Delta-like Ligand 3 (DLL3)-targeted Therapies Market

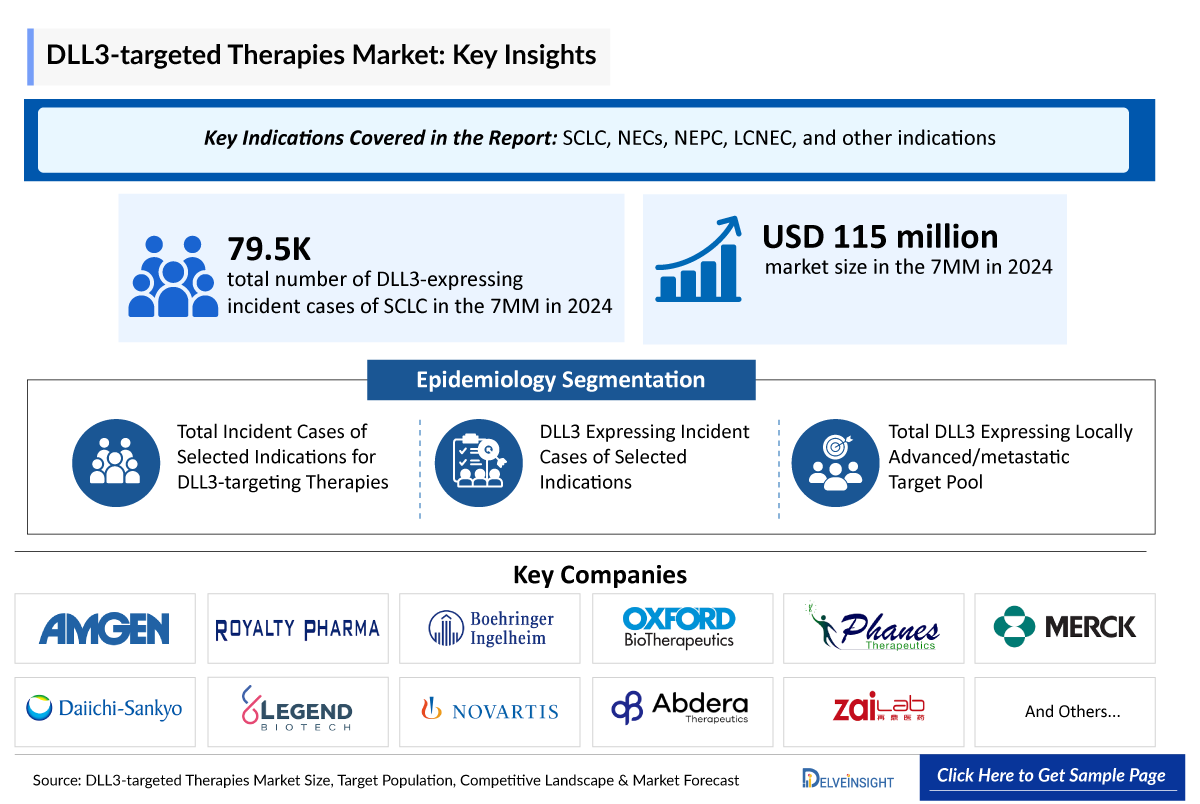

- The DLL3-targeted therapies market size in the 7MM was USD 115 million in 2024.

- The DLL3-targeted therapies market is expected to grow with a significant CAGR during the forecasted period in the leading markets.

Delta-like Ligand 3 Market and Epidemiology Analysis

- Delta-like ligand 3 (DLL3) has evolved from an obscure Notch ligand into a key oncology biomarker, impacting Small Cell Lung Cancer (SCLC), Neuroendocrine Tumors (NETs), Neuroendocrine Carcinoma (NEC), including Neuroendocrine Prostate Cancer (NEPC) and Extra-pulmonary NEC (EP-NEC), and Large cell Neuroendocrine Lung Carcinoma (LCNEC).

- Among the selected indications for DLL3-targeted therapies, SCLC contributed to the highest number of cases in the 7MM. NEC is the least contributor. The increasing burden is fueled by multiple factors, including exposure to environmental toxins and insecticides, lifestyle risks such as chronic stress and diets associated with obesity, as well as broader social challenges like inadequate healthcare access among lower-income populations.

