Alpha-1 Antitrypsin Deficiency Market Summary

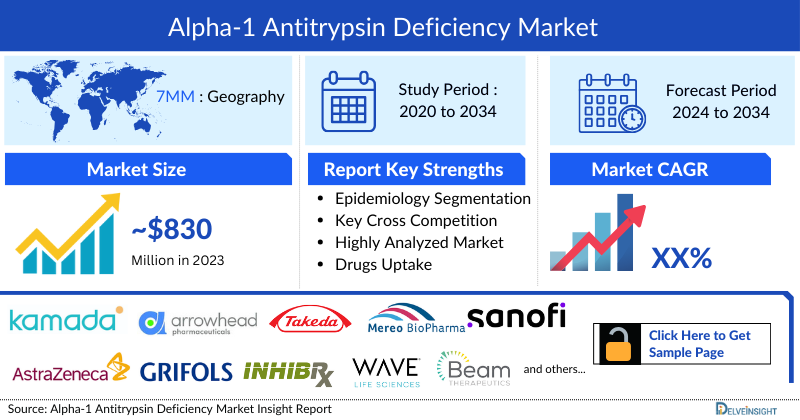

- The Alpha-1 Antitrypsin Deficiency market size in the 7MM was around USD 830 million in 2023 and is expected to increase with a significant CAGR during the forecast period.

- Among the 7MM, the United States accounted for the largest Alpha-1 Antitrypsin Deficiency market size, i.e., approximately 84% of the overall Alpha-1 Antitrypsin Deficiency market in 2023.

Alpha-1 Antitrypsin Deficiency Market Insight and Trends

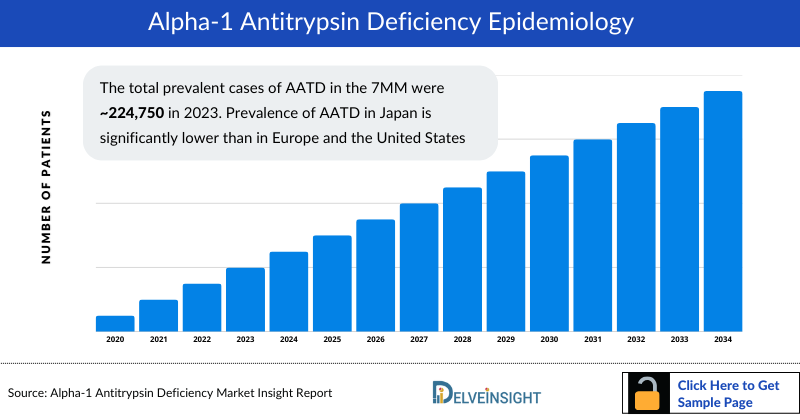

- The total prevalent cases of Alpha-1 Antitrypsin Deficiency in the 7MM were ~224,750 in 2023. Prevalence of Alpha-1 Antitrypsin Deficiency in Japan is significantly lower than in Europe and the United States

- The current Alpha-1 Antitrypsin Deficiency treatment landscape lacks curative therapies. Augmentation therapy, also called replacement therapy, is approved for treating alpha-1-related lung disease. There are four augmentation therapy products available in the US, Grifols’ PROLASTIN-C, Takeda’s ARALAST, CSL Behring’s ZEMAIRA, and Kamada/Takeda’s GLASSIA. RESPREEZA (ZEMAIRA in the US), PROLASTIN, PROLASTINA, PROLASPLAN, PLITALFA, and ALFALASTIN are the augmentation therapies available in selected European countries for Alpha-1 Antitrypsin Deficiency. In Japan, PROLASTIN-C is marketed as LYNSPAD.

- PROLASTIN manufactured by Grifols is the Alpha-1 Antitrypsin Deficiency market leader among augmentation therapies in Alpha-1 Antitrypsin Deficiency based on 2023 sales.

- Key challenges remain in areas such as low diagnosis rate, delay in timely diagnosis, disease awareness, accessibility to genetic testing, availability of disease-modifying treatments, effective management, lack of therapies for liver disease and the discomfort associated with current drug administration methods. New Alpha-1 Antitrypsin Deficiency therapies are emerging to address these gaps.

