How Could the Approval of JOURNAVX Accelerate the Non-opioids Drug Approval Momentum in Post-Operative Care?

Jun 23, 2025

Table of Contents

Imagine waking up after successful surgery only to experience moderate-to-severe pain (acute or chronic). For decades, the standard of care (SoC) has been the same for postoperative care: prescribe an opioid. While effective in limiting pain signals, opioids have left behind a baggage of addiction and overdose.

Now, with nearly 10% of post-surgical patients slipping into prolonged opioid use and 85,000 new cases of opioid use disorder annually, the healthcare system faces an urgent call to evolve. Today, the opioid epidemic has become a public health crisis. Declared “national shame” and a public health emergency by President Trump in 2017, the opioid epidemic continues to scar American life. Each wave, first from prescription opioids, then heroin, now synthetic fentanyl, has been deadlier than the last. Countries like Germany are among the highest consumers of opioid analgesics in Europe, particularly for non-cancer pain. Despite this, the country has not experienced an opioid epidemic, possibly due to effective monitoring and regulation. Regardless of the unmet need for non-opioid therapies, new options have been slow to enter the postoperative pain market until the approval of JOURNAVX.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Novo Nordisk to Acquire Ocedurenone; FDA Awards Orphan Drug Designation to SLS009 in AML; FDA App...

- AstraZeneca Scraps £450M UK Vaccine Factory; FDA Approves First Non-Opioid Pain Reliever JOURNAVX...

- How do we curb the Opioid Epidemic?

- Vertex’s JOURNAVX: A Historic Milestone in Pain Treatment After a Long Dry Spell

- FDA just lost a gem as Scott Gottlieb resigns

JOURNAVX: First approved non-opioid therapy for acute pain in more than two decades

About 50% of acute pain patients (commonly used for postoperative pain) receive one or more prescriptions or administrations of opioids in the United States. The opioid prescription proportion is generally lower in chronic pain patients. To reduce unregulated and inappropriate opioid prescribing habits to curb deadly opioid misuse, several measures are taken. Many companies are developing non-opioid pain therapies to address the opioid crisis. These therapies offer a robust competitive edge and seamlessly integrate into both inpatient and outpatient care environments.

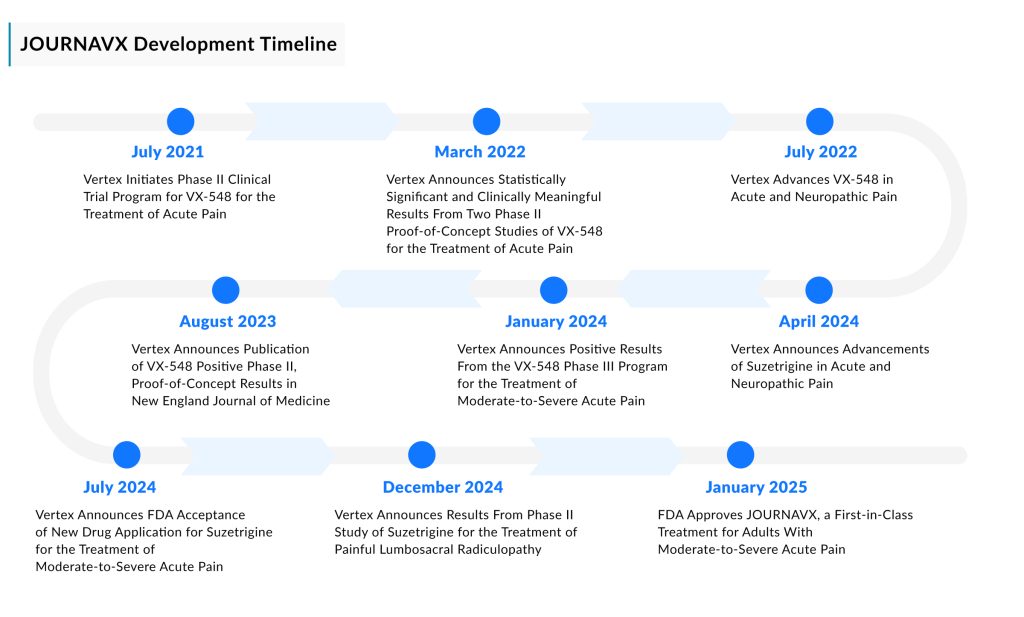

In January 2025, the FDA approved Vertex Pharmaceuticals’ JOURNAVX (suzetrigine)—marking not just a regulatory milestone but also a historic shift in moderate-to-severe acute pain care. As the first-in-class, oral, selective, non-opioid NaV1.8 pain signal inhibitor, JOURNAVX blocks peripheral pain signals before they reach the central nervous system without the baggage of addiction. Patients who underwent bunionectomy and abdominoplasty surgery were the subjects of this study. In both trials, JOURNAVX demonstrated statistically significant pain reduction when compared to a placebo. JOURNAVX’s phase III clinical trials revealed no indications of an addiction risk.