- Intracellular by nature, DLL3 resists traditional monoclonal antibodies, but aberrant surface expression on cancer cells enables Bispecific T-cell Engagers (BiTEs), Chimeric Antigen Receptor T Cells (CAR-T), and Antibody-drug Conjugates (ADCs) to achieve precise tumor targeting.

- Rovalpituzumab tesirine (Rova-T), the first experimental DLL3-targeting ADC, showcased the potential of surface DLL3 targeting but failed in late-stage SCLC trials due to limited efficacy and toxicity, highlighting the need for next-generation DLL3 therapies.

- Following the failure and discontinuation of Rova-T in August 2029, IMDELLTRA (tarlatamab-dlle), and Amgen’s first-in-class DLL3-targeting immunotherapy, leverages T- cell engagement to selectively eliminate DLL3-expressing SCLC cells, addressing the unmet need left by Rova-T.

- With region-specific regulatory approaches, IMDELLTRA has been approved in the US (May 2024, post-platinum chemotherapy ES-SCLC), Japan (Dec 2024, IV infusion 1 mg & 10 mg, post-chemotherapy), and the UK (Jan 2025, conditional approval after =2 prior therapies), demonstrating its flexible clinical positioning across diverse treatment settings for extensive-stage SCLC.

- Tarlatamab therapy faces operational challenges due to intensive monitoring requirements, prompting exploration of flexible observation strategies like hospital- at-home to improve treatment accessibility and efficiency. It is commercially reimbursed in the US, whereas in the UK, NICE Final Draft Rejects IMDELLTRA for ES-SCLC due to uncertain clinical and cost-effectiveness.

- IMDELLTRA is estimated to secure a first-mover advantage in first-line and relapsed SCLC. Early use of Durvalumab ± Chemotherapy regimens boosts physician familiarity and clinical adoption. Emerging competitors like ZL-1310, peluntamig, obrixtamig, and gocatamig launch later or have narrower indications, giving IMDELLTRA an edge in market presence, patient accrual, and treatment sequencing preference.

- Similarly, across second-line and later settings, DLL3-targeted therapies show a differentiated presence by tumor type: in NEPC, gocatamig and IMDELLTRA are leading agents; in LCNEC, both obrixtamig (in combination with ezabenlimab) and LB2102 are active, reflecting a mix of combination and monotherapy strategies; whereas in EPNEC, obrixtamig, gocatamig, and ZL-1310 are under evaluation, highlighting a competitive landscape shaped by both relapsed/refractory and locally advanced/metastatic indications.

- The DLL3-targeting therapy market holds substantial potential, driven by the high unmet medical need in SCLC and neuroendocrine carcinoma, an expanding pipeline of innovative modalities, and the opportunity to capture significant commercial value across both early and late-stage development candidates.

DelveInsight’s “Delta-like Ligand 3 (DLL3) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the DLL3-targeted therapies, historical and forecasted epidemiology, as well as the DLL3-targeted therapies’ market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The DLL3-targeted therapies’ market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM DLL3-targeted therapies market size from 2020 to 2034. The report also covers current DLL3-targeted therapies, treatment practices/algorithms, and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Scope of the Delta-like Ligand 3 Market Report

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

DLL3-targeted Therapies Epidemiology |

Segmented by:

|

|

DLL3-targeted Therapies Key Companies |

|

|

DLL3-targeted Therapies Key Therapies |

|

|

DLL3-targeted Therapies Market |

Segmented by:

|

|

DLL3-targeted Therapies Market Analysis |

|

Key Factors Driving the DLL3-targeted Therapies Market

IMDELLTRA: Only Approved DLL3-targeted Therapy

The launch of IMDELLTRA, the first DLL3-targeted therapy, has garnered widespread attention and marked a major milestone in DLL3-directed treatment, generating around USD 115 million in revenue in 2024 in the US. This DLL3-targeting therapy in ES-SCLC comprises a transformative option demonstrating long-lasting responses in pretreated patients.

Expanding Indications for DLL3 Therapies

Beyond SCLC, DLL3 is also expressed in other neuroendocrine carcinomas, some prostate cancers, and pediatric tumors, providing a broader potential market as research progresses.

