CD-38 Market Summary

- The CD38 Inhibitors Market is expected to witness robust growth in the coming years, fueled by a rising global burden of cancer, increasing clinical validation of CD38 as a therapeutic target, and expanding interest from leading pharmaceutical companies.

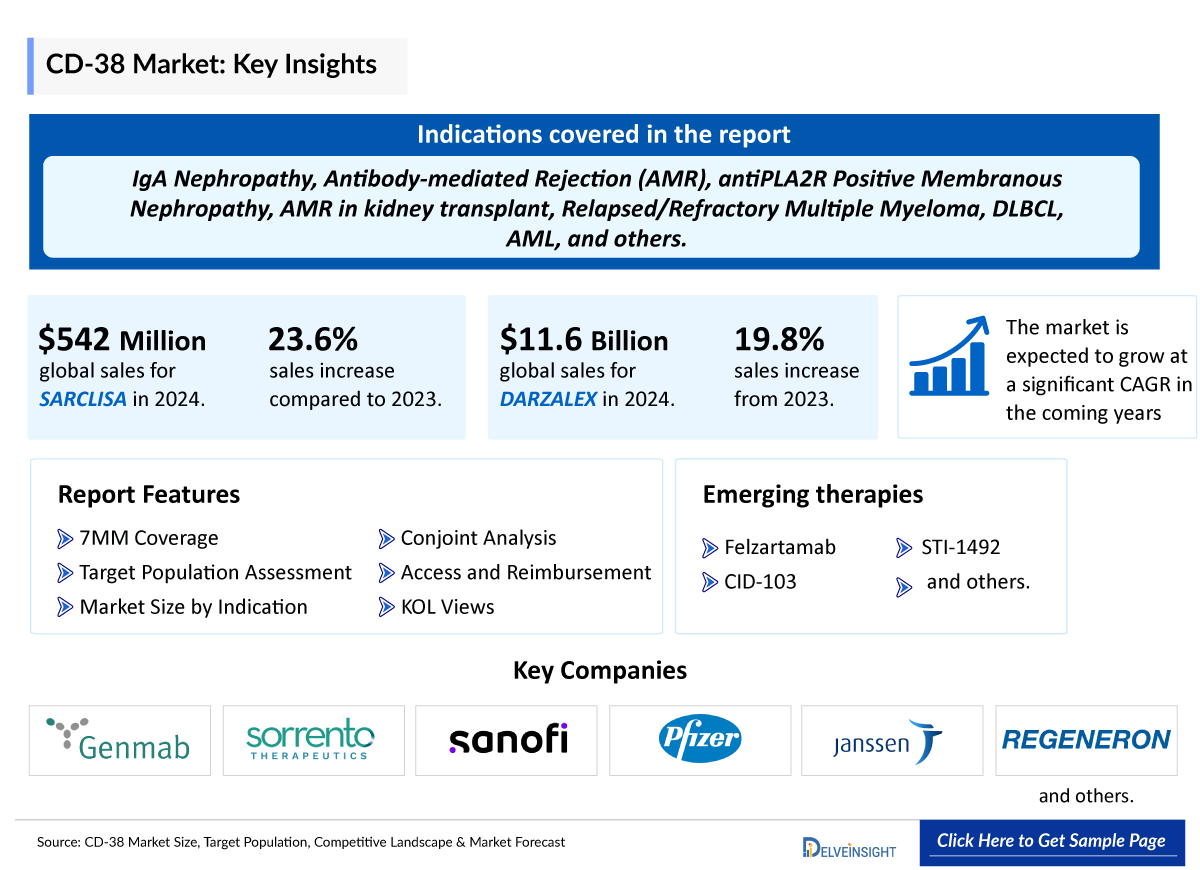

- The leading CD38 Companies, such as Genmab, Sorrento Therapeutics, and others, are currently engaged in the development and production of CD38 inhibitor, which has the potential to significantly impact and enhance the CD38 Inhibitors market.

CD38 Market Insights and Forecast

- CD38 inhibitors have revolutionized the treatment of multiple myeloma, where over 90% of malignant plasma cells express CD38. Their therapeutic use also extends to other blood cancers, including T-cell leukemia and lymphoblastic leukemia, due to CD38’s overexpression in these malignancies.

- CD38 inhibitors shows high efficacy in multiple myeloma, reducing the risk of disease progression by ~50%. This significant improvement in progression-free survival outperforms other emerging treatments, reinforcing CD38 inhibitors as a powerful and promising option in the Multiple Myeloma Treatment Market Landscape.