- Key Alpha-1 Antitrypsin Deficiency Companies such as Kamada Pharmaceuticals (Inhaled AAT), Arrowhead Pharmaceuticals and Takeda (Fazirsiran), Mereo BioPharma/AstraZeneca (Alvelestat), Sanofi/Inhibrx Biosciences (SAR447537/INBRX-101), Wave Life Sciences (WVE-006), Beam Therapeutics (BEAM-302), Grifols (Alpha-1 15%), Krystal Biotech (KB408), and others are evaluating their assets in different stages of clinical development and will significantly impact the Alpha-1 Antitrypsin Deficiency market during the forecast period (2024-2034).

- While there are no licensed pharmacological treatments available for patients with Alpha-1 Antitrypsin Deficiency-associated liver disease, fazirsiran appears as a potentially transformative approach offering a transformative alternative to liver transplants, currently the only effective option.

- Inhaled therapies and self-administered treatments are poised to revolutionize the patient experience, such as Kamada Pharmaceuticals' Inhaled AAT, if approved, would be the first Alpha-1 Antitrypsin Deficiency treatment that avoids weekly intravenous infusions.

- Alpha-1 15%, developed by Grifols, represents a first in-human subcutaneous approach, which if approved would drastically ease the treatment burden of Alpha-1 Antitrypsin Deficiency.

- As emerging treatments like gene therapies (KB408, BEAM-302, and others) and RNA-editing therapy (WAVE-006) move closer to potential approvals, the market could soon offer more durable, minimally invasive options that significantly improve patient quality of life and set new standards in Alpha-1 Antitrypsin Deficiency care.

- Few of the assets, such as Novo Nordisk’s belcesiran and Vertex’s VX-864 have failed in their respective clinical trials due to adverse events or inability to achieve the primary endpoint.

- Ongoing research and an increase in disease understanding have led to the identification of therapies with effective and convenient routes of administration, including subcutaneous, inhalation, and oral, with the potential to improve patient’s quality of life, setting the stage for Alpha-1 Antitrypsin Deficiency market expansion and reshaping patient expectations and treatment experiences.

Alpha-1 Antitrypsin Deficiency Market size and forecast

- 2023 Alpha-1 Antitrypsin Deficiency Market Size: USD 830 million

- United States Alpha-1 Antitrypsin Deficiency Market Size: USD ~700 million

- Largest Alpha-1 Antitrypsin Deficiency Market: United States

DelveInsight’s "Alpha-1 Antitrypsin Deficiency Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Alpha-1 Antitrypsin Deficiency, historical and forecasted epidemiology as well as the Alpha-1 Antitrypsin Deficiency therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Alpha-1 Antitrypsin Deficiency market report provides current treatment practices, emerging drugs, Alpha-1 Antitrypsin Deficiency market share of individual therapies, and current and forecasted Alpha-1 Antitrypsin Deficiency market size from 2020 to 2034, segmented by seven major markets. The Alpha-1 Antitrypsin Deficiency market report also covers current Alpha-1 Antitrypsin Deficiency treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Alpha-1 Antitrypsin Deficiency market.

Key Factors Driving the Alpha-1 Antitrypsin Deficiency Market

Rising AATD Diagnosis and Awareness

Greater screening, provider education, and targeted testing are uncovering far more patients than before, as the condition has been historically underdiagnosed (fewer than ~10% diagnosed in some estimates), and improved detection expands the treated population

Potential of Early-stage AATD Therapies

Krystal Biotech’s KB408 and Beam Therapeutics’ BEAM-302 are promising early-stage therapies with potential as single-dose, curative options for AATD.

AATD Competitive Landscape

The emerging landscape holds a diverse range of therapeutic alternatives for treatment, including immunomodulator (serine peptidase inhibitor [Inhaled AAT]), Reduce production of the mutant Z-AAT protein (Fazirsiran), Neutrophil elastase enzyme inhibitor (Alvelestat), AAT replacement (SAR447537/INBRX-101), GalNAc-conjugated RNA editing (WVE-006), Genetically corrects the E342K point mutation (BEAM-302), Alpha1-Proteinase Inhibitor (Alpha-1 AT 15%), Sequesters mutant protein, Z-protein binder (BMN 349), ADAR-based gene correction (KRRO-110), and others in different lines of treatment. The expected launch of these therapies shall further create a positive impact on the AATD market.