Emergence of Novel DLL3 Therapies

The current pipeline is dominated with early-stage DLL-3 targeted therapies like peluntamig (Phanes Therapeutics), gocatamig (MK-6070) (Merck/Daiichi Sankyo), LB2102/ DLL3-targeted CAR-Ts (Legend Biotech and Novartis), 225Ac-ABD147 (Abdera Therapeutics), obrixtamig (BI 764532) (Boehringer Ingelheim), ZL-1310 (Zai Lab), MP0712 (Molecular Partners and Oranomed), and others.

Diverse Therapeutic Approaches in Development

Multiple modalities are under development ADCs, BiTEs, and CAR-T cell therapies, all leveraging DLL3’s selective expression. This versatility increases the likelihood of finding efficacious options suitable for different patient subgroups.

Delta-like Ligand 3 (DLL3)-targeted Therapies Understanding and Treatment Algorithm

Delta-like Ligand 3 (DLL3)-targeted Therapies Overview

DLL3 is a non-canonical Notch ligand that acts as an inhibitory regulator rather than an activator, localizing mainly to the Golgi and ER to block Notch receptor trafficking and signaling. It is a direct downstream target of the proneural transcription factor ASCL1, linking it closely to neuroendocrine lineage differentiation. Unlike most Notch ligands, DLL3 has minimal expression in normal adult tissues but is highly expressed in ASCL1-driven neuroendocrine tumors, making it a distinctive molecular marker with significant relevance for tumor biology and lineage-specific signaling. Currently, it is being evaluated for SCLC, NECs, NEPC, LCNEC, and other indications.

Delta-like Ligand 3 (DLL3)-targeted Therapies Epidemiology

The epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of selected indications for DLL3 targeting therapies, DLL3 expressing incident cases of selected indications, and total DLL3 expressing locally advanced/metastatic target pool of selected indications covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

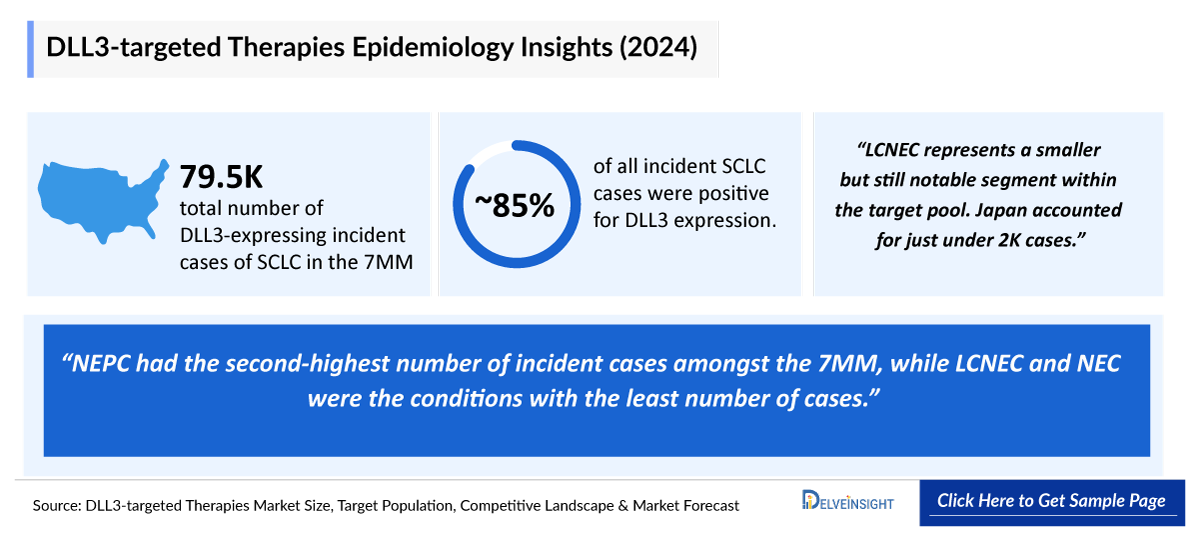

- Among the selected four major indications for DLL3-targeted therapies, SCLC contributed to the highest number of cases in the 7MM. The total number of DLL3-expressing incident cases of SCLC in the 7MM was 79,500 in 2024.

