PCSK9 Inhibitors Market Summary

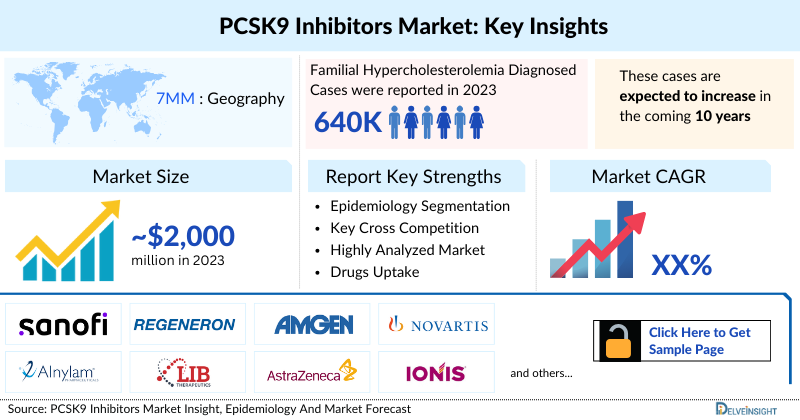

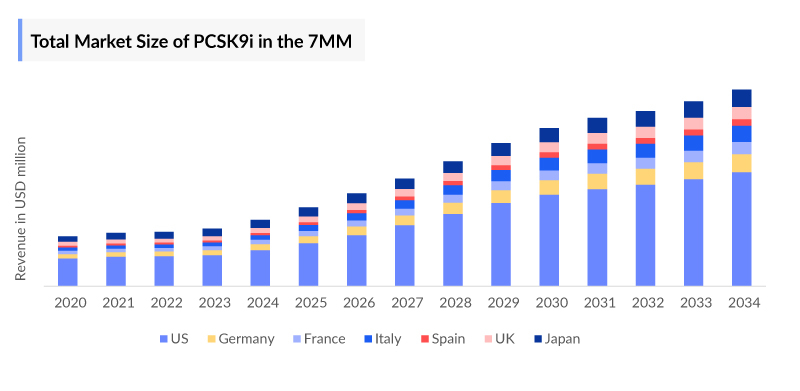

- PCSK9 Inhibitors Market Size in the 7MM was accounted for ~USD 2,000 Millions and the United States accounted for the highest market (~USD 900 Million) in 2023.

- PCSK9 Inhibitors Market Growth is driven by factors like increasing PCSK9 Inhibitors Prevalence of cardiovascular diseases, a growing focus on preventive healthcare, and the wider adoption of innovative therapies. Ongoing research and development efforts aimed at broadening the therapeutic applications of PCSK9 inhibitors are also anticipated to drive market expansion further.

PCSK9 Inhibitors Market Analysis

- Proprotein convertase subtilisin Market/Kexin type 9 (PCSK9) is an enzyme that binds to low-density lipoprotein receptors (LDL receptors), which stops LDL from being removed from the blood, leading to an increase in blood levels of LDL. The PCSK9 inhibitor blocks the PCSK9 enzyme, resulting in more LDL receptors available to remove LDL from the blood, which produces a decrease in LDL blood levels.

- PCSK9 inhibitors are recommended for patients with cardiovascular disease at very high risk with LDL-C levels remaining ≥70 mg/dL, those with severe primary hypercholesterolemia (LDL-C level ≥190 mg/dL), individuals aged 30 to 75 with heterozygous familial hypercholestrolemia (FH) and LDL-C levels of 100 mg/dL or higher, and patients aged 40 to 75 with baseline LDL-C levels of 220 mg/dL or higher.

- Across the 7MM, an estimated 640,000 Familial Hypercholesterolemia Diagnosed Cases were reported in 2023 out of which homozygous cases were very rare.

- In 2023, Peripheral Artery Disease accounted for the highest number in the total risk factor-specific cases of PCSK9 Inhibitors in prophylactic/preventive settings in the 7MM.

