PDE4B Inhibitor Market Summary

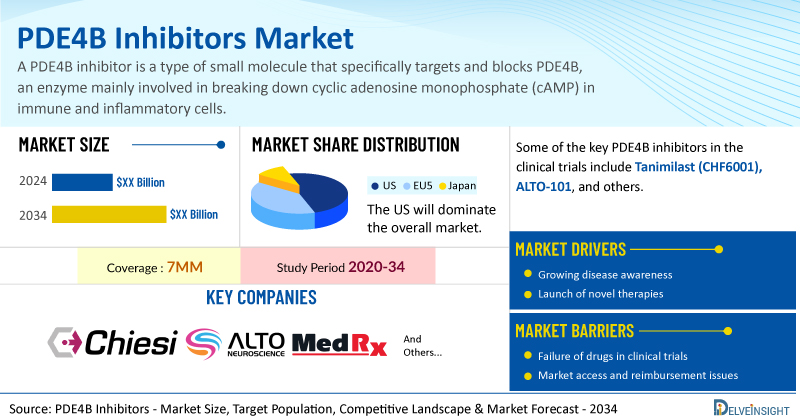

- The Phosphodiesterase 4B inhibitor market in the 7MM is projected to grow at a significant CAGR by 2034 in the leading countries (US, EU4, UK, and Japan).

PDE4B Inhibitor Market and Epidemiology Analysis

- Phosphodiesterase 4B (PDE4B) inhibitors represent a promising class of targeted therapies with potential to reshape treatment paradigms across pulmonary, inflammatory, and neuropsychiatric diseases. Their isoform selectivity offers a clinical edge by balancing efficacy with improved tolerability, positioning them as differentiated candidates in an expanding therapeutic landscape.

- PDE4B inhibitors hold strong multi-indication potential across respiratory, dermatology, and neuropsychiatry, combining clinical relevance with commercial appeal and positioning them as a differentiated class for sustained market growth.

- Currently approved PDE4 inhibitors such as OHTUVAYRE (ensifentrine), ZORYVE (roflumilast), and EUCRISA (crisaborole), among others, validate the therapeutic relevance of PDE4 modulation, highlighting both commercial viability and the expanding clinical footprint of this drug class.

- Emerging PDE4 inhibitors like tanimilast (CHF6001), ALTO-101, and others are advancing through development, reflecting sustained pipeline interest and the pursuit of more selective, better-tolerated therapies to expand clinical and commercial opportunities.

- Alto Neuroscience initiated a Phase II trial in June 2024 for its transdermal ALTO-101 in CIAS, aiming to enhance delivery and efficacy, with results expected in H2 2025 following earlier cognitive benefits seen with the oral form.

Factors Impacting the PDE4B Inhibitor Market Growth

- High chronic disease burden: Persistently increasing global prevalence of chronic inflammatory conditions including COPD, asthma, psoriasis, atopic dermatitis, inflammatory bowel disease, and psoriatic arthritis creating expanding patient base

- Physician and patient preference shift: Increasing preference for non-steroidal, targeted anti-inflammatory options for long-term disease control avoiding corticosteroid side effects

- Pipeline advancement: Emerging candidates including tanimilast (CHF6001), ALTO-101, and other pipeline therapies in clinical trials reflecting growing R&D investment

- Improved delivery systems: Development of advanced topical vehicles, inhaled/nebulized delivery, and novel formulations enabling broader patient populations to be treated including milder disease cases

- Major acquisitions validating market: Merck's $10 billion acquisition of Verona Pharma (announced July 2025) demonstrating industry confidence in PDE4 therapeutic class

DelveInsight’s “PDE4B Inhibitor Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the PDE4B inhibitor, historical and projected epidemiological data, competitive landscape as well as the PDE4B inhibitor therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The PDE4B inhibitor market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM PDE4B inhibitor market size from 2020 to 2034. The report also covers current PDE4B inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