- NEPC had the second-highest number of incident cases amongst the 7MM, while LCNEC and NEC were the conditions with the least number of cases. It stands as the second-largest contributor, with the EU4 and the UK having 6,400 of DLL3-expressing cases in 2024. This population is expected to expand gradually over the next decade, reflecting both incidence growth and increased recognition of this aggressive subtype.

- Approximately 85% of all incident SCLC cases were positive for DLL3 expression.

- LCNEC represents a smaller but still notable segment within the target pool. In 2024, Japan accounted for just under 2,000 cases. Growth in this indication is expected to remain modest, with the US and the EU4+UK, while Japan continues to account for a relatively limited but stable share by 2034.

Delta-like Ligand 3 (DLL3)-targeted Therapies Drug Chapters

The drug chapter segment of the DLL3-targeted therapies report encloses a detailed analysis of marketed and emerging drugs of late-, mid-, early-stage (Phase III, Phase II, Phase I) pipeline drugs. It also deep dives into the DLL3-targeted therapies' pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Delta-like Ligand 3 (DLL3)-targeted Marketed Drugs

IMDELLTRA/IMDYLLTRA (tarlatamab-dlle): Amgen

IMDELLTRA is a first-in-class immunotherapy engineered by Amgen researchers that binds to both DLL3 on tumor cells and CD3 on T cells, activating T cells to kill DLL3-expressing SCLC cells. This results in the formation of a cytolytic synapse with lysis of the cancer cell.

Amgen and BeOne Medicines (formerly BeiGene) have a global collaboration on IMDELLTRA. Amgen leads global development and commercialization (ex-China), while BeOne retains China rights and royalties on worldwide sales. In August 2025, BeOne sold ex-China royalty rights to Royalty Pharma for up to USD 950 million, boosting its financial flexibility as Amgen advances IMDELLTRA’s global market expansion.

In January 2025, Amgen announced that the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) had granted a conditional marketing authorisation to IMDYLLTRA for the treatment of adult patients with ES-SCLC with disease progression on or after at least two prior lines of therapy, including platinum-based chemotherapy.

In December 2024, the Pharmaceuticals and Medical Devices Agency (PMDA) approved IMDELLTRA IV infusion 1 mg and 10 mg for the treatment of SCLC that has progressed after cancer chemotherapy. Amgen launched IMDELLTRA for the treatment of SCLC in Japan on April 16 upon its addition to the NHI reimbursement price list.

In May 2024, Amgen announced that the US FDA had approved IMDELLTRA for the treatment of adult patients with ES-SCLC with disease progression on or after platinum-based chemotherapy.

Note: A Detailed market therapy assessment will be provided in the final report.

Delta-like Ligand 3 (DLL3)-targeted Emerging Drugs

Gocatamig (MK-6070): Merck and Daiichi Sankyo

MK-6070 is an investigational DLL3-directed tri-specific T-cell engager which is currently being evaluated in a Phase I/II clinical trial as a monotherapy in certain patients with advanced cancers associated with expression of DLL3 and in combination with atezolizumab in certain patients with SCLC. The US FDA granted ODD to MK-6070 for the treatment of SCLC in March 2022.

In August 2024, Daiichi Sankyo and Merck expanded their existing global co-development and co-commercialization agreement for three investigational DXd antibody-drug conjugates to include Merck’s MK-6070, an investigational DLL3 targeting T-cell engager. The companies will jointly develop and commercialize MK-6070 worldwide, except in Japan, where Merck will maintain exclusive rights. Merck will be solely responsible for manufacturing and supply of MK-6070.

In March 2024, Merck announced the completion of the acquisition of Harpoon Therapeutics. Harpoon is now a wholly-owned subsidiary of Merck, and Harpoon’s common stock will no longer be publicly traded or listed on the Nasdaq Stock Market. This acquisition has broadened the oncology pipeline with a portfolio of novel T-cell engagers, including HPN328 (MK-6070), an investigational DLL3 targeting T-cell engager, and others.

Obrixtamig (BI 764532): Boehringer Ingelheim/Oxford BioTherapeutics

BI 764532 is an investigational DLL3/CD3 IgG-like T-cell engager for potential treatment of patients with LCNEC that is being developed by Boehringer Ingelheim. The discovery of BI 764532 (OBT620) was enabled through a successful partnership initiated in 2013, leveraging Oxford BioTherapeutics’s proprietary OGAP drug discovery platform for the identification of the DLL3 antigen and Boehringer Ingelheim’s longstanding expertise in oncology and development of biotherapeutics. It is currently being evaluated in Phase II for R/R ES-SCLC and with other R/R NEC.

