Duchenne Muscular Dystrophy Market

- The Duchenne Muscular Dystrophy market size in the 7MM was around USD 2,150 million in 2023. The market is anticipated to witness a substantial positive shift owing to better uptake of existing drugs, the expected market launch of one-time gene therapies, and raised awareness.

- The main therapeutic strategies for the treatment of Duchenne Muscular Dystrophy include gene replacement or other genetic therapies linked to specific mutations to restore dystrophin production, membrane stabilization and/or upregulation of compensatory proteins and reduction of the inflammatory cascade and/or enhancement of muscle regeneration.

- The current US Duchenne Muscular Dystrophy market possesses approved DMD products, EMFLAZA (deflazacort), VYONDYS 53 (golodirsen), EXONDYS 51 (eteplirsen), AMONDYS 45 (casimersen), and VILTEPSO (viltolarsen), ELEVIDYS (delandistrogene moxeparvovec) in patients with Duchenne Muscular Dystrophy.

- In January 2024, Santhera Pharmaceuticals announced the introduction of its AGAMREE (vamorolone) to treat Duchenne Muscular Dystrophy patients aged four years and above in Germany. Santhera Pharmaceuticals has officially entered the commercial stage of its biopharma journey with the launch of this drug in Germany.

- ELEVIDYS, the first FDA-approved gene therapy for Duchenne Muscular Dystrophy, received accelerated approval in June 2023. However, ICER recently challenged the potential conversion of Sarepta's gene therapy to full approval, citing concerns about the surrogate endpoint used in the approval process.

- In the EU4 and the UK, the current market is dominated by steroid therapies along with an approved medication targeting Duchenne Muscular Dystrophy patients with the nonsense mutation, TRANSLARNA (ataluren). In Japan the only approved treatment is VILTEPSO (viltolarsen).

- Expected Launch of potential therapies by key Duchenne Muscular Dystrophy companies like, Santhera Pharmaceuticals/ReveraGen BioPharma (Vamorolone), Taiho Pharmaceutical (TAS-205), FibroGen (Pamrevlumab), Capricor (CAP-1002), Italfarmaco (Givinostat), Antisense Therapeutics (ATL1102), and Sarepta Therapeutics (SRP-5051), may increase the market size in the coming years, assisted by an increase in the prevalent population of Duchenne Muscular Dystrophy. It is expected that these therapies will help thrive the Duchenne Muscular Dystrophy market post-launch, in the United States. Furthermore, these novel therapies will mark there entry in EU4 and the UK and Japan in subsequent years.

Request for Sample Page @ Duchenne Muscular Dystrophy Drugs Market

DelveInsight's “Duchenne Muscular Dystrophy Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Duchenne Muscular Dystrophy historical and forecasted epidemiology as well as the Duchenne Muscular Dystrophy market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Duchenne Muscular Dystrophy market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Duchenne Muscular Dystrophy market size from 2020 to 2034. The Duchenne Muscular Dystrophy treatment market report also covers current Duchenne Muscular Dystrophy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Duchenne Muscular Dystrophy Market |

|

|

Duchenne Muscular Dystrophys Market Size | |

|

Duchenne Muscular Dystrophy Companies |

Sarepta Therapeutics, PTC Therapeutics, Nippon Shinyaku, Santhera Pharmaceuticals/ReveraGen BioPharma, Taiho Pharmaceutical, FibroGen, Capricor, Daiichi Sankyo, Italfarmaco, Antisense Therapeutics, Solid Biosciences, and others. |

|

Duchenne Muscular Dystrophy Epidemiology Segmentation |

|

Duchenne Muscular Dystrophy Treatment Market

Duchenne Muscular Dystrophy Overview, Country-Specific Treatment Guidelines and Diagnosis

Duchenne Muscular Dystrophy is the most common form of muscular dystrophy in childhood. It is a genetic disorder characterized by progressive muscle degeneration and weakness. It is one of nine types of muscular dystrophy. Duchenne Muscular Dystrophy is caused by an absence of dystrophin, a protein that helps keep muscle cells intact. Symptom onset is in early childhood, usually between ages 3–5. The disease primarily affects boys, but in rare cases, it can affect girls.