- Beyond hematologic cancers, research is actively exploring the role of CD38 Inhibitors in immune-mediated conditions such as systemic lupus erythematosus and antibody-mediated rejection in organ transplantation. With a growing pipeline of next-generation CD38 inhibitors, their application in broader immune-driven diseases is a promising frontier in targeted therapeutics.

- The first FDA-approved CD38 inhibitor, DARZALEX revolutionized the treatment of multiple myeloma and became a blockbuster drug. In 2024, it recorded global sales of USD 11.67 billion—a 19.8% increase from its 2023 sales of USD 9.74 billion. US revenue alone reached USD 6.59 billion, underscoring its dominant market presence.

- A subcutaneous formulation of daratumumab, DARZALEX FASPRO, offers a faster, more convenient alternative to intravenous infusion with comparable efficacy. It contributed significantly to the overall sales of DARZALEX.

- In Sep 2024, SARCLISA got an additional approval in the U.S. as the first anti-CD38 therapy in combination with standard-of-care treatment for adult patients with newly diagnosed multiple myeloma who are not eligible for transplant.

- SARCLISA continued to show strong commercial growth in 2024, recording global sales of EUR 471 million (USD 542.34 million), representing a 23.6% increase compared to 2023. In the United States, SARCLISA generated EUR 200 million (USD 230.29 million) in revenue during 2023, reflecting growing market uptake and expanding clinical use.

- Several CD38 inhibitors are currently being evaluated in CD38 Inhibitor Clinical Trials. One of these assets in the late stage is Biogene’s felzartamab, which is in stage III and being developed for Late Antibody-Mediated Rejection, Immunoglobulin A (IgA) Nephropathy, and is anticipated to receive approval during the forecast period.

- In July 2024, Biogen completed its USD 1.15 billion acquisition of HI-Bio to expand its presence in immunology. Through the deal, Biogen bolstered its pipeline with HI-Bio’s US-based anti-CD38 monoclonal antibody candidate, felzartamab.

- In June 2024, CASI Pharmaceuticals announced that it planned to submit an IND application to the FDA for CID-103, a fully human IgG1 anti-CD38 monoclonal antibody, for the treatment of antibody-mediated rejection (AMR) in kidney transplant recipients. CID-103 had demonstrated promising preclinical efficacy and safety compared to other anti-CD38 antibodies.

Request for Unlocking the Sample Page of the "CD38 Inhibitors Market"

Factors Impacting the CD38 Market Growth

-

Rising prevalence of multiple myeloma and other hematologic malignancies

The increasing incidence of multiple myeloma, along with other hematological cancers, continues to be one of the most important growth factors. As diagnostic accuracy improves and awareness spreads, more patients are being identified earlier in their disease course, expanding the pool eligible for CD38-targeted therapies.

-

Strong clinical uptake of lead CD38 agents validates the class

The commercial and clinical success of established CD38 inhibitors, such as daratumumab, has validated the therapeutic potential of this class. Their proven efficacy in improving survival outcomes has encouraged widespread physician adoption, guideline inclusion, and stronger confidence from both healthcare providers and payers.

-

Regulatory approvals and label expansions into earlier therapy lines

Regulatory agencies across the globe are increasingly approving CD38 inhibitors for broader use, including earlier lines of treatment in multiple myeloma. Label expansions allow these therapies to reach a wider patient population, boosting adoption rates and solidifying their role as standard-of-care backbones.

-

Robust pipeline and ongoing clinical development programs

A growing pipeline of novel CD38 inhibitors, along with active clinical development in combination with other immunotherapies and targeted agents, is fueling optimism in the market. Pharmaceutical and biotech companies are investing heavily in R&D, ensuring sustained innovation and long-term growth opportunities.

DelveInsight’s CD38 Inhibitors Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CD38 Inhibitors, historical and Competitive Landscape as well as the CD38 Inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The CD38 Inhibitors Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CD38 Inhibitors market size from 2020 to 2034. The CD38 Inhibitors market report also covers current CD38 inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the CD38 Inhibitor Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

CD38 Inhibitor Market |

|

|

CD38 Inhibitor Market Size | |

|

CD38 Inhibitor Companies |

|

CD38 Inhibitors Market: Understanding and Treatment Algorithm

CD38 inhibitors represent a promising and rapidly evolving area in immunotherapy. CD38 is a multifunctional transmembrane glycoprotein with both receptor and enzymatic functions, playing a central role in calcium signaling, immune cell regulation, and cellular metabolism. It is highly expressed over a variety of immune cells, especially plasma cells, and is markedly upregulated in several pathological conditions, including hematologic malignancies, autoimmune diseases, and inflammatory disorders. This makes CD38 an attractive and versatile therapeutic target. Inhibition of CD38 can modulate immune responses, deplete pathogenic cell populations, and restore immune balance—opening new avenues for treating diseases beyond cancer.

