Peanut Allergy Market Summary

- The Peanut Allergy Treatment market in the 7MM was valued at approximately USD 533 million in 2025.

- The Peanut Allergy Treatment market is projected to grow at a CAGR of 18.50%, reaching USD 2,464 million by 2034 in leading countries (US, EU4, UK and Japan)

Peanut Allergy Treatment Market and Epidemiology Analysis

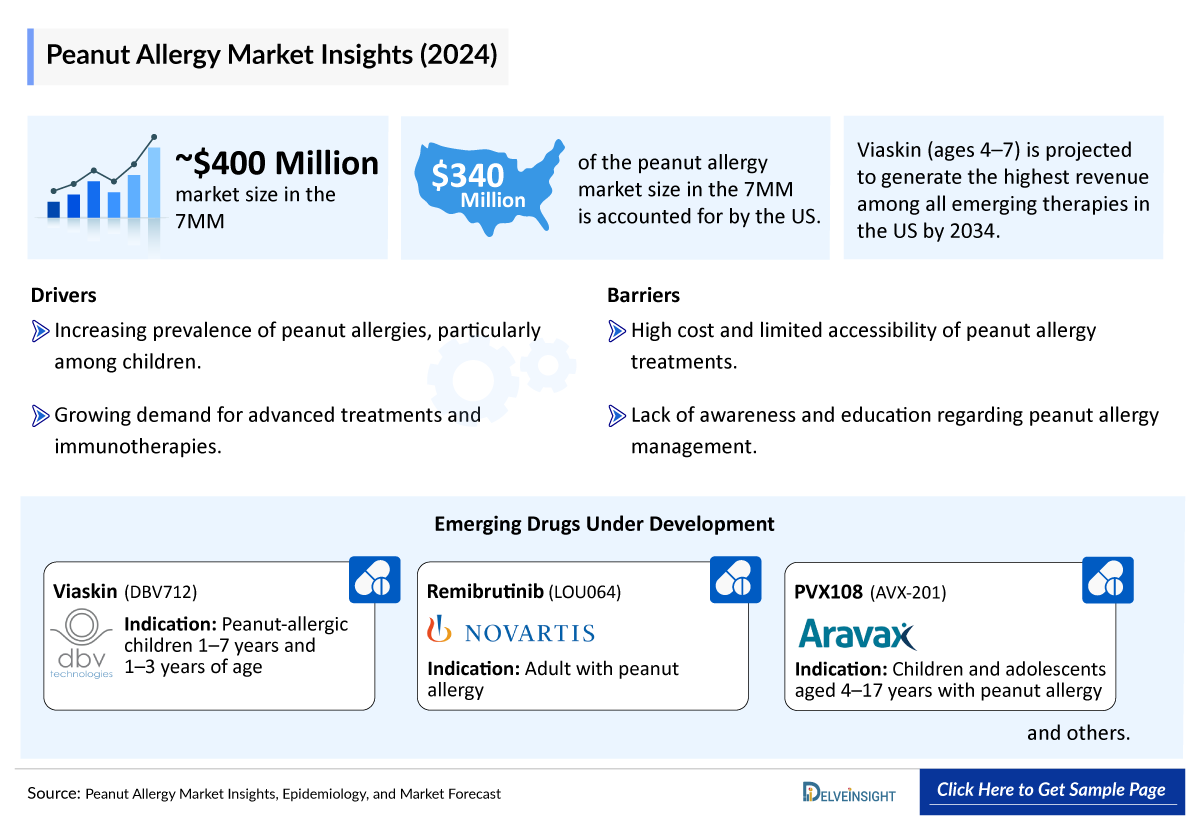

- The evolving Peanut Allergy Treatment Market Landscape features clinical trials led by DBV Technologies (Viaskin [DBV712] Peanut Patch), Novartis (Remibrutinib), Aravax (PVX108), ALK-Abello (Sublingual Immunotherapy-Tablet), InnoUp Farma (INP20), Allergy Therapeutics (VLP Peanut), Intrommune Therapeutics (INT301), Regeneron Pharmaceuticals (Linvoseltamab + Dupilumab), and others.

