Limited Refractory Chronic Cough Treatment Landscape: LYFNUA Approval Restricted to Europe and Japan

Dec 12, 2025

Table of Contents

Refractory chronic cough (RCC) is characterized by ongoing coughing that persists even after comprehensive evaluation and appropriate management of all identifiable underlying causes, pointing to an underlying neurogenic cough hypersensitivity. It is clinically distinct from other forms of chronic cough, and diagnosis is established by exclusion, using tools such as spirometry, FeNO testing, chest imaging, nasendoscopy, and reflux assessments to eliminate treatable drivers and confirm a persistent hypersensitivity-mediated cough.

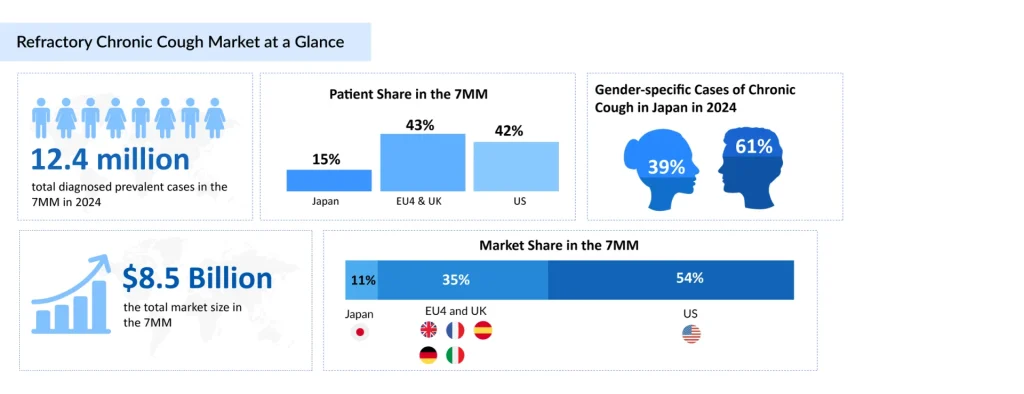

More than 6 million RCC patients across the leading markets (the US, EU4, the UK, and Japan) were estimated in 2024 to have RCC lasting over one year, underscoring the substantial chronic patient population and the growing clinical acknowledgment of long-term, treatment-resistant cough driven by cough hypersensitivity, according to DelveInsight.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Chronic Refractory Cough Market landscape: A new approach to treating cough

- Chronic Refractory Cough Market and the Monopoly of the Over-The-Counter Drugs

- Merck; Bayer; Shionogi set to showcase their candidates indicated for Chronic RefractoryCough in ...

- Will Merck’s P2X3 Receptor Antagonist for Chronic Refractory Cough Treatment Be Able to Turn FDA’...

In the US, females are susceptible to chronic cough, due to various factors such as anatomical differences in airway pipes, and heightened sensitivity to environmental triggers. The rising cases of asthma and GERD in the US, coupled with increasing environmental pollution, are major contributors to the growing burden of chronic cough that significantly impacts the quality of life.

RCC Treatment Gap Persists in the U.S. Despite LYFNUA Approvals Abroad

RCC management relies on medications aimed at reducing neural sensitization, including neuromodulators such as opioids (e.g., morphine, codeine, tramadol), gabapentin, pregabalin, amitriptyline, and baclofen. Additional therapeutic options include proton pump inhibitors, inhaled corticosteroids, and antitussive agents. These approaches focus on mitigating the heightened neural sensitivity that underlies the pathophysiology of RCC.

LYFNUA (Gefapixant, MK-7264) represents the first selective P2X3 receptor antagonist approved for RCC treatment. Developed through collaboration between Merck and Kyorin Pharmaceuticals, gefapixant received approval in Japan in January 2022 and in the European Union in September 2023. The drug works by blocking P2X3 receptors located on sensory C-fibers in the airway, thereby reducing the hypersensitization that triggers persistent cough.

However, gefapixant’s clinical trajectory demonstrates important lessons regarding the complexity of RCC treatment. Despite approval in these regions, gefapixant has faced significant uptake challenges, primarily due to tolerability issues. Notably, dysgeusia (distortion of taste) has emerged as a significant adverse effect, occurring in a substantial proportion of treated patients. This tolerability barrier highlights the need for more effective and better-tolerated therapeutic options.

In December 2023, the FDA issued a Complete Response Letter (CRL) for gefapixant, stating that the available data may not adequately demonstrate clinically meaningful benefit despite statistically significant reductions in cough frequency observed in clinical trials. The FDA emphasized the importance of demonstrating improvements in patient-reported outcomes such as quality of life and symptom relief, not merely objective measures of cough reduction. Currently, no FDA-approved therapy exists for RCC in the United States, representing a significant unmet need.

Pipeline Candidates in Development for RCC Treatment

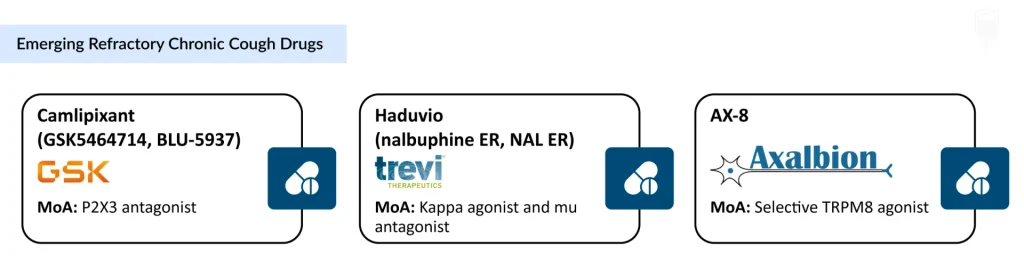

The RCC clinical trial landscape remains relatively limited, with only three emerging therapies, including camlipixant (GSK5464714, BLU-5937), haduvio (nalbuphine ER), and AX-8, advancing through development. This narrow pool of candidates highlights the slow pace of innovation in a condition with significant unmet need, even as these agents signal meaningful momentum toward targeted, mechanism-driven treatment.