PDE4B Inhibitor Market |

|

|

PDE4B Inhibitor Market Size | |

|

PDE4B Inhibitor Companies |

AbbVie, GSK, Pfizer, and Boehringer Ingelheim, Chiesi, Alto Neuroscience, and Verona Pharma, among others. |

PDE4B Inhibitor Treatment Market

PDE4B Inhibitor Overview

A PDE4B inhibitor is a small molecule that selectively inhibits PDE4B, an enzyme primarily responsible for degrading cyclic adenosine monophosphate (cAMP) within immune and inflammatory cells. By blocking PDE4B, these inhibitors elevate intracellular cAMP levels, leading to anti-inflammatory and antifibrotic effects. PDE4B inhibitors are under development and clinical investigation for a range of therapeutic applications, including pulmonary fibrosis, chronic inflammatory diseases, schizophrenia, and related disorders.

Their selectivity for PDE4B—over other isoforms like PDE4D—aims to achieve efficacy while minimizing side effects such as nausea, which are commonly associated with broad-spectrum PDE4 inhibition. Recent advances have produced several structurally diverse and biologically active PDE4B inhibitors, some of which have reached clinical trials or received approval for use in specific conditions.

PDE4B Inhibitor Clinical Relevance

PDE4B inhibitors are emerging as a versatile class with strong potential across respiratory, dermatology, and neuropsychiatry. In respiratory care, their application in COPD, NCFB, cystic fibrosis, and asthma offers opportunities to address persistent inflammation and gaps in disease control. In dermatology, indications such as plaque psoriasis, atopic dermatitis, and seborrheic dermatitis represent commercially attractive markets supported by established efficacy of PDE4 inhibition in skin inflammation. Expanding into CIAS further broadens their scope, opening a differentiated growth avenue. With multi-indication potential and long-term relevance, PDE4B inhibitors are positioned as an attractive therapeutic class for future market growth.

Further details related to country-based variations are provided in the report...

PDE4B Inhibitor Epidemiology

The PDE4B inhibitor epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for PDE4B inhibitor, total eligible patient pool in selected indications for PDE4B inhibitor, and total treated cases in selected indications for PDE4B inhibitor in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

COPD

- According to DelveInsight's estimates, there were ~30 million diagnosed prevalent cases of COPD in the 7MM in 2024, a figure expected to rise by 2034.

- In 2024, the US accounted for the highest diagnosed prevalent cases with ~16.5 million.

- Among EU4 and the UK, Germany accounted for the highest share of diagnosed prevalent cases of COPD in 2024 with ~33%, followed by France with ~24%, while the UK had the lowest at ~9%.

- Japan accounted for ~1 million diagnosed prevalent cases of COPD in 2024.

NCFB

- In 2024, there were ~390,000 diagnosed prevalent cases of NCFB in the US, a number expected to increase by 2034.

- In 2024, EU4 and the UK together accounted for ~620,000 diagnosed prevalent cases of NCFB. Within this group, the UK had the highest with ~230,000 cases, followed by Spain with ~150,000, while Germany reported the lowest with ~50,000 cases.

- Japan accounted for ~9% of the total diagnosed prevalent cases of NCFB in the 7MM in 2024.

CIAS

- In 2024, the US accounted for ~2 million diagnosed prevalent cases of CIAS, a number expected to rise by 2034.

- Among EU4 and the UK, Germany reported the highest diagnosed prevalent cases of CIAS in 2024 with ~458,000 cases, while Italy had the lowest.

- Japan accounted for ~758,000 diagnosed prevalent cases of CIAS in 2024.

Note: Indications are selected based on pipeline activity...

PDE4B Inhibitor Drug Chapters

The drug chapter segment of the PDE4B inhibitor reports includes a detailed analysis of PDE4B inhibitor early, mid-, and late-stage (Phase I, Phase II and Phase III) pipeline drugs. It also helps understand the PDE4B inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

PDE4B Inhibitor Marketed Drugs

Currently approved PDE4 inhibitors include OHTUVAYRE (ensifentrine), ZORYVE (roflumilast), EUCRISA (crisaborole), and several others, highlighting a growing therapeutic focus on PDE4 modulation across multiple inflammatory conditions.