- There are currently two FDA-approved monoclonal antibodies that inhibit the action of PCSK9: PRALUENT (alirocumab) and REPATHA (evolocumab). Recently the European Union and FDA have approved LEQVIO (Inclisiran) a small interfering mRNA that inhibits the intracellular synthesis of PCSK9.

- In August 2023, Merck announced the initiation of the company’s Phase III clinical program, CORALreef, for MK-0616, an investigational, oral proprotein convertase subtilisin Market/kexin type 9 (PCSK9) inhibitor, being evaluated for the treatment of adults with hypercholesterolemia.

- The PCSK9 inhibitors Pipeline is robust, with major pharmaceutical companies such as AstraZeneca, LIB Therapeutics, Merck, Amgen, and others actively developing improved treatment options. LIB’s LIB003 is anticipated to garner the highest market share in the coming decade due to its greater efficiency and only once a month dosage.

- Increasing recognition of the role of LDL cholesterol in cardiovascular disease has bolstered demand for PCSK9 inhibitors., thus resulting in substantial market growth in the upcoming time.

Request for Unlocking the Sample Page of the "PCSK9 Inhibitors Treatment Market"

Request for unlocking the CAGR of the "PCSK9 Inhibitors Drugs Market"

DelveInsight’s “PCSK9 Inhibitors Market Insight, Epidemiology And Market Forecast -2034” report delivers an in-depth understanding of the PCSK9 Inhibitors, historical and Competitive Landscape as well as the PCSK9 Inhibitors therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The PCSK9 Inhibitors Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecast the 7MM PCSK9 Inhibitors market size from 2020 to 2034. The report also covers current PCSK9 Inhibitors Treatment Market practices/algorithms and PCSK9 Inhibitors unmet needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

PCSK9 Inhibitors Market |

|

|

PCSK9 Inhibitorss Market Size | |

|

PCSK9 Inhibitors Companies |

Sanofi, Regeneron Pharmaceuticals, Amgen, Novartis, Alnylam Pharmaceuticals, LIB Therapeutics, AstraZeneca and Ionis Pharmaceuticals, CiVi Biopharma, and others. |

|

PCSK9 Inhibitors Epidemiology Segmentation |

|

PCSK9 Inhibitors Treatment Market

Proprotein convertase Subtilisin Market/Kexin type 9 serine protease (PCSK9) plays a vital role in cholesterol metabolism by regulating low-density lipoprotein (LDL) receptor degradation, which reduces the clearance of circulating LDL particles. PCSK9 activity is inversely related to LDL cholesterol (LDL-C) level: Gain-of-function PCSK9 gene mutations are one cause of elevated LDL-C and cardiovascular risk in familial hypercholesterolemia (FH), whereas loss-of-function mutations cause low LDL-C and reduced risk of atherosclerotic cardiovascular disease (ASCVD).

PCSK9 inhibitor plays a vital role in cholesterol metabolism by regulating low-density lipoprotein (LDL) receptor degradation and reducing the clearance of circulating LDL particles. Hepatocytes are the predominant site for PCSK9 production, with other sites being the intestines and kidneys. PCSK9 reduces the number of LDLR in hepatocytes by promoting their metabolism and subsequent degradation, preventing it from breaking down the receptors and allowing these to continue to reduce blood cholesterol. Three classes of LDL-C-lowering medications, i.e., statins, ezetimibe, and PCSK9 inhibitors, beneficially affect cardiovascular risk and lead to a higher density of LDL receptors on the hepatocyte surface and subsequently enhance LDL uptake.

PCSK9 Inhibitors Treatment

PCSK9 inhibitors are currently involved in the treatment of familial hypercholesterolemia patients who are intolerant to statins or have an elevated LDL-C level despite being on maximally tolerated statin therapy. The inhibitors are also approved for an established cardiovascular disease to reduce the risk of myocardial infarction, stroke, and coronary revascularization. PCSK9 can be inhibited pharmacologically by using monoclonal antibodies that bind and neutralize PCSK9 or by RNA-targeting drugs, which contain an RNA strand complementary to PCSK9 mRNA. It leads to the assembly of an RNA-induced silencing complex (RISC), which degrades PCSK9 mRNA for a prolonged period and thereby inhibits the production of PCSK9.

