Metastatic HR+/HER2− Breast Cancer Market

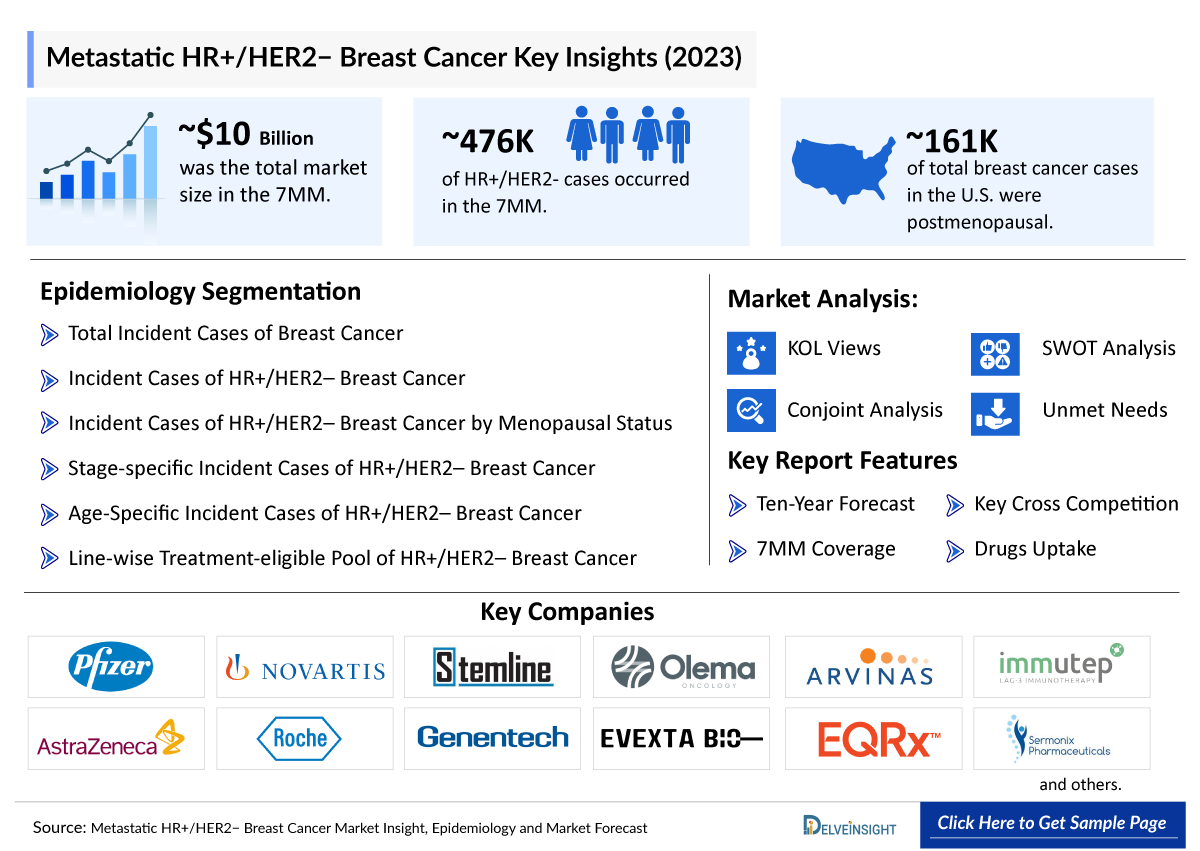

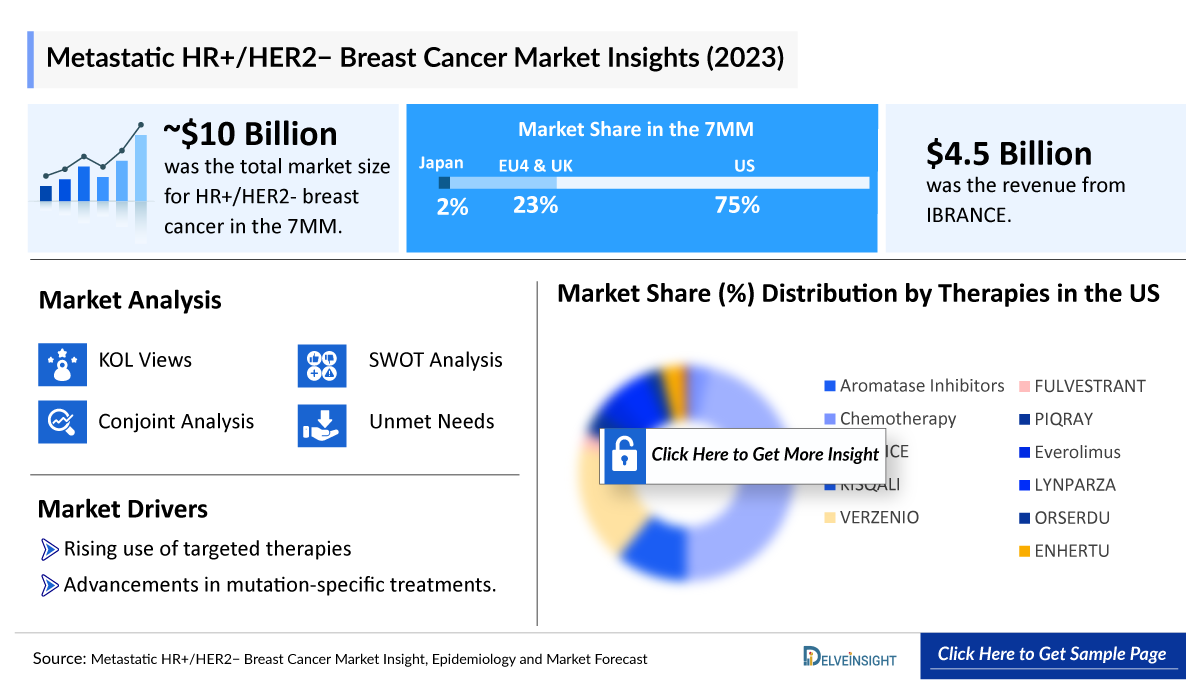

- The total HR+/HER2- breast cancer market size in the 7MM was nearly USD 10 billion in 2023, which is expected to grow by 2034 with the launch of potential emerging therapies, assisted by an increase in the HR+/HER2- breast cancer patient pool.

- The HR+/HER2- subtype is the most common of all the breast cancer subtypes.

- For the past decade, endocrine therapy has been the standard therapy for HR+/HER2– breast cancer in the early and advanced stages. FASLODEX (fulvestrant) is one of the most efficient and well-tolerated medications available in single-agent endocrine therapy formulations. FASLODEX’s poor bioavailability and inconvenient IV formulations create an opportunity for oral next-generation selective estrogen receptor degraders (SERDs) to make a place in both first and second-line settings.

- Among the approved classes, CDK4/6 inhibitors (palbociclib, ribociclib, and abemaciclib) have attracted the most attention in first and second-line settings by providing an extended period of progression-free survival.

- IBRANCE (palbociclib) is the leading molecule in the first line of therapy, as it also has the first-mover advantage in the first-line and second-line setting, along with the highest revenue in terms of sales.

- The NCCN Clinical Practice Guidelines in Oncology for breast cancer recommend KISQALI (ribociclib) as the only Category 1 preferred CDK4/6 inhibitor for first-line treatment of patients with HR+/HER2- MBC when combined with an aromatase inhibitor (AI).

- The leading Metastatic HR+/HER2− Breast Cancer companies such as Merck, Arvinas, Olema Pharmaceuticals, Celcuity, Roche, AstraZeneca, Daiichi Sankyo, Eli Lilly, Sermonix Pharmaceuticals, Genentech, Veru Pharma, DualityBio, BioNtech, Evgen Pharma, Carrick Therapeutics, EQRx, G1 Therapeutics, Immutep, and others are developing therapies for Metastatic HR+/HER2− Breast Cancer treatment.