OHTUVAYRE (ensifentrine): Verona Pharma

OHTUVAYRE (ensifentrine) is an inhaled small-molecule therapy that acts as a dual inhibitor of PDE3 and PDE4, enzymes responsible for hydrolyzing cAMP and, in the case of PDE3, also cGMP. By blocking these pathways, ensifentrine increases intracellular cAMP and cGMP levels, leading to both bronchodilatory and anti-inflammatory effects.

Delivered as an inhalation suspension, it is approved for the maintenance treatment of COPD in adults, offering a novel approach that combines dual-mechanism activity within a single therapy.

Verona Pharma is expanding the clinical scope of ensifentrine beyond COPD, with ongoing Phase II trials evaluating its potential across multiple respiratory indications. The nebulized formulation is being studied for NCFB, cystic fibrosis, and asthma, while Metered Dose Inhaler (MDI) and Dry Powder Inhaler (DPI) formulations are under evaluation for maintenance treatment in COPD, cystic fibrosis, and asthma. Additionally, a nebulized combination of ensifentrine with LAMA is being explored for maintenance treatment of COPD, highlighting the company’s strategy to position ensifentrine as a versatile therapy across diverse respiratory diseases and delivery platforms.

ZORYVE (roflumilast): Arcutis Biotherapeutics

ZORYVE (roflumilast) is a PDE4 inhibitor that increases intracellular cAMP levels by blocking the enzyme responsible for its breakdown, thereby modulating inflammatory pathways central to dermatologic diseases. While the exact mechanism of action remains not fully defined, its clinical utility has been established across multiple indications.

ZORYVE cream 0.3% is approved for plaque psoriasis, including intertriginous areas, in patients 6 years and older, while the 0.15% cream is indicated for mild to moderate atopic dermatitis in the same age group.

Additionally, ZORYVE topical foam 0.3% is approved for seborrheic dermatitis in patients 9 years and older and for plaque psoriasis of the scalp and body in patients 12 years and older, underscoring its broad therapeutic potential in chronic inflammatory skin conditions.

Additionally, ZORYVE is being evaluated as a 0.05% formulation for atopic dermatitis in younger pediatric populations, specifically in children aged 2–5 years and infants aged 3–24 months.

EUCRISA (crisaborole): Pfizer

EUCRISA (crisaborole) is a topical PDE4 inhibitor that enhances intracellular cAMP levels, thereby modulating inflammatory responses implicated in atopic dermatitis, although its precise therapeutic mechanism remains unclear.

It is approved for the treatment of mild to moderate atopic dermatitis in adults and pediatric patients as young as 3 months, making it one of the earliest treatment options available for this condition across a wide age spectrum.

PDE4B Inhibitor Emerging Drugs

Emerging PDE4 inhibitors in development include tanimilast (CHF6001), ALTO-101, and other pipeline candidates, reflecting growing interest in targeting this pathway for inflammatory respiratory and immune-mediated diseases.

Tanimilast (CHF6001): Chiesi Farmaceutici

CHF6001 is an inhaled anti-inflammatory therapy under development for COPD and asthma. As a PDE4 inhibitor, it blocks the degradation of intracellular cAMP in inflammatory cells, thereby suppressing inflammation and modulating immune activity. This mechanism is designed to reduce airway inflammation, relieve symptoms, and improve lung function in patients with chronic respiratory disease.

The drug is currently in Phase III trials for COPD and Phase II trials for asthma.

