JAK Inhibitors Market

Jul 09, 2021

Table of Contents

JAK inhibitors also termed “Jakinibs,” work by inhibiting the activity and response of one or more Janus kinase enzymes. These inhibitors function against the Janus kinases, a group of four proteins that includes JAK1, JAK2, JAK3, and tyrosine kinase 2 (TYK2). These proteins control inflammation by triggering intracytoplasmic transcription factors known as signal transducers and activators of transcription (STAT).

Talking about physiology, they are the intracellular enzymes that transmit signals from cytokines ratified to cell surface receptors to signal transducers and activators of transcription responsible for proinflammatory cellular responses. The pathophysiological processes are aided by the JAK-STAT pathway. After introduction into the market, they were proposed as a promising treatment choice for multiple indications with the potential to make a significant contribution to the therapeutic paradigm.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- JAK Inhibitors: New Lifeline for Hair Loss Treatment

- The Dynamic Landscape of Myelofibrosis Treatment: A 2024 Perspective

- 5 Promising Exosome-based Therapies Paving the Way for Personalized Medicine

- AZ dragout Entasis; Sierra remunerates Gilead; Principia raises; Harbour BioMed and Kelun pen deal

- Kinase Inhibitors: Challenging the established Biologics as the new standard of care in autoimmun...

Before their entry, the autoimmune space was – and still is – dominated by “biologics,” which unquestionably improved clinical outcomes but came with a higher price tag. These high costs put patients and health care providers at a disadvantage. Another concern is their route of administration that is either subcutaneous or infusion. Many patients do not respond satisfactorily despite currently available cytokine therapies. For example, more than one-third of patients with Inflammatory Bowel Disease (IBD) do not respond to these treatments.

In addition, blockade of such cytokines has been reported to associate with the development of severe side effects and/or new immune-mediated pathologies. When clubbed together, all the reasons mentioned above imposed a high burden contributing to a major unmet need faced by the patient segment.

To combat these challenges, these inhibitors were introduced into the market, as these are the class of drugs targeting that specific patient pool that was not getting benefited from biologics or any other interventional therapy. But, more importantly, what makes JAK inhibitors a credible option over these well-known biologics, is an array of advantages that sets them apart.

The second-and third-line biologics’ efficacy is reduced where patients do not respond to biologics. Interestingly, patients who have already tried anti-TNF and other biologic medications may benefit from JAKs as a new therapy option.

First, JAK inhibitors are given as a pill, which is usually quite persuasive than getting a biological drug as an injection or infusion. Second, they can be combined with other medications to increase the likelihood of being treated at a faster rate and in an efficient manner. Furthermore, another major highlighting aspect about them is that they typically have a short “half-life,” which means that they will disintegrate from their system quickly if a person stops taking them.

They appear to be effective in the treatment of Rheumatoid Arthritis (RA), Polycythemia Vera (PV), Ulcerative Colitis (UC), Crohn’s Disease (CD), Polyarticular Course (PC), Juvenile Idiopathic (JIA), Arthritis Psoriasis (AP), and they are being developed to target other indications such as Atopic Dermatitis (AD), Alopecia Areata (AA), Vitiligo and others. According to substantial evidence, JAK inhibition might become valuable in dermatology, with preliminary reports of efficacy in a variety of several other conditions.

