Radioligand Therapy Market Summary

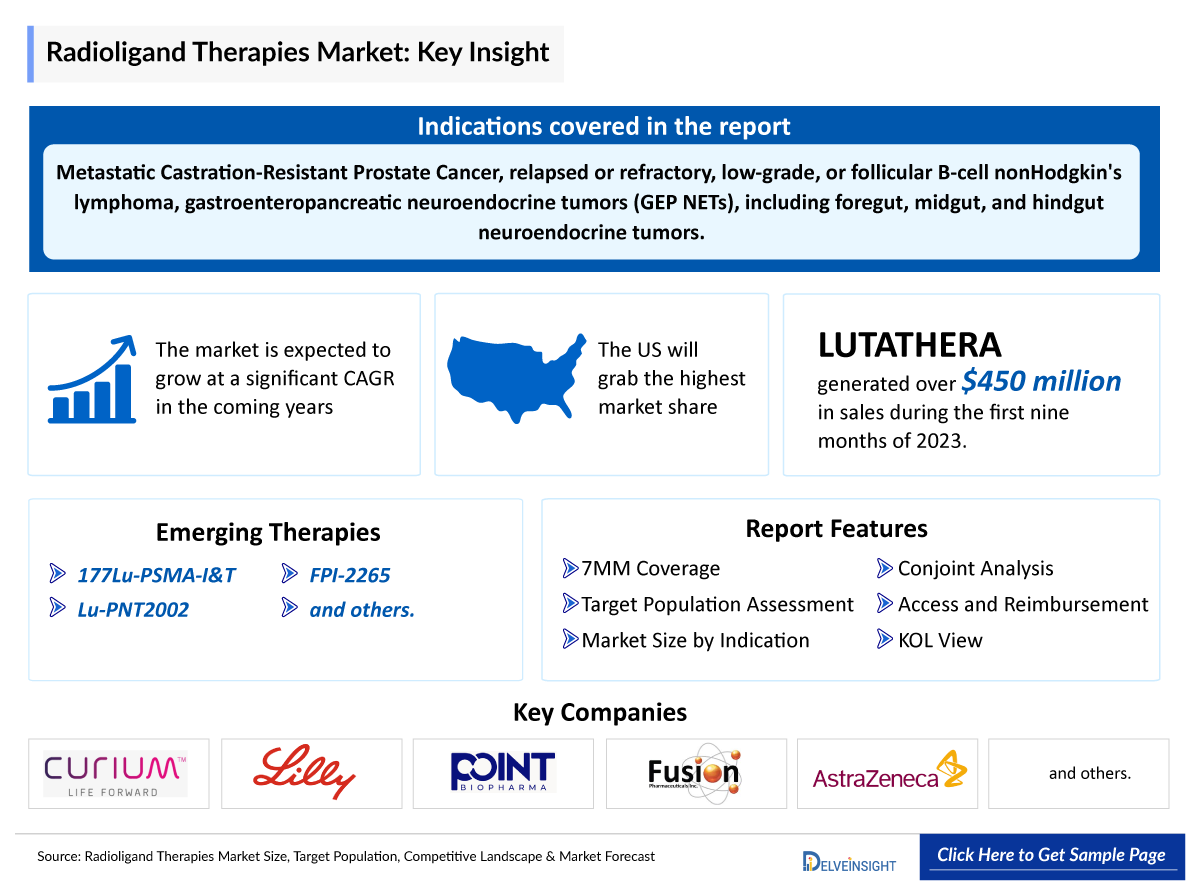

- According to DelveInsight, Radioligand Therapy Market is expected to grow rapidly by 2034.

- LUTATHERA recorded more than USD 450 million in sales in the first nine months of 2023, with a growth rate of 34% year over year and Novartis believes LUTATHERA could notch more than USD 1 billion in peak sales as a first-line therapy.

- Upon approval in 2022, PLUVICTO generated full-year sales standing at USD 980 million and the PSMA-directed therapy barely missed its chance at reaching blockbuster status in its first full year.