While CD38-targeting monoclonal antibodies like DARZALEX and SARCLISA have already transformed the treatment landscape for multiple myeloma, ongoing research is expanding their application to conditions such as systemic lupus erythematosus, antibody-mediated rejection in organ transplantation, and other immune-driven diseases. With a growing pipeline of next-generation inhibitors, CD38-targeted therapies hold vast potential in precision medicine.

CD38 inhibitor Treatment

CD38 inhibitors have emerged as powerful agents in the treatment of a range of immune-mediated and malignant diseases. CD38, a multifunctional glycoprotein expressed over plasma cells, natural killer (NK) cells, and other immune cells, plays a central role in calcium signaling, cell adhesion, and immunoregulation. Its overexpression in pathological conditions such as multiple myeloma, autoimmune diseases, and transplant rejection makes it an attractive therapeutic target.

Monoclonal antibodies targeting CD38 have shown the ability to deplete pathogenic plasma cells and modulate immune responses effectively. DARZALEX (Daratumumab), the first approved anti-CD38 therapy, has significantly improved survival outcomes in multiple myeloma and demonstrated potential in autoimmune diseases like systemic lupus erythematosus (SLE) by reducing autoantibody-producing plasma cells. It has also shown benefit in managing antibody-mediated rejection (AMR) in organ transplantation, where conventional therapies often fail.

DARZALEX is approved for use in adult patients with multiple myeloma both as monotherapy and in various combination regimens. It can be used alone in patients who have received at least three prior lines of therapy, including a proteasome inhibitor and an immunomodulatory agent, or who are double-refractory to both. In combination therapy, DARZALEX is approved with several backbones depending on the treatment setting, including lenalidomide and dexamethasone, bortezomib-based regimens, carfilzomib and dexamethasone, and pomalidomide and dexamethasone. These combinations are indicated across newly diagnosed, transplant-eligible, and -ineligible, and relapsed or refractory patient populations, offering flexible treatment options across different stages of disease.

CD38 Inhibitor Drugs Analysis

The drug chapter segment of the CD38 Inhibitors Drugs Market Reports encloses a detailed analysis of CD38 Inhibitors marketed drugs and late-stage (Phase III and Phase II) CD38 Inhibitor pipeline drugs. It also helps understand the CD38 Inhibitors' clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

CD38 Inhibitor Marketed Drugs

-

DARZALEX (daratumumab): Janssen Pharmaceutical

DARZALEX (daratumumab) is a first-in-class CD38-directed monoclonal antibody used in the treatment of multiple myeloma. CD38 is a surface protein highly expressed over myeloma cells, and daratumumab works by targeting and eliminating these malignant cells through multiple mechanisms, including antibody-dependent cellular cytotoxicity, complement-dependent cytotoxicity, and apoptosis. It also modulates the immune system by depleting immunosuppressive cells.

DARZALEX was first approved by the U.S. Food and Drug Administration (FDA) in November 2015 as a monotherapy for patients with multiple myeloma who had received at least three prior lines of therapy, including a proteasome inhibitor and an immunomodulatory agent, or who were double-refractory to both. This marked a significant advancement in multiple myeloma treatment, offering a novel therapeutic mechanism and improving outcomes for heavily pretreated patients. Further, it got EMEA approval in April 2017 and PMDA approval in September 2017.

Since its initial approval, DARZALEX has gained several expanded indications and is now used widely in combination regimens across various stages of multiple myeloma, from newly diagnosed to relapsed or refractory cases.

-

SARCLISA (Isatuximab): Sanofi

SARCLISA (isatuximab-irfc) is a CD38-directed monoclonal antibody developed for the treatment of multiple myeloma. Like daratumumab, it targets the CD38 antigen highly expressed on the surface of myeloma cells, promoting their destruction through immune-mediated mechanisms such as antibody-dependent cellular cytotoxicity and complement activation. Additionally, it may induce direct apoptosis in tumor cells independent of immune effector functions.

SARCLISA received its initial U.S. FDA approval in March 2020 for use in combination with pomalidomide and dexamethasone in adult patients with relapsed or refractory multiple myeloma who had received at least two prior therapies, including both lenalidomide and a proteasome inhibitor. This approval offered a new therapeutic option for patients with difficult-to-treat disease.