Testing for a Duchenne Muscular Dystrophy mutation in a blood sample is always necessary even if Duchenne Muscular Dystrophy is first confirmed by the absence of dystrophin protein expression on muscle biopsy. The results of genetic testing provide the clinical information required for genetic counseling, prenatal diagnosis, and consideration for future mutation-specific therapies.

The Duchenne Muscular Dystrophy treatment market report provides an overview of Duchenne Muscular Dystrophy pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Duchenne Muscular Dystrophy Treatment

The standard of care for Duchenne Muscular Dystrophy typically involves a combination of corticosteroids and surgical interventions. Prednisone and deflazacort are commonly prescribed glucocorticoids that have been utilized for over two decades to increase muscular strength in Duchenne Muscular Dystrophy patients. Surgery may be necessary to address contractures, spinal curvature, or scoliosis, which can affect breathing and overall mobility. Additionally, interventions such as pacemakers or other cardiac devices may be utilized to improve heart function. Emerging therapeutic strategies include gene replacement therapies tailored to specific mutations to restore dystrophin production, as well as approaches aimed at stabilizing membranes, enhancing compensatory proteins, reducing inflammation, and promoting muscle regeneration.

Recent Developments in Duchenne Muscular Dystrophy Clinical Trials

- In September 2025, Satellos Bioscience submitted an IND application to the U.S. FDA, along with international filings, to begin a Phase 2 clinical trial of SAT-3247 in ambulatory children with Duchenne muscular dystrophy (DMD). The trial marks a key step in advancing this investigational therapy for the progressive muscle-wasting disorder.

- In August 2025, Keros Therapeutics announced that the U.S. Food and Drug Administration (FDA) granted Orphan Drug designation to KER-065 for the treatment of Duchenne muscular dystrophy (DMD). The therapy targets disorders linked to dysfunctional signaling of the transforming growth factor-beta (TGF-β) protein family.

- In July 2025, the FDA cleared Sarepta to resume shipments of ELEVIDYS (delandistrogene moxeparvovec) for ambulatory patients with Duchenne muscular dystrophy.

- In August 2025, Dyne Therapeutics, Inc. announced that the FDA granted Breakthrough Therapy Designation to DYNE-251 for treating Duchenne muscular dystrophy (DMD) patients amenable to exon 51 skipping. This designation is based on promising data from the ongoing DELIVER clinical trial.

- In July 2025, Capricor Therapeutics announced a webinar in collaboration with Parent Project Muscular Dystrophy (PPMD) to discuss the status of its Biologics License Application (BLA) for Deramiocel, provide information on cardiomyopathy in Duchenne muscular dystrophy, and answer community questions. The webinar is scheduled for July 29, 2025

- In July 2025, Precision BioSciences announced that the FDA granted Orphan Drug Designation to PBGENE-DMD, its gene editing therapy in development for Duchenne muscular dystrophy (DMD)

- In July 2025, Avidity Biosciences announced that the FDA granted Breakthrough Therapy designation to delpacibart zotadirsen (del-zota) for treating Duchenne muscular dystrophy (DMD) in patients with mutations amenable to exon 44 skipping (DMD44). Del-zota is currently in a Phase 2 open-label extension trial (EXPLORE44-OLE™) and is the first of several Antibody Oligonucleotide Conjugates (AOCs) the company is developing for DMD.

- In July 2025, Sarepta Therapeutics halted all shipments of Elevidys, its gene therapy for Duchenne muscular dystrophy (DMD), after discussions with the FDA. The decision follows regulatory concerns regarding manufacturing and distribution compliance, despite the therapy’s earlier accelerated approval. Sarepta will now work with the FDA to resolve these issues.

- In July 2025, Capricor Therapeutics received a Complete Response Letter from the FDA for its BLA of Deramiocel, a cell therapy for cardiomyopathy linked to Duchenne muscular dystrophy (DMD).

- In June 2025, Edgewise Therapeutics announced positive data from its MESA open-label extension trial of sevasemten in Becker and Duchenne muscular dystrophies. The trial continues treatment for participants from previous studies, with 99% (85 patients) enrolled as of March 2025.

- In June 2025, Precision BioSciences, Inc. (Nasdaq: DTIL) announced that the U.S. Food and Drug Administration (FDA) granted Rare Pediatric Disease Designation to PBGENE-DMD, its in vivo gene editing therapy developed using the proprietary ARCUS® platform, for the treatment of Duchenne muscular dystrophy (DMD).

