CDK4/6 Inhibitor Market Forecast

- The CDK4/6 inhibitors market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of CDK4/6 inhibitors, and the increasing number of CDK4/6 inhibitors that are under clinical trials and filed for approval by various companies.

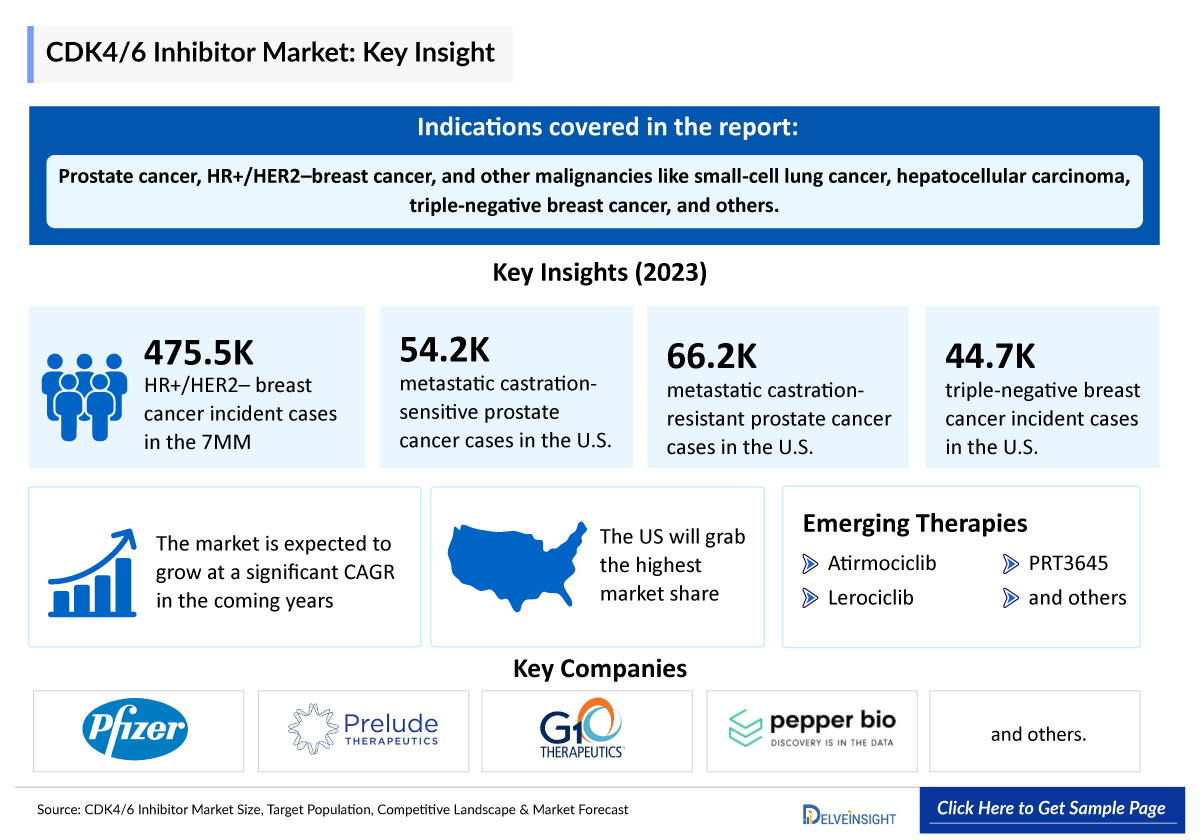

- CDK4/6 inhibitors are effective treatments for prostate cancer, HR+/HER2–breast cancer, and other malignancies like small-cell lung cancer, hepatocellular carcinoma, and triple-negative breast cancer. However, it is primarily utilized for HR+/HER2– breast cancer treatment.

- The development and approval of CDK4/6 inhibitors have transformed the treatment landscape of HR+/HER2−metastatic breast cancer. Currently, three selective CDK4/6 inhibitor agents, including IBRANCE (palbociclib), KISQALI (ribociclib), and VERZENIO (abemaciclib), combined with endocrine therapy. They have been the preferred 1L treatment for many years but now NCCN has recommended KISQALI in 1L metastatic.

- IBRANCE continues to be a leader in the CDK4/6 inhibitors class, with ~70% of patients in the US who are prescribed CDK4/6 inhibitors receiving an IBRANCE prescription.

- There is promising potential for expanding CDK4/6 inhibitor applications beyond HR+/HER2− advanced breast cancer.