ALTO-101: Alto Neuroscience/MEDRx

ALTO-101 is an innovative small molecule designed to treat CIAS. As a brain-penetrant PDE4 inhibitor, it targets the enzyme responsible for breaking down cAMP, a crucial intracellular signaling molecule involved in cognition and neuroplasticity. PDE4 inhibitors have been studied for their potential pro-cognitive and antidepressant effects, making ALTO-101 a promising candidate for CIAS treatment. The drug utilizes a Transdermal Delivery System (TDS), which helps reduce the adverse events typically seen with PDE4 inhibitors, allowing for higher, more effective doses guided by EEG and behavioral biomarker readouts.

In April 2024, Alto Neuroscience reported positive Phase I results for ALTO-101 for the treatment of CIAS. The study showed improved pharmacokinetics and tolerability with the transdermal delivery system compared to oral administration.

In June 2024, Alto Neuroscience initiated a Phase II clinical trial to evaluate its transdermal formulation of ALTO-101 for the treatment of CIAS. Previous studies demonstrated that oral ALTO-101 improves cognition and enhances cognition-related EEG markers in humans. The current trial aims to utilize the innovative transdermal formulation to improve drug delivery and maximize therapeutic benefits, with top-line results anticipated in the second half of 2025.

Note: Detailed emerging therapies assessment will be provided in the final report...

PDE4B Inhibitor Market Outlook

The market outlook for PDE4B inhibitors is gaining momentum as the class shows strong therapeutic potential across respiratory, dermatologic, and inflammatory conditions. Approved drugs like OHTUVAYRE (ensifentrine), ZORYVE (roflumilast), and EUCRISA (crisaborole), among others, have already validated the PDE4 pathway, while emerging candidates such as tanimilast (CHF6001) and ALTO-101, among others, are expanding opportunities into more targeted and differentiated indications. With growing demand for safer, orally active, and more selective anti-inflammatory therapies, PDE4B inhibitors are well positioned to capture increasing market share, particularly as unmet needs in COPD, asthma, and immune-mediated diseases continue to drive innovation.

PDE4B Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging PDE4B inhibitor expected to be launched in the market during 2025–2034.

PDE4B Inhibitor Pipeline Development Activities

The PDE4B Inhibitor pipeline report provides insights into different therapeutic candidates in Phase III, Phase II and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for PDE4B inhibitor market growth over the forecasted period.

PDE4B Inhibitor Pipeline Development Activities

The PDE4B Inhibitor clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for PDE4B inhibitor emerging therapies.

Latest KOL Views on PDE4B Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on PDE4B inhibitor’s evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or PDE4B inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the PDE4B Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of PDE4B inhibitor, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the PDE4B inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM PDE4B inhibitor market.

PDE4B Inhibitor Market Report Insights

- PDE4B Inhibitor Targeted Patient Pool

- PDE4B Inhibitor Therapeutic Approaches

- PDE4B Inhibitor Pipeline Analysis

- PDE4B Inhibitor Market Size and Trends

- Existing and Future Market Opportunity

PDE4B Inhibitor Market Report Key Strengths

- 9 Years Forecast

- The 7MM Coverage

- Key Cross Competition

- PDE4B Inhibitor Drugs Uptake

- Key PDE4B Inhibitor Market Forecast Assumptions

PDE4B Inhibitor Market Report Assessment

- Current PDE4B Inhibitor Treatment Practices

- PDE4B Inhibitor Unmet Needs

- Pipeline Product Profiles

- PDE4B Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

- PDE4B Inhibitor Market Drivers

- PDE4B Inhibitor Market Barriers

Key Questions Answered In The PDE4B Inhibitor Market Report:

- What was the PDE4B inhibitor total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for PDE4B inhibitor?

- Which drug accounts for maximum sales among PDE4B inhibitor?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for PDE4B inhibitor evolved since the first one was approved? Do patients face any access issues driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with PDE4B inhibitor? What will be the growth opportunities across the 7MM for the patient population on PDE4B inhibitor?

- What are the key factors hampering the growth of the PDE4B inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for PDE4B inhibitor?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy PDE4B Inhibitor Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the PDE4B inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.