Top 5 Surgical Simulation Companies Revolutionizing Surgical Education

Aug 20, 2025

Table of Contents

Surgical simulation has emerged as one of the most transformative shifts in medical education and practice. With patient safety at the forefront and growing pressure to reduce medical errors, simulation technologies offer a safe, controlled, and repeatable way to train. Unlike traditional cadaver labs or observation-based learning, modern simulators allow trainees to practice complex procedures, refine motor skills, and even rehearse rare scenarios — all without risk to patients.

What makes today’s surgical simulators so powerful is the fusion of virtual reality (VR), augmented reality (AR), haptics, and robotics. These technologies create immersive, lifelike environments where every incision, suture, and decision feels real. For surgeons in training, it’s the bridge between classroom theory and operating room practice. For experienced surgeons, it’s a tool to master new techniques, prepare for complex patient-specific cases, and even train as a team.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Anticoagulants: Market Analysis and Drug Sales Projections (VTE & AF)

- Kallyope’s Elismetrep Achieves Primary and Secondary Endpoints in Phase 2b Clinical Study; IDEAYA...

- Daiichi Sankyo’s Ezharmia; Pfizer & Sangamo Hemophilia A Gene Therapy Trial; Approval for Fe...

- How is Active Implantable Medical Devices Market Evolving?

- FDA Clears Stryker’s Incompass Total Ankle System; Glaukos Receives EU MDR Approval for iStent in...

Meet the Innovators Transforming Surgical Training

With a growing ecosystem of innovators, several companies have emerged as frontrunners in developing next-generation surgical simulators. Each brings unique strengths, from high-fidelity patient scenarios to VR-powered, patient-specific rehearsals. Let’s explore the top players shaping the future of surgical training.

1. VirtaMed – Precision in Orthopedics & Gynecology

Founded in 2007 as a spin-off from ETH Zurich, VirtaMed has become a global leader in mixed-reality surgical simulators, blending physical anatomical models with VR graphics to ensure surgeons “never perform a procedure for the first time on a patient.”

Flagship simulators:

- ArthroS™ (Orthopedics): The most widely used orthopedic VR surgical simulator in the U.S., supporting knee, shoulder, hip, and ankle arthroscopy.

- LaparoS™ (General & Gynecologic Surgery): Launched in 2020, covering full laparoscopic workflows from trocar placement to operative steps.

- GynoS™ (OB/GYN): Training in hysteroscopy, IUD insertion, embryo transfer, and obstetric ultrasound.

- UroS™ (Urology): TURP, TURBT, and BPH procedures.

- RoboS™ (Robotics): Introduced in 2022, replicating robotic console ergonomics for both surgeon and team training.

Used for: validated curricula in orthopedics, laparoscopy, gynecology, and urology, with adoption by societies such as the Arthroscopy Association of North America (AANA) and the American Society for Reproductive Medicine (ASRM). VirtaMed simulators are also used in Swiss board exams and integrated into training at hospitals like Broward Health (USA).

Regulatory/quality: These are training devices, not therapeutic devices, so no FDA approval is required. VirtaMed adheres to ISO 9001:2015 and ISO 13485 standards, with CE marking in Europe for quality compliance.

Commercial/reach: VirtaMed generates an estimated $15–17M annually, with hundreds of simulators deployed across more than 30 countries. It is widely regarded as the market leader in arthroscopy simulation, while steadily growing its footprint in laparoscopy, gynecology, and robotics.

Why it’s top: unmatched realism in arthroscopy, a broad multi-specialty portfolio, and strong validation from societies and boards, positioning VirtaMed as one of the most trusted surgical simulation companies worldwide.

2. CAE Healthcare – High-Fidelity Patient & Team Simulation

Founded within CAE’s aviation-grade training ecosystem, CAE Healthcare delivers high-fidelity simulators that replicate real clinical environments for team-based training and crisis management. Flagships include SimMan 3G (advanced patient simulator family) and Lucina/LucinaAR for obstetrics, which overlays maternal–fetal anatomy via augmented reality to visualize what’s “inside” the manikin during scenarios.