Entry of JAK Inhibitors

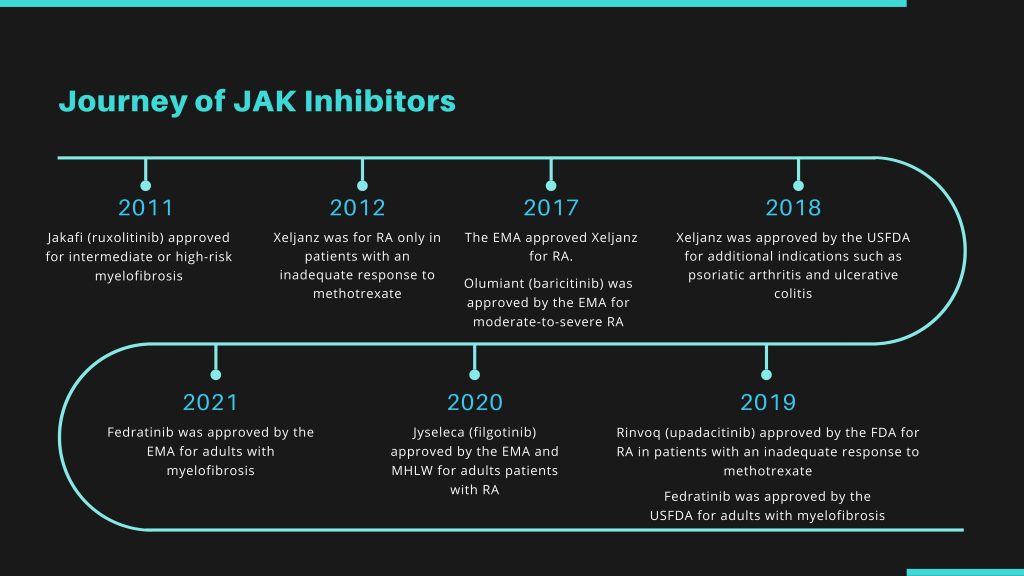

The first JAK inhibitor to enter the market was Jakafi (Ruxolitinib) in 2011 for the treatment for Myelofibrosis including primary MF, post-polycythemia vera MF and post-essential thrombocythemia MF. Xeljanz (tofacitinib) was approved by the US Food and Drug Administration to treat RA in 2012.

Later in March 2017, the European Medicines Agency (EMA) approved the drug at a dose of 5 mg twice daily in combination with methotrexate (MTX) to treat moderate-to-severe RA with inadequate response to one or more disease-modifying antirheumatic drugs (DMARDs).

Initially, after its US approval, Xeljianz had secured a good position and generated satisfactory sales. However, things went downhill after the US FDA began noticing the drug’s side effects.

Serious side effects such as thrombosis, infections, malignancies, and embolisms prompted the US FDA to issue its most severe safety warning: black box labeling. After receiving a black box warning from the regulatory body, which realized how the drug could be hazardous at high doses, the company observed a decline in the overall sales.

According to DelveInsight’s analysts, the company’s business opportunity stayed limited because only the lower dose was approved in the US.

Pfizer has faced a difficult time marketing its RA medicine Xeljanz in recent years, with regulatory authorities raising concerns regarding substantial cardiovascular side effects and cancer risk. Recent research says that the marketing problem will get even more difficult.

A study compared Xeljanz to a TNF inhibitor in more than 4,300 patients over the age of 50 who already had RA and at least one cardiovascular risk factor, these said parameters within the patients were required by the USFDA for this study to be conducted and to elucidate the pending decision on usage of a higher dose of Xeljanz.

However, as per the study results, Xeljanz failed to meet the trial’s primary objectives of noninferiority to TNF inhibitors both in cardiovascular and cancer risk. Pfizer stated that two doses were evaluated, and both were found to be ineffective.

The result was not entirely surprising, given the pileup of warnings on JAK inhibitors in recent years. Pfizer now faces competition from more than just TNF inhibitors like AbbVie’s Humira. It is also up against AbbVie’s Rinvoq, and Eli Lilly’s Olumiant which is currently likened to RA treatment.

In February 2017, Olumiant (JAK inhibitor baricitinib) was approved in Europe for the treatment of moderate-to-severe active RA in adults with an inadequate response to one or more DMARDs at Doses of 2 mg and 4 mg. The next point to consider was the thromboembolic safety profiles of Olumiant, which was of course, crucial, as well as a warning from the FDA for baricitinib.

Later in 2018, although the news of Olumiant approval in the United States was welcomed, it was not quite as fortunate as it could have been for the drug’s manufacturers. Why was that so? First, the manufactures had to deal with lengthy delays, and in the end, it came with certain restrictions. Second, it was handed a “black box” warning – the most serious sanction the US regulator could impose.

Growing Safety Concerns

Regulatory authorities have become increasingly wary about this class of drugs over time, which is why more and more medications are receiving black box warnings. Recently, a sequence of delays in USFDA assessments has been observed in some circumstances.

