Chronic Hepatitis B: The Silent Epidemic Hiding in Plain Sight

Jan 12, 2026

Table of Contents

Summary

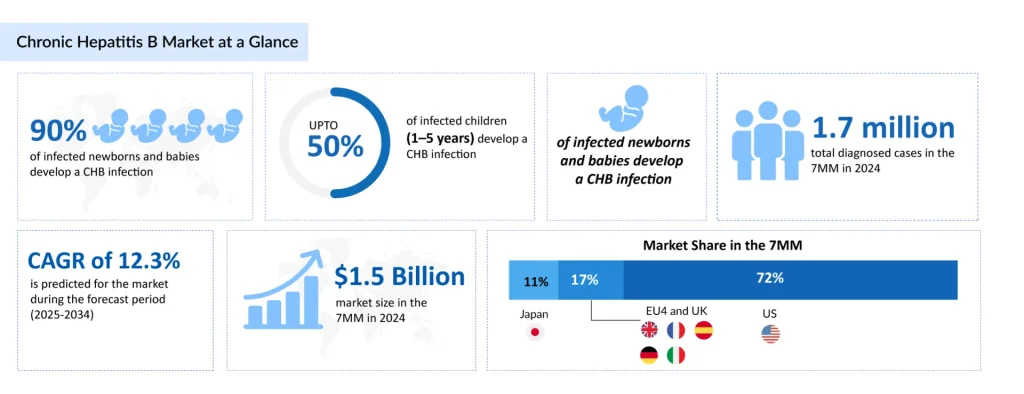

- Chronic hepatitis B continues to pose a major global health challenge, affecting millions globally. ~5 million prevalent CHB cases across the 7MM in 2024.

- No complete cure exists yet, but advances in antivirals and novel modalities are reshaping therapeutic outcomes and hope for a functional cure.

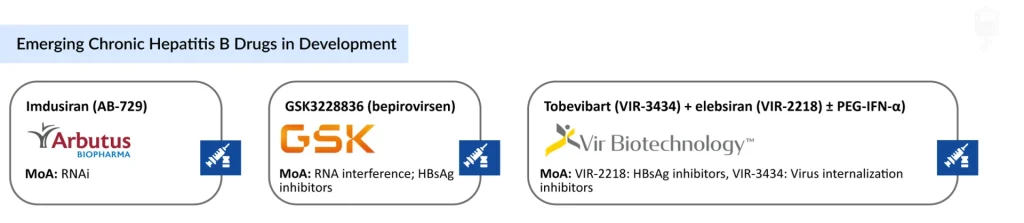

- The potential drugs that can mark a significant change in the forecast period include GSK3228836 (GSK), tobevibart (VIR-3434) + elebsiran (VIR-2218) ± PEG-IFN-α (Vir Biotechnology), Imdusiran (Arbutus Biopharma), and others.

- CHB market valued at ~USD 1.5 billion in 2024, with a projected 12.3% CAGR (2025–2034).

Chronic hepatitis B (CHB) remains one of the most significant global health challenges, affecting millions of patients worldwide. Characterized as a silent epidemic, the condition often goes undiagnosed because most newly infected or chronically infected individuals do not exhibit symptoms, creating a substantial burden on healthcare systems and allowing unintentional transmission to others. While there is currently no complete cure for CHB, advances in antiviral therapies and emerging innovative treatment modalities are fundamentally reshaping the therapeutic landscape, offering patients improved outcomes and the potential for a functional cure.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- GSK Receives FDA Fast Track Designation for Bepirovirsen; Gilead to Acquire CymaBay Therapeutics;...

- FDA Approves BMS’s Reblozyl for MDS; FDA Awards Orphan Drug Designation to NXC-201; Janssen Submi...

- Search for the Cure Continues in the Chronic Hepatitis B Treatment Market

- Lion TCR Secures Triple FDA Milestones with IND Clearance for Chronic Hepatitis B; Corstasis Ther...

Chronic Hepatitis B Disease Burden and Patient Impact

Hepatitis B is a potentially life-threatening liver infection caused by the Hepatitis B Virus (HBV), which specifically attacks and injures hepatocytes. The infection can manifest as either acute or chronic, with CHB developing when the virus persists in the body for more than six months. The disease is particularly insidious because persistent HBV exposure leads to immune exhaustion, a hallmark of CHB, where continued antigenic stimulation results in progressive dysfunction of immune cells, particularly T cells and natural killer (NK) cells.