- ORSERDU is the first and only therapy specifically indicated for the treatment of ER+, HER2- tumors that harbor ESR1 mutations. This approval represents the first innovation in endocrine therapy in nearly two decades.

- Recent developments suggest that the post-CDK4/6 inhibitor treatment landscape could benefit from adopting Antibody–Drug Conjugates (ADCs) and oral SERDs, that can muscle its way into this treatment space for this patient pool. The other class of therapies includes AKT inhibitors, mTOR inhibitors, SERMS, PI3K inhibitors, PARP inhibitors, and TROP-2 targeting ADCs.

- Roche’s Giredestrant, in combination with palbociclib, could be a first-line rival for Camizestrant. However, giredestrant Phase II acelERA (monotherapy) did not meet its primary endpoint of INV-PFS.

- Capivasertib is a leading targeted inhibitor of the cancer-driving protein AKT, also known as PKB.

- Dato-DXd is another TROP2 ADC in the race, with the same cytotoxic payload as trastuzumab deruxtecan. Recently in April 2024, Biologics License Application (BLA) Dato-DXd has been accepted in the US for the treatment of metastatic HR+/HER2– breast cancer who have received prior systemic therapy for unresectable or metastatic disease. The Prescription Drug User Fee Act date (PDUFA) is during the first quarter of 2025.

- The emerging pipeline is crowded by several HR+/HER2- potential therapies in late-stage (Phase III, II/III, II) that have the potential to address current unmet medical needs and are expected to substantially drive market growth in the near future. However, the upcoming pipeline comprises many next-generation SERD drug candidates. They will face strong competition from the existing CDK4/6 inhibitors with a strong hold over most of the market share. This could lead to their slow growth.