- In June 2025, Sarepta Therapeutics provided a safety update on ELEVIDYS, the gene therapy for Duchenne muscular dystrophy, following two cases of acute liver failure in non-ambulatory patients. Shipments for these patients are suspended pending approval of an enhanced immunosuppressive regimen.

- In May 2025, Capricor Therapeutics completed a mid-cycle review meeting with the FDA for its Biologics License Application (BLA) for deramiocel, an investigational cell therapy for Duchenne muscular dystrophy (DMD) cardiomyopathy. The FDA confirmed no significant deficiencies in the review and affirmed that the application is on track for a Prescription Drug User Fee Act (PDUFA) action date of August 31, 2025. An advisory committee meeting is also planned, but no date has been set yet.

- In March 2025, the FDA accepted Capricor Therapeutics’ application for approval of deramiocel, a cell therapy developed to treat heart muscle disease in individuals with Duchenne muscular dystrophy (DMD), and granted it priority review to accelerate the agency's decision.

- In January 2025, Capricor Therapeutics announced the submission of its Biologics License Application (BLA) to the FDA for full approval of deramiocel, an investigational cell therapy for treating Duchenne muscular dystrophy (DMD) cardiomyopathy.

- In November 2024, Regenxbio is advancing its gene therapy RGX-202 for Duchenne muscular dystrophy (DMD) into pivotal development, with plans for a BLA submission by 2026. The company has secured FDA alignment on an accelerated approval pathway, proposing RGX-202 as a one-time treatment, potentially challenging Sarepta’s Elevidys in the DMD market.

- In November 2024, Cumberland Pharmaceuticals Inc. announced that the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation and Rare Pediatric Disease Designation to Ifetroban for the treatment of cardiomyopathy associated with Duchenne muscular dystrophy (DMD). The company is currently conducting the FIGHT DMD™ trial, a Phase II, multicenter, double-blind, placebo-controlled study to evaluate the pharmacokinetics, safety, and efficacy of once-daily oral Ifetroban in DMD patients. Results are expected later this year.

- In June 2024, REGENXBIO Inc. initiated enrollment for a new cohort of 1-3 year-old boys in the Phase I/II AFFINITY DUCHENNE® trial, aiming to evaluate the safety and efficacy of RGX-202 for Duchenne muscular dystrophy.

- In June 2024, Parent Project Muscular Dystrophy (PPMD) hosted its 30th Annual Conference in Orlando, Florida, focusing on the latest developments and community engagement in the fight against DMD.

- In June 2024, Sarepta Therapeutics received FDA approval to expand ELEVIDYS for use in ambulatory DMD patients aged 4 and older, along with accelerated approval for non-ambulatory patients. This approval marked a significant victory, with Sarepta’s stock rising by 40% on the announcement.

- In June 2024, Cranbury Pharmaceuticals received FDA approval for the generic version of Emflaza® (deflazacort) for DMD.

- In June 2024, Pfizer announced that the phase III CIFFREO trial did not meet its primary endpoint of improved motor function in boys with DMD aged 4 to 7.

- In June 2024, Santhera Pharmaceuticals launched an Early Access Program for vamorolone in China for DMD patients in partnership with Sperogenix Therapeutics.

- In June 2024, Capricor Therapeutics announced the completion of a Type-B meeting with the FDA for the BLA submission of CAP-1002 for DMD treatment.

- In June 2024, Genethon, a non-profit gene therapy organization, provided updates on its DMD clinical trials and advances in gene therapies for limb-girdle muscular dystrophies.

- In June 2024, REGENXBIO expanded the Phase I/II AFFINITY DUCHENNE® trial to evaluate RGX-202 by enrolling patients aged 1-3 for a new cohort.

- In May 2024, Dyne Therapeutics announced positive data from their Phase I/II trials for DYNE-101 and DYNE-251, showing improvements in key disease biomarkers and functional endpoints.

- In May 2024, CureDuchenne raised over $1.35 million at the Napa in Newport event to fund DMD research and patient care.

- In May 2024, Kate Therapeutics presented promising preclinical results for their MyoAAV capsids and gene regulation technology at the ASGCT 2024 Annual Meeting.

- In May 2024, a young boy tragically died of cardiac arrest during Pfizer's phase II gene therapy trial for Duchenne muscular dystrophy (DMD). This incident led Pfizer to pause dosing in the phase III CIFFREO trial.