According to DelveInsight’s 2024 analysis, there were approximately 5 million prevalent cases of chronic hepatitis B across the 7MM. During the same year, an estimated 670,000 CHB patients received treatment in the 7MM. The progression of liver disease adds another critical dimension to CHB management. In the United States, it is estimated that there are approximately 100,000 cases of decompensated liver cirrhosis and 500,000 cases of compensated liver disease, highlighting the progression risk for untreated or inadequately managed patients.

Current CHB Treatment Paradigm: Established Therapies

The established treatment landscape for CHB is anchored by two primary drug classes approved by major regulatory agencies: immunomodulators and nucleoside/nucleotide reverse transcriptase inhibitors (NRTIs). These agents form the backbone of current CHB management strategies.

Immunomodulators: Interferon-Based Therapies

Interferons are immunomodulatory agents that support the building and enhancement of the host immune system to fight off HBV infection. The mechanism of action involves stimulating cellular immune responses that result in apoptosis of HBV-infected cells. Although direct evidence is limited, this process is believed to lead to more effective elimination of the highly resistant closed circular covalent (ccc) template of HBV DNA, a critical barrier to achieving a functional cure.

Peginterferon Alfa-2a (PEG-IFN-α-2a) represents the standard interferon-based therapeutic approach. According to clinical guidelines, this agent is prescribed as first-line treatment for patients with satisfactory liver function. PEG-IFN-α-2a is administered via subcutaneous injection once weekly for 48 weeks. Despite its efficacy in certain patient populations, interferon-based therapy faces significant limitations.

In 2024, interferons emerged as the least-utilized therapy for CHB, capturing only approximately 6% of the CHB treatment market share across the 7MM, reflecting a shift toward more tolerable oral antivirals.

Nucleoside/Nucleotide Reverse Transcriptase Inhibitors (NRTIs)

NRTIs represent the preferred class of first-line antivirals for CHB management. These agents exhibit direct antiviral effects by inhibiting viral polymerase, acting by phosphorylating their nucleoside triphosphates or diphosphates. Key agents within this class include:

Tenofovir Disoproxil Fumarate (TDF) has been a cornerstone therapy for CHB, offering potent HBV DNA suppression and favorable long-term safety profiles. However, TDF has been increasingly replaced by more advanced formulations due to improved renal safety profiles.

Tenofovir Alafenamide (TAF), marketed as VEMLIDY (Gilead Sciences), represents a significant advancement in NRTI therapy. Approved for adults in 2016 and expanded to pediatric populations in 2022 in the United States (with 2017 approval in the EU4 and UK, and 2016 in Japan), TAF offers superior renal and bone safety compared to TDF while maintaining comparable antiviral efficacy. At Week 48, HBV DNA suppression rates with VEMLIDY were 92% versus 93% with TDF in cirrhotic subjects (Trial 108), and 63% versus 67% with TDF in Trial 110, demonstrating non-inferior efficacy with improved tolerability.

In 2024, VEMLIDY captured the largest market share among CHB therapies, accounting for approximately 40% of the 7MM market, reflecting its preferred status among clinicians and patients. Entecavir remains another important oral antiviral option, offering effective HBV DNA suppression and ease of administration with once-daily dosing.

Lamivudine, Adefovir, and Telbivudine represent additional NRTI options, though some have been deprioritized or discontinued due to limitations in efficacy or emerging safety concerns. All NRTIs are administered as once-daily oral tablets, requiring long-term therapy, often indefinitely, because these agents suppress viral replication without eliminating the covalently closed circular DNA (cccDNA) from infected hepatocytes.

Next-Generation CHB Therapies Poised for Market Impact

The CHB therapeutic pipeline is undergoing a profound transformation with multiple innovative agents in mid- and late-stage development, poised to fundamentally alter the treatment paradigm. These emerging therapies employ novel mechanisms of action beyond simple viral suppression, aiming to achieve a functional cure, defined as sustained HBsAg loss with or without seroconversion.

GlaxoSmithKline’s GSK3228836 (Bepirovirsen)

Bepirovirsen is a triple-action Antisense Oligonucleotide (ASO) designed to inhibit HBV gene expression and viral antigen production. Unlike traditional antivirals that suppress replication, bepirovirsen reduces the production of all HBV viral proteins and antigens, including hepatitis B surface antigen (HBsAg), potentially enabling immune clearance of infected cells. Currently undergoing evaluation in the B-Well Phase III clinical trial program (NCT05630820, NCT05630807) and Phase II studies (NCT04954859, NCT06497504).

In August 2024, GSK announced that the MHLW had granted SENKU (formerly known as SAKIGAKE) designation for bepirovirsen for the treatment of CHB. In February 2024, GSK announced that the US FDA had granted FTD for bepirovirsen to treat CHB.