Alpha-1 Antitrypsin Deficiency Disease Understanding

Alpha-1 Antitrypsin Deficiency Overview

According to the National Organization for Rare Disorders (NORD), alpha-1 antitrypsin deficiency is a hereditary disorder characterized by low levels of a protein called alpha-1 antitrypsin (AAT) found in the blood. This deficiency may predispose an individual to several illnesses and most commonly manifests as chronic obstructive pulmonary disease (COPD) (including bronchiectasis) and liver disease (especially cirrhosis and hepatoma) or, more rarely, as a skin condition called panniculitis.

The etiology and pathogenesis of Alpha-1 Antitrypsin Deficiency involve a complex interaction between genetic and environmental factors, resulting in immune-mediated reactions affecting the lungs, liver, and skin. The SERPINA1 gene mutations lead to the inadequate production and improper functioning of the AAT protein. This deficiency can result in serious lung and liver complications. A deficiency of A1AT allows substances that break down proteins (so-called proteolytic enzymes) to attack various body tissues. The attack results in destructive lung changes (emphysema) and may affect the liver and skin.

Alpha-1 Antitrypsin Deficiency Diagnosis

Alpha-1 Antitrypsin Deficiency may first be suspected in people with liver disease symptoms at any age or who have symptoms of lung disease (such as emphysema), especially when there is no obvious cause, or it is diagnosed at a younger age. So, Alpha-1 Antitrypsin Deficiency testing is recommended for all adults with emphysema, COPD, or asthma whenever airflow obstruction is present or incompletely reversible after optimized treatment with a bronchodilator. Other rarer forms of Alpha-1 Antitrypsin Deficiency might be present, so unexplained bronchiectasis, granulomatosis with polyangiitis, necrotizing panniculitis, and liver disease of unknown etiology should prompt further Alpha-1 Antitrypsin Deficiency testing. Once the diagnosis is made, familial testing is advocated since Alpha-1 Antitrypsin Deficiency is a heritable disease.

Further details related to diagnosis will be provided in the report…

Alpha-1 Antitrypsin Deficiency Treatment

The primary purpose of treatment is to improve the manifestation of liver and lung disease developed due to Alpha-1 Antitrypsin Deficiency. Behavioral, lifestyle modification, medical, and surgical treatment are recommended for individuals with Alpha-1 Antitrypsin Deficiency.

Current treatment for Alpha-1 Antitrypsin Deficiency includes both medicinal and surgical therapies. Both of these categories provide symptomatic relief to the subjects based on the level and severity of their conditions. Commonly used therapy for Alpha-1 Antitrypsin Deficiency is similar to COPD and emphysema treatment: abstinence from smoking, long-acting bronchodilators, antibiotics, inhalations of corticosteroids, and long-acting beta-agonists are recommended. However, applying such solutions does not increase the functional AAT level in serum. Further, lung transplantation may be an appropriate option for individuals with end-stage lung disease, and liver transplantation is the definitive treatment for severe Alpha-1 Antitrypsin Deficiency-associated liver disease to restore AAT levels in the body. Augmentation therapy, also called replacement therapy, is approved for treating alpha-1-related lung disease.

Therefore, no specific therapy is available for the liver disease associated with Alpha-1 Antitrypsin Deficiency. However, animal studies have shown promise for several Alpha-1 Antitrypsin Deficiency drugs that can increase the liver’s ability to break down unsecreted A1AT (e.g., rapamycin and carbamazepine) and have prompted research studies in Alpha-1 Antitrypsin Deficiency individuals.

Further details related to treatment will be provided in the report…

Alpha-1 Antitrypsin Deficiency Epidemiology

The Alpha-1 Antitrypsin Deficiency epidemiology chapter in the Alpha-1 Antitrypsin Deficiency market report provides historical as well as forecasted epidemiology segmented by the Total Prevalent Cases of Alpha-1 Antitrypsin Deficiency, Total Diagnosed Prevalent Cases of Alpha-1 Antitrypsin Deficiency, Genotype-specific Prevalent Cases of Alpha-1 Antitrypsin Deficiency, and Comorbidity-associated Cases of Alpha-1 Antitrypsin Deficiency in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Alpha-1 Antitrypsin Deficiency Epidemiological Analyses and Forecast

- Among the 7MM, the US accounted for approximately 59%, EU4 and the UK for 40%, and Japan for 1% of the total prevalent cases of Alpha-1 Antitrypsin Deficiency in 2020.

- The total diagnosed prevalent cases of Alpha-1 Antitrypsin Deficiency in the United States is estimated to be ~10,700 in 2023. The cases are expected to increase by 2034.