- In May 2024, Dr. Jerry R. Mendell, a pioneer in neuromuscular research and gene therapy, was named to the inaugural TIME100 Health list for his contributions to DMD treatment.

- In May 2024, PPMD awarded $250,000 to support the establishment of Baby Duchenne, a research network focused on babies diagnosed with DMD through newborn screening.

- In May 2024, Sarepta Therapeutics reported net product revenue of $359.5 million for Q1 2024, a 55% increase over the previous year. ELEVIDYS achieved nearly $134 million in net product revenue for the quarter.

- In May 2024, hC Bioscience presented preclinical data on its tRNA-based protein editing for DMD at the CureDuchenne FUTURES National Conference.

- In May 2024, NS Pharma reported that Viltepso failed to meet its primary endpoint in a confirmatory trial, despite previous accelerated approval based on promising phase II data.

- In April 2024, Ohio Governor Mike DeWine announced that Ohio would become the first state to screen all newborns for DMD.

- In April 2024, PPMD celebrated its 30th anniversary at the PPMD Together meeting in Cincinnati, Ohio.

- In April 2024, PPMD launched the first state-specific Duchenne Advocacy Day in Illinois.

- In April 2024, Edgewise Therapeutics announced positive two-year topline results from the ARCH trial for sevasemten (EDG-5506), an oral therapy designed to prevent muscle damage in dystrophinopathies.

- In April 2024, Sarepta forecast flat sales for its new gene therapy, ELEVIDYS, leading to a first-quarter sales estimate of $131 million. As noted by Mizuho Securities analyst Uy Ear, despite analyst expectations of $138 million, Sarepta’s stock fell by almost 11% following this guidance.

- In April 2024, Givinostat, a histone deacetylase (HDAC) inhibitor, became the first nonsteroidal drug approved by the FDA for all genetic variants of DMD. This approval was based on data from the Phase III EPIDYS trial, making it a milestone in DMD treatment.

- In April 2024, PPMD and UK charity Duchenne UK awarded a $500,000 grant to Professor Peter Kang for a Phase I clinical trial on myogenic progenitors for DMD.

- In March 2024, a study titled "Survival among patients receiving eteplirsen for up to 8 years for the treatment of Duchenne muscular dystrophy" highlighted improved survival rates for eteplirsen-treated DMD patients, with a median survival age of 32.8 years compared to 27.4 years in natural history controls.