- Peanut Allergy is one of the most common and severe forms of food allergy. The Peanut Allergy Prevalence has also been increasing over the past few decades and is more common in younger populations.

- Peanut Allergy typically manifests initially during childhood with symptom occurrence as early as 4 months of age and usually within the first 2 years of life. Approximately 20% of children naturally outgrow their Peanut Allergy and tolerate them without events later on in life.

- Females are more likely to develop adult-onset Peanut Allergy compared to males, which is consistent with many previous population-based studies suggesting a female predominance post-puberty with males more prevalent pre-puberty.

- Peanut Allergy ranks among the top nine food allergies in the US, affecting about 1–2% of the population.

- In 2024, the Peanut Allergy Diagnosed Prevalent Population Cases in the 7MM comprised approximately 9,800,000 cases, among which the United States accounted for the highest number of cases.

- The current standard of care and effective management of Peanut Allergy is avoidance of the allergen and the use of an Adrenaline Auto-injector (AAI) in the event of severe allergic reaction.

- Currently, PALFORZIA and XOLAIR are the only approved Peanut Allergy drugs providing two valuable treatment options for Peanut Allergy patients and healthcare providers; PALFORZIA is approved for age group 1–3 and 4–17 years, while XOLAIR is approved for individuals aged 1 year and older. PALFORZIA, as the sole oral immunotherapy option, presents limitations, as the desensitization it provides requires continuous daily dosing to maintain tolerance.

- In March 2025, the US FDA approved OMLYCLO (omalizumab-igec) as the first and only biosimilar designated as interchangeable with XOLAIR for the treatment of IgE-mediated food allergy.

- Desensitization has enhanced Peanut Allergy treatment by raising the threshold for allergic reactions, reducing the risk of accidental anaphylaxis, and offering significant protection and reassurance to patients.

- The Peanut Allergy Pipeline is advancing with the development of innovative therapies with different mechanisms of action, including BTK inhibitors (Remibrutinib), Immunostimulants (INP20), Immunomodulators (VLP Peanut), Immunosuppressants (INT301), and Cytotoxic T-lymphocyte stimulants in combination with IL 13 receptor (Linvoseltamab + Dupilumab), among others.

Peanut Allergy Treatment Market size and forecast

- 2025 Peanut Allergy Treatment Market Size: USD 533 million

- 2034 Projected Peanut Allergy Treatment Market Size: USD 2,464 million

- Peanut Allergy Treatment Growth Rate (2025-2034): 18.50% CAGR

- Largest Peanut Allergy Treatment Market: United States

Request for Unlocking the Sample Page of the "Peanut Allergy Treatment Market"

Key Factors Driving Peanut Allergy Market

Rising Prevalence of Peanut Allergy

Peanut allergy is one of the most common and severe food allergies, typically manifesting in early childhood, often as early as 4 months and usually within the first 2 years of life. While approximately 20% of children naturally outgrow their peanut allergy, the condition remains persistent in most patients. Females are more likely to develop adult-onset peanut allergy, whereas males are more prevalent pre-puberty. Across the 7MM in 2024, the diagnosed prevalent population of peanut allergy was approximately 9.8 million, with the United States accounting for the highest number of cases. Rising prevalence, especially among younger populations, continues to drive the need for effective therapies.

Current Market Landscape and Approved Therapies

Currently, PALFORZIA and XOLAIR are the only approved treatments for peanut allergy, offering two critical therapeutic options. PALFORZIA, the sole oral immunotherapy option, is approved for children aged 1–3 and 4–17 years but requires continuous daily dosing to maintain desensitization. XOLAIR is approved for individuals aged 1 year and older. In March 2025, the FDA approved OMLYCLO (omalizumab-igec), the first biosimilar designated as interchangeable with XOLAIR for IgE-mediated food allergy, expanding treatment accessibility.