In April 2013, Oxford BioTherapeutics and Boehringer Ingelheim announced a collaboration aimed at identifying new cancer antibody targets using Oxford’s OGAP discovery platform. Under the agreement, Oxford will validate selected targets suitable for different antibody drug formats across multiple cancer types, after which Boehringer Ingelheim will gain exclusive rights to develop and commercialize antibody products for those programs.

Comparison of Emerging Drugs | ||||||

|

Drug Name |

Combination |

Sponsor/ Collaborator |

Indication |

MoA |

Phase |

Trial identifier |

|

IMDELLTRA |

Durvalumab + carboplatin + etoposide |

Amgen |

ES-SCLC |

DLL3-directed CD3 T cell engager |

III |

NCT07005128 |

|

Monotherapy |

Relapsed SCLC |

III |

NCT05740566 | |||

|

Durvalumab |

ES-SCLC |

III |

NCT06211036 | |||

|

Monotherapy |

LSCLC |

III |

NCT06117774 | |||

|

Monotherapy |

SCLC |

II |

NCT06745323 | |||

|

Monotherapy |

R/R SCLC |

II |

NCT05060016 | |||

|

Monotherapy |

ES-SCLC |

I |

NCT06598306 | |||

|

AB248 |

ES-SCLC |

I |

NCT07037758 | |||

|

YL201 ± PD-L1 inhibitor |

I |

NCT06898957 | ||||

|

Atezolizumab ± chemotherapy (carboplatin, etoposide) |

ES-SCLC |

I |

NCT05361395 | |||

|

Durvalumab ± chemotherapy (carboplatin, etoposide) |

ES-SCLC |

I |

NCT05361395 | |||

|

Monotherapy |

Locally advanced/ metastatic NEPC |

I |

NCT04702737 | |||

|

Obrixtamig |

Monotherapy |

Boehringer Ingelheim and Oxford BioTherapeutics |

SCLC |

DLL3/CD3 T-cell engager |

II | NCT05882058 |

|

Monotherapy |

LCNEC |

II | ||||

|

Monotherapy |

EPNEC |

II | ||||

|

Ezabenlimab |

Locally advanced/ metastatic-SCLC |

I/II |

NCT05879978 | |||

|

Ezabenlimab |

Locally advanced/ metastatic LCNEC |

I/II | ||||

|

Monotherapy |

ES-SCLC |

I |

NCT04429087 | |||

|

Topotecan (chemotherapy) |

ES-SCLC |

I |

NCT05990738 | |||

|

Carboplatin + etoposide/cisplatin |

NEC |

I |

NCT06132113 | |||

|

Carboplatin/ cisplatin + etoposide + atezolizumab/ durvalumab |

ES-SCLC |

I |

NCT06077500 | |||

|

Monotherapy |

Glioma |

I |

NCT05916313 | |||

|

Gocatamig (MK-6070) |

Monotherapy |

Merck and Daiichi Sankyo |

ES-SCLC and R/R SCLC |

DLL3-directed tri-specific T-cell engager |

I/II |

NCT06780137, NCT04471727 |

|

I-DXd |

ES-SCLC and R/R SCLC |

I/II |

NCT06780137, NCT04471727 | |||

|

Durvalumab |

ES-SCLC |

I/II |

NCT06780137 | |||

|

Monotherapy |

R/R NEPC |

I/II |

NCT04471727 | |||

|

Monotherapy |

R/R NEC |

I/II | ||||

|

Atezolizumab |

R/R SCLC |

I/II | ||||

|

Atezolizumab |

R/R NEPC |

I/II | ||||

|

ZL-1310 |

Monotherapy |

Zai Lab and MediLink Therapeutics |

Locally advanced/ metastatic NEC |

Targets DLL3 via its topoisomerase 1 inhibitor payload |

Ib/II |

NCT06885281 |

|

Monotherapy |

ES-SCLC |

I |

NCT06179069 | |||

|

Atezolizumab |

ES-SCLC |

I | ||||

|

Atezolizumab + Carboplatin |

SCLC |

I | ||||

|

Peluntamig (PT217) |

Monotherapy |

Phanes Therapeutics and Roche |

ES-SCLC |

Targets DLL3 x CD47 |

I/II |

NCT05652686 |

|