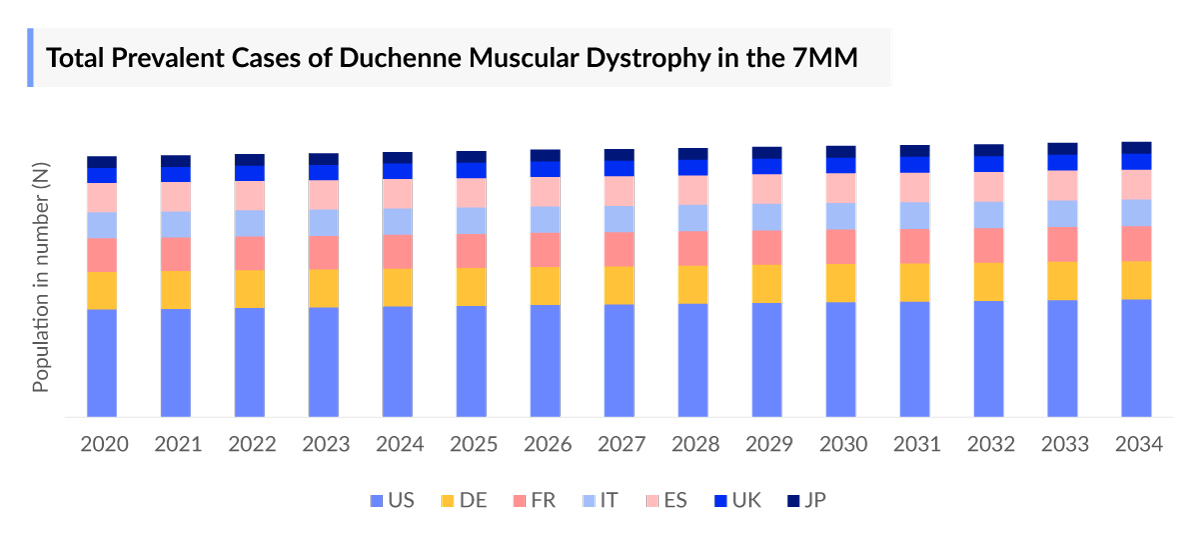

Duchenne Muscular Dystrophy Epidemiology

The Duchenne Muscular Dystrophy epidemiology chapter in the DMD market report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034. The Duchenne Muscular Dystrophy epidemiology is segmented with detailed insights into total prevalent cases of Duchenne Muscular Dystrophy, age-specific prevalent cases of Duchenne Muscular Dystrophy, ambulatory and Non-ambulatory cases of Duchenne Muscular Dystrophy, mutation-specific cases of Duchenne Muscular Dystrophy, and Associated Comorbidities in Duchenne Muscular Dystrophy.

- The total number of prevalent cases of Duchenne Muscular Dystrophy in the 7MM was around 31,400 in 2023.

- The United States encompasses the highest prevalent population of Duchenne Muscular Dystrophy around 17,200 in 2023.

- Among EU4 and the UK, UK accounts for the highest number of prevalent cases of Duchenne Muscular Dystrophy whereas Spain accounts for the least number of prevalent cases.

- In the US, the age group of 5-9 years accounted for the highest cases in 2023, followed by 10-14 years.

- Most cases of Duchenne Muscular Dystrophy involve individuals who are non-ambulatory.

- There are several comorbidities associated with Duchenne Muscular Dystrophy patients. In the United States, the maximum number of Duchenne Muscular Dystrophy patients affected with Scoliosis, followed by Attention-deficit hyperactivity disorder (ADHD) cases in 2023.

Explore detailed insights on Duchenne Muscular Dystrophy epidemiology trends and forecasts through 2032. Get the latest data now! @ Duchenne Muscular Dystrophy Prevalence

Duchenne Muscular Dystrophy Drug Chapters

The drug chapter segment of the Duchenne Muscular Dystrophy treatment market report encloses a detailed analysis of Duchenne Muscular Dystrophy marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the Duchenne Muscular Dystrophy clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Duchenne Muscular Dystrophy Marketed Drugs

ELEVIDYS (delandistrogene moxeparvovec): Sarepta Therapeutics

ELEVIDYS is a prescription gene therapy used to treat ambulatory children aged 4 through 5 years old with Duchenne Muscular Dystrophy who have a confirmed mutation in the dystrophin gene. ELEVIDYS was approved under accelerated approval. Patients will receive oral corticosteroid medication before and after infusion with ELEVIDYS and will undergo weekly blood tests to monitor liver enzyme levels for 3 months after treatment. In June 2023, the USFDA approved ELEVIDYS, the first gene therapy for the treatment of pediatric patients aged 4-5 years with Duchenne Muscular Dystrophy with a confirmed mutation in the DMD gene.

VYONDYS 53: Sarepta Therapeutics

VYONDYS 53, developed by Sarepta Therapeutics, is indicated for the treatment of Duchenne Muscular Dystrophy in patients who have a confirmed mutation of the DMD gene that is amenable to exon 53 skipping. This indication is approved under accelerated approval based on an increase in dystrophin production in skeletal muscle observed in patients treated with VYONDYS 53. In December 2019, the US FDA approved VYONDYS 53 (golodirsen). The FDA granted VYONDYS 53 (golodirsen) NCE exclusivity until December 2024, and Orphan Drug Exclusivity until December 2026.

|

Comparison of Key marketed drugs of Duchenne Muscular Dystrophy | ||||

|

Drug name |

Company |

MoA |

RoA |

Approval |

|

ELEVIDYS (delandistrogene moxeparvovec) |

Sarepta Therapeutics |

Delivers a gene that codes for a shortened form of dystrophin to known as ELEVIDYS micro-dystrophin. |

Intravenous |

US: 2023 |

|

VYONDYS 53 |

Sarepta Therapeutics |

Exon 53 Skipping |

Intravenous |

US: 2019 |

|

AMONDYS 45 |

Sarepta Therapeutics |

Exon 45 skipping |

Intravenous |

US: 2021 |

Note: Detailed current therapies assessment will be provided in the full report of Duchenne Muscular Dystrophy...