Clinical Trial Activity in Peanut Allergy

Active clinical trials are led by companies including DBV Technologies (Viaskin [DBV712] Peanut Patch), Novartis (Remibrutinib), Aravax (PVX108), ALK-Abello (Sublingual Immunotherapy-Tablet), InnoUp Farma (INP20), Allergy Therapeutics (VLP Peanut), Intrommune Therapeutics (INT301), and Regeneron Pharmaceuticals (Linvoseltamab + Dupilumab). This robust pipeline highlights the diverse strategies being explored to address unmet needs in peanut allergy management.

Leading Companies in Peanut Allergy Therapies

The competitive landscape is shaped by major players such as Nestle Health Sciences, DBV Technologies, Regeneron/Sanofi, Camallergy, Vedanta Biosciences, Alladapt Immunotherapeutics, InnoUp Farma, COUR Pharmaceuticals, Novartis/Genentech, and others, all actively developing therapies to expand treatment options and improve patient outcomes.

DelveInsight’s " Peanut Allergy Treatment Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Peanut Allergy, historical and forecasted epidemiology as well as the Peanut Allergy market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Peanut Allergy Treatment Market Report provides current treatment practices, emerging drugs, Peanut Allergy market share of individual therapies, and current and forecasted Peanut Allergy market size from 2020 to 2034, segmented by seven major markets. The report also covers current Peanut Allergy treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Peanut Allergy Treatment Market Understanding

Peanut Allergy Overview

Peanut Allergy is among the most common food allergies in children and has seen a significant rise over the past few decades. It is driven by an abnormal IgE-mediated immune response to peanut proteins, often leading to severe, potentially life-threatening anaphylaxis. This condition not only poses serious health risks but also heavily impacts the quality of life for patients and their families. Compared to other IgE-mediated food allergies, Peanut Allergy is linked to a higher rate of anaphylaxis-related deaths in emergency settings. In allergic individuals, initial exposure to peanut allergens activates Th2 cells, which release cytokines that promote the production of IgE antibodies. These antibodies bind to Fce receptors on mast cells and basophils, priming them for future reactions. Upon re-exposure, the allergen crosslinks the IgE on these sensitized cells, triggering degranulation and the release of mediators like histamine, leukotrienes, and cytokines. This cascade causes vasodilation, increased vascular permeability, and inflammation, resulting in allergic symptoms. Alongside these biochemical signals, mechanical forces within the allergy microenvironment also play a key role in shaping immune responses.

Peanut Allergy Diagnosis

When diagnosing food allergies, including Peanut Allergy, clinical history remains the most critical component, as it provides context for interpreting diagnostic tests. The gold standard for diagnosis of food allergy is the double-blind, placebo-controlled food challenge (DBPCFC). Additionally, Skin Prick Tests (SPT) and specific-IgE for food allergens are the first-line tests to assess sensitization due to their relatively low cost and rapid results. SPTs and specific IgE have high sensitivity and negative predictive value but have low specificity and low positive predictive value for making an initial diagnosis of food allergy and, therefore, may lead to overdiagnosis when used alone. These tests are prone to both false positives and false negatives, meaning that positive results do not always indicate a true allergy and negative results may miss an allergy. Thus, diagnostic test results must always be correlated with the patient’s clinical history to ensure accurate diagnosis and management.

Allergy diagnostic methods can be categorized into traditional and emerging approaches. Allergen diagnostics have experienced significant advancements over the decades, starting with the introduction of skin prick testing in the 1970s, followed by the development of serum IgE testing in the 1980s, the adoption of oral food challenges in the 1990s, and the emergence of molecular diagnostics in the 2000s. In the 2010s, basophil activation tests were introduced, and more recently, the integration of advanced diagnostic technologies such as genetic testing and artificial intelligence in the 2020s has revolutionized the field, with further innovations expected in the future.

- Skin Prick Tests (SPT)

- Serum IgE testing

- Molecular allergy diagnosis

- Oral Food Challenge (OFC)

- Bead-based Epitope Assay (BBEA) etc.

Further details related to diagnosis will be provided in the report…

Peanut Allergy Treatment

Peanut Allergy management involves a multifaceted strategy, with allergen avoidance remaining central to preventing life-threatening anaphylaxis. However, recent clinical guidelines represent a major shift in preventive care, strongly advocating the early introduction of peanut-containing foods between 4 and 6 months of age—even in high-risk infants. This approach is associated with a significantly reduced incidence of Peanut Allergy and replaces older avoidance-based strategies.

