Innovative Vaccines for Clostridium difficile Infection Treatment in the Horizon

Jan 30, 2023

Table of Contents

Clostridium difficile infection (CDI) has emerged as a significant nosocomial infection over the years with increased incidence, recurrence and need for hospitalization. About 15% to 30% of patients who initially respond to antimicrobial therapy experience recurrent CDI (rCDI). After the first recurrence, the risk of subsequent recurrence significantly increases to about 45–65% of patients.

As per DelveInsight’s estimates, there were approximately 669K incident cases of CDI in the 7MM, in 2021, with the United States accounting for nearly 70% of all the cases.

Downloads

Click Here To Get the Article in PDF

Current Clostridium difficile Infection Treatment Landscape

The current treatment regimen for Clostridium difficile infection is restrictive and difficult due to the high recurrence rates, with most broad-spectrum antibiotics such as clindamycin, cephalosporins, quinolones, and penicillins increasing the risk of Clostridium difficile infection because they deplete gut microbiota, creating an environment conducive to C. difficile multiplication. On the other hand, Tetracyclines and aminoglycosides are still effective against Clostridium difficile infection.

Most Clostridium difficile infection treatment guidelines recommend vancomycin, fidaxomicin, and metronidazole as the antibiotics of choice for various lines of therapy. Moreover, as metronidazole’s pharmacokinetics for intestinal infections are inconsistent, vancomycin or fidaxomicin are preferred options for all clinically significant cases of Clostridium difficile infection. However, extended-release of antimicrobial therapy disturbs the natural intestinal flora, allowing spores to develop into propagules that colonize the colon and produce toxins, causing antibiotic-associated diarrhea and pseudomembranous enteritis.

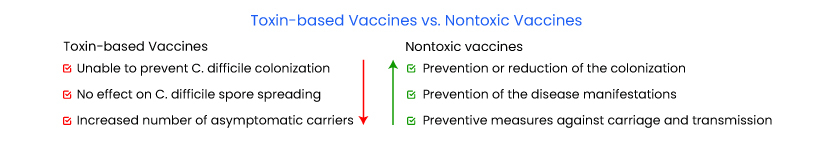

Due to the limitations associated with antibiotic resistance and a lack of reliable preventative measures, a CDI vaccine is an urgent necessity. Toxin-based and nontoxic vaccines are roughly the two primary groups into which CDI vaccines are categorized. Most of the previous C. difficile vaccine studies were based primarily on the two exotoxins, TcdA and TcdB, which are considered to be the primary virulence factors. Several Clostridium difficile infection vaccines have recently undergone various stages of clinical testing.

Emerging Vaccines for Clostridium difficile Infection Treatment

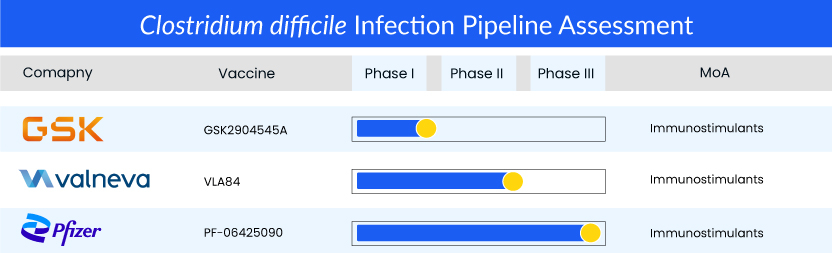

Pfizer’s PF-06425090, a first-in-line vaccine to prevent CDI, is a late-stage bivalent toxoid vaccine that preserves important antigenic epitopes, as it is a genetically detoxified toxin. The results of a recent Phase III CLOVER trial, evaluating the vaccine candidate for the prevention of CDI, were not as expected as the trial did not meet its prespecified primary endpoint of prevention of primary CDI. Vaccine efficacy under the primary endpoint was 31% following the third dose and 28.6% following the second dose for the C. difficile vaccine candidate. However, its safety reviews indicated that the investigational vaccine was safe and well tolerated, with no one requiring medical attention, including hospitalization (0 out of 17) compared to 11 out of 25 in the study’s placebo group. Though PF-06425090’s Phase III results were mixed, leaving everyone ambivalent regarding the success of the vaccine, with a strong safety profile and with better trial results in the future, it still has the potential to be the first approved product in the class, impacting the treatment and market for CDI, and getting a major first mover advantage once approved.

Other toxin-based C. difficile vaccines are also being evaluated in different phases. Valneva’s VLE84, which is currently on hold and is seeking partners to initiate Phase III, achieved satisfactory results in Phase I and Phase II trials, while GSK’s GSK2904545A is in Phase I of development.Although beneficial in preventing the disease manifestations, toxin-based immunizations probably cannot prevent C. difficile colonization. Additionally, research has shown that toxin-based vaccines may not prevent the spread of C. difficile spores from the host to the environment, but they may elevate the number of asymptomatic carriers.

A vaccine targeting surface-associated antigens may have an advantage in managing the illness by preventing both carriage and transmission. Preventing or limiting colonization could restrict transmission in the healthcare facilities where the population at heightened risk for CDI resides, reversing the rise in community-acquired illnesses. A vaccine containing non-toxic components may also be beneficial in preventing the disease’s symptoms, according to multiple studies that link colonization with non-toxigenic strains to a reduced incidence of infection. Passive immunotherapies for CDI target other pathogenic components such as the flagellum, S-layer proteins (SLPs), and others. The SLPs have been examined in conjunction with many adjuvants as a potential vaccine component.