While less than two USFDA regulatory review delays in a particular drug class may not cause alarm, five setbacks in a specific drug class in less than a month surely land minds in the troubled state. To quote a few, Rinvoq was Food and Drug Administration (FDA) approved for the treatment of RA in 2019, but it came with a black box warning about an increased risk of severe infection, malignancy, and thrombosis – an aspect which was also present in the other approved inhibitors, such as Pfizer’s JAK inhibitor Tofacitinib (Xeljanz).

The first setback was when AbbVie announced that the 3-month evaluation of its supplemental new drug application (sNDA) for its, Rinvoq, in psoriatic arthritis (PsA) would be postponed.

This was in response to an FDA request for a revised risk-benefit analysis for the medicine, which the authority needed more time to study. At the time of the release, it was reported that a similar request for the drug’s use in atopic dermatitis had been submitted.

So it was unsurprising when the company revealed in April that the sNDA evaluation for atopic dermatitis would be postponed as well. Later, it was revealed that Eli Lilly and Incyte’s medicine, Olumiant, is suffering an identical lag in Atopic Dermatitis (AD), and Pfizer’s two JAK inhibitors, Xeljanz and abrocitinib, are also experiencing setbacks in AS and AD, respectively.

As mentioned above, the USFDA required further data on Pfizer’s Xeljanz for RA in 2012 during its initial assessment, and the JAK drug class has had challenges since its inception. Because of concerns about the drug’s higher dose’s risk-benefit profile, it was only authorized in the lower concentration. Other JAK inhibitors seeking approval in the United States have followed suit.

Gilead submitted an NDA application to the USFDA seeking approval for filgotinib to treat patients suffering from RA; however, the authority did not approve it and asked the company to present the additional safety data. Gilead has decided not to move further with the developmental activities in the US. They have dropped the idea of getting Filgotinib approved in the US.

However, Filgotinib gained approval by the EMA in September 2020 to treat adults with moderate to severely active RA who have responded inadequately to or are intolerant to one or more DMARDs. Gilead is already conducting two male reproductive safety studies: the MANTA study in men with inflammatory bowel disease and the MANTA-RAy study in men with active Rheumatoid Arthritis, PsA, and Ankylosing Spondylitis.

These trials will be key trials for Ulcerative Colitis and other indications The Company is waiting for these results, and the decision to scale back from the US market was purely on an R&D investment basis.

Indeed, infection risk, malignancy, and thrombosis are serious side effects associated with all JAK inhibitors regardless of which enzyme subtypes they inhibit. Moreover, there is yet not enough long-term surveillance for malignancy risk to truly assess and define the actual risk if any.

Apart from this, even after observing continuous phase III victories in atopic dermatitis, Incyte’s Jakafi cream is not immune to JAK inhibitor safety concerns. The FDA has delayed its judgment on Jakafi cream in the treatment of atopic dermatitis for three months, putting the drug’s new decision date in September.

The decision comes just days after the FDA postponed a decision on Jakafi, in an oral form used to treat chronic graft-versus-host disease. Meanwhile, the jakafi cream delay may provide an opportunity for another topical competitor, Leo Pharma’s delgocitinib cream, to close the gap. Last August, the FDA granted it a fast track designation, and it began phase III testing in persistent hand eczema in May 2021.

Even though JAKs are in the spotlight for lacking the required safety parameters, their growth and development over the number of years or periods cannot be put into a state of question.

JAKs have shown to be efficacious in the number of below-mentioned indications where the initial and generic treatment was not able to suffice the patient’s pool requirements.

Jakafi and Xeljanz have proven themselves and secured their position as blockbuster drugs. Apart from this, there has been the approval of drugs in the same class with lesser side effects. It will be interesting to witness how the approval and entry of upcoming JAKs in the market will contribute to shaping the market and securing a substantial position.

Development of JAK Inhibitors

Even though JAK’s are struggling with the baggage of questionable safety profiles and are consistently being evaluated to overcome this unwanted image, there are key players across the globe that have been trying their level best to bring a trustworthy JAK in the market sphere making sure that they exhibit least side effects along with top-notch safety and efficacy.