In cases of anaphylaxis, immediate intramuscular epinephrine administration is the only definitive treatment. Adjunct therapies—antihistamines and corticosteroids—should follow, not precede, epinephrine. They offer limited acute benefits and are ineffective in preventing biphasic reactions. Moving forward, emphasis should be placed on standardized labeling, patient education, and access to innovative emergency treatments to improve outcomes and quality of life.

Various Immunotherapy approaches to the treatment are:

- Oral Immunotherapy (OIT)

- Sublingual Immunotherapy (SLIT)

- Epicutaneous Immunotherapy (EPIT) etc.

Further details related to treatment will be provided in the report…

Peanut Allergy Epidemiology

The Peanut Allergy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Peanut Allergy Diagnosed Prevalent Cases, Peanut Allergy Gender-specific Cases, Peanut Allergy Age-specific Cases, Peanut Allergy Severity-specific Cases in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Peanut Allergy Epidemiological Analyses and Forecast

- Among the 7MM, the US had the highest reported Peanut Allergy Diagnosed Prevalent Population Cases in 2024, with approximately 5,100,000 diagnosed prevalent cases.

- Among EU4 and the UK, Germany had the highest number of prevalent cases of Peanut Allergy approximately 1,107,000 in 2024.

- Among the age-specific cases, the highest cases were found in the age group 41–64 years age group followed by the age group 65+ years in Japan.

- Among severity-specific cases, mild and moderate cases are slightly more prevalent than severe Peanut Allergy ones.

- Peanut Allergy cases were more prevalent in females than in males.

Peanut Allergy Epidemiology Segmentation

- Total Peanut Allergy Diagnosed Prevalent Cases

- Peanut Allergy Gender-specific Cases

- Peanut Allergy Age-specific Cases

- Peanut Allergy Severity-specific Cases

Peanut Allergy Treatment Market Recent Updates and Breakthroughs

- In November 2024, Aravax announced that it has established a UK subsidiary, based on the Oxford Science Park, as the company continues its development into an international leader in food allergies.

- In December 2024, DBV Technologies announced successful FDA communication outlining a clear regulatory pathway and formalized guidance for accelerated approval of the Viaskin Peanut Patch in toddlers aged 1–3 years.

- In December 2024, ALK announced positive interim results from the Phase I/II clinical trial (ALLIANCE) for its investigational SLIT tablet for the treatment of Peanut Allergy.

- In January 2025, the European Commission approved the extension of the indication of PALFORZIA for the treatment of toddlers (ages 1–3) with a confirmed diagnosis of Peanut Allergy. The marketing authorization covered all 27 European member states and the three European Economic Area states (Iceland, Liechtenstein, and Norway).

- In March 2025, DBV Technologies reached an understanding with the US FDA based on written replies to its Type D IND meeting request. The FDA concurred with DBV’s proposal that safety exposure data from the VITESSE Phase III study of the Viaskin Peanut Patch in children aged 4–7 years would be sufficient to support BLA filing for this age group, thereby accelerating the anticipated timeline for BLA submission to the first half of 2026.

Peanut Allergy Drugs Market Analysis

Peanut Allergy Marketed Drugs

-

PALFORZIA (peanut allergen powder-dnfp): Stallergenes Greer

PALFORZIA, the first oral immunotherapy approved for children aged 4–7 years, later extended its indication to include children as young as 1 year old. The Peanut Allergy Treatment is available exclusively through the PALFORZIA Risk Evaluation and Mitigation Strategy (REMS) Program, reflecting the need for careful monitoring. While Peanut Allergy Clinical Trials data have demonstrated improved efficacy, analysts point to several barriers hindering widespread adoption. These include notable side effects, a stringent and continuous dosing schedule, and the requirement for ongoing peanut avoidance. In addition, complicated billing procedures have led many healthcare providers to avoid offering therapy, and the requirement for biweekly clinic visits over several months has made access challenging for some families. The slow adoption of PALFORZIA may also be partly due to the impact of the COVID-19 pandemic.

