CDK 7 Inhibitors Market

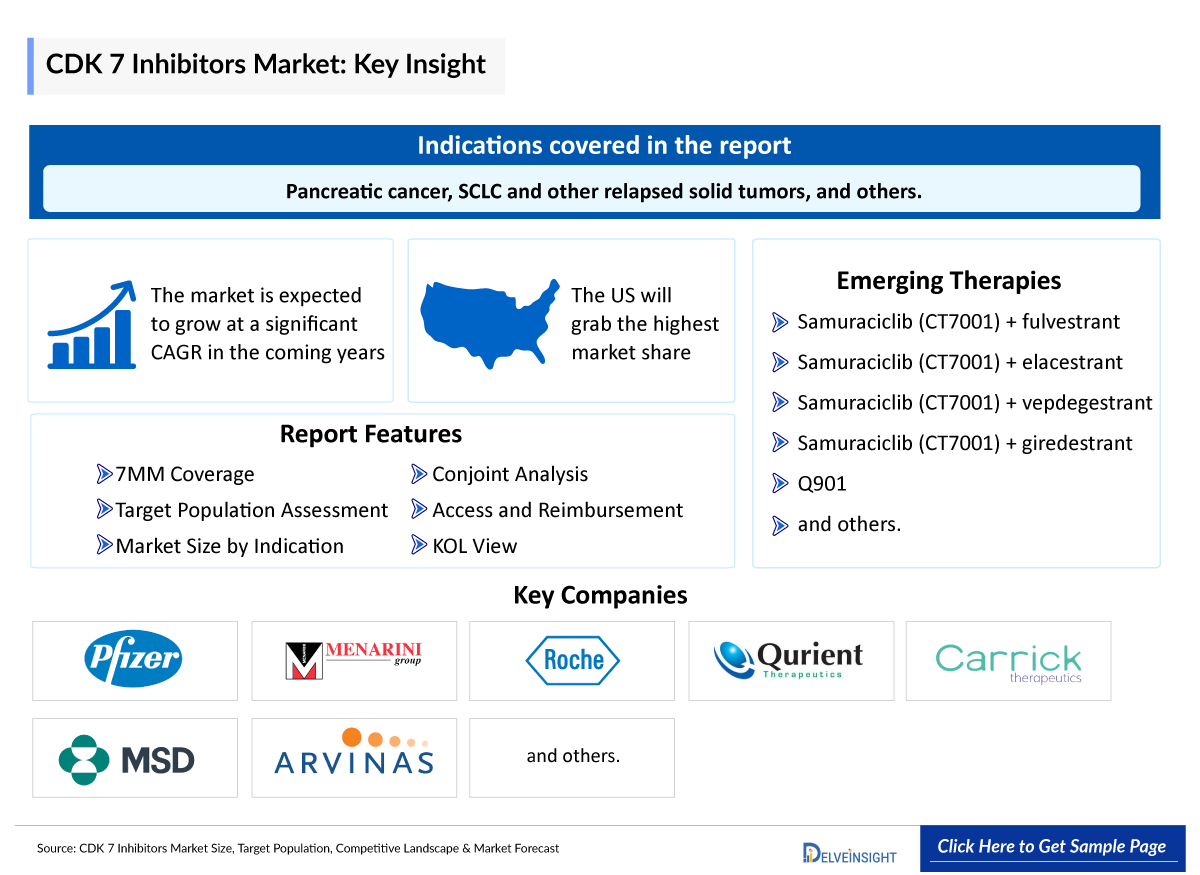

- As per DelveInsight's analysis, the total CDK 7 inhibitors market size in the 7MM is expected to surge significantly by 2034.

- The leading CDK 7 inhibitor Companies such as Carrick, Pfizer, Menarini Group, Roche, Qurient, Merck Sharp & Dohme, Arvinas, Syros Pharmaceuticals, and others are developing novel CDK 7 inhibitors that can be available in the CDK 7 inhibitors market in the coming years.

- Some of the key CDK 7 inhibitors in the pipeline include Samuraciclib (CT7001) + fulvestrant, Samuraciclib (CT7001) + elacestrant, Samuraciclib (CT7001) + vepdegestrant, Samuraciclib (CT7001) + giredestrant, Q901, and others.