Camlipixant (GSK5464714) represents another P2X3 receptor antagonist currently in advanced development by GlaxoSmithKline. An orally available, highly selective small-molecule antagonist, camlipixant, is currently undergoing evaluation in two pivotal Phase III trials: CALM-I and CALM-II. The primary endpoint in both trials is the 24-hour cough frequency change from baseline, assessed at Week 12 in CALM-I and Week 24 in CALM-II. Topline results from the Phase III program are expected in the second half of 2025, with potential regulatory submissions and approvals anticipated in the second half of 2026. GSK’s commitment to this therapeutic area was underscored by its acquisition of Bellus Health in April 2023 for approximately $2.0 billion USD ($14.75 per share), with the transaction finalized in June 2023.

Haduvio (Nalbuphine ER), developed by Trevi Therapeutics, offers a distinct mechanism of action with potentially broader therapeutic applications. Haduvio possesses a dual mechanism: it acts as an agonist (activator) to the kappa opioid receptor while simultaneously acting as an antagonist (blocker) to the mu opioid receptor. This unique profile allows the drug to modulate cough signals both centrally and peripherally, potentially providing efficacy regardless of whether the initial cough trigger originates in the lung or the central nervous system.

In March 2025, Trevi Therapeutics reported positive topline results from the Phase IIa RIVER trial evaluating haduvio oral nalbuphine ER in patients with refractory chronic cough (N=66). The trial met its primary endpoint, demonstrating a 67% reduction in 24-hour cough frequency from baseline and a 57% placebo-adjusted reduction (p < 0.0001). Additionally, in May 2025, further analyses from the Phase IIa trial were presented at the American Thoracic Society meeting. These positive outcomes provided the rationale for commencing a Phase IIb study in refractory chronic cough in early 2026.

AX-8 is a selective oral TRPM8 agonist in development for chronic cough, designed to activate TRPM8-expressing sensory fibers in the upper airways to normalize hypersensitivity, reduce cough, and throat irritation. The approach builds on two decades of evidence linking TRPM8 activation to modulation of sensory dysfunction across neuropathic and inflammatory pathways. In August 2024, Axalbion began dosing in the second part of its Phase II randomized, placebo-controlled trial in patients with chronic cough and moderate-to-severe throat discomfort, supported by secured funding to advance toward Phase III readiness.

The anticipated launch of these emerging therapies are poised to transform the refractory chronic cough treatment market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the refractory chronic cough market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

Recent Developments in the Refractory Chronic Cough Treatment Landscape

- In October 2025, Trevi Therapeutics presented an oral presentation and supporting abstracts at the CHEST 2025 Annual Meeting, including a poster highlighting patient-reported outcomes from the Phase IIa RIVER trial evaluating nalbuphine ER in RCC.

- In September 2025, Trevi Therapeutics presented Phase IIa RIVER trial data in RCC across two posters at the ERS Congress in Amsterdam.

- In September 2025, GSK presented several posters at the ERS Congress, including one focused on camlipixant and RCC, addressing awareness and understanding challenges among the US healthcare professionals.

- In May 2025, GSK shared new analyses at ATS supporting camlipixant development in RCC, including a model-based dose-response meta-analysis assessing reductions in taste-related side effects associated with the P2X3 class.

What Lies Ahead in RCC Therapeutic Space?

The RCC treatment market is entering a phase of accelerated expansion driven by advances in clinical understanding, diagnostics, and therapeutic innovation. The refractory chronic cough market reflects this transformation in its economic trajectory. In the US, market size exceeded USD 4.6 billion in 2024 and is expected to expand further with the launch of novel neurobiology-focused treatments.

Increasing recognition that cough reflex hypersensitivity, rather than persistent airway inflammation—is the primary driver of RCC, coupled with heightened awareness of its psychosocial impact, is widening the pool of patients who can benefit from targeted treatment.

Despite broad use of PPIs, inhaled corticosteroids, bronchodilators, neuromodulators, and opioid-based suppressants, current management remains largely empirical and symptomatic. Relief is often partial or inconsistent, and many patients are exposed to significant polypharmacy without durable benefit.

A new class of mechanism-based therapies is now poised to redefine the treatment paradigm. Camlipixant addresses peripheral sensory nerve hypersensitivity through selective P2X3 antagonism; Haduvio modulates both central and peripheral mechanisms via dual KAMA activity; and AX-8 recalibrates upper-airway sensory pathways through TRPM8 activation. By directly correcting the neural dysregulation underlying RCC, these agents represent a shift from symptom suppression to targeted, biology-driven intervention.

Supported by strong R&D momentum, evolving clinical guidelines, and growing real-world evidence of unmet need, RCC is transitioning into a mechanistic era—one defined by precision therapies designed to deliver sustained symptom control and meaningful improvements in patient quality of life.

Downloads

Article in PDF

Recent Articles

- Chronic Refractory Cough Market and the Monopoly of the Over-The-Counter Drugs

- Chronic Refractory Cough Market landscape: A new approach to treating cough

- Will Merck’s P2X3 Receptor Antagonist for Chronic Refractory Cough Treatment Be Able to Turn FDA’...

- Merck; Bayer; Shionogi set to showcase their candidates indicated for Chronic RefractoryCough in ...