Used for: interprofessional team training across emergency medicine, anesthesia, ICU, and obstetrics—everything from airway crises to postpartum hemorrhage—often aligned to AHA and obstetric protocols. Lucina/LucinaAR is widely promoted as a wireless childbirth simulator with validated, integrated maternal–fetal physiology.

Regulatory/quality: CAE’s manikins are training devices (not therapeutic devices), so FDA “approval” is not required; the emphasis is on curriculum validation and quality systems.

Adoption & scale: CAE Healthcare runs as a dedicated segment of CAE Inc.; reported Healthcare revenue of ~$193M in FY2023, with ongoing quarterly disclosures underscoring scale and global reach across academic centers and health systems.

Why it’s top: unmatched breadth of team simulation (not just procedural), strong crisis-resource management scenarios, and enterprise-grade deployment supported by a large OEM. LucinaAR’s AR overlay for obstetrics further differentiates the platform for high-acuity, low-frequency events.

3. Simbionix (Surgical Science) – Pioneers of Procedural VR Simulation

Simbionix, now part of Surgical Science (Sweden), is synonymous with procedural simulators. ANGIO Mentor (endovascular) and LAP Mentor (laparoscopy) are staples in skills labs, with extensive procedure libraries, metrics, and imaging integration for pre-op rehearsal. ANGIO Mentor platforms run 40+ modules, with options like iCase and Procedure Rehearsal Studio.

Used for: interventional cardiology/radiology and minimally invasive surgery, from vascular access to complex endovascular cases, plus comprehensive laparoscopic curricula validated across multiple studies and programs.

Regulatory/quality: As training systems, the simulators themselves aren’t FDA-approved therapeutic devices; however, parts of the portfolio (e.g., rehearsal/planning software) have historically pursued clinical-grade development pathways. Surgical Science acquired Simbionix from 3D Systems in 2021; Simbionix had USD ~$41M sales in 2020. Surgical Science’s 2023 annual report shows rising license revenue and global scaling post-acquisitions (Mimic + Simbionix), solidifying a market-leading footprint in VR surgical simulation.

Why it’s top: depth and breadth of procedural content, long track record of validation, and global adoption by hospitals, societies, and device companies for both training and pre-case rehearsal.

4. ImmersiveTouch – Patient-Specific VR/AR Planning & Rehearsal

ImmersiveTouch specializes in turning CT/MRI data into interactive 3D models for surgical planning and rehearsal. Its FDA-cleared ImmersiveView software enables surgeons to manipulate patient-specific anatomy in VR; in July 2024, the company received FDA 510(k) clearance for ImmersiveAR, extending these plans into the OR with augmented-reality visualization for intraoperative guidance.

Used for: neurosurgery, spine, craniofacial, where millimeter-level nuance matters—helping teams align pre-op, anticipate challenges, and reduce intraoperative trial-and-error. Leading centers have implemented ImmersiveTouch for patient-specific rehearsals and team briefings.

Regulatory/quality: multiple FDA 510(k)-cleared software platforms (planning and AR), positioning ImmersiveTouch beyond pure training and into clinical workflows.

Commercial reach: FDA clearances and hospital deployments in major U.S. systems have expanded adoption; the 2024 ImmersiveAR clearance is a notable catalyst for growth in OR integration.

Why it’s top: unique patient-specific digital twin capability plus VR-to-AR continuity from pre-op planning to intraoperative visualization—an emerging gold standard for complex cases.

5. OSSimTech – Orthopedic Open-Surgery & Haptics-Heavy Skill Building

Montreal-based OSSimTech focuses on open orthopedic surgery—not just scopes—via Sim-Ortho, which simulates bone drilling, cutting, and implant placement with lifelike haptic force feedback and even auditory cues for realism. It fills a crucial gap for residents who need hands-on, kinesthetic training for fracture fixation and arthroplasty outside the OR.