- In May 2024, Qurient Therapeutics entered into a cooperative research and development agreement (CRADA) with the US National Cancer Institute (NCI), to evaluate Q901, in combination with an ADC targeting TROP2 for the treatment of SCLC and other relapsed solid tumors.

- In May 2024, interim results from the first-in-human trial of the selective CDK7 inhibitor, Q901, were presented at the American Society of Clinical Oncology (ASCO) annual meeting. The preliminary data from the QRNT-009 study indicated that Q901 is well tolerated, with early signs of antitumor activity and pharmacodynamic effects being promising.

- In April 2024, Syros Pharmaceuticals was granted a patent for compounds that selectively inhibit CDK7, inducing cellular apoptosis and inhibiting transcription of disease-related genes.

- In September 2022, Syros Pharmaceuticals received Orphan Drug Designation for CDK7 inhibitor candidate SY-5609 for the treatment of pancreatic cancer.

Request for unlocking the Sample Page of CDK7 Inhibitors Market

DelveInsight’s “CDK 7 Inhibitors Market Size, Target Population, Competitive Landscape and Market Forecast - 2034” report delivers an in-depth understanding of CDK 7 Inhibitors, addressable patient pool, competitive landscape, and future market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan.

The CDK 7 Inhibitors Market report provides insights around existing treatment practices in patients with CDK 7 Inhibitors, approved (if any) and emerging CDK 7 Inhibitors, market share of individual therapies, patient pool eligible for treatment with CDK 7 Inhibitors, along with current and forecasted 7MM CDK 7 Inhibitors market size from 2020-2034 by therapies and by indication. The CDK 7 Inhibitor market report also covers current unmet needs and challenges while incorporating new classes in treatment paradigm, variations in accessibility and acceptability of new CDK 7 Inhibitors in different geographies, along with insights on CDK 7 Inhibitors pricing reimbursements to curate the best opportunities and assess the CDK 7 Inhibitor market’s potential.

|

Study Period |

2020 to 2034 |

|

Geographies Covered |

|

|

CDK 7 Inhibitors Companies |

|

CDK 7 Inhibitors Market Overview

Cyclin-dependent kinase 7 (CDK7) inhibitors represent a promising class of anticancer agents due to their unique role in regulating the cell cycle and transcription. CDK7 is a key player in the activation of other cyclin-dependent kinases, particularly CDK1, CDK2, CDK4, and CDK6, which are crucial for cell cycle progression. Moreover, CDK7 is involved in the phosphorylation of RNA polymerase II, a process essential for transcription initiation. Inhibition of CDK7 can therefore simultaneously disrupt cell cycle regulation and transcription, leading to potent antitumor effects. This dual impact makes CDK7 inhibitors particularly attractive in cancer therapy, where deregulated cell cycle control and transcription are common.

Research into CDK7 inhibitors has shown significant potential, especially in treating cancers that are resistant to other therapies. These inhibitors have been found to selectively target cancer cells with minimal effects on normal cells, reducing the likelihood of adverse side effects. Notably, CDK7 inhibitors have shown efficacy in preclinical models of various cancers, including breast cancer, leukemia, and neuroblastoma. Ongoing clinical trials aim to establish the safety and efficacy of these inhibitors in humans, with the hope that they will provide a new therapeutic option for patients with difficult-to-treat cancers.

CDK 7 Inhibitors in Clinical Practice

This section will give in depth information about the existing local and systemic options in the current treatment paradigm of all the potential indications, in which most of the pharmaceutical companies are actively evaluating their inhibitors. Potential of the emerging CDK 7 Inhibitors in changing the current clinical practice guidelines is crucial to analyze especially when it comes to real world scenario.

It will also include the relevance and importance of incorporation of biomarker testing at varying stages of the disease. It is also important to understand that implementing such tests in routine clinical practice is not uniform in different countries due to issues such as cost, accessibility, reimbursement and non-recommendation in guidelines.

CDK 7 Inhibitors Drug Chapters

The drug chapter segment of the CDK 7 Inhibitors drugs market report encloses a detailed analysis of marketed therapies and late-stage (Phase III and Phase II) therapies. It also helps understand the CDK 7 Inhibitors clinical trial details, pharmacological action, agreements and collaborations related to CDK 7 Inhibitors, their approval timelines, patent details, advantages and disadvantages, latest news and press releases.