JAK inhibitors for Alopecia Areata currently in development are the most advanced treatments for patients. The JAK/STAT pathway is important in the pathophysiology of Alopecia Areata because it regulates CD8 and Natural Killer Group 2D (NKG2D T)-cells, which are both important components of the disease. Although they have shown to be very effective in patients with Alopecia Areata, key opinion leaders (KOLs) are still displeased about the drugs’ side effects and the elevated annual cost of therapy (ACoT).

Moreover, because these are a long-term treatment, the patient may experience a relapse if the drug is stopped. Because JAKs do not provide a cure for the disease, patients may prefer to use a scalp prosthesis, which is a less expensive and safer option.

JAKs are also being investigated in the treatment of Psoriasis, although the number of Psoriasis JAK inhibitors trials is still limited. Most of those drugs investigated have just had Phase II testing, and it is unlikely that they will undergo additional testing.

Only Xeljanz has been advanced to Phase III, with many Phase III trials for the TYK2 inhibitor BMS-986165 are presently underway. The pharmaceutical industry is coming across as intensely competitive due to many biological medications in the market, all of which are highly effective in treating psoriasis and have few adverse effects.

Consequently, existing evidence suggests that novel JAK inhibitors, particularly TYK2 inhibitors, will not surpass the most recent biologics. However, the efficacies of JAKs are superior to those of some recent systemic therapies, such as apremilast, and certain older biologics, such as etanercept.

They can be introduced into the Psoriasis therapy algorithm only if they do not produce elevated adverse reaction rates. Besides, JAK inhibitors being oral therapies that are somewhat less expensive than biologics will come as an added advantage.

Crohn’s Disease (CD) and Ulcerative Colitis (UC) have primarily been treated with “conventional” treatments and anti-TNF antibodies throughout the previous two decades. The therapy arsenal of these illnesses has lately been strengthened with the release of novel biologics and numerous novel small molecule drugs (SMD), which are increasing clinicians’ options for managing IBD patients.

They are the most promising medications in this circumstance because Xeljanz has already been licensed for UC patients, and numerous other medications are being studied for both UC and CD.

Rinvoq is a JAK1 inhibitor that has already been evaluated in Phase II and is in Phase III double-blind placebo-controlled dose-ranging randomized experiment in individuals with moderate-to-severe UC.

To summarize, JAK inhibitors have been one of the luring discoveries in UC treatment. The impending availability of such medications is likely to significantly influence patients suffering from this ailment, with future studies focusing on increasing patient safety and patient selection.

Additionally, these inhibitors are now being studied for Atopic Dermatitis for both oral and topical dose formulations. Four JAK inhibitors are now being investigated in clinical trials for Atopic Dermatitis (i.e., Phase III): Abrocitinib (Pfizer), Olumiant (Incyte and Lilly), Rinvoq (Incyte), and Jakafi (Abbvie). Each inhibitor does have its profile, while the efficacy data available now is considerable.

Specialists already have commenced speculating about how these inhibitors might contribute to the future of Atopic Dermatitis management, currently awaiting FDA approval, while also acknowledging that there would be a learning experience around optimal use for patient populations, including more long-term efficacy and safety information (for all age groups) to be obtained over time.

Vitiligo is an autoimmune disorder whose pathogenesis is triggered by interferon-gamma, which activates JAK 1 and 2 cellular processes. In addition, a topical version of Jakafi, a JAK1/2 inhibitor, has exhibited substantial repigmentation over 52 weeks in a Phase II randomized dose-finding study.

In a report, Pfizer stated that it has a significant pipeline of second-generation inhibitors. With the approval of AbbVie’s Rinvoq and multiple potential entrants over the next few months, the sector is becoming more crowded, and it is unclear whether Pfizer’s plan will work. Analysts are also concerned about the safety risks that have surrounded the entire JAK class.

JAKs are currently facing the challenge of overcoming their tainted history, including safety concerns and “messy” medication perceptions, to preserve their position in the evolving patient care landscape and a share of the rapidly growing immunology drugs market.

Finally, with the availability of various treatment options, deciding whether to use an oral JAK inhibitor over a biologic or other topical, topical corticosteroids, or other topical medicines should be left to a shared decision-making dialogue between patients, caretakers, and healthcare practitioners.

