Dilated Cardiomyopathy Market Summary

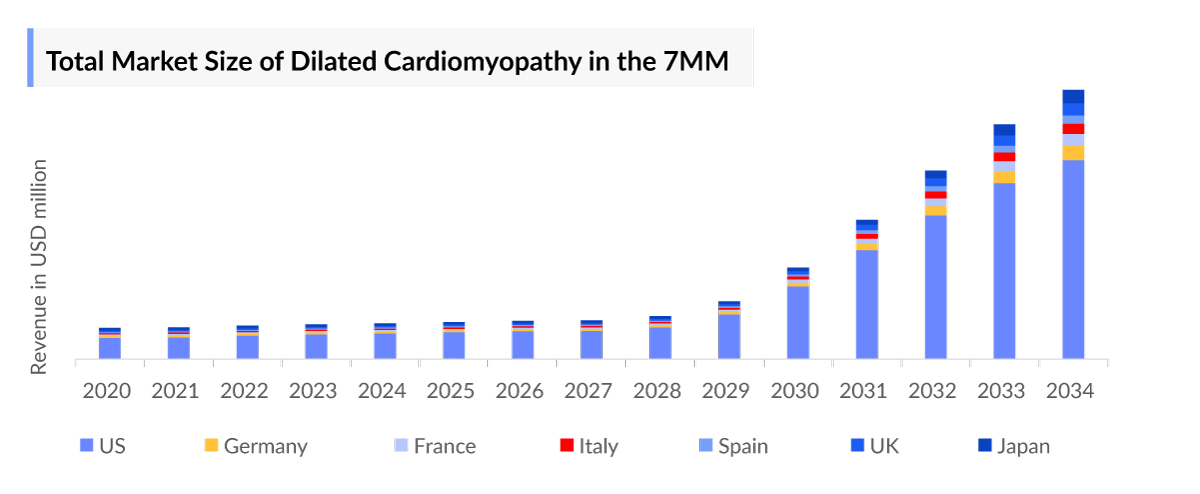

- The total dilated cardiomyopathy market size in the 7MM was approximately USD 463.6 million in 2023 and is projected to increase during the forecast period (2024-2034).

- In 2023, the US had the largest dilated cardiomyopathy market size among the 7MM, accounting for approximately USD 329.4 million. This is expected to increase further by 2034.

- The total dilated cardiomyopathy market size of EU4 and the UK was calculated to be approximately USD 100.0 million in 2023, which was nearly 22% of the total market revenue for the 7MM.

- According to DelveInsight’s estimates, among EU4 and the UK, Germany accounted for the highest dilated cardiomyopathy market with approximately USD 25.6 million in 2023, followed by France with approximately USD 20.8 million in the respective year, and the UK with USD 20.7 million in 2023.

- Dilated Cardiomyopathy companies working in the Dilated Cardiomyopathy market are Bristol Myers Squibb, Berlin Cures, Cumberland Pharmaceuticals, and others.

Dilated Cardiomyopathy Market Insight and Trends

- The dilated cardiomyopathy prevalence has increased in the last decade, due to improvements in disease diagnosis and increased awareness. Further unhealthy life choices like poor diet, lack of exercise, smoking, drug and alcohol abuse, stress, etc increase the risk of developing dilated cardiomyopathy. It is one of the leading causes of heart failure worldwide. When left untreated or poorly managed, can lead to progressive deterioration of heart function, ultimately resulting in heart failure.

- A progressive disease of heart muscle, the most common etiology of dilated cardiomyopathy is idiopathic and without any identifiable cause. It also has a familial or genetic predisposition.

- With noteworthy technological advancements in diagnosing heart-related disorders, the diagnosis is projected to improve further.

- The current dilated cardiomyopathy treatment market involves a combination of medications, lifestyle modifications, and, in some cases, surgical interventions.

- Pacing dilated cardiomyopathy therapies including the use of implantable cardioverter defibrillators (ICD), biventricular pacemakers, and others have been observed. Heart transplantation is a well-established treatment that enhances the quality of life for patients with dilated cardiomyopathy who have severe symptoms, and a poor prognosis. Unfortunately, suitable donor availability is extremely limited.