-

XOLAIR (omalizumab): Roche and Novartis

XOLAIR is an FDA-approved medicine to reduce allergic reactions in people with one or more food allergies. XOLAIR is given as an injection under the skin, either by a healthcare provider or at home through self-injection (after initiating treatment in a healthcare setting). In February 2024, the FDA approved XOLAIR for the reduction of allergic reactions, including anaphylaxis that may occur with accidental exposure to one or more foods in adult and pediatric patients aged 1 year and older with IgE-mediated food allergy.

Peanut Allergy Emerging Drugs

-

Viaskin (DBV712) peanut patch: DBV Technologies

Viaskin Peanut is an Epicutaneous Immunotherapy (EPIT) that delivers small amounts of peanut protein through a wearable patch to induce desensitization. Viaskin peanut have been designated Fast Track Designation (FTD) and Breakthrough Therapy Designation (BTD) status by the FDA. It is currently in Phase III Peanut Allergy Clinical Trials.

In March 2025, DBV Technologies reached an understanding with the US FDA based on written replies to its Type D IND meeting request. The FDA concurred with DBV’s proposal that safety exposure data from the VITESSE Phase III study of the Viaskin Peanut Patch in children aged 4–7 years would be sufficient to support BLA filing for this age group, thereby accelerating the anticipated timeline for BLA submission to the first half of 2026. Looking ahead, DBV plans to pursue an Accelerated Approval pathway for toddlers, with the COMFORT Toddlers safety study set to begin in Q2 2025, aiming to enroll around 480 participants, and a BLA submission for this age group anticipated in the second half of 2026.

-

Remibrutinib (LOU064): Novartis

Remibrutinib is a highly selective, potent, oral, covalent Bruton’s Tyrosine Kinase (BTK) inhibitor that is in development for the treatment of autoimmune disorders (including chronic spontaneous urticarial, myasthenia gravis, and multiple sclerosis), food allergy, and hidradenitis suppurativa. Remibrutinib is currently being evaluated in a Phase II Peanut Allergy Clinical Trials.

Peanut Allergy Drugs Class Analysis

BTK inhibitor

BTK inhibitors are an emerging class of immunomodulatory agents with potential application in allergic diseases, including Peanut Allergy. BTK is a key signaling molecule in the B-cell receptor pathway and also plays a crucial role in FceRI-mediated signaling in mast cells and basophils—cells central to the pathophysiology of IgE-mediated allergic reactions. Inhibitors work by selectively targeting and inhibiting BTK, thereby disrupting the intracellular signaling required for mast cell and basophil activation, degranulation, and the release of inflammatory mediators such as histamine and cytokines. This downstream effect reduces the severity of allergic responses and may prevent anaphylaxis upon allergen exposure.

While still under investigation, early-phase clinical trials suggest that BTK inhibitors can acutely suppress allergic reactivity to peanut exposure. These agents may offer a novel therapeutic option, particularly as a pre-treatment before intentional or accidental allergen exposure, such as during oral food challenges or immunotherapy. Notably, BTK inhibitors act rapidly within hours making them attractive as on-demand prophylaxis.

Apart from the BTK inhibitors other classes such as Immunomodulators and cytotoxic T lymphocyte stimulants/IL 13 receptor are also investigated for Peanut Allergy.

Peanut Allergy Market Outlook

Peanut Allergy is one of the leading causes of anaphylaxis—a rapid, potentially fatal allergic reaction that demands immediate intervention. In recent years, both awareness and reported cases of Peanut Allergy, particularly in children, have increased significantly. The cornerstone of effective management is avoidance of the allergen and auto-administrated epinephrine carriage, and prompt treatment of allergic symptoms.

Antihistamines, corticosteroids, and bronchodilators may also be used, but it is essential to realize these medications do not treat anaphylaxis; rather, they are adjunctive therapies for anaphylaxis management. Although avoidance is the mainstay of treatment, new strategies are being tested to prevent food allergies. Peanut immunotherapy clinical trials have been promising to date using incremental ingestion of small amounts of peanuts over time with oral immunotherapy. Epicutaneous immunotherapy is another desensitization method tested where peanut is transdermally introduced over time to build up a tolerance. Desensitization has enhanced Peanut Allergy treatment by raising the threshold for allergic reactions, reducing the risk of accidental anaphylaxis, and offering significant protection and reassurance to patients.

