe 7MM was approximately USD 400 million in 2023, which is expected to grow during the forecast period (2024-2034).

- In the EU4 & the UK, Germany accounted for the highest Palmoplantar Pustulosis Drugs Market share in 2023, with around 60% followed by France and the UK; these numbers are expected to increase during the forecast period (2024-2034)

- In 2023, Germany held the largest Palmoplantar Pustulosis drugs market share among the 7MM, with more than USD 120 million, followed by Japan with around USD 107 million.

- Among all the therapies available in the7MM, Biologics accounted for the highest Palmoplantar Pustulosis drugs market share with around USD 200 million in 2023.

- The key Palmoplantar Pustulosis companies actively involved in the Neuroleptic Malignant Syndrome Treatment include - Janssen, Kyowa Kirin, Amgen, and others

Palmoplantar Pustulosis Market and Epidemiology Analysis

- Palmoplantar Pustulosis can affect individuals of all ages, with females being more likely to be affected than males.

- In 2023, Japan accounted for the highest number of Palmoplantar Pustulosis diagnosed prevalent cases.

- In the United States, individuals of the 40-64 year age group reported the highest number of Palmoplantar Pustulosis cases.

- In EU4 and the UK, Germany accounted for the highest number of Palmoplantar Pustulosis diagnosed prevalent cases in 2023, while Spain accounted for the lowest number of diagnosed prevalent cases.

- In 7MM, Mild cases outnumbered moderate-severe cases in 2023.

- Palmoplantar Pustulosis is a condition with yellow-brown pustules on the palms and soles. Although once classified as psoriasis, it is now separate, though 10–25% of those with PPP also have chronic plaque psoriasis.

- A doctor usually diagnoses Palmoplantar Pustulosis by taking a history and examining the skin. A painless skin scrape can check for fungal infections, and a swab of pustule fluid may rule out bacterial infection. Sometimes, a biopsy is needed for confirmation.

- Currently, there is no cure for Palmoplantar Pustulosis and its treatment is challenging, with no approved treatments specifically for the disease in the US or EU. However, treatments like topical corticosteroids, phototherapy, oral retinoids, coal tar ointments, and skin-moisturizing creams can help alleviate symptoms.

- Currently, three drugs are approved specifically for the Palmoplantar Pustulosis treatment in Japan, TREMFYA (Guselkumab), LUMICEF (Brodalumab), and SKYRIZI (Risankizumab).

- OTEZLA (apremilast), a drug that is being developed by Amgen, and is in Phase III development for treating Palmoplantar Pustulosis.

- In September 2024, Amgen presented 52-week results from a Phase III Palmoplantar Pustulosis clinical trials evaluating the efficacy and safety of apremilast in Japanese patients with Palmoplantar Pustulosis during a Late-Breaking Research Session at the European Academy of Dermatology and Venereology (EADV) 2024 Annual Meeting in Amsterdam.

- There is a crucial need for understanding the disease and focused research for availing a better treatment to provide an ease to the Palmoplantar Pustulosis patients suffering from the condition.

Request for Unlocking the Sample Page of the "Palmoplantar Pustulosis Treatment Market"

Key Factors Driving Palmoplantar Pustulosis Market

- Growing Palmoplantar Pustulosis Target Patient Pool: In the EU4 and the UK, Germany recorded the highest Palmoplantar Pustulosis prevalence in 2023, accounting for nearly 60% of cases, followed by France and the UK. In Japan, the diagnosed patient pool was the largest across Asia, while in the United States, the 40–64-year age group represented the highest burden. Across the 7MM, mild cases significantly outnumbered moderate-to-severe cases in 2023.

- Recognition as a Distinct Disease: Palmoplantar Pustulosis (PPP) is marked by yellow-brown pustules on the palms and soles. Once considered a subtype of psoriasis, it is now recognized as a separate condition, though up to 25% of patients also present with chronic plaque psoriasis. Diagnosis relies on clinical evaluation, skin scraping, and sometimes biopsy to rule out fungal or bacterial infections.

- Limited Treatment Options in the US and EU: Currently, there are no specifically approved therapies for Palmoplantar Pustulosis in the US or EU. Standard care includes topical corticosteroids, phototherapy, oral retinoids, and supportive agents like coal tar ointments and emollients. Treatment remains challenging due to the chronic and relapsing nature of the disease.

- Japan’s Leadership in PPP Approvals: Japan leads in approved therapies with three marketed drugs: TREMFYA (guselkumab), LUMICEF (brodalumab), and SKYRIZI (risankizumab). Notably, in August 2023, Kyowa Kirin’s LUMICEF became the first IL-17 pathway inhibitor approved for PPP, following positive Phase III results demonstrating efficacy and safety. AbbVie’s SKYRIZI, targeting IL-23, also offers a precision approach, modulating immune pathways driving PPP inflammation.

- Emerging Therapies in Development: Beyond marketed therapies, promising candidates are advancing through late-stage pipelines. Amgen’s OTEZLA (apremilast) is currently in Phase III development, and additional novel approaches are expected to expand the treatment arsenal for PPP in the coming years.