- Among EU4 and the UK, in 2023, the UK accounted for the highest Alpha-1 Antitrypsin Deficiency cases, followed by Germany.

- As per estimates, in 2020, in the US, comorbidity associated with lung diseases was most common, occurring in around 77% of the total Alpha-1 Antitrypsin Deficiency cases, followed by other diseases occurring in around 15% of the cases, while 8% of the cases had liver diseases.

Discover the latest Alpha-1 Antitrypsin Deficiency epidemiology trends and forecasts up to 2032.

Recent Developments in Alpha-1 Antitrypsin Deficiency Clinical Trials

- In May 2025, Beam Therapeutics (Nasdaq: BEAM) announced that the FDA granted RMAT designation to BEAM-302, a liver-targeted base editing therapy for alpha-1 antitrypsin deficiency (AATD), a genetic disorder causing lung and liver disease with high unmet medical need.

- In March 2025, Beam Therapeutics Inc. (Nasdaq: BEAM) announced that the U.S. Food and Drug Administration (FDA) has cleared the investigational new drug (IND) application for BEAM-302, a treatment for alpha-1 antitrypsin deficiency.

Alpha-1 Antitrypsin Deficiency Drug Analysis

Alpha-1 Antitrypsin Deficiency Marketed Drugs

PROLASTIN-C LIQUID/LYNSPAD: Grifols

PROLASTIN-C LIQUID is an A1-PI indicated for chronic augmentation and maintenance therapy in adults with clinical evidence of emphysema due to severe hereditary deficiency of A1-PI. PROLASTIN increases the antigenic and functional levels of serum and antigenic lung epithelial lining fluid levels of A1-PI. PROLASTIN-C LIQUID is the first ready-to-infuse liquid formulation of an A-1 antitrypsin deficiency replacement therapy manufactured in the US. It requires less preparation time than the lyophilized product and less volume for infusion compared to others.

In October 2009, PROLASTIN-C was approved by the FDA for the treatment of individuals with Alpha-1 Antitrypsin Deficiency and evidence of emphysema. Later in September 2017, PROLASTIN-C liquid was approved by the US FDA for chronic augmentation and maintenance therapy in adults with clinical evidence of emphysema due to severe Alpha-1 Antitrypsin Deficiency. In November 2022, Grifols announced that its AlphaID At Home Genetic Health Risk Service, the first-ever free direct-to-consumer program in the US to screen for genetic risk of Alpha-1 Antitrypsin Deficiency, has been cleared by the US FDA.

GLASSIA: Kamada Pharmaceuticals/Takeda

GLASSIA is an intravenous AAT product that is indicated for chronic augmentation and maintenance therapy in individuals with clinically evident emphysema due to severe hereditary deficiency of A1-PI. GLASSIA increases antigenic and functional (anti-neutrophil elastase capacity, ANEC) serum levels and antigenic lung epithelial lining fluid levels of Alpha-1 Proteinase Inhibitor (A1-PI).

In July 2010, the US FDA approved GLASSIA for the treatment of chronic augmentation and maintenance therapy in individuals with clinically evident emphysema due to severe hereditary deficiency of A1-PI. Later in June 2016, the US FDA approved an expanded label for GLASSIA to treat emphysema due to severe Alpha-1 Antitrypsin Deficiency that can be self-infused at home after appropriate training. In April 2021, Kamada amended the GLASSIA license agreement with Takeda. Under the amendment, Kamada transferred the GLASSIA US BLA to Takeda.

|

Company |

Indication |

Molecule Type |

MoA |

RoA |

|

Grifols |

Emphysema due to severe hereditary deficiency of A1-PI |

Biologic |

Alpha-1 Proteinase Inhibitor (A1-PI) |

IV |

|

CSL Behring |

Alpha-1 Antitrypsin Deficiency with emphysema |

Biologic |

A1-PI |

IV |

|

Kamada Pharmaceuticals/Takeda |

Emphysema due to severe hereditary deficiency of A1-PI |

Biologic |

A1-PI |

IV |

|

Takeda |

Emphysema due to severe congenital deficiency of A1-PI |

Biologic |

A1-PI |

IV |

|

LFB Biotechnologies |

Emphysema due to genetic deficiency of AAT |

Biologic |

A1-PI |

IV |

Emerging Alpha-1 Antitrypsin Deficiency Drugs

Inhaled Alpha 1-Antitrypsin (AAT): Kamada Pharmaceuticals

Inhaled AAT, an investigational medicine researched for Alpha-1 Antitrypsin Deficiency patients, aims to replace the deficient AAT protein in the lung. It acts as an immunomodulator (serine peptidase inhibitor) that prevents inflammation and tissue degradation by regulating the imbalance of proteases and antiproteases in the lungs.