- In April 2025, AstraZeneca and Daiichi Sankyo’s Enhertu (trastuzumab deruxtecan) was approved in the EU as monotherapy for adults with unresectable or metastatic HR-positive, HER2-low/ultralow breast cancer, after at least one endocrine therapy and when further endocrine therapy is unsuitable.

DelveInsight’s “Metastatic HR+/HER2- Breast Cancer Market Insights, Epidemiology, and Market Forecast –2034” report delivers an in-depth understanding of the HR+/HER2- Breast Cancer, historical and forecasted epidemiology as well as the HR+/HER2- breast cancer therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The HR+/HER2- breast cancer market report provides current treatment practices, emerging drugs, HR+/HER2- breast cancer market share of the individual therapies, and current and forecasted HR+/HER2- breast cancer market size from 2020 to 2034 segmented by seven major markets. The report also covers current HR+/HER2- breast cancer treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Metastatic HR+/HER2− Breast Cancer Market |

|

|

Metastatic HR+/HER2− Breast Cancer s Market Size | |

|

Metastatic HR+/HER2− Breast Cancer Companies |

Merck, Arvinas, Olema Pharmaceuticals, Celcuity, Roche, AstraZeneca, Daiichi Sankyo, Eli Lilly, Sermonix Pharmaceuticals, Genentech, Veru Pharma, DualityBio, BioNtech, Evgen Pharma, Carrick Therapeutics, EQRx, G1 Therapeutics, Immutep, and others |

|

Metastatic HR+/HER2− Breast Cancer Epidemiology Segmentation |

|

Metastatic HR+/HER2- Breast Cancer Treatment Market

HR+/HER2- Breast Cancer Overview

HR+/HER2- breast cancer is the most common subtype of breast cancer, characterized by cancer cells with hormone receptors for estrogen and progesterone but lacking the overexpression of HER2. This subtype generally has a better prognosis and is often treated with hormone therapy to block hormone-driven growth. Surgery and radiation may be used to remove or target tumors, while chemotherapy and targeted therapies like CDK4/6 inhibitors may be considered for more advanced cases. Early detection is crucial, and support from healthcare providers and loved ones is vital for coping with the diagnosis and treatment of HR+/HER2- breast cancer.

Metastatic HR+/HER2- Breast Cancer Diagnosis

A patient’s journey through HR+/HER2- breast cancer diagnosis typically begins with the recognition of concerning symptoms, leading to clinical evaluation and imaging tests. A biopsy confirms the diagnosis and determines the cancer’s characteristics. Staging tests assess the cancer’s extent, guiding a multidisciplinary team in devising a personalized treatment plan, often involving hormone therapy, surgery, radiation, and possibly chemotherapy or targeted therapies. Emotional support plays a crucial role in managing the emotional toll of the diagnosis, and follow-up care ensures ongoing monitoring and adjustment of treatment as needed, fostering hope for successful recovery and survivorship.

Further details related to diagnosis will be provided in the report…

Metastatic HR+/HER2- Breast Cancer Treatment

The treatment of HR+/HER2- breast cancer typically involves a multimodal approach. Hormone therapy is a cornerstone, blocking estrogen’s effects on cancer cells. Surgery, such as lumpectomy or mastectomy, may be performed to remove the tumor. Radiation therapy targets any remaining cancer cells after surgery. In more advanced cases, chemotherapy or targeted therapies like CDK4/6 inhibitors can be considered. The specific treatment plan depends on factors like cancer stage, receptor status, and patient preferences. Regular follow-up and monitoring are essential to track progress and adjust treatment as needed, offering the best chance for successful management and long-term survival. Metastatic HR+/HER2- breast cancer clinical trials are exploring innovative therapies aimed at improving survival outcomes, with several targeted agents showing promising efficacy and safety in ongoing global studies.

A number of classes of anti-estrogenic agents are available for patients with early, advanced, or metastatic breast cancer, which include selective estrogen receptor modulators (SERMs), aromatase inhibitors (AIs), and selective estrogen receptor degraders. However, the clinical development of combinations of antiestrogenic therapy with targeted agents that inhibit the phosphatidylinositol 3 kinase (PI3K)/AKT murine thymoma viral oncogene (AKT)/mammalian target of rapamycin inhibitor (mTOR) signaling pathway or the cyclin-dependent kinase 4/6 (CDK4/6) pathway at the G1/S checkpoint of the cell cycle is currently a key focus of clinical research in patients with hormone-receptor-positive breast cancer who have demonstrated disease recurrence or progression.

Further details related to treatment will be provided in the report...