Alternative Therapies to JAK Inhibitors

To overcome the issues imposed by JAK inhibitors to the patient segment, a new class of drugs that can be used as their replacement are in the developmental stage, and some of them have already got a green signal from the regulatory authorities. Bruton’s tyrosine kinase (BTK) inhibitors are a promising novel agent that has already exhibited a potential efficacy in some of the indications, namely, B-cell malignancies, evobrutinib (M2951) is a selective inhibitor of the nonreceptor enzyme Bruton’s tyrosine kinase (BTK).

BTK helps B lymphocytes evolve and function, a type of white blood cell capable of attacking and destroying the neuroprotective myelin sheath that accompanies nerve cells in the brain and spinal cord. Evobrutinib is designed to block the actions of primary B-cells, which disrupt normal immune responses and, eventually, neurodegeneration. It is anticipated that neurologic and functional decline would be slowed or even precluded due to this mechanism of action.

Sphingosine-1-phosphate (S1P) receptors are another unique route of action that could influence UC. The S1P1 receptor, found on the cell surface, is involved in lymphocyte trafficking through lymphoid organs.

S1P1 receptor agonists induce internalization and degradation of the S1P1 receptor, due to which B- and T-cells are unable to migrate from secondary lymphoid organs. The result is a reversible decrease in the number of circulating lymphocytes in the bloodstream.

Zeposia from Bristol-Myers Squibb got a green signal from the USFDA to treat multiple sclerosis. S1P receptor modulators are a type of immunomodulator commonly used to treat multiple sclerosis. The G-protein coupled S1P receptor can be modulated by these drugs. Additionally, Zeposia also got approved in May 2021 for the treatment of adults with moderately to severely active UC.

Etrasimod (APD334) is a next-generation, once-daily, oral, highly selective S1P receptor modulator discovered by Arena and designed to optimize the pharmacology and engagement of S1P receptors 1, 4, and 5, which may lead to an improved efficacy and safety profile. Etrasimod provides systemic and local effects on specific immune cell types and has the potential to treat multiple immune-mediated inflammatory diseases, including CD and UC.

Conclusion

So, what does the future of the JAK inhibitors market hold? Their promise has been hampered by delays in regulatory clearances and labeling restrictions. Therefore, JAKs must overcome their tainted background, including safety concerns and ‘messy’ drug perceptions, to protect their position in the evolving patient care paradigm.

A significant element fueling the advancement of the these inhibitors portfolio is encouraging preclinical and clinical results of therapeutic candidates. Eli Lilly, Astellas, Pfizer, Baxter, Novartis, Abbvie, Sierra Oncology, CTI BioPharma, and Incyte are all still participating and investing in the worldwide JAKs business. Pfizer intends to double down on their investment in the JAK MoA with various pipeline assets, despite recent FDA warnings for Xeljanz.

Although the destiny of JAKs is uncertain at the moment, one thing is certain: JAKs always had the potential to become blockbuster medications for chronic conditions that innumerable patients require.

To summarize, in the years ahead, the JAK inhibitors pipeline is expected to be fuelled by rising prescription demand. They can indeed find a place in the emerging therapeutic process as high-dose induction, low-dose maintenance, or combination therapies. For the pharma sector, the question is not whether but how they will cement their place as valuable emerging therapeutics.

While the efficacy of JAKs is unquestionable, the dosage and safety aspects of JAKs remain to be questioned. The question remains as to how to set the threshold for the best therapeutic effect. Key players that are involved in developing the ideal JAKs, are trying their level best to meet the requirements of the regulatory authorities, and some of them have witnessed success as recently JAKs with lesser side effects and safety issues received green signals from the authorized bodies.

Therefore, despite apprehensions, selective JAKs are expected to hit the market soon and create their market share.

Downloads

Article in PDF

Recent Articles

- 5 Promising Exosome-based Therapies Paving the Way for Personalized Medicine

- AZ dragout Entasis; Sierra remunerates Gilead; Principia raises; Harbour BioMed and Kelun pen deal

- JAK Inhibitors: New Lifeline for Hair Loss Treatment

- Kinase Inhibitors: Challenging the established Biologics as the new standard of care in autoimmun...

- The Dynamic Landscape of Myelofibrosis Treatment: A 2024 Perspective