- In May 2024, G1 Therapeutics and Pepper Bio announced a global licensing agreement (excluding Asia-Pacific) for lerociclib, a selective CDK4/6 inhibitor. Using their COMPASS platform, Pepper Bio identified CDK4/6 as key targets for Hepatocellular carcinoma, with preclinical models showing superior efficacy. Lerociclib is now advancing to Phase II trials.

- Patients who develop resistance to combined CDK4/6 inhibitors and endocrine treatments often switch to conventional chemotherapy due to disappointing outcomes with single-agent fulvestrant.

- G1 Therapeutics’ COSELA is recommended in updated small-cell lung cancer guidelines from the American Society of Clinical Oncology (ASCO).

- Emerging CDK4/6 inhibitors companies such as Pfizer, Prelude Therapeutics, G1 Therapeutics, Pepper Bio, and others are evaluating drugs for CDK4/6 in clinical trials.

Unlock vital industry insights with a sample page. Request yours today @ CDK4/6 Inhibitors Market Outlook

Factors affecting Cdk4/6 Inhibitor Market Growth

-

Rising Incidence of Breast Cancer and Other Cancers

CDK4/6 inhibitors are primarily used in hormone receptor-positive breast cancer. The increasing global prevalence of breast cancer, along with other solid tumors, is driving demand for these targeted therapies.

-

Advancements in Targeted Cancer Therapies

The development of selective CDK4/6 inhibitors with improved efficacy and safety profiles has significantly enhanced treatment outcomes. These advancements encourage higher adoption in oncology treatment protocols.

-

Growing Awareness Among Oncologists and Patients

Increasing awareness of the benefits of CDK4/6 inhibitors in improving progression-free survival and overall patient outcomes is boosting their clinical use.

-

Expansion of Clinical Trials and Research

Continuous research and numerous clinical trials exploring CDK4/6 inhibitors for various cancers are expanding the therapeutic indications, supporting market growth.

-

Rising Geriatric Population

Cancer incidence rises with age, particularly breast cancer in postmenopausal women. The growing geriatric population globally increases the patient pool for CDK4/6 inhibitors.

-

Combination Therapy Approaches

CDK4/6 inhibitors are increasingly being used in combination with endocrine therapies or immunotherapies, enhancing treatment efficacy and broadening their clinical application.

-

Improved Healthcare Infrastructure

Enhanced access to oncology care, diagnostics, and treatment facilities in emerging markets allows more patients to benefit from advanced therapies like CDK4/6 inhibitors, fueling market growth.

DelveInsight’s “CDK4/6 inhibitors Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CDK4/6 inhibitors, historical and Competitive Landscape as well as the CDK4/6 inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The CDK4/6 inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CDK4/6 inhibitors market size from 2020 to 2034. The CDK4/6 inhibitors market report also covers current CDK4/6 inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

CDK4/6 Inhibitors Treatment Market

CDK4/6 Inhibitors Overview

CDKs are proline-binding serine/threonine protein kinases. Based on the sequence of the kinase domain, CDKs are called cyclin-dependent protein kinases, mitogen-activated protein kinases, glycogen synthase kinases, or CDC-like kinases (CMGC). The CDK4/6 inhibitors act at the G1-to-S cell cycle checkpoint. This checkpoint is tightly controlled by the D-type cyclins and CDK4 and CDK6. When CDK4 and CDK6 are activated by D-type cyclins, they phosphorylate the retinoblastoma-associated protein (pRb). This releases pRb’s suppression of the E2F transcription factor family and ultimately allows the cell to proceed through the cell cycle and divide. In HR+ breast cancer, cyclin D overexpression is common, and loss of pRb is rare, making the G1-to-S checkpoint an ideal therapeutic target. The CDK4/6 inhibitors prevent progression through this checkpoint, leading to cell cycle arrest

Currently, the US FDA approved three CDK4/6 inhibitors are Palbociclib (Pfizer), Abemaciclib (Eli Lilly), and Ribociclib (Novartis) for breast cancer. Considering the effectiveness of CDK4/6 inhibitors in HR + /HER2- metastatic breast cancer treatment, these drugs are under investigation for various cancers in different clinical scenarios. For instance, several preclinical studies have indicated that CDK4/6 inhibitors can boost tumor cell immunogenicity, leading to the exploration of CDK4/6 inhibitors and Immune checkpoint inhibitor (ICI) combinations. CDK4/6 inhibitors, either alone or in combination therapy, have been studied in preclinical and clinical trials for Small-cell lung cancer treatment, yielding promising results.

Further details related to country-based variations are provided in the report...