PCSK9 Inhibitors Recent Developments

- In March 2025, AstraZeneca announced that positive results from the PURSUIT Phase IIb trial for AZD0780 showed a statistically significant reduction in low-density lipoprotein cholesterol (LDL-C) when added to standard statin therapy, compared to placebo. AZD0780 is an once-daily oral PCSK9 inhibitor for patients not reaching their LDL-C lowering goal with statins.

PCSK9 Inhibitors Drugs Market Chapters

The drug chapter segment of the PCSK9 Inhibitors drugs market reports encloses a detailed analysis of PCSK9 Inhibitors marketed drugs and late-stage (Phase III and Phase I/II) PCSK9 Inhibitors pipeline drugs. It also helps understand the PCSK9 Inhibitors' clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest PCSK9 Inhibitors news and press releases.

PCSK9 Inhibitors Marketed Drugs

- PRALUENT (Alirocumab): Sanofi/Regeneron Pharmaceuticals

PRALUENT is a human monoclonal antibody that binds to proprotein convertase Subtilisin Market/Kexin type 9 (PCSK9). PCSK9 binds to the low-density lipoprotein receptors (LDLR) on the surface of hepatocytes to promote LDLR degradation within the liver. By inhibiting the binding of PCSK9 to LDLR, alirocumab increases the number of LDLRs available to clear LDL, thereby lowering LDL-C levels.

In the US, PRALUENT is approved for use as an adjunct to diet and maximally tolerated statin therapy to treat adults with Heterozygous Hypercholesterolemia (HeFH) or clinical atherosclerotic cardiovascular disease (ASCVD) who require additional lowering of LDL-C. PRALUENT has received Orphan Drug designation for the treatment of HoFH.

- REPATHA (Evolocumab/AMG 145): Amgen

Evolocumab is a human monoclonal IgG2 directed against PCSK9, which binds to the low-density lipoprotein receptor (LDLR) on the surface of hepatocytes to promote LDLR degradation within the liver. By inhibiting the binding of PCSK9 to LDLR, evolocumab market increases the number of LDLRs available to clear LDL from the blood, thereby lowering LDL-C levels. The US FDA granted Orphan Drug designation to REPATHA for the treatment of HoFH.

PCSK9 Inhibitors Emerging Drugs

- MK-0616: Merck Sharp & Dohme

MK-0616 is Merck’s investigational PCSK9 inhibitor, which is expected to be a breakthrough, despite having competition from several approved agents that lowers elevated cholesterol levels by targeting the same protein. The drug is being studied in its Phase II (NCT05261126) trial to determine the efficacy and safety of oral MK-0616 in lowering low-density lipoprotein cholesterol (LDL-C) in participants with hypercholesterolemia and yielded a positive result and significantly reduced LDL-C compared to placebo and the placebo-adjusted reduction.

- LIB003 (Lerodalcibep): LIB Therapeutics

Lerodalcibep is a novel, third-generation, PCSK9 inhibitor in development to overcome the limitations of current low-density lipoprotein-cholesterol (LDL-C) lowering treatments, including statins and ezetimibe, to achieve lower LDL-C targets. Lerodalicibep is being developed as a convenient, small-injection volume, once-monthly dose with long-ambient stability. Currently, it is under Phase III clinical trial.

PCSK9 Inhibitors Companies

List of companies working in the PCSK9 Inhibitor drugs market are

-

Amgen

-

Sanofi

-

Novartis

-

Eli Lilly & Company

-

Pfizer

-

F. Hoffmann-La Roche Ltd

-

AstraZeneca

-

Merck & Co.