Since then, its indications have expanded. Most notably, in September 2024, SARCLISA became the first FDA-approved CD38 therapy in combination with standard of care i.e. bortezomib, lenalidomide, and dexamethasone (VRd) for adults with newly diagnosed multiple myeloma who are not eligible for autologous stem cell transplant (ASCT). It is also approved in combination with carfilzomib and dexamethasone for patients with relapsed or refractory disease who have received one to three prior lines of therapy. These approvals mark SARCLISA as a growing force in the treatment landscape of multiple myeloma, especially for patients who may not be candidates for transplant or who have relapsed following standard regimens.

|

Product |

Company |

Indication |

|

DARZALEX (daratumumab) |

Janssen Pharmaceutical |

Lenalidomide + dexamethasone Bortezomib + melphalan + prednisone Bortezomib + thalidomide + dexamethasone

Lenalidomide + dexamethasone Bortezomib + dexamethasone Carfilzomib + dexamethasone

in combination with pomalidomide + dexamethasone As Monotherapy |

|

SARCLISA (Isatuximab) |

Sanofi |

Bortezomib + lenalidomide + dexamethasone

carfilzomib and dexamethasone

carfilzomib + dexamethasone pomalidomide + dexamethasone |

CD38 Inhibitor Emerging Drugs

-

Felzartamab: Biogen

Felzartamab is an investigational human monoclonal antibody targeting CD38, designed to deplete pathogenic plasma cells in immune-mediated diseases. Originally developed for multiple myeloma, it is now being advanced for conditions like antibody-mediated rejection (AMR), IgA nephropathy, and Primary membranous nephropathy (PMN). It has received FDA Breakthrough Therapy and Orphan Drug Designations. Phase 2 studies are complete, with Biogen planning Phase 3 trials in 2025. Felzartamab is not yet approved and remains under investigation.

- CID-103: CASI Pharmaceuticals

CID-103 is a fully human IgG1 anti-CD38 monoclonal antibody that targets a unique epitope and has shown promising preclinical efficacy and a favorable safety profile compared to other CD38-targeting antibodies. CASI Pharmaceuticals recently announced the dosing of the first patient in a Phase 1/2 CD38 Inhibitor Clinical Trials evaluating CID-103 for the treatment of immune thrombocytopenia (ITP).

|

List of Emerging Drugs | ||||

|

Felzartamab |

Biogen |

Immunoglobulin A (IgA) Nephropathy |

II |

NCT05065970 |

|

CID-103 |

CASI Pharmaceuticals |

Antibody-mediated rejection (AMR) in kidney transplant recipients Relapsed or Refractory Multiple Myeloma Diffuse Large B Cell Lymphoma (DLBCL) Acute Myeloid Leukemia (AML) |

I |

NCT04758767 |

|

STI-1492 |

Sorrento Therapeutics |

Relapsed or Refractory Multiple Myeloma |

I |

NCT05007418 |

CD38 Inhibitors Market Outlook

The CD38 Inhibitors Market is expected to witness robust growth in the coming years, fueled by a rising global burden of cancer, increasing clinical validation of CD38 as a therapeutic target, and expanding interest from leading pharmaceutical companies. Growing awareness about the therapeutic potential of CD38 inhibition, especially in hematologic malignancies and autoimmune conditions, is driving further investment and research.CD38 inhibitors have already demonstrated substantial clinical benefit in multiple myeloma, improving overall survival and progression-free survival when used as monotherapy or in combination regimens. Beyond multiple myeloma, their potential is now being explored in indications such as light chain (AL) amyloidosis, systemic lupus erythematosus (SLE), antibody-mediated rejection (AMR) in kidney transplant, and immune thrombocytopenia (ITP).

Several investigational CD38 monoclonal antibodies are in clinical development, including felzartamab (under development for AMR, IgAN, and PMN), CID-103 (in trials for ITP), and others with ongoing Phase 2 and Phase 3 studies. Biogen, through its acquisition of HI-Bio, is expanding its footprint in immunology with felzartamab, while CASI Pharmaceuticals is advancing CID-103 with encouraging early results. CD38 Inhibitor Companies such as Sanofi, Johnson & Johnson, and Biogen are actively engaged in developing and commercializing CD38-targeted therapies. J&J’s DARZALEX, the first FDA-approved CD38-targeting therapies, has revolutionized multiple myeloma treatment and set a commercial benchmark, with 2024 sales exceeding USD 11.6 billion. Sanofi’s SARCLISA is gaining ground with multiple combination approvals and recent frontline indications.

With a growing number of CD38 Inhibitor Clinical Trials, expanding indications, and continued pharma investment, the CD38 inhibitor landscape is positioned for accelerated expansion. As current studies mature, they will further define the scope of CD38 inhibitors in oncology and immune-mediated diseases, solidifying their role as a transformative class of therapeutics.