Palmoplantar Pustulosis Treatment Market Report Summary

- The Palmoplantar Pustulosis treatment market report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current Palmoplantar Pustulosis treatment market landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Palmoplantar Pustulosis treatment market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The Palmoplantar Pustulosis treatment market report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Palmoplantar Pustulosis drugs market.

The table given below further depicts the key segments provided in the report..

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Palmoplantar Pustulosis Market |

|

|

Palmoplantar Pustulosiss Market Size | |

|

Palmoplantar Pustulosis Companies |

Janssen, Kyowa Kirin, Amgen, and others |

|

Palmoplantar Pustulosis Epidemiology Segmentation |

|

Palmoplantar Pustulosis Disease Understanding

Palmoplantar Pustulosis is a chronic skin condition characterized by the appearance of yellow-brown pustules on the palms of the hands and the soles of the feet. Once considered a type of psoriasis, Palmoplantar Pustulosis is now classified separately, though 10-25% of individuals with Palmoplantar Pustulosis may also have chronic plaque psoriasis. The exact cause of PPP is not fully understood, but contributing factors may include smoking, bacterial infections, contact allergies (especially to metals), and certain medications. Common symptoms of PPP include red, tender skin, blisters, pustules, itchiness, pain, and thick, scaly skin. While there is no cure for PPP, various treatments can help manage the symptoms and improve the quality of life for those affected.

Further details are provided in the report….

Palmoplantar Pustulosis Diagnosis

The Palmoplantar Pustulosis diagnosis involves examining the affected skin and may include skin swabs to confirm the pustules are sterile, without bacteria or fungi. In some cases, a skin biopsy is needed, where a sample of the affected skin is taken and examined under a microscope to identify specific features of the disease. This helps differentiate PPP from other similar skin conditions, such as psoriasis. A thorough patient history, including potential triggers like smoking and infections, also aids in the diagnostic process.

Further details related to country-based variations are provided in the report…

Palmoplantar Pustulosis Treatment

The main strategies for treating patients with PPP include topical agents, phototherapy, systemic therapies (such as acitretin and biologics), and emerging treatments targeting the IL-36 or IL-1 pathways. The treatment approach should be individualized, taking into account disease severity, patient preferences, and contraindications to certain therapies. These strategies aim to provide symptom relief and control inflammation while exploring new therapeutic targets such as monoclonal antibodies blocking IL-36.

Further details related to treatment and management are provided in the report…

Palmoplantar Pustulosis Epidemiology

The Palmoplantar Pustulosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases, Gender-specific cases, Age-specific cases, Severity-specific cases, and total treated cases of PPP in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, Japan accounted for the highest Palmoplantar Pustulosis diagnosed prevalent cases with approximately 119,500 cases.

- In the United States, Females reported more cases than males with around 13,000 cases in 2023.

- In 2023, the age group of 40-64 years accounted for the highest number of cases, with approximately 160,000 cases across the 7MM. This was followed by the 20-39 years age group, which had the second highest number of cases.

- In the United States, Mild cases outnumbered moderate-severe cases in 2023.

Palmoplantar Pustulosis Drugs Analysis

The section dedicated to drugs in the Palmoplantar Pustulosis drugs market report provides an in-depth evaluation of late-stage Palmoplantar Pustulosis pipeline drugs analysis (Phase III and Phase II). The drug chapters section provides valuable information on various aspects related to Palmoplantar Pustulosis clinical trials, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting PPP.

Palmoplantar Pustulosis Marketed Therapies

-

LUMICEF (brodalumab): Kyowa Kirin

Kyowa Kirin received approval from the Ministry of Health, Labour, and Welfare (MHLW) in Japan in August 2023, for a partial change in the approved indication of LUMICEF (brodalumab) to include the Palmoplantar Pustulosis treatment in patients who have had an inadequate response to existing therapies. LUMICEF is a fully human anti-interleukin-17 (IL-17) receptor. An antibody that selectively inhibits inflammatory cytokines like IL-17A, IL-17A/F, IL-17F, and IL-17C by binding to the IL-17A receptor. This makes it the first IL-17 pathway inhibitor approved for PPP. The approval is based on positive results from a Phase III clinical trial in Japan, which showed that LUMICEF met its primary endpoint, confirming its efficacy and safety for PPP patients.

LUMICEF was first approved in Japan in 2016 for psoriasis and has since been approved for other indications, including ankylosing spondylitis. The approval of LUMICEF for PPP provides a new treatment option for patients suffering from this painful and debilitating condition.