-

Alnylam Pharmaceuticals

-

Ionis Pharmaceuticals

-

Esperion Therapeutics

-

Akcea Therapeutics

-

Arrowhead Pharmaceuticals

-

Silence Therapeutics

-

Hanmi Pharmaceutical

-

China Meheco

-

CSPC Pharmaceutical

-

Innovent Biologics

PCSK9 Inhibitors Market Outlook

The PCSK9 inhibitors Therapeutics Market is positioned for significant expansion, driven by heightened awareness of LDL cholesterol's impact on cardiovascular disease and the efficacy of PCSK9 inhibitors in lowering LDL cholesterol levels. FDA approval like alirocumab, evolocumab, and inclisiran has accelerated market growth, particularly benefiting patients with familial hypercholesterolemia or atherosclerotic cardiovascular disease who require additional LDL cholesterol reduction despite maximum tolerated statin therapy.

Key drivers of PCSK9 Inhibitors Market Growth include the increasing PCSK9 Inhibitors Prevalence of cardiovascular diseases, a growing focus on preventive healthcare, and the wider adoption of innovative therapies. Ongoing research and development efforts aimed at broadening the therapeutic applications of PCSK9 inhibitors are also anticipated to drive market expansion further.

Understanding the role of PCSK9 in cholesterol metabolism suggested that inhibiting its actions might lower LDL-C levels therapeutically. Monoclonal antibodies directed at PCSK9 are the first to be approved. Currently, there are three PCSK9 inhibitors available in the United States: alirocumab, evolocumab, and Inclisiran approved by the FDA for adult patients to reduce the risk of myocardial infarction, stroke, and unstable angina requiring hospitalization in adults with established cardiovascular disease as an adjunct to diet, alone or in combination with other lipid-lowering therapies, for the treatment of adults with primary hyperlipidemia drugs market (including HeFH) to reduce LDL-cholesterol.

PCSK9 Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging PCSK9 Inhibitors expected to be launched in the PCSK9 Inhibitors market during 2020–2034.

PCSK9 Inhibitors Pipeline Development Activities

The PCSK9 Inhibitors pipeline segment provides insights into PCSK9 Inhibitors clinical trials within Phase III, Phase II, and Phase I. It also analyzes PCSK9 Inhibitors Companies involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for PCSK9 Inhibitors market growth over the forecast period.

PCSK9 Inhibitors Clinical Trial Activities

The PCSK9 Inhibitors pipeline segment covers information on collaborations, acquisitions and mergers, licensing, and patent details for PCSK9 Inhibitors emerging therapies.The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion.

KOL Views on PCSK9 Inhibitors

To keep up with current and future PCSK9 Inhibitors market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on PCSK9 Inhibitors evolving PCSK9 Inhibitors treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapy treatment patterns or PCSK9 Inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the PCSK9 Inhibitors unmet needs.

|

KOL Views |

|

“Inclisiran does provide advantages over PCSK9 targeting antibodies including its fully synthetic composition that confers manufacturing advantages and allows for the company to demonstrate pricing flexibility unlikely to be matched by biologics” |

|

“Inclisiran (siRNA) follows the natural pathway of mRNA interference and PCSK9 silencing and has several proposed advantages. Inclisiran requires only twice a year of administration, which is also user-friendly. Anti-PCSK9 monoclonal antibodies require 12–26 injections per year, whereas statin therapy requires daily pill administration, and compliance is an issue with these therapies.” |

|

“With progressive advancements, researchers are also developing virus-like particles (VLPs) targeting PCSK9, which will act as the vaccine for LDL-C reduction and eventually lead to low incidences of cardiovascular events. These VLPs are displaying PCSK9-derived protein which activates the immune system for the generation of high-titer antibodies that bind to circulating PCSK9.” |

Qualitative Analysis

We perform Qualitative and PCSK9 Inhibitors Drugs Market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving PCSK9 Inhibitors Treatment Market Landscape.

