Bayer’s Lynkuet Ushers in New Class of Therapies for Menopause

Nov 07, 2025

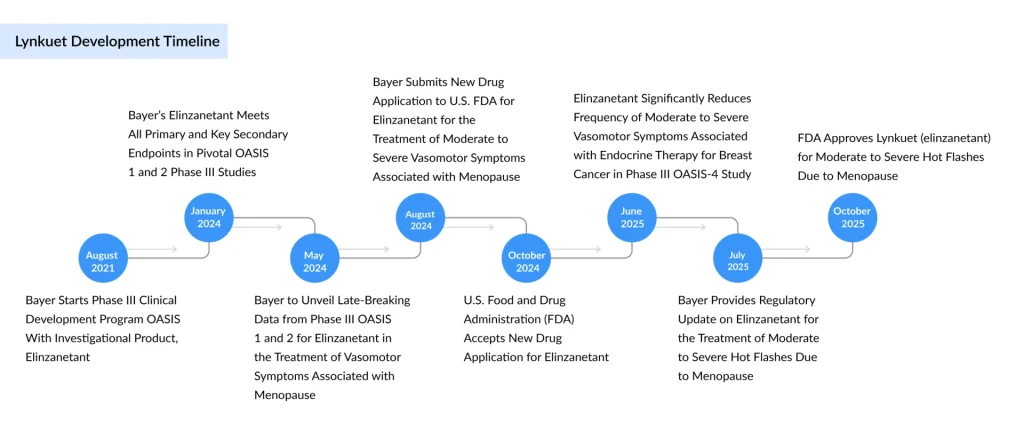

After a brief delay earlier this year, and following its world-first approval in the UK over the summer, Bayer has now secured FDA approval for its novel therapy, expanding the limited range of nonhormonal options available for managing common menopausal symptoms. The FDA has approved Bayer’s dual neurokinin (NK) inhibitor, elinzanetant, which will be marketed in the US as Lynkuet, for the treatment of moderate to severe vasomotor symptoms (VMS) such as hot flashes and night sweats associated with menopause.

Elinzanetant (BAY-3427080) is a first-in-class, oral, nonhormonal therapy that blocks both neurokinin-1 and neurokinin-3 receptors to modulate a cluster of estrogen-sensitive neurons in the hypothalamus. These neurons, known as KNDy neurons (kisspeptin/neurokinin B/dynorphin), become overactive during menopause due to declining estrogen levels, disrupting the body’s temperature regulation and causing hot flashes. By inhibiting the effects of neurokinin B and Substance P, Lynkuet helps stabilize these pathways, reducing GnRH pulsatility and thereby lowering luteinizing hormone and estradiol levels.

Bayer plans to launch Lynkuet in the US beginning in November 2025. Since its first approval in the UK in July, the drug has also received clearances in Australia, Canada, and Switzerland, with regulatory reviews ongoing in the EU and other regions.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Hormone Replacement Therapy Market: Unveiling the Growth Opportunities and Key Players Exploring ...

- Unlocking the Future of Women’s Healthcare Market: The Promise of FemTech

- Top 7 Trends Shaping the Future of FemTech

- Sarepta Therapeutics’s SRP-9001 Gene Therapy; FDA Approves Astellas’ VEOZAH; FDA Orphan Drug Desi...

- What is the Link Between Alzheimer’s and Menopause?

“For over a century, Bayer has been committed to advancing innovations in women’s health, and this FDA approval marks an important milestone—our first hormone-free therapy to ease vasomotor symptoms associated with menopause,” said Christine Roth, Executive Vice President of Global Product Strategy and Commercialization and a member of Bayer’s Pharmaceuticals Leadership Team. “There remains a strong need for more personalized menopause care, and Lynkuet helps fill a crucial gap in available treatment options. This US approval underscores our steadfast dedication to providing science-based solutions that address women’s changing healthcare needs and empower them to take control of their well-being at every stage of life.”

According to Bayer, up to 80% of women experience hot flashes during menopause, and more than one-third suffer from severe symptoms that can persist for over a decade. The company estimates that by 2030, 1.2 billion women worldwide will be menopausal, with around 47 million entering menopause each year. In the US alone, 58 million women experienced vasomotor symptoms associated with menopause in 2024, a number projected to rise to 59 million by 2034, according to DelveInsight.

The FDA’s decision was supported by data from Bayer’s Phase III OASIS clinical program. In the OASIS 1 and OASIS 2 trials, Lynkuet reduced vasomotor symptoms by 56–58% after four weeks and 65–67% after twelve weeks, compared to placebo. Participants who switched from placebo to Lynkuet later also experienced marked symptom reductions.

