Vascular Grafts Market Summary

Vascular Grafts Market Trends & Insights

- The Vascular Grafts Market is experiencing steady growth, driven by the rising prevalence of cardiovascular diseases, increasing incidence of peripheral artery disease, and a growing volume of vascular and endovascular surgical procedures worldwide.

- The leading Vascular Grafts Companies such as BD, Getinge AB, Medtronic, B. Braun Melsungen AG, Cardinal Health, Terumo Corporation, W. L. Gore & Associates, Inc., JOTEC GmbH, LeMaitre Vascular, Inc., Perouse Medical, CryoLife, Inc, BIOVIC Sdn Bhd, Abbott, Bentley, BioIntegral Surgical, Cook, Merit Medical Systems, SCITECH, and others.

Request for Unlocking the Sample Page of the "Vascular Grafts Market"

Key Factors Impacting the Vascular Grafts Market Growth

-

Rising Burden of Cardiovascular Diseases

The increasing global prevalence of cardiovascular disorders, including peripheral artery disease, coronary artery disease, and aortic aneurysms, is a major driver of the Vascular Grafts market. As these conditions often require surgical or endovascular interventions, the demand for reliable and durable Vascular Grafts continues to rise.

-

Growing Geriatric Population

An expanding aging population is significantly contributing to market growth. Older individuals are more susceptible to vascular disorders due to age-related degeneration of blood vessels, leading to a higher need for vascular reconstruction and bypass procedures using grafts.

-

Advancements in Graft Materials and Technologies

Continuous innovation in biomaterials, such as improved synthetic grafts, bioengineered grafts, and tissue-engineered vascular substitutes, is enhancing graft performance, biocompatibility, and long-term patency. These technological advancements are increasing surgeon confidence and expanding clinical applications.

-

Increase in Minimally Invasive and Endovascular Procedures

The growing preference for minimally invasive vascular surgeries has accelerated the adoption of Vascular Grafts compatible with endovascular techniques. These procedures offer reduced hospital stays, faster recovery, and lower complication rates, boosting overall market demand.

-

Rising Number of Dialysis Patients

The increasing incidence of chronic kidney disease and end-stage renal disease has led to a higher demand for vascular access grafts for hemodialysis. This segment represents a steady and recurring source of revenue within the Vascular Grafts market.

-

Improved Healthcare Infrastructure and Access to Surgical Care

Expanding healthcare infrastructure, especially in emerging economies, along with improved access to advanced surgical interventions, is supporting the uptake of Vascular Grafts. Increased healthcare spending and better reimbursement frameworks further encourage market expansion.

-

Growing Focus on Early Diagnosis and Surgical Intervention

Greater awareness of vascular diseases and advancements in diagnostic imaging are enabling earlier detection and timely surgical treatment, directly increasing the utilization of Vascular Grafts across multiple clinical indications.

-

Favorable Clinical Outcomes and Expanding Indications

Demonstrated improvements in long-term clinical outcomes and expanding indications for vascular graft use in complex procedures are reinforcing physician adoption, thereby driving sustained growth in the Vascular Grafts market.

Vascular Grafts Market by Product Type (EndoVascular Grafts [Abdominal Grafts and Thoracic Grafts], Access Grafts, Peripheral Grafts, and Others), Type (Knitted, Woven, and Others), Material (Synthetic [Polytetrafluoroethylene [PTFE], Polyester, Polyurethane], Biological, and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising cases of cardiovascular disorders and associated risk factors, increasing awareness and screening programs, increase in product development activities among the key market players across the globe.

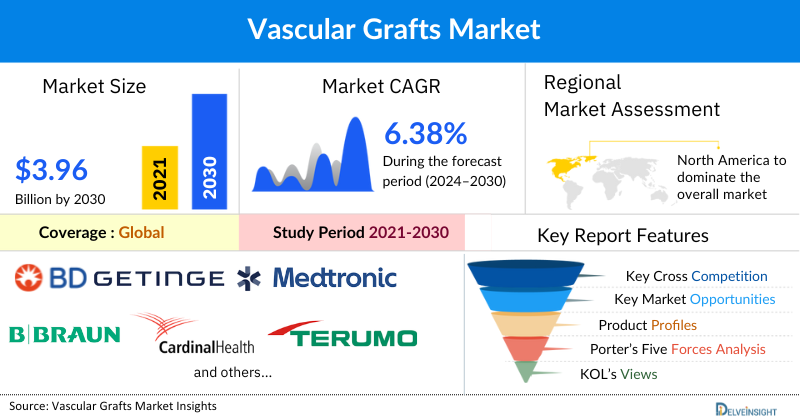

The global Vascular Grafts market was valued at USD 1,863.09 million in 2024, growing at a CAGR of 6.86% during the forecast period from 2025 to 2032 to reach USD 3,153.39 million by 2032. The rising cases of cardiovascular disorders and associated risk factors such as hypertension, diabetes, and obesity are driving the need for surgical interventions thereby boosting the vascular graft market. Additionally, increasing awareness and the expansion of cardiovascular screening programs are leading to earlier diagnosis and timely treatment, further escalating the demand for Vascular Grafts.