Inhaled AAT received positive scientific advice from the EMA that reconfirmed the overall design of the ongoing study and acknowledged the statistically and clinically meaningful improvement in lung functioning. In March 2016, Kamada submitted an MAA to EMA for the inhaled AAT to treat Alpha-1 Antitrypsin Deficiency. However, later, in 2017, it was withdrawn due to insufficient data. Currently, the company is conducting a Phase III clinical trial to evaluate the safety and efficacy of Kamada AAT for Inhalation in the EU and has completed Phase II and II/III trials in the US and EU, respectively.

As per the news released in Q2 2024 report, Kamada Pharmaceuticals has filed an IND amendment with the FDA consisting of a revised Statistical Analysis Plan (SAP) and study protocol, which, if approved, may allow for the acceleration of the program of its ongoing pivotal Phase III InnovAATe clinical trial for the inhaled AAT.

Fazirsiran (ARO-AAT/TAK-999): Arrowhead Pharmaceuticals and Takeda

Fazirsiran is an investigational RNA interference therapy designed to reduce the production of mutant alpha-1 antitrypsin protein (Z-AAT) as the first potential treatment for liver disease associated with Alpha-1 Antitrypsin Deficiency. In October 2020, Takeda Pharmaceuticals and Arrowhead Pharmaceuticals announced a collaboration and licensing agreement to develop fazirsiran to treat Alpha-1 Antitrypsin Deficiency. The drug has received BTD, FTD and ODD from the US FDA to treat AAT-associated liver disease.

Currently, Arrowhead Pharma is advancing fazirsiran in two Phase III studies, REDWOOD (NCT05677971) in patients with Alpha-1 Antitrypsin Deficiency-associated liver disease with METAVIR Stage F2–F4 Fibrosis and another trial (NCT06165341) for patients with Alpha-1 Antitrypsin Deficiency-associated liver disease with METAVIR Stage F1 Fibrosis.

|

Company |

Patient Segment |

Phase |

Molecule Type |

MOA |

|

Kamada Pharmaceuticals |

Alpha-1 Antitrypsin Deficiency |

III |

Biologic |

Immunomodulator (Serine peptidase inhibitor) |

|

Arrowhead Pharmaceuticals and Takeda |

Alpha-1 Antitrypsin Deficiency-associated with liver diseases |

III |

Small interfering RNA (siRNA) |

Reduce production of the mutant Z-AAT protein |

|

Mereo BioPharma/ AstraZeneca |

Alpha-1 Antitrypsin Deficiency-associated lung diseases |

II |

Small molecule |

Neutrophil elastase enzyme inhibitor |

|

Sanofi/Inhibrx Biosciences |

Emphysema due to Alpha-1 Antitrypsin Deficiency |

II |

Recombinant human AAT-Fc fusion protein |

AAT replacement |

|

Wave Life Sciences |

Pi*ZZ Alpha-1 Antitrypsin Deficiency |

I/II |

RNA editing therapy |

GalNAc-conjugated RNA editing |

|

Beam Therapeutics |

PiZ mutation in Alpha-1 Antitrypsin Deficiency |

I/II |

Gene therapy |

Genetically corrects the E342K point mutation (PiZZ genotype) |

|

Intellia Therapeutics |

Alpha-1 Antitrypsin Deficiency-lung Disease |

I/II |

CRISPR-mediated gene therapy |

Delivers a copy of the SERPINA1 gene |

|

Krystal Biotech |

Alpha-1 Antitrypsin Deficiency |

I |

Gene therapy |

Delivers SERPINA1 via HSV-1, enhancing alpha-1 antitrypsin production in the lungs |

