Medical Tourism Trends in 2025: What’s New and What’s Next

Jul 16, 2025

Table of Contents

Medical tourism is rapidly transforming the global healthcare landscape, as more patients cross borders in search of affordable, high-quality treatments and timely care. Driven by the promise of advanced treatments, reduced costs, and shorter wait times, millions seek medical care in countries offering specialized services. Leading destinations like Thailand, India, and Turkey have established themselves as hubs for procedures ranging from cosmetic surgeries to complex treatments, while emerging medical tourism markets are gaining traction. Advances in technology, such as telemedicine and AI diagnostics, are enhancing the patient experience, and the pharmaceutical industry’s innovations are making cutting-edge therapies more accessible abroad. This blog explores the key trends, technologies, and destinations shaping medical tourism and health tourism in 2025 and what lies ahead for this rapidly evolving sector.

What Is Medical Tourism and Why Is It Skyrocketing in 2025?

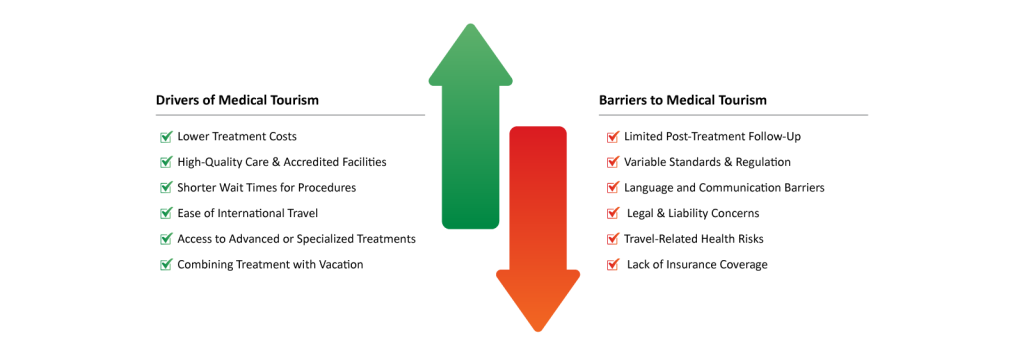

Medical tourism—also known as health tourism—is the practice of traveling to another country to receive medical care, ranging from essential surgeries to elective procedures and wellness treatments. In 2025, this global phenomenon is skyrocketing as patients seek better value, faster access, and cutting-edge care beyond their national borders. With rising healthcare costs, limited availability of specialized treatments, and long waiting lists in many countries, medical tourism has become a viable, and often preferable, option for those prioritizing both quality and affordability. The surge is fueled by several key drivers explained below:

Downloads

Click Here To Get the Article in PDF

Cost Savings: One of the primary reasons patients seek treatment abroad is the significant cost advantage. Procedures such as cardiac surgery, cosmetic enhancements, and dental work are often far less expensive in countries like Thailand, India, and Turkey compared to Western nations. These savings, even when factoring in travel and accommodation, allow patients to access high-quality care at a fraction of the cost, appealing to both insured and uninsured individuals.

Access to Advanced Treatments: Medical tourism hubs are increasingly recognized for offering cutting-edge procedures and therapies that may not be widely available or approved in patients’ home countries. From robotic surgeries to innovative cancer treatments, destinations like South Korea and Singapore provide access to state-of-the-art medical technology and highly trained specialists. The pharmaceutical industry’s role in developing novel therapies, such as targeted drugs and regenerative treatments, further enhances the appeal of these destinations.

Shorter Wait Times: Long waiting periods for elective and specialized procedures in countries with overburdened healthcare systems drive patients to seek faster care abroad. Nations with robust medical tourism infrastructures, such as Malaysia and Mexico, have streamlined processes to accommodate international patients, offering consultations and treatments with minimal delays. This efficiency is particularly critical for time-sensitive conditions, making medical tourism a practical solution.

Globalization’s Role: The rise of globalization has facilitated this boom by improving access to information and travel. Patients can easily research accredited hospitals, compare treatment options, and book services through medical tourism online platforms and medical tourism facilitators. Improved international travel infrastructure and relaxed visa policies, such as extended medical visas in certain countries, further simplify the process. Additionally, partnerships between hospitals, travel agencies, and insurance providers are creating seamless experiences for patients, driving the industry’s expansion.