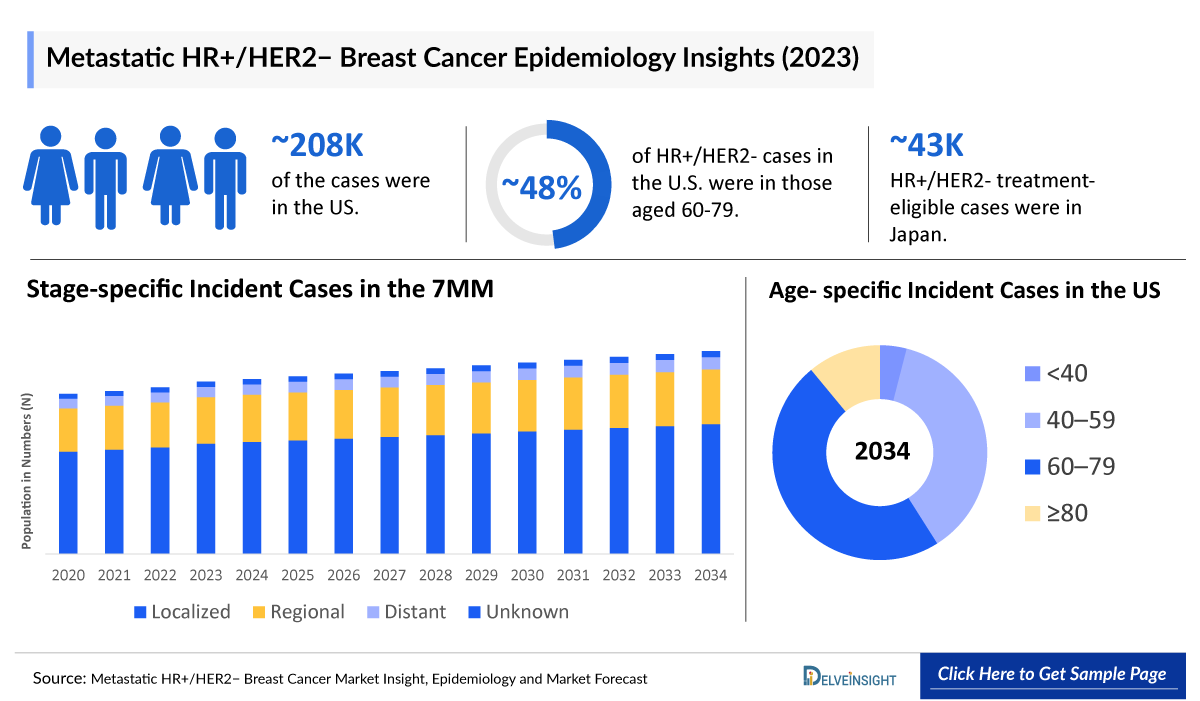

Metastatic HR+/HER2- Breast Cancer Epidemiology

The Metastatic HR+/HER2- Breast Cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total incident cases of breast cancer, incident cases of HR+/HER2- breast cancer, the menopausal status of HR+/HER2- breast cancer, stage-specific cases of HR+/HER2- breast cancer, age-specific cases of HR+/HER2- breast cancer and treatment-eligible Pool for HR+/HER2- Breast Cancer in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- According to the estimates, the total incident population of HR+/HER2- Breast Cancer in the 7MM was nearly 476,000 cases in 2023. The cases in the 7MM are expected to increase during the forecast period, i.e., 2024–2034.

- The HR+/HER2- breast cases were highest in the United States, accounting for ~208,400 cases in 2023.

- According to the estimates, most cases of HR+/HER2- breast cancer occur in people aged between 60 and 79 years in the United States, accounting for ~48% of cases in 2023.

- Among EU4 and the UK, Germany had the maximum total incident cases of HR+/HER2- breast cancer, with ~50,200 cases in 2023, while Spain accounted for the least number of incident cases.

- In 2023, in Japan, there were approximately 43,000 treatment-eligible cases of HR+/HER2– breast cancer.

Metastatic HR+/HER2- Breast Cancer Recent Developments

- In August 2025, Celcuity Inc. announced that the FDA accepted its New Drug Application for gedatolisib in treating HR+/HER2- advanced breast cancer (ABC) under the Real-Time Oncology Review (RTOR) program.

- In April 2025, AstraZeneca and Daiichi Sankyo’s Enhertu (trastuzumab deruxtecan) was approved in the EU as monotherapy for adults with unresectable or metastatic HR-positive, HER2-low/ultralow breast cancer, after at least one endocrine therapy and when further endocrine therapy is unsuitable.