EPNEC | ||||||

|

LCNEC | ||||||

|

Carboplatin + etoposide |

LCNEC | |||||

|

Carboplatin + etoposide |

EPNEC | |||||

|

Carboplatin + etoposide |

SCLC | |||||

|

Paclitaxel |

SCLC | |||||

|

Paclitaxel |

LCNEC | |||||

|

Paclitaxel |

EPNEC | |||||

|

Atezolizumab |

R/R ES-SCLC | |||||

|

Atezolizumab |

R/R LCNEC | |||||

|

Atezolizumab |

R/R EPNEC | |||||

|

Atezolizumab |

ES-SCLC | |||||

|

Carboplatin + etoposide + atezolizumab |

ES-SCLC | |||||

|

LB2102 |

Monotherapy |

Legend Biotech and Novartis |

ES-SCLC |

DLL3 directed autologous |

I |

NCT05680922 |

|

Monotherapy |

LCNEC | |||||

|

ABD147 |

Monotherapy |

.Abdera Therapeutics |

ES-SCLC |

Targets DLL3 |

I |

NCT06736418 |

|

Monotherapy |

Locally advanced/ metastatic LCNEC | |||||

|

Alveltamig (ZG006) |

ZG006 |

Suzhou Zelgen Bio-pharmaceuticals |

SCLC |

Targets DLL3×DLL3×CD3 |

I |

NCT06592638 |

|

Clesitamig/ALPS12/CHU* |

Obinutuzumab |

Chugai Pharmaceutical and Roche |

ES-SCLC |

Targeting DLL3, with bivalent CD3/ CD137 binding |

I |

NCT07107490 |

|

IDE849 |

- |

Jiangsu Hengrui/ IDEAYA Biosciences |

SCLC, NET |

Targets DLL3- topoisomerase-I |

I |

- |

|

RG6810/IBI3009 |

- |

Roche and Innovent |

SCLC |

DLL3 targeted ADC with Topo1 isomerase payload |

I |

- |

|

AMG 119**** |

- |

Amgen |

R/R SCLC |

Target DLL3 |

I |

NCT03392064 |

|

*The trial is scheduled to begin in September 2025 and is currently listed as not yet recruiting. **As per July 2025, the US Phase I trial of IDE849 in SCLC patients initiated in 3Q 2025. ***IBI3009 has already obtained IND approvals in the US, with the first patient for the Phase I study dosed in December 2024. Currently, only the Phase I trial (NCT06613009) in China and Australia is active. ****The Phase I trial of AMG 119 in relapsed/refractory SCLC (NCT03392064, sponsored by Amgen) is currently suspended, with enrollment on hold and no active subjects, but may potentially resume; the study was last updated in September 2024. | ||||||

DLL3-targeted Therapies Market Outlook

IMDELLTRA (tarlatamab-dlle) marks a breakthrough in DLL3-targeted therapy, becoming the first approved bispecific antibody to leverage DLL3 expression for selective T cell-mediated cytotoxicity in ES-SCLC. Developed by Amgen, it addresses a critical unmet need in patients progressing after platinum-based chemotherapy (the US 2024, Japan 2024, the UK 2025) through an IV infusion with step-up dosing that balances efficacy and safety. The regulatory approvals have varied by region and line of therapy: in the US (2024), the FDA approved IMDELLTRA for the treatment of adult patients with ES-SCLC with disease progression on or after platinum-based chemotherapy (2L); in Japan (2024), the PMDA approved it for SCLC that has progressed after prior chemotherapy (a broader label); and in the UK (2025), the MHRA granted conditional marketing authorization for adult patients with ES-SCLC who have progressed on or after at least two prior lines of therapy, including platinum-based chemotherapy (3L).