PCSK9 Inhibitors Drugs Market Access and Reimbursement

In Italy, in the context of primary hypercholesterolemia (heterozygote familial and non-familial) or mixed dyslipidemia, PCSK9 inhibitors (alirocumab and evolocumab) are reimbursed according to the AIFA prescribing criteria. In adult patients below 80 years of age who do not reach predefined LDL-C levels despite at least 6 months of prior combination therapy with a maximum tolerated dose of high-potency statin agent and ezetimibe or ezetimibe monotherapy in case of stating-intolerant patients, more specifically alirocumab, is reimbursed in:

- Primary CVD prevention in patients with familial heterozygote hypercholesterolemia (HeFH) and LDL-C ≥ 130 mg/dL;

- Secondary CVD prevention in patients with HeFH or non-familiar hypercholesterolemia or mixed dyslipidemia with LDL-C ≥ 100 mg/dL

The PCSK9 Inhibitors Drugs Market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

PCSK9 Inhibitors Drugs Market Report Scope

- The PCSK9 Inhibitors drugs market report covers a segment of key events, an executive summary, and a descriptive overview of PCSK9 Inhibitors across the several selected indications, explaining its various classes, benefits, and challenges for future.

- Comprehensive insight has been provided into the PCSK9 Inhibitors epidemiology and treatment in the 7MM.

- Additionally, an all-inclusive account of both the current and emerging therapies for PCSK9 Inhibitors is provided, along with the assessment of new therapies, which will have an impact on the current PCSK9 Inhibitors Treatment Market Landscape.

- A detailed review of PCSK9 Inhibitors Treatment Market; historical and forecasted is included in the report, covering drug outreach in the 7MM.

- The PCSK9 Inhibitors Therapeutics Market Report provides an edge while developing business strategies, by understanding trends shaping and driving the global PCSK9 Inhibitors Drugs Market through SWOT analysis and expert insights/KOL views.

PCSK9 Inhibitors Treatment Market Report Insights

- PCSK9 Inhibitors Targeted Patient Pool

- PCSK9 Inhibitors Therapeutic Approaches

- PCSK9 Inhibitors Pipeline Drugs Analysis

- PCSK9 Inhibitors Market Size

- PCSK9 Inhibitors Market Trends

- Existing and future PCSK9 Inhibitors Treatment Market Opportunity

PCSK9 inhibitors Treatment Market Key Strengths

- 10 Years PCSK9 Inhibitors Market Forecast

- The 7MM Coverage

- Key Cross Competition

- PCSK9 Inhibitors Drugs Uptake

- Key PCSK9 Inhibitors Market Forecast Assumptions

PCSK9 inhibitors Treatment Market Report Assessment

- Current PCSK9 Inhibitors Treatment Market Practices

- PCSK9 Inhibitors Unmet Needs

- PCSK9 Inhibitors Pipeline Drugs Analysis Profiles

- PCSK9 Inhibitors Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT)

- PCSK9 Inhibitors Market Drivers

- PCSK9 Inhibitors Market Barriers

Key Questions Answered In The PCSK9 Inhibitors Market Report

- What was the PCSK9 inhibitor Treatment Market Size, and PCSK9 Inhibitors Therapeutics Market Share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative PCSK9 inhibitors Market?

- Which drug type segment account for maximum PCSK9 inhibitors sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for PCSK9 inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the PCSK9 Inhibitors patient types/pool where unmet need is more and whether emerging therapies will be able to address the residual unmet need?

- What are the key factors hampering the PCSK9 Market Growth?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What key designations have been granted for the PCSK9 inhibitors emerging therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy PCSK9 Inhibitors Market Forecast Report

- The PCSK9 Inhibitors drugs market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the PCSK9 inhibitors Therapeutics Market.

- Understand the existing PCSK9 Inhibitors Drugs Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming PCSK9 Inhibitors Companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the PCSK9 Inhibitors unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Ready to Dive Deeper? Purchase the Complete Report for in-depth Market Analysis by Clicking Here:-

-inhibitors-market-report.png&w=256&q=75)