Metastatic HR+/HER2- Breast Cancer Drug Chapters

The drug chapter segment of the HR+/HER2- Breast Cancer report encloses a detailed analysis of the marketed and late-stage (Phase III) pipeline drug. The marketed drugs segment encloses drugs such as KISQALI (Novartis), PIQRAY (Novartis), IBRANCE (Pfizer), and others. Furthermore, the current key players for the upcoming emerging drugs and their respective drug candidates include ARV-471 (Arvinas), OP1250 (Olema Pharmaceuticals), Capivasertib (AstraZeneca), and others. The drug chapter also helps understand the HR+/HER2- Breast Cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases. The Metastatic HR+/HER2- Breast Cancer drugs market is witnessing significant growth, driven by innovative targeted therapies, rising prevalence, and increasing investments in advanced breast cancer treatment research.

Metastatic HR+/HER2- Positive Breast Cancer Marketed Drugs

KISQALI (ribociclib): Novartis

KISQALI is a kinase inhibitor indicated for the treatment of adult patients with HR+, HER2- advanced or metastatic cancer in combination with:

An aromatase inhibitor as initial endocrine-based therapy

Fulvestrant as initial endocrine-based therapy or following disease progression on endocrine therapy in postmenopausal women or men

KISQALI was first approved in March 2017 for use with an AI to treat HR+/HER2– metastatic breast cancer in postmenopausal women. The FDA approval was based on the superior efficacy and demonstrated safety of KISQALI plus letrozole versus letrozole alone in the pivotal Phase III MONALEESA-2 trial. In July 2018, the FDA approved KISQALI, in combination with an aromatase inhibitor for pre/perimenopausal women with HR+/HER2– advanced or metastatic breast cancer, as initial endocrine-based therapy. KISQALI became the only CDK4/6 inhibitor indicated for use with an aromatase inhibitor for the treatment of pre-, peri- or postmenopausal women in the US, and also is indicated for use in combination with fulvestrant as both first- or second-line therapy in postmenopausal women. Novartis is conducting a Phase III NATALEE trial of KISQALI in patients diagnosed with HR+/HER2 early breast cancer.

PIQRAY (alpelisib): Novartis

PIQRAY is an orally bioavailable, alpha-specific PI3K inhibitor developed by Novartis. In breast cancer cell lines harboring PIK3CA mutations, PIQRAY has been shown to inhibit the PI3K pathway potentially and have antiproliferative effects. The FDA approved PIQRAY in combination with fulvestrant for postmenopausal women and men, with HR+/HER2–, PIK3CA-mutated, advanced or metastatic breast cancer as detected by an FDA-approved test following progression on or after an endocrine-based regimen. PIQRAY was the first new drug application approved under the FDA Oncology Center of Excellence Real-Time Oncology Review pilot program. The FDA approval was based on results of the Phase III trial, SOLAR-1, that showed PIQRAY plus fulvestrant nearly doubled median progression-free survival (PFS) compared to fulvestrant alone in HR+/HER2- advanced breast cancer patients with a PIK3CA mutation.

Detailed current therapies assessment will be provided in the report...

Metastatic HR+/HER2- Positive Breast Cancer Emerging Drugs

ARV-471 (vepdegestrant): Arvinas

ARV-471 is an investigational, oral PROTAC estrogen receptor protein degrader for treating patients with ER+/HER2- locally advanced or metastatic breast cancer. Arvinas and Pfizer are collaborating to develop and commercialize vepdegestrant. This program is currently in Phase III clinical studies.

In the first quarter of 2023, Arvinas and Pfizer requested a meeting with the US Food and Drug Administration, or the FDA, to review the proposed update to the trial protocol for the VERITAC-3 first-line, metastatic ER+/HER2– breast cancer Phase III trial of ARV-471 in combination with IBRANCE (palbociclib) to determine the optimal dose of palbociclib as part of the trial design.

OP1250 (palazestrant): Olema Pharmaceuticals

OP-1250 is a small molecule complete estrogen receptor antagonist (CERAN). OP-1250 competes with the endogenous activating estrogenic ligand 17-beta estradiol for binding in the ligand-binding pocket. OP-1250 blocks estrogen-driven transcriptional activity, inhibits estrogen-driven breast cancer cell growth and induces degradation of the estrogen receptor.

The company is advancing OP-1250 toward pivotal Phase III studies. In addition to that, the pivotal Phase III combination study with CDK 4/6 inhibitors is expected to be initiated by 2024.

|

Comparison of Emerging Drugs | ||||||

|

Drug Name |

Company |

Patient Segment |

MoA |

RoA |

Molecule Type |

Designation |

|

ARV-471 |

Arvinas |

ER+/HER2- Breast Cancer |

SERD |

Oral |

Small molecule |

- |

|

OP1250 |

Olema Pharmaceuticals |

ER+, HER2- Advanced or mBC |

Complete estrogen receptor antagonist and SERD |

Oral |

Small molecule |

FTD |

Detailed emerging therapies assessment will be provided in the final report...