- Pharmacological therapy includes the use of angiotensin-converting enzyme (ACE) inhibitors or angiotensin II receptor blockers (ARBs), beta-blockers, diuretics, aldosterone antagonists, anticoagulants, and other off-label therapies. These medications help dilate blood vessels, reduce blood pressure, and decrease the workload on the heart. Among the current therapies, the majority of the dilated cardiomyopathy market share was of renin-angiotensin system inhibitors, with USD 146.9 million in 2023, in the 7MM.

- CORLANOR (ivabradine) is the only drug approved by the US FDA for the dilated cardiomyopathy treatment in pediatric patients aged 6 months to 18 years. The lack of FDA-approved dilated cardiomyopathy medications in adults is a significant gap

- The absence of standard regulatory guidelines for the dilated cardiomyopathy treatment makes it difficult for physicians to distinguish dilated cardiomyopathy from other cardiac abnormalities. Novel pharmacological agents that target specific pathways involved in the development and progression of dilated cardiomyopathy, and potentially eliminate the need for long-term maintenance therapy are urgently needed.

- Given the existing high-unmet medical need, new dilated cardiomyopathy therapies are being investigated in the early stage-mid/late stage of development for patients with dilated cardiomyopathy, including Bristol-Myers Squibb Company’s Danicamtiv (MYK-491), Berlin Cures BC007, Cumberland Pharmaceutical’s DYSCORBAN (ifetroban), Rocket Pharmaceutical’s REN-001, Solid Bioscience’s AVB-401, SGT-601, and others. These are anticipated to bring some shuffle in the existing market scenario if approved, as they may provide the much-needed cure for dilated cardiomyopathy.

- Danicamtiv (MYK-491) being developed by Bristol Myers Squibb, is designed to increase the number of myosin-actin cross-bridges formed during cardiac muscle contraction while having minimal impact on diastolic function. It will capture a significant share of the dilated cardiomyopathy market, upon its entry in the year 2027 in the US.

- Various early-phase dilated cardiomyopathy drugs such as AVB-401, SGT-601, and others are based on modified gene therapies that will significantly impact the dilated cardiomyopathy market.

DelveInsight’s “Dilated Cardiomyopathy Market Insights, Epidemiology, and Market Forecast - 2034” report delivers an in-depth understanding of dilated cardiomyopathy, historical and forecasted epidemiology, as well as the dilated cardiomyopathy market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The dilated cardiomyopathy market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM dilated cardiomyopathy market size from 2020 to 2034. The Dilated Cardiomyopathy treatment market report also covers dilated cardiomyopathy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the Dilated Cardiomyopathy market’s potential.