Emerging Duchenne Muscular Dystrophy Drugs

ITF2357 (givinostat): Italfarmaco

Italfarmaco is developing Givinostat (ITF2357), an orally available small molecule that acts as a histone deacetylase inhibitor with potential anti-inflammatory, anti-angiogenic, and antineoplastic activities. ITF2357 inhibits HDAC enzyme to increase the amount of the follistatin protein in muscle cells, which in turn increases the muscle mass and prevent muscle degeneration by opposing the effects of myostatin to reduce the symptoms of Duchenne Muscular Dystrophy. The drug is currently being studied in Phase III trial. The FDA has granted Givinostat Orphan Drug, Rare Pediatric Disease Designation and Fast Track Designation for the treatment of Duchenne Muscular Dystrophy. The European Commission has granted Orphan Medicinal Product Designation for Givinostat for the treatment of Duchenne Muscular Dystrophy.

|

Comparison of Key emerging drugs | |||||

|

Drug name |

Company |

RoA |

MoA |

Phase |

Any Special Status |

|

ITF2357 (givinostat) |

Italfarmaco |

Oral |

histone deacetylase inhibitor |

III |

US: Orphan Drug designation, Rare pediatric disease designation, Fast track designation EU4 and the UK: Orphan medicinal product designation |

|

TAS-205 |

Taiho Pharma-ceutical |

Oral |

Selectively inhibits hematopoietic prostaglandin D synthase (HPGDS) |

III |

US: Orphan drug designation, Fast track designation, Rare pediatric disease designation EU4 and the UK: Orphan drug designation |

Note: Detailed emerging therapies assessment will be provided in the final report...

Duchenne Muscular Dystrophy Market Outlook

The medical management for Duchenne Muscular Dystrophy comprises several aspects such as cardiac care, diet, exercise, respiratory care, braces, and spinal curvatures. Duchenne Muscular Dystrophy Treatments include the standard care for Duchenne Muscular Dystrophy along with the new upcoming therapeutic strategies, including genetic therapies, cell therapy using muscle precursor cells or stem cells, membrane stabilization and upregulation of cytoskeletal proteins, and treatment of secondary cascades. The treatment strategy also encompasses supportive treatment and psychosocial management. In EU4 and the UK, the current Duchenne Muscular Dystrophy market is dominated by steroid therapies along with an approved medication targeting Duchenne Muscular Dystrophy patients with the nonsense mutation, TRANSLARNA (ataluren). In Japan the only approved treatment is VILTEPSO (viltolarsen).

Get More Insights @ Ornithine Transcarbamylase Deficiency (OTC) Deficiency Market

Sarepta Therapeutics is a key player in the Duchenne Muscular Dystrophy market, boasting three approved assets and two in the current pipeline. Despite its dominance, emerging competition is evident. The historical success rate for market entry varies across the 7MM (Seven Major Markets). Notably, the Duchenne Muscular Dystrophy market exhibits geographic disparities in regulatory approvals, with instances of products approved in one jurisdiction and rejected in another, despite identical clinical data, reflecting the distinct standards of regulatory bodies such as EMA and FDA.

Key Duchenne Muscular Dystrophy companies, such as Pfizer, AbbVie, Italfarmaco and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Duchenne Muscular Dystrophy.

- The United States accounts for the largest Duchenne Muscular Dystrophy market size (around USD 1,900 million) in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Japan accounts for the second highest DMD market size in the 7MM during the forecast period 2024–2034.

- Among EU4 and the UK, the UK had the highest Duchenne Muscular Dystrophy market size and Spain accounts for the lowest DMD market size.

- In 2023, EXONDYS 51 garnered the largest share in the current Duchenne Muscular Dystrophy market in the United States.

Duchenne Muscular Dystrophy Drugs Uptake

This section focuses on the uptake rate of potential Duchenne Muscular Dystrophy drugs expected to be launched in the Duchenne Muscular Dystrophy market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key Duchenne Muscular Dystrophy companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Uncover the latest developments in Duchenne Muscular Dystrophy Pipeline Insight 2024. Access cutting-edge research now! @ Duchenne Muscular Dystrophy New Drugs

Duchenne Muscular Dystrophy Pipeline Drugs Market

The Duchenne Muscular Dystrophy treatment market report provides insights into different Duchenne Muscular Dystrophy clinical trials within Phase III and Phase II stages. It also analyzes key Duchenne Muscular Dystrophy companies involved in developing targeted therapeutics.