HR+/HER2- Breast Cancer Drug Class

The emergence of several novel CDK4/6 inhibitors in the ER+/HER2– breast cancer space has demonstrated widespread potential for this patient population in combination and as monotherapy. Moreover, the upcoming SERDS could also muscle its way into this treatment space for this patient pool. The other therapies include AKT inhibitors, mTOR inhibitors, SERMS, PI3K inhibitors, and TROP-2 targeting antibody–drug conjugate.

CDK4/6 inhibitors

Cyclin-dependent kinase (CDK) inhibitors, the newest class of interest for advanced breast cancer, work by specifically inhibiting CDK4/6 proteins and blocking the transition from the G1 to the S phase of the cell cycle. This drug class inhibits kinase activity, which phosphorylates the retinoblastoma protein pathway. By blocking this path, CDK4/6 inhibitors are able to block cell-cycle progression in the middle of the G1 phase and prevent cancer cell progression. The approved CDK4/6 inhibitors have already gained a higher revenue than mTOR protein inhibitors, followed by SERDS and other therapies. Three CDK4/6 inhibitors (palbociclib, ribociclib, and abemaciclib) have been approved as combination therapies for HR+/HER2–, advanced or metastatic breast cancer.

SERD and SERM

The benefit of SERD over SOC ET appears to be more pronounced in patients with endocrine-sensitive tumors harboring ESR1 mutations without significant activation of other pathways. Recently, in January 2023, the FDA approved an oral SERD elacestrant (ORSERDU) for postmenopausal women or adult men with ER + /HER2-, ESR1-mutated ABC after progression on at least one line of ET. Ocular or cardiac toxicities reported with other SERDs, SERMs, or SERCAs, such as giredestrant, camizestrant, and tamoxifen, were not observed with elacestrant. Compared with the other SERDS, Giredestrant (SERD) has witnessed disappointment in its Phase II acelERA study but showed some promise in ESR1 mutation. Roche is conducting another Phase III trial for evaluating giredestrant + everolimus for ER+ HER2- mBC.

PIK3 and AKT inhibitors

Approximately 40% of HR+ and HER2- breast cancers harbor an activating mutation in PIK3CA.The gene product of PIK3CA is phosphatidylinositol 3-kinase (PI3K), a tyrosine kinase and a key component of the PI3K and protein kinase B (AKT) pathway that regulates cell growth. Dysregulation of the PI3K and AKT pathway occurs in several subtypes of breast cancer, and although a degree of pathway activation may be highest in triple-negative breast cancers, the incidence of these mutations is most common in HR+ and HER2– breast cancers. Alpelisib, in combination with fulvestrant, is approved by the US FDA for PIK3CA-mutated advanced HR+ and HER2-breast cancer based on SOLAR-1.

Further information will be provided in the final report...

HR+/HER2- Breast Cancer Market Outlook

For the past decade, endocrine therapy has been the preferred treatment for HR-positive and HER2- metastatic breast cancer, including cases with visceral involvement. This therapy, encompassing antiestrogens and aromatase inhibitors (AIs), remains the primary systemic approach for HR+/HER2- metastatic breast cancer due to its favorable treatment profile. Currently, there are three AIs available: anastrozole and letrozole are nonsteroidal AIs, while exemestane is a steroidal AI. Combining endocrine therapy with targeted agents, such as CDK 4/6 inhibitors or mTOR inhibitors, is an option for patients who do not meet the criteria for chemotherapy or sole endocrine treatment.

The addition of the three registered CDK4/6 inhibitors (CDK4/6i) to an endocrine drug in the first line of treatment, like in MONALEESA 2, 3, and 7 (ribociclib), PALOMA-2 (palbociclib) and MONARCH-3 (abemaciclib) showed a significant increase in the median progression-free survival (PFS). CDK4 and 6 inhibitors are relatively new drugs in Japan, and two of them, palbociclib and abemaciclib, have received regulatory approval for clinical use. In August 2022, AstraZeneca and Daiichi’s ENHERTU received expedited approval for widespread HER2-low breast cancer. ENHERTU has emerged as the first therapeutic intended for treating HER2-low, metastatic, or unresectable breast cancer, a newly created subgroup previously associated with HR+/HER2– breast cancer. Later, the FDA authorized TRODELVY in February 2023 for previously treated HR-positive, HER2-negative breast cancer.

There is promising potential for expanding CDK4/6 inhibitor applications beyond HR+, HER2- advanced breast cancer. Patients who develop resistance to combined CDK4/6 inhibitor and endocrine treatments often switch to conventional chemotherapy due to disappointing outcomes with single-agent fulvestrant. Recent developments suggest that the post-CDK4/6 inhibitor treatment landscape could benefit from adopting Antibody–Drug Conjugates (ADCs) and oral selective estrogen receptor degraders (SERDs).