Key Factors Driving the Dilated Cardiomyopathy Market

Rising Dilated Cardiomyopathy Prevalence

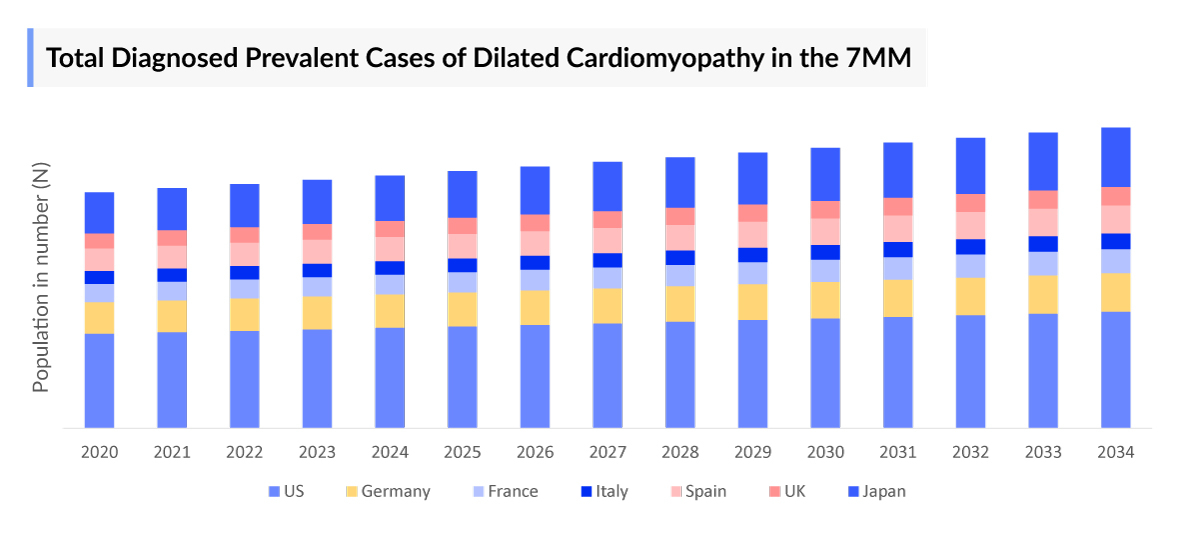

According to DelveInsight’s estimates, the total prevalent cases of dilated cardiomyopathy in the 7MM were estimated to be nearly 3 million cases in 2023. These cases are further expected to increase by 2034.

Advances in Device Therapies for Dilated Cardiomyopathy

Recent advances in device therapies such as ICD, CRT, and surgical interventions have shown significant reductions in mortality and hospitalization rates among dilated cardiomyopathy patients.

Launch of Emerging Dilated Cardiomyopathy Drugs

Various therapies are being developed including Bristol-Myers Squibb Danicamtiv (MYK-491), Berlin Cures BC007, Cumberland Pharmaceutical’s DYSCORBAN (ifetroban), Rocket Pharmaceutical’s REN-001, Solid Bioscience’s AVB-401, SGT-601, and others.

Dilated Cardiomyopathy Treatment Market

Cardiomyopathy is a general term that refers to the disorders of the cardiac muscle that cause mechanical or electrical dysfunction resulting in dilated, hypertrophic, or restrictive pathophysiology. According to the National Organization for Rare Disorders (NORD), dilated cardiomyopathy is a disease of the heart muscle, which primarily affects the heart’s main pumping chamber, the left ventricle.

It is the most common type of cardiomyopathy and typically affects those aged 20-60. The heart muscle has difficulty contracting normally, which can lead to irregular heartbeats (arrhythmia), blood clots, or sudden death. Over time, the heart becomes weaker, and heart failure can occur.

In its early stages, dilated cardiomyopathy may not produce any symptoms. Symptoms may worsen gradually or quickly from asymptomatic to severe heart failure. Some symptoms include shortness of breath during exercise, fatigue, swelling in the legs and other areas, coughing, abnormal heart rhythms, and others. While the exact cause of dilated cardiomyopathy is often unknown (idiopathic), several factors have been identified that may increase the risk of developing the condition. These risk factors can be broadly categorized into genetic, environmental, and lifestyle factors (substance abuse, and chemotherapeutic agents).

Dilated cardiomyopathy diagnosis

A methodical approach is used to diagnose dilated cardiomyopathy to rule out other possible causes of cardiac dysfunction and identify structural and functional abnormalities in the heart. A comprehensive evaluation of medical history, physical examination, imaging tests, and cardiac tests—such as cardiac MRI, ECG, echocardiogram, and blood tests—as well as other tests are performed.

Further details related to country-based variations are provided in the report…

Dilated cardiomyopathy treatment

The dilated cardiomyopathy treatment management and dilated cardiomyopathy treatment market are in concordance with the standard heart failure guidelines. Currently, the dilated cardiomyopathy treatment patterns are mainly dependent on pharmacological therapy, pacing therapy, and surgical options.

ACE inhibitors, beta-blockers, diuretics, and aldosterone antagonists are commonly prescribed to manage symptoms and improve heart function. However, the response to these medications can vary among individuals, and some patients may not achieve adequate improvement with pharmacotherapy alone. Even CRT involving the implantation of a device to coordinate the contractions of the heart's ventricles can be beneficial for some patients, particularly those with conduction abnormalities or dyssynchrony in their heart muscle contraction but not all patients with dilated cardiomyopathy may benefit from CRT, and response rates might vary.