Radioligand Therapy Market Insights and Trends

- In 2018, the US FDA approved LUTATHERA (lutetium Lu 177 dotatate) and it became the first Radioligand Therapy Market Driver or radiopharmaceutical that has been approved for the treatment of gastroenteropancreatic neuroendocrine tumors (GEP-NETs). Then, in 2024, the FDA approved it as the first medicine specifically for pediatric patients with gastroenteropancreatic neuroendocrine tumors.

- Radioligand therapy is an innovative treatment approach, which is administered through an intravenous infusion. It combines the power of radioisotopes with a target-seeking ligand to deliver radiation to cancer cells expressing a specific target, even when they have spread throughout the body. With RLT, the goal is to deliver the treatment to the target cells to damage or destroy those cells while limiting impact to surrounding cells.

- Moreover, several Radioligand Therapy is currently being evaluated in clinical trials. An example is Lillys, Lu-PNT2002 which is in the developmental stage and is anticipated to receive approval during the forecast period.

- In March 2024, Novartis announced that it had acquired Mariana Oncology, a biotech specializing in developing radioligand Therapy (RLTs) for cancer treatment. As per terms of the agreement, Novartis is expected to make an upfront payment of $1 billion, with further potential payments of up to $750 million upon the completion of pre-specified milestones.

- In October 2023, Lilly acquired Point Biopharma with USD 1.4 billion and deepened its oncology pipeline. In the deal, Lilly will gain ownership of Point’s lead asset PNT2002, a radioligand therapy against targeting the prostate-specific membrane antigen (PSMA), being trialed for patients with metastatic castration-resistant prostate cancer who had progressed after hormonal treatment. The candidate carries the beta-emitting radioisotope lutetium-177.

- In March 2024, AstraZeneca announced that it will acquire Fusion Pharmaceuticals for USD 2 billion to accelerate the development of next-generation radioconjugates to treat cancer. The acquisition brings new expertise and pioneering R&D, manufacturing, and supply chain capabilities in actinium-based RCs to AstraZeneca

- In January 2024, the FDA approved Novartis's new automated radioligand therapy production plant for PLUVICTO - a radioligand therapy (RLT) for prostate cancer.

- In January 2024, InHealth launched the United Kingdom’s first relocatable radioligand therapy service.

- Eli Lilly, Curium, AstraZeneca/Fusion, and several other companies are currently engaged in the development and production of radioligand, which has the potential to significantly impact and enhance the radioligand Therapy market.

Request for Sample Page of Radioligand Therapies Market

Factors Affecting Radioligand Therapy Market Growth

Rising Cancer Prevalence

Increasing cases of prostate cancer, neuroendocrine tumors (NETs), and other malignancies boost demand for targeted RLT options.

Advancements in Targeted Therapies

Development of novel radiopharmaceuticals and improved radionuclides (like Lu-177 and Ac-225) enhance treatment precision and efficacy.

Expanding Clinical Evidence

Strong clinical trial outcomes demonstrating improved survival and reduced side effects are increasing physician and patient adoption.

Regulatory Approvals & Pipeline Expansion

Approvals of therapies such as Lutathera and Pluvicto, along with a robust pipeline, are accelerating market momentum.

Growing Investments & Collaborations

Increased funding from pharma companies and strategic partnerships are advancing R&D and global commercialization.

Rising Awareness & Adoption in Oncology Centers

Broader availability of nuclear medicine facilities and growing clinician awareness support faster adoption.

Personalized Medicine Trend

Demand for patient-specific and precision oncology approaches is fueling interest in RLT.

Favorable Reimbursement & Government Support

Expanding healthcare coverage and supportive regulatory frameworks are facilitating access to radioligand therapies.

DelveInsight’s “ Radioligand Therapy Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the radioligand Therapy, historical and forecasted epidemiology, competitive landscape as well as the radioligand Therapy market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Radioligand therapy market outlook report provides current Radioligand Therapy Market Treatment practices, emerging drugs, market share of individual Therapy, and current and forecasted 7MM radioligand therapy market size from 2020 to 2034. The Radioligand therapy market report also covers current radioligand therapy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the Radioligand therapy market’s potential.