CDK4/6 Inhibitors Epidemiology

The CDK4/6 inhibitors epidemiology chapter in the CDK4/6 inhibitors market report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for CDK4/6 inhibitor, total eligible patient pool of selected indications for CDK4/6 inhibitors, total treated cases in selected indication for CDK4/6 inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total incident cases of HR+/HER2– breast cancer in the 7MM comprised approximately 475,500 cases in 2023.

- Most cases of HR+/HER2– breast cancer occur in people aged 60-79 years.

- In 2023, in the United States, the total cases of metastatic castration-sensitive prostate cancer and metastatic castration-resistant prostate cancer were around 54,200 and 66,200, respectively.

- As per the DelveInsight analysis, the total incident cases of Triple-negative breast cancer in the United States comprised around 44,700 cases in 2023.

- Most cases of prostate cancer occur in people aged 54 years and older.

CDK4/6 Inhibitors Drug Chapters

The drug chapter segment of the CDK4/6 inhibitors market reports encloses a detailed analysis of CDK4/6 inhibitors marketed drugs and late-stage (Phase III and Phase I/II) pipeline drugs. It also helps to understand the CDK4/6 inhibitor’s clinical trial details, pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed CDK4/6 Inhibitors Drugs

- COSELA (trilaciclib): G1 Therapeutics

COSELA is a kinase inhibitor indicated to decrease the incidence of chemotherapy-induced myelosuppression in adult patients when administered prior to a platinum/etoposide-containing regimen or topotecan-containing regimen for extensive-stage small-cell lung cancer. The US FDA granted Fast Track designation to COSELA (trilaciclib) investigation for use in combination with chemotherapy to treat locally advanced or metastatic triple-negative breast cancer in July 2021.

In February 2021, the US FDA authorized COSELA (trilaciclib), a kinase inhibitor, for use in adult patients to reduce the occurrence of chemotherapy-induced myelosuppression when given before a platinum/etoposide-containing regimen or topotecan-containing regimen for extensive-stage small cell lung cancer.

- KISQALI (ribociclib): Novartis and Astex Pharmaceuticals

KISQALI is a kinase inhibitor, approved by the US FDA for treating adult patients with HR+/HER2- metastatic breast cancer. It can be used in combination with an aromatase inhibitor as initial endocrine-based therapy with fulvestrant as initial endocrine-based therapy, or after disease progression on endocrine therapy in postmenopausal women or men. The European Commission (EC) expanded its indication for KISQALI (ribociclib) in December 2018, following its initial approval by the FDA in 2017.

|

Table 1: Comparison of Key Marketed Drugs | ||||

|

Product |

Company |

RoA |

Initial US Approval |

Indication |

|

COSELA |

G1 Therapeutics |

IV |

US: 2021 |

Chemotherapy-induced myelosuppression in adult patients of extensive-stage small-cell lung cancer |

|

KISQALI |

Novartis/Astex Pharmaceuticals |

Oral |

US: 2017 |

Adult patients with HR+/HER2–advanced or metastatic breast cancer |

|

VERZENIO |

Eli Lilly |

Oral |

US: 2017 |

Adult patients with HR+/HER2–advanced or metastatic breast cancer |

|

IBRANCE |

Pfizer |

Oral |

US: 2015 |

Adult patients with HR+/HER2–advanced or metastatic breast cancer |

Note: Detailed current therapies assessment will be provided in the full report of CDK4/6 Inhibitors...

Emerging CDK4/6 Inhibitors Drugs

- Atirmociclib (PF-07220060): Pfizer

PF-07220060 is a next-generation highly selective CDK4 inhibitor with significant sparing of CDK6. Because of its greater selectivity for CDK4 over CDK6, PF-07220060 leads to less neutropenia in vivo models and, consequently, can be dosed higher to attain tolerated plasma concentrations that exceed those reported for dual CDK4/6i. This results in greater projected CDK4 target coverage in tumors and improved tumor growth inhibition by PF-07220060 across CDK4-driven in vivo models of human breast cancer and other tumor types. Currently, the drug is being evaluated in a Pivotal Phase III trial for the treatment of second-line hormone receptor-positive (HR+) metastatic breast cancer.