Marketed CDK 7 Inhibitors Drugs

The CDK 7 Inhibitors marketed drug section will provide detailed drug profiles of already approved therapies. Information around clinical development activities, launch timing, regulatory milestones along with safety and efficacy data of the therapy will be included.

Inhibiting CDK7 is a promising approach for cancer therapy because CDK7 controls the transcription of genes that drive cancer, supports uncontrolled cell cycle progression, and contributes to resistance against anti-hormone treatments. Cyclin-dependent kinase 7 (CDK7), together with cyclin H and MAT1, forms the CDK-activating complex (CAK), which regulates the cell cycle by phosphorylating cell cycle CDKs at the T-loop. CAK also plays a role in the general transcription factor TFIIH.

The phosphorylation of RNA polymerase II (Pol II) by CDK7 at active gene promoters enables transcription. Dysregulation of the cell cycle is a well-known feature of cancer, and many cancers exhibit abnormal transcriptional control through various mechanisms. Additionally, CDK7 levels are increased in several types of cancer and correlate with clinical outcomes, indicating a higher reliance on CDK7 activity compared to normal tissues.

Emerging CDK 7 Inhibitors Drugs

Apart from a comprehensive CDK 7 Inhibitors competitive landscape in tabular form, the emerging CDK 7 Inhibitors chapters provides the product details and other development activities of the emerging CDK 7 Inhibitors under the late and mid-stage of clinical development for various indications.

Carrick, Pfizer, Roche, Qurient, Merck Sharp & Dohme, and several other CDK 7 inhibitors companies are currently engaged in the development and production of selective CDK 7 inhibitors, which have the potential to significantly impact and enhance the CDK7i market.

- Samuraciclib: Carrick Therapeutics

Samuraciclib is the most advanced oral CDK7 inhibitor in clinical development. The primary indication for samuraciclib, is HR+, HER2- breast cancer. In addition, it has the potential to treat many other cancer types. Samuraciclib has demonstrated a favorable safety profile and encouraging efficacy in early clinical studies.

The FDA granted Fast Track designation to samuraciclib in combination with fulvestrant for CDK4/6i resistant HR+, HER2- advanced breast cancer and samuraciclib in combination with chemotherapy for the treatment of locally advanced or metastatic triple-negative breast cancer (TNBC).

In December 2023, the company announced that the first patient has been dosed in its Phase IIb clinical trial evaluating the combination of samuraciclib (CT7001) and fulvestrant in women with HR+, HER2- advanced breast cancer previously treated with a CDK4/6 inhibitor.

- Q901: Qurient Therapeutics

Q901 is a highly selective CDK7 inhibitor that disrupts tumor cell division cycle progression and blocks DNA damage repair, resulting in tumor cell apoptosis. The genomic instability triggered by Q901 not only contributes to cell death but also provokes immune surveillance against tumor cells. Q901 is the company’s second oncology drug candidate being developed to treat patients with advanced solid tumors. Q901 demonstrated strong tumor growth inhibition in multiple cancer models including HR+ breast cancer, pancreatic cancer, prostate cancer, ovarian cancer, and small cell lung cancer as a single agent, as well as in combination with other therapies. Q901 in combination with fulvestrant is in a clinical trial for HR+ breast cancer patients who are refractory to CDK4/6 inhibitor and estrogen therapy combination.

A Phase I/II study (NCT05394103) is being conducted at six investigative sites in the US, and approximately 70 patients with advanced solid tumors are scheduled to be enrolled. The primary objectives of the Phase I/II study are to determine the maximum tolerated dose, safety profile, and anticancer efficacy of Q901.

Note: Detailed list will be provided in the final report.

CDK 7 inhibitors Drug Class Insights

The Drug Class Insights section will provide comprehensive information on CDK 7 Inhibitors as a class. This will include a broad overview of the class and its role in treating specific conditions. Insights may cover the historical clinical development of CDK 7 Inhibitors, their mechanism of action, their subtypes and future commercial prospects. Additionally, the section will provide detailed information about current trends, challenges, and future prospects for this class of drugs.

CDK 7 Inhibitors Market Outlook

This section will include details on changing CDK 7 Inhibitors market dynamics post initiation of clinical development activities of the inhibitor. It will also provide a detailed summary and comparison of all the therapies being developed by leading players in this space. This section will highlight the advantages of one therapy over the other after assessment based on parameters such as data availability in the form of safety and efficacy, number of patients enrolled in each trial, and trial’s inclusion criteria. There will be a Key focus on the importance of development and need for the commercial success of these targeted therapies to achieve treatment goals that physicians and patients are looking for. It will also sum up all the early stage players active in this space.