Scope of the Radioligand Therapies Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Radioligand Therapies Market |

|

|

Radioligand Therapies Market Size | |

|

Radioligand Therapies Companies |

Curium US, Eli Lilly, Point Biopharma, Fusion, Astrazeneca, Endocyte, Progenics Pharmaceuticals, Inc., AdvanCell Isotopes Pty Limited, and others. |

|

Radioligand Therapies Epidemiology Segmentation |

|

Radioligand Therapy Treatment Market

Radioligand therapy are a form of targeted nuclear medicine that may recognize and treat diseases such as cancer. Radioligand therapy deliver radiation to certain cancer cells that express specific targets. Radioligand therapy marks a significant advancement in precision oncology, offering a targeted approach to cancer treatment

Radioligand Therapy have 2 primary components the radioisotope and the cell-targeting compound, or ligand which are joined together by a chemical with each other. A radioisotope is a radioactive particle that releases radiation to target cells and destroys them and the targeting ligand is the one that attaches to cells that express specific targets and directs the radioisotope to cells with these targets.

Therapeutic radioisotopes are produced in special nuclear reactors or generators, and then shipped to a production facility where the radioisotope is bonded to the cell-targeting compound. The finished product is then placed in vials, sent through quality testing, packaged into special lead-shielded containers, and shipped directly to the hospital or clinic as a ready-to-use therapy.

The most common forms of radionuclide or radioligand therapy include XOFIGO, PLUVICTO (both for prostate cancer), and ZEVALIN (for lymphomas).

Further details related to country-based variations are provided in the report

Radioligand Therapy Market

For Radioligand Therapy Treatment. The targeting compound part of radioligand is designed to bind specifically to proteins or receptors that are overexpressed on the surface of cancer cells.

Radioligand therapy generally works in the following ways:

Target Identification: Researchers identify specific proteins or receptors that are overexpressed on the surface of cancer cells. These proteins serve as targets for the radioligand.

Radioligand Development: A targeting molecule (ligand) is developed or selected to bind specifically to the identified target protein or receptor. This ligand is then attached to a radioactive isotope, usually through a chemical linker.

Administration: The radioligand is administered to the patient, typically intravenously. The radioligand circulates in the bloodstream and binds to the target proteins on the surface of cancer cells.

Localization: The radioligand accumulates in the cancer cells, delivering radiation directly to the tumor sites while sparing surrounding healthy tissues.

Radiotherapy: Once localized within the cancer cells, the radioactive isotope emits radiation, which damages the DNA of the cancer cells, leading to their death.

Elimination: Any unbound radioligand is cleared from the body through urine or feces, minimizing exposure to healthy tissues.

One of the advantages of radioligand therapy is its ability to deliver high doses of radiation directly to cancer cells while minimizing damage to surrounding healthy tissues, thus reducing side effects.

Recent Developments in Radioligand Therapy Clinical Trials

- In October 2024, Sanofi has partnered with Orano Med, a subsidiary of the Orano Group and a leader in developing targeted alpha therapies for oncology, to pool their expertise in combating rare cancers and speed up the advancement of next-generation radioligand treatments.

Radioligand Therapy Drug Analysis

The drug chapter segment of the Radioligand therapy market reports encloses a detailed analysis of radioligand therapy marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the radioligand therapy clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Radioligand Therapy Marketed Drugs

-

LUTATHERA (lutetium LU 177 dotatate): AAA USA/Novartis

LUTATHERA is the very first therapy approved specifically for children with gastroenteropancreatic neuroendocrine tumors (GEP-NETs). It is now offering new hope to young patients living with this rare cancer. LUTATHERA is also approved in Europe for unresectable or metastatic, progressive, well-differentiated (G1 and G2), SSTR-positive GEP-NETs in adults, and in Japan for SSTR-positive NETs.

LUTATHERA is a radioactive drug that works by binding to a part of a cell called a somatostatin receptor, which may be present in certain tumors. After binding to the receptor, the drug enters the cell allowing radiation to cause damage to the tumor cells.

-

PLUVICTO (lutetium lu-177 vipivotide tetraxetan): Novartis

PLUVICTO is the first FDA-approved targeted radioligand therapy (RLT) for eligible patients with metastatic castration-resistant prostate cancer (mCRPC) that combines a targeting compound (ligand) with a therapeutic radioisotope.