|

BioMari |

Alpha-1 Antitrypsin Deficiency |

I |

Small molecule |

Sequesters mutant protein, Z-protein binder |

|

AlveoGene |

Alpha-1 Antitrypsin Deficiency |

Pre-clinical |

Gene therapy |

Promotes production of AAT |

|

Korro Bio |

Alpha-1 Antitrypsin Deficiency |

Pre-clinical |

Oligonucleotide |

ADAR-based gene correction |

|

Kamada Pharmaceuticals |

Alpha-1 Antitrypsin Deficiency |

Early stage |

Recombinant protein |

Immunomodulator |

|

Santhera Pharmaceutical/Spexis |

Alpha-1 Antitrypsin Deficiency |

- |

Peptide inhibitor |

Human neutrophil elastase inhibitor |

Alpha-1 Antitrypsin Deficiency Drug Class Insight

Neutrophil elastase enzyme inhibitor

Neutrophil elastase inhibitors specifically target and block the activity of neutrophil elastase. This action helps prevent the breakdown of elastin and other connective tissues in the lungs, slowing the progression of emphysema and preserving lung function. By regulating neutrophil elastase levels, these inhibitors help restore the normal balance between proteases and antiproteases that are disrupted in the treatment of Alpha-1 Antitrypsin Deficiency. Mereo Biopharma’s Alvelestat, a neutrophil elastase inhibitor is in development for Alpha-1 Antitrypsin Deficiency-associated lung disease.

Explore the latest advancements in Alpha-1 Antitrypsin Deficiency therapies with the latest 2025 pipeline insights.

Alpha-1 Antitrypsin Deficiency Market Outlook

Alpha-1 antitrypsin deficiency is a genetic disorder that can lead to lung and liver disease. Early diagnosis and appropriate medical care are important for managing the condition and improving the quality of life for individuals with Alpha-1 Antitrypsin Deficiency. The current treatment landscape lacks curative and disease-modifying therapies. Augmentation therapy, also called replacement therapy, is approved for treating alpha-1-related lung disease. Several off-label drugs are used for symptomatic relief and managing lung-related complications like COPD or emphysema; bronchodilators, corticosteroids, and antibiotics are commonly used. In the severe stage of the disease, a surgical option like lung volume reduction surgery and bullectomy is recommended, and patients with very advanced emphysema may require lung transplant surgery, which involves removing a damaged lung and replacing it with a healthy lung; however, it involves many risks, including infection and rejection. Alpha-1 Antitrypsin Deficiency is commonly associated with liver disease; however, no therapy has yet been approved to address liver-associated disease. Treatment is designed to maintain normal nutrition and to provide the liver and the body with essential nutrients. IV replacement therapy, majorly used to manage lung diseases, utilizes AAT protein from healthy human donors’ blood plasma to augment the alpha-1 levels in the blood and lungs diagnosed with emphysema.

The views on augmentation therapies differ in the respective countries, with some therapies being available in only a particular country, whereas some countries are devoid of any augmentation therapy. Currently, four augmentation therapy products are available in the US, approved by the US FDA; Grifols’ PROLASTIN-C, Takeda’s ARALAST, CSL Behring’s ZEMAIRA, and Kamada/Takeda’s GLASSIA. In Europe, currently, RESPREEZA (ZEMAIRA in the US), PROLASTIN, PROLASTINA, PROLASPLAN, PLITALFA, and ALFALASTIN are the augmentation therapies available in selected European countries for Alpha-1 Antitrypsin Deficiency. Since the prevalence of Alpha-1 Antitrypsin Deficiency in Japan is estimated to be very low as compared to the US and Europe, resulting in fewer patients to date, only one augmentation therapy, i.e., LYNSPAD (PROLASTIC C liquid), has been approved in Japan.

Continued in report...

- Alpha-1 Antitrypsin Deficiency companies are actively working toward the development of therapeutic options for Alpha-1 Antitrypsin Deficiency associated with lung and liver disease including Arrowhead Pharma/Takeda, Kamada, Mereo BioPharma/AstraZeneca Sanofi/Inhibrx Biosciences Wave Life Sciences, and others.

- Among the 7MM, the US accounted for the largest market size of Alpha-1 Antitrypsin Deficiency. i.e., USD ~700 million in 2023.

- Among EU4 and the UK, Germany accounted for the highest market size in 2023, while the UK occupied the lowest.

- The pipeline for Alpha-1 Antitrypsin Deficiency consists an innovative therapies including an immunomodulator (serine peptidase inhibitor), neutrophil elastase enzyme inhibitor, RNA editing therapy, gene therapies, and others.

- In 2034, among all the emerging therapies, the highest revenue is expected to be generated by PROLASTIN/PROLASTIN-C/LYNSPAD in the 7MM.