The DLL3-targeted therapy landscape continues to evolve, with a robust emerging pipeline of next-generation agents aiming to improve efficacy, safety, and patient convenience. Key investigational therapies include Peluntamig (PT217) (Phanes Therapeutics and Roche), Gocatamig (MK-6070/DS3280) (Merck and Daiichi Sankyo), ZL-1310 (Zai Lab), Obrixtamig (BI 764532) (Boehringer Ingelheim and Oxford BioTherapeutics), LB2102 (Legend Biotech and Novartis), ABD147 (Abdera Therapeutics), and ZG006 (Suzhou Zelgen Biopharmaceuticals). These agents leverage diverse modalities, including bispecific antibodies, CAR-T platforms, ADC, and others, reflecting a concerted effort by leading biotech and pharma companies to expand therapeutic options and overcome limitations observed with first-generation DLL3 therapies.

- The market for DLL3-targeted therapies effectively began in 2024 with the launch of the first approved therapy, IMDELLTRA.

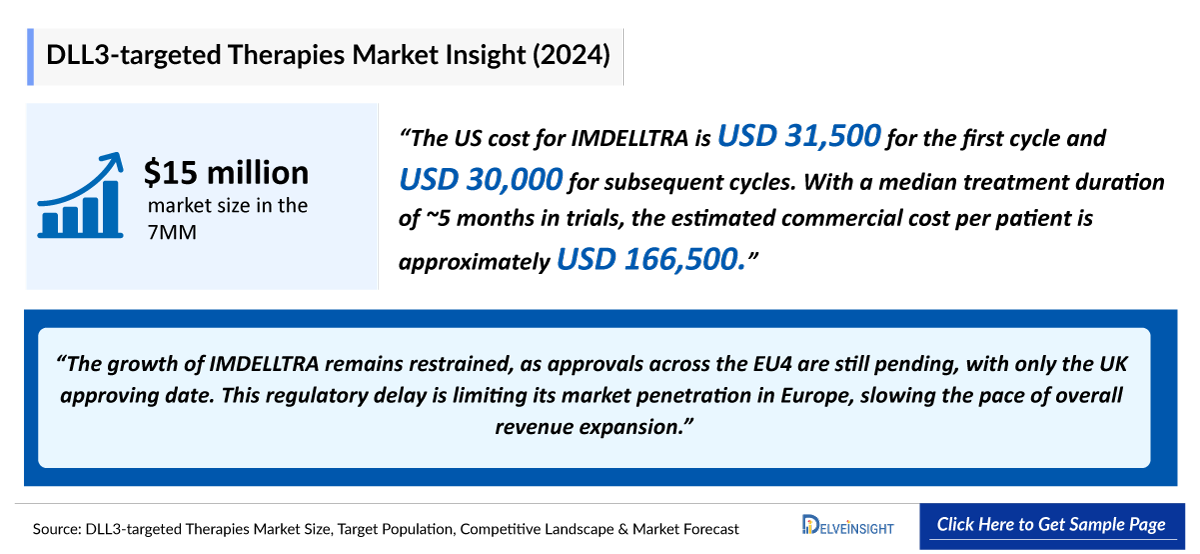

- The market size of DLL3-targeted therapies in the 7MM was USD 115 million in 2024.

- The growth of IMDELLTRA remains restrained, as approvals across the EU4 are still pending, with only the UK approving date. This regulatory delay is limiting its market penetration in Europe, slowing the pace of overall revenue expansion.

- Among all the selected indications, SCLC is expected to generate the highest market share.

- The US cost for IMDELLTRA is USD 31,500 for the first cycle and USD 30,000 for subsequent cycles. With a median treatment duration of ~5 months in trials, the estimated commercial cost per patient is approximately USD 166,500.

- AbbVie’s DLL3-ADC (Rova-T) had failed previously, but this was primarily due to a limited understanding of the toxin and ADC, which has since expanded and improved.

- In January 2025, Innovent Biologics strategically partnered with Roche, licensing the global rights to its DLL3-ADC candidate IBI3009/RG6810, underscoring the growing industry interest in DLL3-targeted therapies and highlighting Roche’s commitment to expanding its oncology pipeline.

DLL3-targeted Therapies Drugs Uptake

With multiple Phase III trials underway, including both monotherapy and combination regimens, IMDELLTRA is well-positioned to dominate the market for an extended period, benefiting from a clear first-mover advantage. Meanwhile, ZL-1310 is emerging as a key competitor, with pivotal trials in ES-SCLC and NEC that may support approvals by 2028. Other emerging therapies (e.g., Obrixtamig, Gocatamig, LB2102, Peluntamig, and ABD147) are also expected to reshape the US market landscape in the next decade.