The emerging pipeline is crowded by HR+/HER2- potential therapies, whereas few of them have shifted their focus to evaluate the therapies targeting the HER2 Low segment. The emerging pipeline for HR/HER2- includes several potential drugs in late-stage (Phase III, II/III, II) that include Giredestrant, Camizestrant (AZD9833), LY3484356 (Imlunestrant), Lasofoxifene, ARV-471, Capivasertib, Inavolisib, KEYTRUDA (pembrolizumab), Enobosarm, OP1250, Samuraciclib, Lerociclib, SFX-01, Endoxifen, whereas HER2 Low include Datopotamab deruxtecan, DB1303, Eftilagimod alpha, being administered in various combinations. The focus of this research is mostly on new oral SERDs. Overall, the evolving landscape holds the potential for more tailored and effective treatments, providing renewed hope for patients facing this form of breast cancer.

While research advances have significantly improved the management of ER+, HER2- breast cancer, there remains substantial room for enhancement in this field. Dedicated research efforts are necessary to better comprehend factors such as mutations, the discovery of biomarkers, and the development of improved therapeutic approaches.

Detailed market assessment will be provided in the final report...

Key Findings

- Among the 7MM, the United states accounted ofr the highest market share for HR+/HER2- Breast Cancer, accounting for nearly USD 7,500 million in 2023, which is expected to show significant growth during the forecast period.

- Among the EU4 countries, Germany captured the maximum market share in 2023, whereas Spain was at the bottom of the ladder.

- The current treatment market for HR+/HER2–Breast Cancer includes CDK4/6 inhibitors, PARP inhibitors, SERDS, PI3K-alpha inhibitor, and others.

- Among all the therapies in 2023, IBRANCE had the largest market size with a revenue of USD ~4,500 million.

- The market size of HR+/HER2- Breast Cancer in EU4 and the UK in 2023 was around USD 2,300 million, which is expected to increase during the forecast period (2024–2034).

- Potential Therapies expected to launch are Lasofoxifene, Camizestrant, Capivasertib, ARV-471, and others. The upcoming combination therapies of HR+/HER2- breast cancer are expected to benefit the current market and deliver less adverse effects and more effective treatment.

Metastatic HR+/HER2- Breast Cancer Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034. The landscape of HR+/HER2- breast cancer treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Novel SERDs exhibit increased efficacy because they have a higher bioavailability than fulvestrant. Giredestrant, an oral SERD, showed higher clinical benefits and objective response rates, compared to ET (fulvestrant or an AI) in patients with HR-positive and HER2-negative ABC The binding affinity of lasofoxifene, which is comparable to that of 17-estradiol, sets it apart from other SERMs. It also has significant preclinical evidence in AI-resistant ER-mutated breast cancer models. The drug is expected to have a medium uptake. Furthermore, with Capivasertib, an oral inhibitor of the serine/threonine kinase AKT that is very selective, the company is working with the FDA to bring this potential first-in-class AKT inhibitor to patients as quickly as possible. The drug is expected to have a medium uptake. The combination of OP-1250 with palbociclib also resulted in a tolerable safety profile, induced tumor responses, and stabilized disease. It is also expected to have a medium uptake

Detailed emerging therapies assessment will be provided in the final report...

Metastatic HR+/HER2- Breast Cancer Pipeline Development Activities

The Metastatic HR+/HER2- Breast Cancer pipeline report provides insights into Metastatic HR+/HER2- Positive Breast Cancer Clinical Trials within Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Metastatic HR+/HER2- Breast Cancer Pipeline Development Activities

The Metastatic HR+/HER2- Breast Cancer clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HR+/HER2- breast cancer emerging therapy.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the HR+/HER2- breast cancer evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including oncologists, radiation oncologists, surgical oncologists, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as the Institute for Personalized Cancer Therapy, Anderson Cancer Center, Aichi Cancer Center, University Hospital Ulm, International Breast Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or HR+/HER2- breast cancer market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

KOL Views

“CDK 4/6 inhibitors with ET is the standard first option in treating advanced luminal breast cancer. There is no predictive biomarker easily applicable in clinical practice despite unprecedented research efforts. ADCs use an attractive concept, and some of them will soon achieve clinical implementation.”