In 2025, cost efficiency, advanced care, reduced wait times, and global connectivity are fueling the unprecedented growth of medical tourism. As more patients embrace the opportunity to combine quality healthcare with international travel, the industry continues to redefine access to medical services worldwide.

Top Destinations Redefining Medical Tourism

Medical tourism in 2025 is defined by a select group of countries that combine advanced healthcare, affordability, and strategic infrastructure to attract international patients. Established leaders like Thailand, India, and Turkey continue to dominate, while emerging hubs such as Brazil, the UAE, and South Korea are gaining prominence. The Asia-Pacific region, in particular, stands out as a global powerhouse, driven by its robust healthcare systems and patient-centric services.

Thailand, India, and Turkey: The Reigning Champions

Renowned for their world-class care, affordable treatments, and advanced medical infrastructure, leading destinations in medical tourism include Thailand, India, and Turkey, each excelling in areas like cosmetic surgery, cardiac care, and wellness therapies. Its hospitals, accredited by international bodies, offer comprehensive packages that include medical procedures, accommodation, and travel assistance, attracting patients from the Middle East, Europe, and North America.

India excels in complex procedures like cardiac surgeries, organ transplants, and oncology, supported by a network of internationally accredited hospitals and English-speaking medical professionals. The country’s integration of traditional therapies, such as Ayurveda, adds a unique appeal for wellness-focused travelers. In May 2025, the Government of India announced plans to launch a unified digital portal for medical tourism, aiming to streamline patient journeys and position India as a leading destination for medical value travel.

Turkey has emerged as a hub for cosmetic procedures, hair transplants, and dental care, leveraging its strategic location between Europe and Asia to draw patients from both regions. Its modern facilities and competitive pricing make it a top choice for elective surgeries. Similarly, Indonesia is strengthening its position through government initiatives, with an April 2024 announcement highlighting a multi-sectoral approach to boost medical tourism by fostering collaboration among stakeholders to overcome challenges and capitalize on opportunities.

Emerging Hubs: Brazil, UAE, and South Korea’s Rising Influence

Brazil, the UAE, and South Korea are rapidly gaining traction as medical tourism destinations. Brazil has carved a niche in cosmetic and dental procedures, particularly for North American patients seeking affordable alternatives to high-cost treatments at home. Its reputation for procedures like the Brazilian Butt Lift, combined with modern clinics, is driving growth. The UAE, particularly Dubai and Abu Dhabi, is emerging as a premium destination, offering advanced treatments in oncology, orthopedics, and fertility, paired with luxury wellness experiences.

In 2018, the Department of Health Abu Dhabi and the Department of Culture and Tourism – Abu Dhabi launched the Abu Dhabi Medical Tourism e-portal, providing access to 40 healthcare facilities, over 287 medical treatment packages, and services like medical tourism insurance, visa issuance, and appointment booking. South Korea is a rising star in cosmetic and reconstructive surgeries, with a focus on facial contouring and anti-aging treatments, backed by government initiatives and cutting-edge technology.

Additionally, efforts to link healthcare with insurance systems are boosting growth. For instance, in 2020, India’s Union Minister of State for Culture & Tourism planned to establish a working group to connect Indian hospitals, wellness centers, and Ayurveda clinics with foreign medical tourism insurance firms, enhancing medical tourism’s appeal. These developments position Brazil, the UAE, and South Korea as key players in the evolving medical tourism landscape.

Why Asia-Pacific Leads the Medical Tourism Market Share

According to DelveInsight, the Asia-Pacific region held a major share of the medical tourism market in 2021 and is expected to maintain its dominance during the forecast period (2025-2032). This leadership is driven by improvements in healthcare infrastructure, access to high-quality services, and the adoption of advanced medical devices. Countries like Singapore, Japan, and India ranked among the top 10 in the 2020 Medical Tourism Index, reflecting their appeal to international patients. The region’s emphasis on hospitality and streamlined administrative processes, such as simplified visa procedures, attracts patients from across the globe. For example, in April 2022, the Government of India launched the Ayush visa under the ‘Heal in India’ program to promote medical tourism in traditional medicine, further boosting the region’s attractiveness.