- Lerociclib: G1 Therapeutics and Pepper bio

Lerociclib is a differentiated oral CDK4/6 inhibitor based on its unique attributes, including its increased selectivity and potency for CDK 4 and CDK 6 and shorter half-life. Preliminary clinical data in HR+/HER2- breast cancer have demonstrated proof-of-concept of the differentiated clinical profile of continuously dosed lerociclib versus currently marketed CDK4/6 inhibitors, with improved tolerability and less neutropenia while maintaining robust clinical activity. Lerociclib has been licensed to Genor Biopharma in the Asia-Pacific region (excluding Japan) and is under National Medical Products Administration review in China for 1L and 2L HR+/HER2- breast cancer. In March 2024, G1 Therapeutics and Pepper Bio announced the global (excluding Asia-pacific region) license agreement for lerociclib.

|

Table 2: Comparison of Key Emerging Drugs | ||||

|

Product |

Company |

RoA |

Phase |

Indication |

|

Atirmociclib (PF-07220060) |

Pfizer |

Oral |

III |

Hormone receptor-positive (HR+) metastatic breast cancer. |

|

Lerociclib |

G1 Therapeutics/Pepper Bio |

IV |

I/II |

HR+, HER2-Negative Locally Advanced or Metastatic Breast Cancer |

|

PRT3645 |

Prelude Therapeutics |

Oral |

I |

Advanced or metastatic solid tumors including breast cancer, head and neck squamous cell carcinoma, GBM, non-small cell lung cancers, and others |

Note: Detailed emerging therapies assessment will be provided in the final report.

Access the data that matters. Request a sample page of our report now @ CDK 4/6 Inhibitor Drugs Market

CDK4/6 Inhibitors Market Outlook

The CDK4/6 inhibitors market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of CDK4/6 inhibitors, and the increasing number of CDK4/6 inhibitors that are under clinical trials and filed for approval by various companies.

CDK4/6 inhibitors, when combined with endocrine therapy, have become the preferred palliative treatment approach in the first-line setting for HR+/HER2− advanced breast cancer. In 2015, IBRANCE (palbociclib) marked a significant milestone as the first FDA-approved CDK4/6 inhibitor for HR+/HER2– breast cancer. This approval extended to its use alongside aromatase inhibitors (AIs) as initial therapy for postmenopausal women or men and in combination with fulvestrant for patients progressing after prior endocrine therapy. Palbociclib approval stemmed from positive outcomes in the Phase II PALOMA-1 trial, where it outperformed letrozole alone as the initial therapy for endocrine therapy-naïve advanced breast cancer patients. Palbociclib demonstrated manageable tolerability and improved quality of life in combination therapy compared to endocrine monotherapy.

Endocrine Therapy (ET) is a common first-line treatment in advanced or metastatic breast cancer (MBC), and resistance inevitably develops. Some patients may develop resistance to ET with one agent class, and a response to treatment may occur with exposure to another class. Sequential ET is preferred in postmenopausal women with HR+, HER2− MBC. Guidelines currently recommend Aromatase Inhibitors (AIs) with the CDK4/6 inhibitors, palbociclib or ribociclib, or fulvestrant as a first-line ET option. As a second-line ET option, fulvestrant in combination with palbociclib or abemaciclib is recommended for patients with prior adjuvant ET exposure or patients who received ET in the metastatic setting.

Several key CDK4/6 inhibitors companies, including Pfizer, G1 Therapeutics, and others, are involved in developing drugs for CDK4/6 inhibitors for various indications such as Prostate cancer, breast cancer, lung cancer, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of CDK4/6 inhibitors and define their role in the therapy of cancer.

CDK4/6 inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CDK4/6 inhibitors expected to be launched in the CDK4/6 inhibitors market during 2024–2034.

CDK4/6 Inhibitors Pipeline Development Activities

The CDK4/6 inhibitors market report provides insights into different therapeutic candidates in Phase III, Phase I/II. It also analyzes key CDK4/6 inhibitors companies involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for CDK4/6 inhibitors market growth over the forecasted period.

CDK4/6 inhibitors Clinical Trials Activities

The CDK4/6 inhibitors market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CDK4/6 inhibitor therapies.

Latest KOL Views on CDK4/6 inhibitors

To keep up with current and future CDK4/6 inhibitors market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CDK4/6 inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University Hospital in Munich and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or CDK4/6 inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the CDK4/6 inhibitors market and the unmet needs.

|

KOL Views |

|

“As we think about other targeted therapies, there are other drugs, like CDK4/6 inhibitors. They have made tremendous headway in breast cancer, are approved as monotherapy in the refractory setting, and are approved in combination with hormonal therapy in the earlier metastatic setting. Abemaciclib is even approved in the localized early setting. Several CDK4/6 inhibitors have been evaluated in prostate cancer.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

CDK4/6 inhibitors Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

Eli Lilly’s VERZENIO Continuous Care Program provides access to the patients to its different programs, such as savings card through which commercially insured and eligible patients may pay as little as USD 0 a month, Companion in Care program that provides patients with help from the same person every time, and MyRightDose program simplifies midcycle dose reductions for patients and at no cost to them.