-

SKYRIZI (risankizumab): AbbVie/ Boehringer Ingelheim

SKYRIZI (risankizumab) is a monoclonal antibody that works by binding to the p19 subunit of interleukin-23 (IL-23), a cytokine involved in the inflammatory process. By binding to this subunit, risankizumab effectively prevents IL-23 from interacting with its receptor on immune cells. This Palmoplantar Pustulosis mechanism of action helps to reduce the inflammatory responses that are associated with certain autoimmune conditions, including PPP. By inhibiting the IL-23/IL-23 receptor interaction, risankizumab can modulate the immune system and reduce the overactive immune response that drives the Palmoplantar Pustulosis symptoms. Currently, risankizumab is approved in Japan for the Palmoplantar Pustulosis treatment, providing a targeted therapeutic option for patients with this chronic and challenging condition.

Palmoplantar Pustulosis Emerging Therapies

-

OTEZLA (apremilast): Amgen

OTEZLA (apremilast market) is an oral medication used to treat certain types of psoriasis and psoriatic arthritis. It works as a selective inhibitor of phosphodiesterase 4 (PDE4), which helps to reduce inflammation. In the United States, OTEZLA is approved for the treatment of adults with active psoriatic arthritis, plaque psoriasis in patients who are candidates for phototherapy or systemic therapy, and oral ulcers associated with Behçet's disease. In the European Union, OTEZLA is indicated for the treatment of active psoriatic arthritis in adults who have had an inadequate response to or have been intolerant of prior disease-modifying antirheumatic drug (DMARD) therapy. It is also approved for moderate to severe chronic plaque psoriasis in adults who have not responded to, are contraindicated for, or are intolerant of other systemic therapies such as cyclosporine, methotrexate, or psoralen and ultraviolet-A light.

Note: Detailed assessment will be provided in the final report of Palmoplantar Pustulosis…

Palmoplantar Pustulosis Market Outlook

While no medications are currently FDA-approved specifically for PPP, several therapeutic options show promise. Topical treatments can be effective for patients with limited disease, though long-term responses are often not sustained. Systemic therapies, including biologics, JAK inhibitors, DMARDs, and retinoids, may achieve PPP clearance, but come with potential side effects. Phototherapy is also effective, though it can present challenges related to accessibility and cost.

In Japan, three drugs are currently approved for the treatment of Palmoplantar Pustulosis (PPP): TREMFYA (Guselkumab), an IL-23 p19 subunit inhibitor approved in 2018; LUMICEF (Brodalumab), the first IL-17 pathway inhibitor approved for PPP in 2023; and SKYRIZI (Risankizumab), an IL-23 inhibitor approved for PPP in May 2023. These therapies target key inflammatory cytokines to manage Palmoplantar Pustulosis patients who do not respond to existing treatments. However, the pipeline for new Palmoplantar Pustulosis treatments remains limited, with OTEZLA (apremilast market) by Amgen being the most notable candidate.

In a nutshell, not many potential therapies are being investigated to manage PPP. Even though it is too soon to comment on the above-mentioned promising candidate to enter the market of the US and Europe during the forecast period (2024–2034). Eventually, this drug will create a significant difference in the landscape of PPP in the coming years. The treatment space is expected to experience a significant positive shift in the coming years owing to the improvement in healthcare spending worldwide.

Further details are provided in the report…

KOL Views on the Palmoplantar Pustulosis Report

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research. We have reached out to industry experts to gather insights on various aspects of PPP, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the Harvard Medical School, Skin Centre for Dermatology, GISED Study Center, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the PPP market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Palmoplantar Pustulosis Therapeutics Market Report Qualitative Analysis

We perform Qualitative and Palmoplantar Pustulosis Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Palmoplantar Pustulosis treatment market landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for PPP, One of the most important primary endpoints was achieving at least a 50% reduction from baseline in the PPP Area and Severity Index (PPPASI-50) at week 16. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Palmoplantar Pustulosis Therapeutics Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Palmoplantar Pustulosis Therapeutics Market Report Insights

- Patient-based Palmoplantar Pustulosis Market Forecasting

- Palmoplantar Pustulosis Therapeutic Approaches

- Palmoplantar Pustulosis Market Size and Trends

- Existing Palmoplantar Pustulosis Drugs Market Opportunity

Palmoplantar Pustulosis Therapeutics Market Report Key Strengths

- 11 -year Palmoplantar Pustulosis Market Forecast

- The 7MM Coverage

- Palmoplantar Pustulosis Epidemiology Segmentation

- Key Cross Competition

Palmoplantar Pustulosis Therapeutics Market Report Assessment

- Current Palmoplantar Pustulosis Treatment Market Practices

- Palmoplantar Pustulosis Market Reimbursements

- Palmoplantar Pustulosis Drugs Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

- Palmoplantar Pustulosis Market Drivers

- Palmoplantar Pustulosis Market Barriers

Key Questions Answered In The Palmoplantar Pustulosis Market Report:

- Would there be any changes observed in the current Palmoplantar Pustulosis treatment approach?

- Will there be any improvements in Palmoplantar Pustulosis management recommendations?

- Would research and development advances pave the way for future tests and Palmoplantar Pustulosis therapies?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the Palmoplantar Pustulosis treatment market landscape?

- What kind of uptake will the new therapies witness in the coming years in Palmoplantar Pustulosis patients?

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs

.jpg)