Simultaneously, key market players are accelerating product development activities by introducing technologically advanced graft materials, bioengineered solutions, and minimally invasive procedures. These combined factors are expanding the adoption of Vascular Grafts globally further contributing to steady market growth and driving the overall market during the forecast period from 2025 to 2032.

What are the Vascular Grafts Market Dynamics and Trends?

According to data provided by the British Heart Foundation (2025), globally, around 640 million people are living with heart and circulatory diseases across the world. Furthermore, as per the recent data provided by the British Heart Foundation (2024), coronary (ischemic) heart disease, the most commonly diagnosed worldwide, affects an estimated 200 million people globally. Approximately 110 million men and 80 million women were affected. Additionally, around 56 million women and 45 million men were stroke survivors. It is estimated that at least 13 million people worldwide live with congenital heart disease, with potentially millions more undiagnosed.

Thus, these conditions often result in damaged or blocked blood vessels that require surgical intervention to restore proper blood flow. Vascular Grafts either synthetic or biological are used to replace, repair, or bypass these damaged vessels thereby escalating the overall market of Vascular Grafts.

Additionally, increasing awareness programs for cardiovascular health are playing a vital role in early diagnosis, preventive care, and timely surgical interventions, which in turn are escalating the market for Vascular Grafts. For example, World Heart Day, led by the World Heart Federation, is an annual campaign that raises global awareness about cardiovascular disease (CVD), prevention strategies, and the importance of early diagnosis. Thus, the impact of awareness programs encourages screenings and treatments, including surgical options like Vascular Grafts for high-risk patients which in turn escalate the market.

Moreover, the increasing product development activities in the vascular graft market are significantly fueling its overall growth by introducing advanced, more effective, and patient-specific solutions for vascular diseases. For instance, in September 2023, MicroPort® Endovastec™ received approval from the Thailand FDA for three key aortic intervention products i.e., the Castor™ Branched Aortic Stent-Graft, Minos™ Abdominal Aortic Stent-Graft, and Hercules™ Thoracic Stent Graft with Low Profile Delivery System. The Castor™ Branched Stent-Graft is for aortic arch dissection, the Hercules™ LP Stent Graft is with a low-profile design for thoracic aortic aneurysms, and the Minos™ Stent-Graft is China's first 14F device for treating infrarenal abdominal aortic aneurysms.

Thus, the factors mentioned above are expected to boost the overall market of Vascular Grafts across the globe during the forecast period from 2025 to 2032. However, the risk of complications and graft failure due to thrombosis, infection, or poor integration with the patient’s tissue and the increased number of product recalls may slightly hinder the growth of the market.

Vascular Grafts Devices Market Segment Analysis

Vascular Grafts Market by Product Type (EndoVascular Grafts [Abdominal Grafts and Thoracic Grafts], Access Grafts, Peripheral Grafts, and Others), Type (Knitted, Woven, and Others), Material (Synthetic [Polytetrafluoroethylene [PTFE], Polyester, Polyurethane], Biological, and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others). In the product type segment of the Vascular Grafts market, the abdominal grafts segment is expected to hold a significant share in 2024. Abdominal grafts are significantly boosting the overall market of Vascular Grafts, largely due to the rising prevalence of abdominal aortic aneurysms and advancements in minimally invasive surgical techniques.

According to the data provided by the government of the UK (2023), in the United Kingdom, from April 2022 to March 2023, around 314,900 men were offered screening for AAA, with 80.8% undergoing testing. During this period, 1,942 aneurysms (aorta measuring ≥3.0 cm) were detected. Additionally, about 15,100 men remained under surveillance, and approximately 23,000 surveillance scans were conducted for AAA. Abdominal aortic aneurysms are life-threatening if not treated promptly, leading to a growing demand for effective graft solutions to repair or replace the weakened sections of the abdominal aorta.

Abdominal grafts, particularly those used in endovascular aneurysm repair (EVAR), offer a highly effective solution by reinforcing the weakened sections of the abdominal aorta and preventing rupture. These grafts provide several advantages, including reduced surgical trauma, shorter hospital stays, faster recovery times, and lower postoperative complication rates compared to traditional open surgical repair. Technological advancements, such as low-profile delivery systems, customized branched and fenestrated graft designs, and improved biocompatibility, have further expanded the use of abdominal grafts even in patients with complex vascular anatomies.

Additionally, companies are actively contributing to this market growth by launching innovative abdominal grafts. For example, Medtronic offers the Endurant™ II Stent Graft System, designed for Abdominal Aortic Aneurysms Treatment with superior conformability and ease of use. Gore Medical provides the GORE® EXCLUDER® AAA Endoprosthesis, known for its reliability and long-term performance. Moreover, the increase in product development activities among the key market players is further escalating the overall market of Vascular Grafts. For instance, in August 2024, Terumo India, the Indian subsidiary of Terumo Corporation, a global leader in medical technology, announced the launch of the TREO® Stent-Graft System, an advanced solution for Endovascular Aneurysm Repair (EVAR).