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies' drug uptake in the report…

DLL3-targeted Therapies Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase II, II/I, and I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for DLL3-targeted therapies and emerging therapies.

Latest KOL Views on DLL3-targeted Therapies

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including MDs, PhD, Senior Researcher, and others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the National Center for Tumor Diseases, Germany, Albert Einstein College of Medicine, US, National Cancer Center Hospital, Tokyo, Japan, TUD Dresden University of Technology, Germany, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or DLL3-targeted therapies market trends.

|

Region |

KOL Views |

|

United States |

“DLL3 expression appears to be most prevalent in patients with SCLC, with reported estimates reaching approximately 85–90%. Definitions of DLL3 positivity vary, with some studies applying a threshold of greater than 1%, while others use greater than 50%. Notably, when DLL3 positivity is observed, expression levels are typically high.” |

|

Germany |

“First-line treatment for NECs can induce remissions; however, these responses are typically short-lived. Upon relapse, patients are often treated with additional chemotherapy, which is associated with lower response rates, shorter DoR, and a rapid exhaustion of therapeutic options. Importantly, it has been discovered that NECs express DLL3 on the cell surface, a molecule largely absent from normal adult tissues, making it an attractive and highly specific target for immunotherapeutic strategies.” |

DLL3-targeted Therapies Market Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Market Access and Reimbursement Key Developments in 2025

|

Region/Country |

Key 2025 Developments |

|

United States |

|

|

Europe (EU-wide) |

|

|

Germany |

|

|

France |

|

|

Italy |

|

|

Spain |

|

|

United Kingdom |

|

|

China |

|

|

Japan |

|

Market Access and Reimbursement of DLL3-targeted Therapies: The United States

US Reimbursement for DLL3-targeted Therapies | |

|

Drug |

Access Program |

|

IMDELLTRA |

|

Recent Updates on DLL3-targeted Therapies Market

- In January 2025, Amgen announced that the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) had granted a conditional marketing authorisation to IMDYLLTRA for the treatment of adult patients with ES-SCLC with disease progression on or after at least two prior lines of therapy, including platinum-based chemotherapy.

- In June 2025, Zai Lab announced that updated data from an ongoing, global Phase Ia/Ib clinical trial evaluating ZL-1310 for patients with ES-SCLC were presented during a poster session at the 2025 ASCO Annual Meeting.

- As per Zai Lab’s corporate presentation 2025, the company anticipates initiating a global pivotal study in 2L ES-SCLC, global Phase I data update in 2L+ ES-SCLC, and global Phase I/II data in other NECs in H2 2025. The company also anticipates the dose optimization data of 2L ES-SCLC update in H2 2025.

DLL3-targeted Therapies Report Insights

- DLL3-targeted Therapies Targeted Patient Pool

- DLL3 Competitive Landscape

- DLL3-targeted Therapies’ Pipeline Analysis

- DLL3-targeted Therapies Market Size and Pricing Trends

- Reimbursement Scenario

- Existing and Future Market Opportunity

DLL3-targeted Therapies Report Key Strengths

- Ten-Years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

- Physicians perspective on Drug Performance and Prescribing feasibility

DLL3-targeted Therapies Report Assessment

- Current Treatment Practices

- Unmet Needs

- Safety and Efficacy head to head comparison

- Pipeline Product Profiles

- Market Attractiveness

- Cost analogues and pricing trends

- Anticipated launch years

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the DLL3-targeted Therapies Market Report

- What could be the possible DLL3-targeted therapies total market size, the market size by therapies, market share (%) distribution in next 5 years, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- What is the most lucrative market for the DLL3-targeted therapies?

- Which drug will account for maximum DLL3-targeted therapies sales?

- What are the pricing variations among different geographies?

- What are the risks, burdens, and unmet needs of treatment with a DLL3-targeted therapies? What will be the growth opportunities across the 7MM for the patient population of the DLL3-targeted therapies?

- What are the key factors hampering the growth of the DLL3-targeted therapies market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for the DLL3-targeted therapies?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy DLL3-targeted Therapies Market Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the DLL3-targeted therapies market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies reforms in 2025, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-targeted-Therapies-thumbnail.jpg&w=3840&q=75)