CDK 7 Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential CDK 7 Inhibitors already launched and expected to be launched in the CDK 7 Inhibitors market during 2020–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key CDK 7 Inhibitors manufacturers evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

CDK 7 Inhibitors Pipeline Development Activities

The CDK 7 inhibitors market report provides insights into CDK 7 inhibitors clinical trials within Phase III and Phase II stages. It also analyzes key CDK 7 Inhibitors companies involved in developing targeted therapeutics.

CDK 7 Inhibitors Clinical Trials Activities

The CDK 7 inhibitors market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CDK 7 Inhibitors.

KOL Views on CDK 7 Inhibitors

To keep up with current and future CDK 7 inhibitors market trends, we incorporate Key physicians, Therapy Area Researcher’s, and other Industry Experts’ opinions working in the domain through primary research to fill in the data gaps and validate our secondary research. 25+ Key Opinion Leaders (KOLs) were contacted for insights on CDK 7 Inhibitors’ incorporation in the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along with challenges related to accessibility.

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the cost analysis and existing and evolving treatment landscape.

CDK 7 inhibitors Market Access and Reimbursement

This section will include insights around the standard HTA pricing, recent reformations in 2024 and modifications in reimbursement process in the 7MM. For example, In the United States, a multi payer model exists when it comes to drug pricing regime, which is currently undergoing significant changes, with recent federal legislation, such as the Prescription Drug Pricing Reform provisions of the Inflation Reduction Act, significantly altering the pricing regime under certain federal programs. Whereas in Germany, the market access differs from the systems followed in many other countries as no pricing and reimbursement approval is required during launch of a new therapy.

Moreover, this section will also provide details on reimbursement of approved therapy, if any.

CDK 7 inhibitors Market Report Scope

- The CDK 7 inhibitors market report covers a segment of key events, an executive summary, target patient pool, epidemiology and market forecasts, information around patient journey and varying biomarker testing rates

- Additionally, an all-inclusive account of the current and emerging therapies drug chapters, insights on CDK 7 Inhibitors addressable patient pool

- A detailed review of the CDK 7 Inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, and treatment preferences that help in shaping and driving the 7MM CDK 7 Inhibitors market.

- Market Size of Inhibitors by therapies and indication will be provided

CDK 7 Inhibitors Market Report Key Strengths

- 11 Years CDK 7 Inhibitors Market Forecast

- The 7MM Coverage

- CDK 7 Inhibitors Competitive Landscape of current and emerging therapies

- CDK 7 Inhibitors Total Addressable patient population

- CDK 7 inhibitors Drugs Uptake

- Key CDK 7 inhibitors Market Forecast Assumptions

- Approved and Emerging CDK 7 inhibitors therapy Profiles

- Physician’s perspectives/KOL opinions

- Biomarker testing and Patient journey

- Qualitative Analysis (SWOT and Analyst Views)

- CDK 7 Inhibitors Market Size by therapy

- CDK 7 inhibitors Market size by indication

- Existing and Future CDK 7 inhibitors Market Opportunity

- CDK 7 inhibitors Unmet Needs

FAQs

- What was the CDK 7 Inhibitors market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for CDK 7 Inhibitors market growth?

- Which CDK 7 Inhibitors is going to be the largest contributor by 2034?

- What is the market access and reimbursement scenario of CDK 7 Inhibitors?

- What are the pricing variations among different geographies?

- How would the market drivers, barriers, and future opportunities affect the CDK 7 Inhibitors market dynamics and subsequent analysis of the associated trends?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

Reasons to Buy CDK 7 inhibitors Market Forecast Report

- The CDK 7 inhibitors market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the CDK 7 Inhibitors Market.

- Understand the existing CDK 7 Inhibitors market opportunities and future trends in varying geographies

- Identifying strong upcoming CDK 7 Inhibitors companies in the CDK 7 Inhibitors market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility and acceptability of emerging treatment options along with unmet need of current therapies

- Details on CDK 7 inhibitors market report methodology, top indications covered, market assumptions, patient journey and KOLs to strengthen the pharmaceutical companies’ development and launch strategy.

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs