CD-19 Market Summary

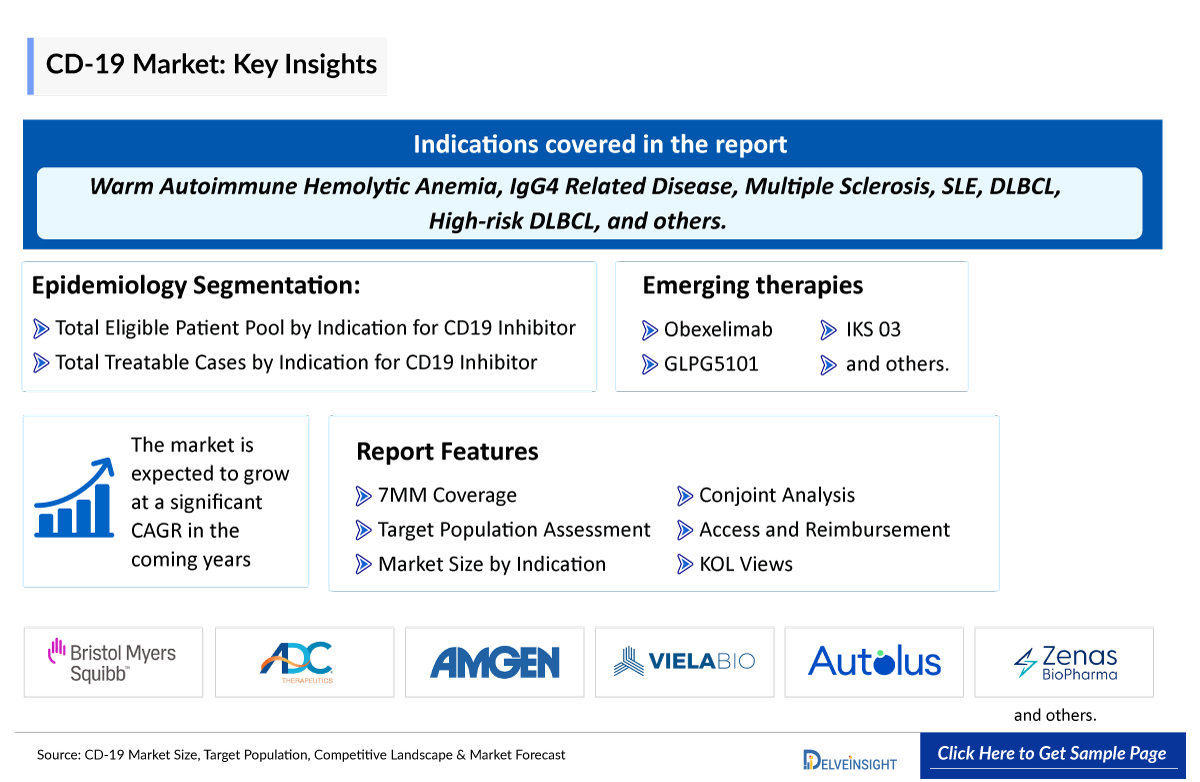

- The CD19 Inhibitors Market is expected to witness significant growth in the coming years, driven by the rising prevalence of conditions such as NHL, ALL, NMOSD, IgG4-RD, SLE, and multiple sclerosis; increasing awareness of CD19 inhibitors; and a growing pipeline of emerging drugs currently in clinical trials or filed for regulatory approval by various pharmaceutical companies.

- The leading CD-19 Companies such as Bristol Myers Squibb, ADC Therapeutics, Amgen, Viela Bio, Autolus Therapeutics, Zenas BioPharma, Iksuda Therapeutics, Galapagos NV, and others.

CD19 Inhibitors Market Insights

- CD19 is a key target in B-cell cancers like non-Hodgkin lymphomas (NHL) and acute lymphoblastic leukemia (ALL) due to its high expression on malignant B cells. It's also being investigated in autoimmune conditions such as neuromyelitis optica spectrum disorder (NMOSD), Immunoglobulin G4-related disease (IgG4-RD), systemic lupus erythematosus (SLE), and multiple sclerosis, underscoring its broad therapeutic potential.

- CD19 inhibitors encompass a variety of immunotherapeutic approaches, including monoclonal antibodies, bispecific antibodies, Antibody-Drug Conjugates (ADCs), and CAR T-cell therapies, all targeting the CD19 antigen on B cells. They represent important advances in the treatment of B-cell malignancies, particularly for patients with relapsed or refractory disease.

- The CD19 Market features several approved therapies, including MONJUVI (tafasitamab), UPLIZNA (inebilizumab-cdon), BLINCYTO (blinatumomab), ZYNLONTA (loncastuximab tesirine-lpyl), BREYANZI (lisocabtagene maraleucel; liso-cel), AUCATZYL obecabtagene autoleucel), and others.

- In March 2025, Bristol Myers Squibb announced that the European Commission had granted approval to BREYANZI (lisocabtagene maraleucel; liso-cel), a CD19-directed chimeric antigen receptor (CAR) T cell therapy, for the treatment of adult patients with relapsed or refractory follicular lymphoma after two or more lines of systemic therapy.

- In December 2024, the National Comprehensive Cancer Network (NCCN) added AUCATZYL to its Clinical Practice Guidelines in Oncology for treating adult relapsed/refractory B-cell acute lymphoblastic leukemia (r/r B-ALL). This inclusion highlights AUCATZYL as a recognized treatment option based on current evidence.

- In December 2024, Galapagos NV, announced additional results from the ongoing Phase I/II ATALANTA-1 study of its CD19 CAR T-cell therapy, GLPG5101. The results, which were presented during an oral presentation at the 66th American Society of Hematology (ASH) Annual Meeting and Exposition, demonstrated an encouraging efficacy and safety profile in patients with relapsed/refractory non-Hodgkin lymphoma (R/R NHL). The majority of patients in the study had received GLPG5101 as a fresh, fit, stem-like, early memory CD19 CAR T-cell therapy, with a median vein-to-vein time of seven days.

- In November 2024, Autolus Therapeutics, announced that the US Food and Drug Administration (FDA) had granted marketing approval for AUCATZYL (obecabtagene autoleucel) for the treatment of adult patients with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (r/r B-ALL).

- While CD19 inhibitors, like CAR T-cell therapies, have shown efficacy in treating B-cell cancers and some autoimmune diseases, they often lead to depletion of B cells, which can increase the risk of infections and negatively affect the immune system. Developing CD19 inhibitors that can selectively modulate B cell function without depleting them could offer a safer and more effective treatment option, especially for chronic autoimmune conditions.

Request for Unlocking the Sample Page of the "CD-19 Market"

Factors Impacting the CD19 Inhibitors Market Growth

-

Rising Burden of Hematological Malignancies

The increasing prevalence of B-cell malignancies, including acute lymphoblastic leukemia (ALL), chronic lymphocytic leukemia (CLL), and non-Hodgkin lymphoma, is a key driver fueling demand for CD19-targeted therapies. With rising diagnosis rates and improved screening methods, the market for CD19-based treatments continues to expand globally.

-

Expanding Adoption of CAR-T Cell Therapies

CD19-directed CAR-T therapies have revolutionized the treatment of relapsed and refractory B-cell cancers. Growing approvals of CAR-T products such as tisagenlecleucel and axicabtagene ciloleucel across multiple geographies have significantly strengthened the market landscape. Increasing investments in next-generation CAR-T platforms are further accelerating growth.

-

Strong Clinical Pipeline of CD19-Targeted Therapies

A robust pipeline of CD19-focused agents, including monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates (ADCs), is driving innovation. Numerous late-stage clinical trials exploring expanded indications and combination regimens are expected to enhance treatment options and market penetration.

-

Rising Awareness and Early Diagnosis

Improved patient awareness programs, availability of advanced diagnostic tools, and enhanced physician education are contributing to earlier diagnosis of B-cell malignancies. This is boosting demand for targeted treatment options like CD19 therapies.

DelveInsight’s “CD19 inhibitors Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CD19 inhibitors, historical and Competitive Landscape as well as the CD19 inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The CD-19 Inhibitors Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CD19 inhibitors market size from 2020 to 2034. The report also covers current CD19 inhibitor Treatment practices and algorithms, as well as unmet medical needs, to identify the best opportunities and assess the CD19 market’s potential.

Scope of the CD19 Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

CD-19 Market |

|

|

CD-19 Market Size | |

|

CD-19 Companies |

|

CD19 Inhibitors Disease Understanding

CD19 inhibitors are a class of therapeutic agents designed to target the CD19 protein, a transmembrane glycoprotein expressed on the surface of B cells throughout their development and on most B-cell malignancies. CD19 plays a crucial role in B-cell activation and signaling, making it an attractive target for immunotherapy in diseases such as non-Hodgkin lymphomas (NHL) and B-cell acute lymphoblastic leukemia (ALL). The main types of CD19 inhibitors include monoclonal antibodies (e.g., tafasitamab), bispecific T-cell engagers (e.g., blinatumomab), antibody-drug conjugates (e.g., loncastuximab tesirine), and chimeric antigen receptor (CAR) T-cell therapies (e.g., tisagenlecleucel). These agents work by binding to CD19, leading to direct tumor cell killing, recruitment of immune effector cells, or delivery of cytotoxic payloads. CD19-targeted therapies have shown significant clinical benefits in relapsed or refractory B-cell malignancies, offering options for patients resistant to CD20-targeted treatments. While CAR T-cell therapies are highly effective, monoclonal antibodies and ADCs provide more accessible alternatives with manageable safety profiles. Ongoing research continues to optimize these therapies to improve efficacy, reduce toxicity, and overcome resistance mechanisms such as CD19 antigen loss.

Further details related to country-based variations are provided in the report

CD19 Inhibitors Overview

The global CD19 inhibitors market is experiencing robust growth driven by increasing prevalence of B-cell malignancies such as non-Hodgkin lymphoma and leukemia, alongside advances in immunotherapy and personalized medicine. Key growth drivers include rising cancer incidence globally, increasing demand for targeted therapies with improved efficacy and safety profiles, expanding clinical approvals (e.g., CAR T therapies and novel monoclonal antibodies). CAR T-cell therapies, which target CD19, currently hold over 40% of the CD antigen cancer therapy market share and are a major growth segment due to their success in hematologic malignancies. The CD-19 Market is highly competitive with key CD19 Companies such as Roche, AstraZeneca, Incyte, BeiGene, and MorphoSys investing heavily in R&D to develop next-generation CD19 inhibitors with enhanced potency and safety.

CD19 Inhibitors Potential Patient Pool

This chapter focuses on the potential patient pool for CD19 inhibitors, covering nearly 10 key indications where CD19-targeted therapies may be applicable. It provides both historical and projected data on the total number of cases, the eligible population for treatment, and estimated treated patients across the 7 major markets (the United States, EU4 – Germany, France, Italy, and Spain – the United Kingdom, and Japan) from 2020 to 2034.

CD19 Inhibitor Drugs Analysis

The drug chapter segment of the CD19 inhibitors Drugs Market Reports encloses a detailed analysis of approved CD19 inhibitors, late-stage (Phase III and Phase II) CD19 inhibitors pipeline drugs. It also helps understand the CD19 inhibitor’s clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

CD-19 Marketed Drugs

-

AUCATZYL (obecabtagene autoleucel): Autolus Therapeutics

AUCATZYL (obecabtagene autoleucel) is a CD19-directed, genetically modified autologous T cell immunotherapy approved for adults with relapsed or refractory B-cell precursor acute lymphoblastic leukemia. This therapy is manufactured from a patient’s own T cells, which are collected, genetically engineered using a lentiviral vector to express an anti-CD19 chimeric antigen receptor (CAR), expanded, and then reinfused into the patient. The CAR construct includes a murine anti-CD19 single chain variable fragment linked to 4-1BB and CD3-zeta co-stimulatory domains, enhancing T cell activation, proliferation, and persistence. Upon infusion, these modified T cells target and kill CD19-expressing leukemia cells, resulting in anti-tumor activity. AUCATZYL is administered as a cell suspension for intravenous infusion and is supplied in patient-specific infusion bags. The most common risks include cytokine release syndrome and neurotoxicity, which require specialized monitoring and management.

-

MONJUVI (tafasitamab-cxix): Incyte Corporation/ MorphoSys

Tafasitamab is a humanized, Fc-engineered monoclonal antibody targeting the CD19 antigen expressed on B cells, including malignant B cells in diseases like diffuse large B-cell lymphoma (DLBCL). It exerts its anti-tumor effect through direct cytotoxicity and enhanced immune effector functions such as antibody-dependent cellular cytotoxicity (ADCC) and antibody-dependent cellular phagocytosis (ADCP), achieved by modifications in its Fc region that increase affinity for Fc gamma receptors on natural killer cells and macrophages. Tafasitamab is approved in combination with lenalidomide for patients with relapsed or refractory DLBCL who are ineligible for autologous stem cell transplantation. Clinical studies have demonstrated significant reductions in peripheral B-cell counts and durable responses in this patient population. Common adverse effects include infusion-related reactions and myelosuppression, necessitating monitoring during treatment. Its unique mechanism and enhanced effector function make tafasitamab a valuable option in B-cell malignancy therapy.

Comparison of Key Marketed Drugs | |||

|

Product |

Company |

RoA |

Indication |

|

AUCATZYL |

Autolus Therapeutics |

IV |

|

|

MONJUVI |

Incyte Corporation/ MorphoSys |

IV |

|

Emerging CD-19 Drugs

-

Obexelimab: Zenas BioPharma

Obexelimab (XmAb5871) is a monoclonal antibody that targets CD19 with its variable domain and uses Xencor's XmAb immune inhibitor Fc domain to target FcγRIIb, a receptor that inhibits B-cell function. XmAb5871 is the first drug candidate that Xencor is aware of that targets FcγRIIb inhibition. Obexelimab’s highly potent and broad blockade of B-cell activation without depleting B cells differentiates it from other B-cell targeting therapies and has potential for treating many autoimmune diseases. Currently, the drug is in the Phase III stage of its CD-19 Clinical Trials for the treatment of Warm Autoimmune Hemolytic Anemia and IgG4 Related Disease. The drug is also being developed for the treatment of Multiple Sclerosis and Systemic Lupus Erythematosus.

-

GLPG5101: Galapagos NV

GLPG5101 is a second generation anti-CD19/4-1BB CAR-T product candidate, administered as a single fixed intravenous dose. The safety, efficacy and feasibility of decentralized manufactured GLPG5101 are currently being evaluated in the ATALANTA-1 Phase I/II study in patients with relapsed/refractory non-Hodgkin lymphoma (R/R NHL). The primary objective of the Phase I part of the study is to evaluate safety and to determine the recommended dose for the Phase II part of the study. Secondary objectives include assessment of efficacy and feasibility of decentralized manufacturing of GLPG5101.

Comparison of Key Emerging Drugs | |||||

|

Product |

Company |

RoA |

Phase |

Designation |

Indication |

|

Obexelimab |

Zenas BioPharma |

Subcutaneous |

III |

Orphan |

|

|

GLPG5101 |

Galapagos NV |

IV |

II |

N/A |

Relapsed/refractory hematological malignancies including:

|

|

IKS 03 |

Iksuda Therapeutics |

IV |

I |

N/A |

|

CD19 Inhibitor Market Outlook

The CD19 Inhibitors Market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with NHL, ALL, NMOSD, IgG4-RD, SLE, multiple sclerosis, and many more indications; the growing awareness of CD19 Inhibitors; and the increasing number of emerging drugs that are under clinical trials and filed for approval by various companies.

The leading CD-19 Companies such as Bristol Myers Squibb, ADC Therapeutics, Amgen, Viela Bio, Autolus Therapeutics, Zenas BioPharma, Iksuda Therapeutics, Galapagos NV, and others, are involved in developing drugs for CD19 inhibitors for various indications such as NHL, ALL, NMOSD, IgG4-RD, SLE, multiple sclerosis, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of CD19 inhibitors and define their role in the therapy of cancers and autoimmune disorders.

CD19 inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CD19 expected to be launched in the CD19 market during 2020–2034.

CD19 Inhibitor Pipeline Development Activities

The CD-19 Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key CD-19 Companies involved in developing targeted therapeutics. The presence of numerous drugs at different stages is expected to generate immense opportunities for the CD19 inhibitors market growth over the forecasted period.

CD19 Clinical Trials Activities

The CD-19 Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CD19 inhibitor therapies.