Further details will be provided in the report….

Alpha-1 Antitrypsin Deficiency Market Recent Developments and Breakthroughs

- In October 2024, Wave Life Sciences announced that it is expecting to share multidose data from the RestorAATion-2 trial in 2025.

- In September 2024, Krystal Biotech amended the protocol for its KB408 Phase I SERPENTINE-1 study to include mandatory bronchoscopies in this cohort to measure alpha-1 antitrypsin expression.

- In July 2024, Beam Therapeutics entered into a settlement agreement with a research institution pursuant to which, in exchange for a release of claims in its favor, the company agreed, among other things, to pay the research institution an upfront payment of USD 15 million and to make additional payments contingent upon the development and commercialization of BEAM-302.

- In February 2024, Grifols announced that it had introduced 4 and 5 g vials of PROLASTIN used for long-term AAT augmentation therapy in patients with severe Alpha-1 Antitrypsin Deficiency who show evidence of progressive lung disease.

- In January 2024, the US FDA approved the supplement Biologics License Application (sBLA) for Alpha-1-Proteinase Inhibitor ZEMAIRA.

To be continued in the report….

Alpha-1 Antitrypsin Deficiency Drugs Uptake

This section focuses on the uptake rate of potential Alpha-1 Antitrypsin Deficiency drugs expected to be launched in the Alpha-1 Antitrypsin Deficiency market during 2020–2034. The landscape of Alpha-1 Antitrypsin Deficiency treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Given the promising efficacy results of siRNA-based approaches in early phase II clinical trials in liver-associated Alpha-1 Antitrypsin Deficiency, fazirsiran is expected to have a fast uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Alpha-1 Antitrypsin Deficiency Clinical Trials Activities

The Alpha-1 Antitrypsin Deficiency pipeline report provides insights into different Alpha-1 Antitrypsin Deficiency clinical trials within Phase III, Phase II, PhaseI/II, Phase I, and preclinical developement. It also analyzes key Alpha-1 Antitrypsin Deficiency companies involved in developing targeted therapeutics.

Alpha-1 Antitrypsin Deficiency Pipeline Developmental Activities

The Alpha-1 Antitrypsin clinical trials analysis report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Alpha-1 Antitrypsin Deficiency emerging therapies.

Latest KOL- Views on Alpha-1 Antitrypsin Deficiency

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, Professor and Vice Chair Department of Critical Care Medicine and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Alpha-1 Antitrypsin Deficiency market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Alpha-1 Antitrypsin Deficiency market and the unmet needs.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the RWTH Aachen University Hospital, University of Valencia, Vall d'Hebron University Hospital, Drexel University, Saint Louis University, University of Birmingham, Juntendo University, Kyoto University, etc., were contacted. Their opinion helps understand and validate Alpha-1 Antitrypsin Deficiency epidemiology and market trends.

Alpha-1 Antitrypsin Deficiency Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging Alpha-1 Antitrypsin Deficiency therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Alpha-1 Antitrypsin Deficiency Market Access and Reimbursement

The PROLASTIN DIRECT Program

PROLASTIN-C LIQUID (Grifols)

It is a comprehensive program that uses experts exclusively dedicated to Alpha1 to provide personalized support for patients receiving PROLASTIN-C LIQUID. The PROLASTIN DIRECT program is managed by EVERSANA, the only specialty pharmacy that fills prescriptions for PROLASTIN-C LIQUID. The program provides the patient with a team dedicated to alpha-1 care that will assist with securing insurance coverage, coordinating infusions, and managing one's health with their physician's guidance. The program's patient service coordinator is the primary point of contact the patient can rely on for everything related to the treatment.

It assists Alpha1 expert nurses and pharmacists 24 h a day, 7 days a week. One can take comfort in knowing that the PROLASTIN DIRECT program handles every detail of the patient's infusion, from shipping medicine, scheduling infusion, and administering infusion everything is handled.

The PROLASTIN DIRECT program works with health insurance to determine if the patient has received an infusion at home, at work, infusion center, or even while traveling. Additionally, it also covers disease management through AlphaNet.

Moreover, an individual's insurance is reviewed every year to ensure effective coverage.

