Congenital Adrenal Hyperplasia Treatment in Transition: Innovations, Setbacks, and Strategic Shifts Shaping the Market

May 09, 2025

Congenital Adrenal Hyperplasia (CAH) is a group of inherited genetic disorders that affect adrenal gland function, most commonly caused by a deficiency in the enzyme 21-hydroxylase. This enzyme deficiency disrupts the production of cortisol and often aldosterone, leading to hormonal imbalances and excess androgen production. Per DelveInsight’s estimates, as of 2024, the total number of diagnosed prevalent cases of CAH across the 7MM [the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] reached ~69K cases. The United States stands out as the largest market with accounting for ~50% of these cases.

CAH is more than a rare disorder—it’s a lifelong battle. Patients face a high risk of adrenal crises, frequent hospitalizations, and a shortened life expectancy by an average of seven years. The standard treatment? Lifelong glucocorticoids like hydrocortisone or dexamethasone. But the high doses needed often come at a cost: osteoporosis, growth issues, metabolic disease, and even iatrogenic Cushing’s. Beyond the physical toll, CAH disrupts fertility, mental health, and cognitive function, deeply impacting quality of life. And until recently, treatment options were limited. That changed in December 2024, when the FDA approved CRENESSITY (crinecerfont)—the first treatment specifically approved for CAH in the US. CRENESSITY generated USD 2 million in sales in 2024 alone, signaling strong early demand. This CRF1 receptor antagonist, used alongside standard steroid therapy, is designed to reduce excessive androgen production, helping patients regain balance while easing the steroid burden.

Let’s delve into the current market size and what is the future potential in the CAH treatment landscape

Downloads

Click Here To Get the Article in PDF

Recent Articles

Congenital Adrenal Hyperplasia Treatment Milestones

Until 2021, lifelong glucocorticoid therapy remained the standard treatment for CAH, with mineralocorticoids like fludrocortisone and salt supplements required in salt-wasting forms to maintain electrolyte balance and blood pressure. Surgery was sometimes performed for virilized genitalia. In 2021, EFMODY (modified-release hydrocortisone) developed by Diurnal and approved in the EU4 and UK—offered more physiologic cortisol delivery by mimicking natural daily secretion patterns. However, as it is still a glucocorticoid, patient acceptance was limited.

In 2022, Neurocrine Biosciences acquired Diurnal, expanding its adrenal health portfolio. Building on this momentum, in December 2024, the FDA approved CRENESSITY (crinecerfont) as an adjunct to glucocorticoid therapy for patients aged 4 and older with classic CAH. As the first therapy to directly suppress ACTH and androgen production, CRENESSITY enables lower glucocorticoid dosing and offers improved hormonal control.

With the approval of CRENESSITY and the strategic acquisition of EFMODY, Neurocrine Biosciences has positioned itself as a leading and virtually unrivaled player in the congenital adrenal hyperplasia treatment landscape, offering innovative, targeted therapy for this lifelong and challenging condition.

The Evolving Congenital Adrenal Hyperplasia Competitive Outlook

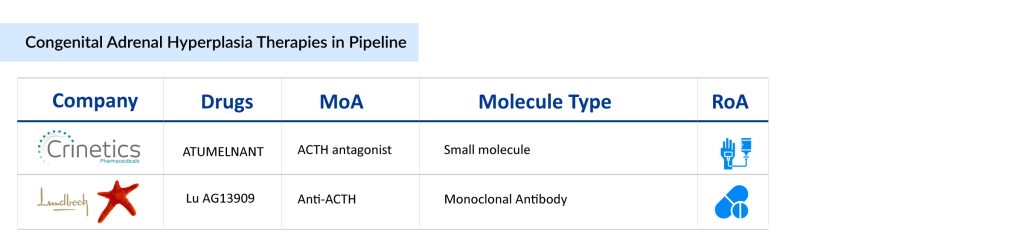

The congenital adrenal hyperplasia competitive landscape is becoming increasingly dynamic, with companies such as Crinetics Pharmaceuticals and H. Lundbeck A/S gaining traction. Crinetics brings innovation through its focused pipeline in rare endocrine diseases, while Lundbeck leverages its strong global presence and expertise.

Crinetics’ Atumelnant is the first oral selective ACTH antagonist targeting the melanocortin type 2 receptor (MC2R) in the adrenal gland. Based on the results of a Phase II open-label study, atumelnant demonstrated strong potential for the treatment of CAH in adult patients. The study aimed to assess the drug’s safety, efficacy, and pharmacokinetics across multiple dose levels, while also evaluating key biomarkers such as serum androstenedione (A4) and 17-hydroxyprogesterone (17-OHP) to gauge therapeutic impact. Positive initial findings were reported by Crinetics Pharmaceuticals in June 2024, with topline data from 28 patients released in January 2025. Atumelnant showed statistically significant reductions in A4 levels as early as two weeks into treatment across all dose groups, with sustained effects through the 12-week primary endpoint. The suppression of A4 was dose-dependent and remained statistically significant throughout. Additionally, atumelnant was well tolerated, with no treatment-related severe or serious adverse events observed. Based on these findings, Crinetics plans to initiate a Phase III program in adult CAH patients in the first half of 2025 and a Phase IIb/III pediatric development program in the second half of 2025. We anticipate the first launch in 2028 in the US.

Meanwhile, Lundbeck’s Lu AG13909 remains in early development, currently in Phase I congenital adrenal hyperplasia clinical trial, offering longer-term promise pending clinical validation.

While recent breakthroughs have brought new hope to the congenital adrenal hyperplasia treatment landscape, 2024 also saw notable setbacks that narrowed the competitive field when two major players, namely Spruce Biosciences and BridgeBio Pharma, exited the congenital adrenal hyperplasia treatment space, marking significant shifts in the market.

Spruce Biosciences announced disappointing topline results from its CAHmelia-204 and CAHptain-205 trials, which were evaluating tildacerfont in adult and pediatric patients with CAH. Although the drug was found to be safe and well tolerated, CAHmelia-204 failed to meet its primary efficacy endpoint, and CAHptain-205 data suggested that higher or more frequent dosing might be necessary. As a result, Spruce discontinued both trials and suspended further investment in tildacerfont to conserve resources and explore strategic alternatives.

On the other side, BridgeBio Pharma halted development of its investigational gene therapy BBP-631 for congenital adrenal hyperplasia treatment. This decision followed the termination of key partnerships with Bayer and Navire-BMS, leading to a broader strategic realignment. The shift triggered major restructuring efforts, including workforce reductions and business shutdowns.

These developments, while disappointing, underscore the challenges of innovation in CAH treatment and highlight the need for continued investment and research in this underserved area.

In a nutshell, the congenital adrenal hyperplasia therapeutic segment is undergoing rapid transformation, driven by clinical innovation and evolving congenital adrenal hyperplasia market dynamics. The FDA approval of CRENESSITY marked a major milestone as the first non-steroidal therapy specifically targeting ACTH suppression. According to DelveInsight projections, CRENESSITY is poised to dominate the congenital adrenal hyperplasia market with peak sales approaching USD 700 million by 2034. Atumelnant, its most promising pipeline challenger, is expected to reach around USD 400 million, positioning itself as a strong second-in-line therapy. As the field continues to evolve, the focus remains clear: advancing safer, more effective therapies to improve outcomes and quality of life for patients living with CAH.

Downloads

Article in PDF