Cost-effectiveness is a significant factor, with procedures like coronary angioplasty in Malaysia ranging from USD 4,200 to USD 10,000, compared to USD 28,000 to USD 30,000 in the United States. This affordability, combined with high-quality care, draws substantial patient volumes. For instance, the Malaysia Tourism Promotion Board reported that Malaysia welcomed 1.3 million medical tourists in 2019, a significant increase from 643,000 in 2011. Government initiatives also play a critical role. Policies promoting medical tourism, such as Thailand’s extended medical visas and India’s digital portal initiatives, enhance accessibility. These factors—advanced infrastructure, affordability, and supportive policies—position Asia-Pacific as the global leader in medical tourism, with continued growth expected in 2025 and beyond.

Leading providers like Apollo Hospitals Enterprise Ltd., Fortis Healthcare, Samitivej PCL, KPJ Healthcare Berhad, Prince Court Medical Centre, Medanta The Medicity, Wockhardt Hospitals, Metro Group of Hospitals, Penang Adventist Hospital, Zulekha Healthcare, Asian Institute of Medical Sciences, Hospital CMQ, San Javier Hospital, Médica Sur, Kameda Medical Center, Universal Hospital, Cocoona Centre for Aesthetic Transformation, Fakih IVF Fertility Centre, 97.7 B&H Hospital, BLK-MAX Super Specialty Hospital, and others drive health tourism with world-class care and specialized services.

Cutting-Edge Treatments Fueling the Journey

Medical tourism in 2025 is driven by access to advanced treatments that combine innovation, affordability, and expertise. Health tourism hubs like Thailand, India, and Turkey offer procedures that attract patients seeking high-quality care at lower costs, from cosmetic surgeries to specialized treatments and pharmaceutical breakthroughs.

Cosmetic Surgery’s Dominance: Rhinoplasty, Liposuction, and Beyond

Cosmetic procedures remain a cornerstone of medical tourism, with rhinoplasty, liposuction, and breast augmentation leading the demand. Countries like Turkey and Thailand excel in these surgeries, offering internationally accredited facilities and skilled surgeons at competitive prices. Patients are drawn to health tourism destinations for their ability to provide aesthetic enhancements alongside recovery in appealing settings, making cosmetic surgery a key driver of medical tourism growth.

The Rise of Specialized Procedures: Organ Transplants, Oncology, and Fertility Treatments

Specialized treatments are gaining prominence in medical tourism, addressing complex health needs. India is a leader in organ transplants, such as liver and kidney procedures, supported by advanced hospitals and cost-effective care. Oncology services, including targeted cancer therapies, are thriving in Singapore and South Korea, where cutting-edge facilities attract international patients. Fertility treatments, like IVF, draw patients to Malaysia and Thailand due to high success rates and affordability, further solidifying medical tourism’s appeal for specialized care.

Breakthrough Therapies: How Pharma Innovations are Reshaping Medical Travel

The pharmaceutical industry’s advancements are transforming health tourism by making novel therapies accessible abroad. Targeted drugs and regenerative treatments, such as stem cell therapies, are offered in countries like India and South Korea at lower costs than in Western medical tourism markets. These breakthroughs, often unavailable or unapproved in patients’ home countries, drive medical tourism by providing access to innovative care, enhancing outcomes for international patients.

Technology as the Game-Changer

In 2025, technology is revolutionizing medical tourism, streamlining processes and enhancing patient experiences. From AI diagnostics to digital health records, these advancements make health tourism more efficient and accessible, attracting patients to leading medical tourism destinations.

AI-driven Diagnostics and Personalized Treatment Plans

Artificial intelligence is reshaping medical tourism by enabling precise diagnostics and tailored treatment plans. Hospitals in Singapore and the UAE utilize AI to analyze medical data, thereby improving accuracy in areas such as oncology and cardiology. Personalized treatment plans, designed using AI, enhance patient outcomes, making health tourism destinations more appealing for those seeking customized care.