In severe cases of dilated cardiomyopathy, surgical interventions such as heart transplantation may be considered. Heart transplantation remains the gold standard for end-stage dilated cardiomyopathy, but it is limited by donor availability and the need for lifelong immunosuppression.

While existing treatments can alleviate symptoms and improve quality of life, unfortunately, they do not reverse or halt the progression of dilated cardiomyopathy in many cases. Despite these treatment options, some patients may continue to experience disease progression and symptoms that are difficult to manage. Therefore, the goal of treatment for dilated cardiomyopathy is primarily to manage symptoms, slow down disease progression, and improve the patient's quality of life.

Ongoing research is focused on identifying novel therapeutic approaches, including gene therapy, stem cell therapy, and novel pharmacological agents, to improve outcomes for patients with dilated cardiomyopathy. Additionally, optimizing the management of comorbidities such as hypertension, diabetes, and arrhythmias is crucial in the comprehensive care of patients with dilated cardiomyopathy.

Dilated Cardiomyopathy Epidemiology

As the dilated cardiomyopathy market is derived using a patient-based model, the dilated cardiomyopathy epidemiology chapter in the report provides historical as well as forecasted dilated cardiomyopathy epidemiology segmented by total dilated cardiomyopathy prevalence, total diagnosed dilated cardiomyopathy prevalence, gender-specific cases of dilated cardiomyopathy, familial and non-familial cases of dilated cardiomyopathy in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Dilated Cardiomyopathy Epidemiological Analyses and Forecast

- In the 7MM, the total dilated cardiomyopathy prevalence were estimated to be approximately 3,045,174 in 2023, of which the US accounted for around 45%, while EU4 and the UK accounted for nearly 43%, and Japan accounted for approximately 12% of the total dilated cardiomyopathy prevalent cases. These cases are expected to increase by 2034.

- Among the 7MM, the US accounted for nearly 52% of the total diagnosed dilated cardiomyopathy prevalence. These cases are expected to increase during the study period (2020-2034).

- As per DelveInsight analysis, EU4 and the UK accounted for around 402,538 diagnosed prevalent cases of dilated cardiomyopathy in 2023. These cases are expected to change during the forecast period (2024-2034).

- Among the EU4 and the UK, Germany accounted for the highest diagnosed prevalent cases of dilated cardiomyopathy, accounting for nearly 103,096 cases, followed by France and the UK with approximately 83,529, and 83,410, respectively while Spain had the least cases i.e. around 57,806 in 2023.

- According to estimates based on DelveInsight’s epidemiology model, dilated cardiomyopathy exhibits a higher male preponderance than females in the US. Of the total diagnosed prevalent cases in the US, nearly 63% were males and 37% were females, in 2023.

- In the US, there were nearly 194,036 cases due to family history or genetic causes, while other non-familial causes accounted for approximately 360,352 cases in 2023. As per the analysis, these cases are expected to increase by 2034.

- In 2023, among the 7MM, Japan had the second-highest cases of dilated cardiomyopathy, contributing approximately 11% to the total diagnosed prevalent cases of dilated cardiomyopathy.

- As per DelveInsight’s estimates, in Japan, non-familial/other cases and genetic/familial cases of dilated cardiomyopathy accounted for 70% and 30% of the total diagnosed cases of dilated cardiomyopathy respectively in 2023, which are expected to increase by 2034.

Dilated Cardiomyopathy Drugs Analysis

The dilated cardiomyopathy drugs chapter segment of the dilated cardiomyopathy drugs market report encloses a detailed analysis of dilated cardiomyopathy-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the dilated cardiomyopathy clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Dilated Cardiomyopathy Drugs

CORLANOR (ivabradine): Amgen/Les Laboratoires Servier

CORLANOR (ivabradine) is a hyperpolarization-activated cyclic nucleotide-gated channel blocker indicated for the dilated cardiomyopathy treatment of stable symptomatic heart failure due to dilated cardiomyopathy in pediatric patients aged 6 months and older, who are in sinus rhythm with an elevated heart rate. Its mechanism of action involves the inhibition of the IF channels in the sinoatrial node of the heart.