Duchenne Muscular Dystrophy Clinical TrialsActivities

The DMD market report covers information on collaborations, acquisitions and mergers, licensing, and patent details emerging Duchenne Muscular Dystrophy therapies.

KOL Views

To keep up with the real-world scenario in current and emerging Duchenne Muscular Dystrophy market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as Center for Duchenne Muscular Dystrophy at UCLA, Boston Children's Hospital, Akron Children's Hospital etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of Duchenne Muscular Dystrophy. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Duchenne Muscular Dystrophy market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acdrugs ceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging Duchenne Muscular Dystrophy therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Duchenne Muscular Dystrophy Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

The DMD treatment market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Duchenne Muscular Dystrophy Market Report

- The Duchenne Muscular Dystrophy treatment market report covers a segment of key events, an executive summary, descriptive overview of Duchenne Muscular Dystrophy, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Duchenne Muscular Dystrophy treatment market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The DMD treatment market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Duchenne Muscular Dystrophy market.

Duchenne Muscular Dystrophy Market Report Insights

- Duchenne Muscular Dystrophy Patient Population

- Duchenne Muscular Dystrophy Therapeutic Approaches

- Duchenne Muscular Dystrophy Pipeline Analysis

- Duchenne Muscular Dystrophy Market Size and Trends

- Existing and future Market Opportunity

Duchenne Muscular Dystrophy Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Duchenne Muscular Dystrophy Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Duchenne Muscular Dystrophy Drugs Uptake

- Key Duchenne Muscular Dystrophy Market Forecast Assumptions

Duchenne Muscular Dystrophy Market Report Assessment

- Current Duchenne Muscular Dystrophy Treatment Practices

- Duchenne Muscular Dystrophy Unmet Needs

- Duchenne Muscular Dystrophy Pipeline Product Profiles

- Duchenne Muscular Dystrophy Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Duchenne Muscular Dystrophy Market Drivers

- Duchenne Muscular Dystrophy Market Barriers

FAQs

- What is the growth rate of the Duchenne Muscular Dystrophy treatment 7MM?

- What was the Duchenne Muscular Dystrophy market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the DMD market drivers, barriers, and future opportunities affect the Duchenne Muscular Dystrophy market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Duchenne Muscular Dystrophy?

- How many DMD companies are developing therapies for the treatment of Duchenne Muscular Dystrophy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Duchenne Muscular Dystrophy therapies?

Reasons to buy Duchenne Muscular Dystrophy Market Report

- The Duchenne Muscular Dystrophy treatment market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Duchenne Muscular Dystrophy market.

- Insights on patient burden/Duchenne Muscular Dystrophy prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing Duchenne Muscular Dystrophy market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Duchenne Muscular Dystrophy companies in the Duchenne Muscular Dystrophy market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Duchenne Muscular Dystrophy drugs market so that the upcoming Duchenne Muscular Dystrophy companies can strengthen their development and launch strategy.

Stay Updated with us for New Articles:-

- Sarepta’s ELEVIDYS: First Gene Therapy for Duchenne Muscular Dystrophy (DMD) Treatment

- Zealand Pharma’s Phase III Results of Glepaglutide; FDA Approves Amylyx’s ALS Drug Relyvrio; Novo Nordisk and Ventus Therapeutics Signs Licencing Deal; FDA Approves Futibatinib; Sarepta Files Duchenne Muscular Dystrophy for FDA Approval; Biogen and Eisai’s Lcanemab Phase III Study

- What Does the Future Hold For Gene Therapy in the Duchenne Muscular Dystrophy (DMD) Treatment Market?

- Duchenne Muscular Dystrophy Market: What's More Beyond Exon-Skipping Therapies?

- In Search for a Curative Treatment Option for Duchenne Muscular Dystrophy

- Is the cure for Duchenne Muscular Dystrophy in the pipeline?

- Duchenne Muscular Dystrophy Market: Blog

- Duchenne Muscular Dystrophy Market: Infographics

- Duchenne Muscular Dystrophy Market: Newsletter

Explore More Insights: Encourages readers to delve deeper into related reports for comprehensive insights @ Latest DelveInsight Blogs

.jpg)

.jpg)

-pipeline.png&w=256&q=75)