Market Positioning and Strategic Rollout

Vertex’s initial trials focused on pain following an abdominoplasty or bunionectomy. JOURNAVX’s clearance has been well-received, despite its subpar effectiveness. Vertex may eventually broaden the scope of care and create novel formulations that target more pain indications. Vertex Pharmaceuticals’ JOURNAVX launch plan includes:

- Robust patient support program (co-pay and savings programs) to reduce patient financial burden

- Aggressive market penetration strategy targeting formulary inclusion

- Presence of JOURNAVX on every major retail pharmacy shelf

- Tailored physician education to accelerate prescriber confidence

The result? A strong patient share trajectory to capture a major market share in the post-operative pain market.

Innovation beyond JOURNAVX: A Pipeline of Promise

When it comes to treating acute pain with non-opioid options, Vertex is not alone in this space. This post-operative pain pipeline space is expected to boom and may become crowded as well. Several non-opioid therapies under clinical development are promising and better than JOURNAVX in terms of clinical performance. It is worth noting, JOURNAVX did not outperform VICODIN (an opioid combination of hydrocodone and acetaminophen); however, it effectively relieved pain without the hazards associated with opioid usage. Due to the significant unmet need in pain care, it is possible that more than one non-opioid option can coexist, and they should be able to generate solid revenue in the coming years.

Latigo’s LTG-001: Similar mechanism of action to JOURNAVX, but quicker

Another NaV1.8 inhibitor, LTG-001 by Latigo Biotherapeutics, is gaining investor and regulatory attention. Backed by USD 150 million in Series B funding and FDA Fast Track Designation in 2025, LTG-001 has shown:

- Rapid absorption (Tmax ~1.5 h), hinting at quicker pain relief than JOURNAVX

- Clean safety and pharmacokinetic profile in Phase I

If LTG-001 enters the post-operative pain market, it could offer an even faster onset of pain control in clinical scenarios where timing is critical.

Cebranopadol: Tris Pharma’s dual NOP/MOP receptor agonist

Tris Pharma’s Cebranopadol stands apart as a dual nociceptin/orphanin FQ peptide receptor (NOP) and the mu-opioid receptor (MOP) receptor agonist, modulating pain through central pathways without classical opioid euphoria. Highlights include:

- ALLEVIATE-1 and 2 Trials: Statistically significant reductions in pain vs. placebo

- 57.5% of patients required no opioid rescue in the bunionectomy trial

- Human Abuse Potential (HAP) study: Substantially less “likability” than oxycodone

- Supported by a USD 16.6 million NIH HEAL Initiative grant

Tris Pharma expects to submit a new drug application (NDA) in late 2025, with further chronic pain studies underway.

Navigating the Challenges Ahead

As the global healthcare community seeks safer alternatives to opioids, the non-opioid drug landscape is evolving rapidly, but not without significant challenges. Some of the challenges include:

The Cost Barrier

Despite clear clinical benefits, JOURNAVX enters a market dominated by low-cost generics. JOURNAVX is more expensive if compared with generic opioids. High cost could be a barrier because this healthcare system generally prioritizes the least expensive alternative. This could encourage the use of opioids by pharmaceuticals, insurance companies, and drugstores.

- JOURNAVX: USD 15.50 per pill/USD 420 per 14-day course

- Generic opioids: as low as USD 0.50 per pill

Policy Shifts to Watch

Policy changes are also aligning with scientific advancements. The NOPAIN Act (effective January 2025) mandates Medicare reimbursement for non-opioid pain drugs, removing a key barrier to access and supporting alignment with the FDA’s Overdose Prevention Framework.

Looking Ahead: Redefining Recovery and Responsibility

JOURNAVX’s approval is a symbol of a broader paradigm shift in pain care. For the first time in two decades, a therapy is available that delivers effective post-operative pain relief without opening the door to addiction. This is just the beginning; ensuring long-term safety, real-world efficacy, and equitable access will be critical. Cost parity with generics, broader insurer acceptance, and ongoing comparative studies will shape the future trajectory of this movement.

JOURNAVX’s approval is not just historic but symbolic as well because the approval came a few days after Purdue Pharma’s landmark USD 7.4 billion settlement (to resolve a long-running legal battle to compensate victims and stop the opioid crisis), offering a long-overdue accountability, and a glimmer of hope that the now pain patients would not have to choose between pain and peril.

It is important to highlight that in post-operative care, opioids may not be inevitable, but JOURNAVX and its successors promise something better: relief without regret. With numerous emerging options in the pipeline, postoperative pain care is poised for significant advancements in the coming years.

The growing geriatric population, rising lifestyle-related ailments, broader acceptance, and better access to therapies are expected to drive the expansion of the non-opioid market. Favorable laws, increased research investment, and expedited approvals will all contribute to boosting the market’s expansion and growth.

Downloads

Article in PDF

Recent Articles

- Novo Nordisk to Acquire Ocedurenone; FDA Awards Orphan Drug Designation to SLS009 in AML; FDA App...

- Vertex’s JOURNAVX: A Historic Milestone in Pain Treatment After a Long Dry Spell

- How do we curb the Opioid Epidemic?

- AstraZeneca Scraps £450M UK Vaccine Factory; FDA Approves First Non-Opioid Pain Reliever JOURNAVX...

- FDA just lost a gem as Scott Gottlieb resigns