“With a significant number of ER+ HER2– patients ultimately developing ESR1 mutations at some point in their metastatic journey, it is important to test for ESR1 each time an mBC patient experiences disease progression to understand what is fueling their breast cancer. ORSERDU approval gives the first-ever treatment option that directly acts against the very mutations that make this form of breast cancer more difficult to treat and provides hope to our patients and their families.”

|

KOL Views |

|

“CDK 4/6 inhibitors with ET is the standard first option in treating advanced luminal breast cancer. There is no predictive biomarker easily applicable in clinical practice despite unprecedented research efforts. ADCs use an attractive concept, and some of them will soon achieve clinical implementation.” |

|

“With a significant number of ER+ HER2– patients ultimately developing ESR1 mutations at some point in their metastatic journey, it is important to test for ESR1 each time an mBC patient experiences disease progression to understand what is fueling their breast cancer. ORSERDU approval gives the first-ever treatment option that directly acts against the very mutations that make this form of breast cancer more difficult to treat and provides hope to our patients and their families.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The Patient Assistance Now Oncology (PANO) program assists with accessing Novartis medicine(s), from insurance verification to financial assistance. Free Trial and Access Program can help patients receive a free PIQRAY supply for a US FDA-approved indication. Patients may be eligible for immediate copay savings with a PIQRAY copay card; eligible patients with private insurance may pay USD 0 per month, and Novartis will pay the remaining copay, up to USD 15,000 per calendar year, per product. The program is unavailable for patients enrolled in Medicare, Medicaid, or any other federal or state healthcare program.

Novartis supports the patients in accessing AFINITOR through its Oncology Universal Copay Program, through which eligible patients with private insurance may pay USD 0 per month, and Novartis will pay the remaining copay, up to USD 15,000 per calendar year per product. AfiniTRAC is another support program for eligible patients taking AFINITOR (everolimus) tablets or AFINITOR DISPERZ (everolimus tablets for oral suspension). The program provides one-to-one telephone support directly to patients through AfiniTRAC Care Champions, who provide comprehensive educational support, including help with a treatment routine and reminders to patients to take medication as prescribed.

Detailed market access and reimbursement assessment will be provided in the final report...

Scope of the Metastatic HR+/HER2- Positive Breast Cancer Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of HR+/HER2- breast cancer, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the HR+/HER2- breast cancer market, historical and forecasted market size, and market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM HR+/HER2- breast cancer market.

Metastatic HR+/HER2- Positive Breast Cancer Market Report Insights

- Metastatic HR+/HER2- Positive Breast Cancer Patient Population

- Metastatic HR+/HER2- Positive Breast Cancer Therapeutic Approaches

- HR+/HER2- Breast Cancer Pipeline Analysis

- HR+/HER2- Breast Cancer Market Size and Trends

- Existing and Future Market Opportunity

Metastatic HR+/HER2- Breast Cancer Market Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- HR+/HER2- Breast Cancer Epidemiology Segmentation

- Key Cross Competition

- Metastatic HR+/HER2- Positive Breast Cancer Drugs Uptake

- Key Metastatic HR+/HER2- Positive Breast Cancer Market Forecast Assumptions

Metastatic HR+/HER2- Breast Cancer Market Report Assessment

- Current Metastatic HR+/HER2- Positive Breast Cancer Treatment Practices

- Metastatic HR+/HER2- Positive Breast Cancer Unmet Needs

- Metastatic HR+/HER2- Positive Breast Cancer Pipeline Product Profiles

- Metastatic HR+/HER2- Positive Breast Cancer Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

- Metastatic HR+/HER2- Positive Breast Cancer Market Drivers

- Metastatic HR+/HER2- Positive Breast Cancer Market Barriers

FAQs

- What was the HR+/HER2- breast cancer market size, the market size by therapies/class, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What can be the future treatment paradigm of HR+/HER2- breast cancer?

- What are the disease risks, burdens, and unmet needs of HR+/HER2- breast cancer? What will be the growth opportunities across the 7MM concerning the patient population with HR+/HER2- breast cancer?

- What is the impact of biosimilar on the sales of FASLODEX or AFINITOR?

- Who is the major competitor of ENHERTU in the market?

- How much market share antibody–drug conjugate (ADC) will be capture by 2034?

- What are the current options for the treatment of HR+/HER2- breast cancer? What are the current guidelines for treating HR+/HER2- breast cancer in the US, Europe, and Japan?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

Reasons to Buy Metastatic HR+/HER2- Breast Cancer Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the HR+/HER2- breast cancer market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles:-

- Metastatic HER2-Positive Breast Cancer

- Estrogen Receptor Positive Breast Cancer: Market Outlook

- Global HR+/ HER2- Breast Cancer Market Scenario

- How HR+/ HER2- Breast Cancer Emerging Drugs Will Transform the Market?

- HR-positive/ HER2-negative Breast Cancer Market Insights: Upcoming Therapies and Market Analysis

- Breast Cancer: Understand Your Breasts, Recognize the Symptoms

- Key Facts To Know About Triple-Negative Breast Cancer In The Breast Cancer Awareness Month

- 7 Most Common Myths About Breast Cancer Demystified

- Roche’s HER2-Positive Breast Cancer Treatment Franchise

- Latest DelveInsight Blogs