Currently, for the Peanut Allergy treatment PALFORZIA and XOLAIR are the only approved drug providing two valuable treatment options for Peanut Allergy patients and healthcare providers; PALFORZIA is approved for age groups 1–3 and 4–17 years, while XOLAIR is approved for individuals aged 1 year and older. Peanut Allergy has a strong emerging pipeline advancing with the development of innovative therapies with different Peanut Allergy mechanisms of action, including Remibrutinib, INP20, VLP Peanut, INT301, and Linvoseltamab + Dupilumab, among others. Viaskin Peanut Patch is likely to emerge as a leading noninvasive treatment, offering convenience and a favorable safety profile, potentially positioning it as a top choice for pediatric patients (1–7 years).

Emerging treatments, which target various mechanisms and molecular pathways, offer promising alternatives to current therapies by introducing novel approaches to managing Peanut Allergy. Their development reflects a growing focus on more precise, targeted treatments for these complex conditions.

- Among the 7MM, the US accounted for the largest Peanut Allergy Treatment Market Size. i.e., USD ~340 million in 2024.

- Among EU4 and the UK, Germany accounted for the highest Peanut Allergy Market Size in 2024, while Spain occupied the lowest.

- The Peanut Allergy Pipeline consists of BTK inhibitors, Immunostimulants, Immunomodulators, Immunosuppressants, and Cytotoxic T-lymphocyte stimulants in combination with IL 13 receptor, among others.

- In 2034, among all the Peanut Allergy Emerging Therapies, the highest revenue is expected to be generated by Viaskin (Age 4–7) in the US.

Peanut Allergy Drugs Uptake

This section focuses on the uptake rate of potential Peanut Allergy drugs expected to be launched in the market during 2025–2034. The potential drugs that can significantly change the market landscape during the forecast period, including Viaskin, Remibrutinib, PVX108, and SLIT-tablet, are being evaluated in different stages of clinical development.

Viaskin (DBV712) is a promising therapeutic option in young peanut-allergic children demonstrated continued increases in treatment effects without new safety signals. This supports the potential as a safe and effective treatment for Peanut Allergy in young children. DBV Technologies anticipates reporting top-line results from the VITESSE trial (NCT05741476) in the fourth quarter of 2025. The BLA submission for the 1–3-year-old indication is expected in the second half of 2026, subject to the successful completion of the COMFORT Toddlers Study. If successful, Viaskin could address a significant unmet need in the management of Peanut Allergy in children aged 1–3 years.

Peanut Allergy Pipeline Development Activities

The Peanut Allergy Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I/II and analyzes major Peanut Allergy Companies involved in developing targeted therapeutics. The report also covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Peanut Allergy emerging therapies.

Latest KOL Views on Peanut Allergy Treatment

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, PhD, Research Project Manager, Director, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Peanut Allergy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Peanut Allergy Therapeutics Market and the unmet needs.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Stanford University School of Medicine, Northwestern University Feinberg School of Medicine, University of Colorado School of Medicine, Imperial College London, Padua University Hospital, Humboldt-Universität zu Berlin, NHO Sagamihara National Hospital, etc., were contacted. Their opinion helps understand and validate Peanut Allergy epidemiology and market trends.

What KOLs are saying on Peanut Allergy Patient Trends?

- United States: “The increasing prevalence rates combined with the rise in food products, dishes and flavors containing peanuts or processed in a facility that uses peanuts, has become a global public health priority to research and develop management and treatment therapies for this condition.”

- Italy: “In the past, anti-IgE antibodies were shown to decrease the risk of anaphylaxis by reducing the allergic patients' reactivity to peanuts. Recent investigations, driven by the need to develop efficient treatment and prevention strategies for Peanut Allergy, suggest that oral immunotherapy with peanuts, although exposing the patients to significant risk, may represent a promising therapeutic approach.”