CD38 Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CD38 Inhibitors expected to be launched in the market during 2020–2034.

CD38 Inhibitors Pipeline Development Activities

The CD38 Inhibitor Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key CD38 Inhibitor Companies involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for CD38 Inhibitors market growth over the forecasted period. The CD38 Inhibitor Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CD38 Inhibitors emerging therapies. The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example, in July 2024 Biogen completed its USD 1.15 billion acquisition of HI-Bio to expand its presence in immunology. Through the deal, Biogen bolstered its pipeline with HI-Bio’s US-based anti-CD38 monoclonal antibody candidate, felzartamab.

Latest KOL Views on CD38 Report

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CD38 Inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Charite University, Dana-Farber Cancer Institute and others. Their opinion helps understand and validate current and emerging therapy treatment patterns or CD38 inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the CD38 Inhibitor unmet needs.

|

KOL Views |

|

“The cellular depletion strategy of felzartamab, which targets CD38+ plasma cells responsible for pathogenic antibody production, holds significant potential across a broad range of immune-mediated diseases. Originally developed for primary membranous nephropathy (PMN), this approach is now being expanded to include conditions such as IgA nephropathy, antibody-mediated rejection (AMR), and lupus nephritis—highlighting its versatility in addressing antibody-driven pathology across multiple indications” |

CD38 Inhibitor Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

CD38 Inhibitor Therapeutics Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

In the United States, the Janssen CarePath Savings Program offers eligible patients reduced out-of-pocket costs for DARZALEX, allowing them to pay as little as USD 5 per dose, up to an annual maximum of USD 26,000. The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on CD38 Inhibitors Market Landscape

- In Mar 2025, Biogen initiated a Phase 3 study of felzartamab for the treatment of late antibody-mediated rejection (AMR) in kidney transplant patients.

- In Nov 2024, felzartamab was designated as an orphan medicine for the treatment of primary IgA nephropathy in the European Union.

- In Oct 2024, Biogen received U.S. FDA Breakthrough Therapy Designation for felzartamab for the treatment of antibody-mediated rejection in kidney transplant recipients.

- In July 2024, Biogen completed its USD 1.15 billion acquisition of HI-Bio to expand its presence in immunology. Through the deal, Biogen bolstered its pipeline with HI-Bio’s US based anti-CD38 monoclonal antibody candidate, felzartamab.

- In June 2024, CASI Pharmaceuticals announced that it planned to submit an IND application to the FDA for CID-103, a fully human IgG1 anti-CD38 monoclonal antibody, for the treatment of antibody-mediated rejection (AMR) in kidney transplant recipients. CID-103 had demonstrated promising preclinical efficacy and safety compared to other anti-CD38 antibodies.

CD38 Inhibitor Market Report Scope

- The CD38 Inhibitor Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the CD38 Inhibitors Treatment Market, historical and forecasted CD38 Inhibitor Market size, CD38 Inhibitor Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CD38 Inhibitor Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CD38 Inhibitors Drugs Market.

CD38 Inhibitors Market Report Insights

- CD38 Inhibitors Targeted Patient Pool

- CD38 Inhibitors Therapeutic Approaches

- CD38 Inhibitors Pipeline Analysis

- CD38 Inhibitors Market Size and Trends

- Existing and Future CD38 Inhibitor Market Opportunity

CD38 Inhibitors Market Report Key Strengths

- 10-Year CD38 Inhibitor Market Forecast

- The 7MM Coverage

- Key Cross Competition

- CD38 Inhibitor Drugs Uptake

- Key CD38 Inhibitor Market Forecast Assumptions

CD38 Inhibitors Market Report Assessment

- Current CD38 Inhibitor Treatment Practices

- CD38 Inhibitor Unmet Needs

- CD38 Inhibitor Pipeline Drugs Profiles

- CD38 Inhibitor Drugs Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the CD38 Inhibitor Market Report

CD38 Inhibitor Market Insights

- What was the CD38 Inhibitors Treatment Market Size, the CD38 Inhibitor Market Size by therapies, CD38 Inhibitor Drugs Market Share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative CD38 Inhibitor Market?

- Which drug type segment accounts for maximum CD38 inhibitors sales?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for CD38 has Inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CD38 Inhibitors? What will be the growth opportunities across the 7MM for the patient population on CD38 Inhibitors?

- What are the key factors hampering the growth of the CD38 Inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CD38 Inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy the CD38 Market Report

- The CD38 Inhibitor Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the CD38 Inhibitor Drugs Market.

- Understand the existing CD38 Inhibitor Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the CD38 Inhibitor Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CD38 Inhibitor Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ Latest DelveInsight Blogs