Discover how AI is transforming diagnostics in healthcare—click here to learn more.

Telemedicine and Virtual Consultations

Telemedicine is a cornerstone of medical tourism, allowing patients to consult with specialists remotely before traveling. Virtual consultations, offered by hospitals in India and Thailand, simplify pre-treatment planning and follow-up care. This technology reduces barriers for international patients, enhancing the efficiency and convenience of health tourism.

Digital Health Records

Digital health records (DHRs) are critical for seamless medical tourism experiences. Countries like Malaysia and South Korea implement DHRs to share patient data securely across borders, ensuring continuity of care. This technology allows medical tourism providers to coordinate treatments effectively, building trust and supporting patients throughout their health tourism journey.

The Pharma and Wellness Connection

Medical tourism in 2025 is propelled by cutting-edge pharmaceuticals and the rise of wellness tourism, positioning Malaysia and Thailand as global leaders in health tourism. These countries offer innovative drugs, cost-effective treatments, and holistic wellness programs, supported by government initiatives and advanced healthcare systems, attracting patients seeking both medical and rejuvenative care.

Access to Breakthrough Drugs and Cost-Effective Generics/Biosimilars

Pharmaceutical innovations are a key driver of medical tourism, with Malaysia and Thailand providing access to breakthrough drugs and affordable generics, and biosimilars. In Malaysia, the National Pharmaceutical Regulatory Agency (NPRA) approved new biosimilars for oncology and autoimmune diseases in 2024, such as trastuzumab for breast cancer, offered at 40–60% lower costs than in Western markets.

Thailand’s Government Pharmaceutical Organization (GPO) launched a 2025 initiative to produce generics for novel hepatitis C and diabetes therapies, reducing costs by up to 70% compared to the U.S. For example, a course of sofosbuvir-based treatment in Thailand costs approximately USD 1,000, versus USD 80,000 in the U.S. These savings, combined with stringent regulatory oversight, draw health tourism patients seeking advanced treatments at accessible prices. Hospitals like Prince Court Medical Centre in Malaysia emphasize these cost-effective options, enhancing medical tourism’s appeal for chronic disease management.

Wellness Tourism: Holistic and Anti-Aging Treatments

Wellness tourism is transforming health tourism by offering holistic and anti-aging treatments that combine medical expertise with relaxation. In Thailand, hospitals like Samitivej Sukhumvit introduced integrative medicine programs in 2024, blending acupuncture, naturopathy, and platelet-rich plasma (PRP) therapies for skin rejuvenation, attracting patients from Europe and the Middle East. Malaysia’s Gleneagles Hospital launched a regenerative wellness clinic in early 2025, focusing on non-invasive anti-aging treatments like peptide therapies, which promote cellular repair. These programs, often unavailable or prohibitively expensive in patients’ home countries, cater to health tourism’s growing demand for preventive and aesthetic care, enhancing recovery in serene environments.

Malaysia and Thailand’s Wellness Hubs

Malaysia and Thailand solidify their status as wellness hubs through strategic investments and specialized offerings. Malaysia’s Healthcare Travel Council (MHTC) expanded its wellness tourism campaign in 2024, promoting Penang and Melaka as destinations for medical check-ups paired with spa retreats, drawing 30% more Indonesian and Middle Eastern patients than in 2023. Thailand’s Ministry of Public Health partnered with private hospitals in 2025 to certify 20 new wellness centers, offering yoga, meditation, and detoxification alongside medical procedures. For instance, Chiva-Som in Hua Hin provides tailored wellness packages with dietary therapy and stress management, serving over 10,000 international patients annually. These initiatives, supported by cultural compatibility and affordable pricing, position Malaysia and Thailand as premier health tourism destinations in 2025.

Future Trends and Challenges

Medical tourism in 2025 stands at a crossroads of innovation and opportunity, propelled by dynamic drivers and tempered by persistent challenges. Health tourism is evolving as governments, healthcare providers, and patients embrace cutting-edge technologies and personalized care, while addressing barriers to ensure seamless experiences. Travelers seek tailored solutions, supported by robust policies and digital platforms, shaping the future of global healthcare.