GLASSIA

- Takeda Patient Support Copay Assistance Program

- Takeda Patient Support assists the patient in the following ways:

- Enroll in the Takeda Patient Support Copay Assistance Program if the patient qualifies*

- Work with specialty pharmacy (or site of care) to help the patient receive GLASSIA

- Arrange for a trained nursing professional to teach the patient or a caregiver how to infuse the treatment at home, if requested by the healthcare provider

- Navigate the health insurance process

- Direct the patient to community support resources and education

- Provide the patient with tips and timely information throughout GLASSIA treatment

*To be eligible, the patient must be enrolled in Takeda Patient Support and have commercial insurance.

The Takeda Patient Support Copay Assistance Program may help the patient save on the prescribed Takeda treatment.†

- The program can cover up to 100% of the patient’s out-of-pocket copay costs if the patient is eligible. To be eligible for this program, the patient must:

- Be prescribed a Takeda treatment for a condition that the FDA approves to treat

- Have commercial insurance.

- Be enrolled in Takeda Patient Support.

Further detailed analysis will be provided in the report…

Scope of the Alpha-1 Antitrypsin Deficiency Market Report

- The Alpha-1 Antitrypsin Deficiency treatment market report covers a descriptive overview of Alpha-1 Antitrypsin Deficiency, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into Alpha-1 Antitrypsin Deficiency epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Alpha-1 Antitrypsin Deficiency is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the Alpha-1 Antitrypsin Deficiency market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The Alpha-1 Antitrypsin Deficiency treatment market report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Alpha-1 Antitrypsin Deficiency market.

Alpha-1 Antitrypsin Deficiency Market Report Insights

- Alpha-1 Antitrypsin Deficiency Patient Population

- Alpha-1 Antitrypsin Deficiency Therapeutic Approaches

- Alpha-1 Antitrypsin Deficiency Pipeline Analysis

- Alpha-1 Antitrypsin Deficiency Market Size and Trends

- Alpha-1 Antitrypsin Deficiency Market Opportunities

- Impact of Upcoming Alpha-1 Antitrypsin Deficiency Therapies

Alpha-1 Antitrypsin Deficiency Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Alpha-1 Antitrypsin Deficiency Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Alpha-1 Antitrypsin Deficiency Market

- Alpha-1 Antitrypsin Deficiency Drugs Uptake

Alpha-1 Antitrypsin Deficiency Market Report Assessment

- Current Alpha-1 Antitrypsin Deficiency Treatment Practices

- Alpha-1 Antitrypsin Deficiency Unmet Needs

- Alpha-1 Antitrypsin Deficiency Pipeline Product Profiles

- Alpha-1 Antitrypsin Deficiency Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Alpha-1 Antitrypsin Deficiency Market Drivers

- Alpha-1 Antitrypsin Deficiency Market Barriers

Frequently Asked Questions from Alpha-1 Antitrypsin Deficiency Market Report

- What was the Alpha-1 Antitrypsin Deficiency market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Alpha-1 Antitrypsin Deficiency market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- Which country will have the largest Alpha-1 Antitrypsin Deficiency market size during the study period (2020–2034)?

- What are the disease risks, burdens, and unmet needs of Alpha-1 Antitrypsin Deficiency?

- What is the historical Alpha-1 Antitrypsin Deficiency patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Alpha-1 Antitrypsin Deficiency?

- How many emerging Alpha-1 Antitrypsin Deficiency therapies are in the mid-stage and late stage of development for the treatment of Alpha-1 Antitrypsin Deficiency?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Alpha-1 Antitrypsin Deficiency therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Alpha-1 Antitrypsin Deficiency and their status?

- What are the key designations that have been granted for the emerging therapies for Alpha-1 Antitrypsin Deficiency?

Reasons to buy Alpha-1 Antitrypsin Deficiency Market Forecast Report

- The Alpha-1 Antitrypsin Deficiency treatment market report will help in developing business strategies by understanding trends shaping and driving Alpha-1 Antitrypsin Deficiency.

- To understand the future market competition in the Alpha-1 Antitrypsin Deficiency market and Insightful review of the SWOT analysis of Alpha-1 Antitrypsin Deficiency.

- Organize sales and marketing efforts by identifying the best opportunities for Alpha-1 Antitrypsin Deficiency in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming Alpha-1 Antitrypsin Deficiency companies in the Alpha-1 Antitrypsin Deficiency market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Alpha-1 Antitrypsin Deficiency market.

- To understand the future market competition in the Alpha-1 Antitrypsin Deficiency market.

.png)

-liver-disease-pipeline.png&w=256&q=75)