Used for: orthopedic residency bootcamps and procedural skill labs covering trauma, arthroplasty, and spine workflows; research groups have rated Sim-Ortho highly for realism and ergonomics in recent systematic and narrative reviews of orthopedic simulation.

Regulatory/quality: training simulator (not a therapeutic device); emphasis is on haptic fidelity and educational validation rather than FDA approvals.

Commercial reach: a niche leader with adoption in North American programs and frequent presence at simulation events (e.g., IMSH); while smaller than CAE or Surgical Science, OSSimTech’s specialization keeps it top-of-mind in orthopedics.

Why it’s top: best-in-class haptics for open-surgery orthopedics, complementing arthroscopy/laparoscopy-centric VR systems and addressing a training gap for tactile, force-dependent skills.

Leading Surgical Simulators at a Glance

| Simulator / Company | Specialty Focus | Strength | Who Uses It |

| VirtaMed (ArthroS, LaparoS, GynoS, UroS, RoboS) | Orthopedics, Laparoscopy, Gynecology, Urology, Robotics | Mixed-reality models, validated by medical societies, with lifelike tactile feedback | Residents, surgeons, and academic boards |

| CAE Healthcare (SimMan 3G, LucinaAR, Vimedix) | Emergency response, Anesthesia, OB/GYN, Cardiovascular | High-fidelity patient scenarios, crisis team training | Residents, multidisciplinary OR teams |

| Simbionix / 3D Systems (ANGIO Mentor, LAP Mentor, GI Mentor) | Endovascular, Gastrointestinal, Laparoscopy | Extensive procedure library, integration with imaging data | Surgeons, medical schools, hospitals |

| ImmersiveTouch | Neurosurgery, Spine, Cranial procedures | Patient-specific VR from CT/MRI, FDA-cleared modules | Neurosurgeons, spine specialists |

| OSSimTech (Sim-Ortho) | Orthopedics | Realistic bone drilling, implant placement, haptic precision | Orthopedic residents, trauma teams |

Surgical Simulation Market Outlook

The global surgical simulation market is on a strong upward trajectory. According to DelveInsight, the market was valued at USD 372.97 million in 2024 and is expected to expand at a CAGR of 7.57% between 2025 and 2032, ultimately reaching USD 666.40 million by 2032. This growth underscores the increasing importance of simulation technologies in modern surgical training and patient safety initiatives.

North America is anticipated to hold the largest share of the market, thanks to its advanced healthcare infrastructure, well-established training programs, and strong research and development ecosystem. The rising prevalence of musculoskeletal and gastrointestinal disorders, coupled with a rapidly aging population that is more vulnerable to bone-related conditions, is further driving demand for simulation-based surgical education in the region.

Globally, the rise in surgical procedures has created a pressing need for more effective training solutions. Traditional cadaver-based or observational training models are no longer sufficient in meeting the scale and complexity of surgical education. Modern surgical simulators, powered by virtual reality (VR), augmented reality (AR), haptic technology, and robotics, allow for a safe, controlled, and repeatable learning environment. This shift is being widely embraced not just by teaching hospitals, but also by academic and research institutions and specialized training centers worldwide.

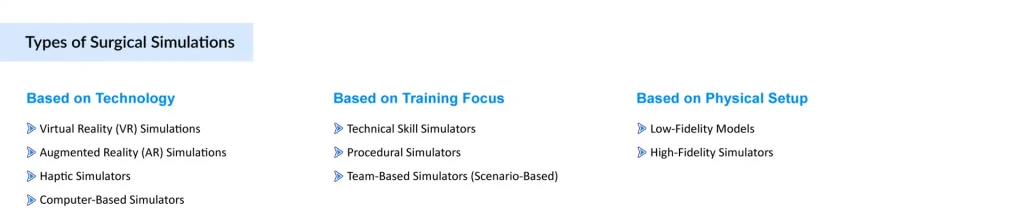

The market is segmented across multiple dimensions, including products and services (hardware, software, and services), applications (orthopedics, laparoscopy, gynecology, cardiac surgery, urology, and others), technologies (VR, AR, and mixed approaches), and end-users (hospitals, clinics, and academic institutions). Such diversity indicates how surgical simulation is moving beyond niche applications to become an integral part of mainstream medical education and clinical practice.