CORLANOR is also approved to reduce the risk of hospitalization for worsening HF in adult patients with stable, symptomatic chronic HF with left ventricular ejection fraction =35%, who are in sinus rhythm with a resting heart rate =70 bpm and either are on maximally tolerated doses of beta-blockers or have a contraindication to beta-blocker use. Moreover, the drug candidate is marketed as PROCORALAN in the EU, for the symptomatic treatment of stable angina and chronic heart failure in patients with elevated heart rates. Additionally, through a collaboration with Servier, Amgen has the rights to commercialize ivabradine in the US.

In April 2019, the US FDA approved the marketing authorization of CORLANOR (ivabradine) for the treatment of stable symptomatic HF due to dilated cardiomyopathy in pediatric patients aged 6 months and older who are in sinus rhythm with an elevated heart rate.

Note: Further marketed drugs and their details will be provided in the report…

Emerging Dilated Cardiomyopathy Drugs

Danicamtiv (MYK-491): Bristol Myers Squibb

Danicamtiv (MYK-491) is an orally administered small molecule designed to increase the number of myosin-actin cross-bridges formed during cardiac muscle contraction while having minimal impact on diastolic function. In the heart, myosin is the motor protein that binds to actin to generate the force and movement of contraction. In patients with dilated cardiomyopathy and systolic heart failure, in which the left ventricle of the heart is too distended and weak to pump blood to meet the body’s needs adequately, MYK-491 is intended to increase myosin-actin engagement, thereby targeting the biomechanical defects underlying disease and improving cardiac contractility.

Currently, the company is conducting a Phase II study in patients with genetically dilated cardiomyopathy. Additionally, danicamtiv is also being investigated in patients with systolic dysfunction and atrial fibrillation.

BC007: Berlin Cures

BC007 is a DNA aptamer-based compound that binds to and eliminates pathogenic autoantibodies directed against the beta-1 adrenoceptor, a receptor belonging to the large family of cell surface receptors known as G-protein coupled receptors (GPCR) that regulate the heart’s rate and contraction strength. Administered via intravenous (IV) route, the drug candidate development is based on the APTACURES platform of GPCR-AAB-binding-aptamers.

In the Phase I study, BC007 was found to be safe, well tolerated, and capable of neutralizing autoantibodies. Following the Phase I study, a Phase IIa study was conducted to assess its impact on patients with fß1-AR-AAb-associated heart failure.

BC007 has completed its Phase IIa trial in patients with dilated cardiomyopathy. Furthermore, based on encouraging data, the company intends to advance the clinical development of BC 007 through a controlled Phase IIb study in heart failure subjects. Additionally, the drug candidate is also being investigated for long COVID syndrome and glaucoma

Note: Further emerging therapies and their detailed assessment will be provided in the final report.

Dilated Cardiomyopathy Drug Class Analysis

Dilated cardiomyopathy is characterized by the enlargement (dilation) of the heart's left ventricle, impairing its ability to pump blood efficiently. Some of the drug classes commonly used in the management of dilated cardiomyopathy include ACE inhibitors, angiotensin receptor blockers, beta-blockers, and others.

Hyperpolarization-activated cyclic nucleotide-gated channels play a crucial role in the generation of pacemaker currents in the sinoatrial node of the heart. These channels, specifically contribute to the IF current, which regulates the spontaneous depolarization of SA node cells, ultimately influencing heart rate in patients with dilated cardiomyopathy. Based on this mechanism of action Amgen’s CORLANOR is US FDA-approved for treating stable symptomatic heart failure due to dilated cardiomyopathy in pediatric patients aged 6 months to 18 years old.

ACE inhibitors or ARB are used in the treatment of heart failure with reduced ejection fraction and are suggested for patients affected with dilated cardiomyopathy. Aldosterone receptor blockade with spironolactone or eplerenone is also recommended in patients with New York Heart Association (NYHA) heart failure class II-IV and systolic dysfunction.