Designed specifically for the treatment of infrarenal abdominal aortic aneurysms in adults with suitable anatomies, the TREO® Stent-Graft System stands out as the only EVAR graft featuring both suprarenal and infrarenal active fixation. Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of Vascular Grafts across the globe.

Scope of the Vascular Grafts Market Report | |

|

Study Period |

2022 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2025 to 2032 |

|

CAGR | |

|

Vascular Grafts Market Size |

~USD 3.96 billion by 2032 |

|

Vascular Grafts Companies |

BD, Getinge AB, Medtronic, B. Braun Melsungen AG, Cardinal Health, Terumo Corporation, W. L. Gore & Associates, Inc., JOTEC GmbH, LeMaitre Vascular, Inc., Perouse Medical, CryoLife, Inc, BIOVIC Sdn Bhd, Abbott, Bentley, BioIntegral Surgical, Cook, Merit Medical Systems, SCITECH, and Many Others. |

Vascular Grafts Devices Market Size is anticipated to be dominated by North America

North America is expected to account for the highest proportion of the Vascular Grafts market in 2024, out of all regions. The region has a high prevalence of vascular diseases, a well-established healthcare infrastructure, and the widespread adoption of advanced surgical techniques such as endovascular repair. The region also benefits from a strong presence of leading medical device companies, increased healthcare spending, and favorable reimbursement policies. Additionally, rising awareness about early diagnosis and treatment of conditions like abdominal aortic aneurysms, along with a growing elderly population, further supports North America's leadership in the Vascular Grafts market.

According to recent data from the Centers for Disease Control and Prevention (2024), approximately 4.9% of adults were diagnosed with coronary heart disease in 2022. Furthermore, by 2023, an estimated 12.1 million individuals in the United States were projected to have atrial fibrillation. Additionally, each year, over 795,000 people in the U.S. experience a stroke, with around 610,000 of these being first-time strokes. Notably, nearly 185,000 of these strokes, or about one in four, occur in individuals who have previously had a stroke. These conditions are caused by blood clots obstructing cerebral blood flow, and may lead to long-term vascular complications requiring graft-based interventions. As global aging populations and lifestyle risk factors such as diabetes, hypertension, and obesity continue to drive up the incidence of cardiovascular conditions, the demand for Vascular Grafts both synthetic and biological continues to rise.

Additionally, in the United States, several recent initiatives have been launched to raise awareness about cardiovascular health which further boosts the market of Vascular Grafts due to early diagnosis, preventive care, and timely surgical interventions. For instance, American Heart Month, February 2024, was organized by the American Heart Association (AHA), this annual campaign emphasizes the importance of heart health. Activities include Heart Walks, advocacy efforts, and sharing heart-healthy recipes to encourage lifestyle changes.

Furthermore, the growing product development activities among the key market players of Vascular Grafts further escalate the market. For instance, in May 2023, Terumo Aortic announced FDA approval of dissection and transection indication expansion for the Relay®Pro Stent-Graft system in the United States. Relay®Pro offers the treatment of thoracic endovascular aortic repair (TEVAR) to patients with smaller access vessels.

Thus, the above-mentioned factors are expected to escalate the market of Vascular Grafts in the region.

Who are the major players in Vascular Grafts Devices?

The following are the leading companies in Vascular Grafts. These companies collectively hold the largest Vascular Grafts market share and dictate industry trends.

- BD

- Getinge AB

- Medtronic plc.

- B. Braun Melsungen AG

- Cardinal Health

- Terumo Corporation

- W. L. Gore & Associates Inc.

- JOTEC GmbH

- LeMaitre Vascular Inc.

- Perouse Medical

- CryoLife Inc.

- BIOVIC Sdn Bhd

- Abbott

- Bentley

- BioIntegral Surgical

- Cook

- Merit Medical Systems

- SCITECH.

- Vascular Graft Solutions

- Healionics

Recent Developmental Activities in the Vascular Grafts Devices Market

- In January 2026, Maastricht University Medical Center initiated the FLOW trial to evaluate follow-up strategies for vascular access in hemodialysis patients. In current clinical practice, vascular access flow volume is routinely monitored to identify and manage asymptomatic stenosis. The FLOW trial aims to assess whether discontinuing this active surveillance approach is safe, with vascular access stenosis managed only when clinically evident flow dysfunction occurs during hemodialysis.

Key Takeaways from the Vascular Grafts Devices Market Report Study

- Market size analysis for current Vascular Grafts devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the Vascular Grafts devices market.

- Various opportunities available for the other competitors in the Vascular Grafts devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Vascular Grafts devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for vascular graft devices market growth in the coming future?

Target Audience Who Can Benefit from this Vascular Grafts Devices Market Report Study

- Vascular graft device product providers

- Research organizations and consulting companies

- Vascular graft devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in vascular graft devices

- Various end-users who want to know more about the Vascular Grafts devices market and the latest technological developments in the Vascular Grafts devices market.

Stay updated with us for Recent Articles @ New DelveInsight Blogs