The active moiety of lutetium Lu 177 vipivotide tetraxetan is the radionuclide lutetium-177 which is linked to a moiety that binds to PSMA, a transmembrane protein that is expressed in prostate cancer, including mCRPC. Upon binding of lutetium Lu 177 vipivotide tetraxetan to PSMA-expressing cells, the beta-minus emission from lutetium-177 delivers radiation to PSMA-expressing cells, as well as to surrounding cells, and induces DNA damage which can lead to cell death.

|

Product |

Company |

Indication |

|

LUTATHERA (Lutetium LU 177 Dotatate)

|

Novartis |

Treatment of adult and pediatric patients 12 years and older with somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP NETs), including foregut, midgut, and hindgut neuroendocrine tumors. |

|

PLUVICTO (Lutetium Lu 177 vipivotide tetraxetan) |

Novartis |

Treatment of adult patients with prostate-specific membrane antigen (PSMA)-positive metastatic castration-resistant prostate cancer (mCRPC) who have been treated with androgen receptor (AR) pathway inhibition and taxane-based chemotherapy. |

|

XOFIGO (Radium ra-223 dichloride) |

Bayer |

Treatment of patients with castration-resistant prostate cancer, symptomatic bone metastases, and no known visceral metastatic disease |

|

ZEVALIN (ibritumomab tiuxetan) |

Spectrum pharms |

Treatment of adult patients with relapsed or refractory, low-grade, or follicular B-cell nonHodgkin's lymphoma. |

Radioligand Therapy Emerging Drugs

-

177Lu-PSMA-I&T: Curium

-

Lu-PNT2002: Eli Lilly/Point biopharma

List of Emerging Drugs in Radioligand Therapy Landscape | |||||

|

177Lu-PSMA-I&T |

Curium US |

Metastatic Castration-Resistant Prostate Cancer

|

Radioligand |

III |

NCT05204927 |

|

Lu-PNT2002 |

Eli Lilly/Point Biopharma |

Metastatic Castration-Resistant Prostate Cancer |

Radioligand |

III |

NCT04647526 |

|

FPI-2265 |

Fusion/Astrazeneca |

Metastatic Castration-resistant Prostate Cancer |

Radioligand |

II/III |

NCT06402331 |

Radioligand Therapy Market Outlook

The radioligand therapy market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of radioligand Therapy, the increasing number of radioligand Therapy that are under clinical trials, and the increasing interest of major pharmaceutical companies toward it.Radioligand Therapy Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging Radioligand therapy therapies expected to be launched in the Radioligand therapy market during 2020–2034.Radioligand Therapy Clinical Trials Analysis

Radioligand therapy Pipeline Activities

Latest KOL Views on Radioligand therapy market

What KOLs are saying on Radioligand therapy Patient Trends?

|

|

“Lutetium Lu 177 vipivotide tetraxetan has been the front-runner of PSMA-targeted Therapy for many years. However other agents are now entering the mix and are under investigation in clinical trials, such as other radioligands, monoclonal antibodies, and PSMA-targeted antibodies.” |

Radioligand Therapy Qualitative Analysis

Radioligand Therapy Market Access and Reimbursement

Reimbursement for Radioligand Therapy market size has been universal in the United States and even in Europe. In the UK, NICE recommended Lutetium (177Lu) oxodotreotide within its marketing authorization, as an option for treating unresectable or metastatic, progressive, well-differentiated (grade 1 or grade 2), somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (NETs) in adults. It is recommended only if the company provides it according to the commercial arrangement. NETs can affect the pancreas and gastrointestinal tissue and are difficult to diagnose and treat. Current treatment options include everolimus, sunitinib, and best supportive care. Clinical trial evidence shows that lutetium (177Lu) oxodotreotide (referred to as lutetium) is effective for treating somatostatin receptor-positive gastrointestinal and pancreatic NETs. Indirect comparison with everolimus, sunitinib, and best supportive care suggests lutetium is effective for treating gastrointestinal and pancreatic NETs in people with progressive disease.

For treating pancreatic NETs, lutetium meets NICE's end-of-life criteria. Compared with everolimus, sunitinib, and best supportive care, the cost-effectiveness estimates are within the range NICE normally considers acceptable. So lutetium can be recommended for treating pancreatic NETs.