Similarly, beta-blockade with carvedilol, bisoprolol, or long-acting metoprolol is recommended in all patients with heart failure with reduced ejection fraction without any contraindications. The addition of isosorbide dinitrate plus hydralazine also has been shown to increase survival amongst those with advanced disease. In some cases, beta-blockers allow an enlarged heart to become more normal in size. Common beta-blockers include carvedilol, metoprolol, propranolol, and atenolol. Side effects include dizziness, low heart rate, low blood pressure, and, in some cases, fluid retention, fatigue, impaired school performance, and depression.

Furthermore, the choice of anticoagulation drugs depends on how likely it is that a blood clot will form. Less strong anticoagulation medications include aspirin and dipyridamole. Common anti-arrhythmia medications include amiodarone, procainamide, and lidocaine.

Continued in report…

|

Report Metrics |

Details |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2023 to 2034 |

|

CAGR | |

|

Market Size |

USD XX Million in 2023 |

|

Key Dilated Cardiomyopathy Companies |

Pfizer, Capricor Therapeutics, MyoKardia, Cumberland Pharmaceuticals, Berlin Cures, and many others. |

Dilated Cardiomyopathy Market Outlook

Currently, the treatment pattern of dilated cardiomyopathy is mainly dependent on pharmacological therapy, pacing therapy, surgical options, and CORLANOR (ivabradine).

The pharmacological therapies consist of diuretics, inotropic agents, afterload-reducing agents, beta-blockers, anticoagulation medications, and anti-arrhythmia medications. The main diuretics that are prescribed for the treatment are furosemide, spironolactone, bumetanide, and metolazone. Common side effects of diuretics include dehydration and abnormalities in the blood chemistry, particularly potassium loss.

Inotropic agents that are prescribed for the treatment are digoxin, dobutamine, dopamine, epinephrine, norepinephrine, vasopressin, and milrinone. Some afterload reducing medications include angiotensin-converting enzyme inhibitors (ACE inhibitors) such as captopril, enalapril, lisinopril, monopril, angiotensin I blocker such as losartan Losartan and milrinone is an inotropic agent that also relaxes the arteries. Stronger anticoagulation drugs are warfarin, heparin, and enoxaparin; these drugs require careful monitoring with regular blood testing.

The symptom-based therapy of dilated cardiomyopathy includes both non-pharmacological therapy like patient training, reduction of salt and water intake, moderate physical exercises, and pharmacologic approaches with angiotensin-converting enzyme inhibitors (ACE-I)/angiotensin receptor antagonists, ß-blockers, mineralocorticoid antagonists. A patient with symptoms or dilated cardiomyopathy-specific echocardiogram is started on a combination of ACE-I and ß-blocker. A mineralocorticoid antagonist is added, if the patient is still symptomatic and the LVEF stays =35% after 3 months. If the patient is still symptomatic and tolerates higher doses of ACE-I or ARB, the newer combination of sacubitril (neprilysin inhibitor) and valsartan, should be considered. This drug showed significantly reduced risks of mortality and hospitalization due to heart failure compared to enalapril.

Invasive therapies include the implantation of defibrillators, if LVEF remains =35% despite heart failure medication in maximum tolerated doses. Dilated cardiomyopathy and its progression causes dys-synchronous ventricular systolic contraction leading to reduced cardiac contractility. CRT helps to synchronize contraction of the left and right ventricle reducing morbidity, and mortality and improving LVEF. The guidelines recommend CRT implantation in patients with sinus rhythm, LVEF =35%, left bundle branch block, and QRS duration of =150 ms.

Key dilated cardiomyopathy companies Bristol Myers Squibb, Berlin Cures, Cumberland Pharmaceuticals, Rocket Pharmaceuticals, Solid Biosciences, and others are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products to treat dilated cardiomyopathy

- The total dilated cardiomyopathy market size in the 7MM was approximately USD 463.6 million in 2023 and is projected to increase during the forecast period (2024-2034).

- The dilated cardiomyopathy market size in the US was approximately USD 329.4 million in 2023, which is anticipated to increase due to the increasing awareness of the disease and the launch of the emerging dilated cardiomyopathy therapies.