“According to Sadaf Javed, Manager of Forecasting and Analytics at DelveInsight, the therapy is expected to enter the market around 2026 and is well-positioned to emerge as a leading chronic hepatitis B treatment by market share across the 7MM during the 2025–2034 forecast period. By 2034, the combination of bepirovirsen with peginterferon-α-2a is projected to reach approximately USD 1.02 million revenue, reflecting strong market uptake driven by its superior efficacy in achieving functional cure endpoints.”

Arbutus Biopharma’s Imdusiran (AB-729)

Imdusiran is an RNAi therapeutic specifically designed to reduce all HBV viral proteins and antigens by targeting HBV mRNA. This approach offers the advantage of suppressing the entire viral proteome through a single mechanism. Imdusiran is an RNAi therapeutic specifically designed to reduce all HBV viral proteins and antigens by targeting HBV mRNA.

This approach offers the advantage of suppressing the entire viral proteome through a single mechanism. Currently in the Phase IIb stage. Primary endpoints include the frequency and severity of treatment-emergent adverse events (TEAEs), discontinuations due to adverse events (AEs), and laboratory abnormalities.

“The entry of imdusiran into the market is expected around 2027. Our analysis indicates that by 2034, the imdusiran and peginterferon-α-2a combination could account for nearly USD 732 million revenue, positioning it as a meaningful contributor within combination therapy strategies,” said Aparna Thakur, Assistant Project Manager, Forecasting and Analytics at DelveInsight.”

Vir Biotechnology’s VIR-3434 (Tobevibart) and VIR-2218 (Elebsiran)

VIR-3434 (tobevibart) functions as a viral entry inhibitor by preventing hepatitis B virus internalization into hepatocytes, while VIR-2218 (elebsiran) is an RNA interference–based HBsAg inhibitor that suppresses the production of hepatitis B surface antigen. Both candidates are being evaluated within combination therapy strategies, frequently alongside peginterferon-α-2a, to improve the likelihood of achieving a functional cure.

The program is currently in Phase II clinical development. Key milestones include the disclosure of positive end-of-treatment findings from the MARCH Study at the AASLD Liver Meeting in November 2024, followed by the presentation of 24-week post-treatment follow-up data in April 2025 from the MARCH Phase II trial assessing tobevibart and elebsiran combinations, with and without peginterferon-α.

The Future of Chronic Hepatitis B Treatment

The landscape of chronic hepatitis B treatment is on the cusp of transformative change, moving beyond long-term viral suppression toward the possibility of a functional cure, defined as sustained loss of hepatitis B surface antigen (HBsAg) and undetectable viral replication after a finite course of therapy. Current standard therapies, such as nucleos(t)ide analogues and pegylated interferon, effectively suppress HBV but rarely achieve durable HBsAg loss, meaning most patients require lifelong treatment.

The CHB market is valued at approximately USD 1.5 billion in the leading markets in 2024, with significant growth at a CAGR of 12.3% projected through 2034. This expansion is being driven by increased diagnostic capabilities, improved screening protocols, and the emergence of novel therapeutic agents that promise to revolutionize patient care.

A wave of novel agents in late-stage development is driving optimism for the future. For example, GSK’s bepirovirsen recently met primary endpoints in pivotal Phase III trials, demonstrating statistically significant improvements in key viral markers when combined with standard care, bringing a functional cure closer to reality for millions affected by HBV worldwide and supporting planned regulatory submissions in 2026. Beyond antisense oligonucleotides like bepirovirsen, the pipeline includes RNA interference drugs, capsid inhibitors, immune modulators, therapeutic vaccines, and combination regimens designed to synergistically suppress viral replication while stimulating host immunity.

Looking ahead, the future of CHB treatment is likely to center on multimodal strategies that tailor therapy to individual patient profiles and the stage of infection. Combination therapies, pairing direct-acting antivirals with agents that enhance immune responses, are gaining traction as they address multiple aspects of HBV pathogenesis simultaneously. While significant scientific and clinical hurdles remain (including variability in response and long-term durability of functional cure), the rapid expansion of therapeutic options and strategic global research efforts raise realistic hopes that finite, curative therapies may become available within the next decade.

Downloads

Article in PDF

Recent Articles

- GSK Receives FDA Fast Track Designation for Bepirovirsen; Gilead to Acquire CymaBay Therapeutics;...

- Lion TCR Secures Triple FDA Milestones with IND Clearance for Chronic Hepatitis B; Corstasis Ther...

- FDA Approves BMS’s Reblozyl for MDS; FDA Awards Orphan Drug Designation to NXC-201; Janssen Submi...

- Search for the Cure Continues in the Chronic Hepatitis B Treatment Market