For treating gastrointestinal NETs, lutetium does not meet the end-of-life criteria because the life expectancy for this form of the disease is between 5 and 6 years. But it can be recommended because the most plausible cost-effectiveness estimate is within what NICE normally considers acceptable and treatment options for gastrointestinal NETs are limited.

The Radioligand therapy market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved Therapy, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on Radioligand Therapy Market Size Report

- Many Radioligand therapy companies presented the data of their radioligand Therapy during the ASCO 2023 conference including Actinium Pharmaceuticals and others. Actinium study finds Actinium-225 PSMA therapy effective in metastatic castration-resistant prostate cancer post-prior approved agent treatments, offering a promising therapy option with substantial antitumor effects

- In March 2024, AstraZeneca acquired Fusion Pharmaceuticals for USD 2 billion, boosting next-gen radioconjugate cancer treatment development with expertise in actinium-based RCs. Acquisition aims to expedite R&D and enhance manufacturing and supply chain capabilities

- In March 2024, Novartis acquired Mariana Oncology, a cancer RLT-focused biotech. The deal involved a USD 1 billion upfront payment, with potential additional payments of up to USD 750 million upon milestone completion.

Scope of the Radioligand Therapy Market Report

- The Radioligand Therapy Market Insights Report covers a segment of key events, an executive summary, and a descriptive overview of radioligand Therapy, explaining its mechanism, and Therapy (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging Therapy and the elaborative profiles of late-stage and prominent Therapy will impact the current landscape.

- A detailed review of the Radioligand Therapy market, historical and forecasted market size, market share by Therapy, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Radioligand therapy market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM radioligand Therapy market.

Radioligand Therapy Market Report Insights

- Radioligand Therapy Targeted Patient Pool

- Radioligand Therapy Therapeutic Approaches

- Radioligand Therapy Pipeline Analysis

- Radioligand Therapy Market Size

- Radioligand therapy Market Trends

- Existing and Future Radioligand therapy Market Opportunity

Radioligand Therapy Market Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake

- Key Radioligand therapy Market Forecast Assumptions

Radioligand Therapy Market Report Assessment

- Current Radioligand therapy Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Radioligand therapy Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions answered in the Radioligand therapy market report

- What was the Radioligand therapy market size, the market size by Therapy, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which Radioligand therapy is going to be the largest contributor in 2034?

- Which is the most lucrative Radioligand therapy market?

- Which drug type segment accounts for maximum radioligand therapy sales?

- What are the pricing variations among different geographies for approved Therapy?

- How has the reimbursement landscape for radioligand Therapy evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with radioligand Therapy? What will be the growth opportunities across the 7MM for the patient population on radioligand Therapy?

- What are the key factors hampering the growth of the radioligand Therapy market?

- What are the indications for which recent novel Therapy and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the Therapy for radioligand Therapy?

- What is the cost burden of approved Radioligand therapy on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Radioligand therapy?

Reasons to buy the Radioligand Therapy Market Outlook Report

- The Radioligand Therapy Market Insights Report will help develop business strategies by understanding the latest trends and changing dynamics driving the radioligand Therapy Market.

- Understand the existing Radioligand therapy market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming Radioligand therapy companies in the Radioligand therapy market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging Therapy under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved Therapy, barriers to accessibility of expensive off-label Therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Radioligand therapy market so that the upcoming Radioligand therapy companies can strengthen their development and launch strategy.

Click here to view the latest blogs:

- Novartis’ LUTATHERA for GEP-NET Treatment: Ray of Hope for Pediatric Patients

- LEQEMBI Intravenous Infusion Approval; Novartis' Presented Updates on Lutathera

- LumiThera’s US LIGHTSITE III Trial; First Patient Enrolled in Vascular Closure Device Study of Teleflex; Varian’s Flash Technology Clinical Trial

- Amgen to acquire Rodeo for $55M; Novartis expands radioligand portfolio; Organon acquires Alydia for $240M; Forma announces positive FT-4202 dose levels

- Asher Bio raises $55M; Roche halts Huntington's phase 3 trial; Novartis' radioligand hits goal in phase 3; EpimAb raises $120M in Series C

- Latest Delveinsight Blogs