- The total dilated cardiomyopathy market size of EU4 and the UK was calculated to be approximately USD 100.0 million in 2023, which was nearly 22% of the total market revenue for the 7MM.

- According to DelveInsight’s estimates, among EU4 and the UK, Germany accounted for the highest dilated cardiomyopathy market with approximately USD 25.6 million in 2023, followed by France with approximately USD 20.8 million in the respective year, and the UK with USD 20.7 million in 2023.

- According to DelveInsight’s analysis, in the US, among the currently used dilated cardiomyopathy therapies, the majority of the market share was of Renin-angiotensin system inhibitors (RASi) (ACE inhibitors and ARB), with a revenue of approximately USD 94.1 million, in 2023.

- The only US FDA-approved product, Amgen’s CORLANOR (ivabradine), generated the second-highest revenue of USD 90.3 million, in the US, in 2023.

- In 2023, Japan with a revenue of approximately USD 34.2 million, accounted for the second-highest dilated cardiomyopathy market size among the 7MM, which is expected to increase significantly by 2034.

- As the late-stage pipeline for dilated cardiomyopathy is restrictive, among the emerging therapies, danicamtiv (MYK-491) being developed by Bristol-Myers Squibb, is a selective cardiac myosin activator that has an improved LV volume and functioning while maintaining relaxation, will have a first mover advantage and with a potential to change the market dynamics upon its entry in the year 2027 in the US.

- Berlin Cure’s BC007 is a DNA aptamer-based compound that binds to and eliminates pathogenic autoantibodies directed against the beta-1 adrenoceptor, a receptor belonging to the large family of cell surface receptors known as G-protein coupled receptors (GPCR) that regulate the heart’s rate and contraction strength. BC007 is anticipated to generate a market share of USD 4.2 million in its launch year (2028), in the US.

Dilated Cardiomyopathy Drugs Uptake

This section focuses on the uptake rate of dilated cardiomyopathy potential drugs expected to be launched in the market during 2020-2034. For example, Berlin Cures BC007 is expected to enter the US market by 2028 and is projected to have a slow-medium uptake during the forecast period.

Further detailed analysis of emerging therapies drug uptake in the report…

Dilated Cardiomyopathy Clinical Trials Analysis

The dilated cardiomyopathy treatment market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key dilated cardiomyopathy companies involved in developing targeted therapeutics.

Dilated Cardiomyopathy Pipeline activities

The dilated cardiomyopathy treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for dilated cardiomyopathy.

KOL Views on Dilated Cardiomyopathy

To keep up with current Dilated Cardiomyopathy market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on dilated cardiomyopathy evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of Washington, Johns Hopkins University School of Medicine, University Heart Centre Hamburg, Germany, Careggi University Hospital, Italy, and the Royal Brompton Hospital, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or dilated cardiomyopathy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

According to our primary research analysis, various ACE inhibitors, and ARB therapies are available in the market and prescribed for symptomatic relief and managing heart-related complications however, no therapy has yet been approved to address dilated cardiomyopathy in adults. Surgical options, such as heart transplant, are considered the gold standard treatment for end-stage dilated cardiomyopathy when medical therapy is no longer effective and the patient's quality of life is significantly impacted. However, as with any surgical procedure, heart transplantation has potential risks and side effects. For example, the body's immune system may still recognize the transplanted heart as foreign tissue and attempt to reject it.

The current Dilated Cardiomyopathy pipeline contains adeno-associated virus gene therapy therapies, BAG3 protein replacements, and several small molecules that target different pathways in dilated cardiomyopathy. The entry of these drugs will provide different options relating to patient-specific needs based on the severity of dilated cardiomyopathy.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging Dilated Cardiomyopathy therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Dilated Cardiomyopathy Market Access and Reimbursement

The current treatment regime for dilated cardiomyopathy in the US has high costs of treatment that affect the affordability and access of drugs to patients. The reimbursement challenges related to medical care and treatment for individuals with dilated cardiomyopathy can be significant as it often requires specialized medical attention, covering the costs of diagnosis, treatment, and ongoing care.

Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. There is financial assistance available from both governments and pharmaceutical companies to help people who cannot afford the cost of their medications and to expand the coverage.

The CORLANOR (ivabradine) Patient Support Program, launched by the Amgen Safety Net Foundation, a nonprofit patient assistance program sponsored by Amgen, aims to provide qualifying patients with free access to Amgen medications. Eligible commercially insured patients with dilated cardiomyopathy can pay as little as USD 20 per month through the CORLANOR (ivabradine) Copay Card Program.

Similarly, the HealthWell Foundation estimates that patients in the United States will spend an average of USD 2,520 during the 12-month grant period for this disease area. However, the HealthWell fund can assist with premium payments. Medicare supplemental policies can assist with cost-sharing for many aspects of your healthcare, and a HealthWell Foundation grant to cover premiums may be preferable to treatment-specific cost-sharing.

Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Dilated Cardiomyopathy Market Report

- The Dilated Cardiomyopathy treatment market report covers a segment of key events, an executive summary, and a descriptive overview of dilated cardiomyopathy, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging Dilated Cardiomyopathy therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the dilated cardiomyopathy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Dilated Cardiomyopathy treatment market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM dilated cardiomyopathy market.

Dilated cardiomyopathy Market report insights

- Dilated Cardiomyopathy Patient Population

- Therapeutic Approaches

- Dilated Cardiomyopathy Pipeline Analysis

- Dilated Cardiomyopathy Market Size

- Dilated Cardiomyopathy Marketg Trends

- Existing and Future Market Opportunity

Dilated cardiomyopathy Market report key strengths

- 11 years Forecast

- The 7MM Coverage

- Dilated Cardiomyopathy Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Dilated Cardiomyopathy Drugs Uptake

- Key Dilated Cardiomyopathy Market Forecast Assumptions

Dilated cardiomyopathy Market report assessment

- Current Treatment Practices

- Dilated Cardiomyopathy Unmet Needs

- Dilated Cardiomyopathy Pipeline Product Profiles

- Dilated Cardiomyopathy Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions covered in the Dilated cardiomyopathy Market Report

Dilated Cardiomyopathy Market Insights

- What was the total Dilated Cardiomyopathy market size, the market size of dilated cardiomyopathy by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will danicamtiv (MYK-491), and BC 007 affect the treatment paradigm of dilated cardiomyopathy?

- How will danicamtiv (MYK-491) compete with other upcoming products and marketed Dilated Cardiomyopathytherapies?

- Which Dilated Cardiomyopathy drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed Dilated Cardiomyopathy therapies?

- How would future opportunities affect the Dilated Cardiomyopathy market dynamics and subsequent analysis of the associated trends?

Dilated Cardiomyopathy Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of dilated cardiomyopathy? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to dilated cardiomyopathy?

- What is the historical and forecasted dilated cardiomyopathy patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent dilated cardiomyopathy population during the forecast period (2024-2034)?

- What factors are contributing to the growth of dilated cardiomyopathy cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of dilated cardiomyopathy? What are the current clinical and treatment guidelines for treating dilated cardiomyopathy?

- How many Dilated Cardiomyopathy companies are developing therapies for the treatment of dilated cardiomyopathy?

- How many emerging Dilated Cardiomyopathy therapies are in the mid-stage and late stage of development for treating dilated cardiomyopathy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved Dilated Cardiomyopathy therapy in the US?

- What is the 7MM historical and forecasted Dilated Cardiomyopathy treatment market?

Reasons to Buy Dilated cardiomyopathy Market

- The Dilated Cardiomyopathy treatment market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the dilated cardiomyopathy market.

- Insights on patient burden/Dilated Cardiomyopathy prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Dilated Cardiomyopathy market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current Dilated Cardiomyopathy patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming Dilated Cardiomyopathy companies in the Dilated Cardiomyopathy market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging Dilated Cardiomyopathy therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for dilated cardiomyopathy, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.Detailed insights on the unmet needs of the existing market so that the upcoming Dilated Cardiomyopathy companies can strengthen their development and launch strategy.

Get access to our trending blogs:

.jpg)