A highly competitive landscape is fueling innovation, with major players such as Medtronic, CAE Inc., Elevate Healthcare Inc., InSimo SAS, Surgical Science Sweden AB, VirtaMed AG, Medical-X, Realize Medical, Laerdal Medical, Simulab Corporation, Inovus Limited, Limbs & Things LTD, Osso VR, Biomed Simulation, Gaumard Scientific, CMR Surgical Ltd., IKONA Health, Mentice, Surgical Theater, and ImmersiveTouch actively shaping the field. These companies are not only developing next-generation training platforms but also forging partnerships with hospitals, academic societies, and simulation centers to accelerate adoption.

Recent Developments in Surgical Simulation & Robotics (2025)

- June 2025 – 2EyesVision launched SimVis Gekko2 internationally, enabling patients to preview post-surgery vision outcomes based on their chosen intraocular lens.

- March 2025 – Virtual Incision began leveraging NVIDIA Isaac for Healthcare to create highly realistic digital twins for robotic surgical simulation, accelerating development of its miniature robotic-assisted surgery system (MIRA).

- January 2025 – VirtaMed and InSimo launched RoboS™, a high-fidelity robotic suturing module simulating real robotic console ergonomics, unveiled at IMSH (Orlando).

- April 2025 – LEM Surgical received FDA 510(k) clearance for the Dynamis Robotic Surgical System, enhancing precision in spine (hard tissue) surgeries with real-time imaging and adaptable instruments.

- April 2025 – Pixee Medical secured FDA 510(k) clearance for Knee+ NexSight, an AR-based knee navigation solution offering robotic-level precision without bulky systems, tailored to U.S. ambulatory surgery centers.

- April 2025 – Proprio received its second FDA 510(k) clearance for the Paradigm AI surgical guidance platform, enabling real-time 3D intraoperative measurements for greater surgical accuracy.

The Final Incision

Surgical simulation is no longer a supporting tool in medical education; it is quickly becoming the backbone of how future surgeons will be trained. The companies leading this space are not just refining skills acquisition, but reshaping the culture of surgical preparation itself. What was once confined to textbooks, cadaver labs, or rare real-world opportunities is now evolving into an immersive, technology-driven experience where surgeons can perfect their craft without boundaries.

Looking ahead, the next wave of innovation is likely to blur the line between training and practice even further. We are already seeing the early seeds of AI-driven surgical coaches, digital twins of individual patients for fully customized rehearsals, and the integration of surgical simulators into the metaverse of healthcare. This convergence of simulation with real-time data, robotics, and predictive analytics has the potential to create a continuous learning loop, where every surgery performed feeds back into training systems, raising global standards of care.

Ultimately, the future of surgical simulation is not just about better training; it’s about safer surgeries, more confident surgeons, and healthier outcomes for patients worldwide. The top companies in this sector are laying the foundation for a new era, one where innovation in simulation translates directly into precision in the operating room.

Downloads

Article in PDF

Recent Articles

- Polymerase Chain Reaction (PCR) Market: Evaluating the Major Market Dynamics and Key Trends Drivi...

- FDA Clearance to iRhythm’s ZEUS System; Respiri Introduces the Wheezo Device & App; CONMED to...

- Idiopathic pulmonary fibrosis (IPF) – Market Insights, Epidemiology and Market Forecast-2020

- Notizia

- Innovative Solutions, Lifesaving Possibilities: Evaluating the Artificial Organs Market Dynamics