Latest KOL Views on CD19

To keep up with current and future CD19 market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CD19 inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others. Their opinion helps understand and validate current and emerging therapy treatment patterns or CD19 inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

KOL Views |

|

“Antibody targeting CD19 is engineered to enhance antibody-dependent cellular cytotoxicity and antibody-dependent cellular phagocytosis. Lenalidomide potentiates T-cell and natural killer cell activation/expansion and direct cell death, giving a rationale for its potential activity.” |

|

“Loncastuximab tesirine could be an important agent to consider in patients who still have CD19-positive disease. After CAR T-cell therapy, 20% or so may no longer express CD19.” |

CD-19 Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

CD-19 Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

In the United States, reimbursement for BREYANZI (lisocabtagene maraleucel), involve a combination of insurance coverage and copay assistance. For patients with commercial insurance, the Copay Assistance Program offered through Cell Therapy 360 can help cover out-of-pocket expenses specifically related to the BREYANZI product. However, this program does not apply to patients covered by government-funded health programs such as Medicare, Medicaid, TRICARE, or VA benefits. The assistance provided is limited to the cost of the drug itself and does not extend to hospital stays, physician services, or other related medical costs, which remain the patient's responsibility. Eligibility criteria apply, and Bristol Myers Squibb retains the right to change or terminate the program at any time. Thus, patients may need to work closely with their healthcare provider and a case manager to navigate insurance approvals, understand their financial responsibilities, and explore available support options.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on CD19 Inhibitor Clinical Trials

- In February 2025, Zenas BioPharma announced its 2024 accomplishments, outlined key business objectives for 2025, in which company stated expected key milestones across three major programs:

- MoonStone Trial (multiple sclerosis): Phase II data expected in Q3 2025. Obexelimab aims to address RMS by inhibiting a broader B cell population than CD20 therapies like OCREVUS and KESIMPTA. The trial measures changes in MRI-detected lesions over a 12-week period.

- INDIGO Trial (IgG4-RD): Phase III topline results expected by year-end 2025. With no approved treatments for IgG4-RD, obexelimab may offer a safer alternative to B cell depleting agents, targeting disease flares without the infection risks associated with depletion.

- SunStone Trial (SLE): Enrollment to be completed in 2025, with topline results in H1 2026. The trial builds on prior proof-of-concept results showing enhanced response in patients with higher obexelimab exposure, supporting further development in SLE.

CD-19 Therapeutics Market Report Scope

- The CD-19 Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current CD-19 Treatment Market Landscape.

- A detailed review of the CD19 inhibitor Treatment Market, historical and forecasted CD-19 market size, CD-19 Drugs market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CD-19 Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CD19 inhibitor Drugs market.

CD19 inhibitor Market Report Insights

- CD19 inhibitors Targeted Patient Pool

- Therapeutic Approaches

- CD19 inhibitor Pipeline Drugs Analysis

- CD19 inhibitor Market Size

- CD19 Market Trends

- Existing and future CD-19 Drugs Market Opportunity

CD19 Inhibitor Therapeutics Market Report Key Strengths

- 10 years CD-19 Market Forecast

- The 7MM Coverage

- Key Cross Competition

- CD-19 Drugs Uptake

- Key CD-19 Market Forecast Assumptions

CD19 Inhibitor Therapeutics Market Report Assessment

- Current CD-19 Treatment Practices

- CD-19 Unmet Needs

- CD-19 Pipeline Drugs Profiles

- CD-19 Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the CD-19 Inhibitor Market

CD-19 Inhibitor Market Insights

- What was the CD19 inhibitor Market Size, the CD-19 market size by therapies, CD-19 Drugs market share (%) distribution, and what would it look like in 2034? What are the contributing factors for CD19 market growth?

- Which CD19 drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for CD19 inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for CD19 inhibitors has evolved since the first drug approval? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CD19 inhibitors? What will be the growth opportunities across the 7MM for the patient population of CD19 inhibitors?

- What are the key factors hampering the growth of the CD19 inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CD19 inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy the CD19 Market Report

- The CD-19 Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the CD-19 inhibitor Drugs Market.

- Understand the existing CD-19 Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved CD19 drugs in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming CD19 companies in the CD-19 Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CD-19 Drugs Market, so that the upcoming CD-19 companies can strengthen their development and launch strategy

Stay updated with us for Recent Articles @ Latest DelveInsight Blogs