What’s Cooking in the Clostridium difficile Infection Treatment Market

- In November 2022, Ferring Pharmaceuticals announced that the FDA had approved REBYOTA® (fecal microbiota, live-jslm), a novel first-in-class microbiota-based live biotherapeutic indicated for the prevention of recurrence of Clostridioides difficile infection (CDI) in individuals 18 years of age and older, following antibiotic treatment for recurrent CDI.

- In November 2022, Ferring Pharmaceuticals announced the publication of its pivotal Phase III PUNCHTM CD3 clinical trial data in the journal Drugs, in which a single dose of RBX2660 outperformed placebo in a Bayesian analysis model to reduce the recurrence of Clostridioides difficile infection (CDI) after standard-of-care antibiotic treatment.

- In October 2022, Summit Therapeutics shared the results from its Ri-CoDIFy Phase III clinical trial through an oral abstract presentation at IDWeek 2022; however, the statement provided no update on its plans for ridinilazole.

- In September 2022, the VRBPAC of the US FDA reviewed the data supporting the BLA for RBX2660 and issued a positive vote for REBYOTA (RBX2660). The US FDA has granted FTD, BTD, and ODD to REBYOTA (RBX2660) for treating recurrent Clostridium difficile infection.

- In March 2022, Pfizer announced results from its pivotal Phase III CLOVER trial, evaluating the vaccine candidate, PF-06425090, to prevent Clostridium difficile infection.

Expected Roadblocks in the Clostridium difficile Infection Treatment Market

Certain factors are limiting the growth of the Clostridium difficile infection treatment market. A large cohort is required for vaccine clinical trials, which could significantly delay the clinical development process and eventual release of the Clostridium difficile infection vaccine, which is currently being developed. Moreover, antibiotic therapy is the current standard of care (SoC) for recurrent Clostridium difficile infection, which leads to high recurrence rates because antibiotics do not address the underlying microbiome disruption that causes recurrence.

Furthermore, drug side effects are a source of concern for both patients and clinicians, and they are frequently the reason for the discontinuation of a new drug’s development or result in poor patient compliance. Treatment practices vary between centers, and there is significant heterogeneity among country-specific epidemiology studies. Thus, all these factors collectively will hamper the growth of the Clostridium difficile infection treatment market in the coming years.

What’s Ahead in the Clostridium difficile Infection Treatment Market

With C. difficile becoming the most common microbial cause of healthcare-associated infections in hospitals, there is an increased demand for Clostridium difficile infection treatment. As a result of the high prevalence of Clostridium difficile infection, pharmaceutical companies working in the Clostridium difficile infection treatment market have a tremendous opportunity to develop vaccines to prevent initial Clostridium difficile infection.

As per DelveInsight analysis, the Clostridium difficile infection market size in the 7MM was approximately USD 413 million in 2021, and it is anticipated to increase at a significant CAGR of 12.5% by 2032.

Moreover, the emergence of immunoinformatics has also given vaccine research new opportunities. Multi-epitope vaccines created using immunoinformatic methods have activated researchers’ interest in recent years. The multi-epitope vaccines have numerous benefits over conventional vaccines. For example, they do not need microbial culture, saving time and resources; highly promiscuous epitopes can be recognized and combined by multiple alleles at once to overcome the variations in alleles among the human population, and biological harmfulness and toxicity reversion of conventional inactivated or attenuated vaccines can be avoided. Multi-epitope vaccines are now being researched for various diseases, and it would be interesting to see the development of such vaccines for CDI prevention.

FAQs

Clostridium difficile infection is a widespread nosocomial and community-acquired infection that causes diarrhea and colitis. It is caused by gram-positive, anaerobic, spore-forming C. difficile bacteria and accounts for approximately 500,000 infections in the United States annually.

The clinical Clostridium difficile infection symptoms are diverse, ranging from mild diarrhea to fulminant colitis, and are accompanied by complications such as toxic megacolon, bowel perforation, sepsis, and death.

The detection of toxigenic C. difficile in the stool and colonic histopathology is the gold standard for CDI. Glutamate dehydrogenase (GDH), Toxin enzyme immunoassay (EIA), and Toxin B polymerase chain reaction (PCR) are the most commonly used stool tests.

Most Clostridium difficile infection treatment guidelines recommend vancomycin, fidaxomicin, and metronidazole as the antibiotics of choice for various lines of therapy.

Leading Clostridium difficile infection companies such as Pfizer, Valneva, GlaxoSmithKline, Summit Therapeutics, MGB Biopharma, Acurx Pharmaceuticals, Da Volterra, Synthetic Biologics, Deinove, Oragenics, XBiotech, Crestone, MicroPharm Ltd., SAb Biotherapeutics, Seres Therapeutics, Nestlé Health Science, Finch Therapeutics, Destiny Pharma, Vedanta Biosciences, Mikrobiomik Healthcare, Lumen Bioscience, Adiso Therapeutics, Recursion Pharmaceuticals, and others are developing novel Clostridium difficile infection drugs that can be available in the Clostridium difficile infection market in the upcoming years.

Promising candidates such as PF-06425090 (Pfizer), VLA84 (Valneva), GSK2904545A (GlaxoSmithKline), and others are currently in various stages of development for Clostridium difficile infection treatment.

Downloads

Article in PDF