Subsequent data from the OASIS 3 study, released in September 2024, demonstrated sustained safety and efficacy over 52 weeks, reinforcing earlier findings. Reported side effects included headache, fatigue, dizziness, drowsiness, stomach pain, rash, diarrhea, and muscle spasms. The drug’s label cautions against use during pregnancy due to risks such as potential pregnancy loss, but notably, Lynkuet does not carry a black box warning, unlike Veozah, which includes one for possible liver toxicity.

“These three trials evaluated the safety and effectiveness of elinzanetant in treating moderate to severe menopausal hot flashes,” said JoAnn Pinkerton, M.D., Professor and Director of Midlife Health at UVA Health and Lead Investigator of the OASIS 2 study. “Severe hot flashes can significantly affect women’s daily lives, and this approval offers healthcare providers a new first-line treatment option for managing moderate to severe menopausal symptoms.”

Bayer’s approval comes after a short regulatory delay earlier in the year, when the FDA extended its review by up to 90 days for additional assessment, though no significant issues were raised. The company projects annual peak sales of around €1 billion ($1.16 billion) for Lynkuet. Meanwhile, Astellas’ Veozah underperformed expectations in 2024, generating ¥33.8 billion ($221 million) in revenue, below forecasts. The company now anticipates sales to reach ¥50 billion ($327 million) in fiscal 2025.

With this US approval, Lynkuet enters direct competition with Astellas’ Veozah, another nonhormonal menopause therapy that targets only the NK3 receptor and received FDA approval in May 2023. While hormone therapies containing estrogen, with or without progesterone, have traditionally been used to manage VMS, these carry risks such as endometrial and breast cancers, making nonhormonal alternatives like Lynkuet valuable options.

Apart from Astellas, Bayer will also face competition from other companies, such as Estetra, Gedeon Richter, Noema Pharma, and Fervent Pharmaceuticals, which are working with their lead candidates to enter the menopause market.

Donesta, developed by Gedeon Richter, is an investigational therapy aimed at alleviating hot flashes and other menopause-related symptoms. It contains estetrol and functions as a non-hormonal, SERM-like (selective estrogen receptor modulator-like) compound designed to address the underlying causes of thermoregulatory dysfunction during menopause. The therapy seeks to provide a safer and more precise alternative to conventional hormone-based treatments. In February 2025, the European Medicines Agency (EMA) accepted Gedeon Richter’s Marketing Authorization Application (MAA) for Donesta, marking the beginning of its formal regulatory review process in the European Union.

Noema Pharma’s NOE-115 is an oral, non-hormonal investigational therapy intended to treat vasomotor symptoms such as hot flashes and night sweats in postmenopausal women. Acting as a broad-spectrum monoamine modulator, it targets multiple neurotransmitter systems to address the neurochemical causes of thermoregulatory imbalance, potentially offering symptom relief while also providing benefits in weight management, energy, and cognitive performance. In May 2024, Noema Pharma AG announced the dosing of the first patient in a Phase IIa open-label clinical trial of NOE-115. The candidate is currently being evaluated in Phase II studies for vasomotor and other menopause-associated symptoms.

Fervent Pharmaceuticals’ FP-101 is an oral, non-hormonal, non-herbal, and non-antidepressant therapy that demonstrated a 90% efficacy rate in a pilot study for reducing vasomotor symptoms, including hot flashes and night sweats, in menopausal women. In an 8-week, placebo-controlled Phase IIa clinical trial involving 112 participants, FP-101 significantly reduced the frequency and severity of hot flashes and night sweats compared to placebo.

The anticipated launch of these novel non-hormonal therapies is set to significantly reshape the menopause treatment landscape, long dominated by hormone replacement therapies (HRT). Moreover, the anticipated influx of non-hormonal options could catalyze broader healthcare engagement among women who previously avoided treatment due to safety concerns, thereby driving substantial growth in a market projected to exceed several billion dollars globally over the next decade.

Downloads

Article in PDF

Recent Articles

- Sarepta Therapeutics’s SRP-9001 Gene Therapy; FDA Approves Astellas’ VEOZAH; FDA Orphan Drug Desi...

- World Alzheimer’s Day

- Top 7 Trends Shaping the Future of FemTech

- Hormone Replacement Therapy Market: Unveiling the Growth Opportunities and Key Players Exploring ...

- What is the Link Between Alzheimer’s and Menopause?