Peanut Allergy Therapeutics Market Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Peanut Allergy Treatment Market Landscape. The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Peanut Allergy Market Access and Reimbursement

The United States: Centre for Medicare and Medicaid Services (CMS)

The Centers for Medicare & Medicaid Services (CMS) is the agency within the US Department of Health and Human Services (HHS) that administers the nation’s major healthcare programs. The CMS oversees programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces. CMS collects and analyzes data, produces research reports, and works to eliminate fraud and abuse within the healthcare system.

Types of CMS Programs: Through its Center for Consumer Information & Insurance oversight, the CMS plays a role in the federal and state health insurance markets place by implementing the Affordable Care Act’s (ACA) laws about private health insurance and providing educational materials to the public. Medicare is a taxpayer-funded program for seniors aged 65 and older. Eligibility requires the senior to have worked and paid into the system through the payroll tax. It also provides health coverage for people with recognized disabilities and specific end-stage diseases, as confirmed by the Social Security Administration (SSA). It consists of four parts: A, B, C, and D.

Medicaid is a government-sponsored program that assists with health care coverage for people with low incomes. The joint program, funded by the federal government and administered at the state level, varies. Patients receive assistance paying for doctor visits, long-term medical and custodial care costs, hospital stays, and more. CHIP - The Children's Health Insurance Program (CHIP) is offered to parents of children under age 19 who make too much to qualify for Medicaid but cannot afford regular health insurance. The income limits vary, as each state runs a variation of the program with different names and different eligibility requirements.

Peanut Allergy Therapeutics Market Report Scope

- The Peanut Allergy Therapeutics Market Report covers a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into Peanut Allergy epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Peanut Allergy is provided, along with the assessment of new therapies, which will have an impact on the current Peanut Allergy Treatment Market landscape.

- A detailed review of the Peanut Allergy Treatment Market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The Peanut Allergy Therapeutics Market Report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Peanut Allergy Drugs Market.

Peanut Allergy Therapeutics Market Report Insights

- Patient-based Peanut Allergy Market Forecasting

- Therapeutic Approaches

- Peanut Allergy Pipeline Drugs Analysis

- Peanut Allergy Market Size and Trends

- Peanut Allergy Drugs Market Opportunities

- Impact of Upcoming Peanut Allergy Emerging Therapies

Peanut Allergy Therapeutics Market Report Key Strengths

- 10- Years Peanut Allergy Market Forecast

- 7MM Coverage

- Peanut Allergy Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Peanut Allergy Drugs Market

- Peanut Allergy Drugs Uptake

Peanut Allergy Therapeutics Market Report Assessment

- Current Peanut Allergy Treatment Market Practices

- Peanut Allergy Unmet Needs

- Peanut Allergy Pipeline Drugs Profiles

- Peanut Allergy Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Peanut Allergy Treatment Market Report

- What was the Peanut Allergy Drugs Market Share (%) distribution in 2024 and what it would look like in 2034?

- What would be the Peanut Allergy Treatment Market Size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- Which country will have the largest Peanut Allergy market size during the study period (2020–2034)?

- What are the disease risks, burdens, and Peanut Allergy Unmet Needs?

- What is the historical Peanut Allergy patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Peanut Allergy?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Peanut Allergy?

- What are the key collaborations (Industry–Industry, Industry-Academia), mergers and acquisitions, and licensing activities related to Peanut Allergy therapies?

- What are the recent novel therapies, targets, Peanut Allergy Mechanisms of Action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Peanut Allergy and their status?

- What are the key designations that have been granted for the emerging therapies for Peanut Allergy?

Reasons to Buy Peanut Allergy Treatment Market Report

- The Peanut Allergy Therapeutics Market Report will help in developing business strategies by understanding trends shaping and driving Peanut Allergy.

- To understand the future market competition in the Peanut Allergy Drugs Market and an Insightful review of the SWOT analysis of Peanut Allergy.

- Organize sales and marketing efforts by identifying the best opportunities for Peanut Allergy in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming Peanut Allergy Companies in the market will help in devising strategies that will help in getting ahead of competitors.

Stay updated with us for Recent Articles