The CDK4/6 inhibitors market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

ASCO 2024 Key Highlights

|

ASCO 2024 Highlights | |||

|

Company Name |

Abstract No./NCT ID |

Product |

Description |

|

G1 Therapeutics |

Poster Session #1091 (NCT02574455) |

Trilaciclib + sacituzumab govitecan (SG) |

Trilaciclib combined with sacituzumab govitecan (SG) improves overall survival and tolerability compared to SG alone, based on historical ASCENT trial data |

|

Pfizer |

Poster Session #3108 (NCT04557449) |

Atirmociclib (PF-07220060) |

Updated safety data presented at ASCO, indicate that PF-07220060 combined with endocrine therapy was well tolerated in patients with HR+/HER2- metastatic breast cancer, spanning both post-CDK4/6 inhibitor and CDK4/6 inhibitor-naïve cohorts. |

|

Eli Lilly and Company |

Oral Session #LBA1001 (NCT05169567) |

VERZENIO |

Eli Lilly and Company’s groundbreaking Phase III trial, postMONARCH, marks a pivotal moment in breast cancer treatment. It is the first of its kind to unveil the advantages of maintaining CDK4/6 inhibition with abemaciclib alongside fulvestrant post-progression on CDK4/6 inhibitors. |

|

Eli Lilly and Company |

Oral Session #5001 (NCT03706365) |

Abemaciclib with abiraterone |

Lilly's CYCLONE 2 trial data showed that adding VERZENIO to ZYTIGA did not significantly improve rPFS in mCRPC patients. |

|

Jiangsu Hengrui Pharmaceuticals |

Poster Session #11547 (ChiCTR2200062868) |

Dalpiciclib |

Data presented at ASCO showed that the CDK4 inhibitor dalpiciclib was associated with a favorable PFS rate in patients with advanced CDK4-amplified and RB-expressing WDLS/DDLS. |

The abstract list is not exhaustive, will be provided in the final report

Scope of the CDK4/6 Inhibitors Market Report

- The CDK4/6 inhibitors market report covers a segment of key events, an executive summary, and a descriptive overview of the CDK4/6 inhibitor, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging CDK4/6 inhibitors therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the CDK4/6 inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CDK4/6 inhibitors market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CDK4/6 inhibitors market.

CDK4/6 Inhibitors Market Report Insights

- CDK4/6 inhibitors Targeted Patient Pool

- CDK4/6 Inhibitors Therapeutic Approaches

- CDK4/6 Inhibitors Pipeline Analysis

- CDK4/6 Inhibitors Market Size

- CDK4/6 inhibitors Market Trends

- Existing and future Market Opportunity

CDK4/6 Inhibitors Market Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- CDK4/6 Inhibitors Drugs Uptake

- Key CDK4/6 Inhibitors Market Forecast Assumptions

CDK4/6 Inhibitors Market Report Assessment

- Current CDK4/6 Inhibitors Treatment Practices

- CDK4/6 Inhibitors Unmet Needs

- CDK4/6 Inhibitors Pipeline Product Profiles

- CDK4/6 Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

- CDK4/6 Inhibitors Market Drivers

- CDK4/6 Inhibitors Market Barrier

Key Questions Answered In The CDK4/6 Inhibitors Market Report

- What was the CDK4/6 inhibitor market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which CDK4/6 inhibitors is going to be the largest contributor in 2034?

- Which is the most lucrative market for CDK4/6 inhibitors?

- What are the pricing variations among different geographies for approved CDK4/6 inhibitors therapies?

- How the reimbursement landscape has for CDK4/6 inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CDK4/6 inhibitors? What will be the growth opportunities across the 7MM for the patient population of CDK4/6 inhibitors?

- What are the key factors hampering the growth of the CDK4/6 inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CDK4/6 inhibitors?

- What is the cost burden of approved CDK4/6 inhibitors therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved CDK4/6 inhibitors therapies?

Reasons to buy CDK4/6 Inhibitors Market Report

- The CDK4/6 inhibitors market report will help develop business strategies by understanding the latest trends and changing dynamics driving the CDK4/6 inhibitor Market.

- Understand the existing CDK4/6 inhibitors market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming CDK4/6 inhibitors companies in the CDK4/6 inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging CDK4/6 inhibitors therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CDK4/6 inhibitors market so that the upcoming CDK4/6 inhibitors companies can strengthen their development and launch strategy.

Visit delveinsight latest blogs @ Latest Delveinsight Blogs