Government and Industry Support: Policies and Partnerships

Government initiatives and strategic partnerships are accelerating medical tourism’s growth. In 2024, Singapore’s Ministry of Health launched a USD 50 million fund to enhance medical tourism infrastructure, focusing on robotic surgery and pediatric care, attracting over 500,000 international patients annually. Malaysia’s government partnered with private hospitals in 2025 to offer integrated wellness packages, boosting patient inflows by 25% from Southeast Asia. These policies, alongside collaborations like Singapore’s Raffles Hospital with global insurers to streamline cross-border care, create a robust ecosystem for health tourism, ensuring accessibility and quality.

Patient-Centric Trends: Personalized Care and Facilitators

Travelers in 2025 prioritize personalized care and senior-friendly services, driving demand for tailored health tourism experiences. Facilitators like My 1Health simplify logistics, coordinating visas, accommodations, and multilingual support, with a reported 30% increase in patient satisfaction for UAE and Indian hospitals.

Medical tourism online platforms, showcasing patient testimonials and virtual tours of facilities like Turkey’s Liv Hospital, influence 40% of medical tourists’ decisions, emphasizing trust and transparency. These trends reflect a shift toward patient-empowered medical tourism, prioritizing comfort and cultural sensitivity.

Opportunities and Challenges: AI, Precision Medicine, and Regulatory Hurdles

The global medical tourism market, valued at USD 31,176.14 million in 2023, is projected to reach USD 58,216.94 million by 2032, growing at a CAGR of 11.04%, driven by high treatment costs in developed countries. Advancements in AI, precision medicine, and in silico trials further fuel health tourism’s growth. In 2024, South Korea’s Severance Hospital introduced AI-driven genetic profiling for cancer treatments, drawing 20% more international patients.

However, challenges like ensuring follow-up care across borders persist, with 26% of patients facing continuity issues. The U.S. Inflation Reduction Act, capping drug prices in 2025, may push more Americans to seek affordable treatments abroad, but regulatory disparities complicate care standards. Health tourism providers are addressing these by adopting digital health records and telemedicine, ensuring seamless post-treatment support.

Conclusion

Medical tourism in 2025 is a vibrant tapestry of innovation, accessibility, and patient empowerment. From Asia-Pacific’s cost-effective hubs to emerging destinations like the UAE, health tourism thrives on advanced treatments, wellness integration, and supportive policies. Technologies like AI and telemedicine, alongside facilitators like My 1Health, are redefining patient experiences, while governments bolster infrastructure to meet rising demand. Yet, challenges like follow-up care and regulatory gaps demand strategic solutions. As medical tourism evolves, it promises not just healing but a global journey toward health, blending cutting-edge care with cultural immersion, poised to reshape healthcare in the future.

FAQs

Leading destinations such as Thailand, India, and Turkey have established themselves as hubs for procedures ranging from cosmetic surgeries to complex medical treatments. Emerging medical tourism markets such as Brazil, the UAE, and South Korea are gaining traction, with the Asia-Pacific region standing out as a global powerhouse.

Cutting-edge pharmaceuticals and the growing trend of wellness tourism drive medical tourism in 2025. Countries like Malaysia and Thailand offer innovative drugs, cost-effective treatments, and holistic wellness programs, supported by government initiatives and advanced healthcare systems.

Challenges include ensuring continuity of care across borders, with 26% of patients facing follow-up care issues. Regulatory disparities complicate care standards, and health tourism providers are addressing these by adopting digital health records and telemedicine to ensure seamless post-treatment support.

The global medical tourism market, valued at USD 31 billion in 2023, is projected to reach USD 58 billion by 2032, growing at a CAGR of 11.04%, driven by high treatment costs in developed countries.

Downloads

Article in PDF

Recent Articles

- Alzeimer’s drug; Guardant Health receives approval; First Patient Dosed in Phase 1 Clinical Trial...

- Smart Inhalers: Redefining Respiratory Care with Technology and Data

- Notizia

- Types of Mitochondrial Diseases and the Science Behind Them: A Journey from Dysfunction to Discovery

- Nonalcoholic Steatohepatitis (NASH): A Growing Epidemic